Women starting a family benefit most from the government’s low-income super contribution.

Women are the biggest recipients¹ of the low-income super tax offset (LISTO). The number of females eligible for the tax break increases significantly around the time they start having children.

How low income super tax offset (LISTO) works

LISTO is a government superannuation payment of up to $500 per year to help low-income earners save for retirement.

Before-tax super contributions are taxed by the government at 15%. The low-income tax offset effectively refunds that tax for low income earners straight into their super fund.

You don’t need to do anything to claim the low-income tax offset. It happens automatically when people lodge their tax return, providing the super fund has a copy of the super member’s tax file number.

LISTO and the gender gap

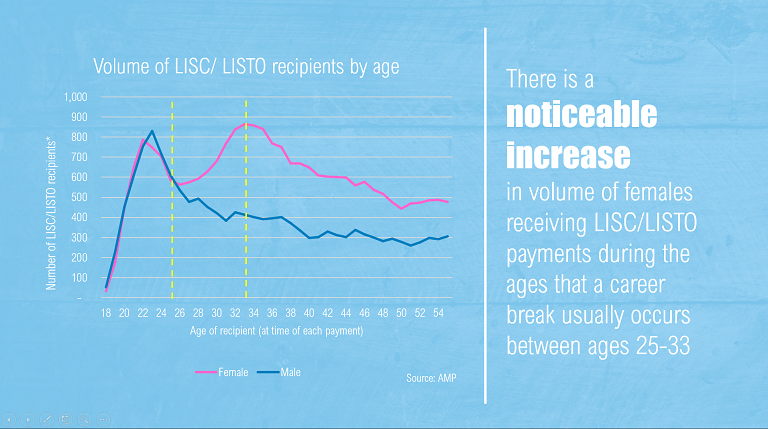

AMP analysis over a four-year period revealed a significant jump in the number of women receiving the low-income super tax offset between the ages of 25 and 33.

Women were twice as likely to receive the low-income super tax offset than men. Although a high proportion of both men and women aged 18 to 24 were eligible for the tax offset, the peak time for men was age 19.

Of the customer accounts analysed, 15% had received the low-income tax offset.

Boosting low-income super balances

AMP Technical Strategy Manager John Perri says the results show the tax offset helps contribute to the super balances of low-income earners.

“We know women retire with less super than men due to a range of factors including time spent out of the workforce to care for small children, returning to part-time, often lower paid roles, where they haven’t had the benefit of pay increases and promotions.”

Owing to the ‘magic’ of compound interest, a $500 tax offset today could be worth much more over four or five decades.

“The more you contribute at an early age, the more likely your balance will grow over time, subject to market fluctuations.”

Generation Z also benefits from the low-income tax offset.

“These Australians have time on their side when it comes to saving into super.”

Find out more

It’s never too early to get set for your future. To find out more about LISTO and other contributions that might help you and your family, check out the super contributions section.

1 AMP’s research and analytics team studied the data of 174,000 employed customers who had consolidated their super over a four-year period.

Subscribe to our newsletter

Super and tax changes that could affect you from 1 July 2024

01 July 2024 | Blog A number of changes to the super and tax system could create opportunities for Australians of all ages. Here’s what’s happening. Read more

How catch-up concessional contributions work

01 July 2024 | Blog If you’ve had interrupted income, or just haven’t been in a position to put as much into super as you’d like, catch-up concessional contributions may provide an opportunity to top up at a more convenient time. Read more

Key points from the 2024-25 Federal Budget

15 May 2024 | Super Here's a 5-minute read on how the 2024-25 Federal Budget proposals could affect you. Read moreWhat you need to know

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account.

It’s important to consider your particular circumstances and read the relevant product disclosure statement, Target Market Determination or terms and conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy.

All information on this website is subject to change without notice. AWM Services is part of the AMP group.