How insurance in super works

It’s usually offered through your employer’s sponsored super plan as cover they’ve negotiated for you and their other employees (called a group insurance policy) which is generally considered the number one way for Australians to access affordable insurance without needing underwriting1.

When you’re making super contributions

Did you know that your insurance premiums are paid from your super account? This can be great news for your budget since it doesn't reduce your take-home pay. Plus, super is generally taxed at a lower rate than income tax, which means you save on taxes too.

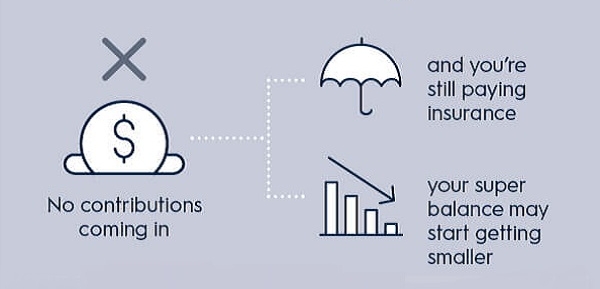

Not making super contributions?

If you are no longer making super contributions, your super balance may decrease. Keep this in mind if you plan to take an extended break from work.

While cancelling your insurance might seem like a quick fix, it's important to remember that you may not get the same cover at the same price later. You may also need to answer health and lifestyle questions (known as underwriting).

Is your insurance eroding your super?

The superannuation industry’s generally held view is that annual insurance premiums should not be more than 1% of your annual salary. It’s important to make sure that your level of insurance cover is appropriate for you, and that your super isn't being reduced more than it needs to be by your insurance payments. This is called insurance erosion.

However, there are a number of reasons why you might pay premiums that are greater than 1% of your annual salary. For example, you and your adviser have determined that you need higher levels of insurance cover which in turn costs more

Things worth considering

Here are some common benefits and considerations for insurance in super. Keep in mind, these points are not tailored to your personal circumstances and there may be other things you need to think about too.

- The costs of insurance premiums come out of your super account, so you won’t be dipping into your take-home pay.

- If premiums are automatically deducted, your insurance may be easier to manage.

- Your take-home pay is taxed at your marginal tax rate, which could be a higher rate than your super, so paying for your insurance through your super could be tax-effective2.

- After joining your employer’s default super plan, you may be able to apply for a higher level of insurance cover within a limited time, without needing to answer health and lifestyle questions.

- Insurance in employer super plans are generally more competitively priced than insurance outside super because it’s provided as group insurance in bulk.

- If a claim is rejected by the insurer, it will go to the trustee of the super fund who will review it and will challenge the insurer if they disagree with the insurer’s decision.

Considerations for insurance inside super

- Cover through super often ends when you reach a certain age, which is typically between 65 and 70 years old. That’s generally different to cover that’s outside a super account.

- It’s important to make sure that your level of insurance cover is appropriate for you, and that your super isn't being reduced more than it needs to be by your insurance payments. This is called insurance erosion.

- If you have multiple accounts with the same type of insurance, you may be paying for insurance you don’t need, or can’t claim against. In particular, for Temporary Salary Continuance (TSC or also known as Income Protection) cover, offsets may apply. Even if you have TSC cover through multiple accounts, the maximum amount you can claim is generally limited to 75% of your pre-disability income. These limits apply regardless of how much TSC cover you’re insured for.

- Where insurance benefits are paid to people who aren’t your dependents, they’ll be taxed according to their marginal tax rate.

- Taxes may be applied to Total and Permanent Disablement (TPD) benefits depending on your age.

- Claim payments may take longer, as the money is normally paid by the insurer to the trustee of the super fund before it’s paid to you or your dependents.

Eligibility

Who can get insurance in super?

Anyone can apply for insurance in their super if their super account offers it. But there are often benefits available for eligible members in an employer super fund. For people who sign up to their employer’s super plan, insurance is often provided automatically to eligible members. Eligible members won’t have to answer any questions about their health and lifestyle (known as underwriting questions) which can mean insurance costs more or has specific exclusions based on health or lifestyle factors.

Am I eligible?

Automatic (default) insurance through your employer super plan is subject to laws applicable to super to ensure affordability and eligibility. It's important to understand these laws to protect your retirement savings. To be eligible for automatic insurance, you must:

Be at least 25 years old

Have a balance of at least $6,000 in your super account

Have had a contribution put into your account within the last 16 months

In most cases, as soon as you meet these eligibility rules, insurance will be applied automatically.

If you’re with AMP, we’ll let you know when this happens and if you don’t want the insurance, you can tell us.

If you want cover but are not currently eligible through your employer super plan, your welcome pack may contain information about a window of time to opt in. This can provide an opportunity to apply for insurance when starting your job.

Managing your insurance

It’s a good idea to keep on top of your insurance needs. Because, as life changes (like if you purchase a home or have children) your insurance needs might too. Also, the cost of your cover may change as you age or if you change jobs.

Have you left your job?

Leaving your job may affect your insurance benefits - depending on your plan you may lose your insurance altogether, or the costs or type of cover may change. If you’ve recently left a job or are thinking about it, make sure you read your insurance guide to understand how it could affect your insurance.

Is your insurance at risk of being cancelled?

Super funds are also required to cancel the insurance in your super account if it hasn’t received a contribution or rollover for 16 months. If you’re with AMP, we’ll let you know if this might happen to you and give you ways to keep it, if you wish.

If the insurance in your super account is cancelled because of these laws, we must transfer the account to the Australian Tax Office (ATO) if the balance is below $6,000. Some exceptions apply.

Combining your insurance

If you have more than one super account, you may already have insurance with another super fund. Before you roll all your super accounts into one, you may want to consider if you still need the insurance. Learn more.

Have an AMP account?

Assessing your insurance needs

As life changes, your insurance needs may change too. It’s important to keep reviewing your cover to make sure it continues to be right for you. Here’s a simple check:

- Ask yourself how much money you or your family would have if you were to become disabled or pass away.

- Compare that with how much money your family might need in the same situation, including how they’d manage paying for day-to-day costs like food, energy bills, child-care and mortgages.

- Then, calculate difference between the two to give you some guidance for how much insurance you may need.

A financial adviser can help you work out your insurance needs. Our calculator might also be a good place to start too.

Estimate your insurance needs

Get a basic idea of how much insurance you may need.

Life insurance

Also known as death cover, which pays a lump sum if you pass away or become terminally ill.

Learn more

Temporary salary continuance

Also known as income protection, pays a monthly benefit if you’re too injured or sick to work.

Total and permanent disablement cover

Provides a lump sum benefit in the event that you become permanently disabled or too ill to ever work again.

Changes you can make to your cover

Request insurance

If you’re an existing AMP super member and don’t currently have insurance in your super, you can request it3. You may need to provide health and lifestyle information. Refer to your Insurance Guide for details. Learn more about why you’d choose insurance in your super.

Request it now or call 131 267

Increase your cover amount

You may be able to apply for a higher level of insurance cover without needing to answer health and lifestyle questions when you first join your employer’s super plan as a default member. Learn more in your insurance guide, or plan summary. Seeking financial advice is also recommended.

Call 131 267

Reduce or cancel your insurance

To reduce your insurance super cover, please call us on 131 267.

To cancel, you can conveniently manage your policy online by logging into your My AMP account. If you do reduce or cancel your insurance, you will not be able to increase it again in the future without going through underwriting, your insurer may not agree to increase your cover, and it can be hard to get the same cover at the same price down the track.

Reinstate your insurance

If your insurance was cancelled, you can ask us to reinstate it within the time frame we provided – you may also need to answer some health and lifestyle questions.

You might also be interested in

How to boost your retirement savings as super and tax laws change

29 March 2024 | Super If you’re looking to maximise your superannuation in the lead-up to retirement, it’s a good idea to be up to speed on any legal updates that could affect the super and tax landscape. Read more

What happens to my super when I die?

12 October 2023 | Super Your super isn’t automatically included in your will, unless you’ve specified certain instructions with your super fund first. Read more

How much super should I have at my age?

06 October 2023 | Super See the average super balance for your age group, so you can get an idea of how your super savings compare. Read moreNeed help

Call us

Standard Hours

Mon - Fri: 8.30am – 7pm (Sydney time)

Complimentary super health check

Book a complimentary 20-minute chat with a super coach at a time that suits you.

Book nowWhat you need to know

Products in the AMP Super Fund and the Wealth Personal Superannuation and Pension Fund are issued by N.M. Superannuation Proprietary Limited (N.M. Super) ABN 31 008 428 322 (trustee), which is part of the AMP group.

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account.

It’s important to consider your particular circumstances and read the relevant product disclosure statement, Target Market Determination or terms and conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy.

All information on this website is subject to change without notice. AWM Services is part of the AMP group.

The super coach session is a super health check and is provided by AWM Services. It is general advice conversation only. It does not consider your personal circumstances.

1 ‘Fiscal Impacts of Removing Insurance in Superannuation' Rice Warner 2018

2 Taxation issues are complex and the decisions you make can affect the amount you receive at claim time.

3 You should seek advice to determine whether holding insurance through super is appropriate for you. The insurance premiums are deducted from your super balance, reducing the money available for your retirement. If you are not making regular contributions to your super, the deduction of premiums may impact your retirement savings balance over time.