Investment markets and key developments

US equities managed to end the week 1.3% higher despite hawkish comments from Fed Chair Powell and other Fed members which led to an increase in bond yields and Moody’s decision on Friday to change the US credit rating to “negative” from stable which increases the risk of a downgrade to their Aaa credit rating. Bond yields drifted higher late into the week with the US 10-year yield back up above 4.6% (although this is still below October highs of ~5%). Markets are pricing in around three rate cuts from the US Fed in 2024. Australian shares were virtually flat over the week. Despite the RBA’s rate hike on Tuesday, the $A still drifted lower to $0.63USD. Eurozone equities were up by 0.5% over the week, Japanese shares rose by 1.9% and Chinese equities were up marginally by 0.07%. The WTI oil price fell to $77USD/barrel, a decent decline from over $85USD/barrel two weeks ago. Energy prices also fell while most metal prices fell apart from iron ore, which is still holding up around $120USD/tonne.

Shares have had a good bounce from their October lows because: bond yields have ticked down from their cyclical highs (on signs that global interest rates are around their highs, less anticipated issuance from the US Treasury and some softer US growth figures indicating a lower need for higher rates), shares were arguably getting to oversold levels and were due for a rise, stronger than expected US September quarter earnings, positive seasonal factors into the end of the year for shares (“Santa Claus rally”) and no further escalation from other countries in the Israel/Palestine war.

However, there are still reasons to be cautious for investors in the near-term and shares would have another leg down on: inflation has fallen but remains higher than central banks would like and could start to rise again, the war in Israel could escalate and broaden to other countries, the risk of a recession in 2024 is high, bond yields could drift up again and pressure share market valuations and investor sentiment is yet to fall to levels that are usually associated with major market bottoms. This means that there’s still a potential for volatility in sharemarkets and some caution is needed.

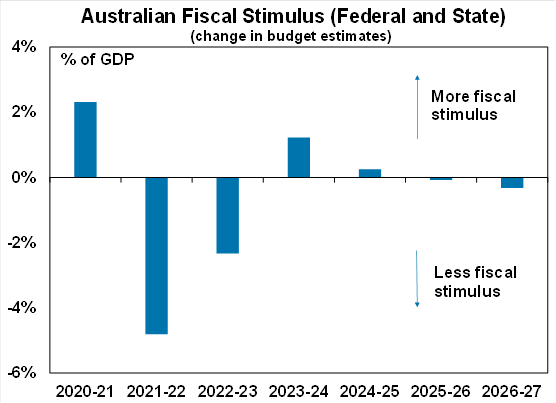

The RBA’s Melbourne Cup Day rate hike (more on that below) led to some speculation that interest rates in Australia would need to go higher with former RBA Board member Warrick McKibbin saying that the RBA cash rate will need to go to 5% because inflation would remain too high, driven by excess government spending. Analysis from Deutsche Bank showed that Australian fiscal stimulus based on government budget projections on both a federal and state level would turn positive in the current financial year and be worth over 1% of GDP (see the next chart) which may be working against the RBA’s attempt to slow economic growth through lifting interest rates.

Source: Deutsche Bank, Macrobond, AMP

This follows comments earlier in the week from Treasurer Jim Chalmers who indicated that the government would be looking at cutting back the Australian infrastructure pipeline which may be adding to construction materials and wages inflation and contributing to the housing supply problem by pulling resources away from that sector. While this may be the case, Australia’s high rates of inflation are now predominantly centred in high services prices which have been driven by solid services spending and elevated wage outcomes which was partly driven by the decisions made by the Fair Work Commission back in June alongside elevated public sector wage gains. The difficulty for the government is that the impact of interest rate hikes is now extremely uneven in Australia. Households with a mortgage (around 37% of households) are under pressure (especially those that have taken out loans in the last 3 years) from high interest rates but this is being offset by older households who typically own their own property and have savings which are being boosted by high savings rates. The bottom line is that overall government spending does need to be lower in the next 1-2 years to make the job of the RBA easier and other policies, like high immigration growth need to be recalibrated given the issues with housing supply.

Economic activity trackers

Our Economic Activity Indicators have been relatively stable in recent months, so are not showing a decisive upwards or downwards trend in the direction of economic activity.

Based on weekly data for eg job ads, restaurant bookings, confidence, mobility, credit & debit card transactions, retail foot traffic, hotel bookings. Source: AMP

Major global economic events and implications

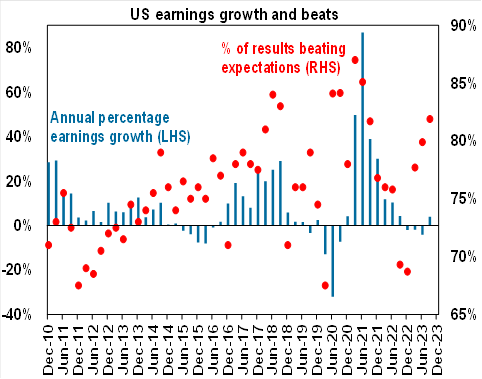

The US September quarter earnings season is nearly complete, with nearly 92% of the S&P500 having reported third quarter earnings growth. 82% of results have had positive growth surprises, up from its long-term average of 76%. Earnings growth estimates are running at +3.9% year on year, a noticeable improvement from the +0.6% year on year expected at the start of reporting season.

Source: Bloomberg, AMP

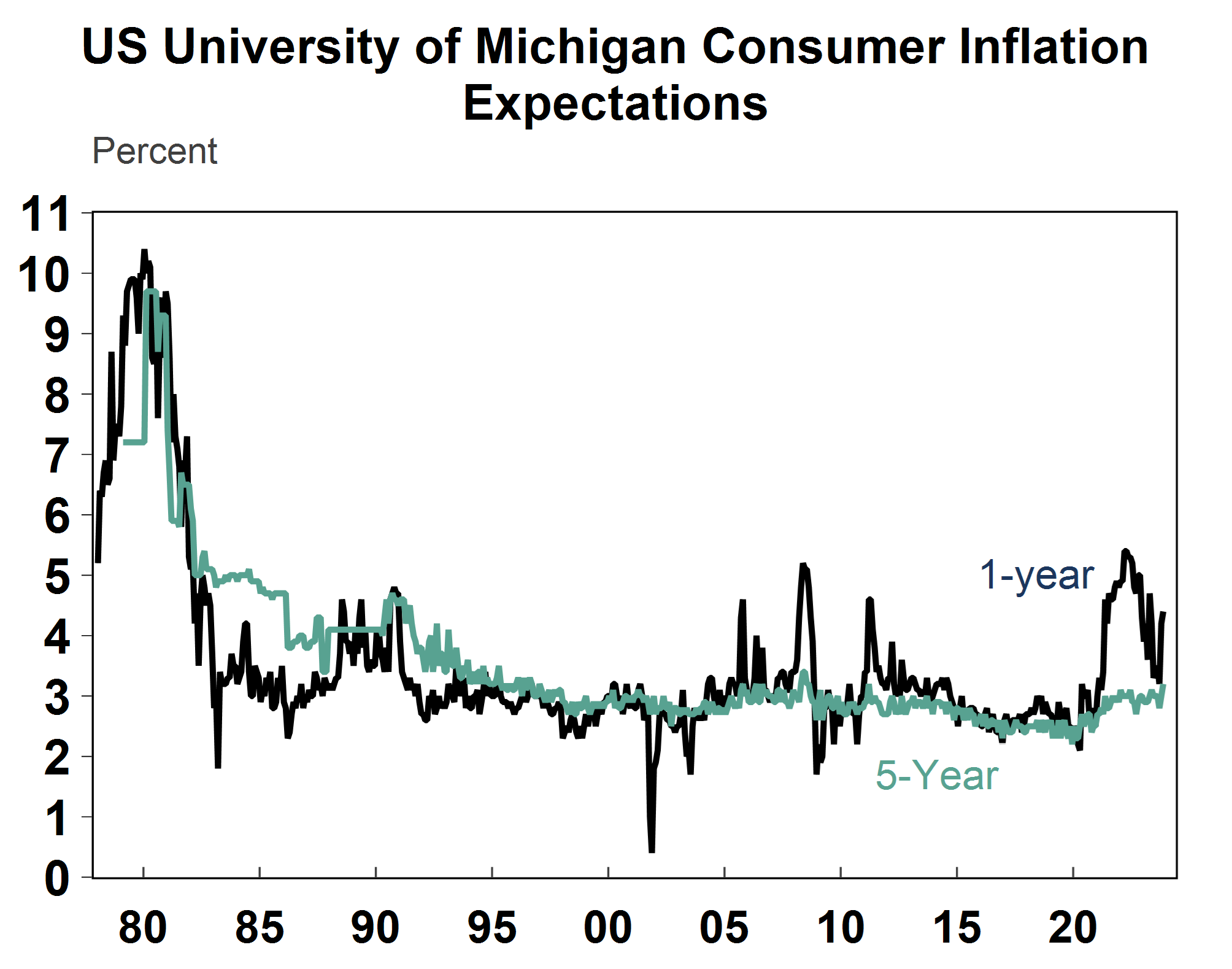

The University of Michigan survey showed a fall in consumer sentiment for November which is running well below long-run average levels and a lift in inflation expectations with 1-year inflation expectations rising to 4.4% (from 4.2% last month) and 5-10 year increasing to 3.2% (from 3% last month) which could become a problem if it continues.

Source: Macrobond, AMP

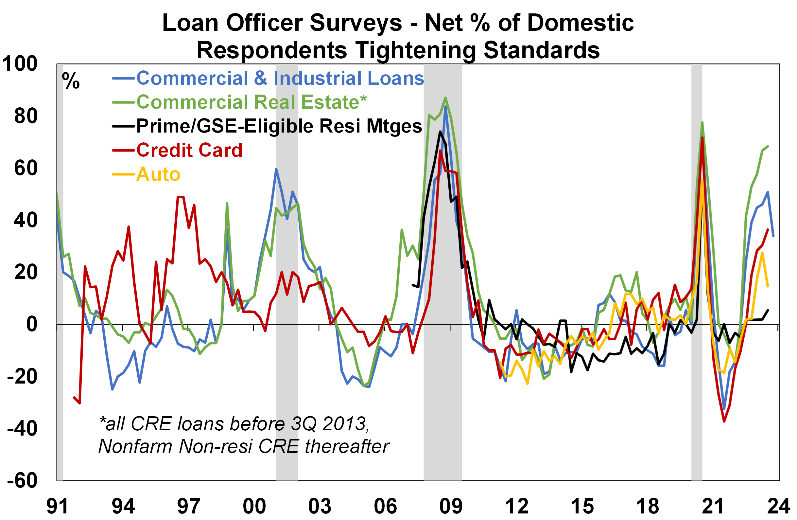

The US Senior Loan Officers survey for the September quarter showed that lending standards remain very tight, especially for commercial real estate loans, where conditions tightened again (see the chart below).

Source: Bloomberg, AMP

There was a flurry of commentary from US Fed officials this week which leaned hawkish. Fed Chair Powell said the Fed would “not hesitate” to tighten policy further if it was needed to control inflation. He also mentioned that the central bank would do another review of its policy framework next year which will focus on the structural changes to the economy and its impact on medium-term inflation. Other comments from Fed members on monetary policy included Kashkari who said that the Fed was yet to win the fight against inflation and will consider more tightening if needed, Bowman expects that the fed funds rate will need to be increased further, Logan said he thought inflation appeared to be trending towards 3% rather than 2%, Paese said that the Fed should “act promptly” if progress on inflation stalls and Daly said that the Fed may need to hike again. There were also some dovish comments, including from Goolsbee who said that the priority is in returning inflation to target but that officials didn’t want to “pre-commit” decisions on rates, Barkin said that policy is “likely sufficiently restrictive” and Bostic said that policymakers can return inflation to their goal without the need to hike further.

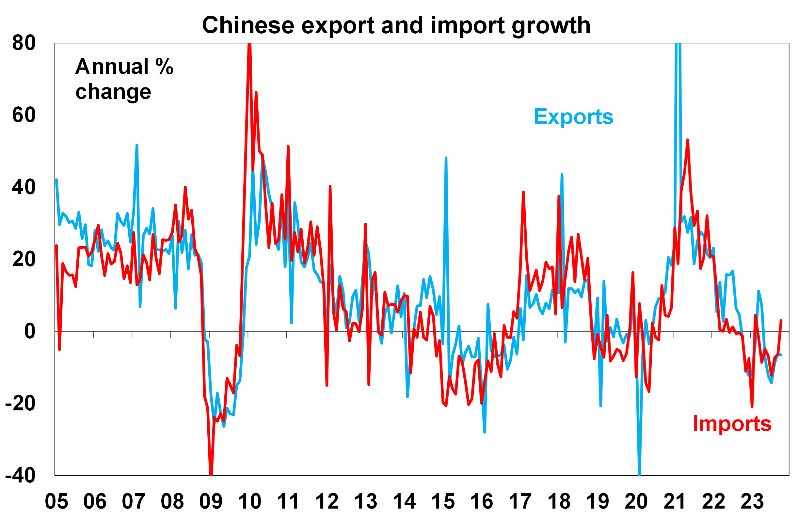

Chinese October trade data was weak. Export growth weakened, to -6.4% year on year in October but import growth improved and turned positive to 3% over the year but this was primarily due to an increase in oil imports, rather than stronger consumer demand.

Source: Bloomberg, AMP

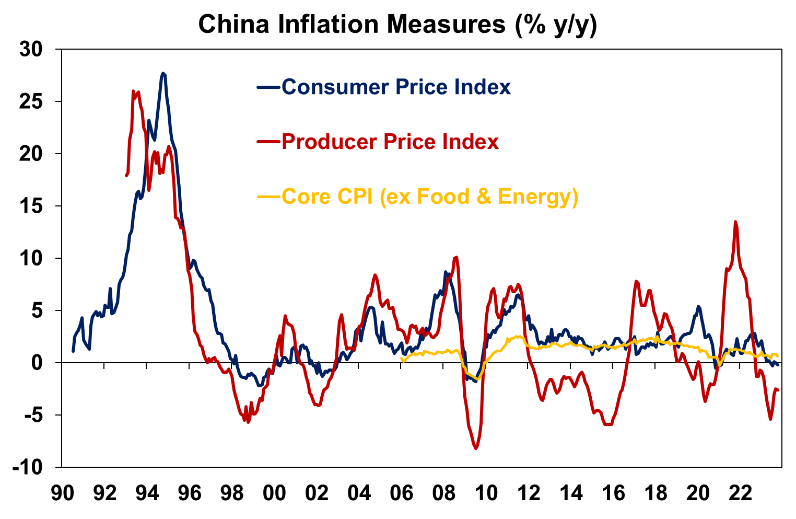

The Chinese consumer price index slumped further in October, down by 0.2% over the year while producer prices were 2.6% lower over the year. Core prices are higher at 0.6% year on year, but clearly still low. While this means that growth in the Chinese economy remains soft, it also means that China is not exporting inflation which should help global inflationary pressures.

Source: Bloomberg, AMP

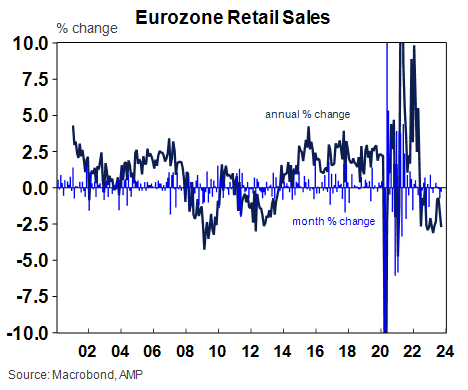

Eurozone retail sales fell by 0.3% in October, slightly worse than expected with annual growth still poor at -2.9%, which is around its lowest levels since 2012 (see the chart below).

Source: Macrobond, AMP

Australian economic events and implications

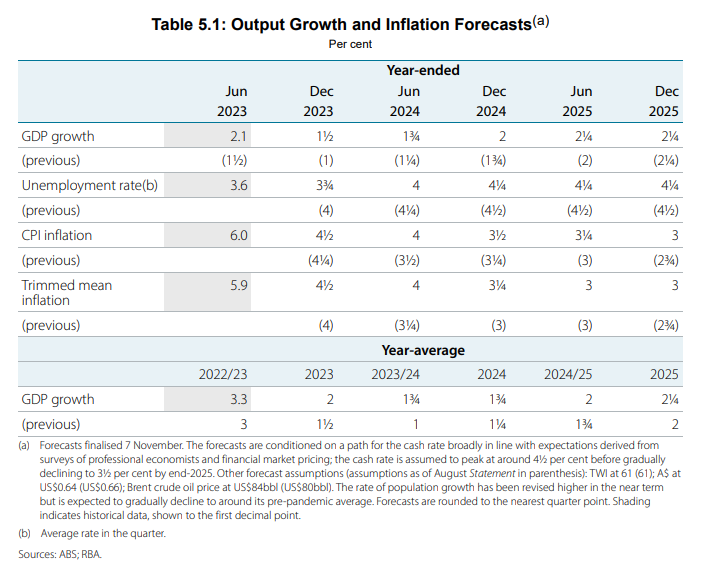

The Reserve Bank of Australia increased the cash rate by 0.25% to 4.35% at its November Board meeting, after being on pause for 4 months (although a pause was also discussed at the meeting). There have been 13 rate hikes totalling 425 basis points since May 2022. Despite the rate hike, forward guidance was less hawkish, with the tightening bias watered down to “whether further tightening of monetary policy is required to ensure that inflation returns to target in a reasonable timeframe will depend upon the data and the evolving assessment of risks” from the previous comments that “some further tightening of monetary policy may be required”. Markets are pricing in nearly 50% chance of another hike by mid-2024. The RBA did make some sizeable upward revisions to near-term growth and inflation forecasts which were presented to the RBA Board at the Board meeting and these forecasts were published today n the quarterly Statement on Monetary Policy today (see the next table).

RBA inflation forecasts have been revised noticeably higher with headline and trimmed inflation now expected to be just under the 2-3% inflation target band by Dec-2025, three months later than assumed in their last forecast update in August. Forecasts for underlying or trimmed mean inflation forecasts increased to 4.5% from 3.9% by Dec-23 and to 3.9% from 3.3% by mid-2024, because inflationary pressures are “dissipating more slowly than previously thought” which also reflects a stronger economic backdrop. The RBA also significantly revised up its near-term GDP growth forecast to 1.6% by Dec-23 (from 0.9% previously) and made slight revisions to medium-term forecasts, with 2% GDP growth expected by Dec-2024 (from 1.6% before) and 2.4% by Dec-25 (from 2.3%). Expectations for the unemployment rate were revised down, with the unemployment rate reaching a high of 4.3% by mid-2025 from 4.5% previously. But, medium-term wage forecasts were revised down ever so slightly, with the peak in wages growth expected to be at 4% in the first half of 2024 before declining to 3.7% by the end of 2024 and 3.5% by Dec-2025.

Source: ABS; RBA

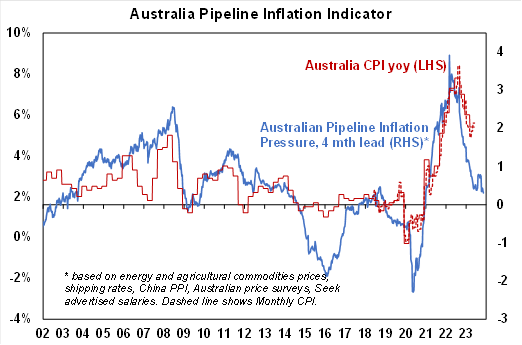

Our own forecasts assume lower inflation in 2024, softer GDP growth and a higher unemployment rate compared to the RBA which is why we expect that there will be rate cuts next year earlier than the market is expecting (from around June). We see inflation trending down faster than anticipated, similar to the experience of countries like the US, Eurozone and Canada which saw an earlier peak in inflation. Our Australian inflation indicator continues to point down (see the chart below). However in the short-term, any major upside data surprises around wages, inflation, the labour market or consumer spending could see the RBA increase interest rates again on concern that it would lead to higher inflation.

Source: Bloomberg, AMP

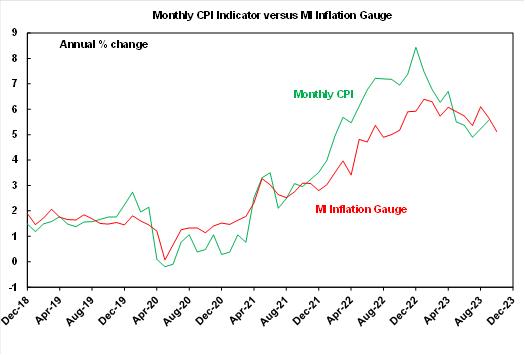

The Melbourne Institute Inflation gauge fell by 0.1% in October with annual growth slowing to 5.1% and is consistent with a further deceleration in inflation.

Source: Bloomberg, AMP

ANZ job advertisements fell by 3% in October and are 11.2% below their peak levels in September 2022.

What to watch over the next week?

Key US data next week is the October consumer price data (on Tuesday US time) which is expected to show a small 0.1% increase in headline inflation or 3.7% year on year with core up by a stronger 4.1%. October retail sales are expected to show a fall of 0.4% after a strong rise in the prior month. Producer prices (on Wednesday) are expected to show a small 0.1% lift over October. There are also some regional Fed manufacturing indicators and housing data including building permits and housing starts.

In Europe, industrial production data for September is released and investor ZEW economic confidence figures.

In Japan, September quarter GDP data is expected to show a slight decline of 0.1% after a large rise in the prior quarter.

Monthly data updates in China include industrial production (expected to be up by 4.6% over the year), retail sales (likely to be stronger in October, up by 7% over the year), fixed asset investment is forecast to remain moderate, up by 3.1% over the year to October the October unemployment rate is expected to remain unchanged at 5% and home price data is also released for October.

In Australia, the key indicator to watch next week is the third quarter wage price index on Wednesday. The decisions from the minimum wage review back in June which impact those on award and minimum wages will add 0.3 percentage points to annual wages growth. We expect quarterly wages to increase by 1.2%, which would take annual growth to 3.8%. If there are signs that wage pressures have broadened out beyond across the industries impacted by minimum wage decisions this would be a concern for the central bank. The November consumer sentiment figures (on Tuesday) will probably show a further decline after the RBA’s latest rate hike and the October NAB business confidence is also released. The October labour force data (on Thursday) is likely to show softer jobs growth of 11K, with the unemployment rate increasing to 3.7% (from 3.6% last month).

Outlook for investment markets

The next 12 months are likely to see a further easing in inflation pressure and central banks moving to get off the brakes. This should make for reasonable share market returns, provided any recession is mild. But for the near-term shares are at high risk of a further correction given high recession and earnings risks, the risk of high for longer rates from central banks, high bond yields which have led to poor valuations and the risk that the war in Israel escalates to include significant oil producing countries like Iran.

Bonds are likely to provide returns above running yields, as growth and inflation slow and central banks become dovish but given the recent rebound in yields this may be delayed a few months.

Unlisted commercial property and infrastructure are expected to see soft returns, reflecting the impact of the rise in bond yields on valuations. Commercial property returns are likely to remain negative as “work from home” continues to hit space demand as leases expire.

With an increasing supply shortfall, our base case remains that home prices have bottomed with more gains likely next year. However, uncertainty around this is high given the lagged impact of interest rate hikes and the likelihood of higher unemployment.

Cash and bank deposits are expected to provide returns of around 4-5%, reflecting the back up in interest rates.

The $A is at risk of more downside in the short term on the back of relatively lower short term interest rates in Australia and global uncertainties, but a rising trend is likely over the next 12 months, reflecting a downtrend in the overvalued $US and the Fed moving to cut rates.

Weekly market update 26-07-2024

26 July 2024 | Blog Dr Shane Oliver discusses the risk off as tech hit continues; correction risks into August/September; global rate cutting cycle underway; Australian June quarter CPI to rise but the hurdle to another RBA rate hike should be high; and more. Read more

Oliver's insights - rise of populism and bigger government

24 July 2024 | Blog This article takes a look at the rise of populism and what it means for economic policies and investors. Read more

Weekly market update 19-07-2024

19 July 2024 | Blog This week shares are down; US election/Trump prospects starting to impact; global rates easing cycle on track; China Plenum; Australian jobs still tight but easing so RBA needs to be careful; and more. Read moreWhat you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

The information on this page was current on the date the page was published. For up-to-date information, we refer you to the relevant product disclosure statement, target market determination and product updates available at amp.com.au.