Investment markets and key developments

Global share markets mostly rose over the last week supported by resilient economic data in the US, lower inflation readings and nothing new from central banks. For the week US shares rose 2.3%, Eurozone shares rose 2.8% and Japanese shares gained 1.2%, but Chinese shares fell 0.6%. Reflecting the positive global lead along with lower-than-expected monthly Australian inflation data the Australian share market rose 1.5% over the last week with gains led by IT, property, consumer discretionary and energy shares. Bond yields rose. Oil prices rose but metal and iron ore prices fell. The $A also fell slightly, while the $US was flat.

The 2022-23 financial year saw a solid rebound in superannuation returns (of around 8-9%) after the negative returns of the prior year as global and Australian shares rebounded on signs that inflation has peaked, central banks may be near the top on rates and as worries about the war in Ukraine receded. Global shares returned around 16% or around 18% once dividends are included and Australian shares rose 9.7% or about 14% allowing for dividends. And Australian bond returns look to have been modestly positive as bond yields settled down, after last year’s losses. The relative underperformance of Australian shares kicked in over the last six months and reflects a combination of increased hawkishness on the part of the RBA and concerns about the strength of the recovery in China.

We continue to see shares doing okay on a 12-month view as central banks ease up as inflation cools but the risk of a near term correction is high. Leading economic indicators continue to point to a high risk of recession in the US and the risk of recession in Australia is now around 50%. China’s recovery is looking less robust than expected and policy stimulus there so far has been pretty modest. Central banks are probably close to the top but they remain hawkish with a high risk of going too far. And while the month of July is often good for shares (particularly in Australian shares after June tax loss selling is reversed) the period out to September-October is often rough for shares.

Central bank leaders are continuing to warn of more rate hikes ahead – while nothing new this was the message from the Fed’s Powell, the ECB’s Lagarde and the Band of England’s Bailey at the ECB’s forum in Sintra. BoJ Governor Ueda also alluded to the possibility of policy tightening if the BoJ became confident in its forecast for 2% inflation in 2024.

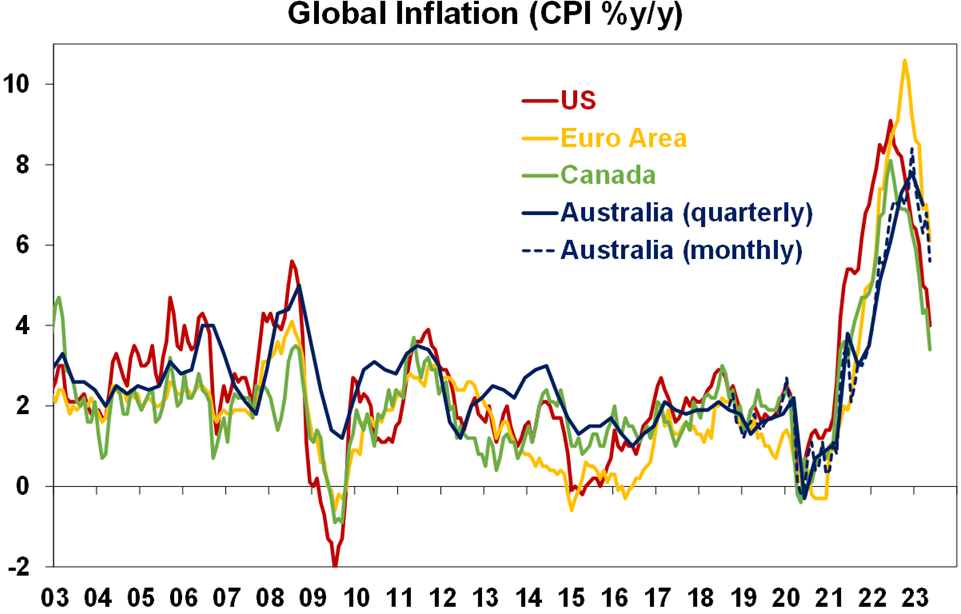

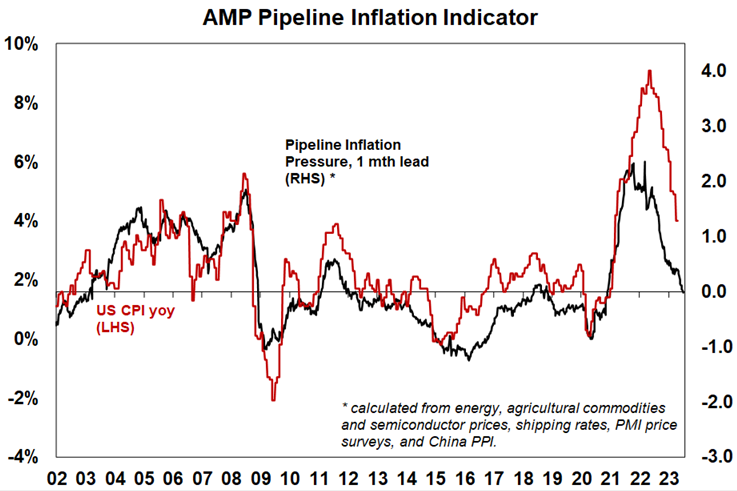

The risk remains high that major central banks will end up tightening more than necessary as the news flow on inflation remains positive - with Canadian inflation falling further to 3.4%yoy in May (from a peak last year of 8.1%), Eurozone inflation falling to 5.5%yoy in June (from a peak last year of 10.7%) with inflation in Spain falling to just 1.9%yoy, US business surveys continuing to show falling inflation pressures along with our US Pipeline Inflation Indicator and Australia’s Monthly CPI Indicator falling to 5.6%yoy in May. While services inflation remains high in many countries, it lagged on the way up and is likely just doing the same thing on the way down. Similarly, while Australian inflation is higher than in the US and Canada this appears to be because it lagged both countries on the way up and so is just doing the same on the way down.

Source: Bloomberg, AMP

Source: Bloomberg, AMP

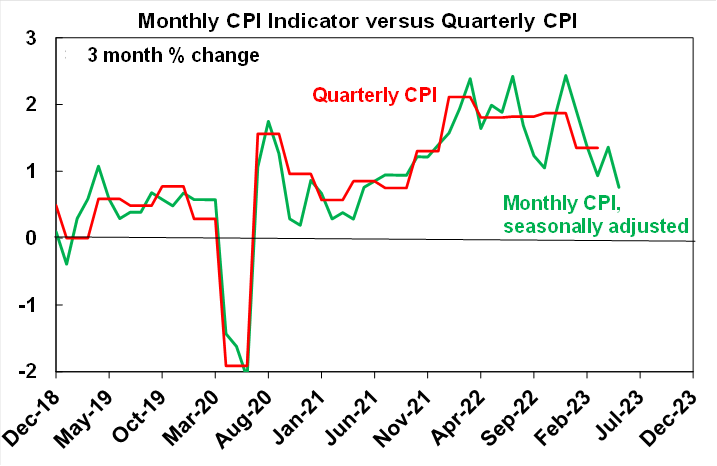

The Australian Monthly CPI Indicator fell to 5.6%yoy its lowest since April last year confirming the downtrend from the 8.4%yoy high in December. There is now a clear downtrend evident in the rates of inflation for clothing (where prices are actually falling), new dwelling costs, furnishings, and holiday travel. In fact the 3 month rate of change in the seasonally adjusted monthly CPI has now slowed to 0.8% (or 3% annualised). The downtrend in the Monthly Inflation Indicator provides some confidence that Australia’s inflation profile is following that of Canada (where inflation has fallen to 3.4%yoy) rather than the UK (where inflation is still 7.9%yoy). Against this though the Monthly CPI Indicator is notoriously volatile (which questions whether its compilation is a good use of public money in the first place), pressure remains on services inflation with eg meals out and takeaway foods, rents and insurance inflation still accelerating and a sharp rise ahead in gas and electricity prices and underlying measures of inflation remain above 6% - particularly once fruit & vegetables, petrol and holiday travel are excluded.

Source: ABS, AMP

On balance, we see the continuing downtrend in the Australian Monthly CPI Indicator as providing confirmation that inflation has now peaked and it provides breathing space for the RBA to pause its rate hikes on Tuesday. But while it’s a close call, on balance we think that the RBA is likely to opt for another 0.25% hike in the week ahead given its concerns about still high underlying inflation, sticky services inflation and rising wages growth. Either way the RBA will likely retain its tightening bias and we are continuing to allow for another two more hikes taking the cash rate to 4.6% over the next few months. (See more details on our cash rate forecast in the “What to watch over the next week?” section below).

The Government has indicated it will announce its decision regarding whether to offer RBA Governor Lowe an extension of his current term which expires in September or to opt for a new Governor. Political commentary suggests the Government will opt for a replacement. From an economic point of view that would be a mistake. The suggested replacements such as the current Deputy Governor Michelle Bullock, Finance Secretary Jenny Wilkinson or Treasury Secretary Steven Kennedy would be imminently qualified to be RBA Governor but we are halfway through the inflation fighting war and changing the RBA Governor now would not be optimal in terms of maintaining inflation fighting credentials which could make it harder to get inflation back down (meaning higher than otherwise interest rates under his replacement until they gain credibility). Changing Governor Lowe might also be interpreted as being due to annoyance that he has raised interest rates but doing so would be seen by many as a form of political interference in the RBA which would raise concerns about its independence and may also result in higher borrowing costs for Australia than would otherwise be the case. Yes, the RBA under Governor Lowe has made some mistakes in recent years but so too have other policy makers in Australia and globally, the times have been extraordinary, and the RBA has played a role in achieving a near 50 year low in unemployment. And if raising interest rates is seen is the problem with Governor Lowe - other central banks have been even more aggressive in raising interest rates than the RBA has.

Russian instability following the Wagner Group mutiny is ambiguous for investment markets. On the one hand cracks in support for Putin may be seen as good news for Ukraine and ending the war, particularly if Putin is replaced by someone less hardline. But on the other hand by emboldening Ukraine it may delay the end of the war, threats to Putin may see him take desperate actions, even if he is replaced it may be by someone who is even more hardline and instability in Russia could further threaten global commodity supply.

In terms of the potential Taylor Swift lift to the economy and maybe inflation its been enhanced by the addition of two more concerts resulting in a total capacity of about 630,000 fans. Taylor's Australian concerts next February will be a big thing. These are big events across consecutive days so there will be a bump in related employment, accommodation demand and demand for transport in and into and out of Sydney and Melbourne. A potential feel-good factor may also help (although this may be offset by the many who missed out on tickets – including me!). There may also be a boost to inflation in February next year via higher travel and accommodation costs (much like the Beyonce blip in Sweden in May). However, any boost to the economy and inflation is likely to be short lived and so the RBA will rightly look through it with no impact on interest rates. However, by February the economy could be quite depressed as cumulative rate hikes impact so any Taylor Swift lift to help shake it off even if its temporary will be welcome.

Economic activity trackers

Our Economic Activity Trackers rose in Australia and the US over the last week but fell slightly in Europe. They continue to indicate a clear slowdown in the US but just a loss of momentum in Australia and Europe.

Levels are not really comparable across countries. Based on weekly data for eg job ads, restaurant bookings, confidence, credit & debit card transactions and hotel bookings. Source: AMP

Major global economic events and implications

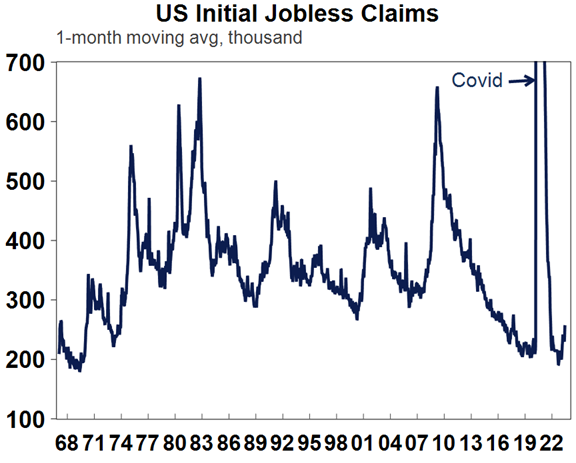

US data releases over the last week were mostly solid. Consumer confidence, durable goods orders, home prices and new home sales all rose by more than expected. Jobless claims fell although the four-week moving average is still rising. And March quarter GDP growth was revised up to 2% annualised from 1.3% reflecting stronger consumer services and net exports. Although it should be noted that consumer confidence remains relatively depressed and core capital goods orders have been flat this year, the US economy generally continues to hold up better than feared even. However, leading indicators are still pointing down, jobless claims remain well above their lows and real consumer spending in May was flat.

On the inflation front in the US, private final consumption deflator inflation fell to 3.8%yoy in May and core PCE inflation came in slightly lower than expected at 4.6%yoy with signs of some slowing in core services ex shelter inflation in the last few months.

Source: Macrobond, AMP

Weaker Eurozone confidence. Consistent with the fall back in Eurozone business conditions PMIs, economic confidence fell in June as did the German IFO business climate index. Unemployment was unchanged in May at 6.5%. Meanwhile, inflation fell more than expected in June to 5.5%yoy and core inflation rose to 5.4%yoy but was less than expected.

Japanese retail sales rose more than expected in May and unemployment remained low at 2.6%, but industrial production fell by more than expected. Tokyo inflation in June fell to 3.1%yoy with core inflation slipping to 2.3%yoy from 2.4%.

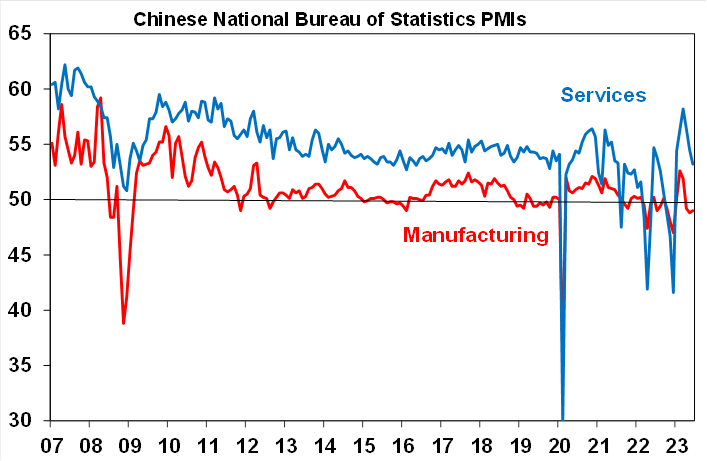

Chinese business conditions PMIs slowed a bit further in June with the composite falling to 52.3 as services slowed, albeit to a sill solid level. Manufacturing remains soft though with the PMIs suggesting that China’s recovery may be continuing to disappoint.

Source: Bloomberg, AMP

Australian economic events and implications

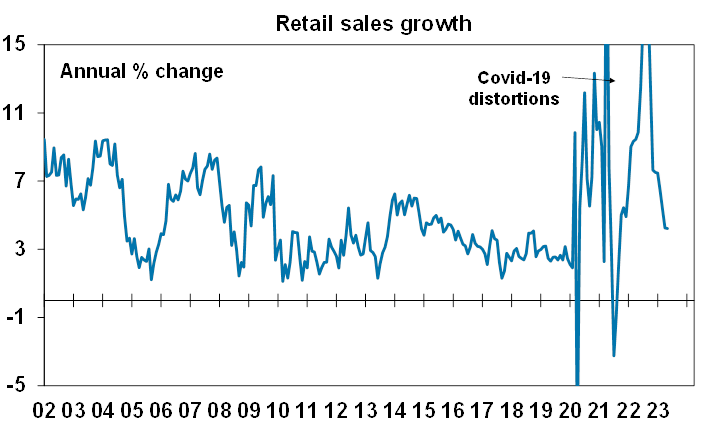

Australian retail sales rose a stronger than expected 0.7% in May. But the ABS notes that it looks due to earlier than normal end of financial year discounting, suggesting a pullback in June. In any case retail sales are little changed since November and have been trending down in real terms as rate hikes weigh on discretionary consumer spending and this is likely to continue. However, continuing strength in demand for services like eating out will likely worry the RBA for now.

Source: ABS, AMP

Job vacancies down again but remaining high. Job vacancies as measured by the ABS fell 2% over the three months to May making their fourth consecutive quarterly decline. However, the ratio of job vacancies to unemployment remains very high indicating that the jobs market while cooling remains very tight posing ongoing upside risks to wages growth.

Source: ABS, AMP

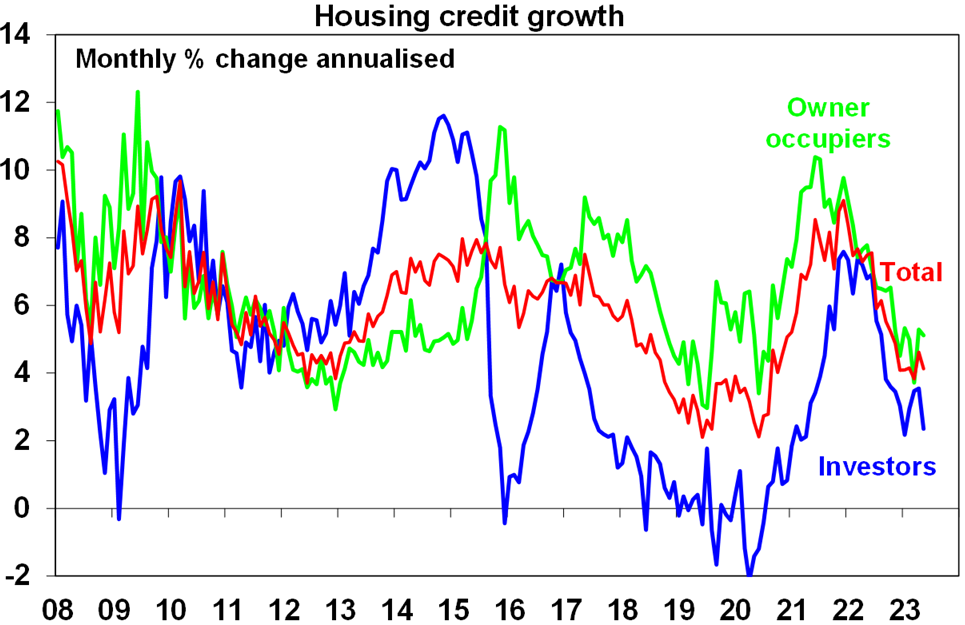

Credit growth slowed a bit in May reflecting slower growth in business credit and a slight slowing in housing credit growth going to investors.

Source: RBA, AMP

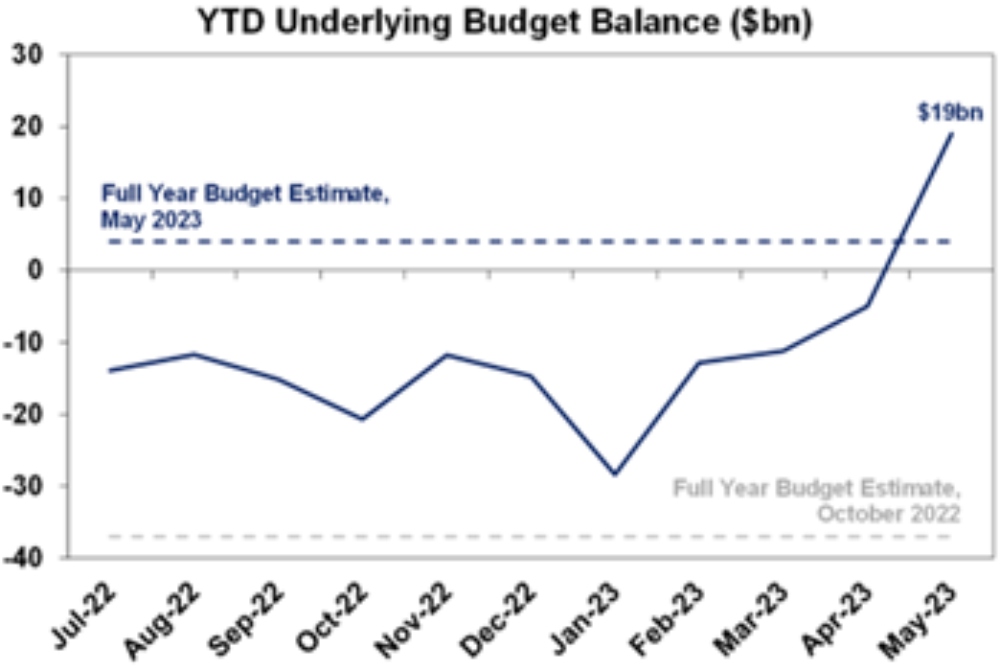

Budget surplus on track to be much bigger than expected – possibly a record surplus. The Treasurer has indicated that the Budget surplus for 2022-23 will be “significantly” higher than the $4.2bn projected in the May Budget. In fact, the latest budget data for the financial year to May showed a budget surplus of $19bn which is way above the financial year to May profile of $7.5bn projected at the time of the May Budget with the further improvement mainly coming from stronger tax revenues (which is understood to be mainly due to corporate tax including higher than assumed commodity prices) but also lower spending. June is often a deficit month and the Government has announced extra spending for this financial year, but if the upside surprise continued in June there is a chance that the surplus will exceed the record 2007-08 surplus of $19.8bn. This is a massive turnaround from the deficit for 2022-23 of $99bn projected in December 2021 and is very good news. Of course, it will make only a modest dent in the massive level of debt built up particularly through the pandemic. But it’s a far better situation than most other comparable countries are in and the stronger starting point could potentially set up a surplus for the 2023-24 financial year – although a faster than expected downturn in the economy could work against that and structural spending pressures are still likely to drive a return to deficit in the years ahead. In the meantime, there is a risk that the bigger surplus may see the Government undertake more spending which could make life harder for the RBA. Alternatively, the Government could seek to strike an Accord type agreement offering more cost-of-living support measures for low income earners in return for unions committing to avoid wage claims based on inflation as to way to help the RBA head off a wage price spiral.

Source: Aust Gov/Dept Finance, AMP

What to watch over the next week?

In the US, expect the minutes from the Fed’s last meeting to reiterate the message that it likely has more to do on rates but can proceed at a more moderate pace. On the data front, expect June jobs data (Friday) to show a slowing in payroll growth to 200,000, with unemployment unchanged at 3.6% and wages growth edging down further to 4.2%yoy. The manufacturing conditions ISM (Monday) is likely to have remained weak at around 47 for June and the services conditions ISM (Thursday) is expected to have edged up slightly to around 51. Job openings data will also be released Thursday.

Chinese Caixin business conditions PMIs for June are likely to show continuing soft conditions in manufacturing (Monday) but stronger services conditions (Wednesday).

The Japanese June quarter Tankan survey (Monday) is likely to show some improvement in business conditions.

In Australia, it’s a very close call but on balance we expect that the RBA will raise the cash rate again on Tuesday by another 0.25% taking it to 4.35%. The lower-than-expected May CPI provides scope for another pause, we continue to think that the RBA has already done enough with inflation already falling and that it’s not paying enough attention to the lags with which monetary policy impacts the economy which runs the now very high risk of tipping us into recession. However, the RBA is likely to be more concerned about continuing underlying inflation readings above 6%yoy, sticky services inflation, the increasing risk of wages growth above levels consistent with the inflation target particularly with recent jobs data remaining relatively strong and so on balance we think it will probably hike by another 0.25% on Tuesday. But it’s a close call (with a roughly 55% probability of a hike and 45% probability of a hold) and whether it hikes or holds on Tuesday, the RBA is likely to retain its tightening bias. If not in the week ahead, then we would expect another 0.25% hike in August followed by a final move in September, taking the cash rate to a peak of 4.6%. The money market is pricing a 28% chance of a 0.25% rate hike on Tuesday and a 100% chance by August.

Another 0.25% rate hike will mean an extra $100 a month in additional debt servicing payments on a $600,000 loan and would take the total increase since April last year to an extra $1419 a month or $17,028 a year. Even if a borrower has secured a 0.5% cut to their mortgage rate their payments would be up an extra $14,616 a year since April last year.

On the data front in Australia, expect CoreLogic data for June to show another 1.3% rise in home prices led by Sydney with a 1.7% gain, a 5% rise in May building approvals after a sharp fall in April and a 2% gain in housing finance (all Monday) and the May trade surplus (Thursday) to fall to around $10bn.

Outlook for investment markets

The next 12 months are likely to see a further easing in inflation pressures and central banks moving to get off the brakes. This along with improved valuations should make for reasonable share market returns. But the next few months are likely to be rough given high recession and earnings risks, uncertainty around US banks and poor seasonality out to around September/October. This is likely to impact both global and Australian shares.

Bonds are likely to provide returns above running yields, as growth and inflation slow and central banks become dovish.

Unlisted commercial property and infrastructure are expected to see slower returns, reflecting the lagged impact of last year’s rise in bond yields on valuations. Commercial property returns are likely to be negative as “work from home” hits space demand as leases expire.

With an increasing supply shortfall, we have revised up our national average home price forecast for this calendar year from a fall of -7% to around flat to up slightly ahead of 5% growth next year. However, the risk is high of a further leg down putting us back on track for a 15-20% top to bottom fall on the back of the impact of high and still rising interest rates and higher unemployment.

Cash and bank deposits are expected to provide returns of around 4%, reflecting the back up in interest rates.

The $A is at risk of more downside in the short term, but a rising trend is likely over the next 12 months, reflecting a downtrend in the overvalued $US and the Fed moving to cut rates.

Oliver's Insights - seasonal patterns in shares

06 May 2024 | Blog This article looks at seasonal patterns in shares and whether its time to “sell in May and go away” along the lines of the old share market saying. Read more

Weekly market update 03-05-2024

03 May 2024 | Blog Fed less hawkish than feared; US stagflation or just getting back on track?; RBA to hold, with a tightening bias; Aust consumer remains weak; Aust budget preview. Read more

Econosights - positive supply shocks

02 May 2024 | Blog Post pandemic, the supply of labour has increased in many major economies, including the US and Australia, through elevated immigration and a lift in the participation rate to a record high. Read moreWhat you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

The information on this page was current on the date the page was published. For up-to-date information, we refer you to the relevant product disclosure statement, target market determination and product updates available at amp.com.au.