Key points

- The release of ChatGPT shows that use of artificial intelligence in the way humans live and work is here to stay.

- Technology has replaced some routine manual and cognitive jobs. Now, AI threatens non-routine cognitive jobs because of its ability to replicate skilled human behaviour.

- Productivity growth has slumped across the major economies in recent years and history shows that technological improvements have long-term benefits on per capita GDP growth which lifts living standards. AI could be the productivity boost we all needed.

- However, it will take some time for widespread AI usage as it is still expensive to maintain and faces many regulatory issues before it is fully integrated into everyday life.

Introduction

The release of ChatGPT in late 2022 is renewing concerns around machines taking over human jobs. We look at the potential impact of Artificial Intelligence (AI) on the global economy in this Econosights.

Humanity is always advancing

ChatGPT is a program developed by OpenAI which uses a large language model (LLM) in its programming. Ultimately, it is a super advanced chat bot. LLM is not new and other tech companies like Alphabet, Amazon and Nvidia have their own versions. However, ChatGPT is superior to many of its rivals and many are calling it a gamechanger. ChatGPT has the ability to process a large amount of data, create new content, replicate human behaviour closely and be applied broadly (it has uses beyond text conversations). Whether or not ChatGPT itself becomes as widely used as expected, artificial intelligence usage is here to stay and will have impacts on how humans live. But, technological advancements are nothing new. Humans have been through many transformative periods through history (see the chart below).

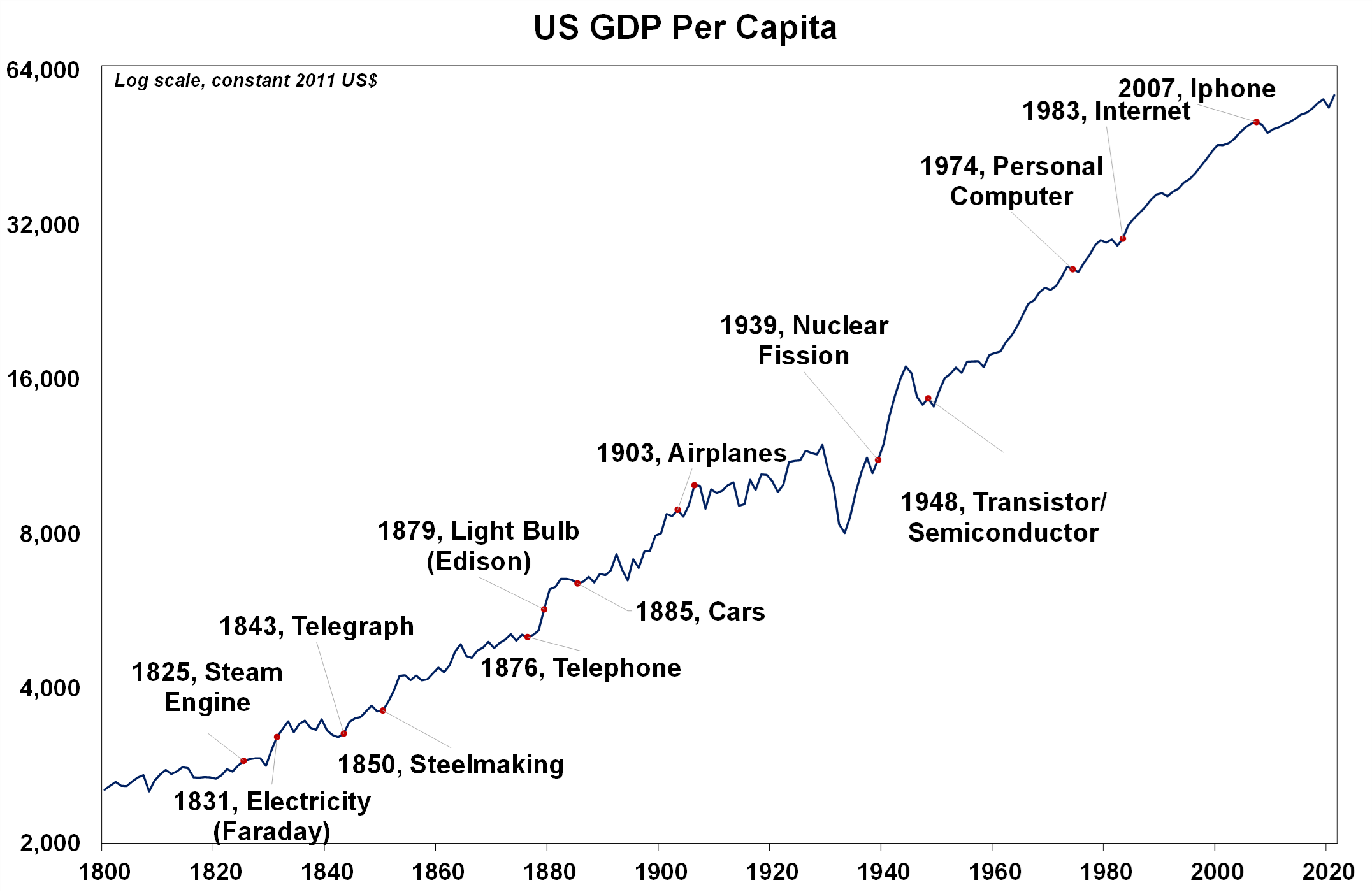

Source: Maddison Project Database 2020, World Bank, AMP

Although each event would have seemed like a big adjustment at the time, the ultimate result has been a rise in per capita GDP growth through time (albeit with bumps along the way!) which has lifted living standards.

Technology and the labour market

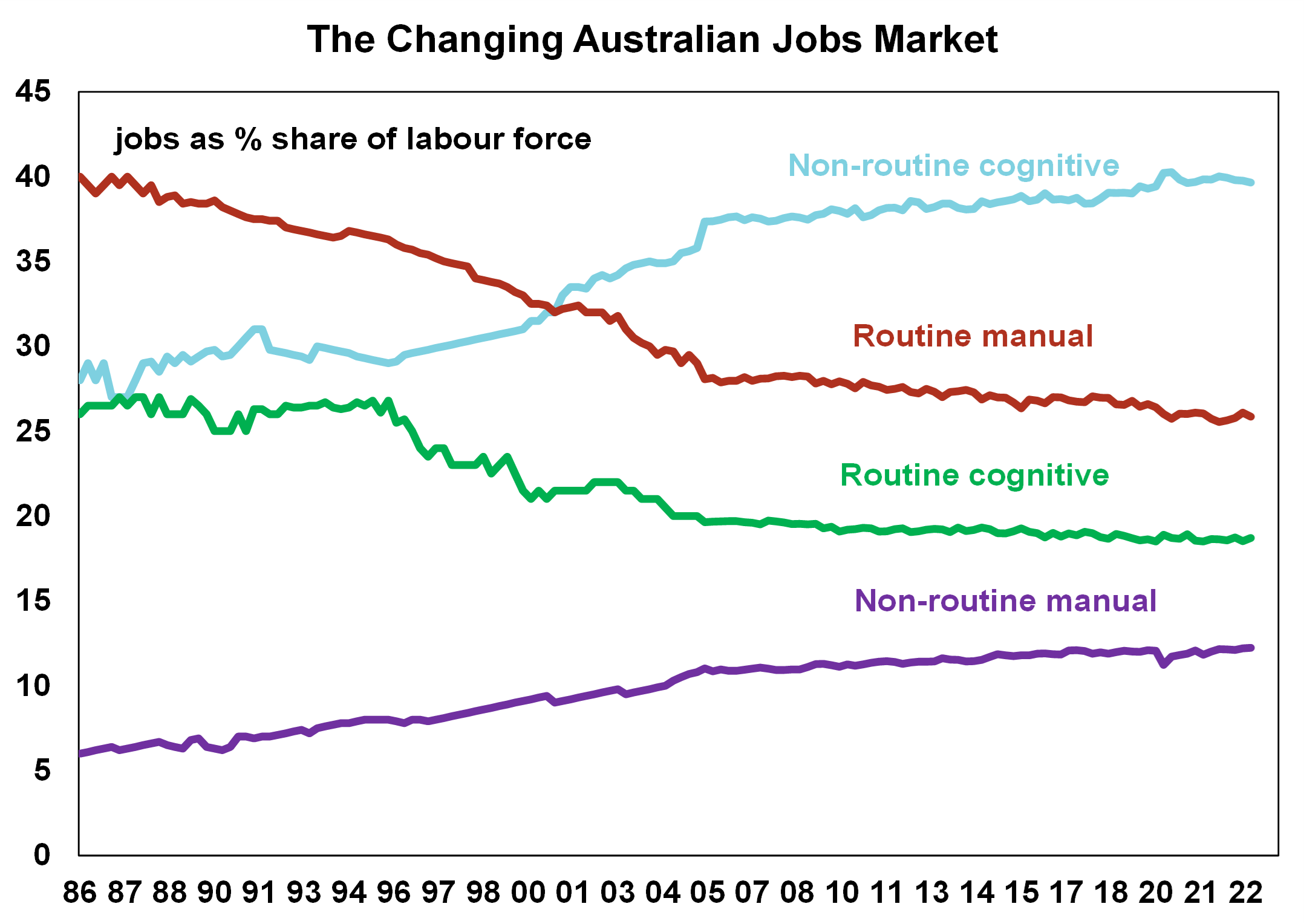

The threat of technology taking jobs traditionally done by humans has been around for many years. Initially, technology and automation was used to replace some routine manual jobs, for example, in the production process which saw a big fall in jobs employed in the traditional sectors of agriculture and manufacturing (in 1900 14% of Australian jobs were in manufacturing and 25% in agriculture versus 6% and 2% most recently). But more recently, tech enhancements through areas like machine learning have started to replace some routine cognitive jobs including, for example in customer service and office occupations. The chart below looks at the Australian labour market and shows that routine manual jobs have fallen as a share of the workforce over time, from 40% in the late 1980’s to 26% recently while routine cognitive jobs have declined from 26% to 19% over this time. Over the same period, non-routine cognitive jobs have risen from 29% to 40% of the workforce which tend to be the higher-skilled jobs that are harder to replace by machines like management and professional skills that require human judgement and expertise. However, the risk from AI is that it threatens this particular group of jobs because of AI’s ability to mimic human behaviour. The jobs least at risk from AI and other technological changes are the non-routine manual jobs which tend to be service-based roles that deal with assisting people and these have grown from 6% of the workforce in the late 1980’s to 12% of the workforce and will continue to be important due to the aging population in the advanced world.

Source: ABS, RBA, AMP

OpenAI estimates that around 80% of the US workforce could have at least 10% of their work tasks impacted by the introduction of tools like ChatGPT and 19% of the workforce will have 50% of their tasks impacted. This is significant. But as history has shown, new jobs be created will be created in this process, especially in areas like compliance, cybersecurity, legal and engineering. And this is occurring at a time when workforce growth is slowing in many countries as the ratio of consumers relative to workers increases (because of the aging of populations). So AI might help with labour shortages. There is also an important role for government to play in the technology transition to ensure that the right education and training are available for their populations.

Will AI boost productivity growth?

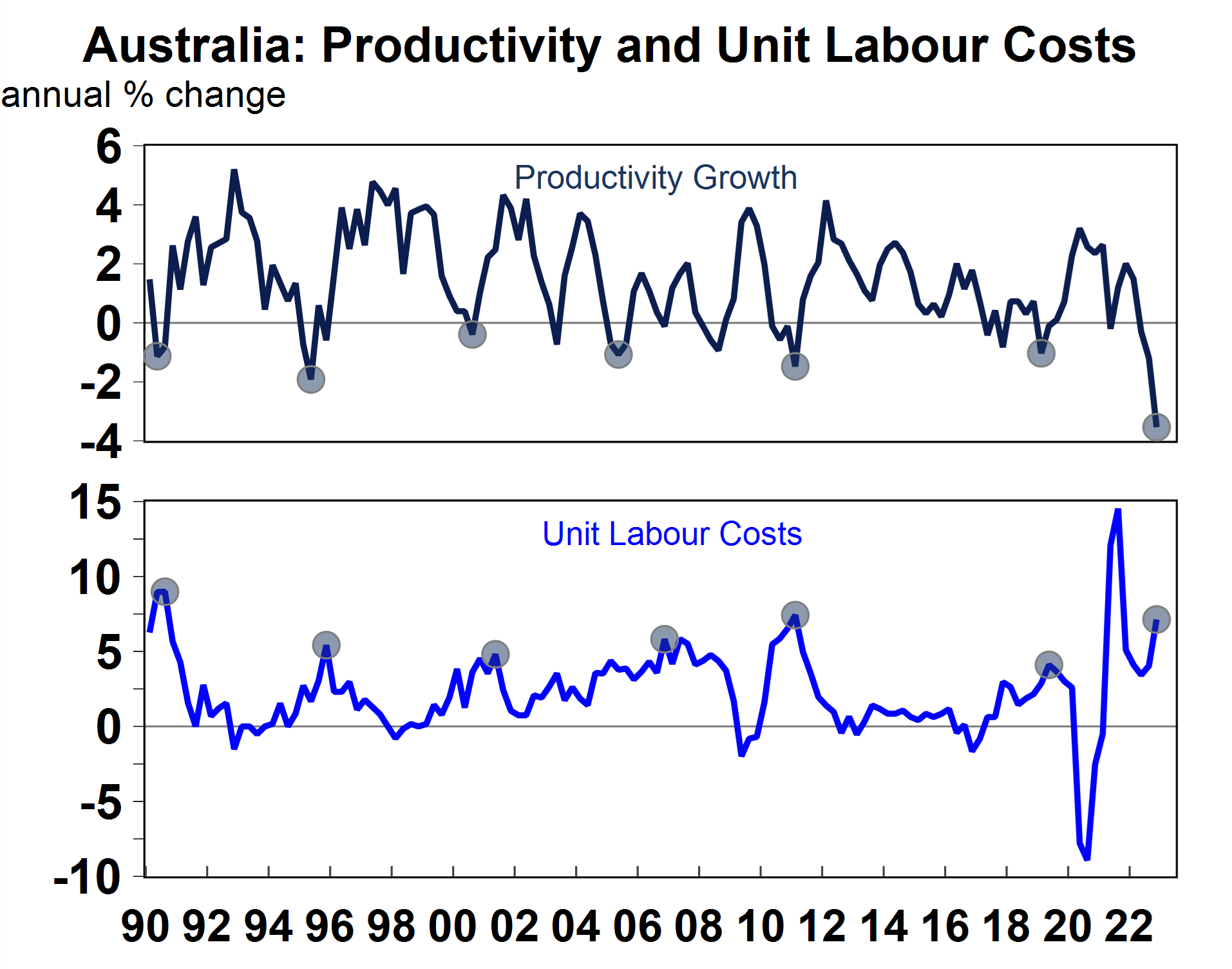

Productivity growth has been poor in major economies over recent years. In Australia, productivity is down by 3.5% over the year to March and -0.9% in the US. There are multiple reasons for this. As economies have moved towards being predominately services-based, productivity gains are arguably harder to achieve compared to industries like manufacturing and agriculture, there appear to be measurement issues of productivity in services industries and Covid-19 disruptions have resulted in a large bounce back in services jobs which have low productivity which is impacting the data. The Reserve Bank of Australia mentioned the need to lift productivity growth as a requirement to lower unit wages growth in Australia. Declines in productivity growth result in a rise in unit labour costs (the chart below shows that at points when productivity growth declines, unit labour costs tend to rise and vice versa) which is inflationary and negative for living standards in the long-run.

Source: Macrobond, AMP

AI could prove to be needed boost to the services industry. Some analysts have tried to measure the potential impact of AI on the economy (Goldman Sachs see a 7% increase in annual GDP growth over a 10-year period and some academics see a 3ppt rise in annual productivity growth) but in reality, it is very difficult and imprecise to predict. And some would say that we have been hearing about the IT revolution driving higher productivity and growth for 20 years now and despite lots of innovations along the way we are still waiting to see the massive productivity boom.

We have looked at major historical technological events and the impact to US GDP growth 20 and 30 years after the event (to allow time for adoption and wide-spread use) – see the table below.

.png)

Source: Maddison Project Database 2020, World Bank, AMP

It shows that GDP growth per capita tended to be 0.3 percentage points higher in the 20 and 30 years after each major technological break-through.

So there does appear to be some long-term benefit to technological progress on GDP and living standards.

Implications for investors

From an investment point of view, the implications for sectors from the impacts of AI are not very clear right now. There is risk that the current big tech firms like Alphabet, Meta, Amazon and Microsoft could suffer long-term and loose relevance, if they do not innovate and are replaced by new AI firms. However, they could end up being a part of the transition and benefit as a result. It is also difficult to put a timeframe on how soon AI could be integrated completely into everyday life with most estimates suggesting that it is at least another 5-10 years away.

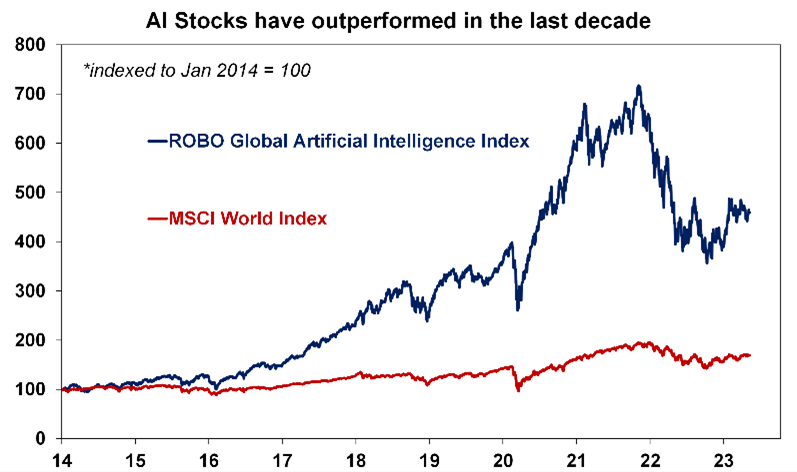

Out of interest, AI stocks have outperformed the MSCI world index significantly over recent years (see the chart below) and more AI-based private companies are likely to become public in coming years.

Source: Bloomberg, AMP

In terms of the impact to other asset classes, large-scale computing power will be necessary to power the programs behind AI which could benefit commodities over the long-term.

There are also significant geopolitical concerns from the adoption of AI. As we move into a multi-polar world and the US and China compete for global tech dominance, AI will feature strongly as an area to control and watch because of its potential usage in warfare. So geopolitical tensions will be an ongoing point of tension in global markets.

It is also important to be mindful of the many risks associated with AI and the numerous steps that are needed to occur before it is widely used in our everyday lives. Currently, AI technology is expensive to maintain, it might not give accurate results, privacy issues will have to be tightened and it has climate issues associated with it because of the large computing power necessary. So, it needs many improvements before it is accessible for widespread use. Recently, major players in the tech space in the “Future of Life Institute” published a letter signed by more than 1,000 experts in the field for a six-month pause in AI research given that the “out-of-control” race could have large negative consequences for humanity. Some countries like Italy have also temporarily blocked ChatGPT usage. So, it will be a while before it is deemed safe to use on a broad scale. This is not our “Terminator moment”…yet.

Oliver's Insights - seasonal patterns in shares

06 May 2024 | Blog This article looks at seasonal patterns in shares and whether its time to “sell in May and go away” along the lines of the old share market saying. Read more

Weekly market update 03-05-2024

03 May 2024 | Blog Fed less hawkish than feared; US stagflation or just getting back on track?; RBA to hold, with a tightening bias; Aust consumer remains weak; Aust budget preview. Read more

Econosights - positive supply shocks

02 May 2024 | Blog Post pandemic, the supply of labour has increased in many major economies, including the US and Australia, through elevated immigration and a lift in the participation rate to a record high. Read moreWhat you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

The information on this page was current on the date the page was published. For up-to-date information, we refer you to the relevant product disclosure statement, target market determination and product updates available at amp.com.au.