Investment markets and key developments

Global shares rose over the last week recovering some of their losses from prior weeks helped by no further escalation in the Israel/Iran conflict and solid profit results in the US. However, the gains were limited by inflation and interest rate concerns. For the week US shares rose 2.7%, Eurozone shares rose 1.7%, Japanese shares gained 2.3% and Chinese shares rose 1.2%. The Australian share market was a laggard though, falling back after higher-than-expected inflation led to talk of further RBA interest rate increases, leaving it up only 0.1% for the week. Bond yields rose further, with the Australian 10-year bond pushing up to its highest since last November. Oil, copper and iron ore prices rose but gold prices slipped on reduced safe haven demand and the outlook for high for longer interest rates. The $A rose as the expected gap between US and Australian interest rates narrowed and the $US fell.

It’s too early to say the correction is over. After 4-5% falls to their lows a week ago shares have retraced some of their losses, with Australian shares a relative laggard. The correction could be over and its noteworthy that investor optimism has now been wound back sharply. But there is a significant risk that it’s just a bounce from oversold conditions as valuations remain stretched, investor confidence has not yet fallen to the sort of pessimism often seen at major market bottoms, uncertainty remains regarding the outlook for interest rate cuts and the risks regarding the Israel/Iran conflict remain high. The last share market correction played out over three months into last October and saw shares fall by 9 to 10%, with several short-lived bounces along the way. Either way, we are still inclined to see recent market action as a correction rather than something deeper and continue to see further gains in shares this year once the correction is over as disinflation resumes, central banks ultimately cut interest rates and recession is avoided or proves mild. That said the gains in global and Australian shares over the remainder of the year are likely to be more constrained and more volatile than was the case in the first three months of the year.

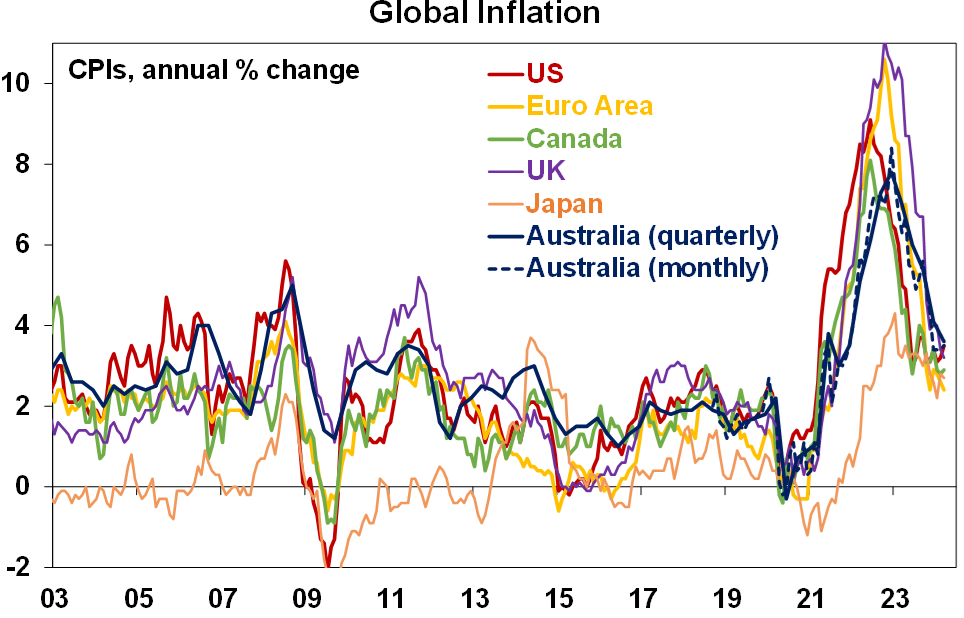

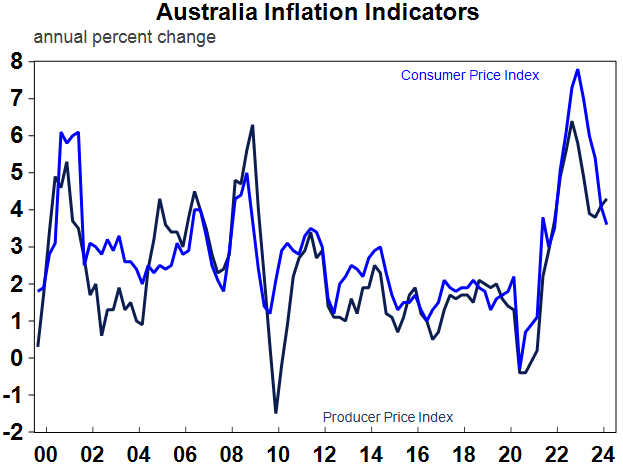

The good news is that annual Australian inflation is continuing to fall being down from a high in December quarter 2022 of 7.8%yoy to 3.6%yoy in the March quarter and it’s in line with the range of other major countries, albeit at the top end.

Source: Bloomberg, AMP

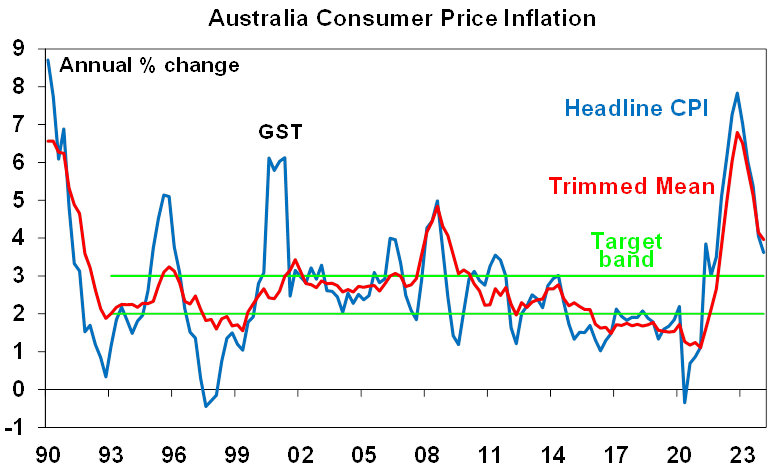

The bad news is that it came in higher than expected and so means that rate cuts will be delayed with a high risk of another rate hike. While annual headline inflation at 3.6%yoy and underlying inflation at 4%yoy slowed in the March quarter both came in stronger than our own, market and RBA forecasts due to strength in services prices - for rents, health, education and insurance in particular. Goods price inflation continues to see softness running at a quarterly annualised pace of 2.1%, but the strength in services inflation at a 5.7% annualised pace pushed up the breadth of CPI items seeing annualised inflation above 3%. While headline CPI inflation still looks on track to fall to the RBA’s forecast for 3.2%yoy by December, underlying inflation looks like coming in above the RBA’s forecast for 3.1%yoy by December and so may be revised up by the RBA in its updated forecasts to be published after its May meeting. Interestingly this will likely just take the RBA’s trimmed mean inflation forecast back to where it was last November. The combination of sticky services inflation will leave the RBA cautious and still waiting for greater confidence that inflation will return to target in a reasonable time frame and its likely to signal this at its May meeting. The RBA will likely also debate whether another rate hike is needed. We don’t think it will be or that the RBA will hike again but it is likely to reinstate its tightening bias and another rate hike is now a high risk. The money market has moved to price in about a 60% probability of a hike by September and sees no cut in the next year.

Source: ABS, AMP

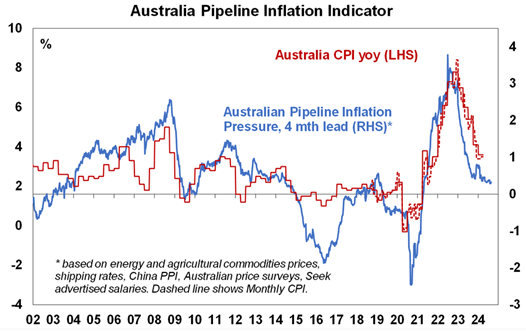

Fortunately, our Pipeline Inflation Indicator is still pointing to lower inflation ahead and the March quarter inflation rate was boosted by seasonal increases for things like health and education so inflation should slow again in the current quarter much as it did in the December quarter. So, although it’s now a high risk we don’t see the need for a resumption of rate hikes and continue to see the RBA being able to start cutting rates this year – but with the March quarter setback it will take longer than earlier thought. So, on the back of stronger jobs data and stronger than expected March quarter inflation we have pushed out our expectation for the start of rate cuts from around mid-year to year end and now only expect one cut this year down from three, but we continue to expect two cuts next year.

Source: Bloomberg, AMP

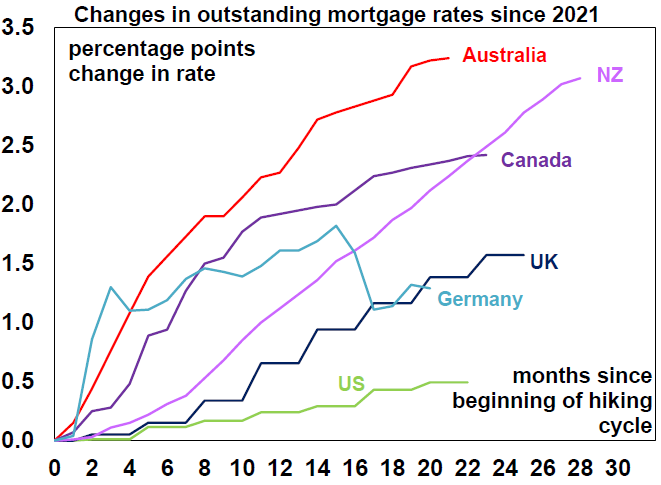

While the RBA has raised rates by less than other major central banks which have converged on 5 to 5.5%, Australian mortgage holders have been world beaters when it comes to the rise in their mortgage rates thanks to their high exposure to variable rates or short dated fixed rates. The average mortgage rate on outstanding mortgages in the US is up just 0.5 percentage points since the start of rate hikes whereas in Australia the rise has been around 3.2 percentage points. While the Australian households have so far been resilient on average despite this, this resilience would be severely tested with more rate hikes particularly as the protective factors (like saving buffers, a strong jobs market and a high proportion of fixed rate loans) of the last two years run down. Which is why we would be cautious of more RBA rate hikes. Of course, this is not to say they won’t happen! Interestingly because of the long and variable lags with which monetary policy impacts the economy Milton Friedman likened a central bank that is too aggressive to “a fool in the shower” who constantly tinkers with the hot and cold taps not allowing for lags and so constantly goes from freezing to being scalded. To its credit and with the benefit of hindsight I think the RBA has managed to avoid this so far.

Source: Bloomberg, AMP

Pre-Budget silly season. The last few weeks have seen the Treasurer commenting that the global outlook is “fragile and fraught” and that the revenue outlook has deteriorated. This looks more like an attempt to dampen expectations ahead of the Budget though as the reality is that the IMF has actually revised up its global growth forecasts and the iron ore price has continued to run ahead of Treasury forecasts making likely another solid budget surplus this financial year. And with inflation proving sticky the upcoming Budget should be focussed on taking slightly more out of the economy than it puts in so as to bear down on inflation and make the RBA’s job easier. There is room for cost-of-living relief and in particular a continuation of energy bill relief makes sense otherwise eligible households will face a rise in electricity bills even though retail prices are falling. And measures are likely to be announced to formally get the “Future Made in Australia” protectionism underway. But any new spending needs to be more than offset by savings elsewhere.

Major global economic events and implications

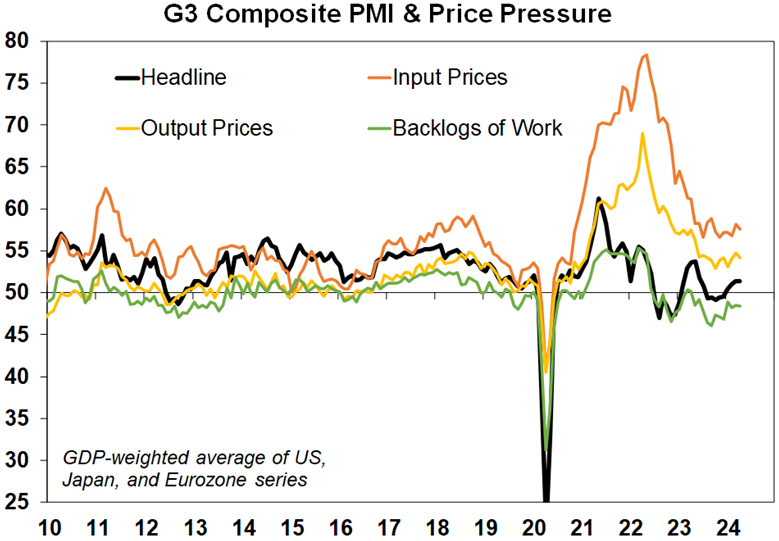

April business conditions PMIs (which are global surveys of businesses) were basically flat on average across major developed countries hanging on to the rebound seen over the last six months and consistent with continued modest growth on average. Manufacturing conditions fell but services rose. Input and output prices fell but only slightly and still remain elevated, particularly for inputs and services.

Source: Bloomberg, AMP

PMIs pointing to global rebalancing? Interestingly the PMIs showed a further improvement in recent underperforming countries – notably Europe, Japan and Australia – but a softening in the strong US economy. The latter is yet to be confirmed by other US indicators but is worth keeping an eye on, particularly the sharp fall in the PMI employment component which points to a sharp slowing in US jobs growth ahead.

Source: Bloomberg, AMP

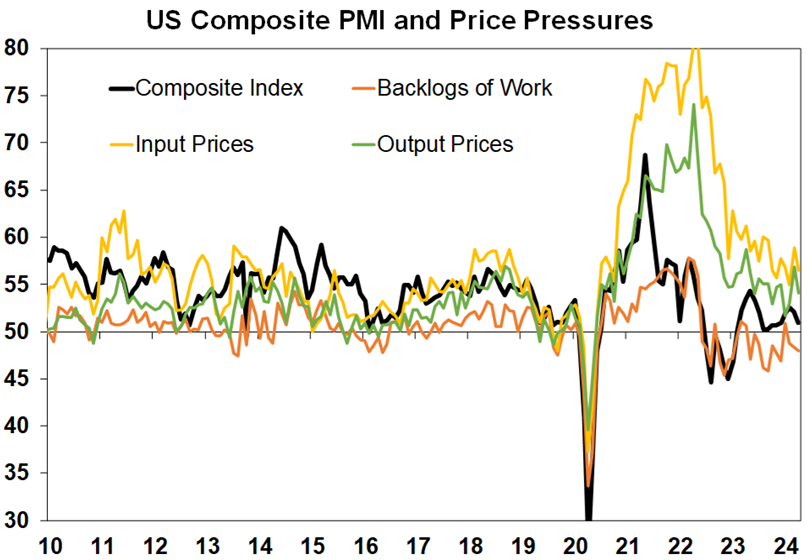

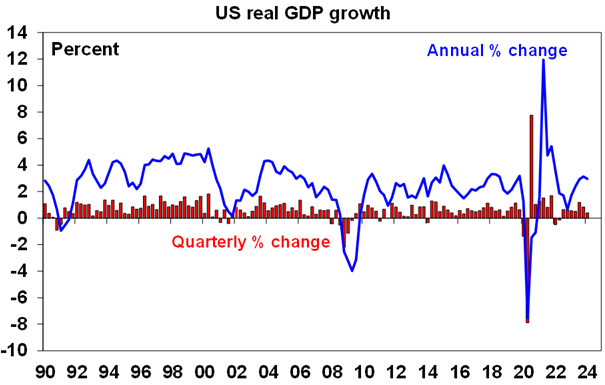

US growth still strong beneath the surface, but March quarter inflation was a concern. US March quarter GDP growth slowed more than expected to a 1.6% annualised pace, but this was due to a 1.3 percentage detraction from trade and inventories, with growth in domestic final demand remaining strong at 2.8% annualised with solid growth in consumer spending, capex and housing construction. Of course, this is dated data with the US PMI along with the US yield curve and leading indicator warning of a slowing ahead.

Source: Bloomberg, AMP

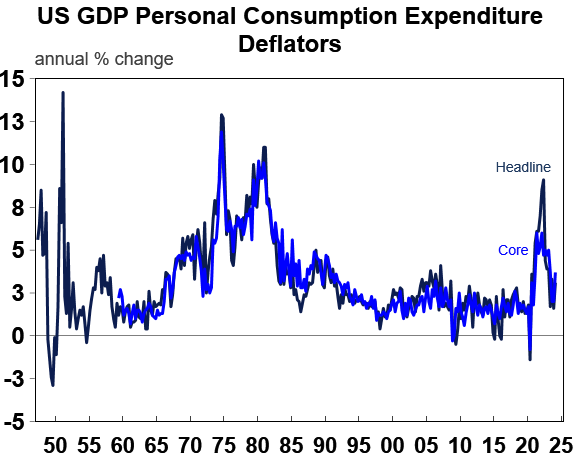

The main concern is that core private final consumption inflation accelerated to a 3.7% annualised pace in the March quarter from 2% in the prior two quarters. Fortunately, most of the rise was in January, with core PCE inflation for March coming in only a little bit higher than expected. But it still had the effect of further pushing out expectations for Fed rate cuts with the first cut now not fully priced in till November, although a cut is 90% priced in for September.

Source: Bloomberg, AMP

In other US data, March underlying capital goods orders and shipments continue to show a flat to modest rising trend and new and pending home sales rose in March but will be constrained like other housing data by the latest back up in mortgage rates. Jobless claims fell and remain very low.

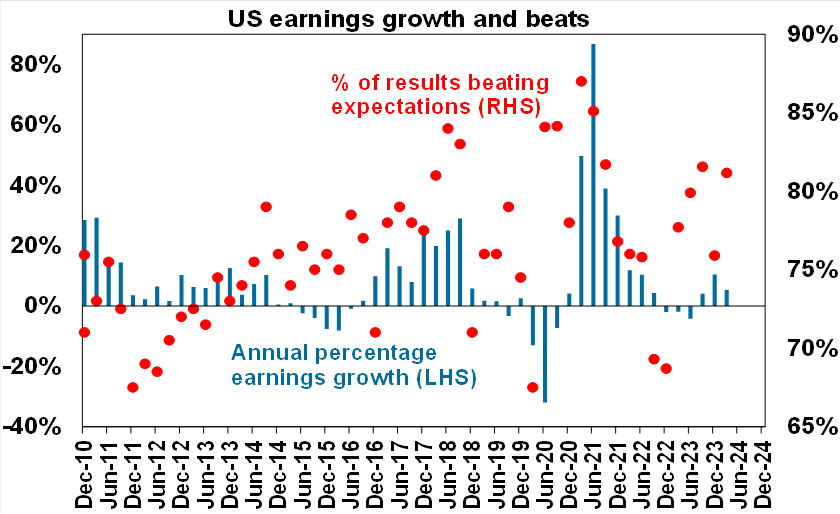

US March quarter earnings to the rescue for shares – well so far at least. 46% of S&P 500 companies have reported so far and the good news is that 80.6% have beaten expectations, against a norm of 76% and earnings growth expectations have increased to 5.3%yoy, from 4.1% two weeks ago. Earnings growth is likely to end up around 8%yoy for the quarter.

Source: Bloomberg, AMP

Along with stronger Eurozone business conditions PMIs in April, the German IFO business climate index also improved further.

The Bank of Japan left rates on hold as widely expected at 0 to 0.1% but removed prior dovish forward guidance (eg “that it anticipates that accommodative financial conditions will be maintained for the time being”). With core inflation only just above 2% its hard to see a lot of tightening from the BoJ. Its key policy rate is only likely to reach around 0.3% or so by year end. Governor Ueda didn’t seem too concerned about the weak Yen which is at a 34 year low and vulnerable to a further fall, seeminly leaving it up to the Ministry of Finance to undertake currency intervention to try and stabilise it.

Australian economic events and implications

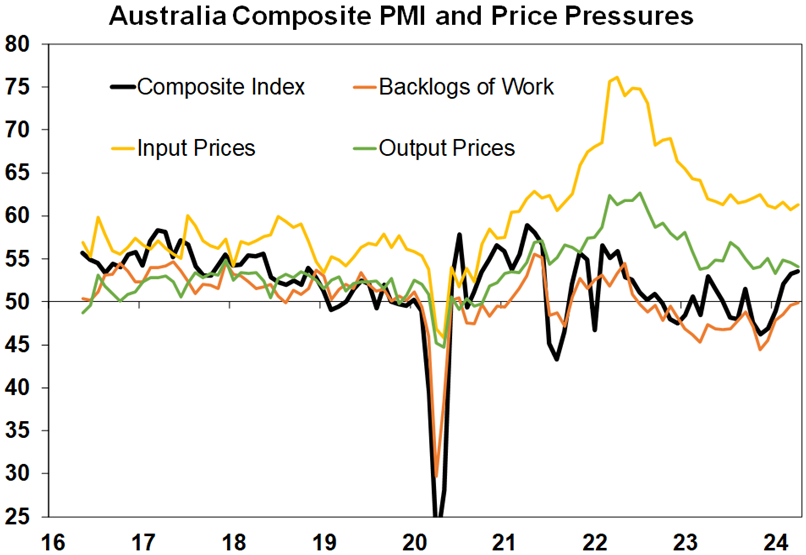

Australian business conditions PMIs for April showed a slight further improvement driven by manufacturing with services remaining solid.

Source: Bloomberg, AMP

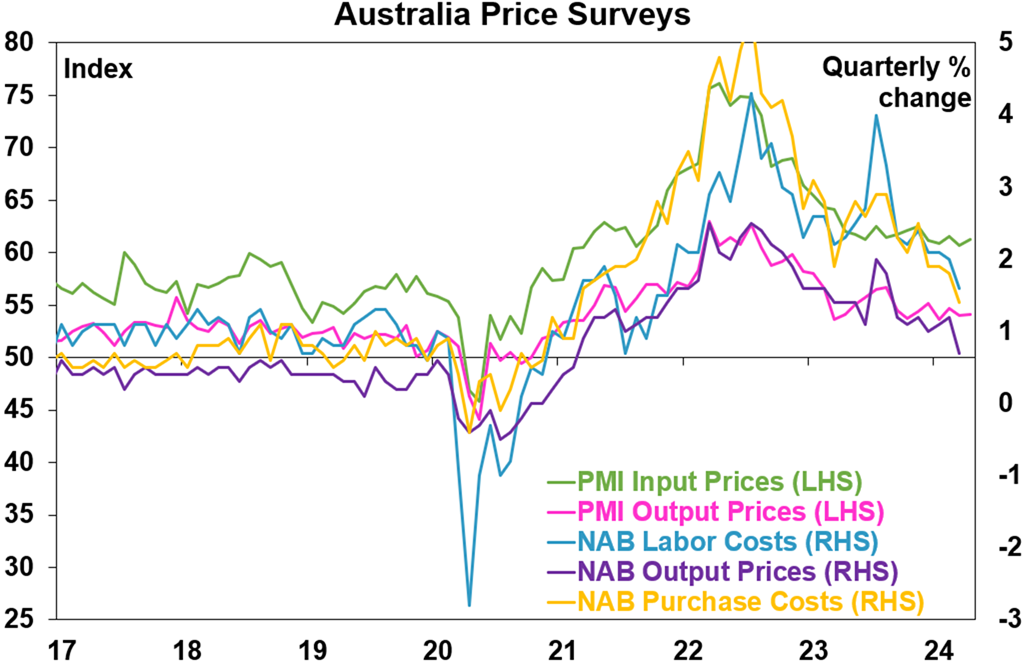

Mixed messages on inflation. The cost and price components in the PMI survey were little changed but still remain elevated. The problem here is all for services, particularly for services input prices possibly reflecting the uplift in labour costs. It contrasts with the much weaker readings in the NAB business survey regarding prices and costs but is consistent with the RBA keeping rates high for longer.

Source: Bloomberg, AMP

Producer price inflation up but import price inflation down. March quarter producer price inflation also came in on the strong side with another 0.9%qoq rise pushing annual producer price inflation up to 4.3%yoy. Against this, import prices fell 1.8%qoq in the March quarter suggesting no upwards pressure on inflation. With the $A still in the same range it’s been for the last year it’s not suggesting that rising imported inflation is a problem for the RBA.

What to watch over the next week?

In the US the focus will be back on the Fed (Wednesday) which is expected to leave rates on hold at 5.25-5.5%. Expect the Fed’s commentary to reiterate the somewhat less dovish guidance we have seen over the last few weeks with Chair Powell likely to repeat that inflation data has not yet provided the Fed with the greater confidence it wants and so it’s appropriate to leave rates high for longer. But he is also likely to indicate that he doesn’t see the economy overheating and still sees the labour market moving into better balance with wages growth moderating leaving the door open for rate cuts later this year. Our base case remains for the first cut to come in September, although a July move is still possible. The March profit reporting season will continue.

On the data front in the US, jobs data for April (Friday) is expected to show a slowing in payroll growth to 250,000 with unemployment unchanged at 3.8% and growth in average hourly earnings edging down further to 4%yoy. The March quarter employment cost index (Tuesday) is expected to have slowed to 4.1%yoy from 4.3%yoy, little change is expected in consumer confidence (also Tuesday), the April manufacturing conditions ISM (Wednesday) is expected to remain around 50 but the services conditions ISM (Friday) is expected to rise to around 52. Job openings and quits data for March will also be released on Wednesday.

Eurozone CPI inflation for April (Tuesday) is expected to have remained at 2.4%yoy with core inflation slowing to 2.7%yoy. March quarter GDP (also Tuesday) is expected to be 0.2%qoq and 0.2%yoy and unemployment for March (Friday) is expected to have remained at 6.5%.

Japanese jobs data for March is expected to show unemployment remaining around 2.6% with industrial production showing a rise.

Chinese business conditions PMIs for April (Tuesday) are expected to soften slightly.

In Australia, retail sales for March are expected to fall 0.2% after a very mild Swift lift in February and March credit growth is likely to have remained modest (Tuesday), CoreLogic home price data for April (Wednesday) is expected to show another 0.6%mom increase, building approvals are expected to show a 2% gain and the trade surplus is likely to remain around $7bn (both Thursday) and housing finance (Friday) is expected to rise 1%.

Outlook for investment markets

Easing inflation pressures, central banks moving to cut rates and prospects for stronger growth in 2025 should make for good investment returns this year. However, with a high risk of recession, delays to rate cuts and significant geopolitical risks, the remainder of the year is likely to be a far rougher and more constrained than the first three months were.

We expect the ASX 200 to return 9% this year and rise to around 7900. A recession is probably the main threat.

Bonds are likely to provide returns around running yield or a bit more, as inflation slows, and central banks cut rates.

Unlisted commercial property returns are likely to be negative again due to the lagged impact of high bond yields & working from home.

Australian home prices are likely to see more constrained gains in the year ahead as the supply shortfall remains, but still high interest rates constrain demand and unemployment rises. The delay in rate cuts and talk of rate hikes risks renewed falls in property prices as its likely to cause buyers to hold back and distressed listings to rise.

Cash and bank deposits are expected to provide returns of over 4%, reflecting the back up in interest rates.

A rising trend in the $A is likely taking it to $US0.70 over the next 12 months, due to a fall in the overvalued $US, but in the near term the risks for the $A are on the downside as the Fed delays rate cuts and given the still high risk of an escalating conflict in the Middle East.

Weekly market update 26-07-2024

26 July 2024 | Blog Dr Shane Oliver discusses the risk off as tech hit continues; correction risks into August/September; global rate cutting cycle underway; Australian June quarter CPI to rise but the hurdle to another RBA rate hike should be high; and more. Read more

Oliver's insights - rise of populism and bigger government

24 July 2024 | Blog This article takes a look at the rise of populism and what it means for economic policies and investors. Read more

Weekly market update 19-07-2024

19 July 2024 | Blog This week shares are down; US election/Trump prospects starting to impact; global rates easing cycle on track; China Plenum; Australian jobs still tight but easing so RBA needs to be careful; and more. Read moreWhat you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

The information on this page was current on the date the page was published. For up-to-date information, we refer you to the relevant product disclosure statement, target market determination and product updates available at amp.com.au.