AMP Capital’s Australian Equities Portfolio Manager, Dermot Ryan, shares why a vaccine could be great news for stocks in 2021.

In a massive healthcare breakthrough in the race to save and protect lives from COVID-19, Pfizer and Moderna have both announced some highly promising vaccine trial results. All going to plan, this should save lives and, in time, help us return to some form of normality.

While it’s not yet a finished product, the vaccine shows great promise and is close to the mark, with largescale testing that hasn’t shown side effects. In the future, we might be able to contain the COVID-19 virus more than the flu, even if it mutates.

Why markets are watching

Markets, of course, are also interested in its progress as it could result in increased movement and reopening for society; and all the spending that comes with it. It may also mean an end for deflation. Both are powerful forces that can push equity profitability higher.

In my view, it won’t be a straight line upwards, but the recent surge of optimism (and its positive reflection in the stock market) could show the path forward as the world emerges from a tough year.

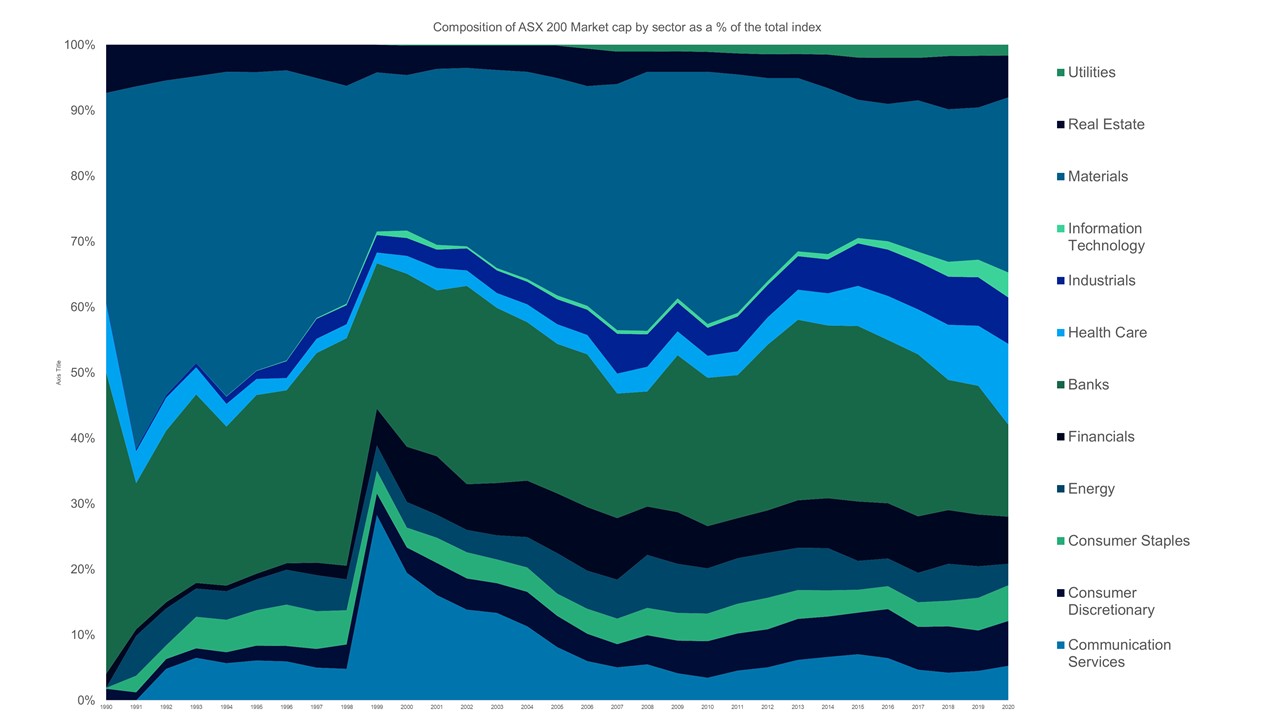

The graph below shows sectors that lead the vaccine rally; Travel, Banks and Energy are coming off all-time lows of market cap share.

Source: AMP Capital, Bloomberg, note travel stocks are a subset of both industrials and consumer discretionary

The winners so far

Sectors like travel, energy and banking that were suffering the most at the beginning of this quarter are among the biggest gainers of the vaccine’s boost so far.

Since the pandemic hit, energy has lacked demand, and we’ve seen weak commodity prices across oil, gas and electricity. Banks have had low margins and credit growth, both of which have bottomed and are now going higher in our market. Travel stocks have, of course, suffered from tourism being depleted.

These three poster child sectors are now so cheap they might offer high earnings per share (EPS) growth. Having much lower valuations than you can get in the growth side of the market means they can make sustained gains as we manage to control the virus.

Could there be losers?

The losers from a vaccine could surprisingly be those that have gained most this year:

- tech disrupters, which had been gaining not on profitability but on the promise of it down the line after a fast transition to a digital and contactless COVID-19 world.

- some health care stocks that provided personal protective equipment or ventilators for the outbreak, and

- online shopping, which enjoyed a massive boom as people shopped from their homes.

If customers start spending again in real businesses, the growth these stocks experienced during COVID may be under pressure and start to decline. This could result in the value of these companies going down.

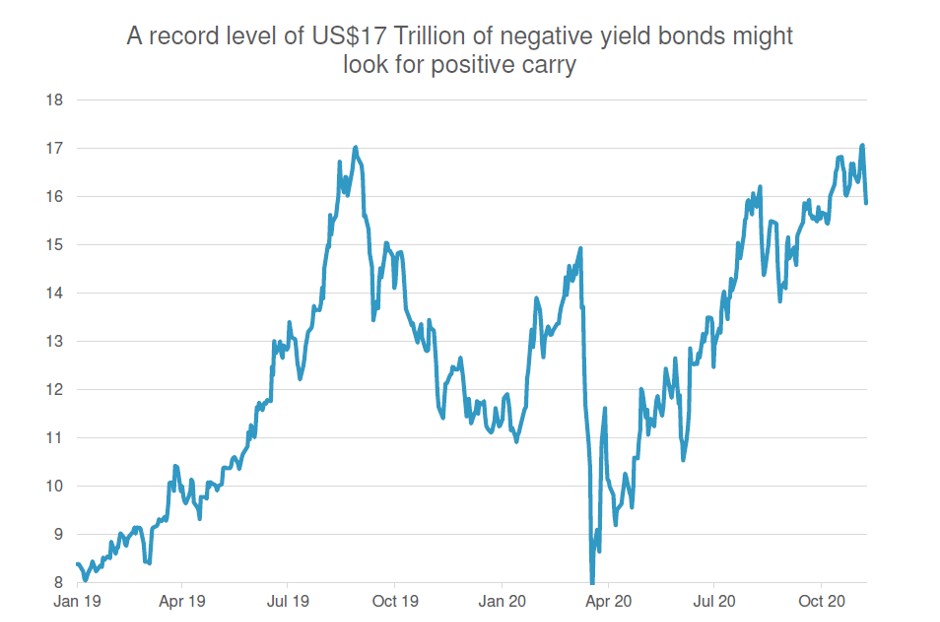

Source: AMP Capital, Bloomberg

Then there is the challenge of finding an alternative to stocks when interest rates are at an all-time low. Would you believe that there are currently US$17 trillion in bonds with negative yields in the world right now? That’s 12 times the size of our Aussie equity market, or about the same value as all stocks currently listed on the New York Stock Exchange. This is because of zero interest rates, risk aversion and a lack of lower risk assets.

Importantly too, should the vaccine fix inflation and boost growth, we should start to see investments roll out of these bonds (which are a cost to hold) and into equities that are reasonably valued.

We also expect dividend growth is going to come back strongly after bottoming in August this year, providing opportunity for strong franked returns for Australian investors.

As we get closer to a widespread vaccination plan, we’ll likely see these trends continue, and it could be a great boost for equity returns in 2021.

For more on economics, markets and investments, check out the AMP Insights hub and AMP Capital website, or subscribe to AMP Capital insights for regular updates.

More investment insights

Weekly market update 26-07-2024

26 July 2024 | Blog Dr Shane Oliver discusses the risk off as tech hit continues; correction risks into August/September; global rate cutting cycle underway; Australian June quarter CPI to rise but the hurdle to another RBA rate hike should be high; and more. Read more

Oliver's insights - rise of populism and bigger government

24 July 2024 | Blog This article takes a look at the rise of populism and what it means for economic policies and investors. Read more

Weekly market update 19-07-2024

19 July 2024 | Blog This week shares are down; US election/Trump prospects starting to impact; global rates easing cycle on track; China Plenum; Australian jobs still tight but easing so RBA needs to be careful; and more. Read moreImportant information

While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent of AMP Capital.