What are the benefits of increasing my home loan?

If you want to consolidate your debts, renovate your home or make a large purchase, you can fund this by increasing your loan. Topping up your loan can be a cost effective solution as interest rates on home loans are typically lower than credit cards or personal loans.

How much can I increase my home loan by?

The amount you are able to increase your loan by is dependent on how much equity is available in your property, your current financial situation and is also conditional on credit approval. Also by increasing your loan amount, this can mean your repayments amounts may increase. It is important that you seek financial advice to determine that this is the best solution for you. There may also be fees associated with increasing your loan amount.

Who is eligible to increase their home loan?

- You have to be a current AMP home loan customer.

- You need to have a My AMP account or create one.

- You must be over 18 years of age.

- You need to be an Australian or New Zealand citizen or permanent resident.

How do I apply?

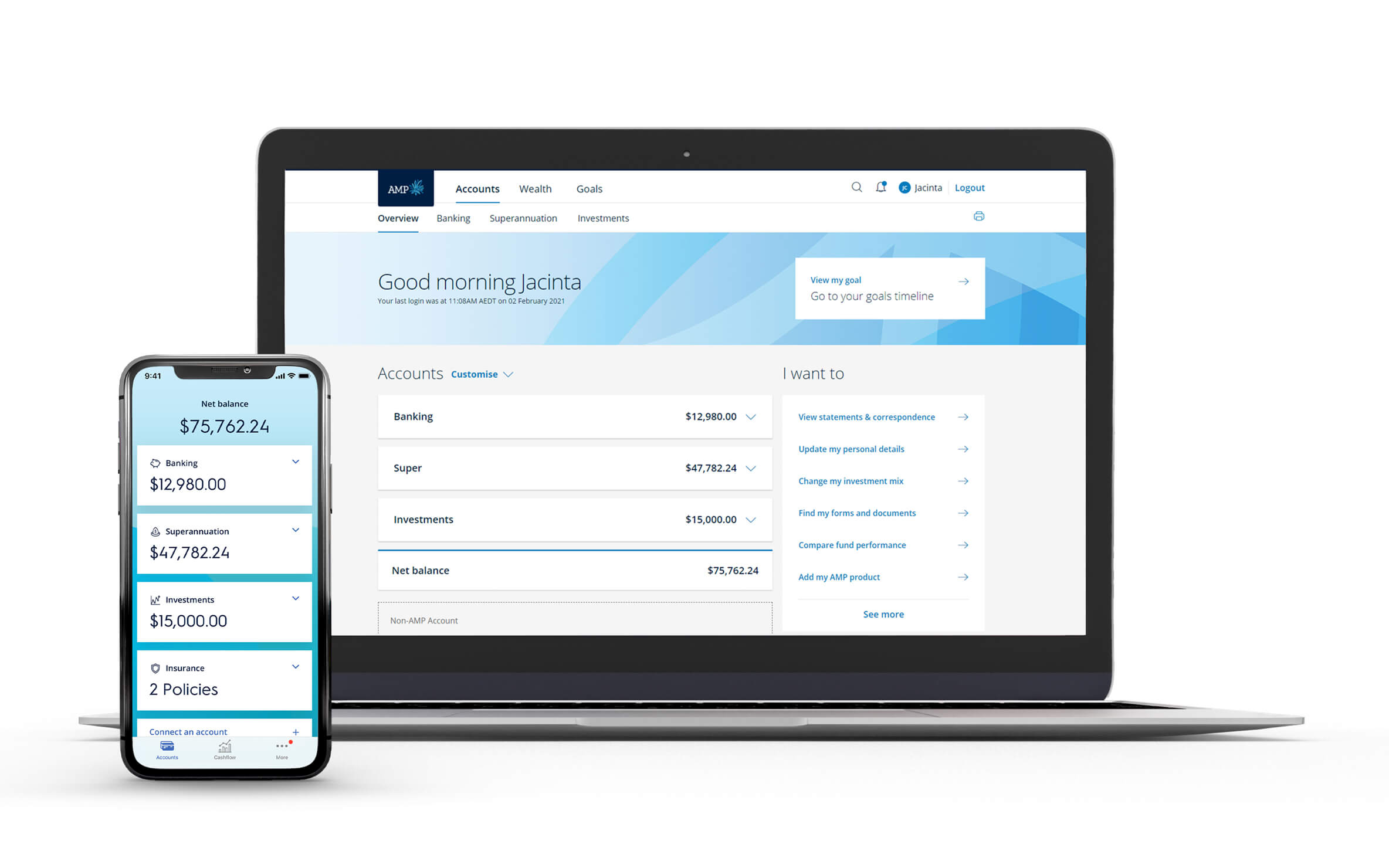

- Login or register for My AMP

- Select your Home loan account

- Under "Your account details", click Apply now next to Apply for an increase

- Complete and submit the form

- Once the form is complete, no matter the outcome, one of our Relationship Managers will be in touch within two business days to talk you through what you're looking for and how we might help.

Remember, increasing your home loan means you're taking on more debt and potentially higher loan repayments, so make sure you consider your circumstances before making any decisions.

What you need to know

The product issuer and credit provider is AMP Bank Limited ABN 15 081 596 009, AFSL and Australian credit licence 234517.

It’s important to consider your circumstances and read the relevant Product Disclosure Statement or Terms and Conditions before deciding what’s right for you. This information hasn’t taken your circumstances into account. Information including interest rates is subject to change without notice.

Any application is subject to AMP Bank’s approval. Terms and conditions apply and are available at amp.com.au/bankterms or 13 30 30. Fees and charges may be payable. Full details are available in the Fees and charges guide.

This information is provided by AMP Bank Limited. Read our Financial Services Guide available at amp.com.au/fsg for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. All information on this website is subject to change without notice.

AMP Bank is a member of the Australian Banking Association (ABA) and is committed to the standards in the Banking Code of Practice.

A target market determination for these products is available on our TMD page.