Key points

- The war in Israel has added to the upside risks to oil prices and downside risks to shares in the near term.

- If Iran stays out of the conflict & a major supply disruption is avoided the impact on shares should ultimately be minimal.

- If alternatively, oil prices do have a renewed surge it’s more likely to be deflationary as it will act as a “tax on spending”. So central banks, including the RBA, should look through it.

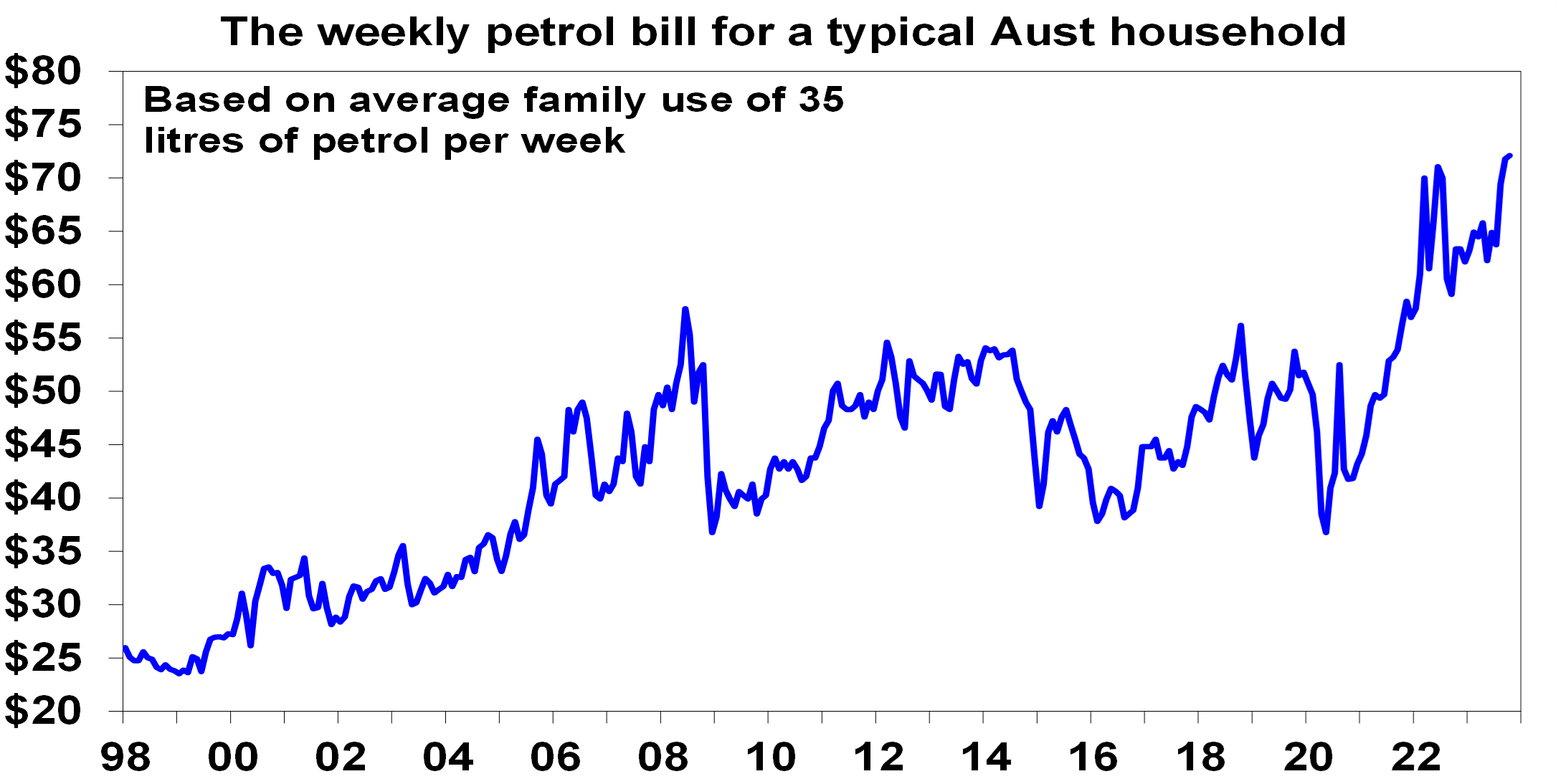

- The rise in petrol prices has already added $12 a week to the average household fuel bill in Australia since May.

Introduction

The war in Israel is terrible from a humanitarian perspective. From an economic and investment perspective the concern is that it will lead to a surge in oil prices that will add to inflation, keep interest rates higher for longer and add to the risk of recession. This note looks at the main issues.

Oil prices were already up

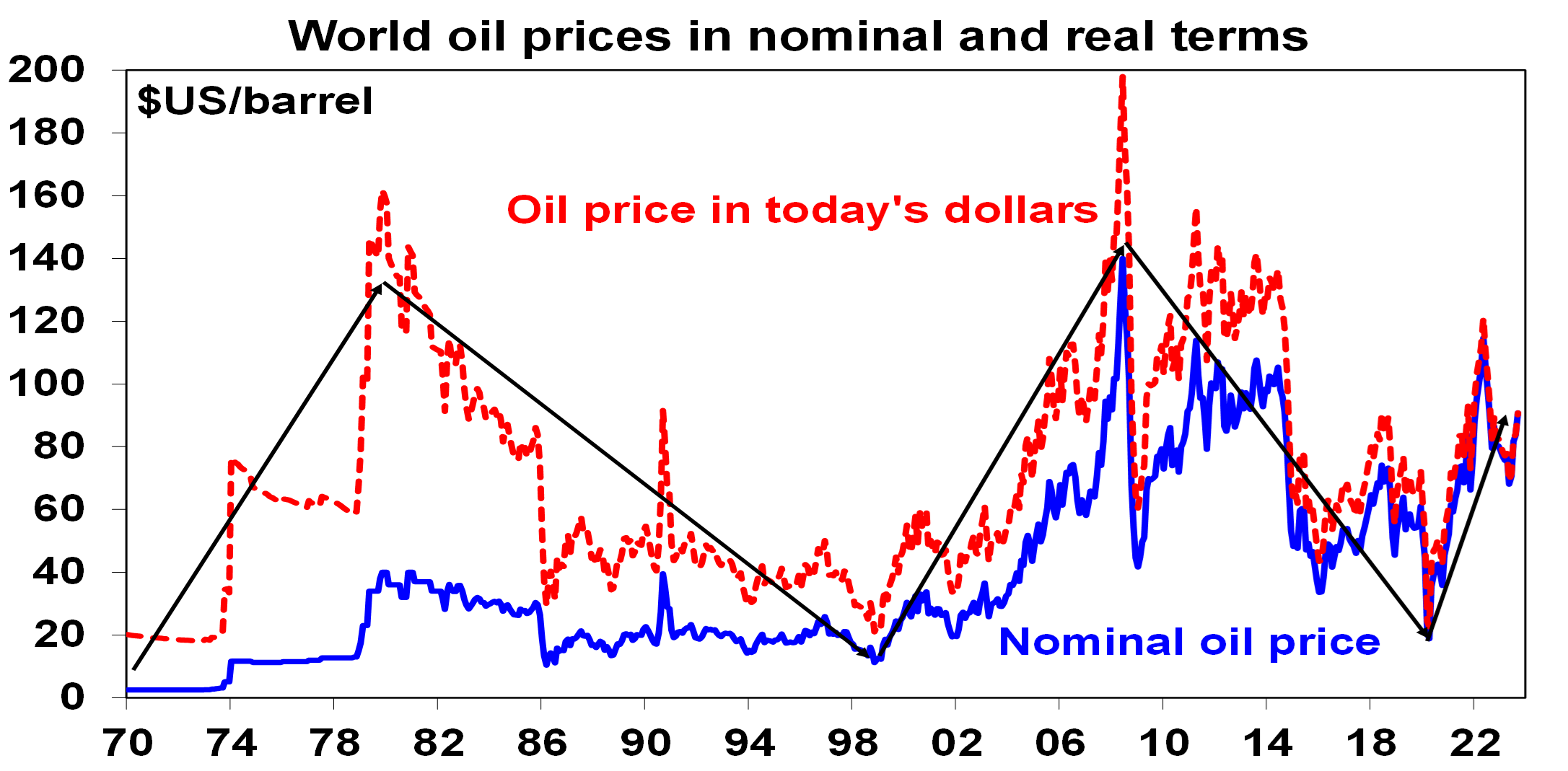

So far, the impact on oil prices has been modest with oil prices up about $US4 a barrel to around $US0.87 for West Texas Intermediate since Hamas’ attack on Israel. However, it comes at a time when oil prices had already reversed a large part of their fall into June to just below $US70 a barrel post their rise last year to a high of $US123.7 on the back of the invasion of Ukraine, which was their highest since 2008 when they peaked at $US145. For context, the next chart shows world oil prices since 1970 both in nominal terms (blue line) and after adjusting for inflation (red line). Oil prices are currently high in nominal terms, particularly compared to pandemic lows but in line with their range since the mid-2000s. In real terms they are below the highs reached in the second oil crisis in 1979.

Source: Bloomberg, AMP

The rebound in oil prices since mid-year reflected a combination of:

- production cutbacks by Saudi Arabia and Russia;

- the risk of more to come with Russia keen to punish the West;

- low inventory levels; and

- global oil demand holding up better than feared.

And the fear is that the latest conflict in Israel will send prices even higher.

Oil prices and conflicts in Israel & the Middle East

Since Hamas’ attacks share markets are little changed to up slightly and the $US4/barrel rise in the oil price is consistent with normal volatility. So why aren’t markets more concerned? Surely any conflict in the Middle East is bad via higher oil prices? Well, not necessarily - as it depends on whether global oil supplies are significantly impacted or not.

- The first global oil shock in 1973 came with the Arab/Israeli war that saw many Arab countries against Israel and saw OPEC boycott oil supplies to the US which drove a fourfold increase in world oil prices.

- The second oil shock in 1979 came as the Iranian revolution saw its oil production collapse and resulted in a threefold increase in oil prices.

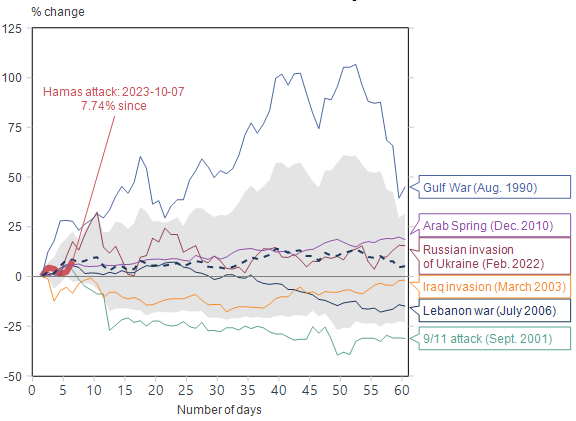

- Since then its been more mixed: the first Gulf War in 1990-91 (which saw Iraq invade Kuwait and a coalition led by the US dislodge it) saw a spike in oil prices but it was brief; the second Gulf War in 2003 (which saw the invasion of Iraq) had little impact; and the war in Lebanon (2006), Arab Spring (from December 2010), war in Syria & numerous flare ups in the Israeli/Palestinian conflict have had little impact.

Oil prices and various geopolitical events since 1990

Source: Macrobond, AMP

The key is whether oil supplies from major producers in the Middle East are impacted. Israel along with Lebanon & Syria are not big oil producers. And this is not a re-run of the 1973 conflict – now Arab countries are on the sidelines with many having better relations with Israel. In fact, the timing of Hamas’ actions looks motivated to prevent progress towards a Saudi/Israeli security pact which could have further isolated them & Iran.

The main risk is if Iran, which backs Hamas and Hezbollah in Lebanon, is drawn into the war which could threaten its oil production (2.5% of global consumption), the flow of oil through the Strait of Hormuz (through which 20% of world oil flows) or even Saudi production (as Iran did in 2019).

Scenarios

One can’t discount the possibility that Israel doesn’t take the bait and holds its fire to avoid giving Hamas the overreaction it’s hoping for – we will know pretty soon. But our base case (with 70% probability) is that the conflict is limited to Israel/Hamas in Gaza and with some expansion to include Hezbollah in Lebanon and maybe other groups in Syria (with Iran supporting its proxies but not getting directly involved). This would cause bouts of uncertainty in investment markets as the war escalates and expands but not enough to significantly threaten oil supplies.

- The US will likely want to avoid bringing Iran directly into the conflict until after next year’s election (in order to avoid a surge in oil prices) & Israel may not want to open another front or to put the US offside.

However, while it’s not our base case the risk of Iran becoming directly involved is significant and can’t be ignored. Iran’s backing of Hamas and its nuclear weapons breakout capability mean Israel has a strong incentive to attack Iran at some point (as does the US after the next election) resulting in a greater threat to world oil supplies. If this occurred, it could conceivably push oil prices above $US150. So, it’s something to keep a close eye on. And even if Iran does not directly become involved the risk of a further cut in Russian oil production (which accounts for about 10.5% of global oil production) is high given its desire to punish the West for supporting Ukraine. So, the risk of a further rise in oil prices is high.

Impact of higher oil prices on the global economy

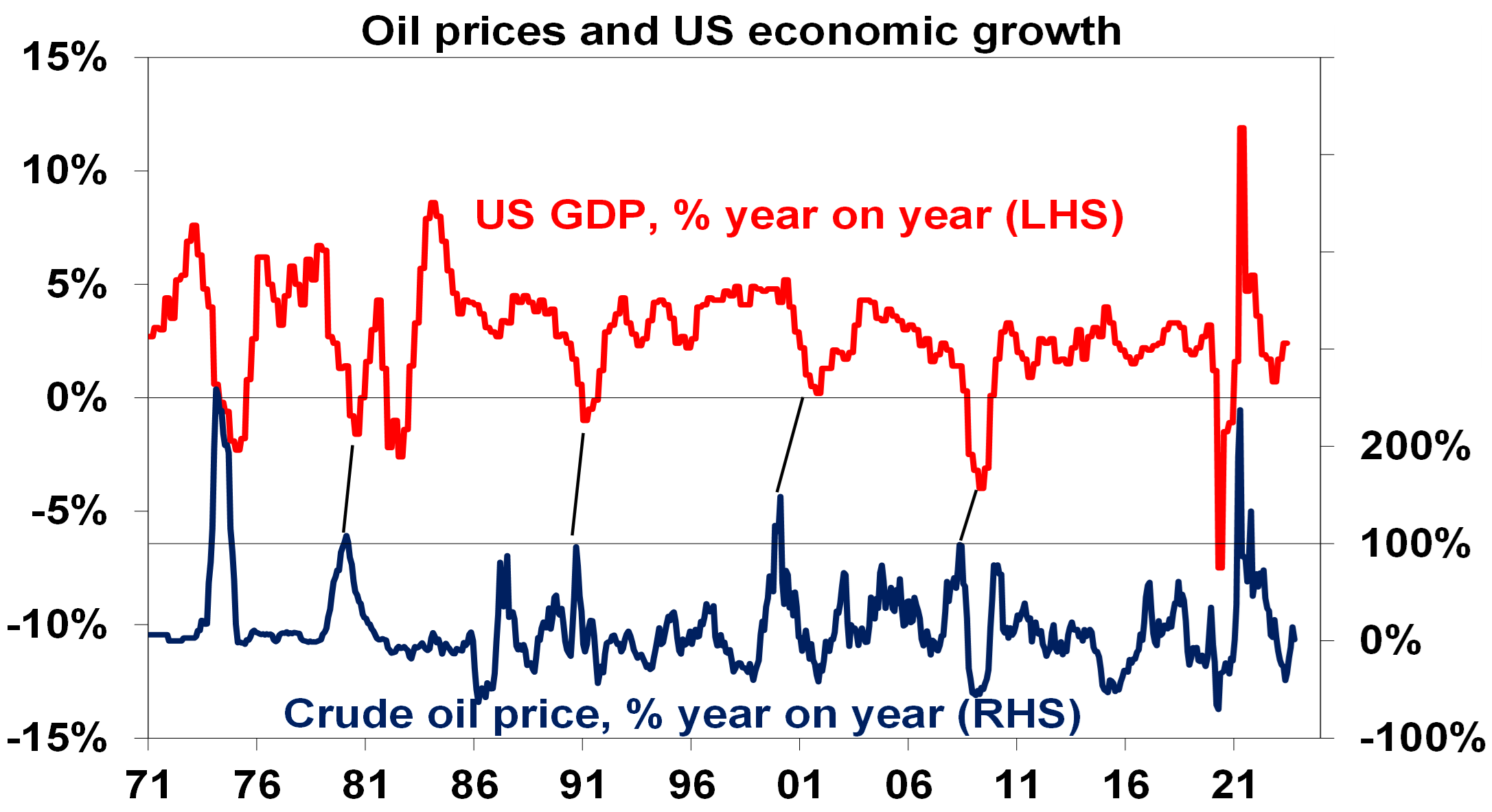

Given upside risks to oil prices its worth considering what this might mean for the global and Australian economies with many fearing it will add to inflation keeping interest rates higher for longer. But it’s not that simple. Past oil price surges have played a role in US & global downturns – in the mid-1970s, the early 1980s, the early 1990s, early 2000s and even the GFC. See the next chart. They weren’t necessarily the driver of these recessions as other factors (like tight monetary policy, the tech wreck of 2000 and the US housing downturn prior to the GFC) often played a much bigger role. But they made things worse because a rise in energy prices is a tax on consumer spending which leads to lower spending power.

Note: the relationship between oil prices & GDP looks messy over 2020 and 2021 as oil prices crashed with the pandemic & then rebounded into 2021 but were still low. Source: Reuters, AMP

It’s not so much the oil price level that counts as its rate of change, as businesses and consumers get used to higher prices over time. Trouble often ensues if the oil price doubles over 12 months, ie goes above the 100% line on the right hand side axis of the last chart.

18 months ago, when oil prices surged into the Ukraine war, the impact was mainly inflationary reinforcing the need for central banks including the RBA to raise interest rates. Back then household budgets were strong, households wanted to spend with reopening, everything was going up in price and monetary policy was easy. Now all of that is reversed so a further surge in oil & petrol prices is more likely to be a “tax on spending” than a further boost to inflation and hence be deflationary which will make it very hard for higher fuel and transport costs to be passed on to consumers beyond the direct impact of the increased price of petrol. This means it mainly will add to the risk of recession. However, while it will ultimately depend on how high oil and hence petrol prices go there are some positives suggesting it may not be quite as negative as feared:

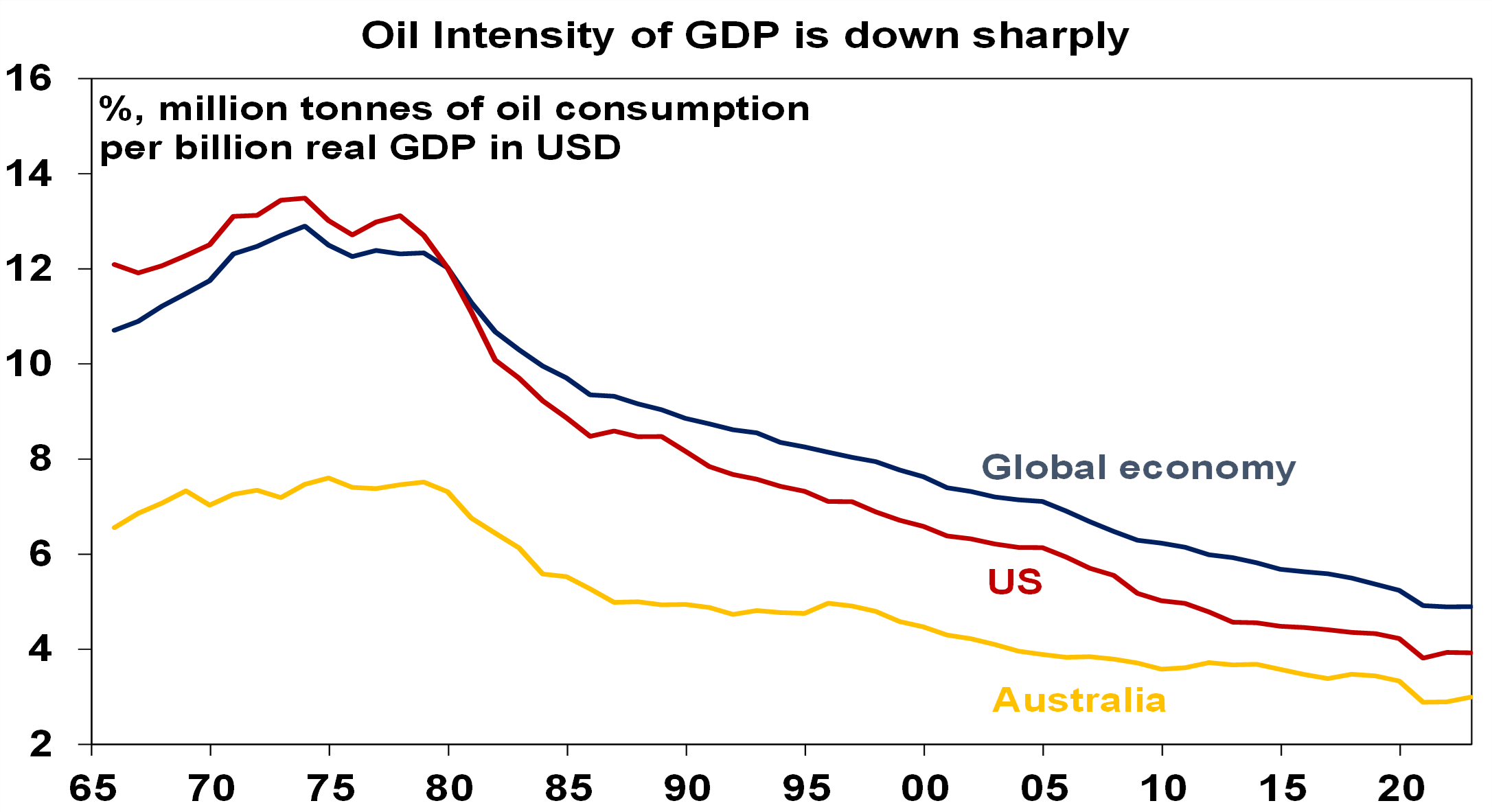

- First, the oil intensity of economic activity has been falling with energy efficiencies & the growth of the services sector. Compared to 1973 it’s down about 70% in the US & about 60% in Australia. So, the impact of an oil price surge today is less than it used to be. It will still hurt though.

Source: World Bank, Energy Institute, Bloomberg, AMP

- Secondly, we have not yet seen a doubling over 12 months in oil prices suggesting they have not yet at least gone up enough to cause a major hit to global growth. That said they are an additional negative.

Impact on Australia

Australian petrol prices track the Asian Tapis oil price in Australian dollars pretty closely. This is because our prices are largely set globally – to which is then added the GST, fuel excise, distribution costs and retailer margins. Current petrol prices already reflect current oil prices – although there is some scope of a fall if oil refinery margins fall. The rise in petrol prices will add around 0.3 percentage points directly to September quarter inflation and if sustained another 0.2 percentage points this quarter.

Source: Bloomberg, AMP

However, the rise in petrol prices since May has increased the typical Australian household’s weekly car fuel bill by about $12. With household budgets now stretched and the reopening boost behind us this likely means that $12 a week less is available for spending elsewhere, which in turn will likely reduce underlying inflation pressures and add to the risk of recession. And with other commodity prices being soft (unlike 18 months ago) there won’t be the additional boost to national income (and the Federal budget) that came with last year’s surge in oil prices.

So overall we would see any further surge in oil and petrol prices that may flow from events in the Middle East as being a further dampener on economic growth and underlying inflation. As such, the RBA should look through it rather than further increase interest rates.

Implications for investors

The war in Israel has added to the upside risks to oil prices and downside risks to shares in the near term. If Iran stays out of the conflict and a major supply disruption is avoided, the impact on shares on a 12-month view should be minimal.

Weekly market update 26-07-2024

26 July 2024 | Blog Dr Shane Oliver discusses the risk off as tech hit continues; correction risks into August/September; global rate cutting cycle underway; Australian June quarter CPI to rise but the hurdle to another RBA rate hike should be high; and more. Read more

Oliver's insights - rise of populism and bigger government

24 July 2024 | Blog This article takes a look at the rise of populism and what it means for economic policies and investors. Read more

Weekly market update 19-07-2024

19 July 2024 | Blog This week shares are down; US election/Trump prospects starting to impact; global rates easing cycle on track; China Plenum; Australian jobs still tight but easing so RBA needs to be careful; and more. Read moreWhat you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

The information on this page was current on the date the page was published. For up-to-date information, we refer you to the relevant product disclosure statement, target market determination and product updates available at amp.com.au.