Tax cuts proposed in the Federal Budget were passed in parliament on Friday 9 October, and you might see some of the benefits before Christmas.

The government has brought forward tax cuts originally planned for 1 July 2022 and backdated them to 1 July 2020. Plus, low and middle-income earners are still able to benefit from existing tax offsets.

Has my marginal tax rate changed?

The upper thresholds have increased for some tax brackets, as highlighted in the table below.

| Marginal tax rate* % | Original threshold income range $ pre-budget | New threshold income range $ 2020/21 |

| 0 | 0 - 18,200 | 0 - 18,200 |

| 19 | 18,201 - 37,000 | 18,201 - 45,000 |

| 32.5 | 37,001 - 90,000 | 45,001 - 120,000 |

| 37 | 90,001 – 180,000 | 120,001 - 180,000 |

| 45 | > 180,000 | > 180,000 |

(*excluding 2 % Medicare Levy)

Source: https://www.amp.com.au/insights/grow-my-wealth/2020-21-federal-budget-roundup

Can I benefit from the tax offsets?

If you earn up to $126,000 per year, you may be eligible for the low and middle income tax offset (LMITO). This was previously introduced as a temporary measure and scheduled to end when the 1 July 2022 tax cuts kicked off. But the good news is that despite bringing forward these tax cuts, the government has kept the LMITO for the 2020–21 financial year1.

And, if you earn less than $66,667 per year, you may be eligible for an additional tax offset called the low income tax offset (LITO). As part of this package of tax cuts, this tax offset was increased from $450 to $700.

Find out more information on what you might be entitled to here.

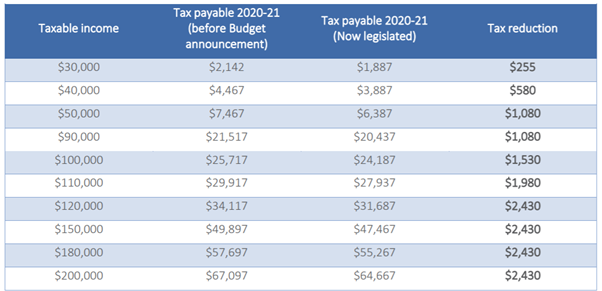

How much will I save from the tax cuts?

The below table2 shows indicative tax cuts, based on the legislative changes for an individual in 2020-21, to the tax rates, thresholds, and offsets that were applicable for 2020-21 (before these changes):

Source: Lower Taxes Budget 2020-21 fact sheet (extract) – Individual below Age Pension age

When will I receive the new tax savings?

Your take-home pay should reflect the new rates before Christmas. The Australian Taxation Office (ATO) has given employers until 16 November to make changes to payroll processes and systems3.

As you’ll have already paid personal income tax at the original rate since 1 July this year, you’ll receive your entitlement to the reduced tax payable for the entire 2020–21 income year when you lodge your income tax return.

Where to go for more information

The good news is that most working Aussies will be taxed less this financial year, and if you want to get an idea of how much better off you might personally be, try the government’s Budget calculator.

If you find yourself with a little extra in the bank over the coming months, consider ways you can make the most of it:

- Think about starting an emergency or rainy day fund, so you can feel more financially prepared.

- With 1 in 6 people struggling with credit card debt, paying off a bit extra each month can help reduce the amount of interest you pay.

- Give your super a boost by making additional contributions. This may be an especially good idea if you’ve withdrawn some super through the government’s early access scheme this year.

For more tips on how to better manage your money, check out our Insights hub.

1 JobMaker Plan - bringing forward the Personal Income Tax Plan

2 AMP TapIn Flash, Personal income tax now law, October 9 2020/14

3 https://www.ato.gov.au/Rates/Tax-tables/6

Subscribe to our newsletter

7 ways to start saving this new financial year

18 July 2024 | Super The 2023-24 financial year is now behind us and there’s nothing like closing a chapter to inspire thoughts of a fresh start. Here are some tips to get on top of your finances for 2024-25. Read more

How to maximise your 2024 tax refund

18 July 2024 | Finance 101 With tax time nearly upon us, you might be interested in the following tips, which may help to increase the amount of money you get back. Read more

Super and tax changes that could affect you from 1 July 2024

01 July 2024 | Blog A number of changes to the super and tax system could create opportunities for Australians of all ages. Here’s what’s happening. Read moreWhat you need to know

This information is provided by AWM Services Pty Ltd (ABN 15 139 353 496), is general in nature only and hasn’t taken your circumstances into account. Before deciding what’s right for you, it’s important to consider your particular circumstances and read the relevant product disclosure statement or terms and conditions available from AMP at amp.com.au or by calling 131 267.

All information on this website is subject to change without notice. Although the information is from sources considered reliable, AMP does not guarantee that it is accurate or complete. You should not rely upon it and should seek professional advice before making any financial decision. Except where liability under any statute cannot be excluded, AMP does not accept any liability for any resulting loss or damage of the reader or any other person.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive relating to products and services provided to you. You can also ask us for a hardcopy. All information on this website is subject to change without notice. AWM Services is a part of AMP group.