How do Australians feel?

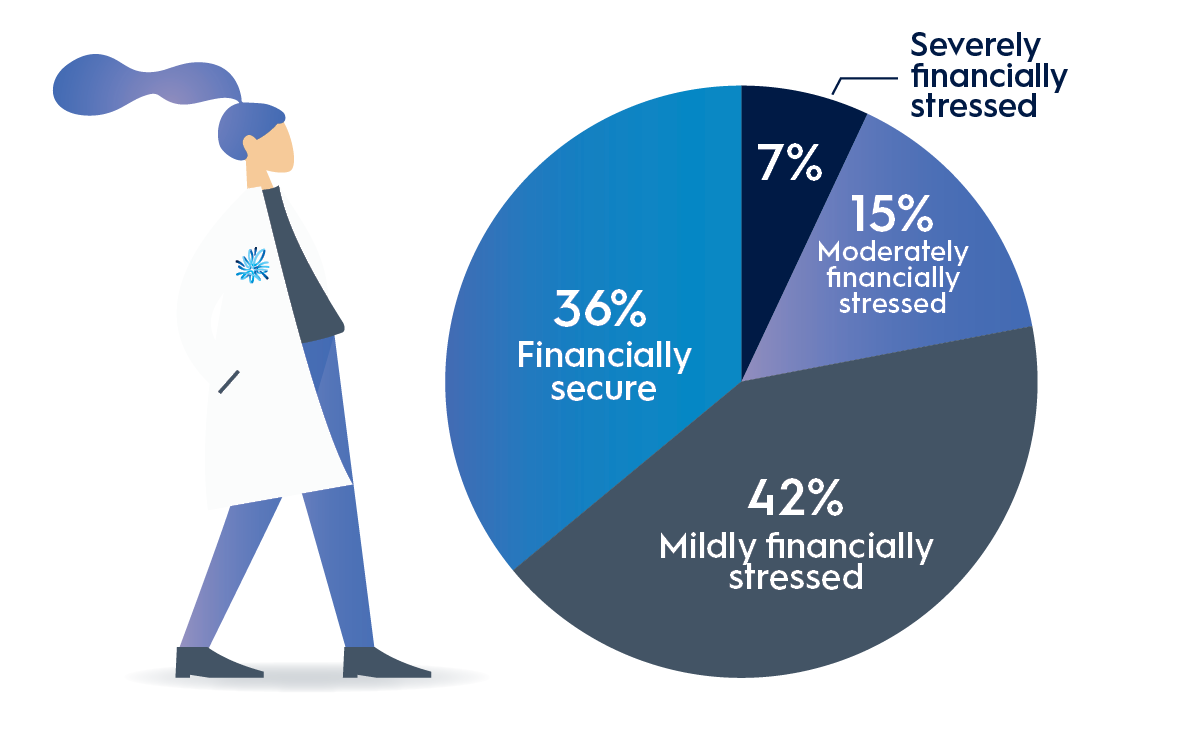

Financial stress is being felt by 64% of Australians

$66.8bn in economic revenue is being lost annually due to financial stress

61% of Australians would rather work longer than adjust their expected standard of living in retirement

27% of women, up from 19% in 2020, are feeling financially stressed

2022 financial stress

Australians’ feelings of financial stress have increased from 2020, 64% of you don’t feel secure about your finances. We understand; the cost of living is rising, political uncertainty has increased and the effects of the COVID-19 pandemic are being felt.

Our research also shows that people who set financial goals and plan for the future not only have a more optimistic outlook on their future, but also enjoy better financial outcomes.

We have created a number of educational articles to bring our Financial Wellness research to life, shine a light on key insights and provide you with simple actions you can take to improve your financial wellness today.

Test your financial wellness

Explore our educational articles

Different strokes for different folks – Australians and money

17 October 2022 | Blog AMP’s 2022 Financial Wellness in the Workplace report highlights seven different personal finance profiles. So which one are you? Read more

How to cool down if you’re getting in a hot state with your finances

02 September 2022 | Blog The 2022 AMP Financial Wellness report highlights increasing stress levels Read more

Are you on track with your finances?

26 August 2022 | Blog Ahead of the game or racing to catch up…find out what you should be doing at your age with your finances Read more

How the job you do can affect your financial stress

26 August 2022 | Blog AMP’s 2022 Financial Wellness report highlights different levels of stress among Australian workers Read more

Financial wellness over the years

26 August 2022 | Blog If you think it’s been a tough few years, you’re not wrong. But there are ways to take control of your finances…starting with super Read more

Stressed but surviving - Aussie women and their finances

19 August 2022 | Blog The 2022 AMP Financial Wellness in the Workplace report highlights increasing stress levels. Read more

Why do you need superannuation?

19 August 2022 It pays to start taking your super seriously. After all, it’s your money and your future. Read more

How much super should I have at my age?

06 October 2023 | Super See the average super balance for your age group, so you can get an idea of how your super savings compare. Read moreWe're here to help

Let us help you

All AMP clients have access to our team of super coaches, at no extra cost. Let us help you take control of your finances and plan for the future.

Download the 2022 research report

The full AMP Financial Wellness report is available for you to download.

What you need to know

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account.

It’s important to consider your particular circumstances and read the relevant product disclosure statement, Target Market Determination or terms and conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy.

All information on this website is subject to change without notice. AWM Services is part of the AMP group.

Products in the AMP Super Fund and the Wealth Personal Superannuation and Pension Fund are issued by N.M. Superannuation Proprietary Limited (N.M. Super) ABN 31 008 428 322 (trustee), which is part of the AMP group (AMP).

The super coach session is a super health check and is provided by AWM Services. It is general advice conversation only. It does not consider your personal circumstances.