Every two years AMP commissions a large-scale body of research to better understand how Australians are feeling about their finances.

We look at mental health levels, work productivity and fulfilment, and feelings towards retirement, and dig deep into what’s driving concerns to better understand how Australians want to be supported when it comes to their finances.

Other profiles

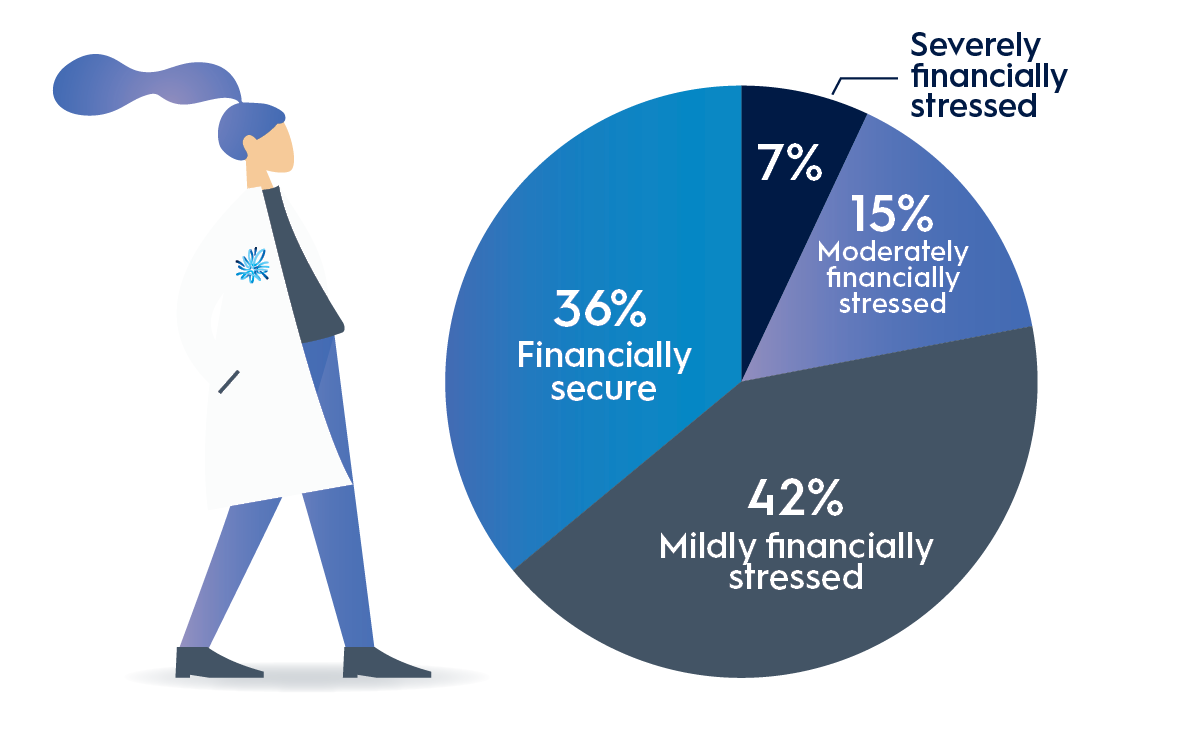

Financially secure

You’re fortunate enough to be feeling financially secure, along with 36% of other working Australians, although COVID has left fewer people feeling the same – two years ago it was half the workforce. You’re more likely to seek advice from professionals such as advisers, brokers and bank managers to help you achieve a specific goal, one goal at a time (e.g. pay off your home loan faster, buy an investment property or pay for children’s education). You’re quite confident about your finances and, crucially, you’re more likely to have well-defined goals. You know where you want to go and how you want to get there. You’ve created so many good habits, it would be a shame not to pass them on to the next generation. If you have kids, you can start teaching them about spending wisely and saving.

Moderately financially stressed

Like almost two million other working Australians, you’re feeling the pinch – that’s 15% of the workforce, up from 11% two years ago. Your working hours were more likely to be affected by the COVID restrictions and you’re probably worried about cost of living pressures. If you’re starting to feel your finances are in danger of getting out of control, you could look at how to manage your money better and get on top of your debt to avoid paying too much in interest.

Mildly financially stressed

Like 42% of working Australians, you’re not feeling too worried about your finances – up from 35% two years ago. You’re more likely to be retired or if you’re working, your hours probably weren’t too affected by COVID restrictions. You could get on the front foot with your finances – think about whether your money could be working harder by investing as well as saving. And it’s never too early – or late – to create a retirement checklist…here’s a starting point.

Severely financially stressed

Like almost a million other working Australians, you’re not feeling great about your finances – that’s 7% of the workforce, up from 3% two years ago. You’re more likely to be a woman, a part-time worker or aged between 30 and 44. And you could very well be working in an industry like wholesale trade, administrative and support services or health care and social assistance. If you’re feeling overwhelmed it’s hard to know where to start getting on top of your finances. But one good place is budgeting – work out what’s coming in, what’s going out and go from there. And planning can really help you feel more in control – here are 6 steps to building good financial habits. We have also created a number of specific action guides that provide step-by-step guidance, tips and information on money management, debt management, super, retirement and property.

Download our action guides

We have compiled a range of easy-to-use action guides that provide in-depth information on how to tackle specific financial issues. Feel free to download these step-by-step guides to access expert information, tips and case studies.

We're here to help

Financial wellness hub

Visit our financial wellness hub to access articles and tips designed to give you tools to help ease financial stress.

Explore AMP’s advice pathways

Sometimes it’s hard to know where to start when it comes to finances. AMP customers have access to a range of free advice channels where you can speak to an expert and get help.

Explore nowWhat you need to know

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account.

It’s important to consider your particular circumstances and read the relevant product disclosure statement, Target Market Determination or terms and conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy.

All information on this website is subject to change without notice. AWM Services is part of the AMP group.

Products in the AMP Super Fund and the Wealth Personal Superannuation and Pension Fund are issued by N.M. Superannuation Proprietary Limited (N.M. Super) ABN 31 008 428 322 (trustee), which is part of the AMP group (AMP).

The super coach session is a super health check and is provided by AWM Services. It is general advice conversation only. It does not consider your personal circumstances.