Super

Supercharge your super with Lifetime Boost

With the award-winning AMP Super Lifetime Boost, you could be as much as $100,000 better off in the first ten years of retirement.* Find out how much you could get with Lifetime Boost.

All you need to do is join AMP Super and unlock Lifetime Boost. The sooner you start, the bigger the boost could be.

Supercharge your future income and improve overall retirement options for no extra fees.

It works in the background to increase your eligibility for the Government Age Pension. The longer you have Lifetime Boost, the bigger the boost could be to your retirement income.

The feature doesn’t lock you in, it just gives your future self better retirement options.

Get expert insights, tips and updates on Lifetime Boost - including how it works and how the average Aussie could be as much as $100,000 better off in their first 10 years of retirement - delivered straight to your inbox.

Want to understand more about the Lifetime feature? Watch our explainer video to see how it works while you grow your super.

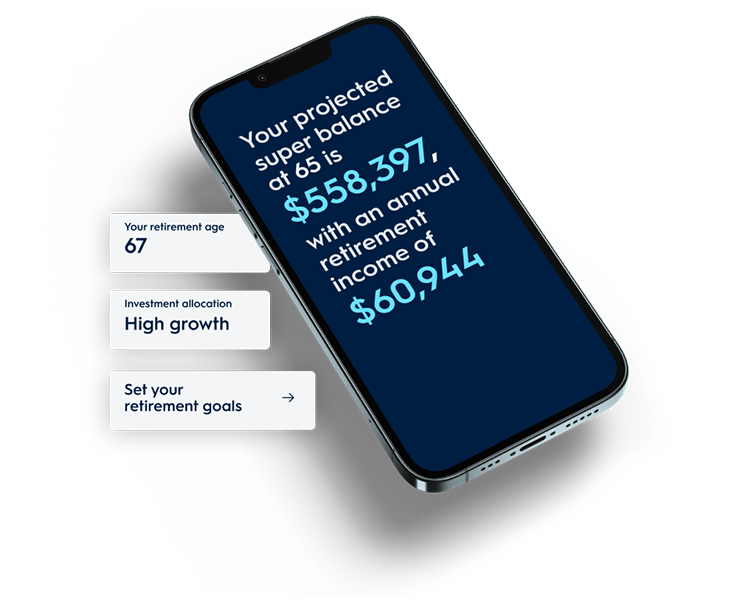

Retirement simulator

In just a few minutes, our retirement simulator shows you how different choices like adding a Lifetime solution could supercharge your retirement.

Available to eligible members as part of an AMP Super account. The Lifetime feature can help to increase your income in retirement. The feature means that if you decide to invest in an AMP Lifetime Pension* at retirement, the balance counted for social security purposes is subject to a discount.

In retirement, if you’ve invested in an AMP Lifetime Pension, Centrelink will use this discounted value when they apply the 'means test' to assess your eligibility for the Age Pension. Where you have an overall lower value of assets, it can lead to better eligibility for the Age Pension and that creates more income in retirement for you!

The earlier you have the Lifetime feature switched on in your account, the bigger discount it can create for you. The feature doesn't change anything else in your account. There's no fees to switch it on and it doesn't lock you into anything.

*AMP Lifetime Pension launches in 2026.

The Lifetime Boost feature works in the background of your super account. It calculates a lower amount of growth to your account balance than typical actual growth. The rate used to do this is called a 'deeming rate' and it's set by the Government.

The deeming rate is currently 2.75% which is generally a lot lower than the actual growth on your account.

This results in a lower amount being calculated which compounds over your working life.

When you eventually meet a full condition of release to access your money in super, if you decide to allocate at least some of your super into an AMP Lifetime Pension, the lower amount relevant to the proportion you move into Lifetime Pension is what Centrelink will use in the asset test to determine your eligibility for the Age Pension. A lower amount used in the 'asset test' by Centrelink creates a better opportunity to get more Age Pension to add to your retirement income.

Adding the Lifetime Boost feature doesn't change how your super account works. There's no extra cost and it doesn't lock you into anything.

The earlier you switch on the Lifetime Boost feature, the bigger the advantage could be in retirement.

The Lifetime Boost feature will provide a discounted account value for all eligible members, however, some members individual circumstances may mean that the reduced account value used in the asset test won't change their social security outcome. For example:

Members should speak to an Adviser or Super Coach (Intrafund Advice) to consider their personal circumstances.

By law, when you can start accessing your super 'in full', we must turn the Lifetime Boost feature off in your account. The Lifetime Boost feature is designed to convert into a Lifetime Pension* if you decide to start one in retirement. This means when you can start accessing all of your super, you'll need to tell us if you'd like to start a Lifetime Pension* with some or all of your balance. Otherwise, we will have to turn the feature off and the discounted value used in your asset test for Centrelink disappears. To access your super in full, you need to meet one of certain conditions (called ‘Conditions of Release’).

So, if you're withdrawing your super for any of the following reasons, you should be aware that by doing so, you might be turning off the Lifetime Boost feature in your account- and once it's off, it can't be switched back on. See below:

During the time before the Lifetime Pension* is available OR if you aren’t eligible for a Lifetime Pension when you meet a ‘full’ condition of release (outlined above) the feature will simply be turned off in your account. The Lifetime Boost feature will also be turned off if your account is closed.

*Available in 2026.

You can move your super to another fund at any time but if you close your account, you'll lose the Lifetime Boost feature completely along with the discount the Lifetime Boost feature has been calculating.

The law requires that for you to retain the advantage of the discounted growth rate (and for Centrelink to use the lower amount), you must remain within the same super fund.

New members* joining AMP Super will have the Lifetime Boost feature added to their account automatically when they make an investment choice or they can add the feature to their account if not automatically added.

* Subject to eligibility.

The Lifetime Boost feature is suitable for anyone who is in the accumulation phase of their working life in AMP Super.

To be eligible though, you meet the following criteria:

Tools & calculators

Member information

AMP Super refers to SignatureSuper® which is issued by N.M. Superannuation Proprietary Limited ABN 31 008 428 322 AFSL 234654 (NM Super) and is part of the AMP Super Fund (the Fund) ABN 78 421 957 449. NM Super is the trustee of the Fund.

® SignatureSuper is a registered trademark of AMP Limited ABN 49 079 354 519.

Any advice is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature only. It doesn’t consider your personal goals, financial situation or needs. It’s important you consider the appropriateness of any advice and read the relevant product disclosure statement and target market determination available at amp.com.au, before deciding what’s right for you. AWM Services is part of the AMP group and can be contacted on 131 267 or askamp@amp.com.au

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services it provides. You can also ask us for a hard copy.

The benefits of Lifetime is only realised if you take out an AMP Lifetime Pension. There is no obligation however to take up this pension if you have the Lifetime feature but the benefits will not apply.

The AMP Lifetime Pension is not currently available but is expected to be available in 2026. The issuer of AMP Lifetime Pension is NM Super. The TMD and PDS for AMP Lifetime Pension is expected to be available in mid-2026 on www.amp.com.au/resources#pds. Please review the PDS before deciding to acquire or hold the Lifetime Pension as there may be features or conditions of the Lifetime Pension that may not be suitable to you. NM Super may withdraw or change the Lifetime Pension in the future and therefore these benefits may not apply.

Zenith CW Pty Ltd ABN 20 639 121 403 AFSL 226872/AFS Rep No. 1280401 Chant West Awards issued 21 May 2025 are solely statements of opinion and not a recommendation in relation to making any investment decisions. Awards are current for 12 months and subject to change at any time. Awards for previous years are for historical purposes only. Full details on Chant West Awards at https://www.chantwest.com.au/fund-awards/about-the-awards

* This information is illustrative only and does not replace financial advice. It illustrates the potential benefits for an average Australian with the AMP Super Lifetime Boost feature activated for 30 years leading up to retirement, who allocates their balance 50/50 between an AMP Lifetime Pension and an AMP Allocated Pension. The average Australian in this illustration is assumed to be a 37-year-old single male with an $80K super balance, a $90K salary, contributing 12% with no career breaks, retiring at 67 with $175K in other assets at retirement, is a homeowner, and withdraws the minimum from the allocated pension. The illustration assumes annual investment returns of 6.33% and wage inflation of 3% p.a * and the current upper deeming rate of 2.75%pa. All figures are shown in today’s dollars and are adjusted for 3% annual inflation. The benefits of Lifetime Boost are only realised if you take out a Lifetime Pension. There is no obligation to take up this pension if you have the Lifetime Boost feature, but the benefits will not apply if you do not.