Simulate your retirement

Retirement simulator

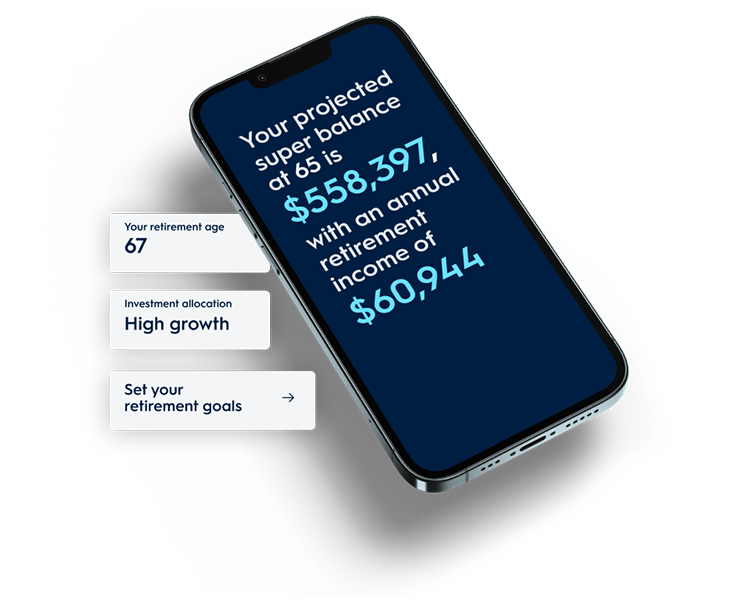

Our retirement simulator lets you see how different choices like adding the Lifetime solution might impact how much income you have in retirement and how long your money may last.

AMP Super’s Lifetime solutions were created by a team of experts determined to make retirement better. One of our solutions, the Lifetime Boost feature works in the background of your AMP Super account with no extra fees or effort and for the average Aussie it could mean $100,000 better off in your first 10 years of retirement1. We spoke to the people behind it to find out what inspired its creation, how the innovation came to life, and how it is can help members feel more confident about their future.

The award-winning feature was built by a team of number-crunchers and innovators passionate about making super simpler and more useful:

Estelle Liu, Head of Retirement Solutions: “We tested 24 different member scenarios and found the benefit held true across most Australians, not just the ‘average case’.”

Ivan Beocanin, Product Manager: “With the Retirement Simulator, you can literally tick a box and see what Lifetime Boost means for your retirement outcome.”

Julie Slapp, Director Growth & Customer Solutions: “Having even a little extra money can mean the difference between dignity in retirement and scraping by. Every retiree deserves that confidence.”

Brooke Veenstra, Senior Product Manager: “I think of my dad, who has kept working past retirement age because he didn’t want to draw down his super. If he’d had Lifetime Boost, it would have given him the confidence to stop working and enjoy retirement.”

Martin Porter, Senior Product Lead: “Switching on Lifetime Boost feature is like having an accountant in the background doing the hard work, so you can just enjoy the benefits of a boosted retirement income.”

Julie: Lifetime Boost is a feature built into your AMP Super account to help you get more income in retirement with an AMP Lifetime Pension – a pension for life. It works in the background for you, and you get more options when you choose to retire.

Estelle: Lifetime Boost is an example of our Lifetime solutions which are not only here to address longevity risk for our customers, but also their fear of running out of money in retirement. With a pension that lasts their lifetime, they can feel more confident to actually spend their money in retirement.

Brooke: Retirement looks different for everyone, but we kept seeing the same problem: people save their whole lives then barely touch their super because they’re scared it’ll run out. Lifetime solutions can help bridge that gap. And with the Government’s Retirement Income Covenant pushing super funds to help people spend with confidence, not just grow a balance, AMP Super developed Lifetime Boost to further boost up the benefit of an AMP Lifetime Pension.

Martin: Think of Lifetime Boost as a bonus feature inside your super. It doesn’t cost extra, and you’re not locked in, so you don’t lose flexibility, and there’s nothing complicated to do. You’re basically preparing a better pension for your future self, so when you retire, one’s already been developing quietly in the background if you want that option.

Here’s what that means in practice:

It sits in your super account while you’re still working.

At retirement, you can choose to use it by converting into a lifetime pension alongside your account-based pension (like an AMP Allocated Pension).

It taps into government concessions, and increases the discount on assets tested for the Age Pension from 40% to as much as 100%.

Estelle: That uplift comes from three sources. First, higher income rate when you retire – a lifetime pension converts retirement savings into higher income efficiently backed by insured living bonus to ensure income never runs out. The second uplift comes from Government Age Pension concessions. For example, there’s a 40% discount for asset tests for any allocation into a lifetime pension. The concessions are boosted up the earlier you switched on Lifetime Boost feature in your AMP Super account. That means your super could unlock more pension benefits. And finally, confidence to spend more freely, knowing you can enjoy a guaranteed income for life.

Julie: Because no one else has done it at this scale. AMP was first to embed the feature directly into members’ super accounts, so everyday Australians, not just people with advisers, could benefit. Our trustee found that nine out of 10 members would be better off with Lifetime Boost and no one would be worse off3. When we won the Chant West Innovation Award, which is one of the most respected ratings houses in the industry, it validated that this is genuinely groundbreaking. It’s not innovation for innovation’s sake; it’s about putting real money back into members’ hands.

Estelle: We get asked this all the time! The truth is, there isn’t one. Switching on Lifetime Boost as early as possible will give you the maximum potential upside, with no extra fees and it doesn’t lock you in. If you decide down the track that an AMP Lifetime Pension is not for you and you do not want to use the option to convert into one in retirement, then what you get in retirement would be no different to if you have never switched on Lifetime Boost.

Julie: It’s a fair question! But the reality is, the Government want people to use their super as income, not just sitting on it in fear of running out. Lifetime Boost gives members the confidence to actually spend and enjoy retirement, especially in those earlier years

Ivan: That’s where the Retirement Simulator comes in. It’s a free online tool where you pop in your own details - income, super, assets - and it shows you what retirement could look like. There is a toggle which you can turn on and off to instantly see the difference lifetime solutions can make. It’s designed to be simple, visual, and holistic looking at all your assets; super, Age Pension eligibility, and income streams.

Ivan: Not at all. Turning it on now just gives your future self more options. When you retire, you still decide how much (if any) of your super goes into a lifetime pension.

Estelle: It’s simple: Lifetime Boost gives you more options in retirement and help build your confidence to enjoy retirement without worrying about outliving their savings. Switching it on early, planning your options, and then combining an AMP Lifetime Pension with an account-based pension at retirement gives you flexibility, higher income, and peace of mind.

Julie: Money stress can overshadow everything else in retirement. If we can take even a bit of that away, people can focus on the good stuff like hobbies and travel. For me, it’s a no-brainer. Lifetime Boost is one of those small switches today that can make a big difference later.

1,2 This information is illustrative only and does not replace financial advice. It illustrates the potential benefits for an average Australian with the AMP Super Lifetime Boost feature activated for 28 years leading up to retirement, who allocates their balance 50/50 between an AMP Lifetime Pension and an AMP Allocated Pension. The average Australian in this illustration is assumed a single female aged 39, with a $62k super balance and $88k salary. The illustration assumes annual investment returns of 6.33% and wage inflation of 3% p.a and the current upper deeming rate of 2.75%pa. All figures are shown in today’s dollars and are adjusted for 3% annual inflation. The benefits of Lifetime Boost are only realised if you take out a Lifetime Pension. There is no obligation to take up this pension if you have the Lifetime Boost feature, but the benefits will not apply if you do not.

3 More members can expect to get a higher retirement income when investing in AMP Lifetime Pension, along with an AMP Allocated Pension. Based on analysis performed by a third-party consulting firm, assuming most members are in good health. The analysis made certain assumptions including about the AMP membership profile, product allocation, investment strategy, returns and draw down rates, and the age pension rules and laws at the time of the analysis.

Lifetime Boost is a feature of AMP Super which is issued by N. M. Superannuation Proprietary Limited ABN 31 008 428 322 AFSL 234654 as trustee of the AMP Super Fund ABN 78 421 957 449. Any advice is general only, doesn't consider your personal goals, financial situation or needs, and is provided by AWM Services Pty Ltd ABN 15139 353 496 AFSL 366121.

You should consider your own circumstances and the AMP Super PDS and TMD on amp.com.au to consider if AMP Super or Lifetime Boost is right for you. Information is based on today's superannuation, tax and social securities laws (including deeming rates). Government policies and laws will change in the future, which may impact this feature, and the benefits discussed.

The AMP Lifetime Pension is not currently available but is expected to be available in 2026. The issuer of AMP Lifetime Pension is NM Super. The TMD and PDS for AMP Lifetime Pension is expected to be available in mid-2026 on www.amp.com.au/resources#pds. Please review the PDS before deciding to acquire or hold the Lifetime Pension as there may be features or conditions of the Lifetime Pension that may not be suitable to you. NM Super may withdraw or change the Lifetime pension in the future and therefore these benefits may not apply.