If you’d like your money to make a difference to the world as well as your future, responsible investing may be for you.

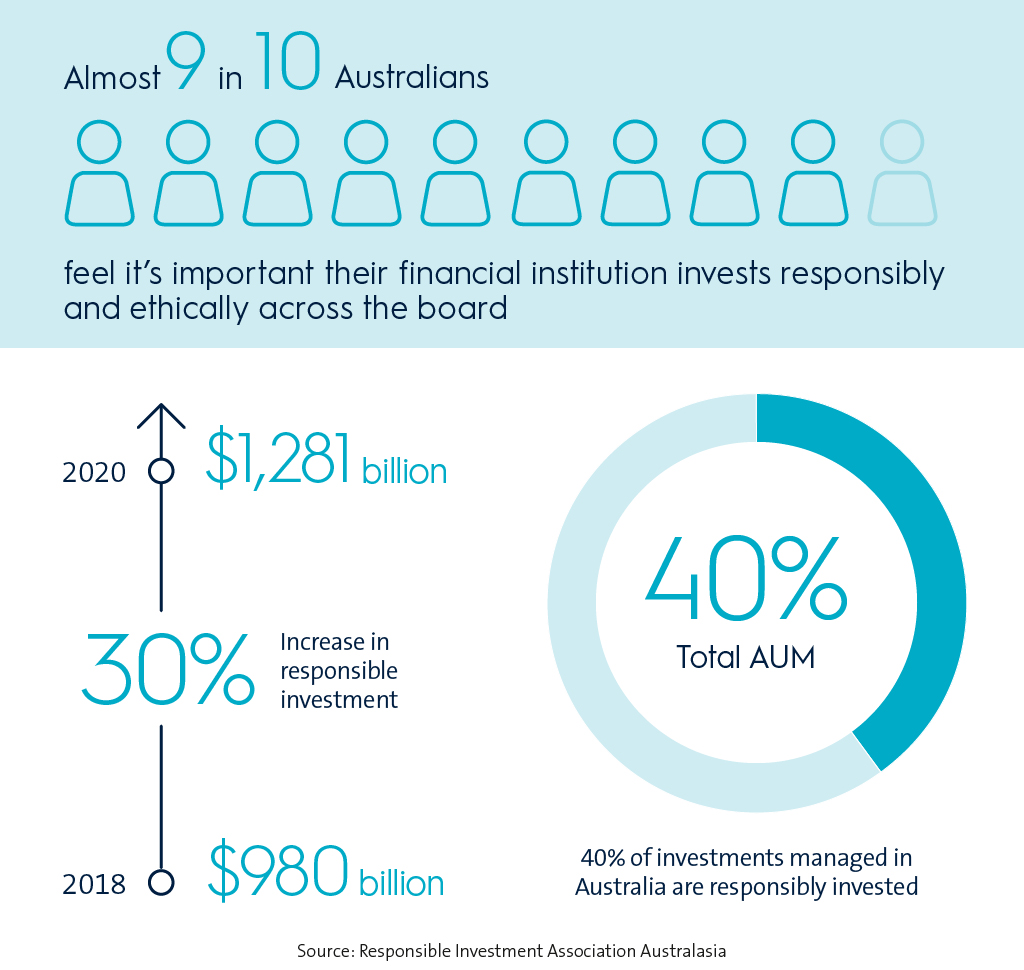

Almost 9 in 10 (89%) Australians feel it’s important their financial institution invests responsibly and ethically across the board1.

Ethical, social and governance (ESG) investments accounted for $1,281 billion—or 40%—of assets under management in Australia at the end of 20202, growing at 15 times the rate of the overall investment market.

What is responsible investing?

As we continue to battle the extremes of bushfires, drought and floods, consumers are increasingly looking for investment managers to take into account ESG issues as well as financial performance.

While environmental concerns are a hot topic, ESG investing also encompasses social issues, as well as how companies make decisions and manage risks.

- Environmental issues—climate change, carbon emissions, waste production, pollution, management of natural resources.

- Social concerns—working conditions, human rights, community engagement, health and safety, employee relations, diversity.

- Governance of companies—executive pay, political lobbying, bribery and corruption, board diversity and structure, tax strategy.

How does ESG investing work?

There are plenty of ways investment managers incorporate ESG into their processes—two common methods are negative and positive screening.

- Negative screening is where investment managers exclude companies or sectors based on specific ESG criteria for example those involved in controversial or unethical business practices, such as human rights abuses, animal testing or selling harmful products like firearms and tobacco.

- Positive screening is where investment managers look for companies or sectors with a strong record in positive solutions and sustainable practices such as renewable energy.

How ESG investing can influence returns

A common concern about responsible investing is that incorporating ESG factors into the investment process, or screening out certain companies, may compromise investment performance. But recent research shows responsible investment can make financial sense, with ESG assets under management matching or outperforming mainstream funds over most time frames and asset classes3, despite the impact of COVID-19.

One thing to be aware of is many of these investment options are still relatively new so their long-term performance is hard to gauge at this stage.

What ESG investment options are out there?

If you’re looking to contribute to positive change in the world, the good news is there’s more choice than ever.

The Responsible Investment Association Australasia has now certified over 200 responsible investment products.

But there’s still some way to go to match investment options with consumer preferences.

As well as fossil fuels, consumers tend to care most about human rights abuses and animal cruelty, while investment managers offer products that most commonly exclude tobacco and weapons.

How to get started with responsible investing

If you’re considering making the change to ethical investing, or you’re keen to see how your current investments stack up, here are some steps you can take to get started.

- Think about what’s important to you—everyone’s values are different so identify the areas where you don’t want to see your money invested and the areas where you could put your money to make a positive impact.

- Ask where your money is invested—a good place to start is online, where many super funds or investment managers have information about sustainability and ESG.

- Do your research—there are many responsible and ethical super funds, investment products and fund managers out there.

- Ask for help—if you need assistance finding out what you’re invested in or how to access more ethical investment options, ask your financial adviser.

Investing responsibly with AMP

At AMP we believe sustainability means meeting the needs of the present without compromising future generations.

- We’ve received the top Prime ranking for the way we manage ESG issues in our corporate business, placing AMP in the top 10% globally in our industry4.

- We’re continually monitoring the way we create and protect value for our clients, our people and our community—check out our 2020 Sustainability Report.

- We’ve added an ESG-focused investment option to our AMP Super Fund product menus.

- We’ve developed MyNorth Sustainable Managed Portfolios to help you invest based on your values—to find out more talk to your financial adviser or call us on 1800 667 841.

1 Responsible Investment Association Australasia, From values to riches 2020 Charting consumer expectations and demand for responsible investing in Australia p5

2 Responsible Investment Association Australasia, Responsible Investment Benchmark Report 20121, p5

3 Responsible Investment Association Australasia, Responsible Investment Benchmark Report 2021 p10 figure 10

4 Institutional Shareholder Services. Rating as of 2 June 2021. More information is available on the ISS website.

Subscribe to our newsletter

Oliver's insights - 21 great investment quotes

05 March 2024 | Blog Investing can be scary and confusing at times. But the basic principles of successful investing are timeless and quotes from experts help illuminate these. Read more

Economic Forecast - 2024

23 February 2024 | Blog Dr Shane Oliver reflects on key themes from the past year and suggests what investors should look out for in 2024. Read more

Oliver's insights - nine key things for successful investing

20 November 2023 | Blog Successful investing is not always easy and can be stressful. Even in good times. For this reason, it’s useful for investors to keep a key set of things in mind. Read moreWhat you need to know

Any advice on this page is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature only. It doesn’t consider your personal goals, financial situation or needs. It’s important you consider the appropriateness of any advice and read the relevant product disclosure statement and target market determination available at amp.com.au, before deciding what’s right for you.

NMMT Limited ABN 42 058 835 573, AFSL 234653 (NNMT) issues the interests in and is the responsible entity for MyNorth Managed Portfolios through which MyNorth Sustainable Managed Portfolios is offered. MyNorth is a trademark registered to NMMT. AWM Services and NMMT are part of the AMP group and can be contacted on 131 267 or askamp@amp.com.au.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services it provides. You can also ask us for a hard copy. All information on this website is subject to change without notice.