Calculate how much money you might have, how long it will last and how much you’ll need in retirement, with our retirement calculators

Working out how much is enough for retirement depends on many factors, such as your lifestyle, plans for the future, and the number of years you’ll spend retired. Additionally, estimating how much you’ll have when you plan to retire depends on factors such as your current salary, super balance and assets. With so many factors, it’s easy to see why you might need a retirement calculator to get an idea of your retirement savings needs.

By using our helpful retirement calculators, you can get an indication of whether there’s a shortfall between how much you are estimated to have and how much you’ll need in retirement, and put a plan in place to address the situation.

How much is enough for retirement?

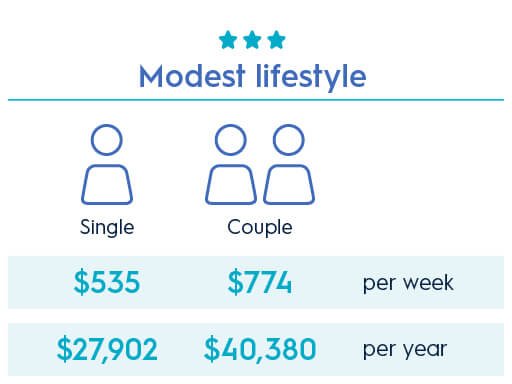

The Association of Superannuation Funds of Australia (ASFA) estimates that Australians aged around 65 who own their own home and are in relatively good health, will need the following amount of money each week and year in retirement1:

A modest lifestyle is considered better than living on the age pension, while a comfortable lifestyle means someone can afford a good standard of living, be involved in a broad range of leisure and recreational activities and travel domestically and occasionally internationally2.

For Australians on above-average incomes, another rule of thumb to estimate how much money you’ll need in retirement is to assume you will require 67% (two-thirds) of your pre-retirement income to maintain the same standard of living3.

What are your retirement lifestyle expectations?

Ultimately, how much money you'll need for your own retirement is very personal, and will depend on your own situation, wants, needs and lifestyle expectations. It may help to factor in your day-to-day spending habits, your recreational activities and hobbies and whether you’ll be entering retirement debt-free. The following figures are a guide taken from the ASFA retirement standard.4

How long will you work for?

The age at which you retire can have a significant impact on how much money you have and how much money you need in retirement. It can depend on factors such as your health, debts, super balance, age you can access your super, whether you have dependants, and your partner’s retirement plans (if you have one).

How long will you be retired?

Keep in mind that if you're planning to retire at around age 65, it’s likely you’ll live for another 20 years or so. Men aged 65 can expect to live to 84.6 years, while women can expect to live to 87.3 years5.

How much money will you have in retirement?

The money you use to fund your life in retirement will likely come from a range of different sources including the following:

Superannuation

Knowing your super balance is a crucial part of planning for retirement, as it's likely to form a substantial part of your retirement savings.

Age pension

Depending on your circumstances and assets, you could be eligible for a full or part age pension, or alternatively, may not be eligible for government assistance at all.

Investments, savings and inheritance

You may be planning to downsize your house, sell shares or an investment property, or use money you’ve saved in a savings account or term deposit to contribute to your retirement. Or perhaps an inheritance or the proceeds from your family’s estate may help you out in your later years.

How our retirement calculators can help

Meet Mac. He’s 51, married and planning to retire at age 65.

To work out how much Mac might need in retirement, he tries our retirement needs calculator. Mac is hoping for a comfortable standard of living in retirement, and our calculator estimates this will cost him $1,154.49 a week – or $60,033 a year. He’s also planning on buying a new car and doing some travelling once retired, and thinks he’ll need $40,000 for these one-off expenses. Based on a life expectancy of 81 years, our retirement needs calculator estimates he’ll need a total of $993,473 to fund his retirement.

So how much might he have in retirement, and how long is his money likely to last, based on his current and expected financial situation?

Mac uses AMP’s retirement simulator to find out. Mac currently has $172,000 in superannuation invested in a balanced investment option, an annual pre-tax salary of $82,000, shares worth $20,000, and the couple owns their family home. Based on this information, our retirement simulator calculates he’ll retire with savings of $294,944. Based on his expected expenditure in retirement outlined above, our retirement simulator estimates his money will only last until age 71, leaving him with a funding shortfall of 10 years in retirement.

While this news may seem scary, it’s not an uncommon situation. Luckily, finding out about the possible shortfall now means there may still be ways to boost his savings before retirement.

What do you do if you won’t have enough to retire?

If, like Mac, you’re facing a shortfall in retirement, there are several things you can do to get your retirement on track. You could consider boosting your super through additional contributions, delaying your retirement, adjusting your retirement lifestyle expectations, or selling other assets.

Simply by having an idea of your current and projected retirement savings, thanks to our retirement calculator and simulator, you could work to improve the situation. The earlier you start, the easier it may be for you to reach your retirement goals.

Contact AMP to see how we can help.

1 Association of Superannuation Funds of Australia (ASFA) Retirement Standard June 2020.

2 Association of Superannuation Funds of Australia (ASFA) Retirement Standard.

3 ASIC Moneysmart, How much super is enough?

4 Association of Superannuation Funds of Australia (ASFA) Retirement Standard June 2020.

5 https://www.aihw.gov.au/reports/life-expectancy-death/deaths-in-australia/contents/life-expectancy

Subscribe to our newsletter

Can I go back to work if I’ve already accessed my super?

01 July 2023 | Finance 101 Generally, you can, but there may be other things to consider. Read more

Super contribution rules when you’re in your 60s and 70s

01 July 2023 | Super Know your options around making contributions, accessing your super savings and when Age Pension entitlements could be affected. Read more

Super bring-forward rules now apply to more people

01 July 2023 | Super More Australians can make up to three years’ worth of non-concessional super contributions in the same financial year, with the government making this option available to individuals up to the age of 75. Read moreWhat you need to know

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account.

It’s important to consider your particular circumstances and read the relevant product disclosure statement, Target Market Determination or terms and conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy.

All information on this website is subject to change without notice. AWM Services is part of the AMP group.

Important information

Products in the AMP Super Fund and the Wealth Personal Superannuation and Pension Fund are issued by N.M. Superannuation Proprietary Limited (N.M. Super) ABN 31 008 428 322 (trustee), which is part of the AMP group (AMP). Before deciding what’s right for you, it’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions available from AMP at amp.com.au or by calling 131 267. Read AMP’s Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you.

Any advice and information provided is general in nature, hasn’t taken your circumstances into account, and is provided by AWM Services Pty Ltd ABN 15 139 353 496 (AWM Services), which is part of the AMP group (AMP). All information on this website is subject to change without notice.