Credit and deposit products are issued by AMP Bank Limited ABN 15 081 596 009, AFSL and Australian credit licence 234517.

This information is provided by AMP Bank Limited. Read our Financial Services Guide available at amp.com.au/fsg for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you.

AMP Bank is a member of the Australian Banking Association (ABA) and is committed to the standards in the Banking Code of Practice.

A target market determination for these products is available on our TMD page.

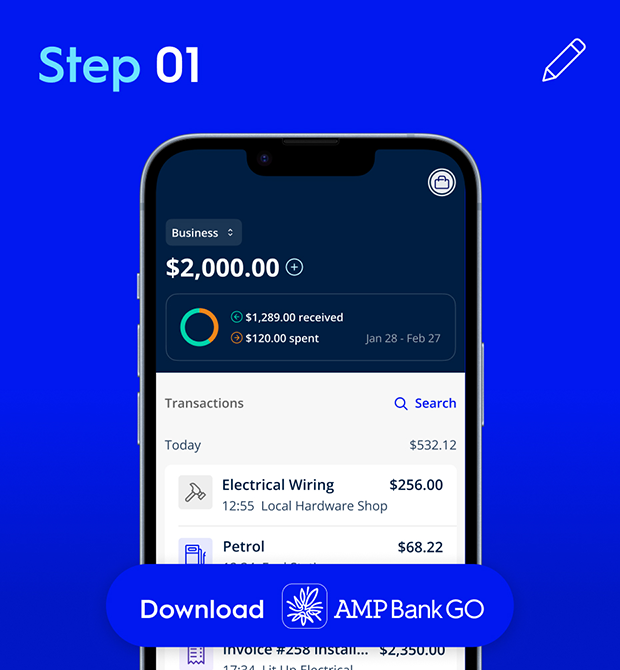

For accounts with BSB number 939 900 and accessed vi AMP Bank GO, Terms and Conditions apply and are available here.

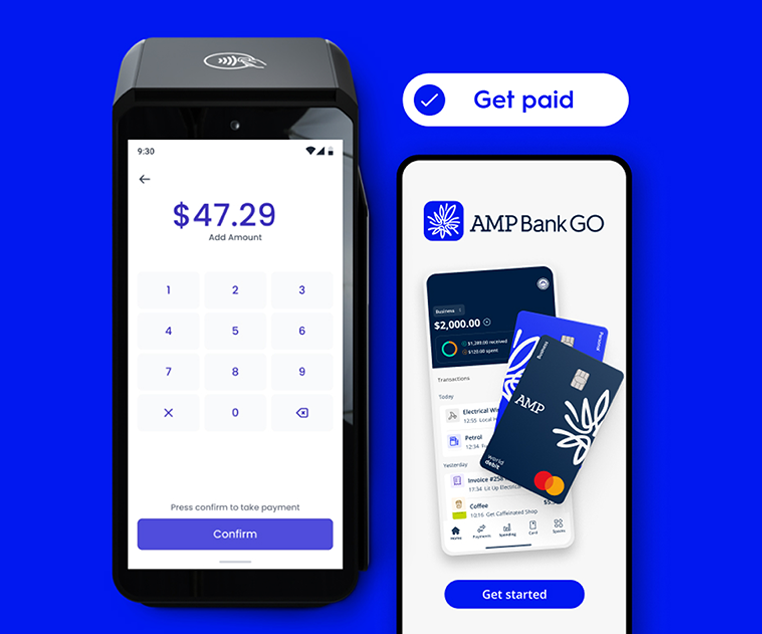

* Transactions processed before midnight Sydney local time will be paid within the next business day

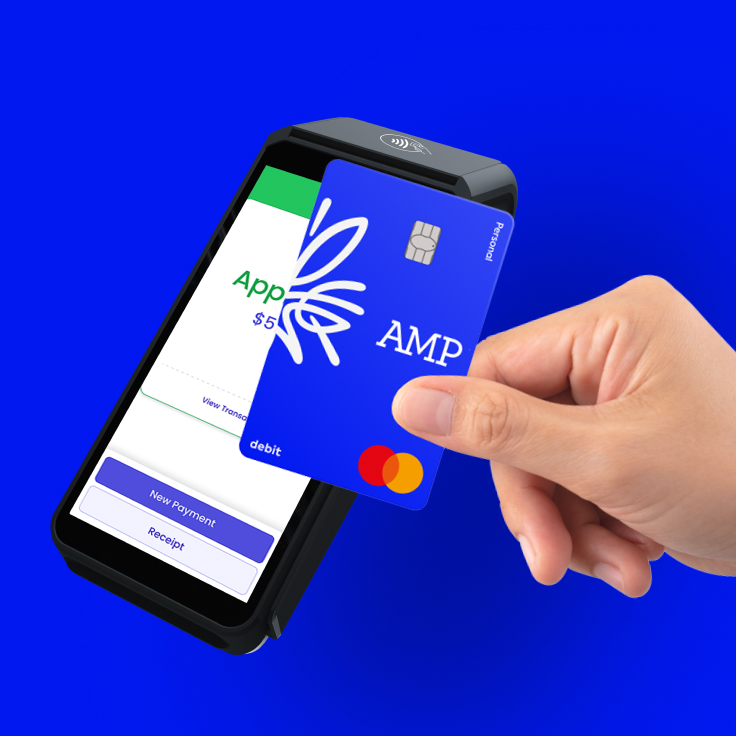

** Card present, VISA, Mastercard and eftpos only

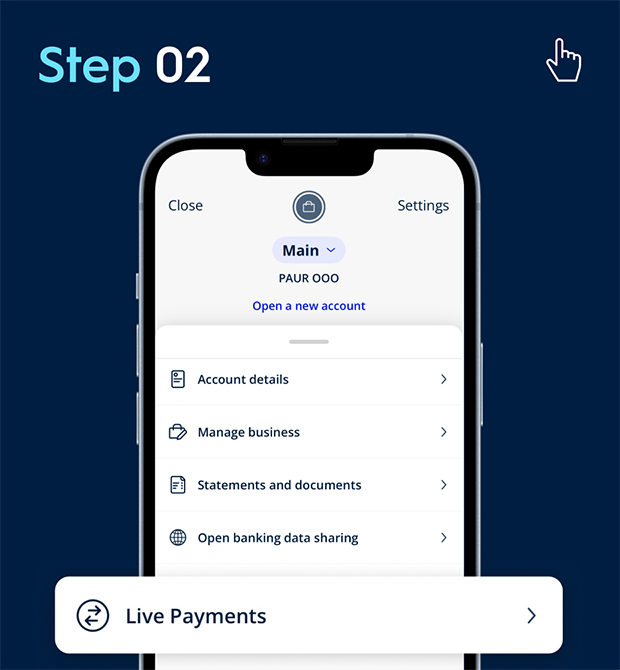

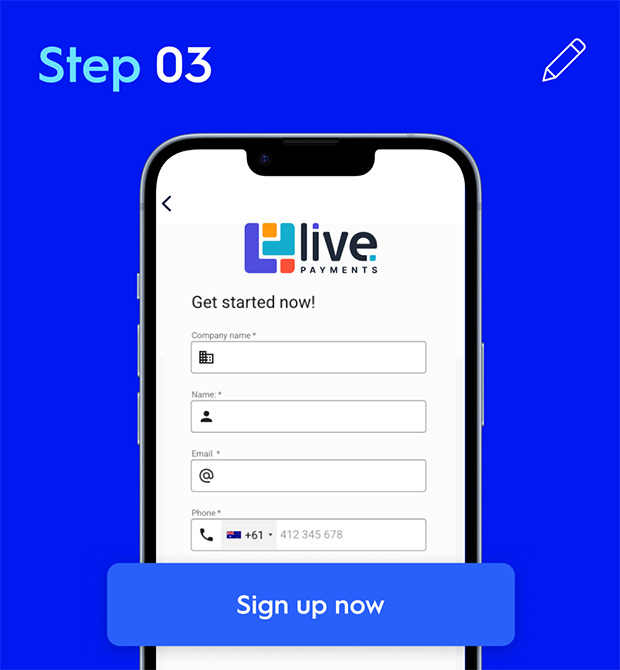

Tap to Pay is available via the LiveTap App on compatible devices. For iPhone, this includes iPhone Xs or later running iOS 17.0 or higher. For Android, your device must be NFC-enabled and running Android 8.0 or higher. An active internet or mobile data connection is required to accept payments. Some contactless cards or devices may not be supported. Apple, iPhone, and iOS are trademarks of Apple Inc., registered in the U.S. and other countries. Android and Google Play are trademarks of Google LLC. The Contactless Symbol is a trademark owned by and used with permission of EMVCo, LLC. Live Payments is not responsible for any service interruptions or limitations caused by device incompatibility, operating system restrictions, or third-party card issuer policies. For more information on Tap to Pay for iPhone, visit developer.apple.com/tap-to-pay.