This information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature only. It hasn’t taken your financial or personal circumstances into account.

Before deciding what’s right for you, it’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions available from AMP at amp.com.au or by calling 131 267 or by emailing ampsuper@amp.com.au

You can read our Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy.

All information on this website is subject to change without notice.

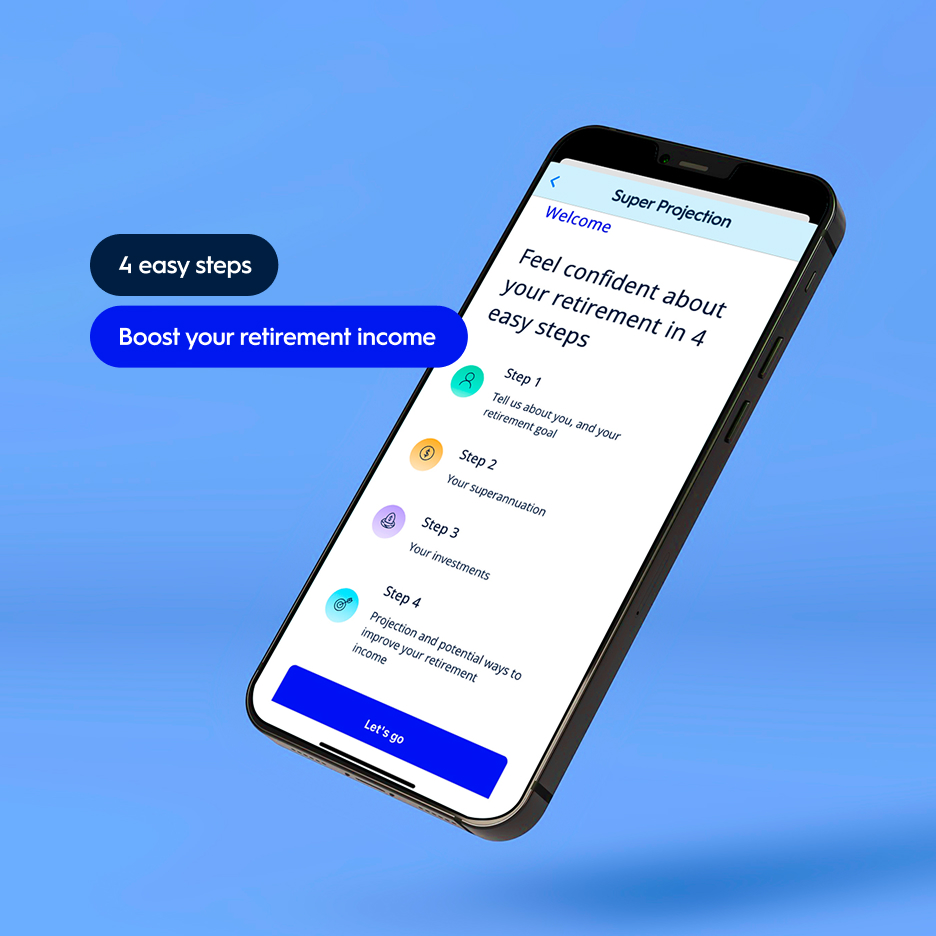

Digital Financial Advice is provided by AWM Services to eligible members of the AMP Super Fund.

Products in the AMP Super Fund are issued by N.M. Superannuation Proprietary Limited (N.M. Super) ABN 31 008 428 322 (trustee), which is part of the AMP group.

The AMP Lifetime Pension is not currently available but is expected to be available in 2026. The issuer of AMP Lifetime Pension is NM Super.

The TMD and PDS for AMP Lifetime Pension is expected to be available in mid-2026 at amp.com.au/resources. Please review the PDS before deciding to acquire or hold the Lifetime Pension as there may be features or conditions of the Lifetime Pension that may not be suitable to you. NM Super may withdraw or change the Lifetime pension in the future and therefore these benefits may not apply.