You can use your AMP Bank Visa Debit card anywhere Visa is accepted globally, or where you see the Visa or Plus logos.

‘Tap and go’ with Visa payWave for any contactless purchases $200 or under, so you don't need to swipe or hand your card to a cashier.

Your card is covered under Visa’s zero liability insurance, which means you'll be protected for any unauthorised transactions (conditions apply).

Withdraw cash for free at domestic ATMs. We'll reimburse fee within Australia but not internationally.

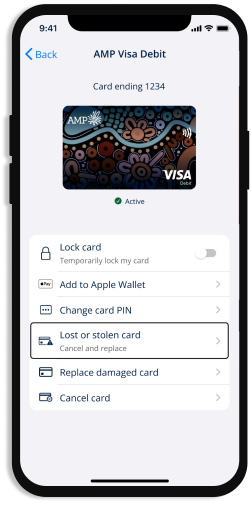

Manage your card in the My AMP app and get greater control, security and peace of mind by either locking. You can lock your card, report as lost or stolen, arrange to replace a damaged card or cancel your card.

Link your card to alternate payment options such as Google Pay, Apple Pay and Samsung Pay.

| Card transaction limits |

| Daily cash withdrawal at ATM and eftpos | $1,000 per day |

| Visa payWave (Tap and Go) transaction without PIN | $200 per transaction |

| Bank@Post cash withdrawal | $1,000 per day |

| Bank@Post cash deposit | $9,999.95 per day |

Card management features in My AMP give you more control over your AMP Visa Debit cards.

Link your AMP Visa Debit card to your digital wallet

You can link your AMP Visa Debit card to your digital wallet to use with a smartphone or device.

This means you'll no longer need to carry a physical wallet, and it speeds up online shopping and transactions.

Card safety and security

At AMP Bank we offer a range of services and security features to help protect your account and cards against the ever-increasing threat of card fraud and scams.

- 24/7 fraud monitoring - We leverage a system developed by Cuscal which operates in near real-time to identify transactions that are potentially fraudulent, based on your usage history and other significant data. By monitoring card activities 24 hours a day, we can detect and sometimes stop fraudulent or suspicious transactions before they affect your account.

- Protection for any unauthorised transactions via Visa’s zero liability insurance, which means you'll be protected for any unauthorised transactions.

- Card management features in My AMP help you control and protect your card.

- Contact the AMP Bank Contact Centre 24/7 via 13 13 30.

- For more information, please visit our Online Security page.

Here's what you can do to protect your AMP Visa Debit Card:

Protecting your card online:

- Stay in control of your card using the card management features in My AMP.

- Regularly monitor your card transaction history in My AMP to check against fraud.

Protecting your Access Card:

- Sign your card as soon as you get it.

- Don't record or disguise your PIN or other Security Access Code on your card, on anything you normally carry with you, e.g. your wallet, or in any low security electronic device of any kind, including calculators, personal computers, electronic organisers, mobile phones.

- If you're no longer using your card or it has expired, cut it into pieces and return it to us.

- Carry your card with you whenever possible.

- Regularly check you have your card.

- Don't let the card leave your sight when making purchases.

- Don't let anyone swipe your card more than once without giving you with a ‘transaction cancelled’ receipt.

- Retrieve your card from ATMs.

- Treat your card as if it were cash.

- Don't give your card to anyone else, including family and friends.

Please refer to Access card security guidelines.

Card FAQs

Where can I use my AMP Visa Debit card?

Accepted anywhere you see the Visa or Plus logos.

What are the transaction limits on my Visa card?

| Daily cash withdrawal at ATM and eftpos | $1,000 per day |

| Visa payWave (Tap and Go) transaction where no PIN is needed | $200 per transaction |

| Bank@Post Cash withdrawal | $1,000 per day |

| Bank@Post Cash deposit | $9,999.95 per day |

Will I be charged an ATM fee on withdrawals?

AMP will reimburse all domestic ATM fees when you use an AMP Visa Debit card (not international).

What is Apple Pay?

Apple Pay is a digital wallet from Apple which lets you use a compatible iPhone, Apple Watch, iPad or Mac to make secure contactless purchase in stores, within selected apps and participating websites.

Does Apple store the card details?

No, your card details are not stored on the device or in the Cloud. When a card is added to Apple Pay, a Device Account Number replaces the need for the card number.

What card management features are available on My AMP?

You can use the My AMP app to activate your card, change PINs and order a replacement card if your card is damaged. And now, you can also lock/unlock your card, report it lost/stolen and cancel your card. On My AMP web you can activate your card, change PINs and order a replacement card if your card is damaged.

What is the difference between lock, report lost/stolen, cancel and replace damaged card?

Lock card – if you’ve misplaced your card, you can lock it which will block any new transactions that need to be authorised.

Report lost/stolen – if your card has been lost/stolen, you can report it so your card can be cancelled, and a new card ordered.

Cancel card – if you no longer want a card, you can cancel it. A new card won't be ordered.

Replace damaged card – if your card has been damaged or the magnetic strip no longer works, you can request a replacement card. The card number will be the same.