Financial wellness is how you feel about your money. It can affect your overall wellbeing and other areas of your life, such as work and family. So, while money isn’t the be-all and end-all, how you feel about it is pretty important.

Since 2014, AMP has been commissioning research1 into the financial wellbeing of Australians and has developed the Financial Wellness Index. It measures a person’s satisfaction with their current and future financial situation. Using this knowledge, we create initiatives to help our clients feel more confident and secure about their finances.

The latest report shows that while COVID-19 has undoubtedly caused many Aussies to feel financial pain (and we’re not through it yet!), we’ve also seen a shift in mindset, with those not impacted counting their blessings and feeling happier. In fact, despite the recent global turmoil, the number of people feeling financially stressed has continued its downwards trend, and a massive 50% feel financially secure.

That said, financial stress is still costing the economy $30.9bn a year through lower productivity and stress-related sick days.

Who’s most financially stressed right now?

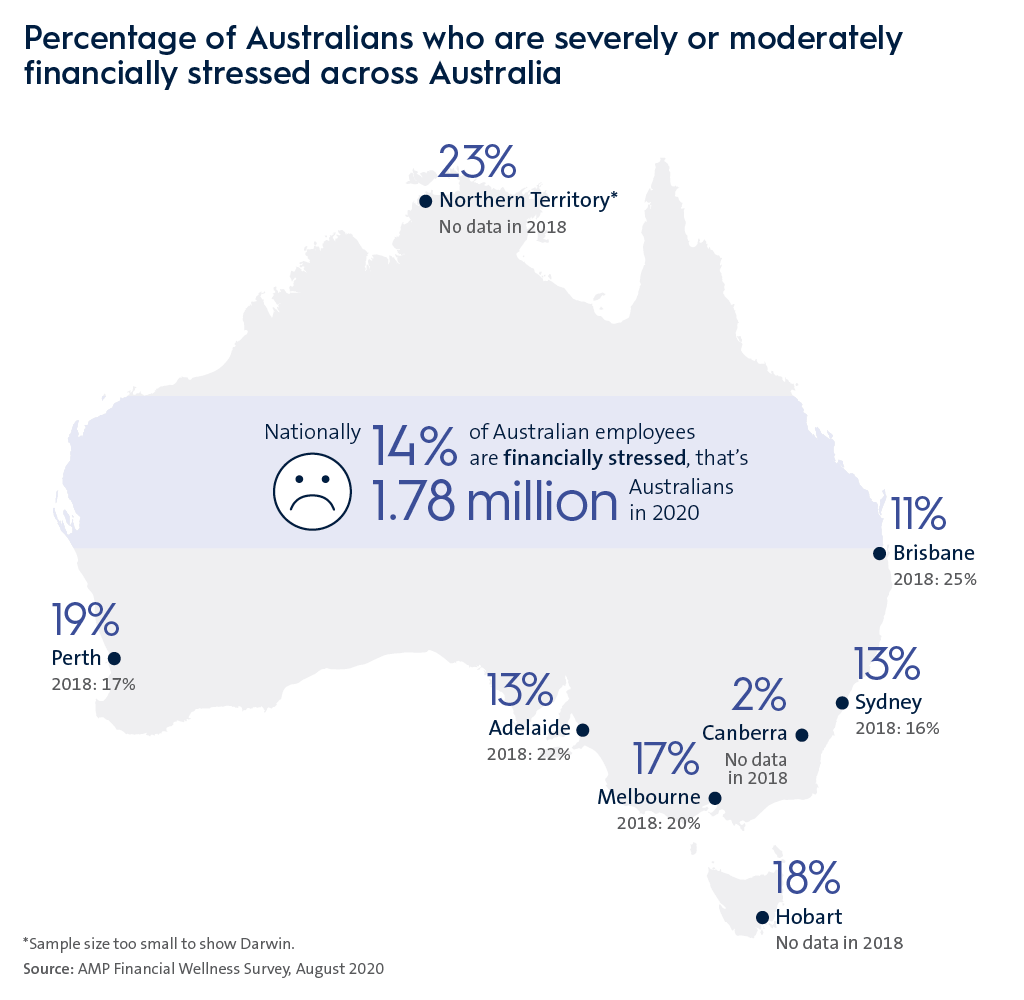

14% of Australian employees are financially stressed – that’s 1.78 million Australians in 2020.

While that’s a lot of Australians feeling financial pain, it’s still down 5% from 2018.

Single parents

Those of us who are single parents with dependent children are much more likely to be financially stressed. Interestingly, this figure has dropped significantly from 35% in 2018 to 24% in 2020. It may be linked to the free childcare implemented across many states during the start of COVID, easing some financial pressure for working parents.

Women aged 18-34 years

Almost 1 in 4 women surveyed in this age group was financially stressed compared to just 1 in 12 men of the same age range. And women face yet more setbacks as COVID impacts their livelihoods and ability to take advantage of typical wage growth that occurs during the first 10 years in the workforce2. What’s more, the research shows that while women are generally better savers than men, men are more likely to direct savings to things that will better secure their financial future, like super and investments.

Aboriginal and/or Torres Strait Islanders

Around two-thirds feel mildly financially stressed, which is almost double compared to the rest of the Australian population. While also less likely to feel financially secure, the cultural attitude to wealth is more balanced. Research shows people of Aboriginal and/or Torres Strait Islander origin are three times less likely to feel it’s important for them to compare their standard of living with others.

Food service and retail: most affected industries

With no tourists and city-working drastically reduced, many hotels, cafes, restaurants and bars have suffered. As a result, the industries where financial stress is being felt the most is predictably accommodation and food services, where we’ve seen a rise in financial stress levels compared to 2018. Perhaps this would have been greater had it not been for the stimulus provided by JobKeeper.

Retail trade was strong leading into the 2020 Christmas period, but most shopping was done online3,4. Retail trade has moved from 3rd most financially stressed industry in 2018, to 2nd place in the 2020 survey. 23% of retail employees now claim to feel financially stressed. And while health and social care remains in the top 3, it has dropped from 20% to 18%. Which is likely linked to an increase in care work as COVID took hold.

We want to be better prepared, in the short-term

COVID delivered a wakeup call for 24% of Australians who were not financially prepared. Having lived through years of economic growth, rainy day funds weren’t a priority. Out of everyone surveyed, 42% are now putting more money aside for unforeseen events in the future; in other words, we don’t want to get caught short again.

It’s made us look more closely at our spending, with 29% of people impacted by COVID cancelling non-essential services. We’ve also decided to get better at setting goals, with 6% more people now actively working towards a financial goal than pre-COVID.

That said, we’ve had to abandon or postpone some of our original goals:

- 43% have stopped saving for an investment property

- 40% are no longer saving for a big-ticket item or holiday

- 35% have postponed investing in the stock market

- 31% have given up saving for a house deposit

We want the best of both worlds for our long-term financial future

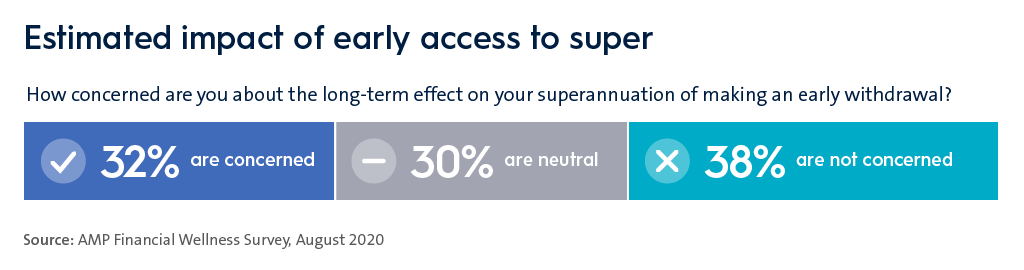

With the Federal Government granting conditional early access to superannuation, our results have established a trend of Australians underestimating the long-term effects of withdrawing their super early. Young people and women are most likely to have accessed some of their superannuation, and 52% don’t plan on replacing the money they’ve withdrawn. Over two-thirds believe they can make better use of the money now than in the future.

Encouragingly, 43% say they spent some of the money on keeping a roof over their head and food on the table, and 2 out of 5 used the money to pay off credit cards or personal loans. Unfortunately, 1 in 3 used it to fund their lifestyle, which could hurt their retirement lifestyle down the road, or mean they’ll have to work for longer.

While 72% say it’s more important than ever to plan for a secure financial future, it seems we don’t consider that to include retirement. A worrying number of Aussies have no plans in place to reach their retirement goals, with half the respondents saying they don’t know how much they’ll have, or need, in retirement. This was also the case for 43% of people who are only 10-15 years away from finishing work.

People are mostly unconcerned with the future long-term impact of taking out their super early. However, 1 in 3 aren’t confident they’ll have enough to retire comfortably, and half of us are in the dark when it comes to knowing how much money we’ll have or need in retirement.

1 AMP Financial Wellness, Behavioural Architects, August 2020

2 Ernst & Young (EY) analysis of census data from the ABS.

3 Australian Bureau of Statistics Retail Trade, Australia, Preliminary, November 2020

4 Australia Post Key insights from the 2020 eCommerce update

According to the research…

of Australians weren’t financially prepared for COVID

say it’s now more important to plan for a secure financial future

the amount financial stress costs the economy each year

Get on top of your finances

7 ways to start saving this new financial year

18 July 2024 | Super The 2023-24 financial year is now behind us and there’s nothing like closing a chapter to inspire thoughts of a fresh start. Here are some tips to get on top of your finances for 2024-25. Read more

How to maximise your 2024 tax refund

18 July 2024 | Finance 101 With tax time nearly upon us, you might be interested in the following tips, which may help to increase the amount of money you get back. Read more

Super and tax changes that could affect you from 1 July 2024

01 July 2024 | Blog A number of changes to the super and tax system could create opportunities for Australians of all ages. Here’s what’s happening. Read moreWhat you need to know

This information is provided by AWM Services Pty Ltd (ABN 15 139 353 496), is general in nature only and hasn’t taken your circumstances into account. Before deciding what’s right for you, it’s important to consider your particular circumstances and read the relevant product disclosure statement or terms and conditions available from AMP at amp.com.au or by calling 131 267.

All information on this website is subject to change without notice. Although the information is from sources considered reliable, AMP does not guarantee that it is accurate or complete. You should not rely upon it and should seek professional advice before making any financial decision. Except where liability under any statute cannot be excluded, AMP does not accept any liability for any resulting loss or damage of the reader or any other person.

Read our Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive relating to products.