Investment markets and key developments

Global shares rose over the last week being buoyed by increasing confidence that central bank interest rates are at or close to the top and solid US earnings reports, despite a brief set back with the BoJ moving to loosen its yield curve control. For the week US shares rose 1%, Eurozone shares rose 1.4%, Japanese shares rose 1.4% despite a brief dip following the BoJ move, and Chinese shares gained 4.5% on Chinese stimulus hopes. Despite a fall on Friday not helped by weaker than expected retail sales and the BoJ move, Australian shares were boosted by news of lower-than-expected inflation and rose 1.2% for the week with gains led by energy, telco, IT and consumer discretionary stocks. Bond yields generally rose on the back of stronger economic data in the US and the BoJ move. Oil prices continued to rise with tight supplies and metal prices also rose but the iron ore price fell slightly. The $A fell as the $US rose.

The risk of a short term correction in shares is still high with recession risks remaining high, China growth worries, central banks still at risk of hiking further, the BoJ now edging towards rightening and the seasonal rough patch often seen from August to October. But the ongoing fall in inflation consistent with interest rates being at or near the top and indications that any recession may be mild is consistent with our positive 12-month view on shares and appears to be dominating. So, any pull back may be shallow.

Despite lower-than-expected inflation readings, the Fed and ECB continued to raise interest rates over the last week but the better inflation backdrop means they are at or close to the top:

- The Fed raised its Fed Funds rate by 0.25% to 5.25-5.5% as expected. On the one hand it upgraded its assessment of economic growth from “modest” to “moderate”, it noted that the labour market remains tight and it retained its tightening bias. However, it tightening bias has softened as it acknowledged the fall in inflation, with Fed Chair Powell non-committal on whether it will raise rates again in September with the outcome being data dependent. The money market is only attaching a 20% probability to another hike. We think the Fed has finished hiking, but the main risk in the US is if there is a resurgence in growth which curtails the cooling in the jobs market.

- Similarly the ECB hiked by another 0.25%, taking its deposit rate to 3.75% and its main refinancing rate (which is more comparable to the RBA cash rate) to 4.25%, but it dropped its tightening bias in favour of full data dependence with ECB President Lagarde no longer saying there is more ground to cover, leaving the door open to another hike but will approach the next meeting in September with an “open mind” as to whether to hike or hold. Money markets are attaching around a 28% probability to another hike.

The BOJ weakened its “yield curve control” – but don’t expect a big impact on global markets in the near term. The BoJ left its short-term policy rate at -0.1% and kept its 10-year bond yield target at zero but appears to be now tolerating a rise in 10-year bond yields to 1%, beyond the cap of 0.5%. This appears to be designed to allow the BoJ to retain other aspects of its ultra easy monetary policy for now, but with various inflation measures above its 2% target it is a move in the direction of tightening, albeit a very mild one, but with more likely to come over time. Since Japan is a large holder of foreign bonds allowing Japanese bond yields to rise further will put some upwards pressure on global bond yields. But with JGBs still set to offer much lower yields than in other markets for some time yet the impact is likely to be minor as was the case after the BoJ raised the yield cap from 0.25% to 0.5% last December, at least until the BoJ pushes further down the tightening path.

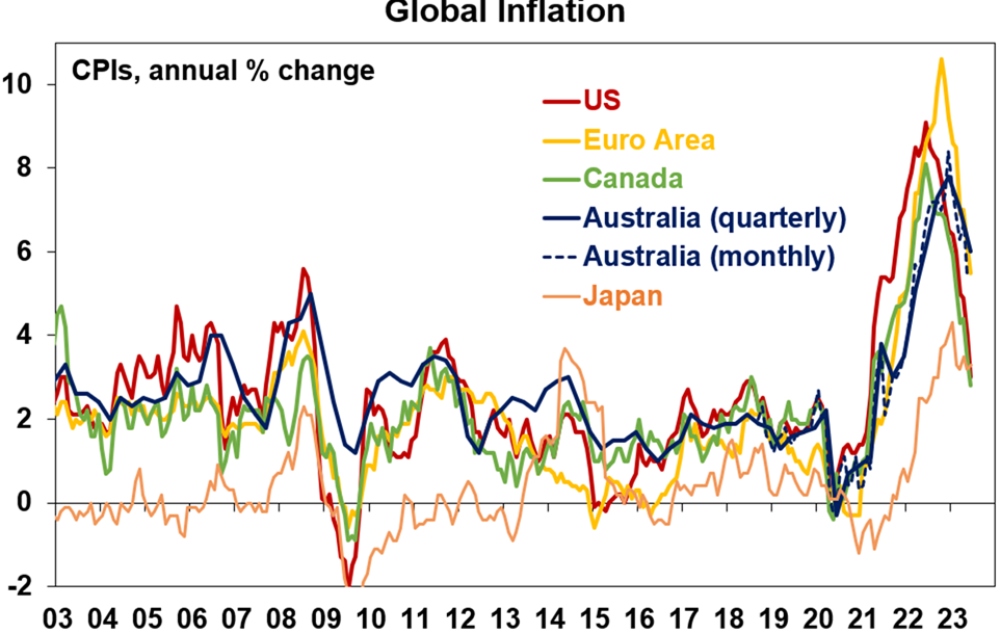

Australian inflation is also moving down with global inflation. From its peak around 8%yoy, the quarterly CPI inflation rate has now fallen to 6%yoy and the Monthly Inflation Indicator has fallen to 5.4%yoy. Just as we lagged the US on the way up by about six months (as we were slower to reopen our economy and the global energy price crisis took longer to hit Australia) we are lagging it on the way down by about six months.

Source: Bloomberg, ABS, AMP

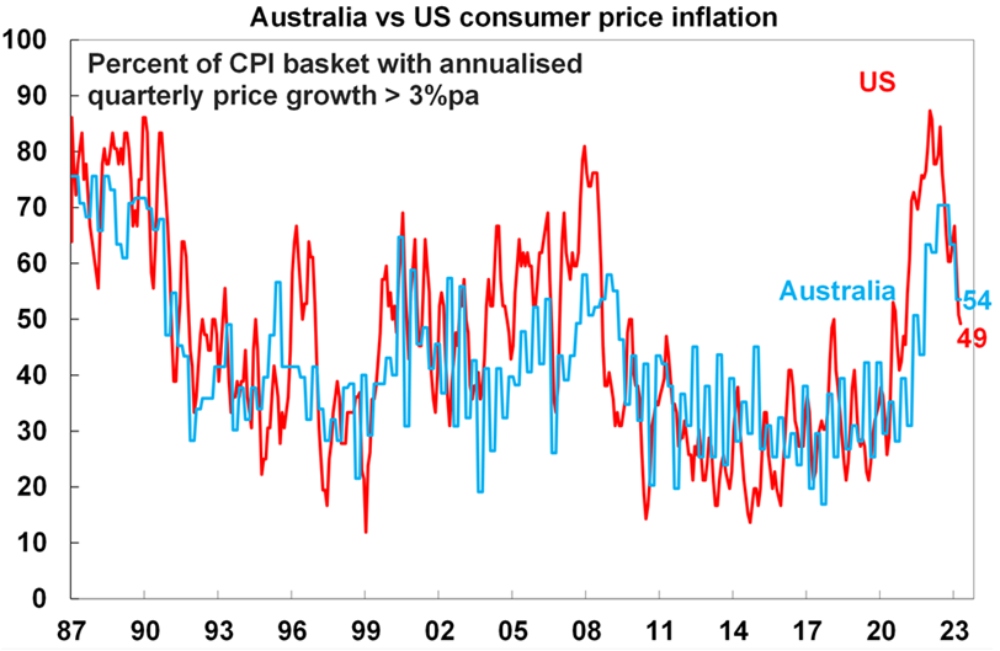

Underlying measures of Australian inflation have also fallen with the trimmed mean at 5.9%yoy (down from a peak of 6.9%yoy) and the breadth of price gains has narrowed with now only 54% of CPI components seeing an annualised gain of 3% or more down from a peak of around 70%.

Source: Bloomberg, ABS, AMP

Recent momentum in Australian inflation is even lower with the 0.8%qoq June quarter CPI rise annualising to 3.3% which is down from a peak of 8.6% in the March quarter last year and the 0.9% rise in trimmed mean inflation annualising to 3.7% down from a peak of 7.7%.

This is a great news and should allow the RBA to leave rates on hold for an extended period – but will it? The arguments for a further increase in rates are that:

- Annual inflation is still high at 6%yoy.

- Services price inflation was held down to some degree in the June quarter by falls in utility prices, a delay in health insurance premium increases and falls in education costs partly due to NSW and Victorian fee relief, and is likely to rise further in the months ahead as rents continue to rise and as increases in gas and electricity prices flow through.

- The still tight labour market and faster rises this year in award and minimum wages suggest upside risk to wages growth at a time when productivity growth is weak.

- Both the Fed and ECB hiked despite having lower inflation than Australia and policy rates are generally higher in other comparable countries.

However, the arguments to leave rates on hold are that:

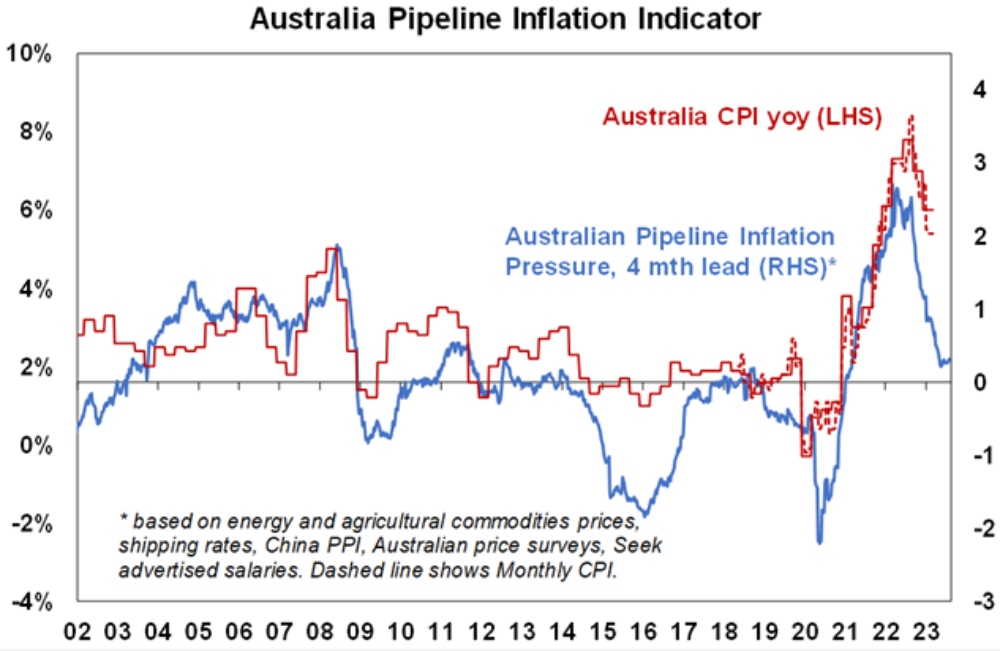

- Inflation is actually falling slightly faster than the RBA is forecasting, our Australian Pipeline Inflation Indicator points to further falls ahead and there is a good chance that it will be at 3% by mid next year, 12 months ahead of RBA expectations. This should provide time for the RBA to “wait and see”.

Source: Bloomberg, AMP

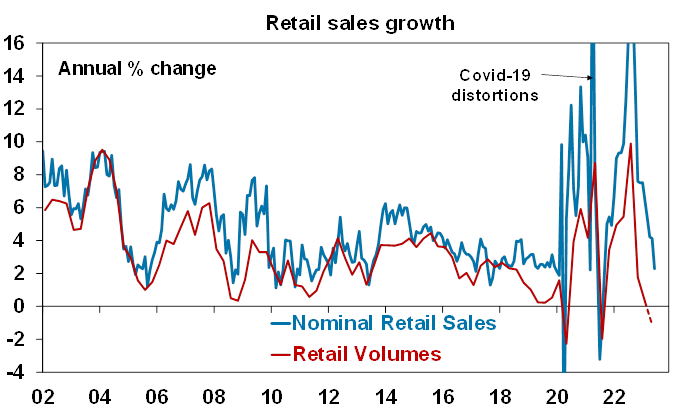

- Growth is slowing particularly as households with large mortgages feel the brunt of the monetary tightening. This is evident in the sharp fallback in retail sales in June which likely means that they have now fallen for three quarters in a row in real terms. Note that while the Fed Funds rate is much higher in the US than in Australia, the pass through of rate hikes to homeowners has been far less in the US as 95% of US home borrowers are on 30-year fixed rates. The risk is that the RBA will end up with much higher unemployment than it thinks it needs to get inflation back to target.

- The RBA has already hiked by 400 basis points and needs to allow more time to assess its lagged impact.

This leaves Tuesday’s RBA meeting a very close call – but, on balance, we expect that the downside surprise in inflation and retail sales in the last week will see the RBA remain on hold at 4.1%. The RBA is now getting what it wanted on inflation and the ongoing weakness in real retail sales highlights the high and increasing risk that it will knock the economy unnecessarily into recession if it keeps tightening. That said it is a close call and given the RBA’s concerns about services inflation and wages it wouldn’t be a surprise to see the RBA hike by another 0.25%. It would be nice to be more definitive, but it often gets like this towards the end of a tightening cycle and right now there are lots of cross currents. In terms of the peak in rates we are still allowing for one more hike to 4.35% probably in September but the bottom line is that the RBA is either at or close to the top and we continue to allow for rate cuts starting in February next year. The money market is attaching just a 9% probability of a 0.25% hike on Tuesday.

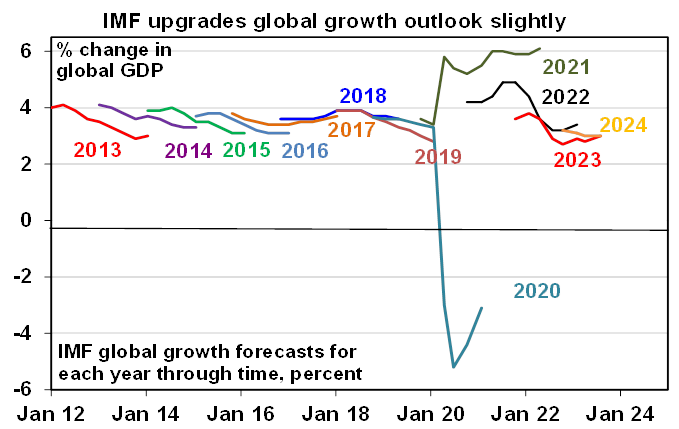

IMF upgrades the global growth outlook slightly. Reflecting the relative resilience in global growth this year the IMF revised up its 2023 global growth forecast to 3% and continues to see 3% next year. This is still slower than last year’s 3.5% thanks to a slowdown in advanced countries but emerging countries growth is being stabilised by the recovery in China (even though its slower than hoped). 3% growth is similar to what was achieved in much of the 2012-19 period.

Source: IMF, AMP

Economic activity trackers

Our Economic Activity Trackers are trending up in the US consistent with better economic data lately, flat to up slightly in Europe and down in Australia.

Levels are not really comparable across countries. Based on weekly data for eg job ads, restaurant bookings, confidence, credit & debit card transactions and hotel bookings. Source: AMP

Major global economic events and implications

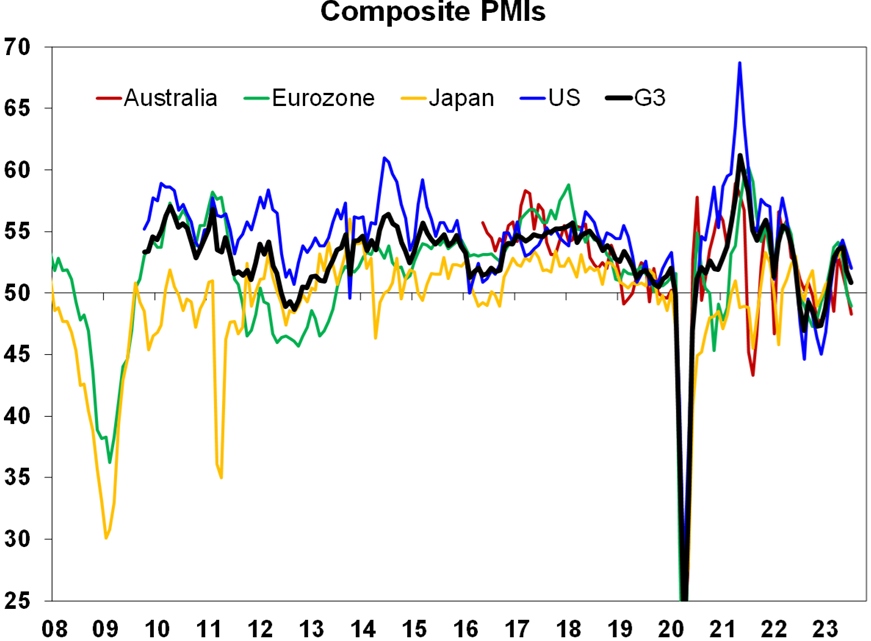

July business conditions PMIs were stable in Japan but fell again in the US, Europe and UK with manufacturing conditions, Europe and Australia in negative territory. Their rebound since late last year looks to be over as rate hikes continue to bear down on economic activity.

Source: Bloomberg, AMP

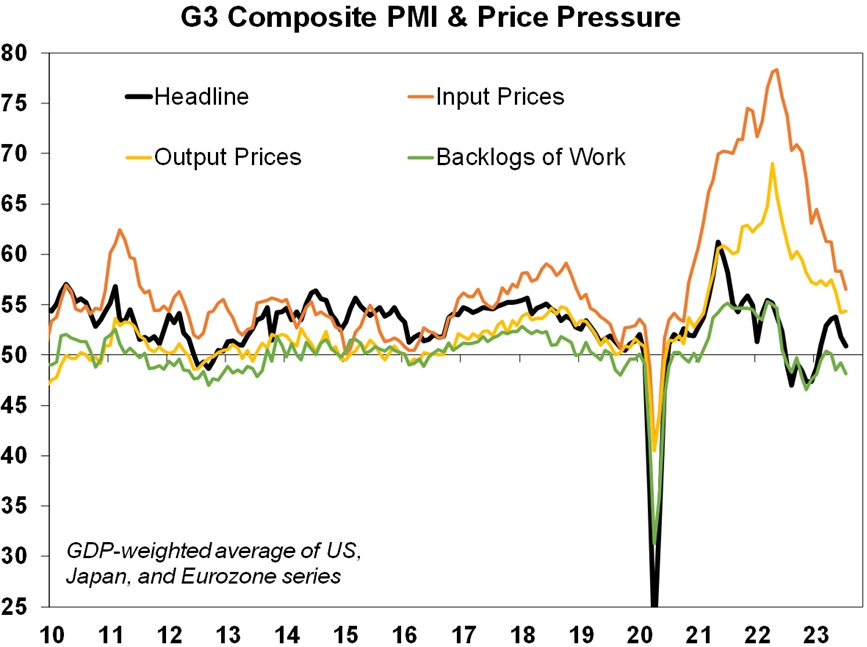

Meanwhile the PMI’s show a continuing downtrend in input and output price measures, order backlogs well down from their 2021-22 highs and delivery times remaining much improved which is all consistent with an ongoing easing in inflationary pressures.

Source: Bloomberg, AMP

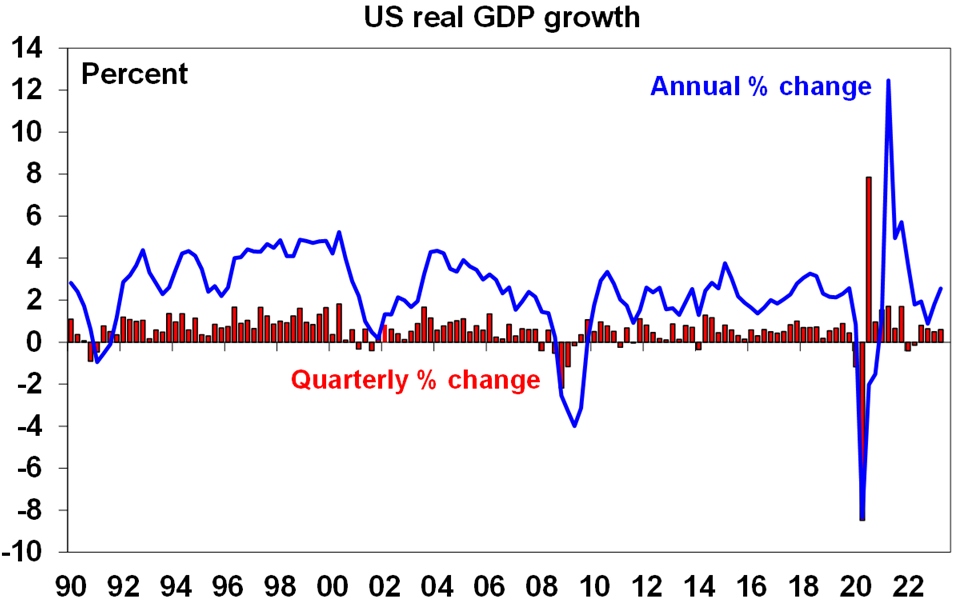

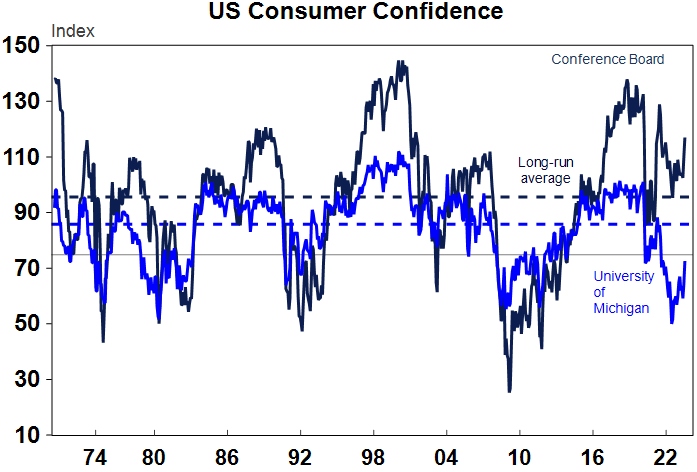

Other US data was mostly solid. June quarter GDP growth was a faster than expected 2.4% annualised with solid consumer spending and capex. Underlying capital goods orders saw modest growth. Jobless claims fell. The Conference Board’s measure of consumer confidence rose sharply in July taking it well above average, in contrast to the University of Michigan confidence index which is up but remains well below its long run average. Personal spending rose more than expected. Home prices also continued to bounce back in May, but new home sales and new mortgage applications fell with the latter remaining very weak. Meanwhile, private final consumption deflator inflation fell to 3%yoy in June, core PCE inflation fell more than expected to 4.1%yoy and the June quarter Employment Cost Index rose a weaker than expected 1%qoq, its slowest in two years, suggesting that the decline in labour market tightness is taking pressure off wages growth. With stronger growth and lower inflation its almost looking a bit like Goldilocks in the US – the downside is that the stronger growth risks a possible resurgence in inflation at some point keeping the Fed higher for longer on interest rates.

Source: Bloomberg, AMP

Source: Macrobond, AMP

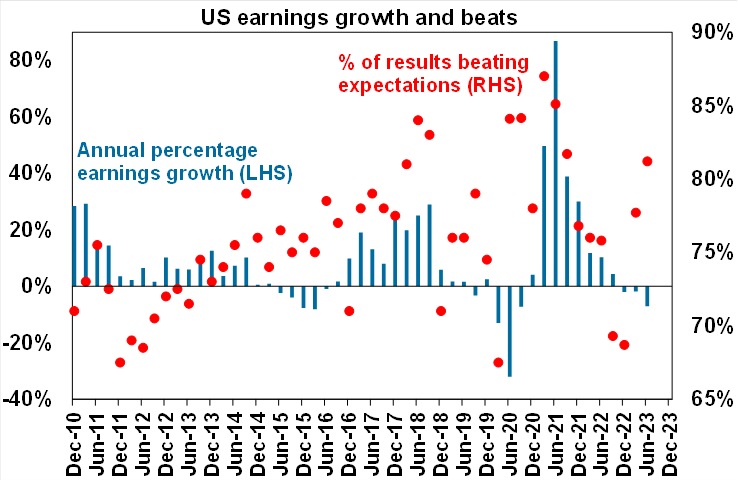

US earnings continue to come in better than expected. More than 50% of S&P 500 companies have now reported with 81% beating earnings expectations (compared to the norm of 76%) with an average beat of 6%. Consensus earnings expectations for the year to the June quarter have been revised up from a 7% decline to a 5.6% fall but still look too pessimistic.

Source: Bloomberg, AMP

The German IFO business conditions index index and Eurozone economic confidence fell in July in line with lower business conditions PMIs. Slowing Eurozone growth in money supply and bank lending, slowing loan demand from firms and weak demand for mortgages all indicate that ECB tightening is getting traction.

Tokyo CPI data for July showed a further rise in core (ie ex food and energy) inflation to 2.5%yoy from 2.3%.

China’s Politburo meeting pledging support for domestic demand was welcomed by commodity markets, but major fiscal and monetary stimulus still looks unlikely with a focus on “adjustments” and implementing measures in a “precise” way.

Australian economic events and implications

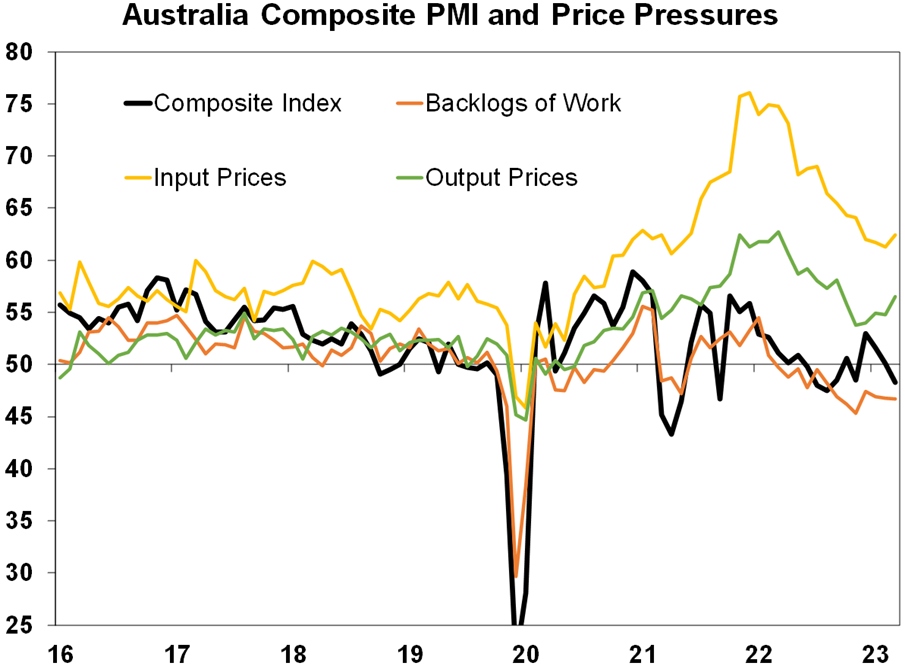

Australian business conditions PMIs for July fell again taking the composite index back below the 50 growth/contraction level with a sharp fall in services conditions. Price and cost pressures remain well down from their highs, but both have edged up lately from elevated levels with faster wages growth possibly impacting in terms of services. This is similar to what the NAB business survey has been reporting. Order backlogs are continuing to improve though.

Source: Bloomberg, AMP

Australian retail sales fell 0.8% in June – rate hikes and cost of living pressures are clearly biting. This followed a stronger than expected rise in May that reflected earlier than normal end of financial year discounting, suggesting spending had been pulled forward which then depressed June as spending was not sustained. This leaves retail sales flat since October and falling in real terms as rate hikes weigh on discretionary consumer spending and this is likely to continue.

Source: ABS, AMP

Australia’s terms of trade on the way back down. After surging into last year on the back of the reopening recovery and then surging gas and coal prices, Australian export prices fell by 8.5% in the June quarter as oil and gas prices fell more than 20% and iron ore prices fell 6%. With import prices down just 0.8% this means the terms of trade fell again. It remains very high but the export price driven boost to national income looks to be over for now.

What to watch over the next week?

In the US, the focus will be on July jobs data (Friday) which are expected to show a further deceleration in payroll growth to 200,000, unemployment flat at 3.6% and a slight further slowing in wages growth. In other data, the manufacturing conditions ISM (Monday) is expected to improve slightly but to a still weak 46.9 but the services conditions ISM (Thursday) is expected to soften slightly to 53. The Fed’s latest lending standards survey will be released Monday with job openings data for June on Tuesday. The US June quarter profit reporting season will continue.

Eurozone June quarter GDP growth (Monday) is expected to be 0.1%qoq with annual growth slowing to just 0.4%yoy. July CPI inflation (also Monday) is expected to have slowed further to 5.2%yoy with core inflation falling to 5.3%yoy (with both at 5.5% in June) and June unemployment (Tuesday) is expected to be unchanged at 6.5%.

The Bank of England (Thursday) is expected to raise its key policy rate by another 0.25% taking it to 5.25% with strong wages growth offsetting the recent downside surprise to inflation.

Japanese industrial production in June (Monday) is likely to rise but unemployment (Tuesday) is likely to be unchanged at 2.6%.

Chinese business conditions PMIs for July are likely to be little changed with the composite likely to remain around 52.3.

In Australia, as noted earlier in this report we expect the RBA to leave rates on hold on Tuesday, but it’s a close call and if they do hike it will likely be the last in this cycle. The RBA’s Statement on Monetary Policy (Friday) is expected to revise the RBA’s wages forecasts for this financial year up slightly following the stronger than expected increase in award and minimum wages, but its unlikely to change its inflation forecasts much and its growth forecasts may be revised down slightly. On the data front expect modest June credit growth (Monday) with an acceleration in housing credit, an 8% fall in building approvals after a 20.6% gain in May, a 1% fall in housing finance and CoreLogic data for July to show some loss of momentum in home price growth to 0.9%mom from 1.1% in June (all due Tuesday), trade data to show a slight rise in the trade surplus to $12.2bn and June quarter real retail sales to show a 0.5% fall (both due Thursday).

Outlook for investment markets

The next 12 months are likely to see a further easing in inflation pressures and central banks moving to get off the brakes. This should make for reasonable share market returns, provided any recession is mild. But the next few months could still see a correction given high recession and earnings risks, the risk of still more hikes from central banks and poor seasonality out to around September/October.

Bonds are likely to provide returns above running yields, as growth and inflation slow and central banks become dovish.

Unlisted commercial property and infrastructure are expected to see soft returns, reflecting the lagged impact of last year’s rise in bond yields on valuations. Commercial property returns are likely to be negative as “work from home” hits space demand as leases expire.

With an increasing supply shortfall, we revised up our national average home price forecast for this calendar year to around flat to up slightly ahead of 5% growth next year. However, the risk is high of a further leg down on the back of the impact of high interest rates and higher unemployment.

Cash and bank deposits are expected to provide returns of around 4%, reflecting the back up in interest rates.

The $A is at risk of more downside in the short term, but a rising trend is likely over the next 12 months, reflecting a downtrend in the overvalued $US and the Fed moving to cut rates.

Weekly market update 10-05-2024

10 May 2024 | Blog Fed less hawkish than feared; RBA holds; Aust consumer remains weak; slowing in CPI inflation, Aust budget preview. Read more

Oliver's Insights - seasonal patterns in shares

06 May 2024 | Blog This article looks at seasonal patterns in shares and whether its time to “sell in May and go away” along the lines of the old share market saying. Read more

Weekly market update 03-05-2024

03 May 2024 | Blog Fed less hawkish than feared; US stagflation or just getting back on track?; RBA to hold, with a tightening bias; Aust consumer remains weak; Aust budget preview. Read moreWhat you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

The information on this page was current on the date the page was published. For up-to-date information, we refer you to the relevant product disclosure statement, target market determination and product updates available at amp.com.au.