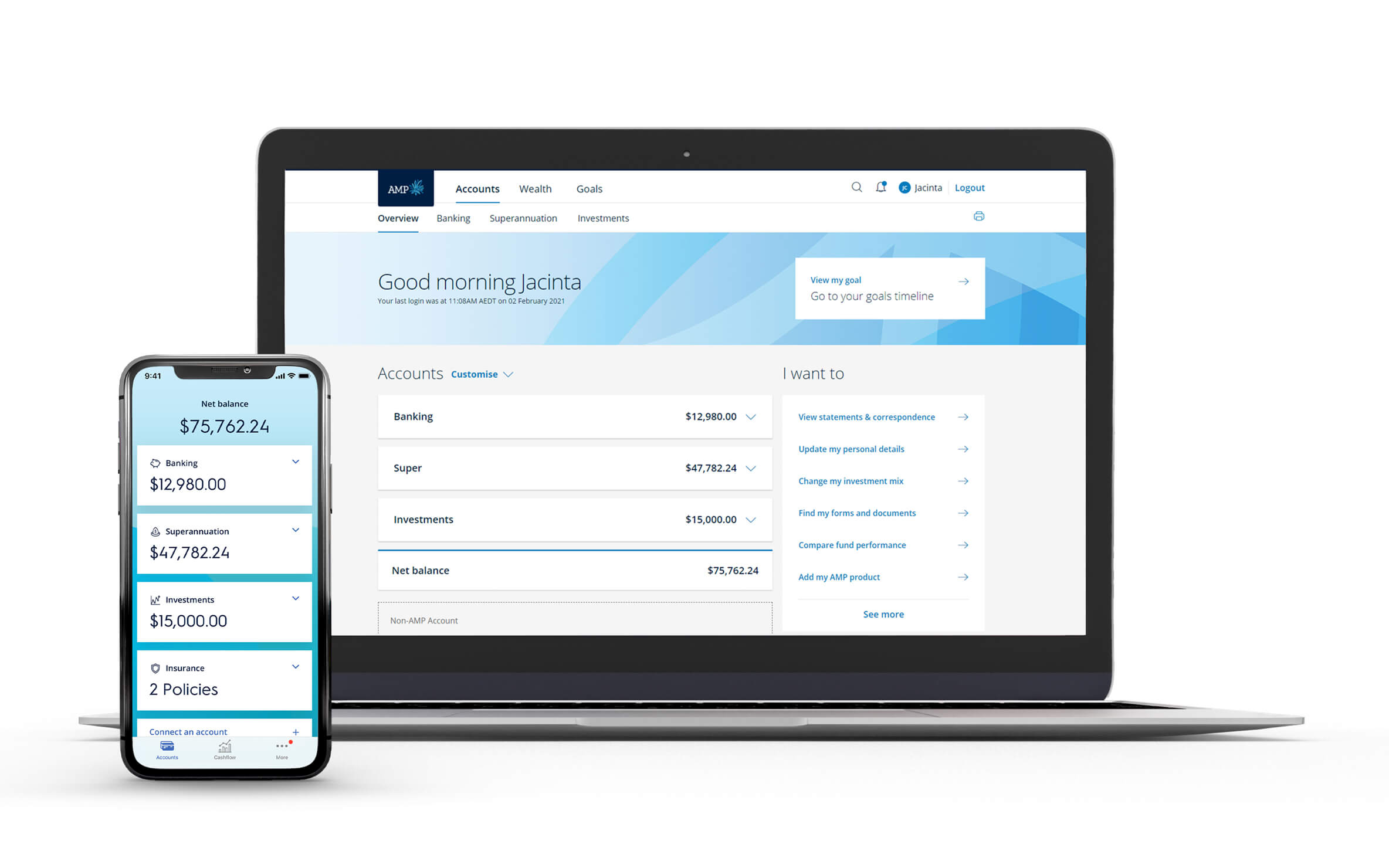

Managing your repayments in My AMP

- Login or register for My AMP

- Select your Home loan account

- Choose Manage repayments in the I want to menu

- Complete and submit the Manage repayements form to update your home loan repayment amount or frequency or type.

Changing your repayments

What changes can I make to my repayments?

Changing your repayment amount

Make extra repayments to get on top of your home loan.

Change payment frequency

Paying fortnightly instead of monthly, for example, can make a big difference to interest charges.

Change repayment type from interest only to principal and interest

The benefit of switching to principal and interest repayments is that it reduces the outstanding loan balance and lowers interest repayments over the life of the loan compared to interest only loans. It is important to consider that switching to Principal and Interest can increase your regular repayment amount.

How do I switch my repayment type to Principal and Interest?

You can send us a request to change your repayment type from Interest Only to Principal and Interest via My AMP secure messaging.

Switching your repayment type from Interest Only to Principal and Interest is free.

What you need to know

The product issuer and credit provider is AMP Bank Limited ABN 15 081 596 009, AFSL and Australian credit licence 234517.

It’s important to consider your circumstances and read the relevant Product Disclosure Statement or Terms and Conditions before deciding what’s right for you. This information hasn’t taken your circumstances into account. Information including interest rates is subject to change without notice.

Any application is subject to AMP Bank’s approval. Terms and conditions apply and are available at amp.com.au/bankterms or 13 30 30. Fees and charges may be payable. Full details are available in the Fees and charges guide.

This information is provided by AMP Bank Limited. Read our Financial Services Guide available at amp.com.au/fsg for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. All information on this website is subject to change without notice.

AMP Bank is a member of the Australian Banking Association (ABA) and is committed to the standards in the Banking Code of Practice.

A target market determination for these products is available on our TMD page.