Investment markets and key developments

Global share markets were mixed over the last week as concerns about rate hikes continue to impact. Eurozone shares rose 1.9% for the week but US shares fell 0.3%, Japanese shares fell 0.6% and Chinese shares fell 1.7%. Australian shares lost 1.2% for the week partly reflecting ongoing concerns about the impact or more aggressive RBA rate hikes on the economy and earnings and company reports pointing to signs of weakening demand with falls led by financials and resources stocks. Bond yields rose in the US as Fed rate hike expectations pushed higher. Oil prices fell but iron ore and copper prices rose. The $A fell below $US0.69 as the $US rose.

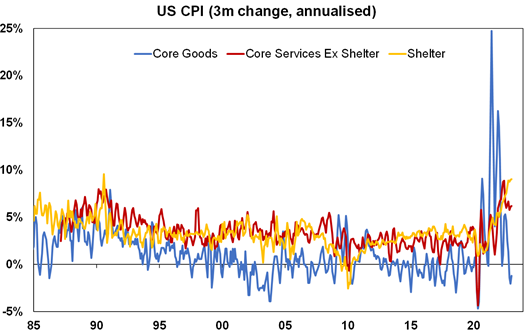

Inflation and interest rates remained the main story. US monthly inflation picked up in January and the breadth of high inflation readings across CPI items increased a bit but the broader trend towards lower inflation continued with annual inflation falling to 6.4%yoy, core inflation falling to 5.6%yoy, 3 month annualised goods price inflation remaining negative and 3 month annualised core services inflation excluding dwellings starting to slow and even rental growth starting to cool (with further falls ahead given a sharp slowing in market rents).

Source: Bloomberg, AMP

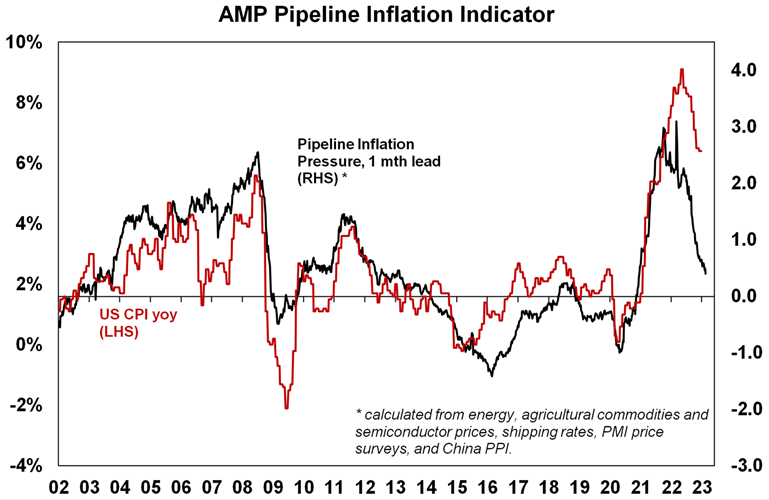

Our US Pipeline Inflation Indicator continues to point to a further sharp fall in inflation ahead. While a rebound in US retail sales coming on the back of strong January payrolls will likely keep the Fed on edge for a while yet we remain of the view that its getting close to the peak in the Fed Funds rate. The departure of Vice Chair Brainard at the Fed (who is going to the White House) may make the Fed sound a bit more hawkish (until she is replaced with another centrist dovish Fed official) but its unlikely to alter what Chair Powell ultimately does.

Source: Bloomberg, AMP

RBA Governor Lowe reiterated the RBA’s hawkish message. Governor Lowe and colleagues’ Senate and House of Reps appearances showed how political the issues around the RBA have become but didn’t really add anything that was new regarding the outlook for interest rates. However, Governor Lowe confirmed that it was the broad-based nature of the rise in inflation in the December quarter that caused it to become more hawkish. The testimony also highlighted that the RBA judges the longer-term cost to the economy of not getting inflation back down as greater than the shorter-term cost of bringing it under control and the risk of triggering recession in the process. So, the RBA is expecting to do more rate hikes in order to be sure that it will bring inflation back under control in a timely way. We agree with the Governor’s assessment about the long term damage continuing high inflation will do to the economy, but our assessment is that it has likely already done enough to bring inflation down – with global supply improving, Australia lagging the global inflation cycle and signs that the economy is cooling – and so given the growing risks to households with high debt levels it makes sense to pause for a while and allow time to assess the lagged impact of past rate hikes. As the RBA noted in its House testimony while 50% or so of borrowers were well ahead on their payments about 10% had no spare cash flow and very low buffers with 880,000 fixed rate borrowers to see their rates reset higher this year. However, the RBA controls the levers and right now their message is still up for interest rates. So, we are allowing for another 0.25% hike next month. Thereafter another set of soft retail sales and jobs outcomes and maybe somewhat softer monthly inflation data could set the scene for a pause in April – consistent with Governor Lowe’s comments that the RBA would review its rate hikes if “we saw another weak jobs report”, but the risk of a further hike in April or May is high.

We remain reasonably upbeat on the outlook for investment markets this year as inflation falls and central banks get off the brake. But as we are starting to see it won’t be smooth sailing given that: the process of getting inflation back down won’t be smooth; the topping process in central bank rates will take time with apparent setbacks along the way as we have seen for both the Fed and the RBA over the last week; recession risks are high; raising the US debt ceiling around the September quarter won’t be smooth; and geopolitical risks around Ukraine, China and Iran are significant. With shares getting overbought after the new year rally and seasonality now less positive, shares are vulnerable to a further pull back in the short term. The RBA’s increased hawkishness has added to the downside risks for the Australian economy and share market – particularly if the cash rate were to rise beyond 4% - but we lean to the view that its bite won’t be quite as strong as its bark.

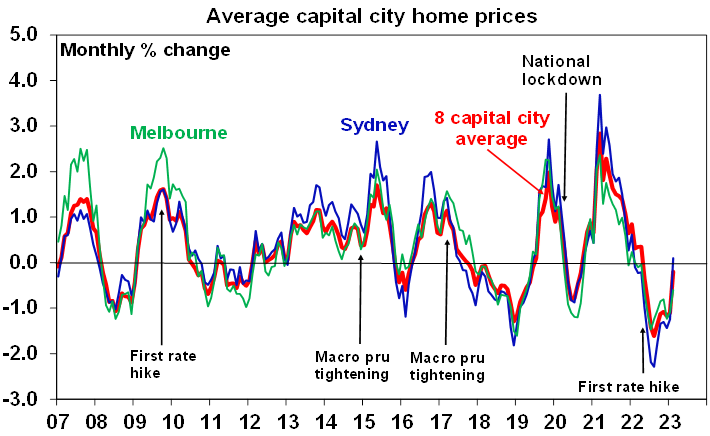

Is the Australian home price cycle turning back up? CoreLogic data so far for February shows a sharp slowing in home price falls with Sydney prices up slightly. This begs the question whether the cycle is now turning up again. Its possible given the return of immigration and the tight rental market and the Australian housing markets does have a tendency to surprise on the upside. But I am a bit sceptical and tend to think it reflects the return of bargain hunters and a bit of “fear of missing out” demand helped along by low listings and optimism coming into the year that interest rates were close to peaking. But with the RBA signalling several more hikes to go, the capacity to borrow and pay being well down from year ago levels and the combination of the fixed mortgage cliff which will see 880,000 mortgages face more than a doubling in their interest bill this year and the increasing risk of recession with much higher unemployment we continue to see more weakness ahead. Its worth noting that the 2010-12 and 2017-19 price fall cycles saw periods where falls moderated or partially reversed only to resume falling.

Source: CoreLogic, AMP

What happened to bass? In Brisbane late last year I got chatting to a finance sector guy and found he was a bass player in many bands and we got into why bass guitar is not so clearly heard in songs these days. In Elvis’ version of The Bee Gees Words which is the best cover of that song I have ever come across Jerry Scheff’s bass line almost seems to lead the song (or maybe I was just focussed on it). This is an amazing clip and shows Elvis arranging the song at the end as it is to be performed. Elvis’ Polk Salad Annie is another.

Coronavirus update

New global Covid cases continue to fall and Chinese Covid deaths – the main driver of global deaths over the last few months - are still falling and are well down from the initial reopening spike.

Reported new cases appear to have stopped falling in Australia, but hospitalisations and deaths are continuing to fall.

Economic activity trackers

Our Economic Activity Trackers rose in the US, were unchanged in Europe and fell in Australia over the last week last week. Momentum has slowed since early last year, but they are not indicating economic collapse.

Levels are not really comparable across countries. Based on weekly data for eg job ads, restaurant bookings, confidence, credit & debit card transactions and hotel bookings. Source: AMP

Major global economic events and implications

US data was mixed. January retail sales surged 3%, the New York manufacturing index improved sharply in February and home builder conditions rose. But against this industrial production was flat in January, small business optimism remained weak, manufacturing conditions in the Philadelphia region fell sharply, housing starts fell and the leading index fell further. Initial jobless claims fell slightly but continuing claims continue to rise. The bounce in retail sales and continuing low jobless claims may concern the Fed, but the retail sales bounce may also be due to a seasonal distortion after some poor months and most other indicators remain soft – even those that bounce.

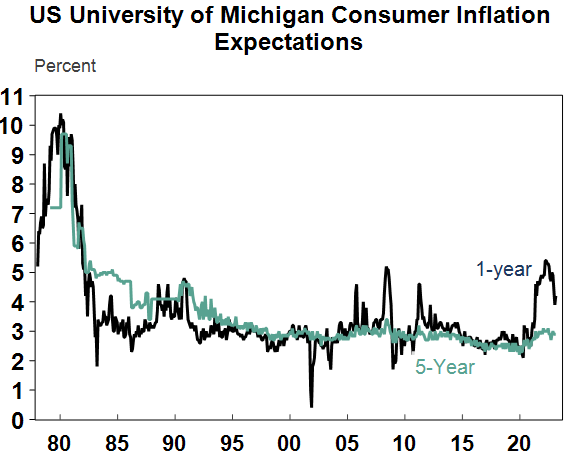

Most US inflation indicators still falling. As noted earlier, CPI inflation continued to trend down in January, but the improvement slowed. In terms of other indicators, producer price inflation was stronger than expected in January but fell further to 6%yoy (from 6.5%), import prices fell 0.2% in January, the price components of the NY and Philadelphia surveys were mixed but continue to trend down and delivery times and order backlogs remain low and capacity utilisation fell further. Short term inflation expectations continue to fall in the US from recent highs and 5-10 year inflation expectations are in the range they have been in for the last few decades suggesting inflation expectations remain “well anchored”. This means the Fed’s task in getting inflation down should be far easier than in the early 1980s.

Source: Macrobond, AMP

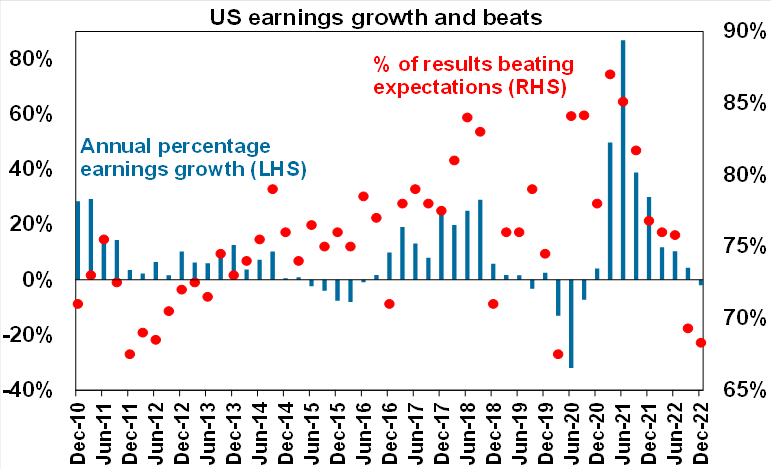

December quarter earnings results in the US have been soft. With 81% of results now in, earnings for the quarter are down 1.9%yoy, which is little different from where consensus expectations were at the start of the quarter whereas earnings beats normally see the final number come in stronger than expected. Only 68% of results have come in better than expected which is below the norm of 76%. Energy and industrials are seeing strong growth, but all other sectors have seen earnings fall and non-US earnings growth is far stronger at +5.6%. Key themes have been more negative forward guidance, rising costs weighing on margins and weaker demand for goods but still solid demand for services.

Source: Bloomberg, AMP

UK inflation fell more than expected in January. It’s still too high at 10.1%yoy and 5.8%yoy for core, but it adds to signs that inflationary pressure have peaked globally.

Japanese December quarter GDP was weaker than expected at 0.2%qoq or 0.6%yoy. Business investment fell but consumer spending was solid and the much of the downside surprise came from a -0.5 percentage point detraction from inventories.

Chinese property prices were flat in January and have stabilised.

Australian economic events and implications

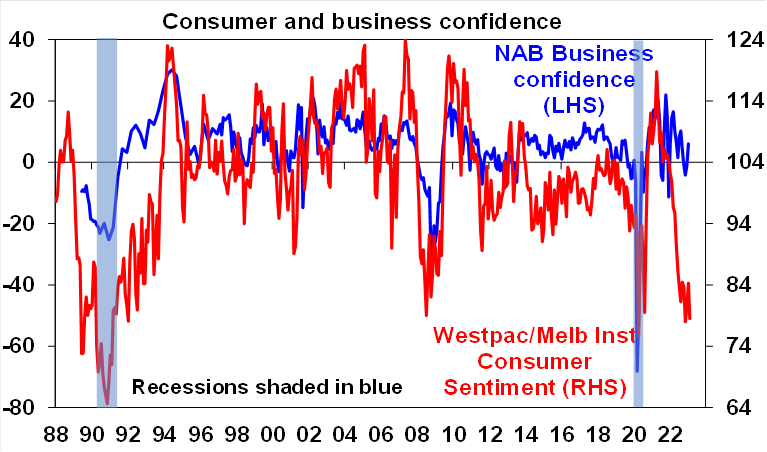

Businesses happy, consumers not. The January NAB business survey showed stronger conditions and confidence, but since then corporate commentary seems to have become less positive. And the hawkish turn by the RBA in February which saw a 7% plunge in consumer confidence is likely to weigh on business confidence.

Source: NAB, Westpac/MI, AMP

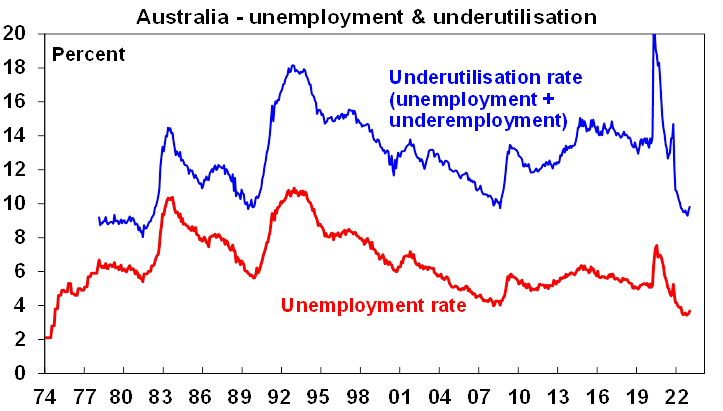

Jobs data weak again. Employment fell again in January and unemployment rose to 3.7% (up from a low of 3.4% in November). As is often the case with data over Christmas/New Year there may be seasonal adjustment distortions with the ABS reporting a larger than normal rise in unemployed people who have a job lined up. So we need to wait to February to get a clearer picture. This also appears to be the RBA’s interpretation with RBA Governor Lowe saying that the January jobs data didn’t make them change their view on interest rates as the jobs market is still tight, but that another weak jobs report might. But there is plenty of evidence that the jobs market is starting to cool: unemployment is trending up; the participation rate looks to be peaking (less people being attracted into the workforce); job vacancies have started to slow; and Roy Morgan’s surveyed unemployment rate has been trending up for some time. And in terms of worries about a prices-wages spiral the Melbourne Institute’s consumer survey shows that workers’ reported pay rises and their wage growth expectations remain moderate – suggesting little sign of a wages breakout.

Source: ABS, AMP

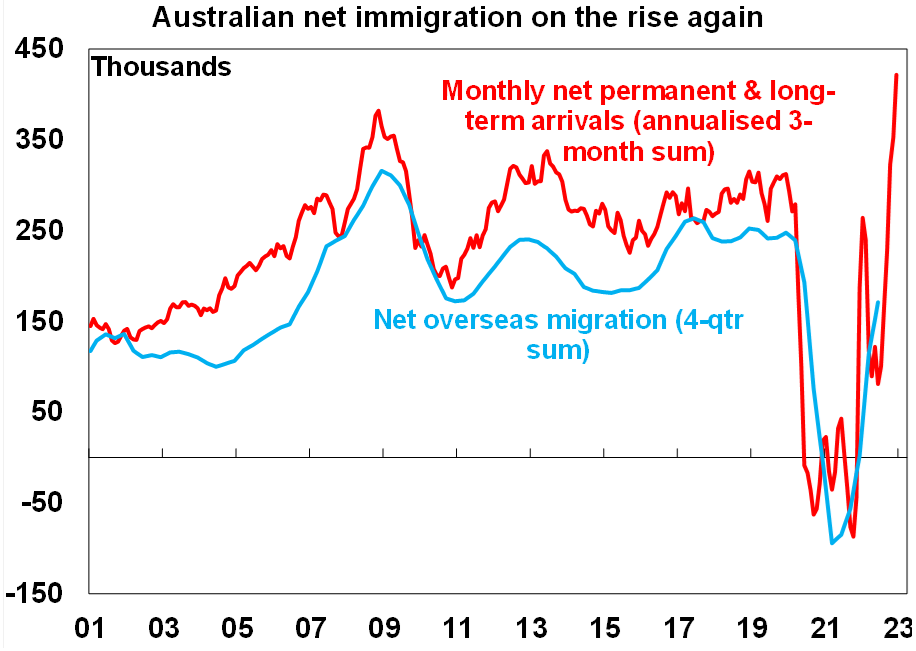

Meanwhile, monthly arrivals data points to a continuing surge in net immigration to Australia. This will add to demand in the economy but it will also help reduce the tight labour market.

Source: ABS, AMP

New home sales halved. The January HIA survey of home builders shows that new home sales fell another 13% and they are running around half what they were a year ago. Higher interest rates are the key driver and this has further to fall, although the return of immigrants will help drive an eventual recovery.

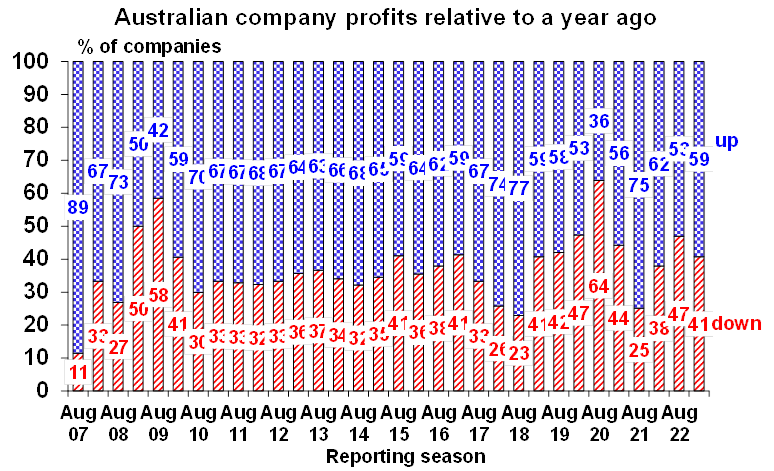

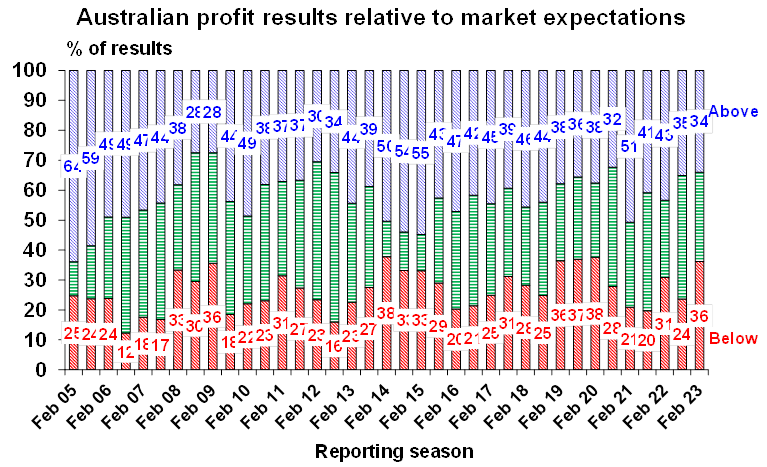

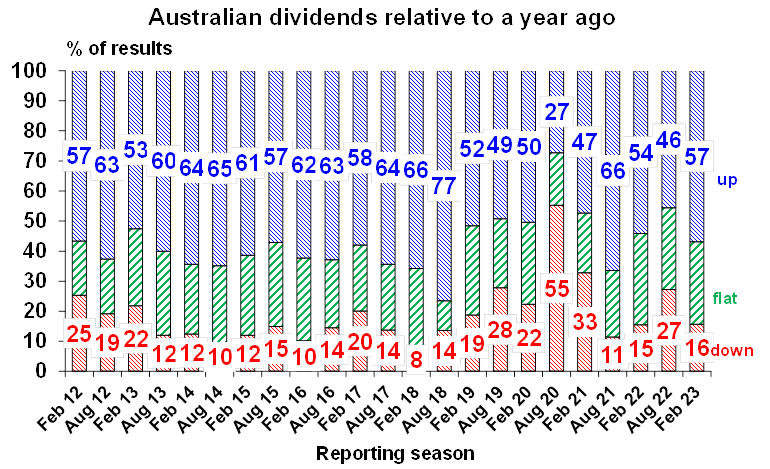

The Australian December half earnings reporting season is now about 45% done and so far it’s been pretty mixed resulting in downgrades to earnings growth expectations. The good news is that 59% of companies have seen earnings up on a year ago and 57% have increased their dividends both of which is an improvement on the August reporting season. However, both were below average, comparisons to December half 2021 are relatively easy given the lockdowns at the time and there have been more companies surprising on the downside (36%) than the upside (34%). Of course, there is still a way to go yet and good results have a tendency to report early. While companies appear to have so far weathered cost pressures and rate hikes reasonably well, corporate comments suggest that the post Christmas trading environment for consumer facing companies appears to be getting tougher with increasing resistance to buying big ticket items and some shifting to discount stores. Bank earnings are also showing signs of having peaked with credit growth slowing, interest margins likely to deteriorate and bad debts likely to rise. As a result consensus earnings expectations for this financial year have been revised down from 7.7% to 7.2%.

Source: AMP

What to watch over the next week?

In the US the minutes from the Fed’s last meeting (Wednesday) are likely to repeat the message that inflation remains too high and more rate hikes are likely but that rates are getting close to the top. On the data front expect February business conditions PMIs to remain softish at around 47 and existing home sales to rise slightly (both Tuesday), personal spending to show a bounce in January with core private final consumption inflation to remain unchanged at 4.4%yoy.

Canadian inflation (Tuesday) is expected to fall further to 6.2%yoy.

Eurozone business conditions PMIs for February (Tuesday) will be watched for a further improvement.

Japanese inflation for January (Friday) is expected to show a further rise to 4.2%yoy, with core inflation rising to 1.9%yoy. Business conditions PMIs (Tuesday) will also be released.

The RBNZ (Wednesday) is expected to hike by 0.5% to 4.75%.

In Australia, the minutes from the last RBA Board meeting (Tuesday) will likely repeat its hawkish stance but the focus will likely be on December quarter wages data (Wednesday) which is likely to show a further acceleration to 1%qoq or 3.5%yoy. Meanwhile, business conditions PMIs for February (Tuesday) are likely to show continued softness with the composite index likely to remain around 48.5, December quarter construction data (Wednesday) is likely to show a 0.6%qoq rise and December quarter business investment (Thursday) is likely to be up 0.8%qoq with investment intentions remaining reasonably solid.

The Australian December half earnings reporting season will see another 80 major companies report results including Bendigo Bank and BlueScope (Monday), BHP, Coles and Stockland (Tuesday), Santos, Scentre and Woolworths (Wednesday), Blackmores, Perpetual and Qantas (Thursday) and Brambles and Genworth (Friday).

Outlook for investment markets

2023 is likely to see easing inflation pressures, central banks moving to get off the brakes and economic growth weakening but proving stronger than feared. This along with improved valuations should make for better returns in 2023. But there are likely to be bumps on the way – particularly regarding interest rates, recession risks, geopolitical risks and raising the US debt ceiling around mid-year.

Global shares are expected to return around 7%. The post mid-term election year normally results in above average gains in US shares, but US shares are likely to remain a relative underperformer compared to non-US shares reflecting still higher price to earnings multiples (17.5 times forward earnings in the US versus 12 times forward earnings for non-US shares). The $US is also likely to weaken which should benefit emerging and Asian shares.

Australian shares are likely to outperform again, helped by stronger economic growth than in other developed countries and ultimately stronger growth in China supporting commodity prices and as investors continue to like the grossed-up dividend yield of around 5.5%. Expect the ASX 200 to end 2023 at around 7,600.

Bonds are likely to provide returns a bit above running yields, as inflation slows and central banks become less hawkish.

Unlisted commercial property and infrastructure are expected to see slower returns, reflecting the lagged impact of weaker share markets and last year’s rise in bond yields (on valuations).

Australian home prices are likely to fall another 8% or so as rate hikes continue to impact, resulting in a top to bottom fall of 15-20%, but with prices expected to bottom around the September quarter, ahead of gains late in the year as the RBA moves toward rate cuts.

Cash and bank deposits are expected to provide returns of around 3.25%, reflecting the back up in interest rates through 2022.

A rising trend in the $A is likely over the next 12 months, reflecting a downtrend in the overvalued $US, the Fed moving to cut rates and solid commodity prices helped by stronger Chinese growth.

Oliver's Insights - seasonal patterns in shares

06 May 2024 | Blog This article looks at seasonal patterns in shares and whether its time to “sell in May and go away” along the lines of the old share market saying. Read more

Weekly market update 03-05-2024

03 May 2024 | Blog Fed less hawkish than feared; US stagflation or just getting back on track?; RBA to hold, with a tightening bias; Aust consumer remains weak; Aust budget preview. Read more

Econosights - positive supply shocks

02 May 2024 | Blog Post pandemic, the supply of labour has increased in many major economies, including the US and Australia, through elevated immigration and a lift in the participation rate to a record high. Read moreWhat you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

The information on this page was current on the date the page was published. For up-to-date information, we refer you to the relevant product disclosure statement, target market determination and product updates available at amp.com.au.