Investment markets and key developments

US sharemarkets continued to track to a new record high throughout the week, with the S&P500 up by 1.1%. The US 10-year bond yield rose to 4.13% but is still well below its 2023 highs. Australian shares were up by 2.8%, with all sectors higher over the week. Eurozone shares rose by 4.2% (also reaching a new record high) while Japanese shares were down by 0.6%, declining later into the week after the Bank of Japan’s meeting. Chinese shares rose by 2% after stimulus announcements, having being under significant pressure in recent months (and most recently were down more than 40% since early 2021 levels on concern about the Chinese growth outlook). This week, the People’s Bank of China announced a 50 basis point cut in the reserve requirement ratio (RRR) for all banks to 7% and a 25 basis point cut to the interest rate on its relending and rediscounting facilities. This is the first RRR cut since September which the central bank says should result in a CNY 1 trillion liquidity injection and push down interbank interest rates. The announcement was positive for risk assets but more still needs to be done to help boost the property sector and support consumer spending. This news followed on from reports earlier this week that policy makers were considering a package worth around CNY 2 trillion rescue package, but its hard to know whether this is genuine stimulus or just speculation. The $A has been depreciating again and is currently at 0.657 USD.

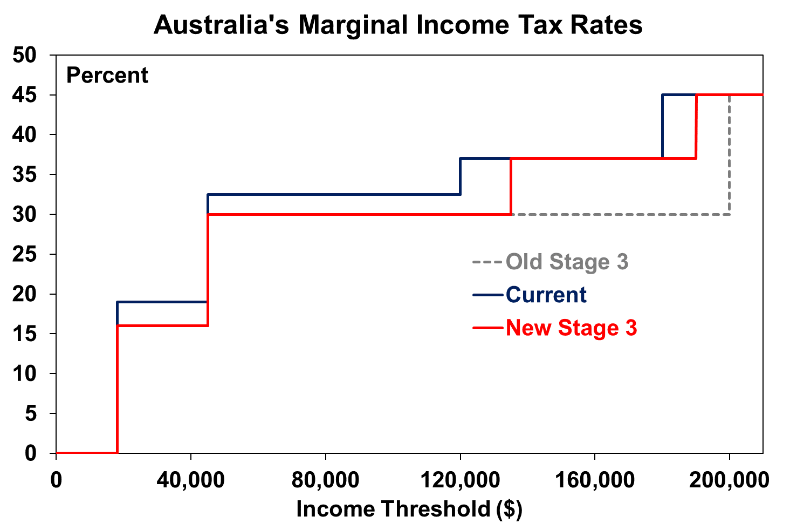

The Australian government delivered some substantial changes to the Stage 3 tax cuts which were legislated in 2019 and due to start from 1 July. Under the original proposal, the 37 per cent tax bracket (that applies to incomes between $120,000 - $180,000) would be abolished in favour of a 30 per cent tax rate to all earnings between $45,000 and $200,000 and the top marginal tax rate of 45 per cent was due to start from incomes of $200,00 (rather than its current level of $180,000). The new proposal announced this week would see the current 19 per cent tax bracket (that applied for incomes between the $18,200 tax-free threshold and $45,000) will be reduced to 16 per cent, the 37 per cent tax rate will be reinstated and apply to incomes between $135,000 and $190,000 and the 45 per cent tax rate will apply from incomes over $190,000 (see the chart below).

Source: AFR, Treasury, AMP

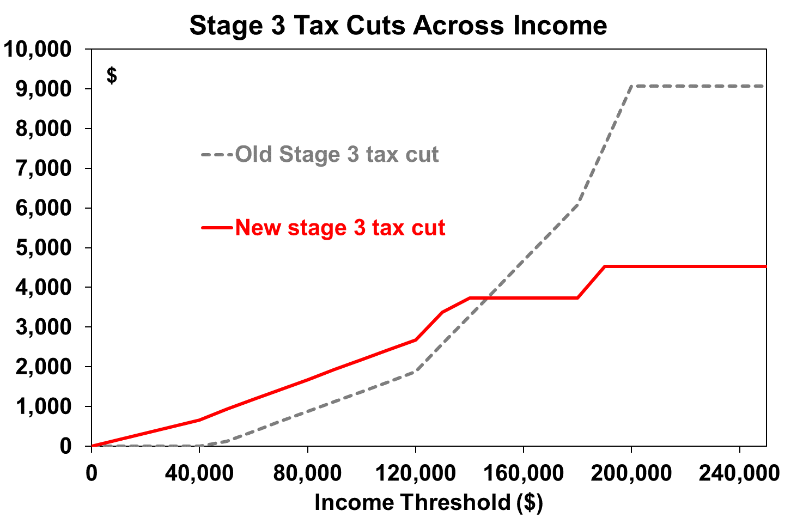

The changes will mean that previously agreed tax breaks for high income households will be re-directed for those earning up to $150,000 (see the chart below). For example, someone earning over $200,000 would have previously received a $9075 tax break will now have their tax cut halved to $4529. And someone on $100,000 would now receive an additional $804 in tax cuts.

Source: AFR, Treasury, AMP

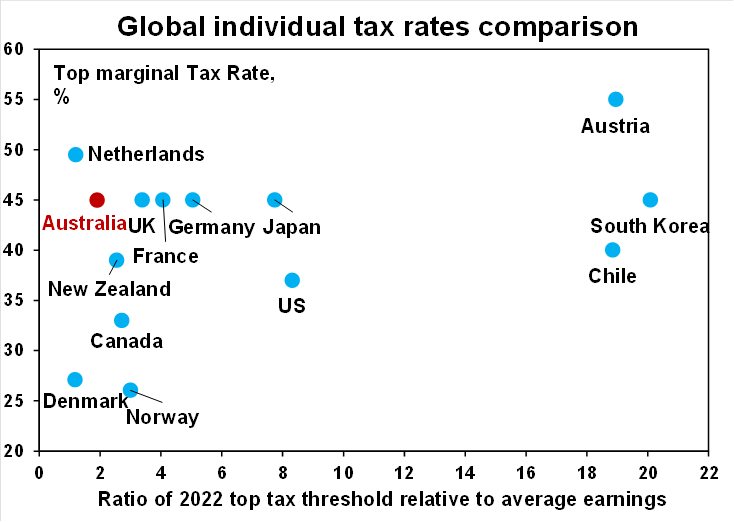

While the new package is arguably more equitable as nine out of 10 taxpayers will benefit from the changes and some reason that they increase workforce participation for middle-income earners, the previously agreed upon tax cuts were already legislated and taken to the election. The other problem is that Australia’s tax system is already very progressive and is becoming more so given significant bracket creep over the past 15 years. In Australia, the highest marginal rate of taxation sets in at a low multiple (around 2x) of average income relative to our global peers (see the chart below).

Source: OECD, AMP

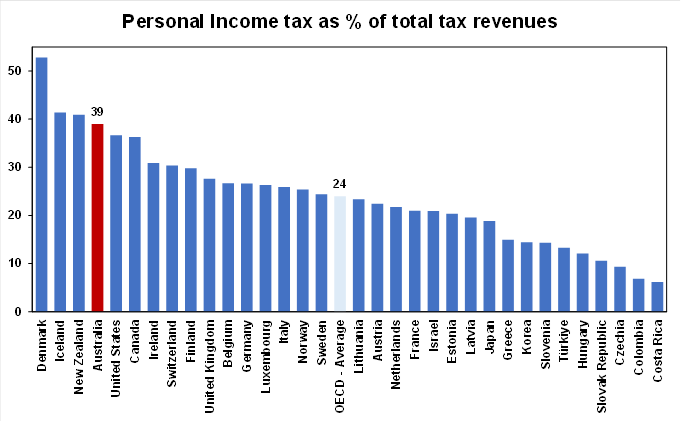

The top 10% of income earners paid around 46% of total taxes, so there is an increasing reliance on top income earners to shoulder the burden of personal income taxation. There is a genuine need to reduce the burden of income tax on employees in favour of broader tax changes to reduce disincentives to workforce participation and increase productivity growth. Australia has a high reliance on personal income tax, with around 39% of tax revenue derived from personal income tax, relative to the 24% average across OECD peers (see the chart below).

Source: OECD, AMP

The government argues that the tax changes will help with cost of living challenges but could end up doing the opposite if they add to inflation at a time when it is coming down. According to the government, the Treasury and the Reserve Bank were briefed on the changes and do not expect the change in tax cuts to have material upside impact to inflation. In our view, the risk is that the larger tax cuts to middle-income households will add to consumer purchasing power, increase consumer spending and add to inflation because low-middle income households spend a larger share of their income than higher income households (who tend to save a higher proportion of income). However, the economic environment when the tax changes start (on 1 July) is likely to be weak as we see the unemployment rising to 4.5% by mid-year (its currently at 3.9%) and home prices declining which will both drag on consumer spending. So while there is a risk that the tax changes add to inflation in mid-2024 and could challenge our current expectation for rate cuts starting from mid-year, for now, the RBA will be focussing on current inflation and growth figures to set interest rates. We expect no change to the cash rate at the RBA’s February meeting.

Economic activity trackers

Our Economic Activity Trackers have bounced around in recent weeks but are not showing anything decisive for the direction of activity.

Based on weekly data for eg job ads, restaurant bookings, confidence, mobility, credit & debit card transactions, retail foot traffic, hotel bookings. Source: AMP

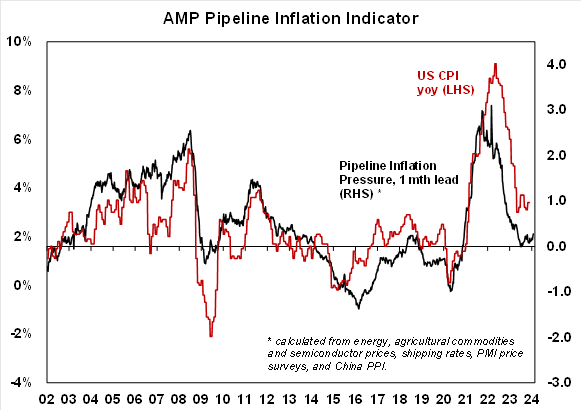

Our Inflation Tracker continues to point to lower inflation ahead (see the chart below).

Source: Bloomberg, AMP

Major global economic events and implications

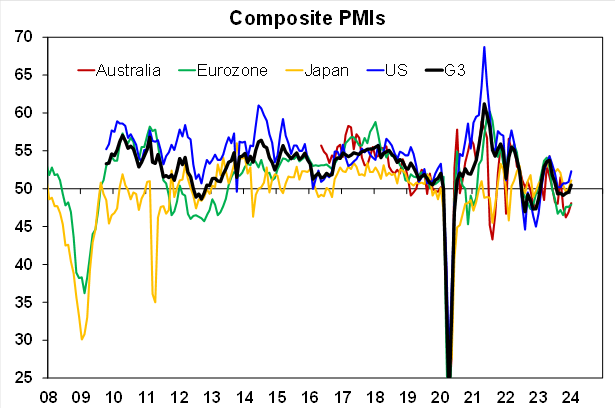

The January global PMIs were mostly positive. Manufacturing conditions improved across the major economies and services conditions also lifted, apart from the Eurozone.

Source: S&P, AMP

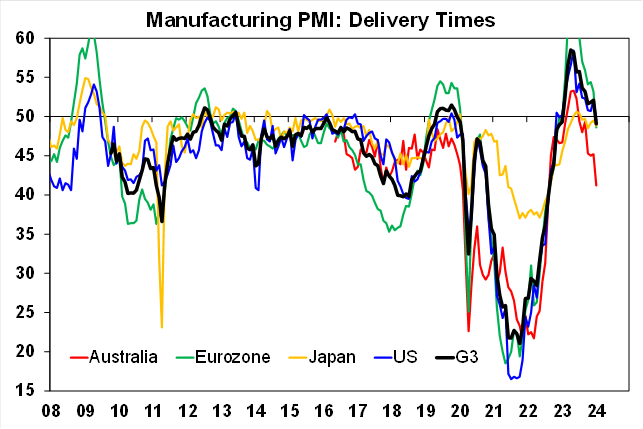

Manufacturing delivery times worsened due to the shipping challenges in the Middle East, but are no where near as bad as conditions during the pandemic (see the chart below).

Source: S&P, AMP

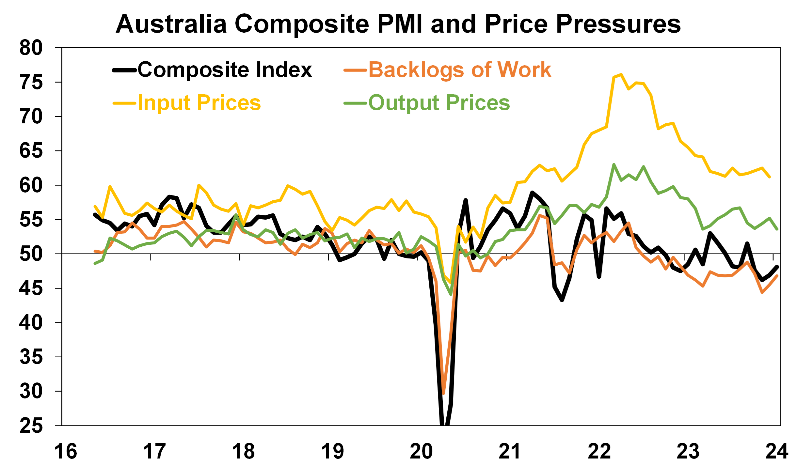

The Australian PMI rose in January with manufacturing and services conditions rising (manufacturing is back to positive but services is still negative which means that activity is contracting). The price indices in the Australian PMI for January also trended down which is another positive sign for inflation (see the chart below).

Source: Bloomberg, AMP

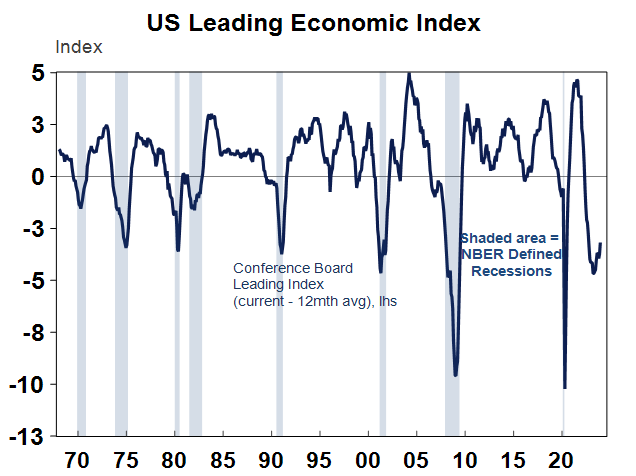

The US leading index fell by 0.1% in November and remains at levels that are typically associated with a recession (see the chart below), despite improving slightly in recent months.

Source: Macrobond, AMP

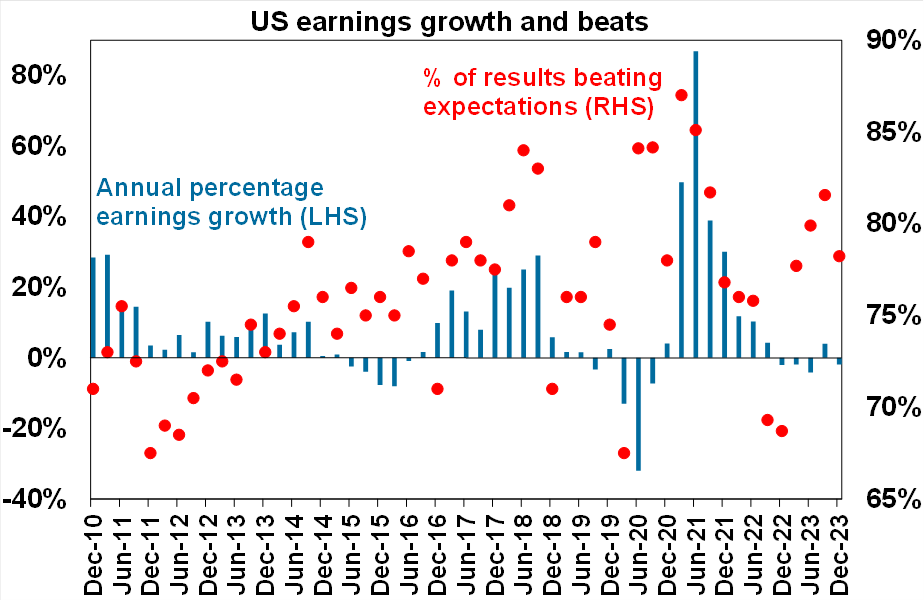

US December quarter earnings are underway, with around 25% of companies having reported results. So far, around 78% of results have had a positive earnings surprise (above the long-run average of 76%) and earnings look to be on track for a 2% year on year fall.

Source: Evercore ISI, Bloomberg, AMP

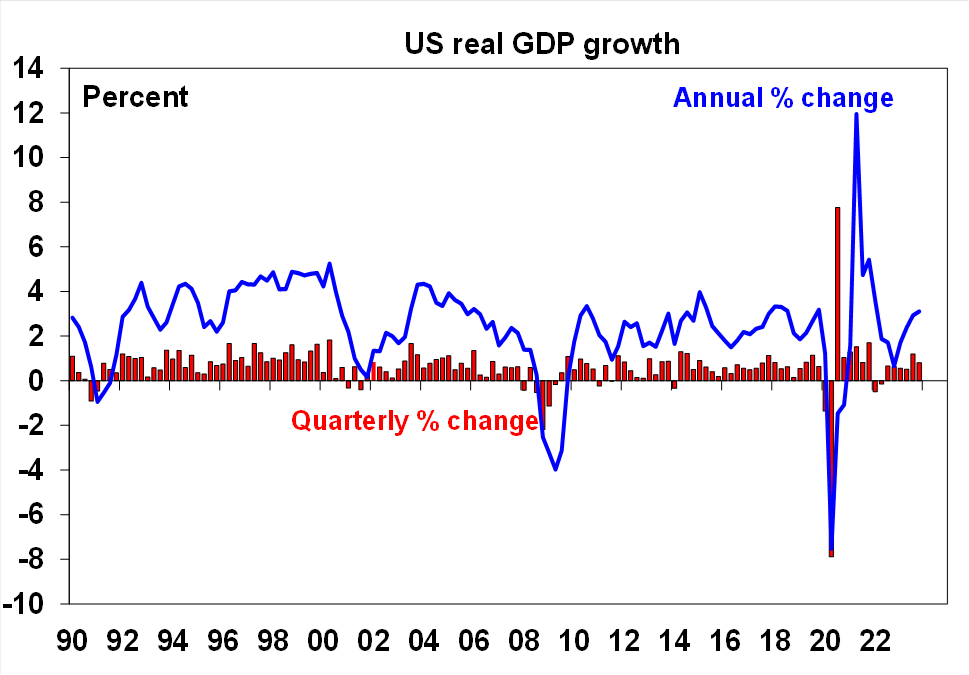

The US economy grew up an annualised 3.3% pace in the December quarter (beating expectations of a 2% lift). The US economy performed very strongly in the second half of 2023 despite rising interest rates but GDP growth is likely to be lower in 2024.

Source: Bloomberg, AMP

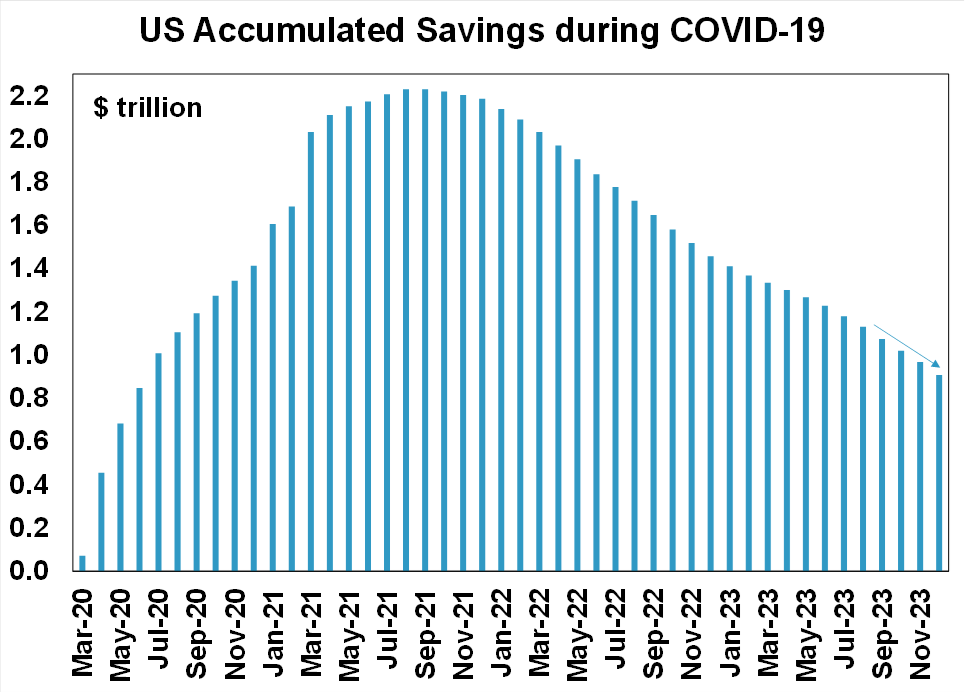

Other US data showed flat durable goods order in December, a rise in December new home sales, better than expected consumer personal spending data and PCE inflation continuing to trend down with the core PCE deflator up by 2.9% over the year to December (down from last month’s 3.2%). Consumer savings data shows that accumulated savings are continuing to dwindle (see the chart below).

Source: Bloomberg, AMP

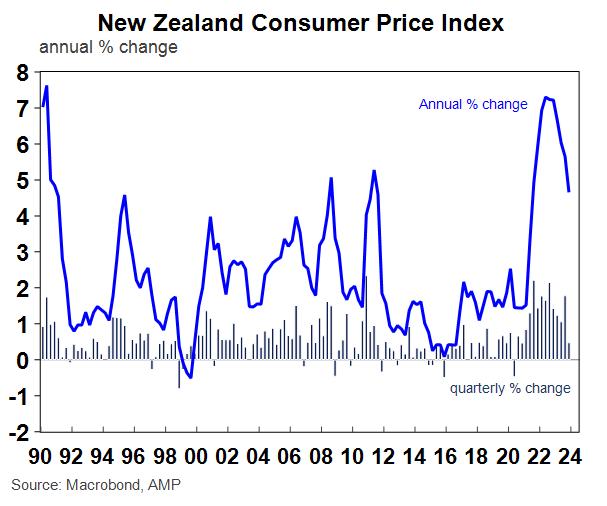

The New Zealand December quarter consumer price index rose by 0.5% or 4.7% over the year (see the chart below), in line with market expectations but below the central bank’s forecasts. CPI inflation has dropped from its peak of 7.3% in Q2 2022. The Reserve Bank of New Zealand is likely to start cutting interest rates in the second half of the year.

Source: Macrobond, AMP

The Bank of Japan kept monetary policy settings unchanged at its meeting this week. Despite mounting pressure on the central bank to tighten monetary policy, the BoJ is waiting to see if core inflation will stay above the 2% target in a “stable manner” before adjusting its stance, but it’s likely that the central bank will move away from its ultra-easy monetary policy conditions in the first half of 2024.

The Bank of Canada kept interest rates unchanged at 5% at its meeting but pivoted in a more dovish direction by removing its bias towards further rate hikes in its policy statement.

The European Central Bank kept interest rates unchanged (with the deposit facility at 4% and the main refinancing rate at 4.5%) with the Governing Council statement indicating that there was progress on inflation but there are no plans to quickly pivot to rate cuts. European economic data is soft and we expect that further deceleration in inflation over coming months will force the ECB’s hand to cut interest rates sooner than it intends.

Australian economic events and implications

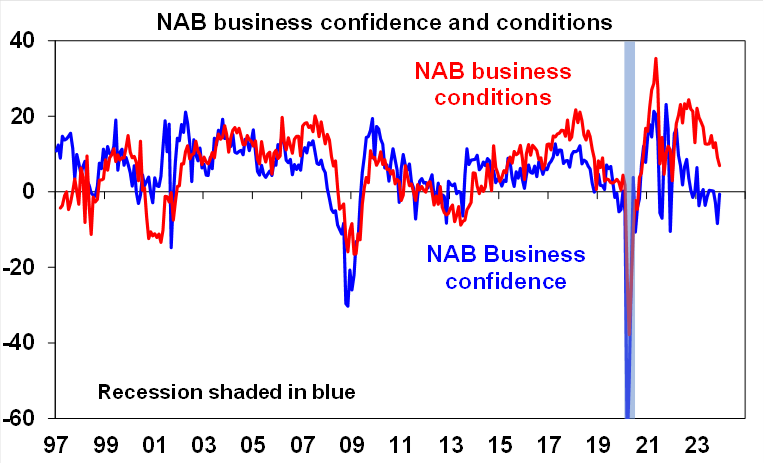

The NAB Business survey for December showed some improvement in business confidence, but the index is still negative and well below long-run average (see the chart below). Business conditions dropped in December but are still positive.

Source: NAB, AMP

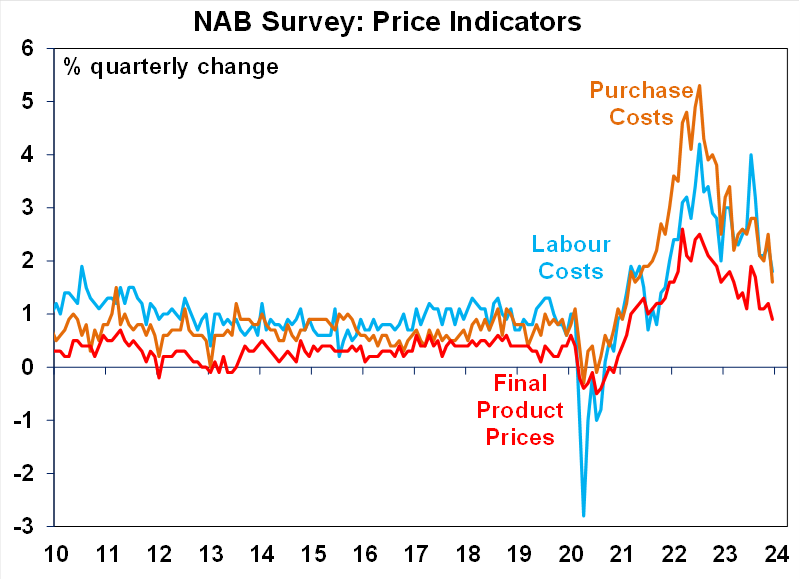

The employment component of the survey eased and cost indicators eased further (see the chart below).

Source: NAB, AMP

What to watch over the next week?

It’s a full data week in Australia, starting with the December retail trade data (on Tuesday) and we expect a 1.8% which would offset the rise in the sales-driven November outcome and indicate a softer-than-usual Christmas trading period. The December quarter consumer price data (on Wednesday) is expected to show headline consumer prices up by 0.7% over the quarter or 4.2% year on year and 0.9% over the quarter for the trimmed mean (4.3% year on year). The monthly consumer price data should show annual inflation running at 3.3% over the year to December. These forecasts are below the RBA’s current inflation projects and should provide some relief that inflation is firmly headed down in Australia. Other data includes December credit figures, January home prices, import and export prices for the December quarter, the NAB quarterly business survey, December building approvals, December quarter producer prices and December housing lending figures.

In the US, the earnings season continues and the FOMC meets next Wednesday. After the release of economic projections and the dot plot at the Fed’s last meeting in December, this meeting is unlikely to deviate significantly from recent communication. Economic data includes a consumer confidence update, the January ISM index and January non-farm payrolls.

Next week’s European data includes consumer confidence, December quarter GDP and consumer price inflation figures.

In China, PMIs for January will be release which are expected to show activity remaining at subdued levels.

Outlook for investment markets

Easing inflation pressures, central banks moving to cut rates and prospects for stronger growth in 2025 should make for okay investment returns in 2024. However, with growth still slowing, shares historically tending to fall during the initial phase of rate cuts, a very high risk of recession and investors and share market valuations no longer positioned for recession, it’s likely to be a rougher and more constrained ride than in 2023.

Global shares are expected to return a far more constrained 7%. The first half could be rough as growth weakens and possibly goes negative and valuations are less attractive than a year ago, but shares should ultimately benefit from rate cuts, lower bond yields and the anticipation of stronger growth later in the year and in 2025.

Australian shares are likely to outperform global shares, after underperforming in 2023 helped by somewhat more attractive valuations. A recession could threaten this though so it’s hard to have a strong view. Expect the ASX 200 to return 9% in 2024.

Bonds are likely to provide returns around running yield or a bit more, as inflation slows and central banks cut rates.

Unlisted commercial property returns are likely to be negative again due to the lagged impact of high bond yields & working from home.

Australian home prices are likely to fall in the next six months or so as high interest rates constrain demand again and unemployment rises. The supply shortfall should prevent a sharper fall & expect a wide dispersion with prices still rising in Adelaide, Brisbane & Perth. Rate cuts from mid-year should help prices bottom and start to rise again later in the year.

Cash and bank deposits are expected to provide returns of over 4%, reflecting the back up in interest rates.

A rising trend in the $A is likely taking it to $US0.72, due to a fall in the overvalued $US & the Fed moving to cut rates earlier and by more than the RBA.

Oliver's insights - the art of happiness

29 April 2024 | Blog This article looks at happiness and whether economics is failing us with its focus on GDP and consumption. Read more

Weekly market update 26-04-2024

26 April 2024 | Blog Dr Shane Oliver notes that shares have bounced but is the correction over?; strong US earnings; US PCE less bad than feared; Australian rate cuts delayed, another rate hike is a high risk; and more. Read more

Weekly market update 19-04-2024

19 April 2024 | Blog Dr Shane Oliver comments on the correction time for shares; escalation risk in Israel's counter-retaliation; rate cut delays but inflation still falling ex US; supply boost helping cool Aust labour market; expect Aust Q1 CPI to slow to 3.4%yoy; and more. Read moreWhat you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

The information on this page was current on the date the page was published. For up-to-date information, we refer you to the relevant product disclosure statement, target market determination and product updates available at amp.com.au.