Key points

- Mortgage stress can become apparent through an increase in households in negative equity, a rise in mortgage delinquencies and/or a significant lift in mortgage repayments due to higher mortgage rates.

- A rise in scheduled mortgage repayments due to higher interest rates is the biggest risk to household spending in 2023 because it will cause a sizeable fall in household cash flows, especially for new borrowers.

- While some households can meet additional repayments through using accumulated savings or existing loan prepayments, household consumption is still likely to fall.

- Rising mortgage stress will be most apparent in new borrowers (those who took out loans in the last 3 years), which are 62% of outstanding loans.

Introduction

The significant increase in interest rates in Australia since May 2022 is leading to questions about the risk of household mortgage stress. We go through this issue in this Econosights.

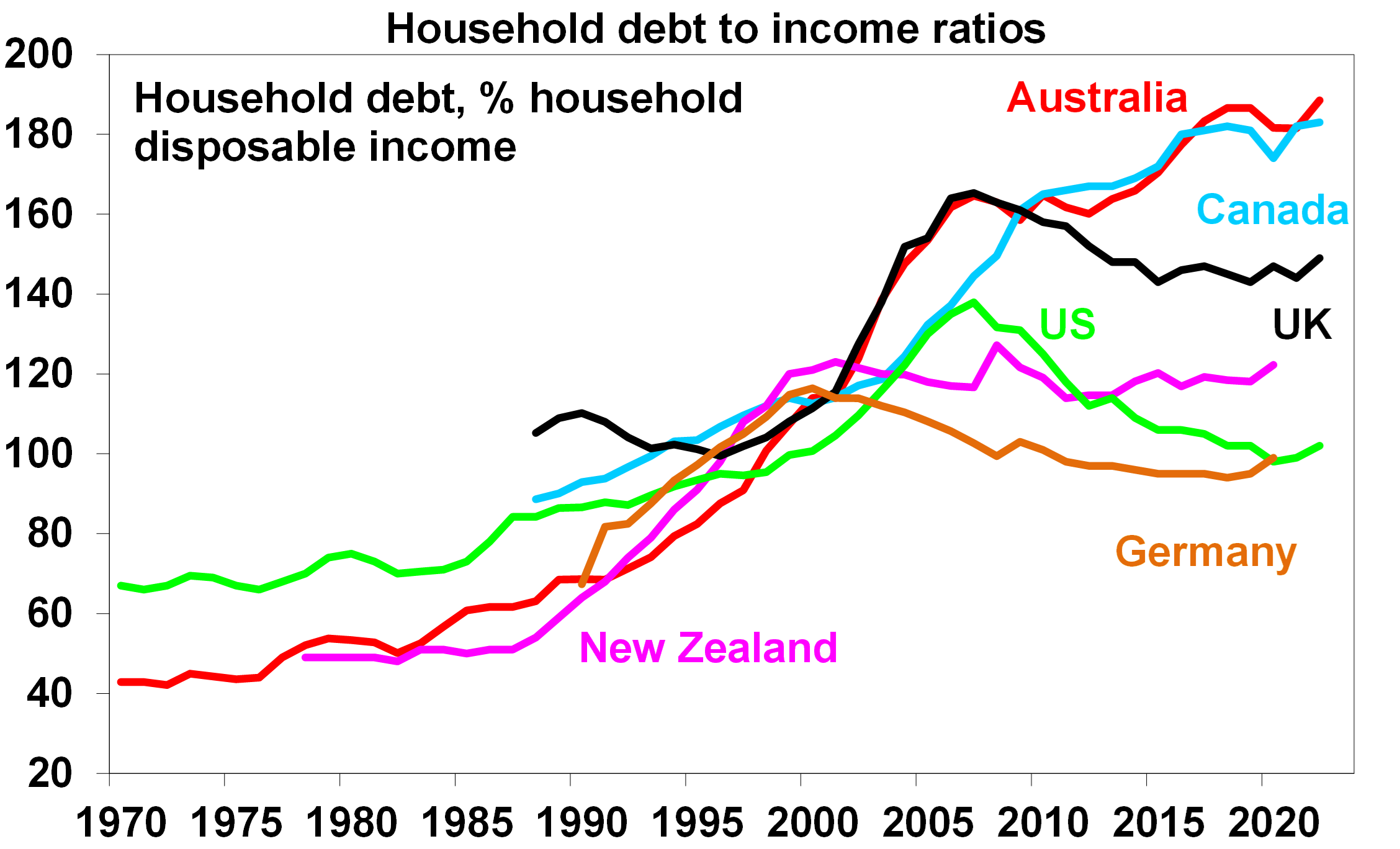

High household debt increases vulnerability to rising interest rates

Australian household debt as a share of income is sitting around a record high at 189% of income, which is significantly above most of our global peers (see the chart below), and the majority of this debt is in housing. This makes Australian households vulnerable to changes in home prices and interest rates, with the risk of mortgage stress increasing as home prices fall and interest rates are increased.

Source: IMF, RBA, AMP

What is mortgage stress?

Traditionally, “mortgage stress” was a loose term applied to housing-related spending (either through mortgage or rent) that exceeded 30% of income. However, this is a very blunt definition and in some capital cities in Australia, some households already spend more than that share of income on housing repayments. There are broader ways to measure mortgage stress such as:

- The share of households in negative equity

Negative equity is where the value of the dwelling is worth less than the purchase price. Some recent buyers are falling into negative equity as home prices fall. Australian national dwelling prices have declined by 9% since their peak in April 2022, taking prices back July 2021 levels. On the Reserve Bank of Australia’s own figures, 0.5% of loans are currently in negative equity and this will rise to 1% if home prices fall another 10% (which is close to our forecast for the peak-to-trough fall in prices). A housing price crash (which would see prices fall another 20%) would see negative equity loans rise to 4% of total loans, which is still low, but this underestimates the risk for new loans. Another 20% fall in prices would see 10% of new loans go into negative equity.

The implications of households falling into negative equity are: a negative wealth effect which is either realised (through selling) or unrealised (when you see the value of your asset declining), a rise in “mortgage prisoners” which are those borrowers trapped with their current lender at an uncompetitive rate because refinancing is not possible as the value of the dwelling has declined and increasing risk for the banks as a decline in the value of assets on its balance sheet means the need to hold more capital.

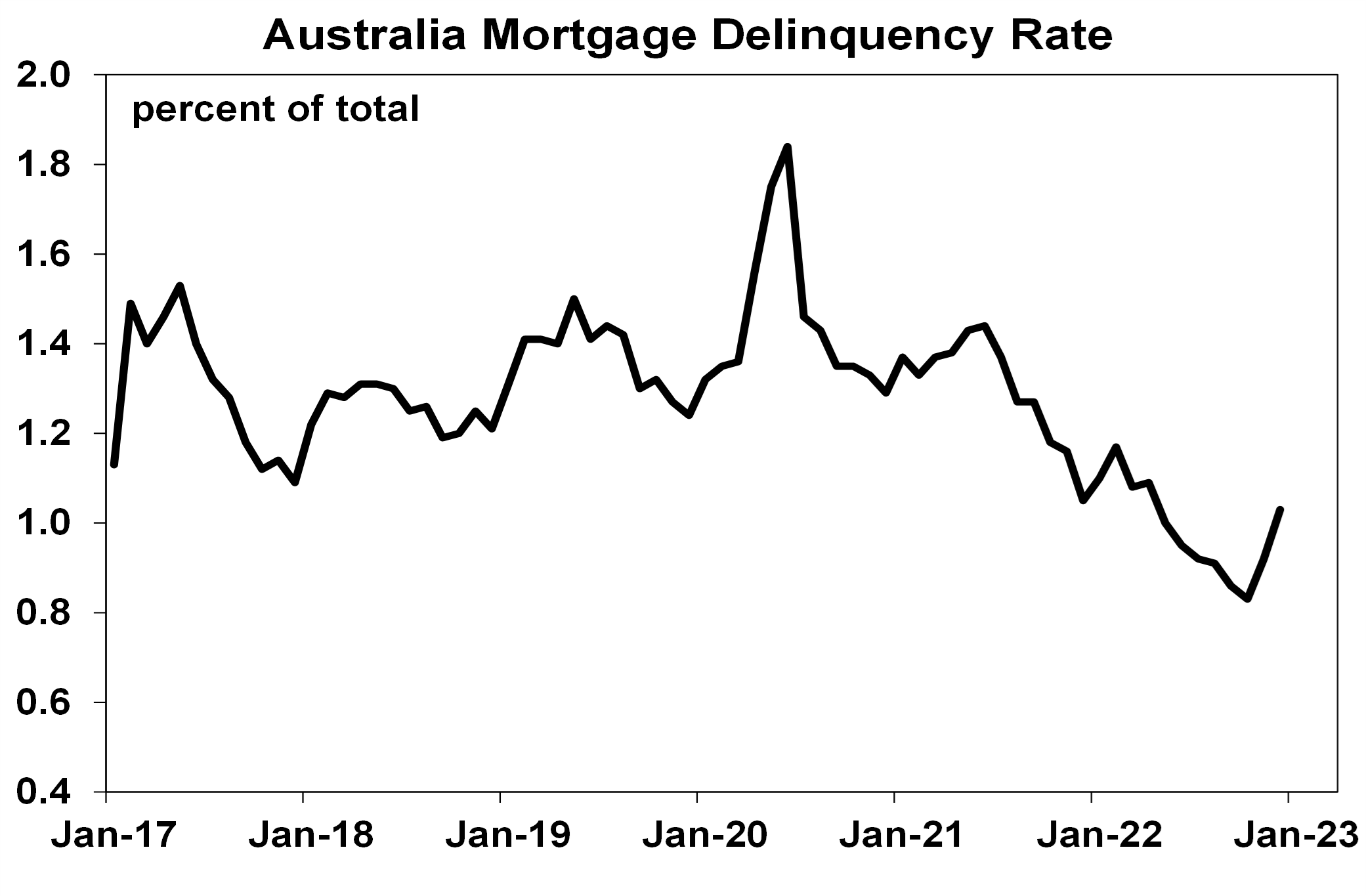

- The level of mortgage delinquencies

The level of Australian mortgage delinquencies (those who are overdue on their mortgage by at least 30 days) is low, ticking up only marginally from its bottom of 0.8% in October 2022 to 1% in December (see the chart below). Further increases are likely from here as home prices decline and as higher interest rates increase the risk of repayment challenges. The pandemic broadened the availability of financial institution support plans like payment deferrals which may keep delinquencies lower than otherwise.

Source: Bloomberg, AMP

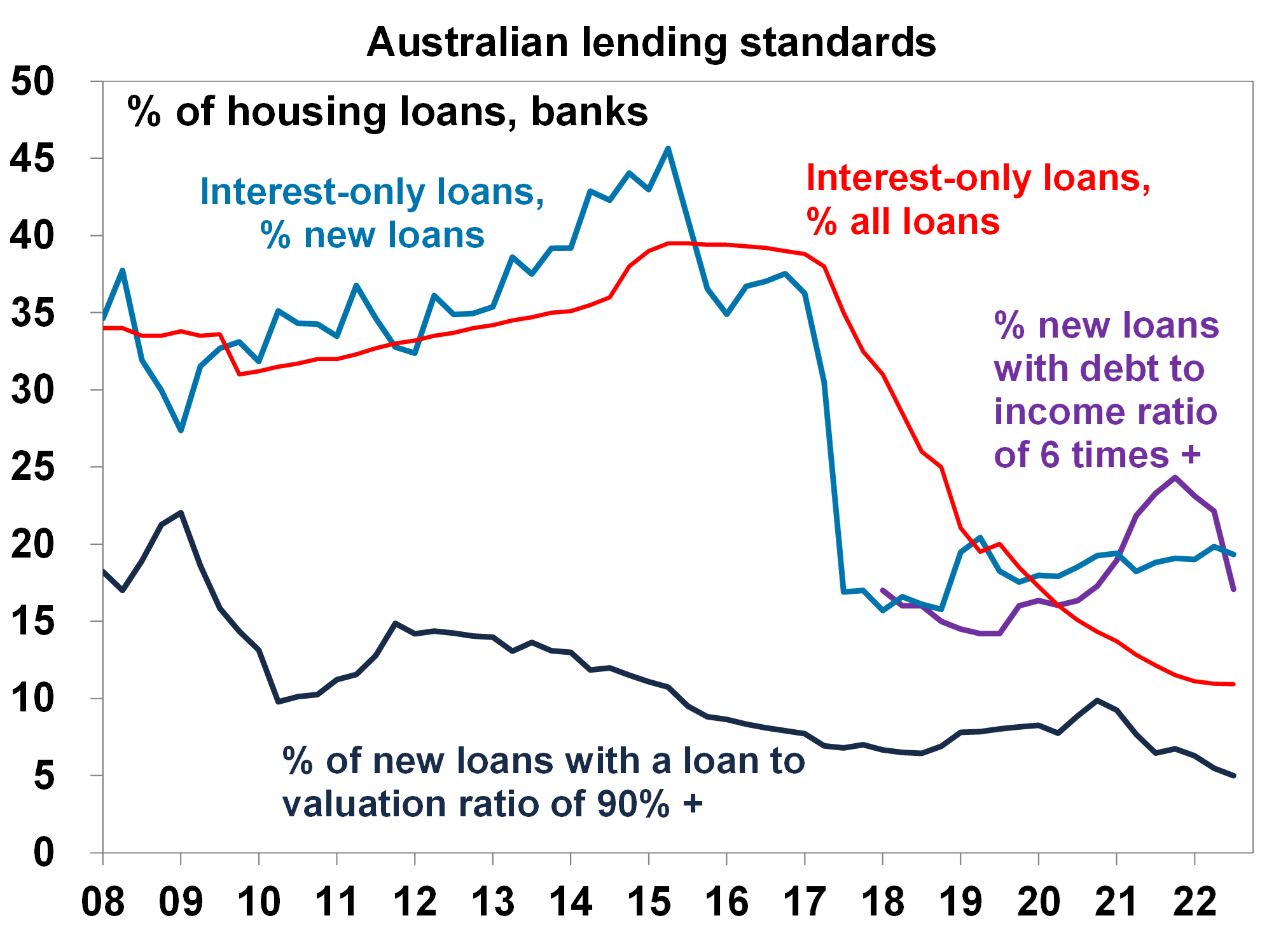

The risk of delinquencies rises with higher-risk lending. Over the past two years, “risky” lending did increase slightly, with a rise in high debt-to-income loans (those above 6 times) although interest-only loans are still well down from 2015 highs and high loan-to-value lending has also been constrained (see the chart below).

Source: APRA, AMP

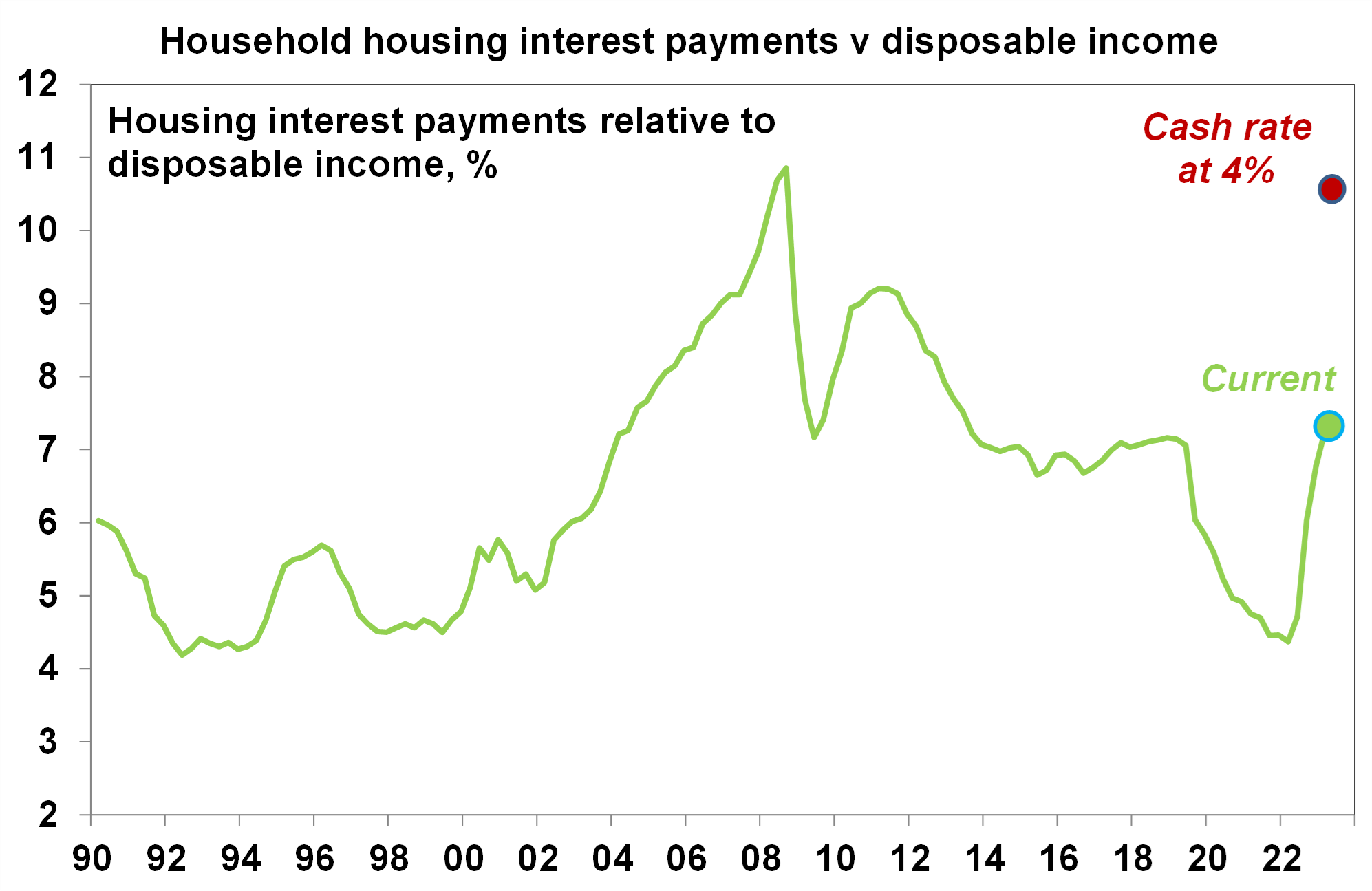

- Rising mortgage repayments due to higher interest rates

A significant increase in mortgage repayments due to higher interest rates is the biggest risk to household spending in 2023. Household interest costs (as a share of income) reached a bottom of 4.4% in March 2022 thanks to the decline in interest rates over the pandemic and have now increased to around 7% (note this measure also includes households that do not have a mortgage, so it dilutes the impact for indebted households). But, the lags involved with monetary policy means that this measure is underestimating the increase in mortgage servicing costs to households that will hit households in coming months. Variable mortgage holders (70% of loans outstanding) see repayments changing around 3 months after the RBA adjusts the cash rate and fixed mortgage holders (30% of outstanding loans) are only impacted when the loan term expires, with most fixed loans set for 2-3 years in Australia. The majority of this impact will happen this year, as around 880,000 fixed loans will expire in the next 12 months and will reset to mortgage interest rates that are 2-3 times higher.

Source: RBA, Macrobond, AMP

The average household in Australia has a mortgage of around $600,000 (across variable and fixed loans). As a rough guide, monthly mortgage repayments are due to increase by around $13,000 per year if we account for the full increase in the cash rate so far (by 325 basis points). So the question then becomes whether households have enough cash flow to meet these additional repayments. RBA analysis on variable-rate households shows that close to 40% of mortgage holders would see a decrease in cash flows of 40% or more if interest rates were to increase by 350 basis points (and 15% would have negative cash flows after these rate rises). So for the average household it would appear that to meet these additional repayments, households will have to cut down on spending (most likely discretionary), tap into savings or find additional income (if this is available through increasing work hours or getting another job but this is not possible for most people and is even harder to do in an environment of a rising unemployment rate).

What could support households?

There are also some positive offsets for households that could assist meeting additional repayments including:

- High accumulated savings for some households

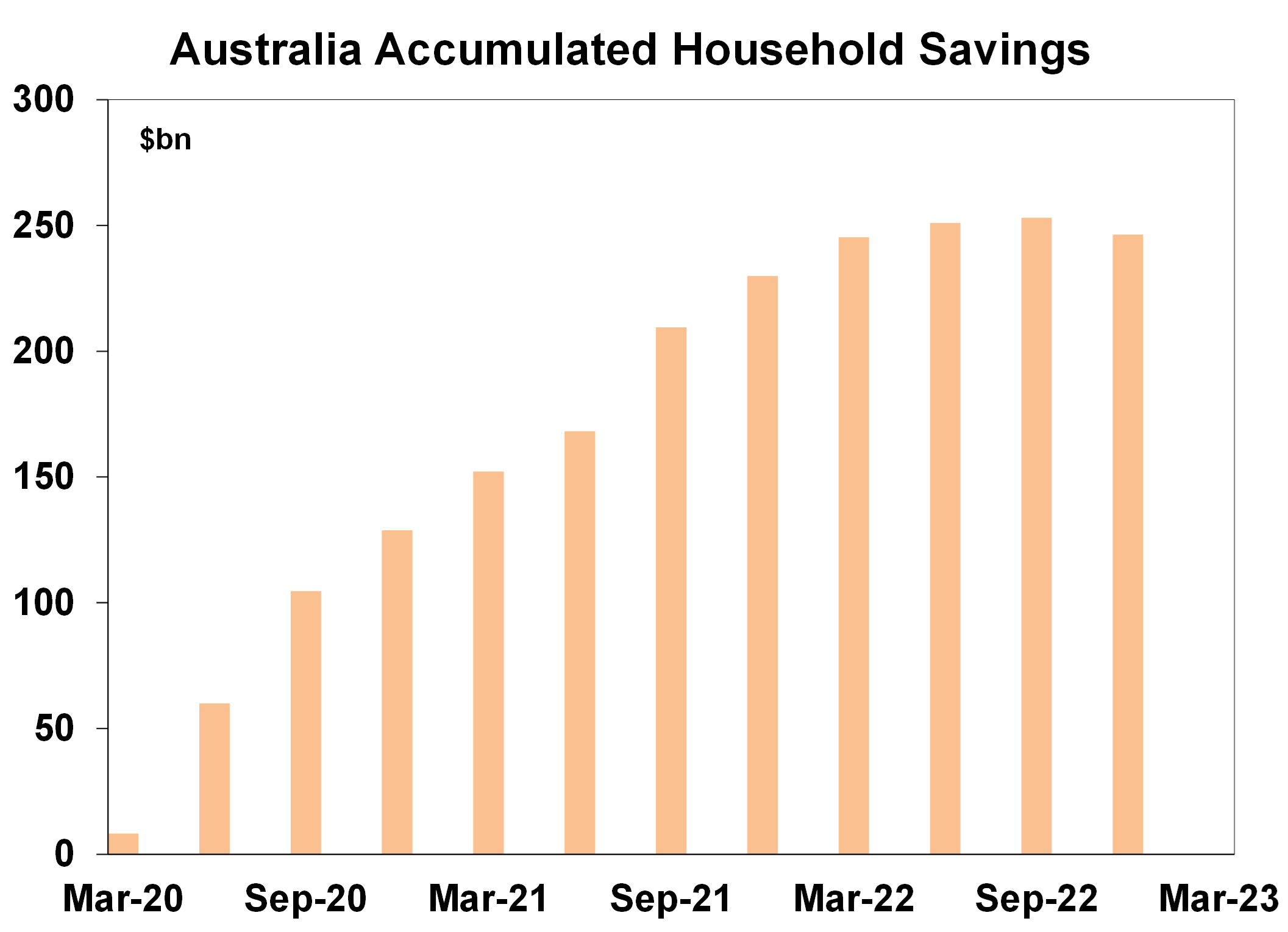

The value of Australian household accumulated savings is worth around $250bn (see the chart below) or around $26K per household, thanks to fiscal transfers and interest rate cuts during the pandemic. Savings will be run-down over 2023 as interest rates increase and higher inflation lifts the cost of living but it could take most of 2023 to completely run-down total savings. However, most of these savings are concentrated in high income earners.

Source: ABS, AMP

- Some households have built up prepayments

On the RBA and our own estimates, the median household is sitting on between 10-15 months worth of additional prepayments (between offset and redraw accounts) which can be used to meet additional repayments. However, drawing down on those prepayments would end up lifting monthly repayments and extending the life of the loan. High prepayments are a protection against forced home selling but would only be used when absolutely necessary. And for new borrowers, those prepayment buffers are much smaller, compared to outstanding loans .

Conclusion

In our view, the risk of mortgage stress lies with recent borrowers (those who have taken out loans between 2020 - mid 2022) which is around 62% of outstanding housing loans. These households have not had time to build prepayment buffers, have faced large declines in home prices, have had a very fast repricing of mortgage rates, are more likely to have taken out larger loans and were probably not stress tested for the current increase in interest rates.

We think that the downside risks to the household sector are greater than the RBA (and most commentators) are estimating. Financial market pricing assumes that the RBA cash rate will reach around 4.2% (it is currently at 3.35%) while we remain on the other side of consensus and think the cash rate will peak at a lower level around 3.6%.

Oliver's insights - ineffective investors

22 October 2024 | Blog In the confusing and often seemingly illogical world of investing, investors often make various mistakes that keep them from reaching their financial goals. This note takes a look at the nine most common mistakes. Read more

Econosights - global housing trends

22 October 2024 | Blog The common belief that Australian homes have become unaffordable is understandable, as all the metrics around affordability have deteriorated. But how does the housing situation in Australia compare to our global peers? We go through this issue in this edition of Econosights. Read more

Weekly market update 18-10-2024

18 October 2024 | Blog Down down for global inflation and rates; soft Chinese data but better than feared; strong Australian jobs and the RBA; US earnings results; time for another baby bonus?; and more. Read moreWhat you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

The information on this page was current on the date the page was published. For up-to-date information, we refer you to the relevant product disclosure statement, target market determination and product updates available at amp.com.au.