Key points

- US inflation surprised to the downside in October. A slower pace of inflation is being driven by lower goods prices. Core goods prices (excluding food and energy) actually fell in October.

- But services inflation is not slowing yet because services prices lag changes in the goods sector and many parts of the services sector still have elevated inflation, especially in rents and recreation. High wages growth is also feeding into services inflation. But, the forward-looking indicators suggest that inflation in these areas will also start to slow.

- US headline consumer price inflation is expected to decline to around 4.5% per annum by the end of 2023, which is much higher than its pre-Covid average of 2% but lower than recent outcomes which saw inflation at multi-decade highs. This should give central banks room to slow the pace of rate hikes before an eventual pause or peak in the tightening cycle.

Introduction

US inflation has started surprising to the downside which means that US inflation has probably peaked for this current cycle. A slowing in inflation is occurring in the goods sector, which was also the area where prices lifted the most over the past 12 months. Services inflation is still rising (albeit at a softer pace compared to recent months) but is slower moving than goods prices (which is why services prices are often referred to as being “sticky”) so it will take longer for services prices to roll over. Lower inflation readings will give room for the major central banks to slow the pace of interest rate hikes before an eventual pause in the tightening cycle. This should be good news for sharemarkets, as long as the economy hasn’t slumped into a downturn or recession.

Goods prices led the upswing in inflation

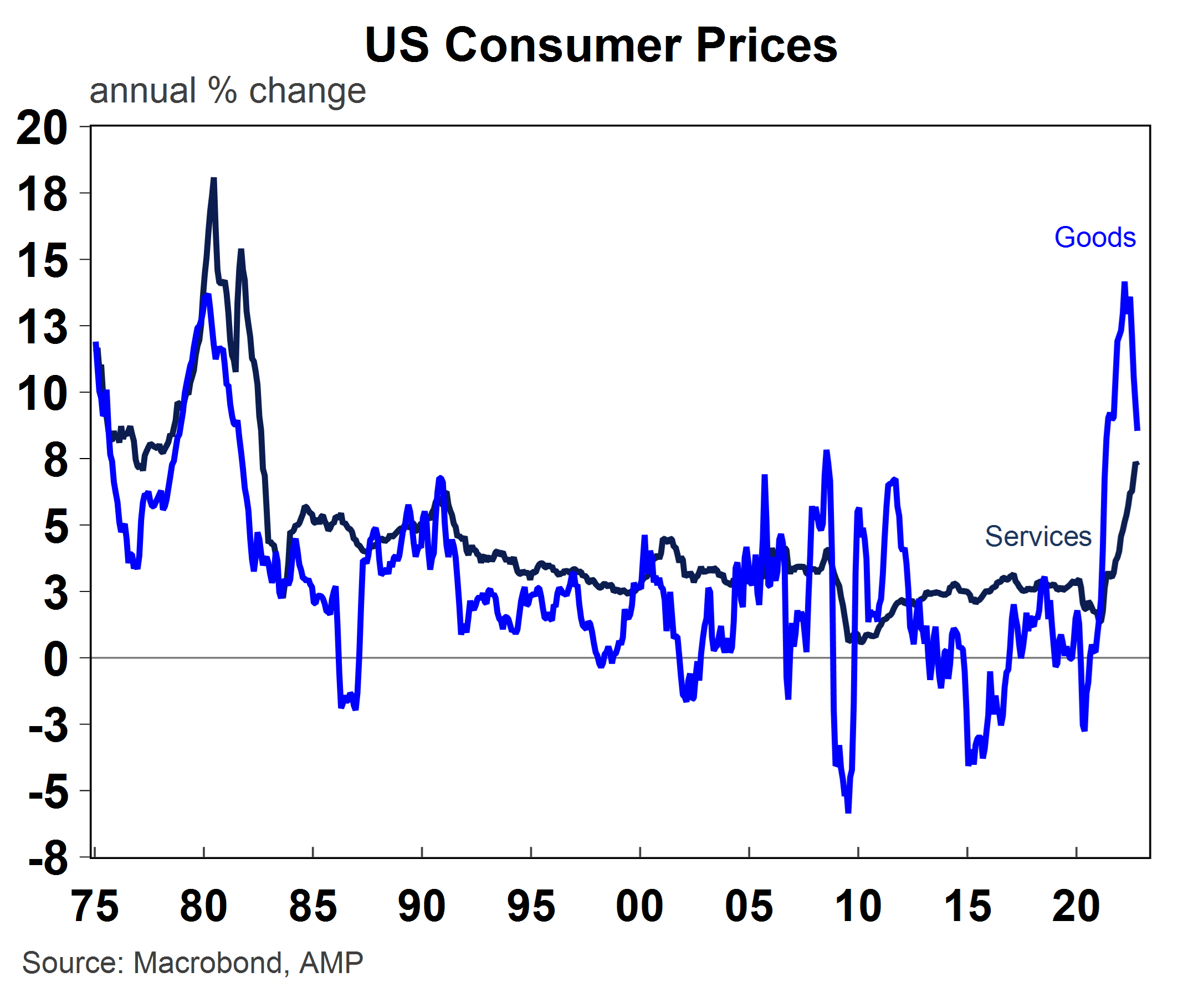

Across the major developed economies, the inflation upswing over 2021/22 was initially led by the goods sector. Consumer goods demand surged over the pandemic because of: a decline in interest rates (which increased purchasing power), government stimulus which gave consumers direct handouts and a collapse in services spending (which meant consumers substituted services spending for goods). Higher goods demand led to a rise in prices for household goods (US household furnishings inflation was running at 10.8% per annum earlier this year and apparel prices were up by nearly 7%) and problems in the supply chain (with goods shortages along with transport costs surging) which created more upwards pressure on goods prices. A surge in commodity prices started in mid-2021 (across agriculture, metals, energy and gas) from the global reopening and supply issues in some commodity markets led to further inflation acrossthe goods and services sector because commodities are an input in the manufacturing and agricultural production processes. Commodity prices received another leg-up from the war in Ukraine in early 2022, which created more dislocations to commodity supply (especially in oil, gas and grains).

Some of this disruption to goods prices was expected to be temporary as the big lift in consumer demand was not permanent, as the supply bottlenecks resolved themselves and as the Russia/Ukraine war did not escalate which is why the central banks kept referring to the lift in inflation as transitory. The issue is that the decline in goods prices took longer than anticipated, with goods prices only starting to turn down recently. US goods price inflation is now running at 8.5% year on year to October (which is still very high), down from 14.2% in March (see the chart below). And, core goods prices (excluding food and energy) were down by 0.4% in October.

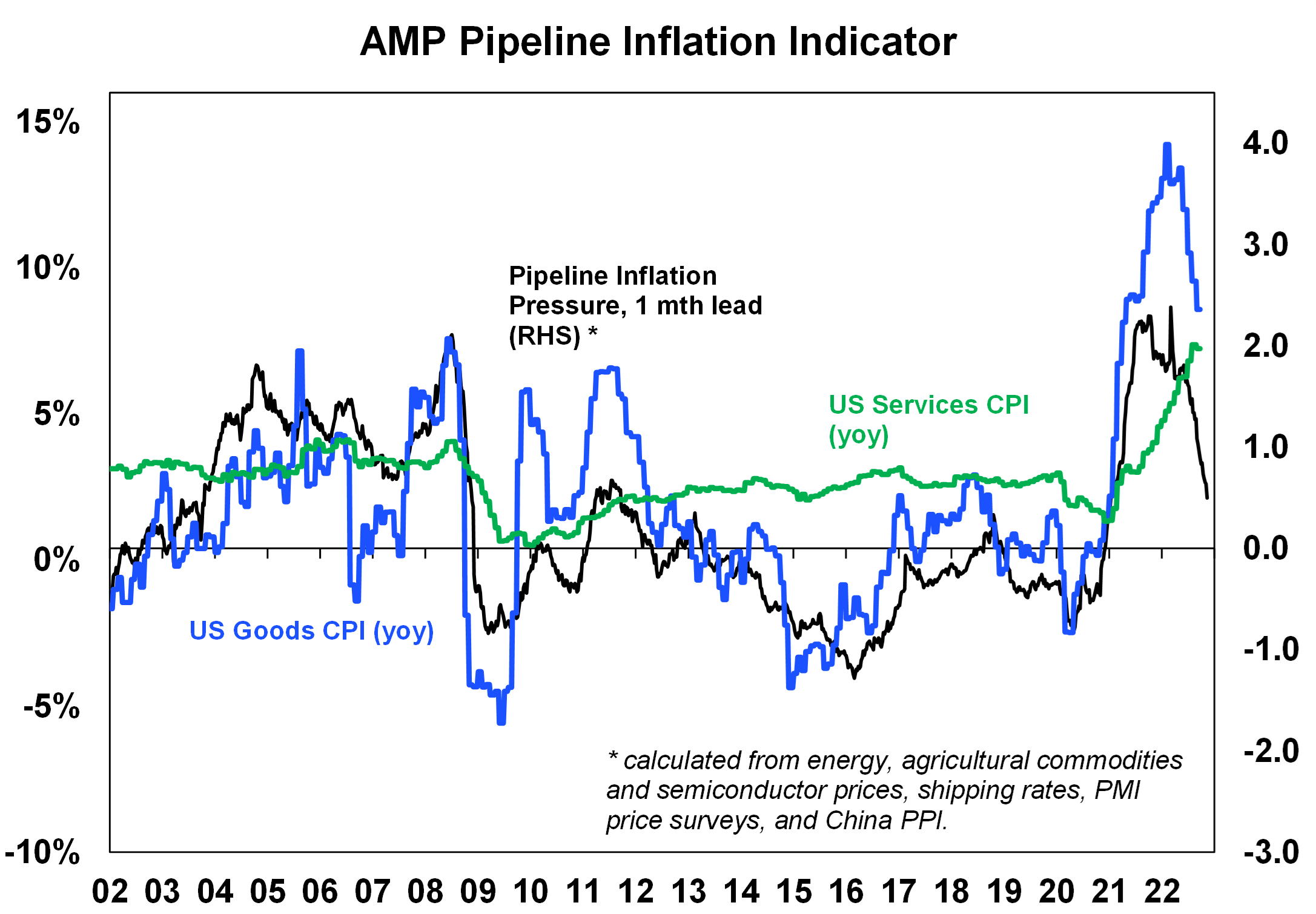

We have constructed a pipeline inflation indicator that capture these demand and supply driven pressures with the key inputs in the model major commodity prices, semiconductor prices, shipping rates, PMI survey prices and the Chinese producer price index (which is a good proxy for global price pressures). Our Pipeline Inflation Pressure indicator has been falling sharply since its peak in March-2022, leading the decline in US goods price inflation and indicating that goods prices have further to fall from here (see the chart below).

Source: Bloomberg, AMP

While this indicator has been a good proxy for goods price inflation, it has been less reliable for services. The chart above shows that services inflation is less volatile than goods prices and moves at a slower pace, usually hovering between 2-3% per annum. Services inflation tends to respond to goods inflation because goods are used in the initial stages of the production process (which are then used by the services industry), so services inflation lags goods price inflation. Although goods inflation is coming down, services inflation is still elevated, currently 7.2% over the year to October, up from 4.6% earlier this year (see the chart below). This is the highest pace of services inflation since the early 1980’s. While services inflation can often be harder to reduce once it takes off and can take longer to respond to blunt policy tools like interest rate changes, it does eventually follow changes in goods inflation, so the recent decline in goods prices should lead to lower services inflation in 2023.

What is driving the lift in services prices?

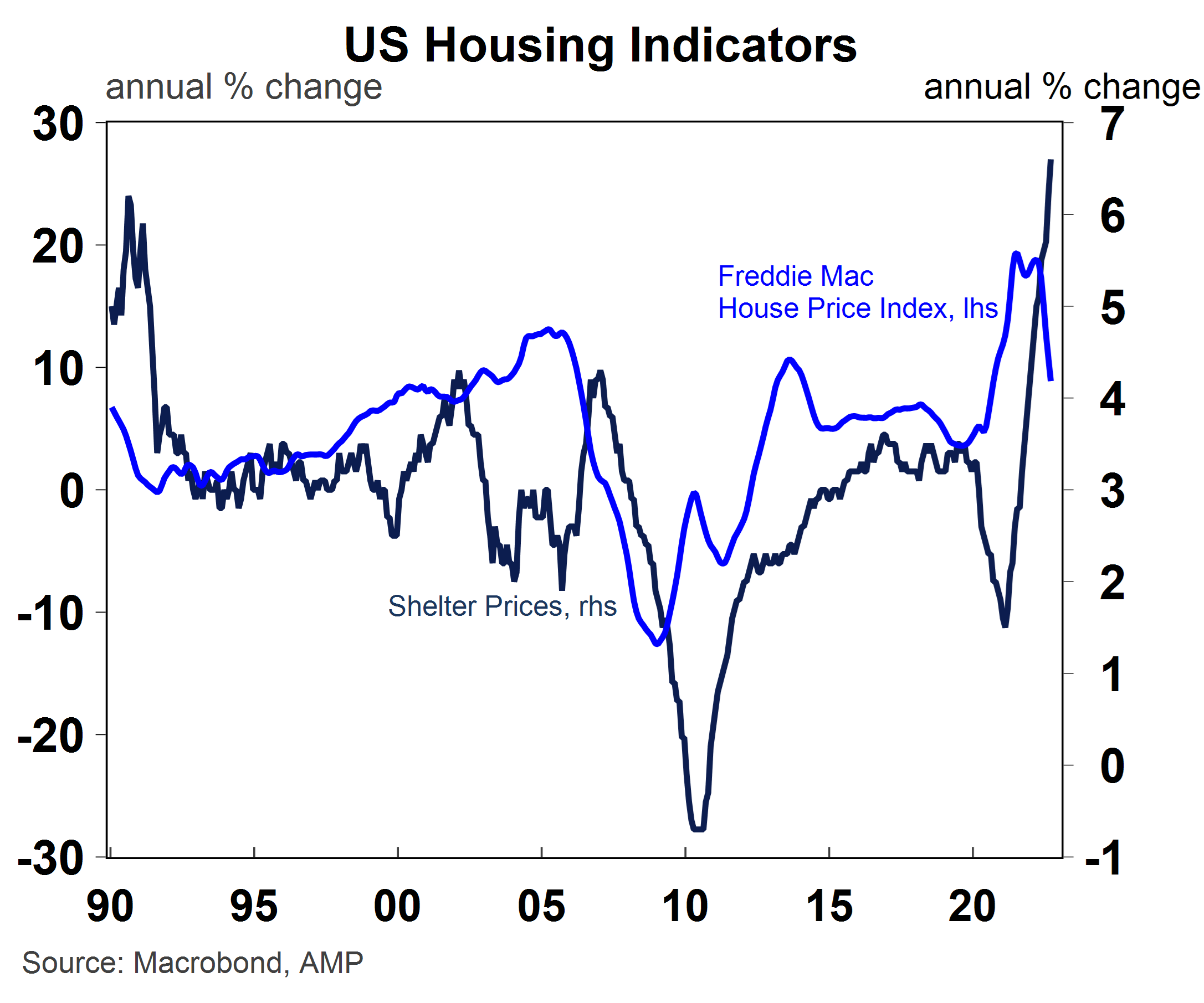

The rise in services inflation reflects a pass through from higher goods prices, a shift in consumer spending from goods towards services (in the US 3-month annualised services spending is up 23.5% while goods spending is down 10.5%) which is lifting services prices (accommodation prices are up 5.9% over the year to October and eating out is 8.6% higher year on year) and rising rents (US rents are up 7% over the year to October), which are the largest individual component of the consumer price basket (at 32%). While US rental growth is strong for now, the housing market is turning down alongside the lift in interest rates (with the US 30-year mortgage at 6.4%, more than double the 2.6% at the beginning of the year). Usually, rental inflation lags the cycle in the housing market (see the chart below), and the recent tick down in US house prices (prices are up by 8.9% over the year to September, down from a pace of 18% per annum in early 2022) should mean that rental inflation reaches a peak soon. Rents for new leases are also now coming down which should be reflected in US inflation in 2023.

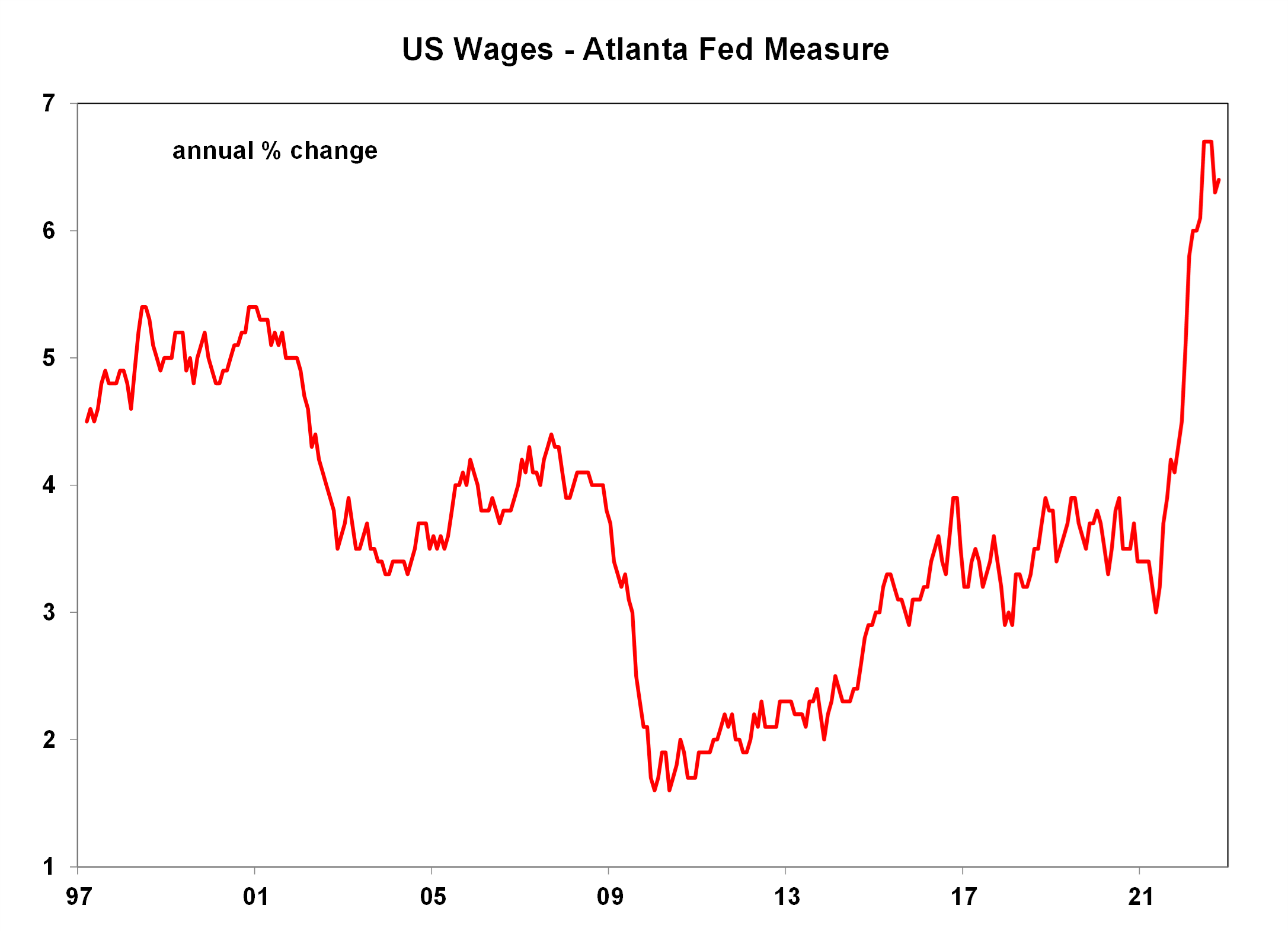

A surge in wages growth is also a major factor behind the rise in services inflation. The US Atlanta Fed wages index is up by 6.4% year on year to October, a dip down on the 6.7% per annum recorded in June but much higher than its usual average of ~3.7%, which is feeding into services prices as wages are often the largest share of business costs.

Source: Atlanta Fed, AMP

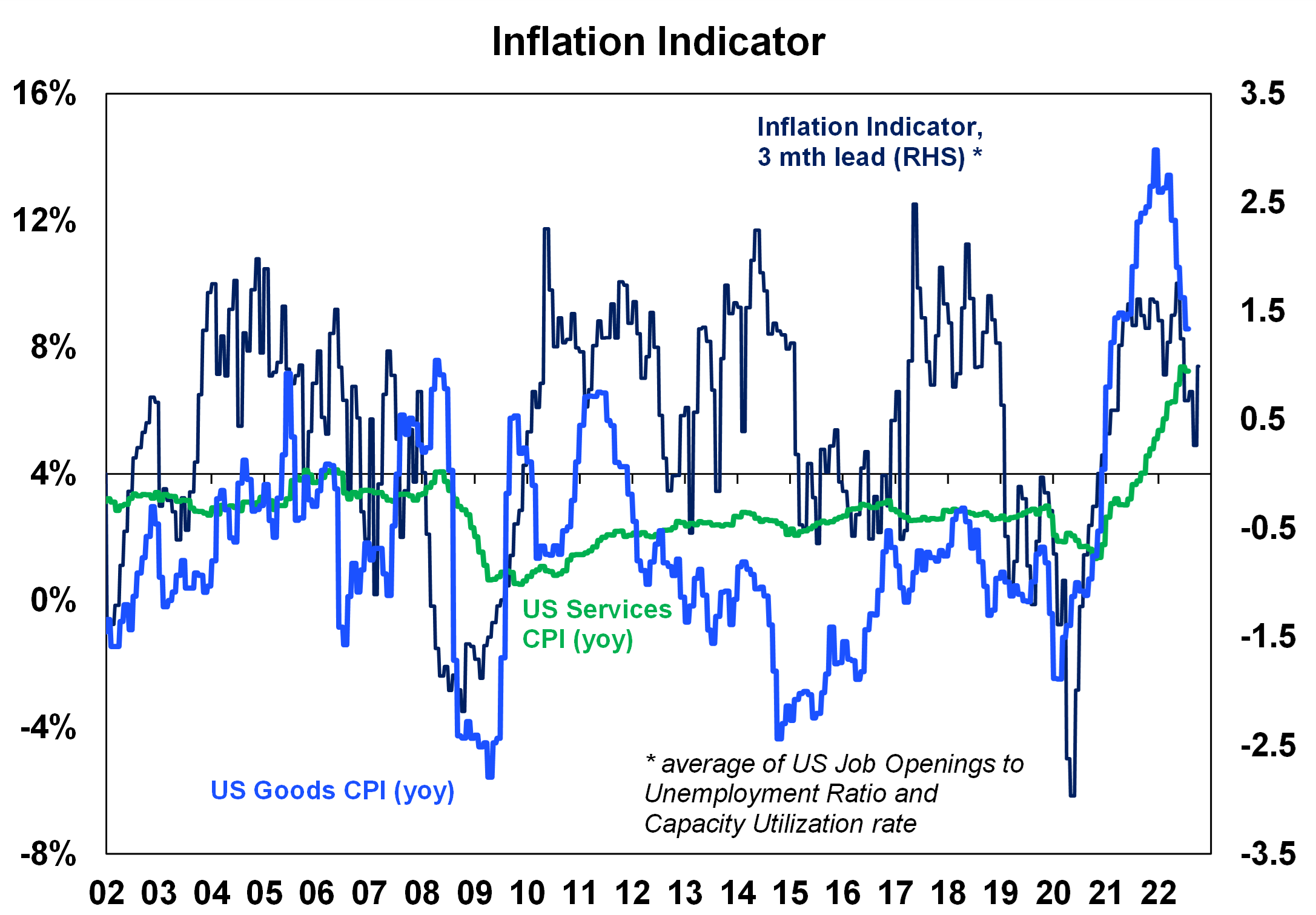

We have also constructed a more traditional measures of services inflation that looks at spare capacity, including the business capacity utilisation rate and labour market spare capacity via the level of job openings to the unemployment rate (see the chart below), which is also pointing to lower spare capacity compared to earlier this year which is negative for inflation.

Source: Bloomberg, AMP

Conclusion

US headline consumer price inflation is expected to decline to around 4.5% per annum by the end of 2023, which is much higher than its pre-Covid average of 2%, but lower than recent outcomes which saw inflation at multi-decade highs. The initial downshift in inflation will be driven by lower goods inflation, and there may even be pockets of deflation in parts of the goods sector. It will take longer for services inflation to decline because it is slower moving. However, some of the leading indicators of services inflation around rents, wages and travel costs are also pointing to a slowing in price growth.

Lower inflation outcomes should give central banks room to slow the pace of rate hikes before an eventual pause or peak in the tightening cycle. This should be good news for sharemarkets, as long as the economy hasn’t slumped into a downturn or recession.

Weekly market update 26-07-2024

26 July 2024 | Blog Dr Shane Oliver discusses the risk off as tech hit continues; correction risks into August/September; global rate cutting cycle underway; Australian June quarter CPI to rise but the hurdle to another RBA rate hike should be high; and more. Read more

Oliver's insights - rise of populism and bigger government

24 July 2024 | Blog This article takes a look at the rise of populism and what it means for economic policies and investors. Read more

Weekly market update 19-07-2024

19 July 2024 | Blog This week shares are down; US election/Trump prospects starting to impact; global rates easing cycle on track; China Plenum; Australian jobs still tight but easing so RBA needs to be careful; and more. Read moreWhat you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

The information on this page was current on the date the page was published. For up-to-date information, we refer you to the relevant product disclosure statement, target market determination and product updates available at amp.com.au.