Key points

- US political risks have increased, with the Treasury now estimating that the debt ceiling will be reached as early as 1 June. This means that Congress will need to make an agreement on lifting or suspending the debt ceiling soon which will require a bill to be passed through both the House of Representatives (held by Republicans) and the Senate (held by the Democrats). History tells us that debt ceiling debates can be drawn-out because they are tied to other spending decisions and are often made at the last minute which leads to market volatility.

- The Republican House of Representatives has approved a bill to raise the debt ceiling for ~ 1 year but this is tied to spending cutbacks which the Democrats are unlikely to agree to in its current form. However, the Democrats will need to concede on some spending cutbacks to pass a bill.

- Investors should worry about the debates around the US debt ceiling that will happen over coming weeks. There is an immaterial risk of a default which we assign to be around 10-15% which would be a big negative for sharemarkets and would see big lifts in short-dated US government bond yields. A deal to raise the debt ceiling will likely also lead to less government spending which could add to recession risks.

Introduction

Issues around the US debt ceiling have started to make headlines again. In this Econosights we look at what the US debt ceiling is, the history of it, the current issues around the debt ceiling and the implications for markets.

Some background to the US debt ceiling

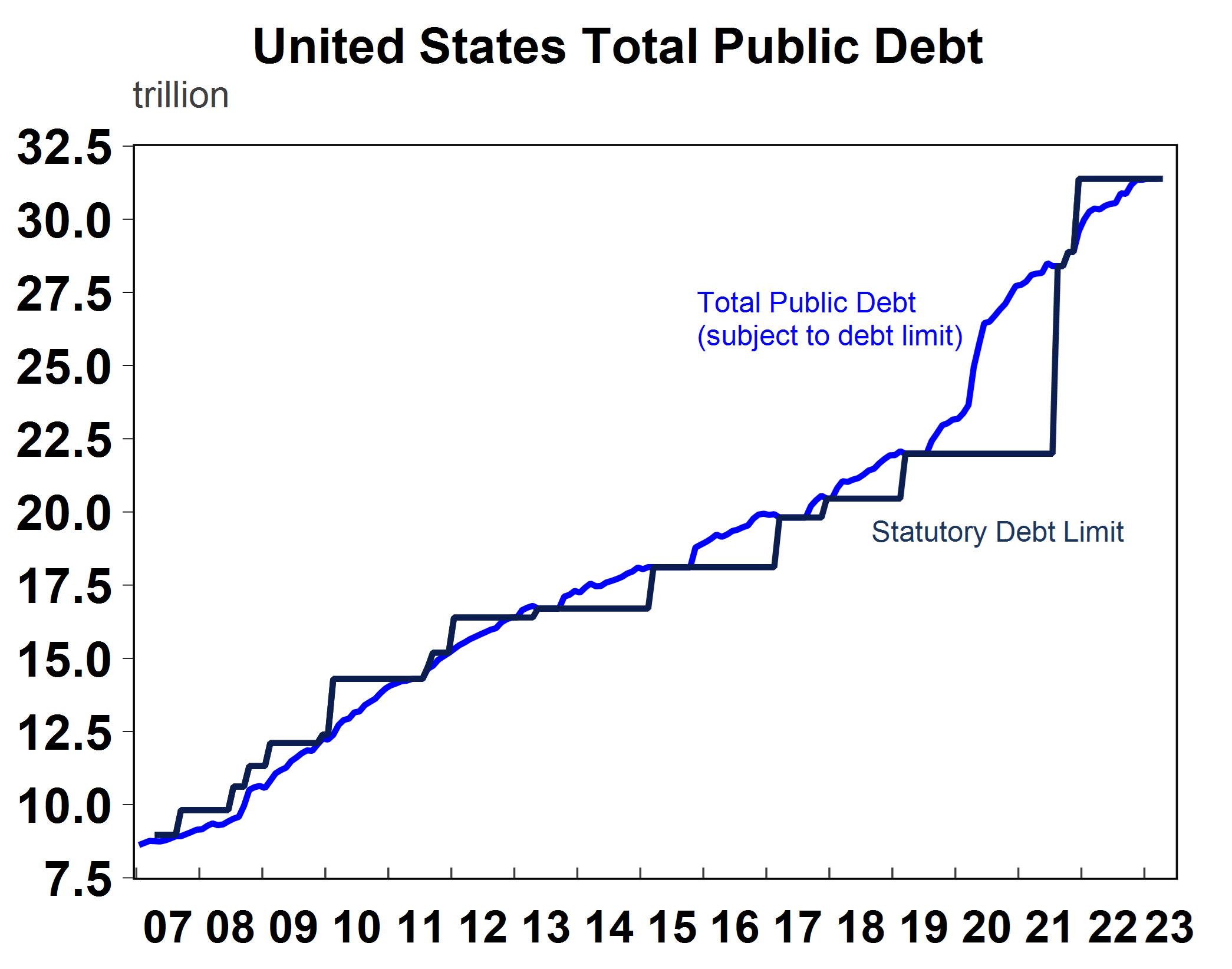

The US debt ceiling is the limit on all Federal debt outstanding. It was initially designed to allow some Congressional control over government spending. Throughout time, the debt ceiling needs to be raised or suspended as government expenditure rises over time with inflation and GDP growth and if the budget remains in deficit. The chart below shows the recent history of total US public debt that is subject to the debt ceiling (blue line) and the actual debt ceiling limits (black line). If the debt ceiling is not raised or suspended then it means that the US Treasury cannot meet all its obligations to pay for its financial obligations, including payments for social security, Medicare benefits and interest on US debt, which would ultimately trigger a technical default by the US government. The risk is that a US government debt default would cause financial market panic through a sell-off in government bonds, a surge in borrowing costs, a sovereign credit rating downgrade, a fall in liquidity and a collapse in business and consumer confidence probably leading to a sharemarket plunge and business bailouts, triggering a financial crisis. There have been two recent examples of the impacts from higher bond yields, with the issues in the US banking system partly to do with the rise in long-dated US bond yields and the UK gilt crisis in late 2022.

Source: Macrobond, AMP

This process of lifting the debt ceiling is unique for the US. In Australia, there is no real limit on total debt issued, but there are non-binding limitations on debt limits like public tolerance of high debt or budget deficits and the risk of a sovereign credit downgrade.

Historical issues with raising the debt ceiling

Raising the debt ceiling has been a contentious issue because it gets tied into other political concessions and spending decisions and often requires bipartisan support. Prior debt ceiling crises occurred in 2011 and 2013 in which periods the US came close to a default, but an agreement was reached at the final hour. But the US government has never defaulted on its debt or spending obligations.

The other issue that can often get tied into debt ceiling debates is the approval for government funding otherwise known as appropriation bills in the US during the US Budget process. This occurs after the start of the new fiscal year in (1 October). Appropriation bills need to be passed annually to keep the various departments of the government funded. Without this funding, people cannot be paid and services shutdown. This situation is called a government shutdown and has happened a few times in history (with the most recent one in December 2018-January 2019). While the process is disruptive, workers are only temporary furloughed and get back paid their incomes, so the damage to the US economy is minimal.

The current situation

According to the US Treasury, total US public debt already reached the debt ceiling back in January. However, “extraordinary measures” have been used by the US Treasury to keep paying bills which includes measures like using cash reserves and suspending reinvestment of securities into public benefit and investment funds. It was expected that these measures could keep funding the US government until sometime between June-August with the uncertainty around the specific date (“X-Date”) subject to change based on revenue and expenditure flows and sensitive to the April tax period. Earlier this week, Treasury Secretary Janet Yellen outlined that the X-Date is now estimated to be as early as 1 June which means that the debt ceiling debate needs to happen sooner than expected.

The first step in the debt ceiling debate occurred last week when the House of Representatives (that has a Republican majority) approving a bill to raise the debt ceiling by $1.5 trillion (which would probably get the government to March 2024) but also decrease government spending (by at least $4.5tn over 10 years by capping federal spending at a 1% growth rate on 2022 levels) and repeal some of Biden’s 2022 Inflation Reduction Act (roll back including imposing work requirements on social programs, reducing subsidies for new energy and clawing back relief on student debt). While this bill was passed relatively seamlessly by the House, it will not be approved by the Democrats who hold power in the Senate so the bipartisan negotiations will now need to begin.

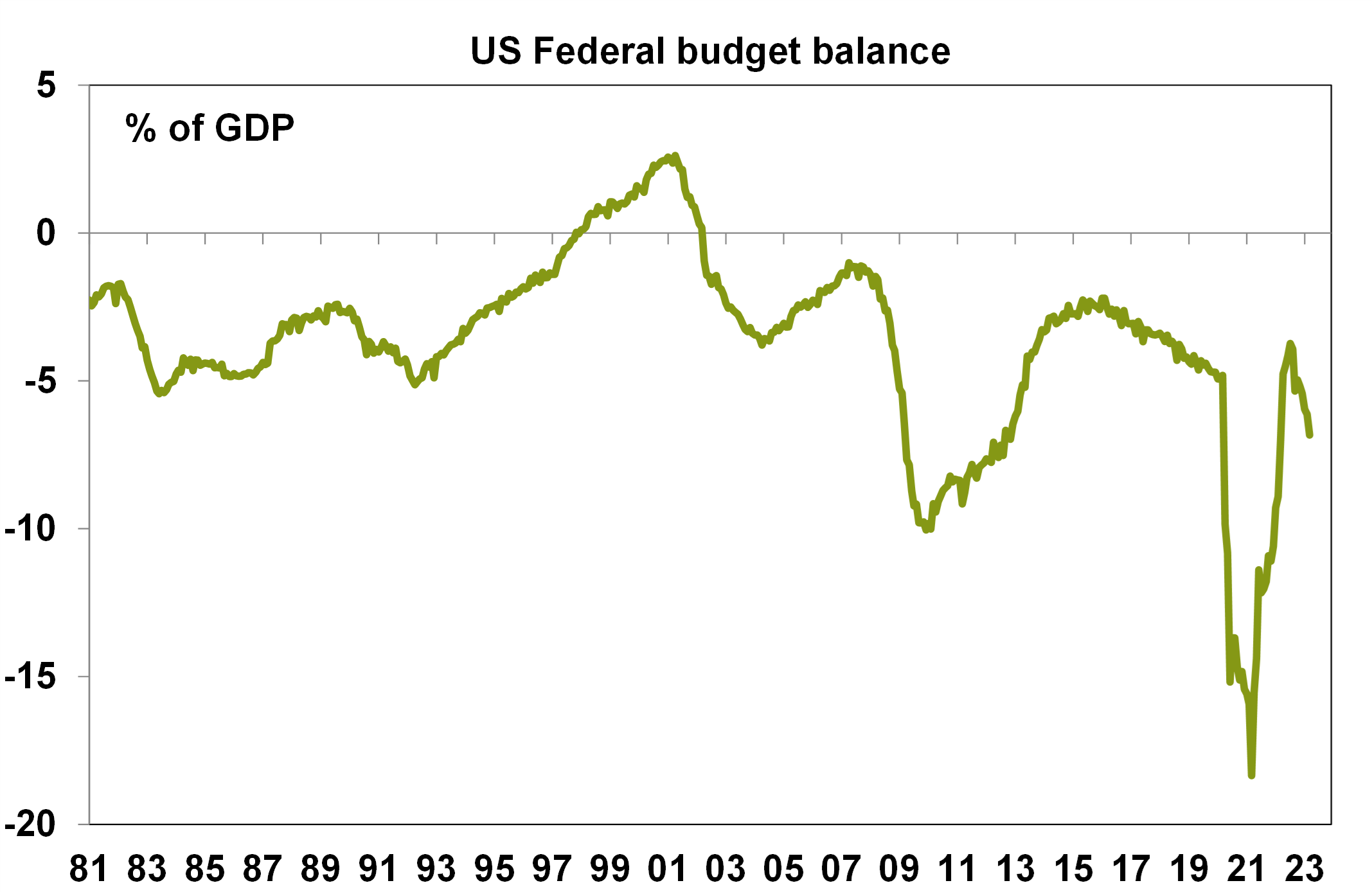

The Democrats will not agree to this current bill because they do not want to cut spending too much ahead of the 2024 election. History shows that a recession in the year of the election will see the incumbent lose. However, the Republicans want to impose some fiscal drag as a recession could increase their odds of a 2024 election victory and the US budget deficit is too large and has been increasing again recently (see the chart below).

Source: Bloomberg, AMP

However the Republican party also need to tread carefully not to reduce spending too much as they would not want to be blamed for a downturn. Based on current projections, the US “fiscal thrust” (which measures the change in the government budget deficit) and is a proxy for fiscal stimulus is expected to be slightly positive in 2023-2024 (see the chart below).

Source: Macrobond, IMF, AMP

Ultimately, the final bill is likely to extend the debt ceiling beyond the 2024 election and include some fiscal austerity (so fiscal thrust in 2024 could actually be flat to negative). But based on a very polarised Congress, its likely to only be agreed upon in the final hour which could cause some downside for sharemarkets in the near-term as investors worry about a US government default. If an agreement is not reached before X-date then there could be some additional measures deployed to prevent a default. Debt interest payments could be prioritised by Treasury, but this could prove difficult to administer. In the event of a default, the Treasury and the Federal Reserve could also reassure markets and inject liquidity into the system through measures and policies available to them in their policy toolkit, just as we saw at the height of the pandemic and recent banking crisis.

Another political risk for the US is the passage of appropriation bills which occurs around the time of the Federal Budget (which needs to be passed by 30 September). But, a government shutdown has less of a financial market impact than the debt ceiling issue.

Implications for investors

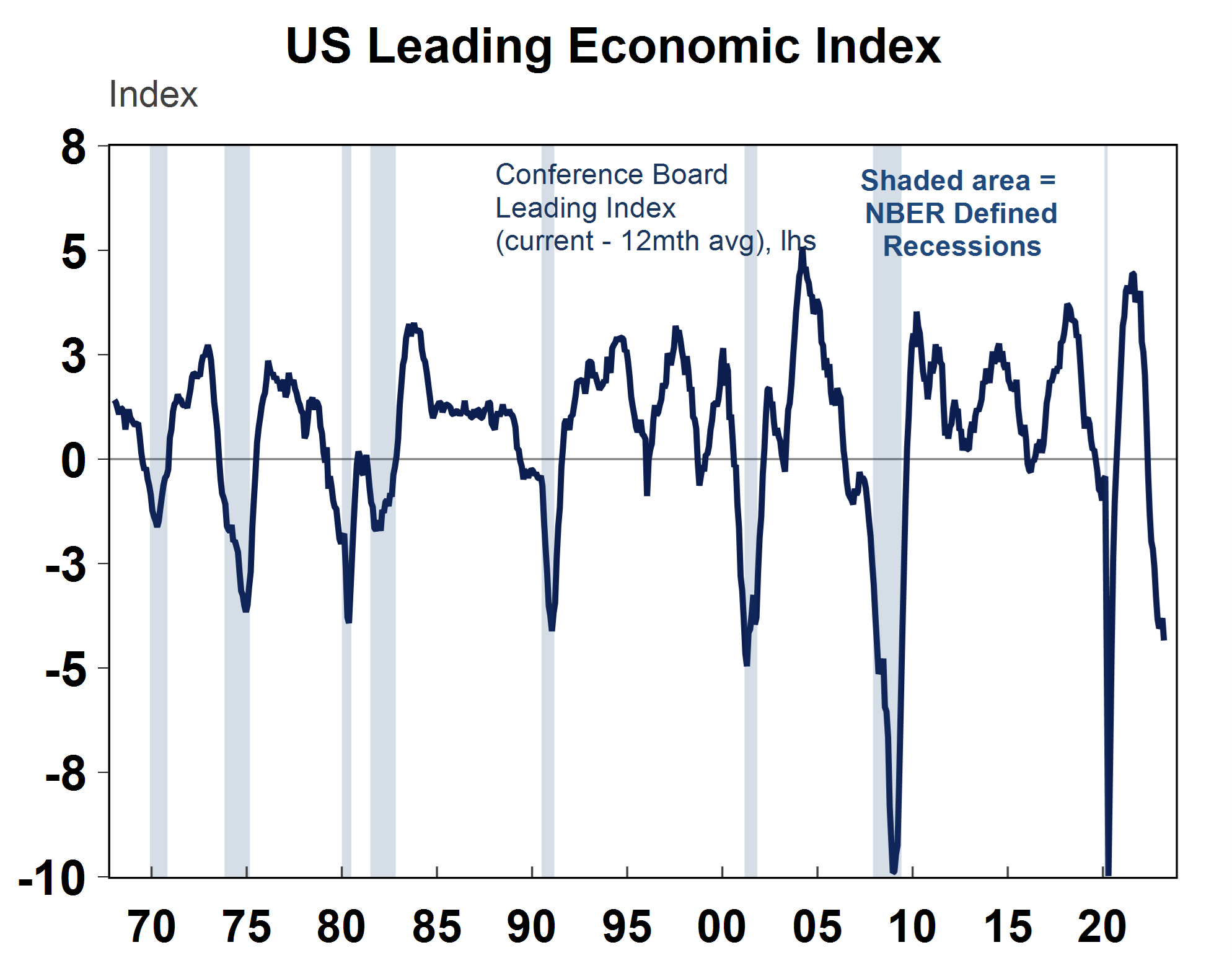

While it may seem inconceivable that the US economy would ever willingly default on its debt obligations but the risk of this happening this year is elevated (we assign a 10-15% probability of a technical default) because political polarisation is at its highest level for years and fiscal policy decisions will influence the 2024 Presidential election. Even a high probability of a default would create a lot of volatility in financial markets and large falls in sharemarkets, especially at a time that markets are already grappling with many issues including elevated inflation, high interest rates and looming recession risks (the chart below shows the US leading index is around recessionary-like levels). This financial market impact could flow through into the real economy through a hit to consumer and business confidence.

Source: Macrobond, AMP

There is also a risk that even if a technical default is temporary, it will damage the credibility of the US economy at a time when the global economy is moving from a unipolar to a multi-polar world as the Chinese economy increases in significance as a share of global growth and increase the risk of a “de-dollarisation” trend.

Once the debt ceiling debate is over, there may not be a “relief rally” from sharemarkets if investors worry about the cutbacks to fiscal spending (which will weigh on GDP growth) that are likely to be included in the debt ceiling bill. Recent increases in liquidity from the US Treasury to support markets are also likely to be reversed after the debt ceiling debate is finalised which could also weigh on shares.

Oliver's Insights - seasonal patterns in shares

06 May 2024 | Blog This article looks at seasonal patterns in shares and whether its time to “sell in May and go away” along the lines of the old share market saying. Read more

Weekly market update 03-05-2024

03 May 2024 | Blog Fed less hawkish than feared; US stagflation or just getting back on track?; RBA to hold, with a tightening bias; Aust consumer remains weak; Aust budget preview. Read more

Econosights - positive supply shocks

02 May 2024 | Blog Post pandemic, the supply of labour has increased in many major economies, including the US and Australia, through elevated immigration and a lift in the participation rate to a record high. Read moreWhat you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

The information on this page was current on the date the page was published. For up-to-date information, we refer you to the relevant product disclosure statement, target market determination and product updates available at amp.com.au.