Why should I find my lost super?

A lost or unclaimed account could have quite a bit of money in it, particularly if it’s had investment earnings while invested and held by your super fund. Plus, if you reclaim it before it’s sent to the ATO, there could be added benefits like:

- you may not lose any insurance cover you may have inside your super (which you will if it’s transferred to the ATO)

- earnings on investments may be more favourable. This is because if your account is taken by the ATO, interest will be calculated using the consumer price index (CPI).

How to find your lost super

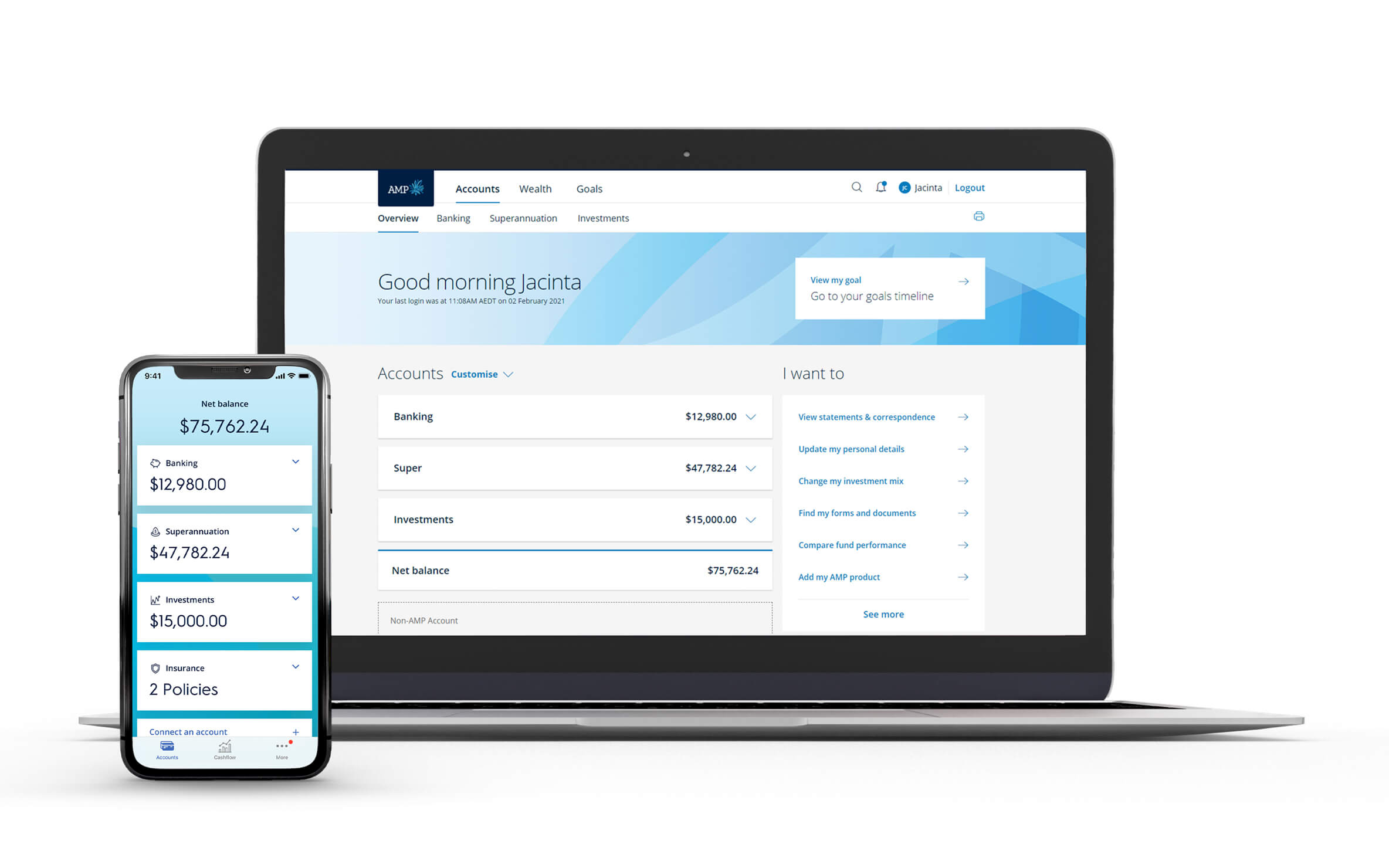

You can find and consolidate your super in My AMP in 5 easy steps:

- Login or register for My AMP.

- Follow the search for my super link.

- Complete a quick security check. You will need two types of ID, like your passport, drivers licence or Medicare number.

- Provide consent for the use of your Tax File Number.

- Get your results in My AMP.

What happens next?

Once the results are ready, we’ll explain some options for next steps – for example, you may want to bring it together (consolidate) into an active super account (account that receives regular contributions).

It’s a good idea to take time to consider your results and get more information from your super providers before deciding what’s right for you. Some things to think about for each of your different accounts include benefits, features or insurance you may lose if you choose to consolidate.

What is the difference between lost and unclaimed super?

Lost super

Your super fund will generally report you as a lost member to the ATO if:

- you’re uncontactable and your account hasn’t received a contribution or rollover in the last 12 months, or

- you joined an employer super plan and the fund has not received a contribution or rollover for you in the last five years.

- your account has been transferred by another super fund as a lost member account.

Unclaimed super

Your super fund is required to transfer your super to the ATO (to hold on your behalf), if it becomes unclaimed super. Your super fund will generally do this if you:

- are over 65 years old, the fund has not received an amount on your behalf in the last two years and has been unable to contact you for five years

- have passed-away, the fund hasn’t received an amount on your behalf in the last two years and they’ve been unable to pay the benefit to the person entitled to receive it

- are a former temporary Australian resident, and at least six months have passed since the later of the date you left Australia or the date your visa expired

- are entitled to be paid an amount as a result of a family law superannuation split, and the fund is unable to make sure you or your legal personal representative receive the amount

- are a lost member whose account balance is less than $6,000

- the fund has not received an amount on your behalf in the last 16 months, you don’t have insurance inside your super and your account balance is less than $6,000 (other exclusions may apply) Learn more

- are a member, former member or non-member spouse of a member or former member, and the fund believes it would be in your best interests to pay your super to the ATO.

How does super go missing?

In the past, people may have lost track of super when they changed jobs. Particularly if the super contributions from their new job were paid into their new employer’s super fund and they didn’t transfer funds from their previous super account.

The good news is that this is less likely to be an issue these days. On 1 November 2021 new laws came in that make it harder to lose track of your super. The laws mean you’ll generally take your super account with you when you change jobs, rather than have a new account automatically opened up for you.

Super can also become lost or unclaimed if a person’s previous super funds don’t have their latest address, email or phone number on file. If you have an AMP super account, you can update your contact details in My AMP.

What you need to know

Products in the AMP Super Fund and the Wealth Personal Superannuation and Pension Fund are issued by N.M. Superannuation Proprietary Limited (N.M. Super) ABN 31 008 428 322 (trustee), which is part of the AMP group (AMP). Before deciding what’s right for you, it’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions available from AMP at amp.com.au or by calling 131 267. Read AMP’s Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you.

Any advice and information provided is general in nature, hasn’t taken your circumstances into account, and is provided by AWM Services Pty Ltd ABN 15 139 353 496 (AWM Services), which is part of the AMP group (AMP). All information on this website is subject to change without notice.