Key points

- US regional bank failures have added to uncertainty about the investment outlook flowing from inflation & rate hikes.

- Specific issues with the failed banks and action to protect depositors may limit broader problems for US banks.

- But the wider risks are high and its normal for problems like this after rapid rate hikes. Given the now high risk of recession (which would curtail inflation) it makes sense for central banks (including the RBA) to pause rate hikes.

- Share market falls are painful for investors but the best approach for most is to stick to a long-term strategy.

Introduction

Shares have hit turbulence again with worries about inflation, interest rates, recession and, now, problems in US banks. After rallying strongly at the start of the year the US share market has reversed much of its year to date gain leaving it down 20% from its January high last year and at risk of a retest of its October lows when it was down 25%. Non-US shares are holding up better with Eurozone shares down by 7% & Australian shares also down 9% from their record highs but are vulnerable to moves in US shares. This note looks at the key worries and what it means for investors.

Are we going to see systemic problems in US banks?

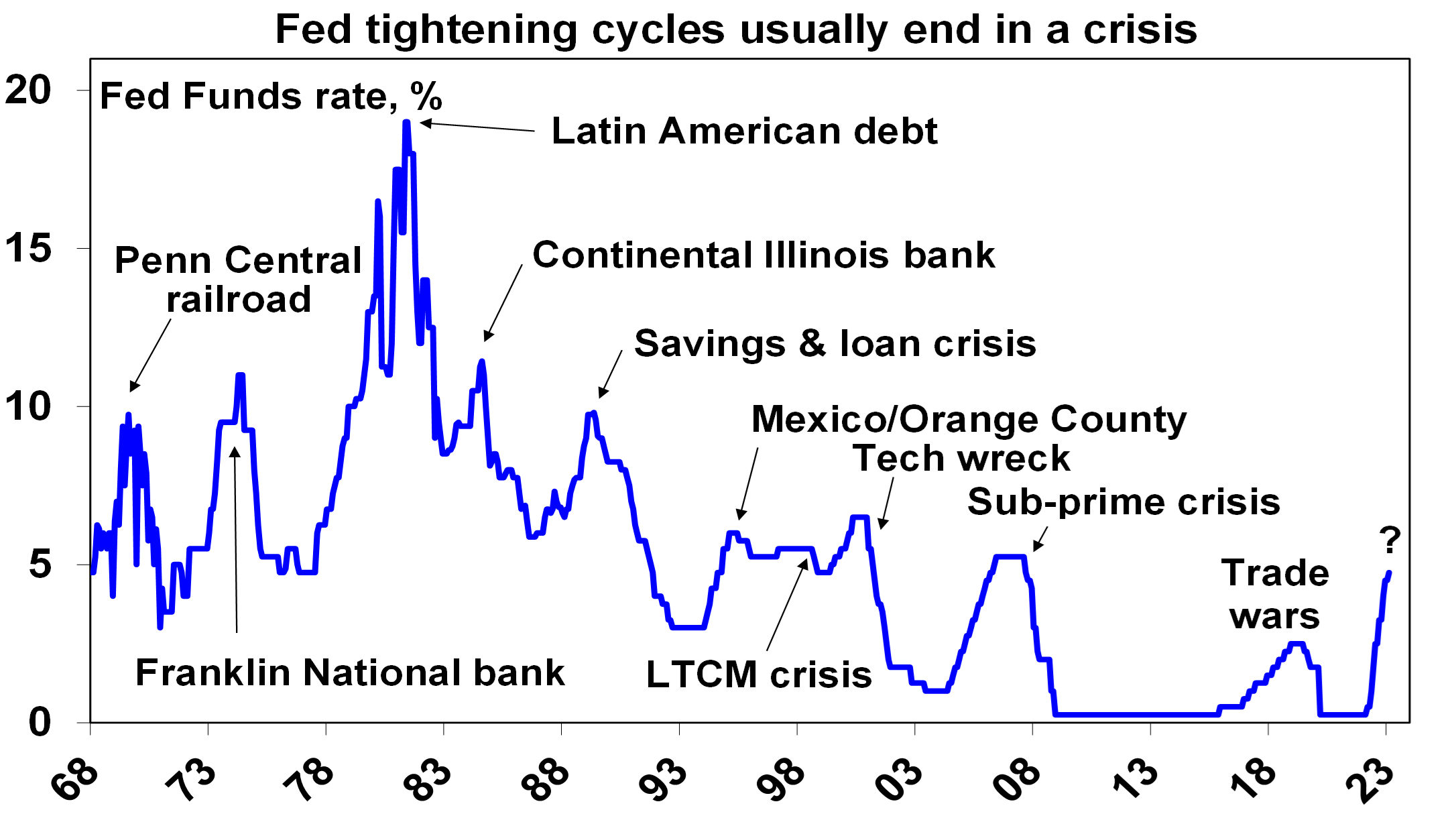

Three regional US lenders have collapsed or closed in recent days. Silicon Valley Bank, which had a deposit base from tech (and some crypto) companies and customers, collapsed after running into trouble as deposits were withdrawn in the face of tough conditions in the tech and crypto sectors. Silvergate Capital & Signature Bank, crypto friendly banks, also closed after they were made vulnerable after the collapse of FTX crypto exchange. These closures have led to concerns they may reflect the start of broader problems in US banks. This is quite possible as Fed rate hiking cycles by tightening financial conditions invariably trigger financial stresses - think the tech wreck and GFC. See the next chart.

That banks exposed to tech and crypto either for deposits or lending are in trouble is not surprising as both sectors benefitted from the pandemic and easy money but have been hard hit by reopening and rate hikes. And its made worse where banks have concentrated investments in long term bonds which have fallen in value as SVB did – so if they have to sell them to meet withdrawals it’s at a loss. For example, there are reported to be $US620bn of unrealised losses on securities at US banks – of course it’s only a problem if they have to sell them. But at this stage it’s too early to know if problems at these lenders reflect isolated problems in the tech & crypto sectors they’re exposed to, made worse by undiversified deposit bases & concentrated holdings of bonds that have fallen in value or are a sign of a broader problem in the US financial system.

Source: Bloomberg, AMP

Fortunately, there are some reasons to suggest that worst case scenarios involving a flow on more broadly in the US and beyond may be limited:

- US authorities have moved quickly to guarantee deposits (beyond the $US250,000 usually covered by deposit insurance) and the Fed has unveiled a Term Funding Facility that enables banks to borrow cheaply from the Fed in order to avoid selling their bonds at a loss. This should help reduce the risk of runs on banks and avoid a fire sale of bonds. And it should help minimise bigger problems for companies that had deposits at these banks – like layoffs & not paying creditors.

- Following the GFC large US banks now have to maintain large capital buffers, have less risky exposures or at least less concentrated asset exposures and have more diverse deposit bases than regional banks. Unfortunately, restrictions were eased for smaller banks in 2018.

- It should also be remembered that US regional bank failures are common – there were 8 in 2018-20 – albeit they were much smaller.

- All Australian banks are required post GFC to maintain much stronger capital buffers and have tougher restrictions in terms of what they can invest in. They also have very diverse deposit bases so are less at risk of high deposit withdrawals than regional US banks. And they won’t have as much exposure to the vulnerable tech and crypto sectors. And Australian bank deposits are implicitly (if not explicitly) protected. But of course, they are vulnerable to defaults by Australian home borrowers particularly if the property market falls precipitously.

However, it will take a while to determine the full impact and for the dust to settle. And either way banks are likely to see a tougher environment ahead as growth slows and higher rates cause more financial stress for borrowers. It probably also means even tighter lending conditions for tech and crypto and for illiquid businesses like private equity and commercial property. And it’s a sign that Fed tightening has got traction!

But what about inflation?

As indicated in the chart above, past financial crisis in the US have resulted in an end to Fed tightening cycles. At this point its not clear that we are seeing a full-blown crisis unfold or not and high inflation is a bit of a barrier on what the Fed can do. As a result, so far it’s just gone down the path of making it easier for banks to access cheap funding so they don’t have to sell bonds at a loss. But how far the Fed and other central banks can support economies will at least partly be impacted by inflation.

Right now, it’s too high but it looks to have peaked. US and Canadian inflation peaked around mid-last year, inflation in Europe later last year. Australian inflation likely peaked in December. Supply bottlenecks have improved, freight costs have fallen and slowing demand will reduce demand side inflation. As is often the case goods price inflation is leading with services price inflation more sticky reflecting still tight labour markets – but these are showing signs of rolling over with job openings according to Indeed rolling over in the US, Europe and Australia. Wages growth is a key driver of services inflation – but in the US it looks to be slowing & in Australia there are no signs of a wages blowout. Easing inflation pressure is reflected in a declining trend in business surveys with respect to input and output prices and work backlogs & delivery times have fallen to normal levels. See the next chart. And if US bank sector problems depress economic activity, it will put more downwards pressure on inflation.

Source: Bloomberg, AMP

Does this mean central banks are nearly done?

If we are right and inflation will fall going forward, albeit with bumps along the way, then central banks are at or near the top and will have more flexibility to respond to financial crisis like the issues now in the US. Indeed, the US banking problems with the risk of a flow on to other countries (where banks also have losses on their bond portfolios) may put pressure on other central banks to provide liquidity support.

- The ECB is lagging and has further to go than other central banks on rate hikes – but US problems may cause it to slow down.

- The Bank of Canada has held rates at 4.5% at looks to have peaked.

- The Fed has been signalling more rate hikes ahead following a recent run of stronger data – but leading US indicators point to slower demand with a high risk of recession (which would slow inflation) and there are tentative signs that the US jobs market is slowing. Bank problems – with the risk of more to come - should help slow the Fed at least heading off a 0.5% hike next week. Our base case is a 0.25% hike but if banking stresses remain high it’s likely to pause. In fact, based on past Fed hiking cycles the collapse in the US 2 year bond yield below the Fed Funds rates suggests the Fed is done!

- The RBA has become less hawkish & has opened the door to a pause if data shows further cooling & slowing inflation. With total household debt servicing costs pushing to record levels our view is the RBA should and will soon pause. US financial problems add to the case.

What is the risk of recession?

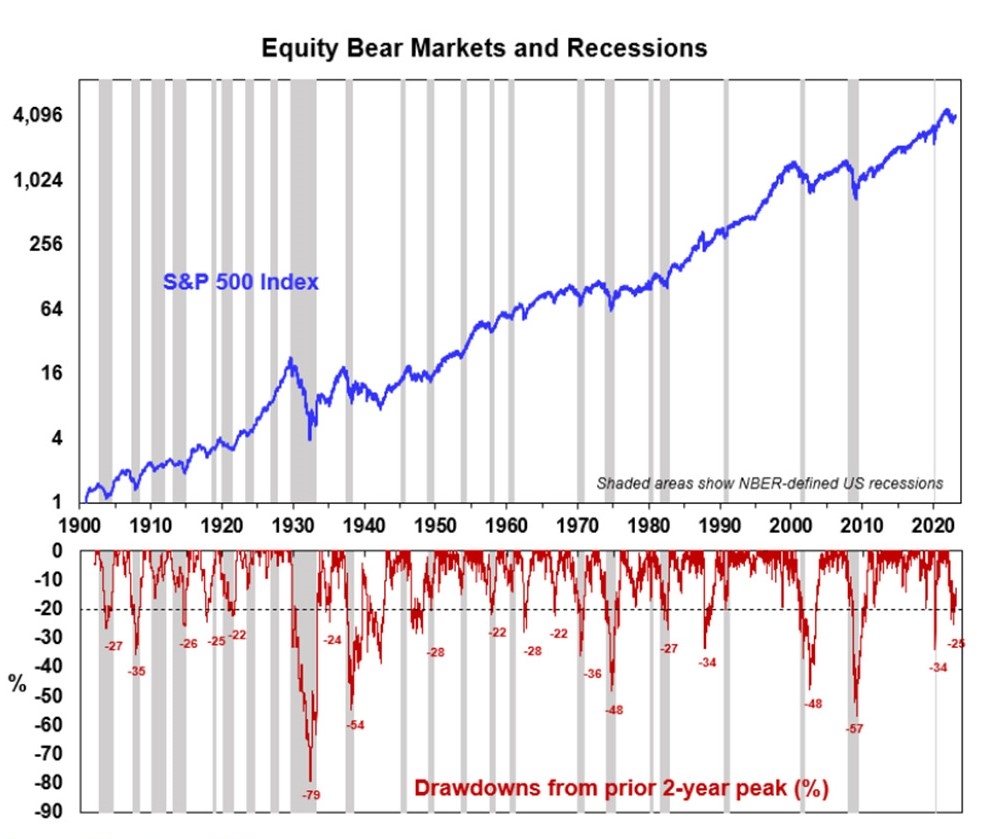

This will likely be critical to how shares perform this year as the historical record shows that deep bear markets in US (and Australian) shares are invariably associated with US recessions. See the next chart. While the risk of recession has receded in Europe (with the collapse in gas prices) it remains high in the US with various leading indicators – including inverted yield curves (where short term interest rates are above long term yields) - warning of a high risk of US recession in the next 6-12 months. Problems in the financial system are adding to this risk which could easily push US shares down beyond the 25% top to bottom fall seen last year. However, if the Fed soon stops tightening a US recession could still be averted or it could be mild which would limit further downside in US shares.

Source: Bloomberg, AMP

In Australia, the risk of recession is high. But our base case is that it will be avoided thanks to strong business investment, Chinese reopening and providing the RBA soon stops hiking and US financial contagion is limited.

What should all this mean for investors?

We see shares being stronger on a one-year view as inflation falls taking pressure of central banks hopefully enabling economies to avoid a deep recession. However, right now shares are at risk of more downside until some of the issues around the US financial system, inflation, recession and short-term interest rates are resolved. There are several implications for investors:

- Unlike last year, investment in government bonds should provide more protection for investors as bond yields are now higher and have potential to fall if worries of recession rise as we saw in the last week.

- Non-US shares are likely to outperform US shares as they are trading on lower price to earnings multiples and have a lower exposure to the tech sector. This includes the Australian share market.

- For short term investors it’s a time to be cautious.

- However, while times like these can be stressful, for superannuation members and most investors the best approach is to stick to basic investment principles. These things are worth keeping in mind:

1. share market pullbacks are healthy and normal - their volatility is the price we pay for the higher returns they provide over the long term;

2. it’s very hard to time market moves so the key is to stick to an appropriate long-term investment strategy;

3. selling shares after a fall locks in a loss;

4. share pullbacks provide opportunities for investors to invest cheaply;

5. shares invariably bottom with maximum bearishness;

6. Australian shares still offer attractive income versus bank deposits; &

7. to avoid getting thrown off a long-term strategy – it’s best to turn down the noise around all the negative news flow.

Weekly market update 26-07-2024

26 July 2024 | Blog Dr Shane Oliver discusses the risk off as tech hit continues; correction risks into August/September; global rate cutting cycle underway; Australian June quarter CPI to rise but the hurdle to another RBA rate hike should be high; and more. Read more

Oliver's insights - rise of populism and bigger government

24 July 2024 | Blog This article takes a look at the rise of populism and what it means for economic policies and investors. Read more

Weekly market update 19-07-2024

19 July 2024 | Blog This week shares are down; US election/Trump prospects starting to impact; global rates easing cycle on track; China Plenum; Australian jobs still tight but easing so RBA needs to be careful; and more. Read moreWhat you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

The information on this page was current on the date the page was published. For up-to-date information, we refer you to the relevant product disclosure statement, target market determination and product updates available at amp.com.au.