Grow your super

A little goes a long way in super

Start now and help grow your super. Even small contributions can make a big difference in the future.

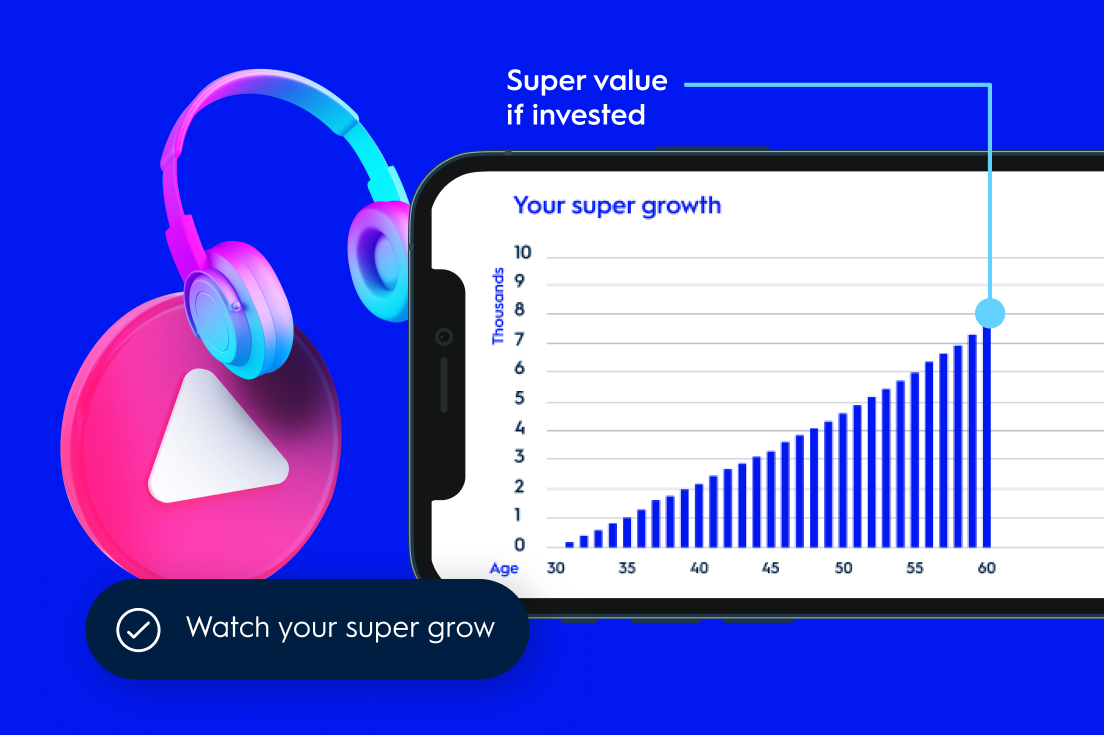

Did you know the cost of a monthly subscription could make a big difference to your super?

Sophie, 30, has set herself a challenge to boost her super by this time next year. She’s decided to finally cancel that subscription that’s been running for too long and contribute that money to her super instead. The estimated super she can accumulate upon turning 60 years by forgoing a single subscription ($18) a month and voluntarily contributing it (or $216 p.a.) into super as an after-tax contribution is $8,935.1

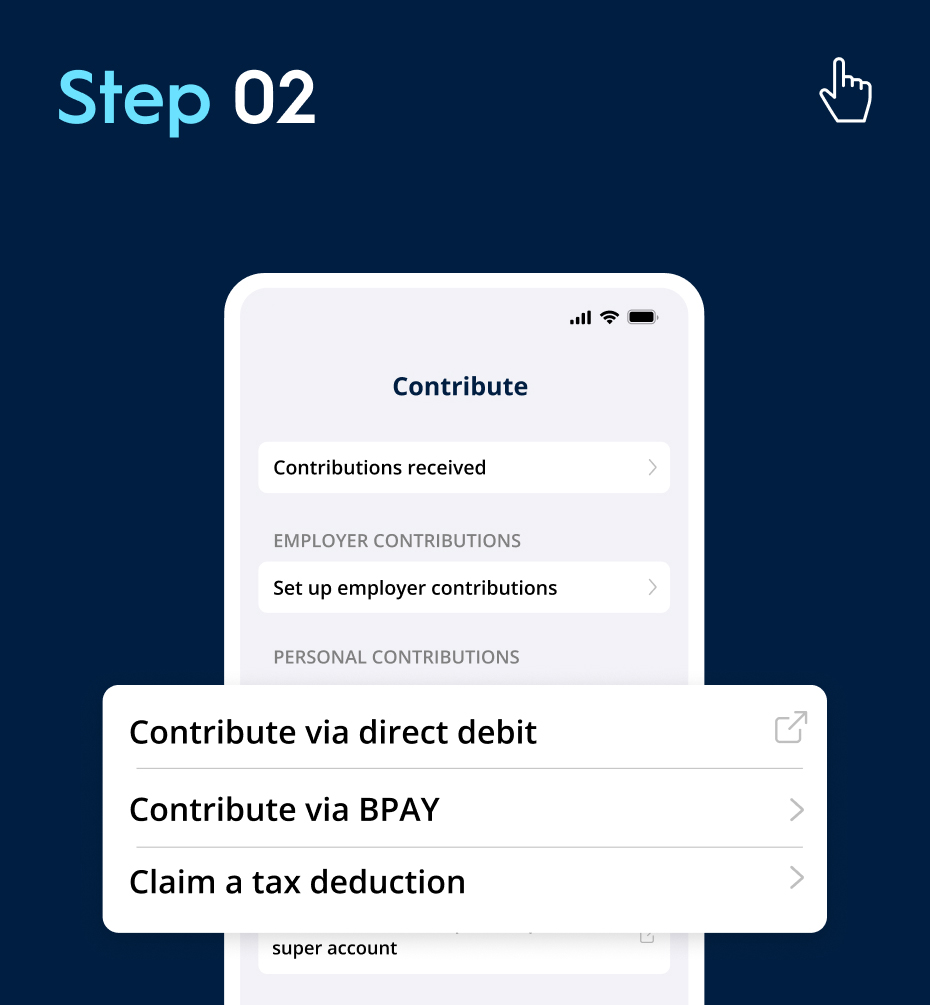

You can grow your super by making contributions before or after tax, helping you build a stronger balance for the future.

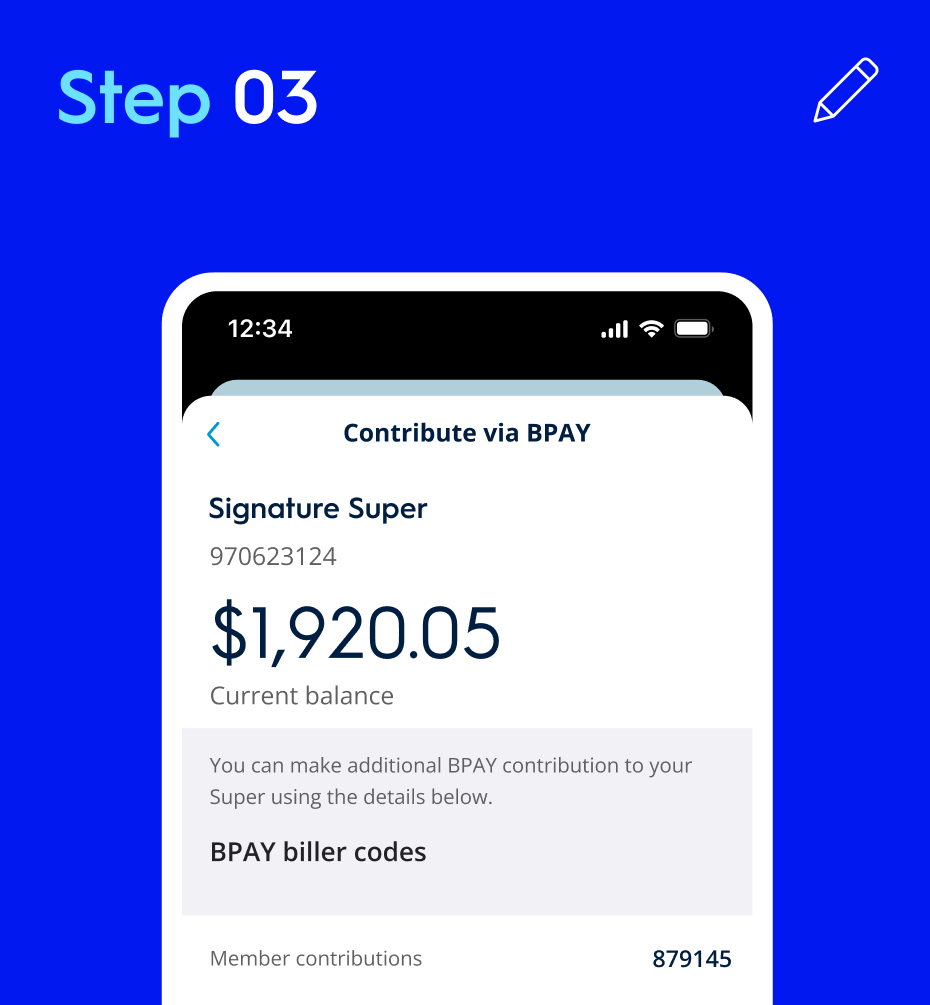

If you do want to claim a tax deduction, you’ll need to let us know by submitting the form and receiving your acknowledgement letter before you submit your tax return.

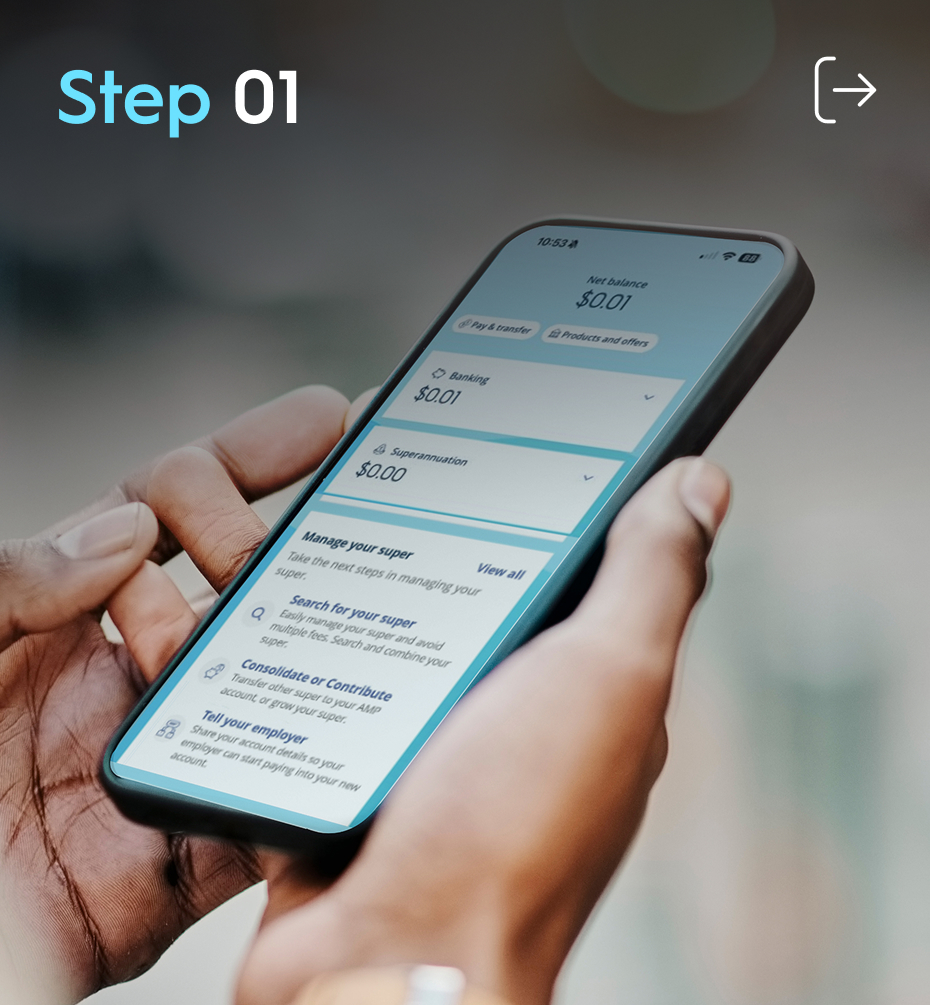

1. Login to My AMP

2. Go to the ‘Manage’ dashboard

3. Select ‘Claim a tax deduction'

4. Complete the form

5. Wait to receive an acknowledgement letter from AMP

6. Submit your tax return

AMP Super refers to SignatureSuper® which is issued by N. M. Superannuation Proprietary Limited ABN 31 008 428 322 AFSL 234654 (NM Super) and is part of the AMP Super Fund (the Fund) ABN 78 421 957 449. NM Super is the trustee of the Fund.

® SignatureSuper is a registered trademark of AMP Limited ABN 49 079 354 519.

1 Chart is for illustrative purposes only. Contribution is indexed by 3.0% each year (wage inflation). 5.42% return on balanced (70% growth) option - this is superannuation return after tax and investment fee. 0.19% admin fee and 0.015% of trustee fees are assumed. The after tax contribution for the year is within the persons’ annual non-concessional contributions cap and no tax deduction is claimed. No insurance cost is taken into account. No advice fees are taken into account. Government co-contribution and low income super tax offset are not taken into account. Results are shown in today's dollars, which means they are adjusted for inflation of 3.0%.

Before deciding what’s right for you, it’s important to consider your particular circumstances and read the relevant Product Disclosure Statement and Target Market Determination from AMP at amp.com.au or by calling 131 267.

Read AMP’s Financial services guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you.

Any advice and information provided is general in nature, hasn’t taken your circumstances into account, and is provided by AWM Services Pty Ltd ABN 15 139 353 496 AFSL 366121 (AWM Services), which is part of the AMP group (AMP). All information on this website is subject to change without notice.

Digital Financial Advice is provided by AWM Services to eligible members of the AMP Super Fund.