Investment markets and key developments

Global share markets were mixed over the last week with uncertainty about the US debt ceiling and interest rates along with worries about the Chinese recovery, but a strong boost to some US tech stocks from strong AI related demand. After a solid gain on Thursday and Friday on the back of AI enthusiasm and confidence that a debt ceiling deal will be reached US shares rose 0.3% for the week. The Japanese share market continued its resurgence rising another 0.4%. However, for the week Eurozone shares fell 1.5% and Chinese shares fell 2.4%. Partly reflecting the mixed global lead and falling metal prices the Australian share market fell 1.7% led down by falls in material, retail, property and financial shares. Bond yields rose globally and in Australia on increased expectations for rate hikes with the Australian money market pricing in just a 4% chance of a 0.25% RBA rate hike next month (which seems a bit too low) but a 72% chance by August. Oil prices rose, but metal and iron ore prices fell and the $A broke below technical support around $US0.66 as the $US rose further.

Apart from AI enthusiasm, the past week has been dominated by the US debt ceiling where a deal has now been agreed, but there is a way to go yet with potential for further setbacks.

- The deal reached between President Biden and House Speaker McCarthy: suspends the debt ceiling through to January 2025; caps non-defence discretionary spending at current levels; rescinds unspent Covid funds; provides a mechanism for automatic continuing resolutions with a 1% spending cut if Congress can’t agree on a funding bill which should avoid the threat of government shutdowns; provides time limits and work requirements for some welfare; and cuts red tape for some energy projects.

- The questions are now whether it gets enough Congressional support and whether it can be passed in time ahead of Treasury’s updated 5 June X date. Objections on the left and right are high but there will probably be enough moderate Republican and Democrat House and Senate members to pass it.

- But setbacks are still possible and a bit more share market volatility (which would impact global and Australian shares as we saw in the past week) may be needed to make sure its passed by Congress in time.

- Resolving the debt ceiling will likely drive a short-term bounce in shares but they are vulnerable to lower spending levels flowing from the deal adding to the risk of recession and the US Treasury reversing the liquidity boost it’s been providing lately by running down its cash reserves at the Fed.

Although global and Australian shares could have a short term bounce if there is a resolution to the US debt ceiling, they continue to look vulnerable over the next few months. Share market gains since the lows last year have been more narrowly based and defensive than would normally be seen this far into a recovery. US debt ceiling brinkmanship and its aftermath could continue to create volatility ahead. Banking stress is continuing in fits and starts in the US resulting in additional monetary tightening. Leading economic indicators continue to point to a high risk of recession in the US and Australia. China’s recovery is looking less robust. The weakness in copper, oil and other industrial commodities suggests weakening demand and this is also being reflected in the growth sensitive Australian dollar. Central banks are probably close to the top but risk doing more. And the period from May to September is often rough for shares. We remain of the view that shares will do okay on a 12-month view as central banks ease up as inflation cools but the next few months are likely to be rough.

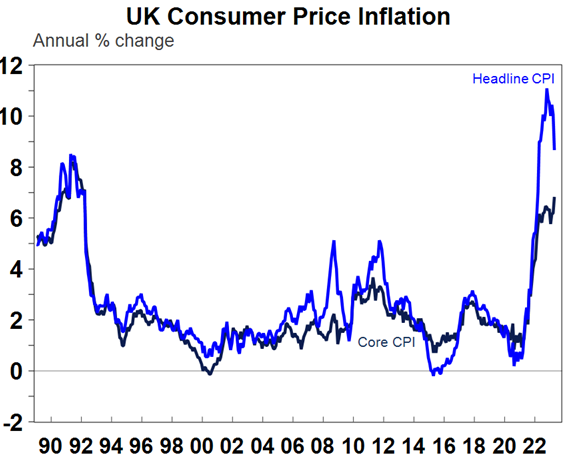

The message from central banks over the last week was mixed: the Bank of England looks certain to hike more given higher than expected UK inflation which may partly be due to Brexit; RBA Governor Lowe repeated his hawkish message to federal MPs warning of more hikes ahead in a reportedly “pretty pessimistic” briefing and warning that raising wages to match inflation without higher productivity would add to the problem – he’s right on wages as a key lesson of the 1970s is that wage rises to match inflation just perpetuated high inflation to the benefit of no one; the Fed looks unclear as to whether it will do more or not but does appear to be leaning to a pause next month although higher than expected personal consumption expenditure inflation in April increases the pressure for more rate hikes; the Bank of Korea and the central Bank of Indonesia left rates on hold; and the RBNZ after another hike signalled rates had likely peaked ahead of rate cuts in the September quarter next year.

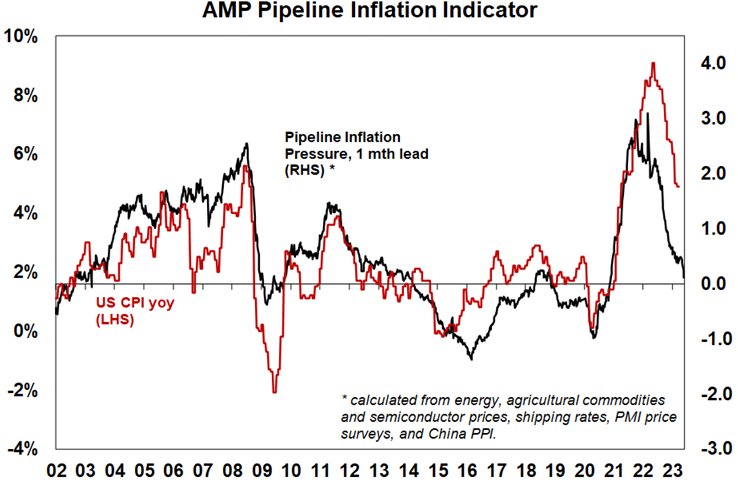

Overall, our assessment remains that central banks are at or near the top on rates as inflation pressures are likely to continue to ease - our US Pipeline Inflation Indicator fell further in the last week reflecting declines in PMI price surveys.

This also applies to Australia where soft data, as seen in April retail sales, provides room for the RBA to leave rates on hold at its June meeting. This is our base case but continuing hawkish commentary from the RBA along with risks around wages (watch the June minimum wage decision as a 7% minimum wage rise would add around 0.45% to wages growth directly plus more indirectly due to its influencing effect), poor productivity growth and rising home prices (which are reversing the negative wealth effect) mean that the risk of further RBA rate hikes is very high. The problem is that we are now seeing clear evidence that rate hikes are slowing the economy – with falling real retail sales, falling building approvals, slowing business investment plans and early indications of a slowing jobs market. At the same time inflation is off its highs and heading down. With the lagged effect of past rate hikes yet to impact there is a high and rising danger that the RBA will end up going too far by focussing too much on unemployment, inflation and wages growth which are lagging indicators of what the economy is doing. A big minimum wage rise will accentuate this risk.

Source: Bloomberg, AMP

Australia is not alone in seeing a stabilisation/rise in home prices. Something similar is being seen in the US, UK, Canada, Germany and Sweden. A number of factors appear to be at work including: the initial rate hike “sticker shock” wearing off; talk that rates may be near the top; constrained supply and a rebound in immigration (Canada’s population is rising almost 3%); still strong jobs markets; savings built up through the pandemic; earlier than normal home price falls in response to rate hikes. If it continues it will worry central banks (with a positive wealth effect possibly boosting spending) but there is also the risk of another leg down in home prices if rates keep rising and economies go into recession with rising unemployment.

Tina Turner was a giant of soul music. River Deep - Mountain High is a classic with its Phil Spector wall of sound. It reportedly cost $US22,000 (a lot of money in 1966!) to make and had 21 musicians. I can’t believe it only made it to #88 on the US Billboard Hot 100, although it got to #14 in Australia and #1 in Spain. Nutbush City Limits which celebrates her hometown seems to pop up everywhere (even on a cruise I went on recently) with its own dance.

Coronavirus update

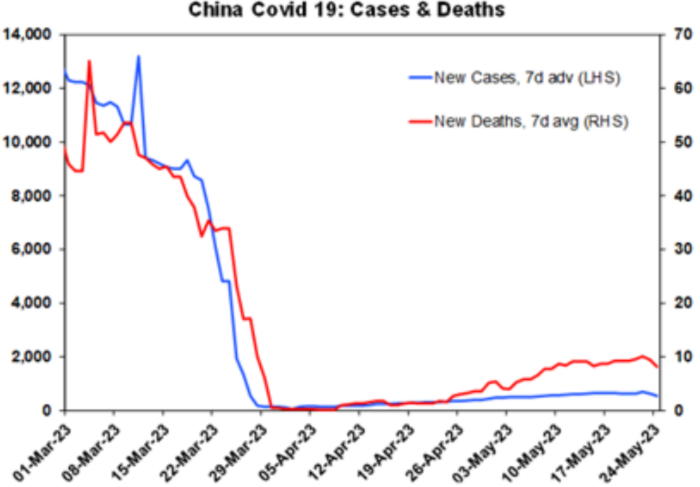

A new covid wave in China. New global covid cases and deaths remain low and continuing to trend down, but China appears to be seeing a rising trend. So far though China’s new wave seems modest with milder symptoms than seen earlier this year. Subway usage in China is down a bit over the last few weeks but still running above normal levels for this time of year.

Source: ourworldindata.org, AMP

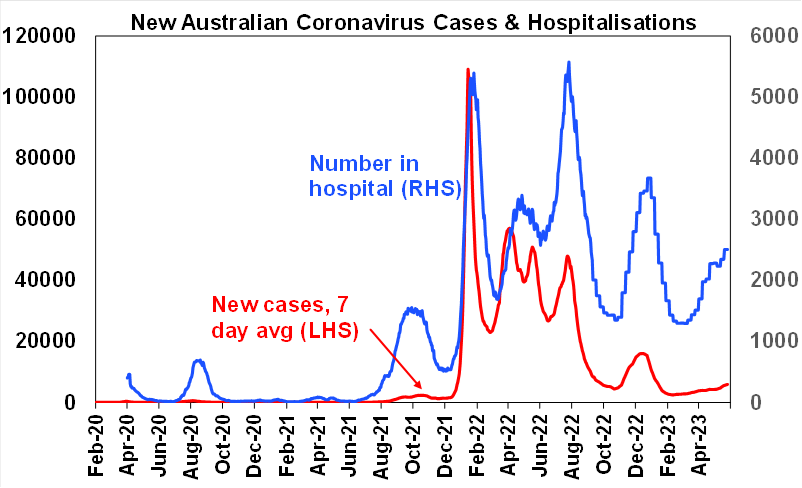

New cases (which aren’t so reliable anymore except in terms of direction), hospitalisations and deaths in Australia are still trending up from their lows.

Source: covidlive.com.au, AMP

Economic activity trackers

Our Economic Activity Trackers rose slightly in Australia and the US in the last week, but fell in Europe. Overall, they are suggesting flat to only slightly positive economic growth year to date in Australia and Europe, but possibly an emerging contraction in the US.

Levels are not really comparable across countries. Based on weekly data for eg job ads, restaurant bookings, confidence, credit & debit card transactions and hotel bookings. Source: AMP

Major global economic events and implications

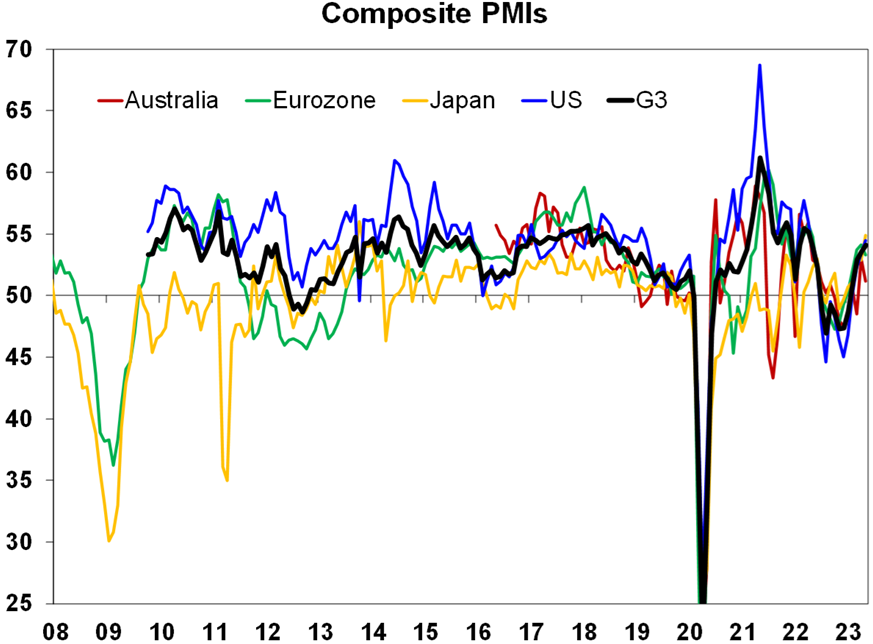

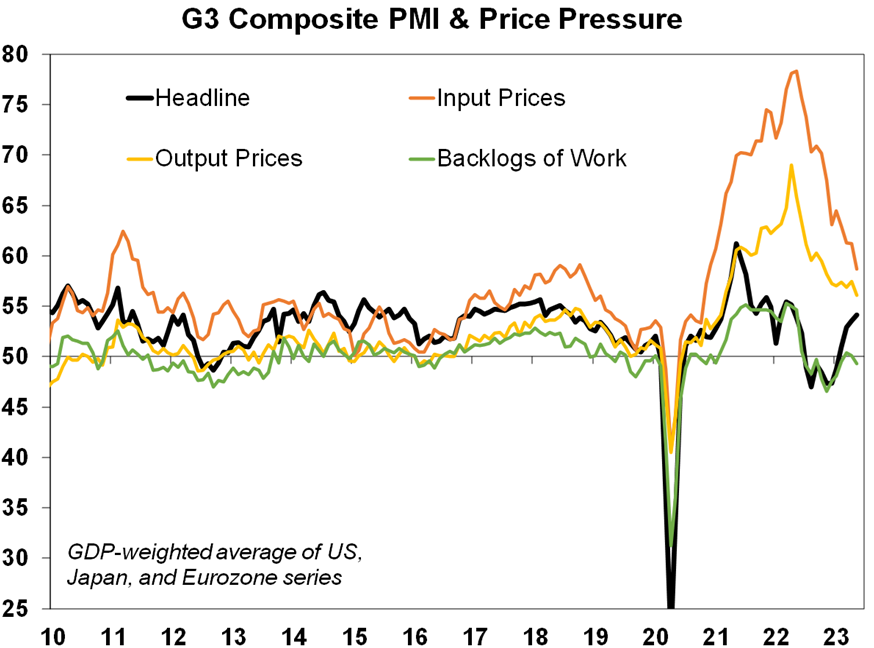

Back to Goldilocks (not too hot, not to cold)? May composite business conditions PMIs provided an almost Goldilocks like picture. Composite economic activity PMIs were solid across the US, Europe and Japan indicating continuing economic growth…

Source: Bloomberg, AMP

…and inflation signals continue to improve with a continuing downtrend in input and output prices, order backlogs well down from their 2021-22 highs and delivery times much improved which is all consistent with an ongoing easing in inflationary pressures.

Source: Bloomberg, AMP

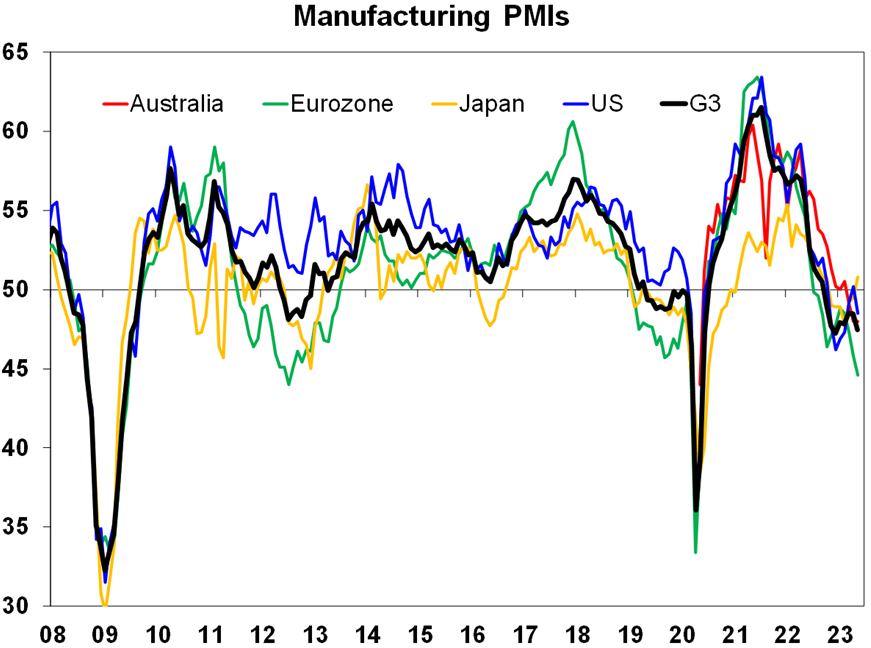

The complication is that the strength in the composite business conditions PMI is being driven by services, but manufacturing is weak and this is normally a better guide to underlying cyclical conditions and continues to warn of weaker conditions ahead.

Source: Bloomberg, AMP

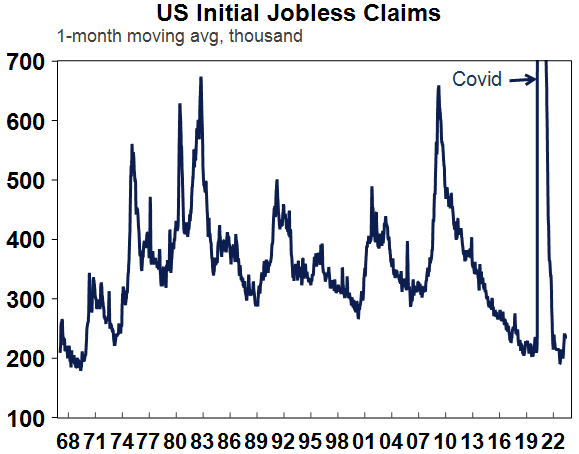

In other US data, personal spending rose solidly in April, new home sales rose and pending home sales were flat adding to the stabilisation/recovery being seen in some housing indicators, jobless claims rose although recent weeks were revised down, consumer sentiment remained weak and March quarter GDP was revised up to 1.3% annualised but income was revised lower with falling profits and slower wage and salary growth which may be a dampener on future growth. Private final consumption deflator inflation cam in slightly stronger than expected with core services inflation remaining sticky. This increases the probability of another Fed rate hike, possibly in July after a pause in June.

Source: Macrobond, AMP

Meanwhile the minutes from the Fed’s last meeting seemed unclear as to what to do next on interest rates with possibly more officials anticipating a likely need for more hikes but an inclination to leave rates on hold at the next meeting in June.

UK inflation fell less than expected in April to 8.7%yoy, with core inflation actually rising to 6.8%yoy. The good news is that price indicators in the UK PMI survey are trending down, but they are running a bit higher than in the G3 and Australia and the acceleration in core UK inflation in recent months contrasts with the US, Europe and Australia where the trend has been flat or down. Special factors in the UK may be at work – including Brexit, but its likely to see the Bank of England continue with rate hikes. Given the divergent trend with other countries there shouldn’t be much flow through to other central banks including the RBA - but the RBA will no doubt be wary of seeing the UK experience replicated here.

Source: Bloomberg, AMP

The RBNZ hiked rates again by another 0.25% taking its key policy rate to 5.5%. This is likely to be the top though: its own cash rate forecasts show no change ahead of rate cuts from the September quarter next year; it expects inflation to be back in the 1-3% target range by then; the Monetary Policy Committee was no longer united behind the hike with two of the 7 members voting for a pause; and another decline in real retail sales indicates that there is a high risk that New Zealand has entered recession.

Australian economic events and implications

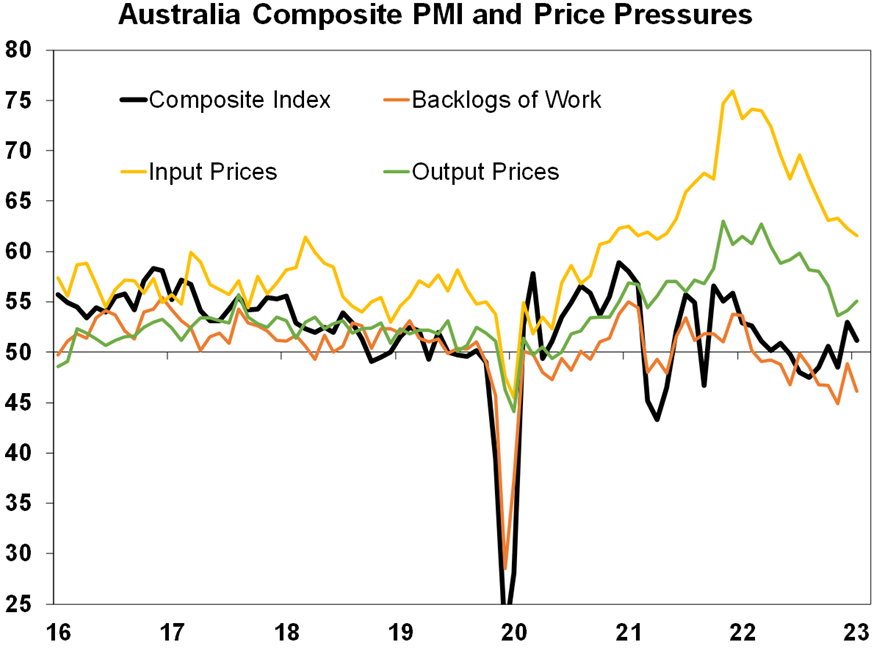

Australian business conditions PMIs for May fell but to a still ok level and as is the case globally are seeing solid services but soft manufacturing. Price pressures are generally continuing to improve with input prices down again, output prices up but well down from their highs and order backlogs continuing to improve. All of which remains consistent with easing inflation pressures.

Source: Bloomberg, AMP

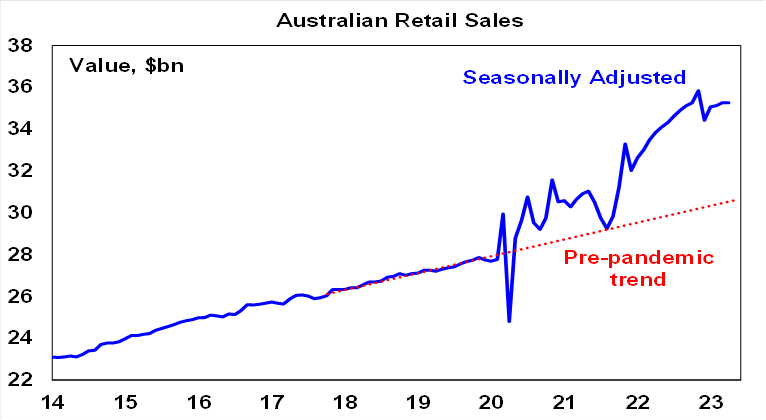

Retail sales were flat in April as rate hikes impact. While retail sales are still way above their pre-covid trend this is now distorted by the rapid price rises of the last 18 months and more importantly nominal retail sales are basically unchanged since September, which means they have been falling real terms. Clothing and department stores were the only categories that gained in April but this likely reflected colder than normal weather. Consumers are curtailing their spending on discretionary goods as part of the rotation back to services with reopening but also increasingly as a result of rate hikes and cost of living pressures. This is a key indicator that the RBA looks at and is firmly in the camp supporting the RBA leaving rates on hold in June.

Source: ABS, AMP

Victoria hits big business and property investors. The Victorian Budget sought to protect most households and small business and contained a positive move abolishing stamp duty for commercial property. However, it hit big business and property investors with increases in payroll tax and land tax as part of a “Covid levy” and cut the state public service by up to 4000 jobs. Roughly one third of the incidence of the tax hikes will flow back to the Federal Government and hence all Australian taxpayers (as businesses and property investors claim payroll and land tax as a cost) but it runs the risk of hitting ordinary Victorians via higher rents, less property investment and big businesses relocating to other states. (Rental caps if included as part of a housing affordability statement would only exacerbate the lack of housing supply.) And despite the tax hikes Victoria’s high compared to other states net debt projections are little different from what they were before the Budget.

What to watch over the next week?

In the US the focus is likely to be on jobs data for May (Friday) which is expected to show a 180,000 gain resulting a continuation of the downtrend, unemployment rising to 3.5% and wages growth cooling a bit further to 4.3%yoy. In other data expect a slight rise in home prices but a fall in consumer confidence (both Tuesday), job openings to remain in a downtrend and the ISM manufacturing conditions index (Thursday) to remain weak at around 47.

Eurozone inflation for May is expected to fall to 6.4%yoy, with core inflation falling to 5.5%yoy and unemployment is expected to be flat at 6.5% (both Wednesday).

Japanese data is expected to show a slight fall in unemployment (Tuesday) to 2.7% and a rise in industrial production (Wednesday).

Chinese business conditions PMI’s (Wednesday and Thursday) are likely to show ongoing strength in services but softness in manufacturing.

In Australia, the focus is likely to be on the monthly CPI Indicator (Wednesday) for April, where we expect a further fall to 6.2%yoy from 6.3%yoy in March, providing further confirmation that we have seen the peak in inflation at 8.4%yoy in December. In terms of other data, expect a 2% gain in building approvals (Tuesday), a stabilisation in housing credit growth as is starting to become apparent in housing finance but a 1.5% fall in March quarter construction data (both Wednesday), a 1% rise in March quarter business investment (Thursday) which is also likely to show some slowing in investment plans and housing finance (Friday) to rise 1%. CoreLogic data for May is likely to show a further acceleration in home price gains to 1.4%mom, making it three months of gains in a row, with Sydney leading the charge with a 1.7%mom rise.

Outlook for investment markets

The next 12 months are likely to see easing inflation pressures, central banks moving to get off the brakes. This along with improved valuations should make for reasonable share market returns in contrast to 2022. But the next few months may be rough given high recession and earnings risks, uncertainty around US banks and raising the debt ceiling and its aftermath, geopolitical risks and poor seasonality out to around September/October. This is likely to impact both global and Australian shares.

Bonds are likely to provide returns above running yields, as growth and inflation slow and central banks become less hawkish.

Unlisted commercial property and infrastructure are expected to see slower returns, reflecting the lagged impact of last year’s rise in bond yields on valuations. Commercial property returns are likely to be negative as “work from home” hits space demand as leases expire.

With an increasing supply shortfall, we have revised up our national average home price forecast for this year from a fall of -7% to around flat to up slightly ahead of 5% growth next year. However, the risk a further leg down putting us back on track for a 15-20% top to bottom fall on the back of the impact of high interest rates and higher unemployment are very high (at around 45%) with the latest RBA hike adding to that risk.

Cash and bank deposits are expected to provide returns of around 3.5%, reflecting the back up in interest rates.

The $A is at risk of more downside in the short term, but a rising trend is likely over the next 12 months, reflecting a downtrend in the overvalued $US and the Fed moving to cut rates.

Weekly market update 17-05-2024

17 May 2024 | Blog Better news on inflation and signs of a “good” moderation in US economic growth; 2024-25 Australian Federal Budget Read more

Federal budget & global markets update 2024

15 May 2024 | Blog In this webinar recording hear from AMP Chief Economist & Head of Investment Strategy, Dr Shane Oliver explain what effects the Federal Budget could have on the Australian economy and investment markets. Read more

Key points from the 2024-25 Federal Budget

15 May 2024 | Super Here's a 5-minute read on how the 2024-25 Federal Budget proposals could affect you. Read moreWhat you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

The information on this page was current on the date the page was published. For up-to-date information, we refer you to the relevant product disclosure statement, target market determination and product updates available at amp.com.au.