House prices falling? Inflation easing? Australian recession? It's shaping up to be a big year. Find out how 2024 is likely going to pan out and what you need to look out for.

5 key themes from 2023

Despite lots of angst at the start of the year, 2023 turned out far better than feared.

1. Stronger than predicted growth. Despite worries recession was inevitable, on the back of rate hikes and a rough reopening in China, it’s been avoided so far. Economic growth in 2023 was around 3% globally and 1.9% in Australia,

helped by a population surge partly offsetting severe mortgage pain for some.

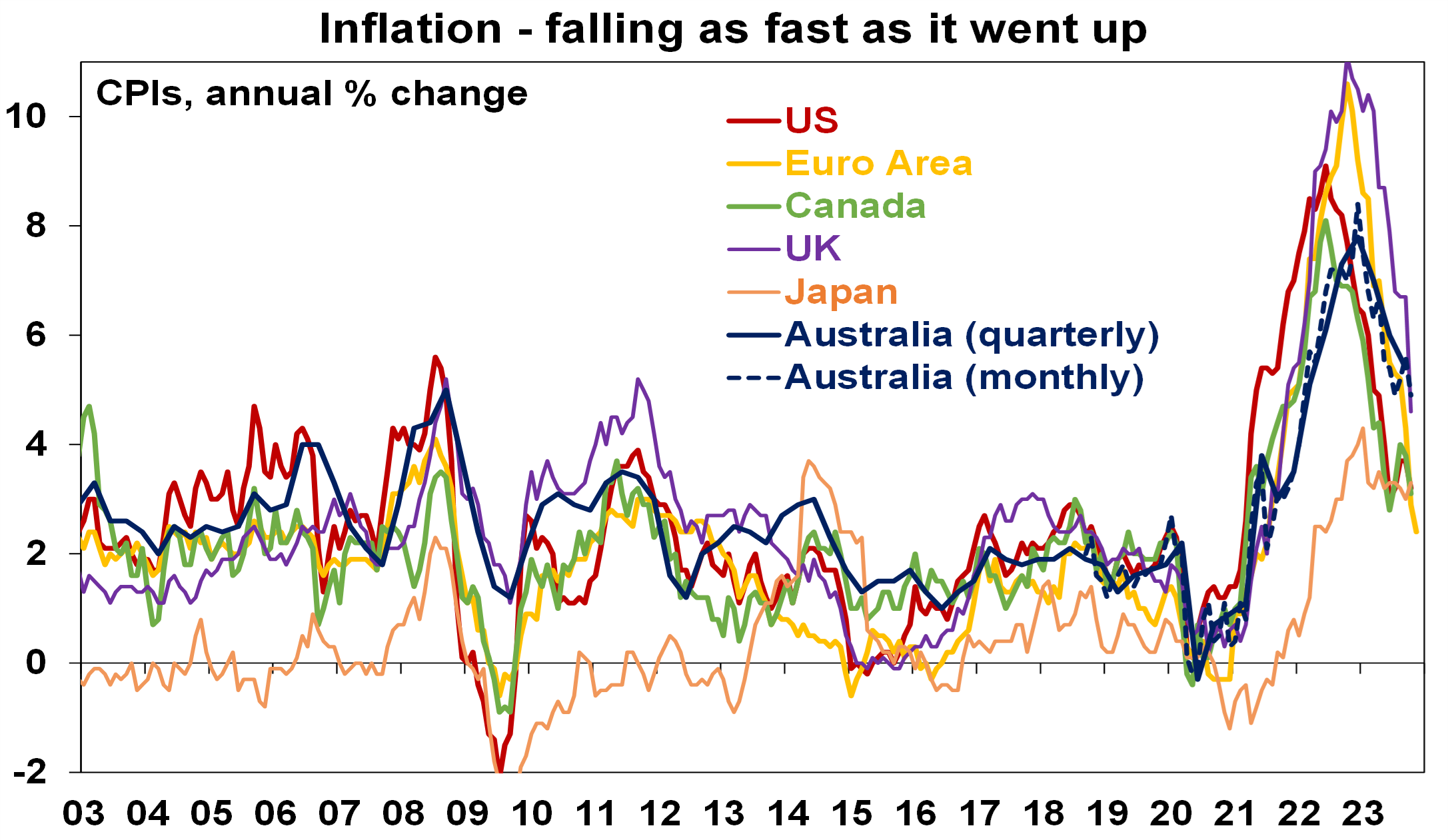

2. Disinflation. Inflation across major countries has fallen sharply from peaks of 8-11% last year to around 3-5%. Australia lagged on the way up and the way down, but we’re falling too.

Source: Bloomberg, AMP

3. Peak interest rates. Most major central banks look to have peaked and this probably includes the Reserve Bank of Australia.

4. Geopolitical threats proved not to be as worrying as feared – the war in Ukraine remained contained, conflict in Israel flared again but hasn’t spread to key oil producers and the Cold War with China thawed a bit. A lack of major elections helped.

5. Artificial intelligence hit the big time after the launch of Chat GPT with hopes it will boost productivity. The immediate beneficiaries were key (mostly US) tech stocks – which helped them reverse the 2022 slump.

There were bumps along the way – notably in the seasonally weak August to October on the back of sticky inflation (a situation where prices do not adjust as quickly to supply and demand changes, leading to persistent inflation) and rates that stayed high for longer. But for diversified investors 2023 turned out okay.

4 big worries for 2024...

1. Inflation is still too high so central banks could still have another drastic turn if it proves sticky above targets.

2. The risk of recession is high reflecting the delayed impact of rate hikes – this could suggest a high risk of a sharp pull back in shares.

3. Risks around the Chinese economy and property sector remain high.

4. Geopolitical risk is high, with half the world’s population seeing 2024 elections.

...and 4 reasons for optimism

1. Inflation has eased sharply to around 3% in major industrial countries and 5% in Australia, and is likely to continue to fall as supply chain pressures reverse, demand cools and labour markets ease.

2. We expect central banks to start cutting rates by mid-year. While there’s still a high risk of one more hike in Australia, falling inflation should head this off. We believe the RBA has peaked ahead of rate cuts starting mid-year, taking the cash rate down to 3.6% by the end of 2024.

3. Any recession in Australia should be mild as there’s a large pipeline of home building work and business investment plans point to growth.

4. Geopolitical risks may not turn out badly – the US wants to avoid escalation in the Israel/Hamas war, Ukraine could turn into a frozen conflict and elections won’t necessarily affect markets.

Overall, global growth in 2024 is likely to be around 2.5%, down from 3% in 2023. Australian growth is expected to slow to 1.5% with very weak, possibly mild recession conditions in the first half but stronger conditions later. Inflation is expected to fall to 3% in Australia.

8 things to expect in 2024…

1. Easing inflation pressures, central banks cutting rates and prospects for stronger growth in 2025 should make for okay returns in 2024. But it’s likely to be a rougher ride than 2023.

2. Global shares are expected to return a far more constrained 7%. The first half could be rough but shares should benefit from rate cuts and lower bond yields.

3. Australian shares are likely to outperform global shares. Expect the ASX 200 to end 2024 at around 7,900.

4. Bonds are likely to provide returns around running yield or a bit more, as inflation slows and central banks cut rates.

5. Unlisted commercial property returns are likely to be negative again due to the delayed impact of high bond yields and working from home.

6. Australian home prices are likely to fall as high interest rates hit demand and unemployment rises, although expect prices to continue rising in Adelaide, Brisbane and Perth. Rate cuts later in the year will help.

7. Cash and bank deposits are expected to provide returns of over 4%.

8. A rising $A is likely to take it to $US0.72.

…and 5 things to keep an eye on

1. Sticky inflation and central banks.

2. The risk of recession and whether it’s mild or deep.

3. The Chinese economy and property sector.

4. US shutdown risks and the presidential election.

5. How Australian consumer and home prices respond to the delayed impact of high rates, including via rising unemployment.

Like to know more?

Oliver's insights - the art of happiness

29 April 2024 | Blog This article looks at happiness and whether economics is failing us with its focus on GDP and consumption. Read more

Weekly market update 26-04-2024

26 April 2024 | Blog Dr Shane Oliver notes that shares have bounced but is the correction over?; strong US earnings; US PCE less bad than feared; Australian rate cuts delayed, another rate hike is a high risk; and more. Read more

Weekly market update 19-04-2024

19 April 2024 | Blog Dr Shane Oliver comments on the correction time for shares; escalation risk in Israel's counter-retaliation; rate cut delays but inflation still falling ex US; supply boost helping cool Aust labour market; expect Aust Q1 CPI to slow to 3.4%yoy; and more. Read moreWhat you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

The information on this page was current on the date the page was published. For up-to-date information, we refer you to the relevant product disclosure statement, target market determination and product updates available at amp.com.au.