* Contributions of cashback can only be made to your SignatureSuper account

AMP Rewards is administered by Citrus Innovations Pty Ltd (ABN 25 667 285 654) (Citro) under an agreement with the trustee of the AMP Super Fund, N. M. Superannuation Proprietary Limited ABN 31 008 428 322 (NM Super).

AMP Rewards is available to eligible members of AMP Super while they continue to be a member of the AMP Super Fund. Terms and conditions apply. You can see these here at amprewards.com.au/terms. Only Citro is responsible for AMP Rewards.

AMP Super refers to SignatureSuper® which is issued by NM Super.

Citro, NM Super, and AWM Services are part of the AMP group. AWM Services can be contacted on 131 267 or askampsuper@amp.com.au. Citro can be contacted on 1300 583 156 or support@amprewards.com.au.

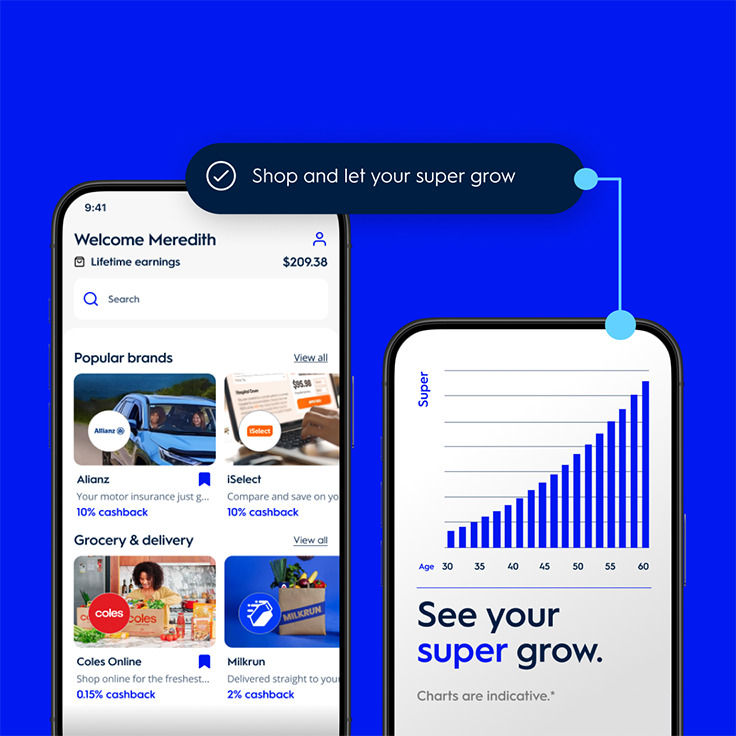

** This projection is based on making additional contributions starting at age 30 and accumulating until age 60 (a 30-year period). The contribution is indexed by 3.0% each year (wage inflation) and assumes a Balanced option investment return of 5.42% after tax and investment fee. An administration fee of 0.19% and a trustee fee of 0.015% are assumed. The following are not taken into account: insurance costs, advice fees, and some administration and investment fees and costs including transaction costs and the member fee as it does not vary based on the account balance. Refer to the PDS for SignatureSuper dated 19 May 2025 for all fees and costs currently applicable to a SignatureSuper account. These fees and costs may change over time. Government co-contributions and low income super tax offsets are also not taken into account. The after tax contribution for the year is within the persons’ annual non-concessional contributions cap and no tax deduction is claimed. Results are shown in today's dollars, which means they are adjusted for inflation of 3.0%.

Apple and the Apple Logo are trademarks of Apple Inc.

Google Play is a trademark of Google LLC.

The brands participating in AMP Rewards are subject to change at any time without prior notice.

What to keep in mind

- If you exceed the super contribution limits, additional tax and penalties may apply.

- The value of your investment in super can go up and down. Before making extra contributions, make sure you understand and are comfortable with any potential risks.

- The government sets general rules about when you can access your super, which means you typically won’t be able to access your super until you retire.

- Any advice and information provided is general in nature and hasn’t taken your circumstances into account. You should always seek financial advice and consider your personal financial circumstances before making additional contributions