Investment markets and key developments

Global share markets were mixed and mostly little changed over the last week amidst mixed economic data. US shares fell 0.1% for the week but Eurozone shares rose 0.3% and Japanese shares rose 0.2%. Chinese shares fell 1.5% though. Australian shares fell 0.4% with falls in resources stocks offsetting gains in finance, industrial and property shares. Bond yields rose, but oil, metal and iron ore prices fell. The $A fell slightly with a slight rise in the $US.

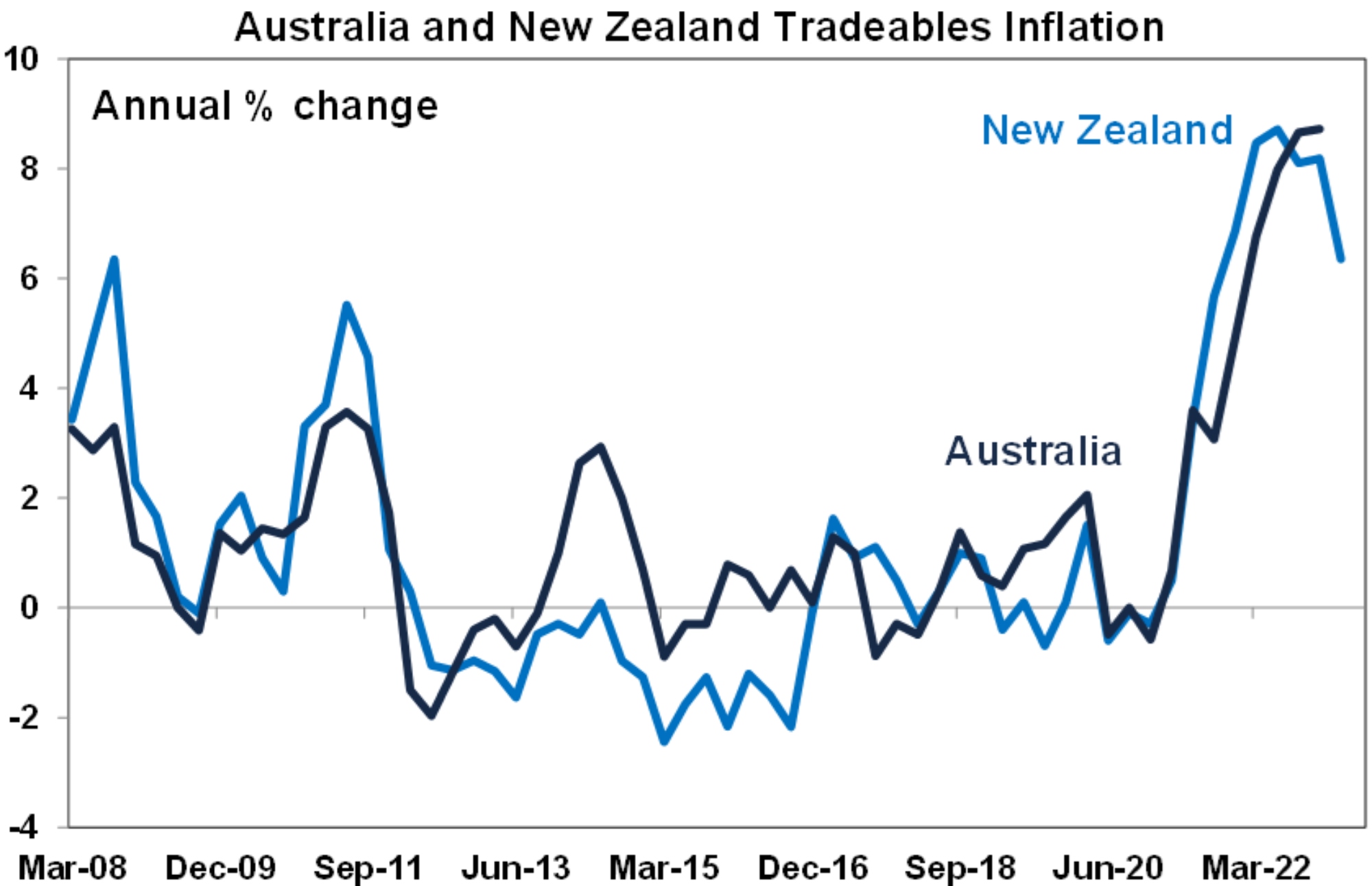

Inflation pressures are continuing to recede. Following the fall in US inflation for March, inflation data in Canada, New Zealand and to a lesser extent the UK all fell in March and by more than expected in Canada and New Zealand. The plunge in tradeable inflation (goods and services that are imported or in competition with imports) in New Zealand suggests reasonable prospects for a similar fall in Australia – see the next chart. Inflation also fell more than expected in Malaysia and the Indonesian central bank left rates on hold.

Source: Macrobond, AMP

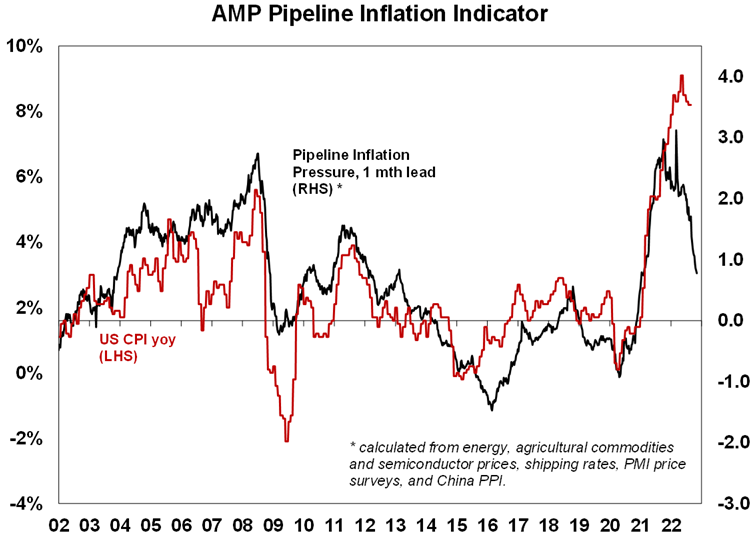

Our US Pipeline Inflation Indicator continues to point to lower US inflation ahead. Higher gasoline prices will impact this month though.

Source: Bloomberg, AMP

Some change coming to the way the RBA does things following the independent review. The review notes that “Australia’s economic performance has been very good since flexible inflation targeting was introduced in the early 1990s” and “at least on a par with other comparable countries” and there is a broad consensus that the RBA has contributed significantly to this. Key recommendations are as follows:

- Affirmation of the flexible 2-3% inflation target which “has generally worked well”, although it recommended the RBA’s objectives should be more clearly and equally defined around price stability and full employment.

- Removal of the “on average, over time” reference to the achievement of the inflation target, which should be replaced with the RBA explaining “how it is using its flexibility”.

- Affirmation of RBA independence and that it be strengthened with removal of the power of the Treasurer to overrule it.

- The creation of a dedicated Monetary Policy Board from 1 July next year compromised of the Governor as chair, Deputy Governor and Treasury Secretary with 6 external members with expertise in macro economics, the financial system, labour markets and the supply side of the economy to set monetary policy. The Board would have formal votes with the 6 external members having the potential to override RBA official recommendations.

- A move to 8 meetings a year to allow for better deliberation.

- Press conferences after each meeting with an increased amount of information, and external Monetary Policy Board members publicly discussing decisions.

But it won’t change the RBA’s focus or what happens to interest rates. Looking at the key recommendations:

- The RBA has already been targeting both price stability and full employment under Governor Lowe – which partly explains why it’s been less aggressive in raising rates than other central banks.

- Its not clear that switching to regular press conferences and commentary from external Monetary Policy Board members will add much except more noise and potentially confusion around RBA decisions (as seen in other countries like the US) and the RBA already supplies a lot of information (maybe too much).

- Removal of the “on average, over time” reference to the inflation target with the RBA explaining “how it is using its flexibility” may make the RBA less tolerant of short-term deviations from the inflation target and so could result in more aggressive and volatile moves in interest rates posing a greater threat to full employment.

- Switching to less meetings may contribute to better quality decisions, but it may also make the RBA less agile, reduce “announcement effects” and necessitate bigger moves.

- Having more monetary policy experts involved in the determination of monetary policy is a move in the right direction in being better able to challenge the RBA and add to its views. It may at the margin help avert a rerun of some of the RBA’s missteps of recent years in relation to yield targeting and the “no rate hike till 2024” guidance, but having learned from that experience the RBA is unlikely to repeat them again anyway. The potential for external members to outvote the RBA members on the Monetary Policy Board could create confusion and actually reduce formal RBA accountability.

- At a high level its questionable whether moving to the separate Monetary Policy Board, less meetings, more press conferences and more speakers model employed in several other countries is justified when those countries have not necessarily achieved better economic outcomes than the RBA.

- Overall, the recommended changes if fully implemented are unlikely to have a significant impact on the outlook for monetary policy. In particular, there is nothing in the recommendations pointing to a less hawkish RBA that some may have been hoping for. Don’t forget that there are plenty of other central banks - in the UK, NZ, Canada and the US - that have separate monetary policy committees, less meetings and press conferences after each meeting, but which have actually been more aggressive and arguably less balanced in raising interest rates than the RBA has!

Should Governor Lowe be reappointed for another term from September? This is now a common question. He has indicated a willingness to serve for another term but of course the Government may opt for change. But there is actually a very strong argument for him to remain. While with the benefit of hindsight the RBA has made some mistakes over the few couple of years, this is not particularly surprising given the wild swings in the economic outlook set off by the pandemic with most governments, central banks and economists being wrong footed at times. And Governor Lowe has learned from them and is most unlikely to repeat them. More importantly, the lessons of the 1970s - in particular the decision in the US to replace William Martin with Arthur Burns at the Fed - warn that its best to let Governor Lowe finish the job of bringing inflation back to target rather than seek a replacement who has to start anew in re-establishing confidence that the inflation target will be met. If Governor Lowe’s term is not extended there are plenty at the RBA who would be well placed to fill his shoes though including Michele Bullock, Luci Ellis and Christopher Kent.

RBA minutes incrementally more hawkish and point to a high risk of another rate hike next month but with a lot riding on March quarter inflation data. Continuing the pause on interest rates makes sense in our view as growth and inflation are likely to continue to slow and evidence of this will build in the months ahead, and not enough time has elapsed yet since the last meeting to assess the impact of rate hikes to date, eg, the last retail sales release was prior to the last RBA meeting and the next retail sales release won’t come until the day after the May RBA meeting.

However, while the RBA looked like it was keen for a pause going into the April meeting, the minutes from that meeting suggest that it is strongly biased towards a further increase in interest rates, particularly with the minutes providing a strong case for another 0.25% hike and noting in particular concerns that stronger than expected population growth could add to housing costs and hence inflation and that there is now an increased risk of faster wages growth, including in the public sector. So while we expect March quarter inflation to be released in the week ahead to slow to 6.9%yoy for the CPI and 6.7%yoy for the trimmed mean (from 7.8%yoy and 6.9%yoy respectively) and this would support the case for a continuation of the pause which is our base case, this may not be enough for the RBA to head off another 0.25% rate hike. We think this would be going too far given that on the RBA’s own estimates 15% of variable rate borrowers will have negative cash flow by year end. A downward surprise on inflation in the week ahead as seen in other countries would add to the case for a continuation of the pause though. The money market is pricing in roughly a 20% change of a 0.25% hike in May, but an 80% chance by August.

In My Room and Barry Manilow. There is a great episode in Daisy Jones and the Six (which seems loosely inspired by Fleetwood Mac) where Daisy and Billy finally learn to write songs together. The Beach Boys classic In My Room gets a look (based on his twitter feed even Brian Wilson noticed) and in the next scene Barry Manilow’s I Write The Songs gets a go. The link is that the latter was actually written by Beach Boy Bruce Johnston. Maybe it was too saccharine for The Beach Boys (and Bruce was having a break from them at the time) but it’s just right for Barry. It’s actually a great song. Speaking of Barry, his sped up super catchy version of Let’s Hang On is worth a look. And of course, Daisy is played by Elvis’ granddaughter.

Economic activity trackers

Our Economic Activity Trackers rose in Europe and Australia as hotel occupancy rose and were revised up in recent weeks reflecting new higher restaurant booking activity. Our US Tracker was revised lower.

Levels are not really comparable across countries. Based on weekly data for eg job ads, restaurant bookings, confidence, credit & debit card transactions and hotel bookings. Source: AMP

Major global economic events and implications

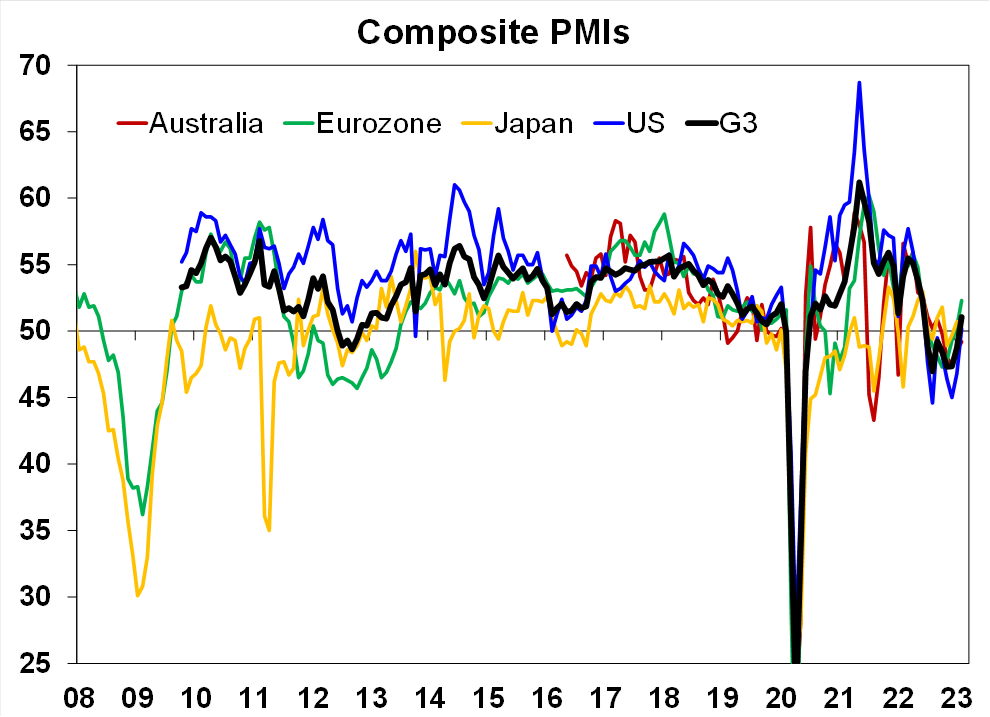

April composite business conditions PMIs in advanced countries were mostly stronger again with the US, Europe, UK and Australia all improving mainly on the back of stronger service sector conditions. Taken on their own the strength evident in the PMIs bias central banks to more interest rate hikes.

Source: Bloomberg, AMP

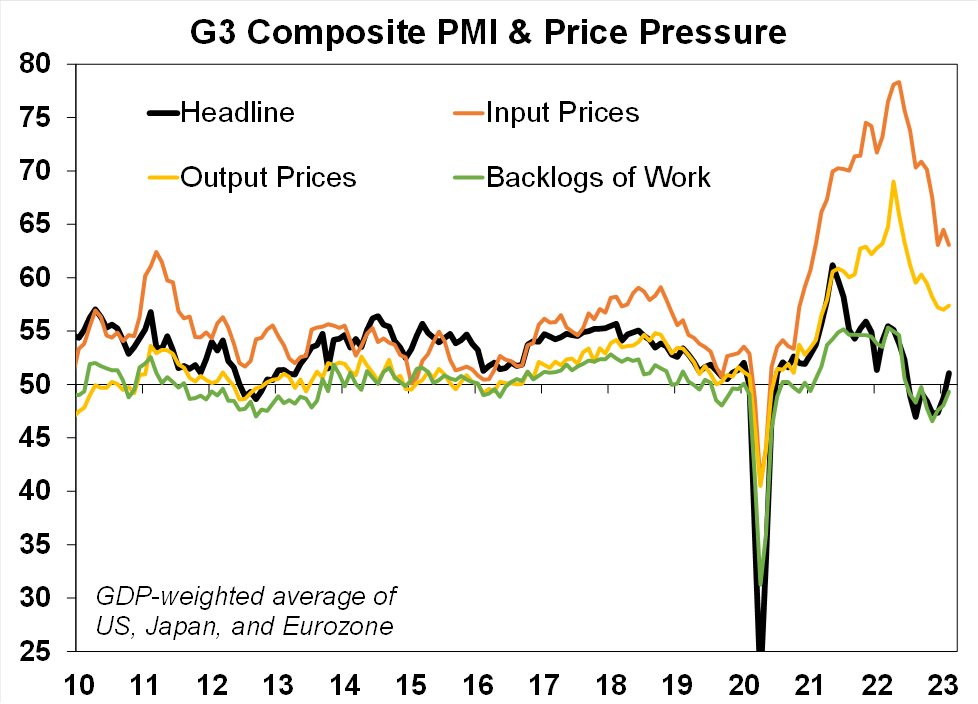

Inflation signals were a bit mixed, but remain far improved compared to 2021-22. The April PMIs averaged across major advanced countries showed flat to slightly down input prices but a slight lift in output prices (with Europe down but the US up), order backlogs running well below last year’s highs and substantially improved delivery times.

Source: Bloomberg, AMP

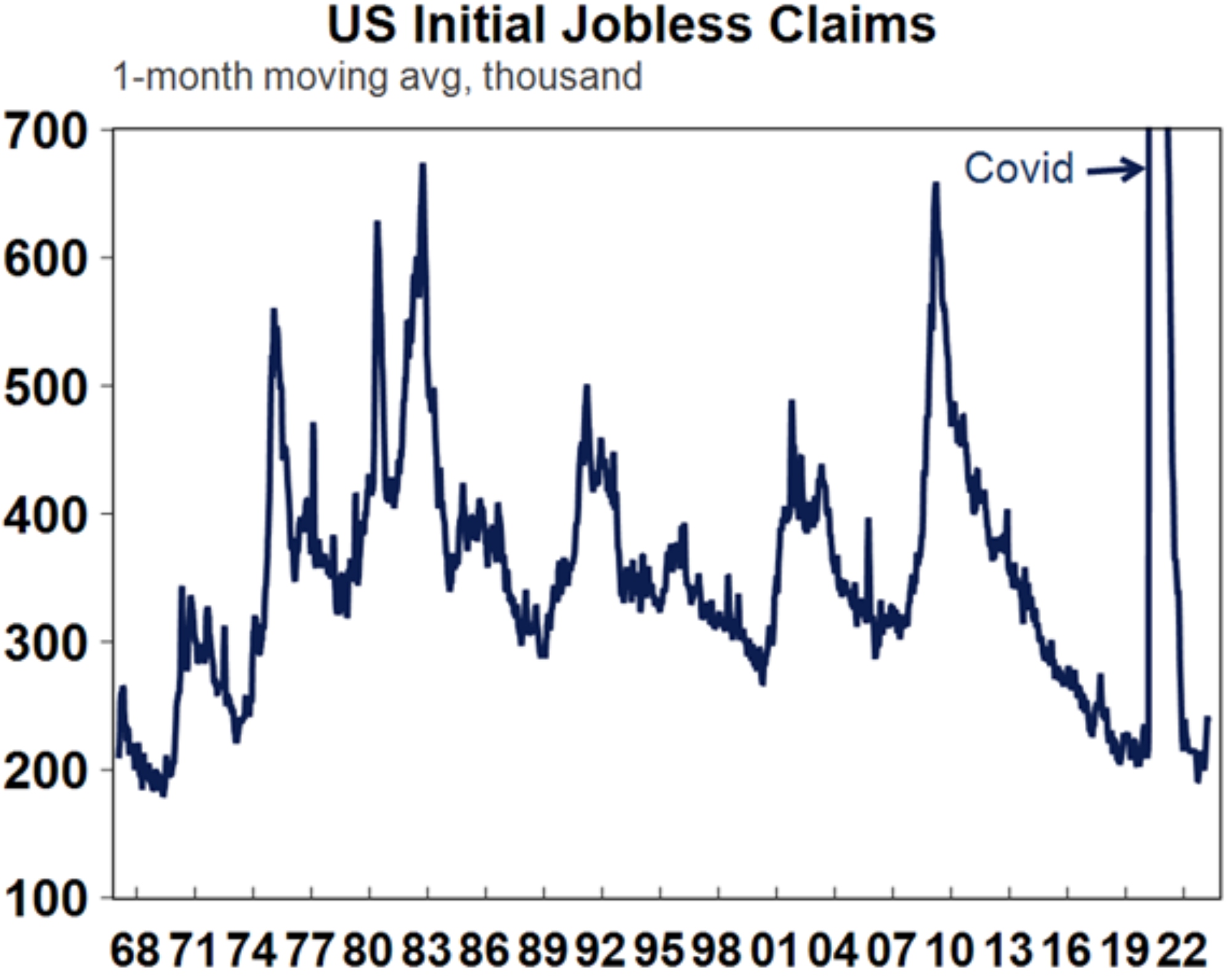

Apart from the PMIs, US economic data was mostly weak. Manufacturing conditions rebounded in the New York region in April but this may be seasonal as the same thing happened last April and the Philadelphia manufacturing conditions index fell to a new low. Housing starts and permits fell in March but with a further slight improvement in home builder conditions look to be trying to stabilise. Leading indicators continue to warn of a sharp slowdown ahead if not recession and jobless claims rose further pointing to a further weakening in the labour market. The Fed’s Beige Book reported basically flat economic activity, some slowing in employment and inflation and a tightening in lending conditions. Fed emergency lending to banks also ticked up a bit over the week suggesting that while banking stress may be contained it hasn’t gone away.

Source: Macrobond, AMP

So far so good with March quarter US earnings results. Only 17% of S&P 500 companies have reported so far but with 76% surprising on the upside which is far better than in the December quarter and in line with the long-term norm. The average beat is running at 5.6%.

Japanese inflation slowed to 3.2%yoy in March, although core (ex food and energy) inflation rose slightly to 2.3%yoy. Business conditions PMIs fell slightly but remained okay with the composite at 52.5.

China’s economy rebounding rapidly thanks to reopening. Chinese Q1 GDP rebounded more than expected by 2.2%qoq/4.5%yoy with a much stronger than expected rebound in retail sales at +10.6%yoy. This is consistent with the rebound in mobility (eg, subway usage) and services conditions PMIs already reported. Property sales activity has also rebounded, and unemployment fell to 5.3%. Our 2023 GDP forecast remains +6% but this appears to be becoming consensus.

Source: Bloomberg, AMP

Australian economic events and implications

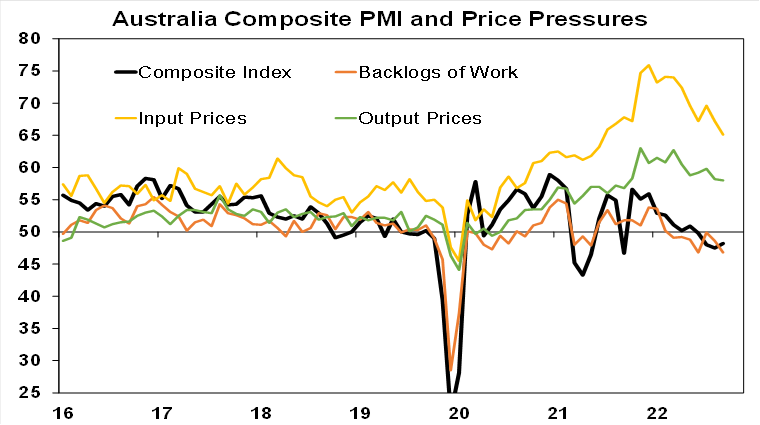

Australian business conditions PMIs for April saw a surprising bounce with services conditions up sharply but with new orders more moderate. Output prices ticked up slightly, but input prices fell further and both are well below their highs. Order backlogs are still negative and delivery times continue to improve. All of which remains consistent with easing inflation pressure.

Source: Bloomberg, AMP

New home sales fell another 7.2% in March, contrary to other signs of an uptick in the property market, and are running down around 46% on the March quarter a year ago.

What to watch over the next week?

US data in the week ahead is expected to show still soft and little changed consumer confidence and a further fall in home prices (Tuesday), weak durable goods orders (Wednesday), March quarter GDP growth of 2% annualised driven mainly by consumer spending, March quarter employment cost growth of 1.1% taking annual growth to 4.7%yoy (down from 5%) and a fall in personal consumption deflator inflation to 4.5%yoy (from 4.6%).

US March quarter earnings reports will also ramp up. Consensus expectations are for a -5.9%yoy but faster than normal downgrades in the last few months and stronger than expected economic growth and a fall in the $US point to upside surprise.

Eurozone March quarter GDP due Friday) is likely to show low but positive growth.

The Bank of Japan (Friday) is likely to leave monetary policy unchanged at the first rate setting meeting under new Governor Ueda. Japanese data for jobs and industrial production will also be released on Friday.

In Australia, we expect March quarter CPI inflation data to provide confirmation that inflation peaked in the December quarter, based partly on moderation already seen in the ABS’ Monthly CPI Indicator and softening inflation pressures in business surveys. We expect the CPI to rise 1.3%qoq or 6.9%yoy, down from 7.8%yoy in the December quarter. Expect a further acceleration in rent, gas & electricity inflation but roughly flat fuel prices and slower goods prices, new dwelling construction costs and holiday travel costs. Trimmed mean inflation is likely to slow to 1.4%qoq or 6.7%yoy from 6.9%yoy in the December quarter which is in line with the RBA’s February SOMP forecast. The March Monthly CPI Indicator is expected to fall to 6.7%yoy from 6.8%. March quarter producer price inflation data is expected to show a further slowing from 5.8%yoy and March credit growth is expected to show a further moderation, with both due Friday.

Outlook for investment markets

The next 6-12 months are likely to see easing inflation pressures, central banks moving to get off the brakes and economic growth weakening but stronger than feared. This along with improved valuations should make for better returns this year than in 2022. But there will still be bumps on the way – particularly regarding interest rates, recession risks, geopolitical risks and raising the US debt ceiling in the September quarter.

Global shares are expected to see reasonable returns this year. The post mid-term election year normally results in above average gains in US shares, but US shares are likely to be a relative underperformer compared to non-US shares reflecting still higher price to earnings multiples versus non-US shares. The $US is also likely to weaken further which should benefit emerging and Asian shares.

Australian shares are likely to boosted by stronger economic growth than in other developed countries and stronger growth in China supporting commodity prices and as investors continue to like the grossed-up dividend yield of around 5.5%.

Bonds are likely to provide returns a bit above running yields, as inflation slows and central banks become less hawkish.

Unlisted commercial property and infrastructure are expected to see slower returns, reflecting the lagged impact of weaker share markets and last year’s rise in bond yields (on valuations). Commercial property returns are actually likely to be negative.

Our base case remains for Australian home prices to fall further out to later this year as interest rate hikes and slower economic growth impact, but the rapid return of immigration, very low rental vacancy rates and constrained supply mean that our expectation for a top to bottom fall of 15-20% may be too pessimistic and we may have already seen the low.

Cash and bank deposits are expected to provide returns of around 3.5%, reflecting the back up in interest rates.

A rising trend in the $A is likely over the next 12 months, reflecting a downtrend in the overvalued $US, the Fed moving to cut rates and solid commodity prices helped by stronger Chinese growth.

Oliver's Insights - seasonal patterns in shares

06 May 2024 | Blog This article looks at seasonal patterns in shares and whether its time to “sell in May and go away” along the lines of the old share market saying. Read more

Weekly market update 03-05-2024

03 May 2024 | Blog Fed less hawkish than feared; US stagflation or just getting back on track?; RBA to hold, with a tightening bias; Aust consumer remains weak; Aust budget preview. Read more

Econosights - positive supply shocks

02 May 2024 | Blog Post pandemic, the supply of labour has increased in many major economies, including the US and Australia, through elevated immigration and a lift in the participation rate to a record high. Read moreWhat you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

The information on this page was current on the date the page was published. For up-to-date information, we refer you to the relevant product disclosure statement, target market determination and product updates available at amp.com.au.