Global shares were mixed over the last week. US shares fell 0.4% with an ongoing rotation out of tech shares and a reduction in Fed rate cut expectations. Chinese shares also fell 0.6%. But Eurozone and Japanese shares continued to make new highs, up 0.5% and 3.8% respectively. Australian shares also rose with a gain of 2.1% powered by resources shares on the back of higher commodity prices, retailers on the back of stronger than expected household spending and financials. After years of underperformance the Australian share market looks to be starting to play catch up to the US, having outperformed so far this year as rebounding mining sector profits help pull Australian profit growth back into positive territory. Bond yields fell in Europe but rose in the US as Fed rate cut expectations were reduced and they also rose in Japan and Australia.

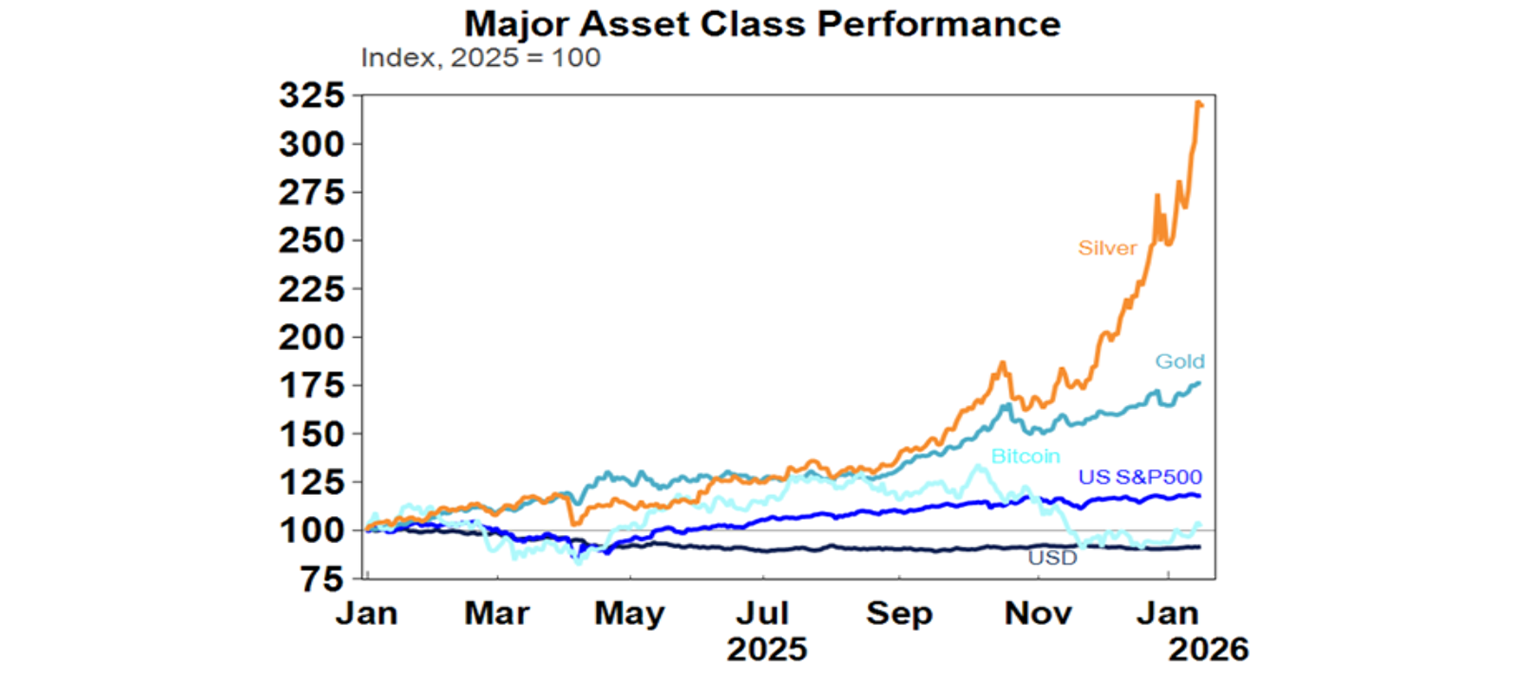

The past week also saw gold and silver reach new record highs as concerns about Fed independence escalated in response to the US Department of Justice issuing a subpoena of Powell in relation to building renovations and Powell tying it to pressure from Trump for the Fed to cut rates by more. Investors are clearly still keen to buy shares given the reasonable profit outlook but at the same time want a hedge against geopolitical risks and worries that Trump will weaken the Fed risking higher inflation and so are buying gold and silver at the same time. Bitcoin also rose. Iron ore and copper prices fell back slightly but the oil price rose slightly on lingering concerns about a US strike on Iran to support protestors. The $A fell slightly as the $US rose slightly.

While a quiet start to the year would have been nice, President Trump clearly had other ideas. On the geopolitical front, there has been a US strike on Nigeria, intervention in Venezuela with Trump saying the US would “run” it, the threat of action against Iran as it cracks down on protests killing its citizens and an escalation in US claims to take over Greenland. The shooting by an ICE agent of a woman in Minneapolis has taken the US further down the path of conflict between Democratic states and the President (and even riled up Joe Rogan). And Trump has flagged a barrage of measures aimed at boosting “affordability” including: a ban on institutions from buying single houses, directing Fannie Mae and Freddie Mac to buy mortgage debt to lower mortgage rates and stepped up pressure to get control of the Fed to lower mortgage rates; announcing that data centres will have to “pay their own way” for power (whatever that means); a 10% cap on credit card interest rates; and its reported he will announce allowing homebuyers access to their retirement funds for a deposit.

The geopolitical moves clearly highlight that geopolitical risk remains high. For now, Trump is holding off directly striking Iran as it assured it would stop killing protestors, but Trump threatened a 25% tariff on countries trading with Iran (which could impact the US-China trade truce). And a military strike on Iran could still occur with the US indicating that “all options are on the table” and that would risk an escalation impacting Iranian oil supply (which is around 3.5% of global production). That said Saudi Arabia and the UAE should have enough spare capacity to cover any loss of Iranian oil so I wouldn’t expect a lasting impact on oil prices.

The intervention in Venezuela risks becoming another forever war for the US without any quick boost to oil supplies as it will take years to ramp up its production.

At a broader level the intervention in Venezuela and new attempt to take Greenland reinforces the “sphere of influence” concept with China and Russia likely concluding that if the US can do it then we can too (with implications for Ukraine, western Europe, Taiwan & East Asia). The threat to Greenland also weakens NATO.

The affordability measures are what US presidents often do in midterm election years in a bid to avoid becoming a lame duck. It’s just that Trump is more populist and aggressive that most past presidents. It’s one reason why midterm election years often see share market weakness ahead of November with most the strength coming once the election is over. Of course, many of Trump’s affordability measures won’t go anywhere as he doesn’t have the power, but this won’t stop him from announcing many more. Tariff rebates and price controls could well be next.

The escalation of attacks on the Fed is most concerning. Central bankers are not perfect, but they do a far better job in keeping inflation low when they are independent of politicians and so set interest rates based on weighing the evidence, rather than being controlled by politicians who have a bias to lower rates in order to get re-elected. While Trump may not have known about the DoJ’s subpoena of Powell, he said that Powell is either “incompetent or he’s crooked” and it does look as if the move was aimed at removing Powell as a Fed Governor once his term as Chair ends in May in order to make it easier for Trump appointees to gain control of the seven person Fed Board. This in turn could severely threaten Fed independence in rate setting. Fortunately, Republican Senators are pushing back in support of Fed independence which could backfire for Trump and see Powell remain as Chair beyond his May expiry. And Trump appears to be paying some attention as he appears to be cooling on Kevin Hassett as his nomination to replace Powell in favour of former Fed Governor Kevin Warsh. They might both be as equally dovish in the near term but Warsh would be a more conventional choice and would likely be more balanced longer term. Warsh would also be easier to get Senate approval. But Trump could easily flip back again!

An imminent Supreme Court ruling on Trump’s emerging powers tariffs could also cause significant uncertainty if the Supreme Court rules against them. Trump can replace the tariffs with a power that gives him the ability to impose up to 15% tariffs for 150 days and then use another power to run fair trade reviews (as has been the case with some of the tariffs on China and sectoral imports) to impose the tariffs under other powers. However, this would take time and in any case there would be near term uncertainty around whether the tariff revenue raised (of around $US130bn) would have to be refunded, what will happen to all the trade deals and would the tariffs under other powers also be subject to challenge. So it could create upwards pressure on US bond yields on fears of a renewed deficit blow out and higher bond yields could make life harder for shares. And a defeat for the tariffs which have been Trump’s key policy on top of election defeats could see the Trump Administration become even more erratic. Meanwhile, new tariffs on semi-conductors flowing from a long-awaited trade investigation were set at 25% but with lots of exemptions including for laptops and smart phones and an investigation of critical minerals resulted in no tariffs at all. All of which adds to the assessment that we have seen “peak tariffs” from Trump and the trend is down.

So far the market response to all of this has been pretty muted. Increased geopolitical uncertainty, Trump’s affordability measures that may make it harder for businesses and reduced Fed independence all threaten a rough ride for US shares, bonds and the $US as investors will demand a higher risk premium to invest in US assets. But despite all this investment markets have been fairly resilient with shares and the $US up year to date and US bond yields little changed because: the recent experience is that geopolitical events don’t have a major market impact (eg, Iran last year); Trump’s bluster over Greenland and affordability issues are likely part of negotiating tactics so the final outcome may not be so bad; on the Fed investors appear to be assuming Trump will back down in the face of opposition by Republican senators and financial markets; Trump ultimately wants shares up ahead of the midterms; and the global economic & profit backdrop remains positive.

Overall our assessment remains that this year will see a volatile ride for investors on the back of geopolitical threats and Trump bluster – consistent with the volatility normally seen in US midterm election years which since 1950 have seen US shares have an average intra year drawdown of 17% - but that ultimately it will turn out okay for shares with reasonable returns on the back of good global economic and profit growth, the Fed cutting rates a few more times, and profit growth turning positive in Australia after three years of falls. Relative strength in consumer discretionary and material shares along with small caps and metals are positive signs from a cyclical perspective. While tech shares are taking a relative breather the rest of the market appears to be filing the gap and this is also potentially positive for the relative performance of Australian shares which have underperformed US shares for several years. At the same time the US dollar is likely to remain in a downtrend as Trump’s policies further dent US exceptionalism and safe havens like gold are likely to continue to push higher as investors seek out a hedge to protect against risks around geopolitical conflict, high public debt levels and the threat to Fed independence.

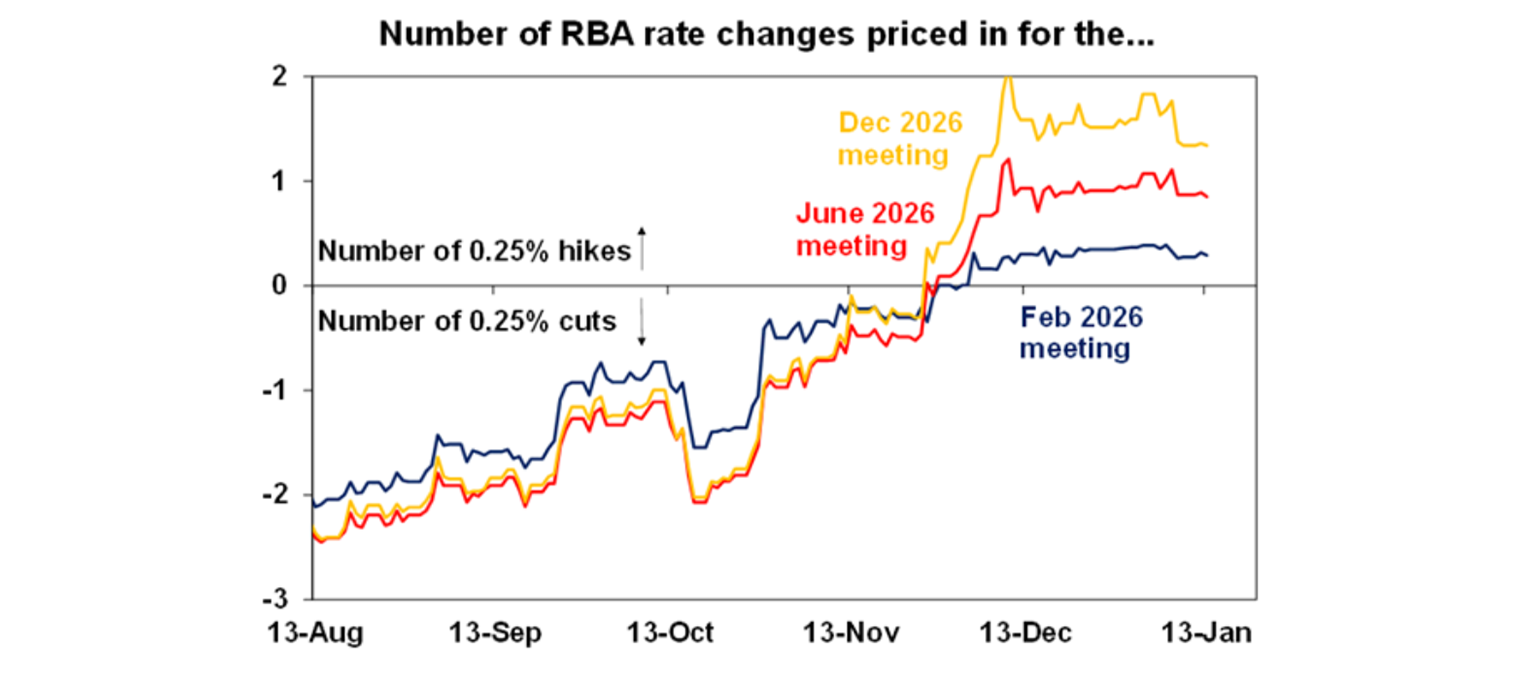

In Australia, our view remains that the RBA will leave rates on hold this year, but it’s a close call. Inflation is too high which will see the RBA retain a tightening bias, but the slight slowing in inflation in November with “trimmed mean” (or underlying) inflation running around its forecasts has provided a bit of breathing space and economic data released so far this year has been mixed with stronger building approvals and household spending but weaker consumer confidence and new job openings. The money market’s expectations for rate hikes have cooled a bit withonly a 24% probability of a February hike now priced in, but still looks too hawkish for the year as a whole. December quarter inflation data to be released at the end of this month will be key though for the next few months. Our expectation is for trimmed mean inflation around 0.8%qoq or 3.2%yoy which would be in line with the RBA’s last set of forecasts and should allow the RBA to sit tight on rates.

Major global economic events and implications

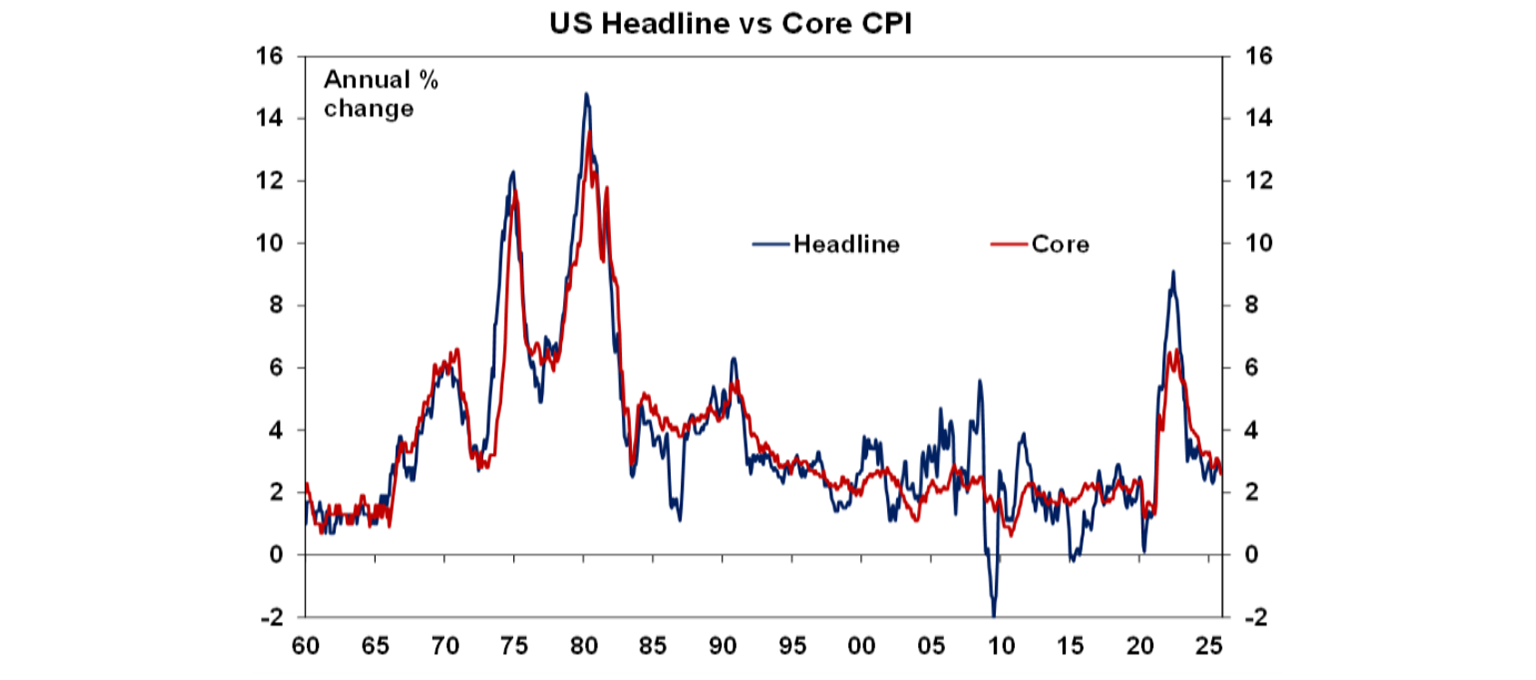

In the US, December inflation came in a bit softer than expected with core inflation remaining at 2.6%yoy. However, it saw unusually sharp falls in prices for some components like other household appliances and communication goods and along with somewhat higher than expected gains in some of the components in the producer price index suggest that its likely to translate to a somewhat higher rise in core PCE inflation of around 3.05%yoy. As a result, the Fed is likely to remain on hold this month. The money market still sees the Fed cutting rates twice this year though.

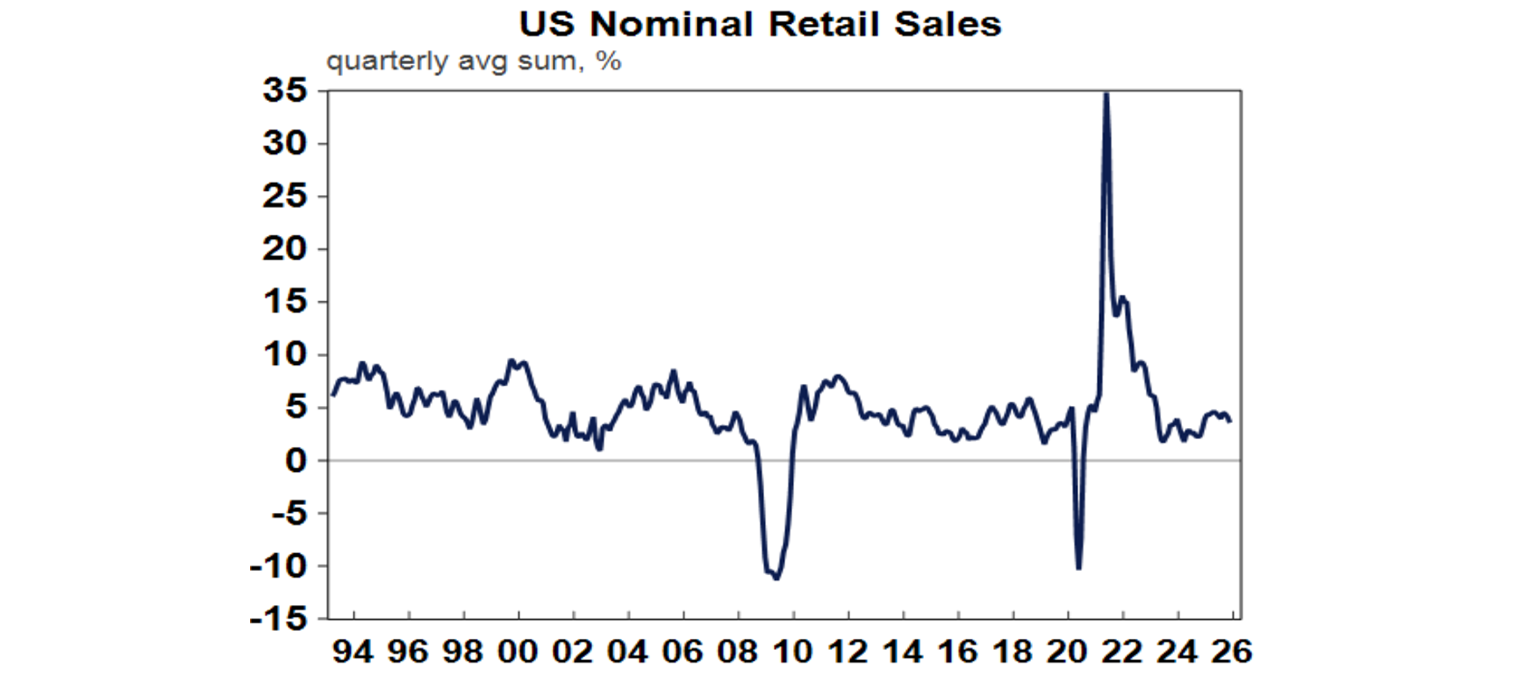

US retail sales remained solid in November. Excluding autos and gasoline they rose a solid 0.5%mom, which suggests that US consumers are still spending okay despite poor confidence levels. There are also some signs of a pickup in housing related activity with existing home sales and mortgage applications hooking up helped by a downtrend in mortgage rates. The January New York and Philadelphia regional manufacturing indexes both improved sharply suggesting stronger business conditions and industrial production rose more than expected in December. The Fed’s January Beige Book of anecdotal evidence noted a slight improvement in economic activity. Meanwhile initial jobless claims fell in the last week and remain low suggesting that the jobs market is ok. All up the run of solid data also gives the Fed scope to pause cutting rates again this month.

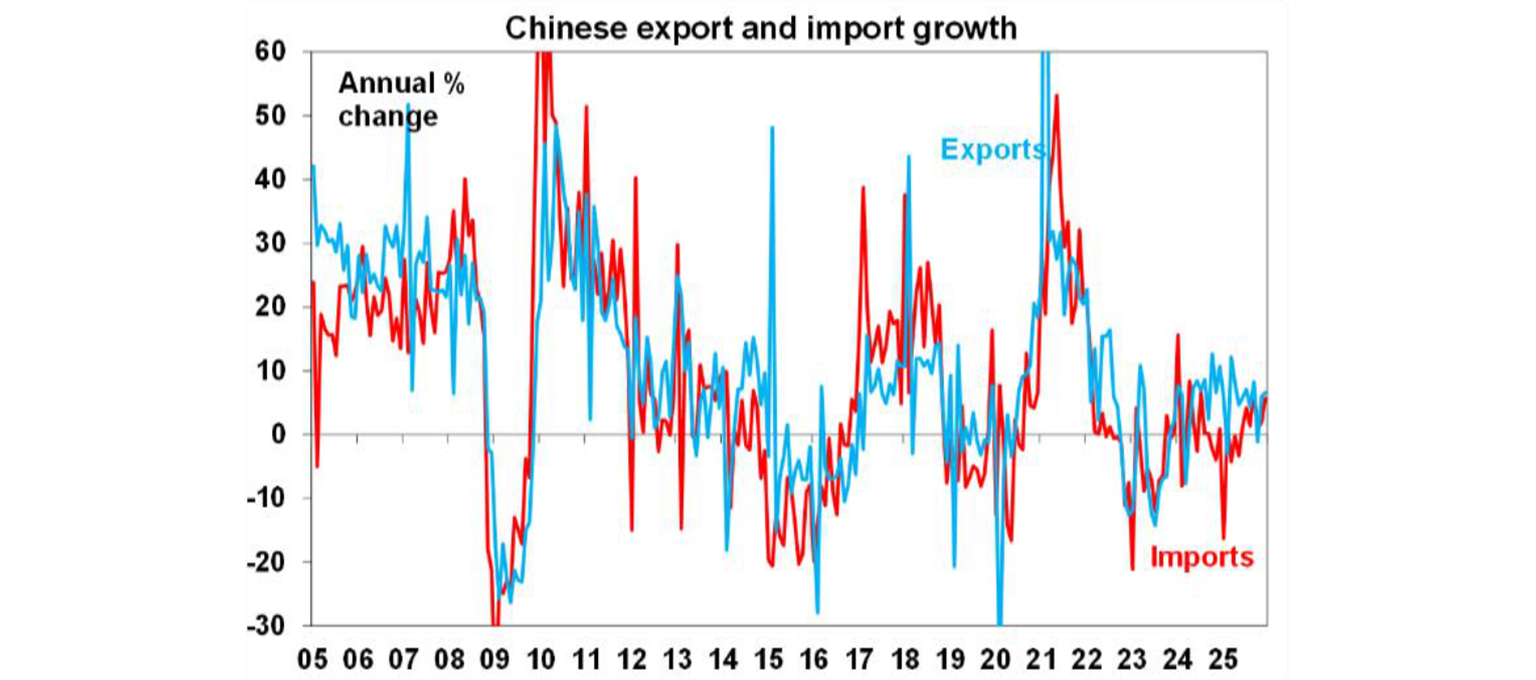

Chinese exports and imports both rose more than expected in December. While exports to the US are running down around 30%yoy, those to most other regions are trending up making up for the tariff hit. Bank lending and credit came in stronger than expected in December, but loan demand still looks weak. Meanwhile the People’s Bank of China unveiled a modest package of stimulus measures and signalled scope for more rate cuts.

Australian economic events and implications

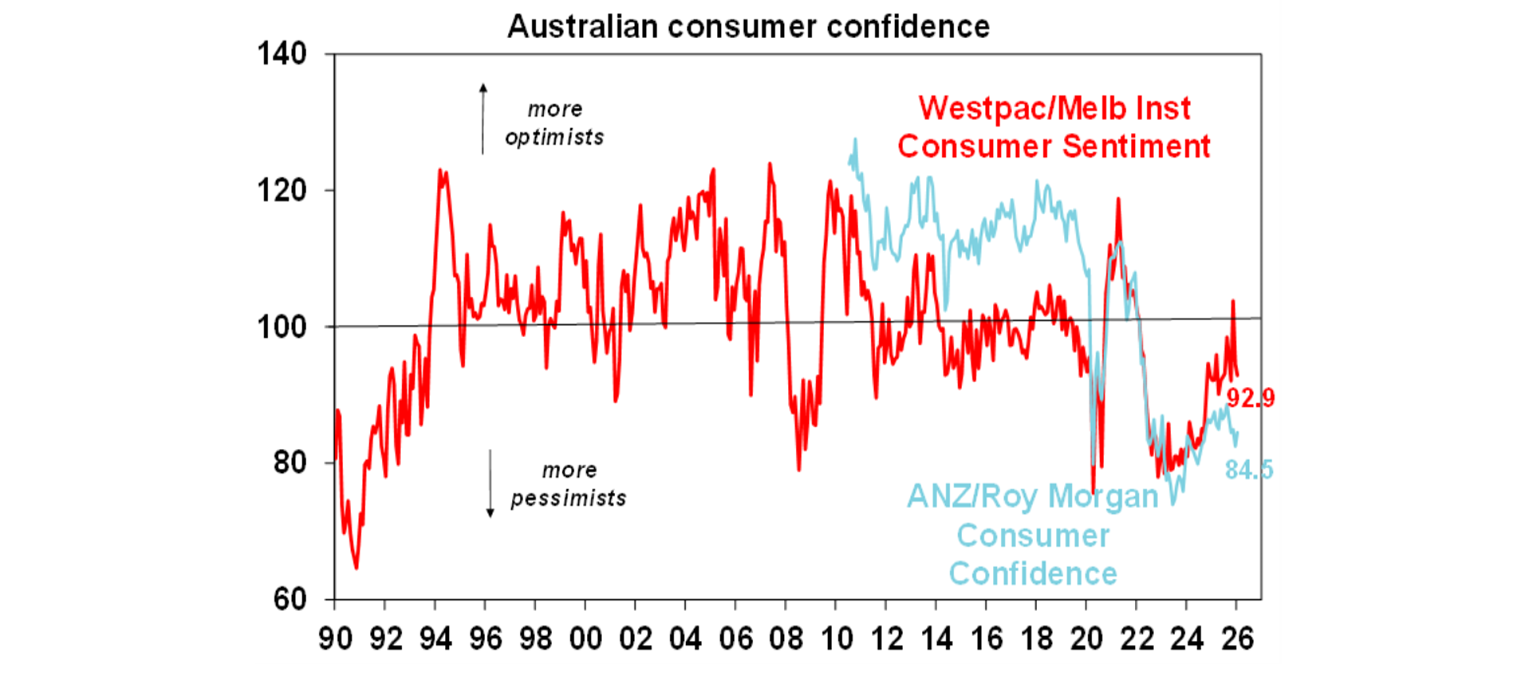

Growth in household spending accelerated further in November with a 1%mom rise taking annual growth to 6.3%yoy, helped by Black Friday sales and major concert and sporting events. Some slowing is likely in December as the impact of these events drop out.Source: ABS, AMP Soft consumer confidence could also be a drag with the Westpac/MI survey showing confidence down another 1.7% not helped by talk of rate hikes. The alternative ANZ/Roy Morgan confidence index remains far weaker. This suggests the upswing in consumer spending may still be fragile and vulnerable if interest rates start rising again. Confidence is only running above average for those who own their home outright, but is still below average for those with a mortgage and tenants.

Amongst other labour market indicators, this week initial jobless claims beat expectations but continuing jobless claims were weaker. So the labour market picture overall has still moderated.

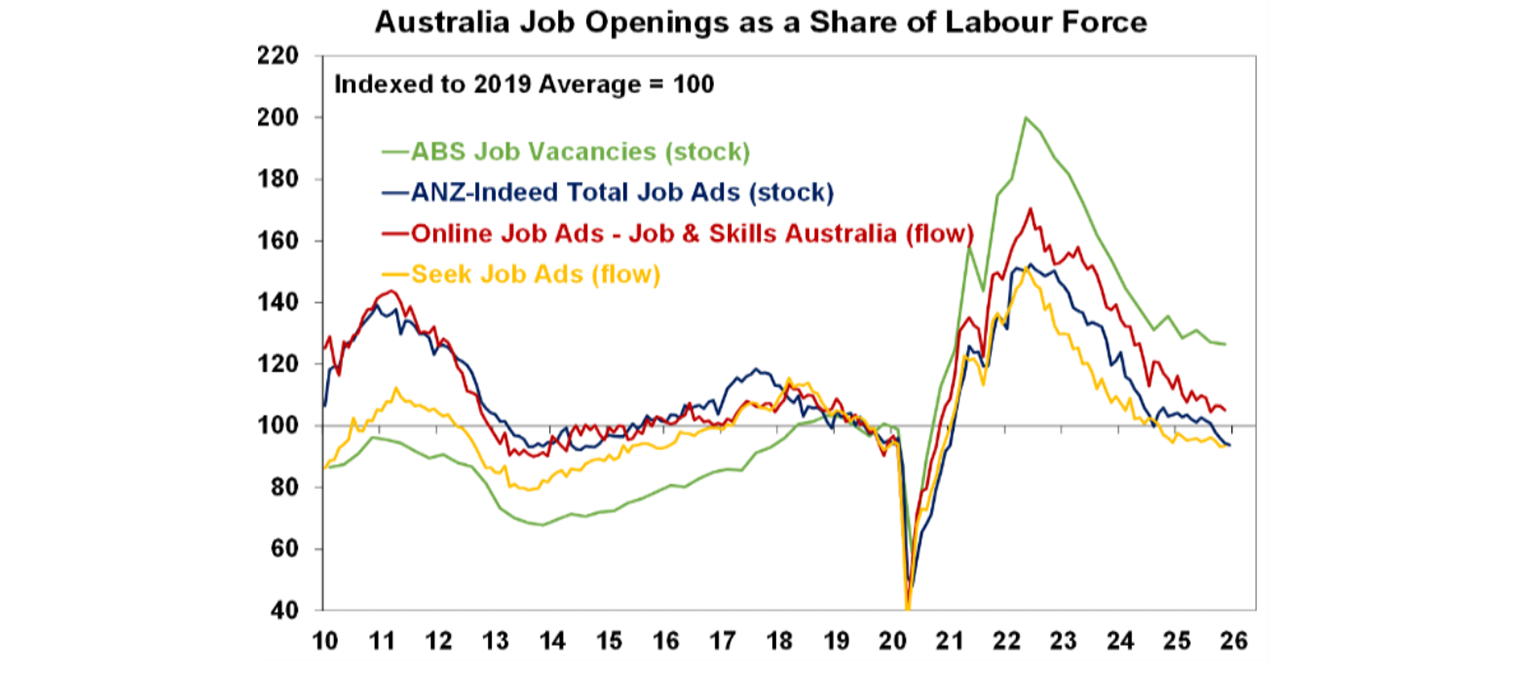

Job vacancy data was mixed. ABS data showed that job vacancies fell slightly over the three months to November but remain relatively high, but job ads look much weaker according to the ANZ-Indeed index.

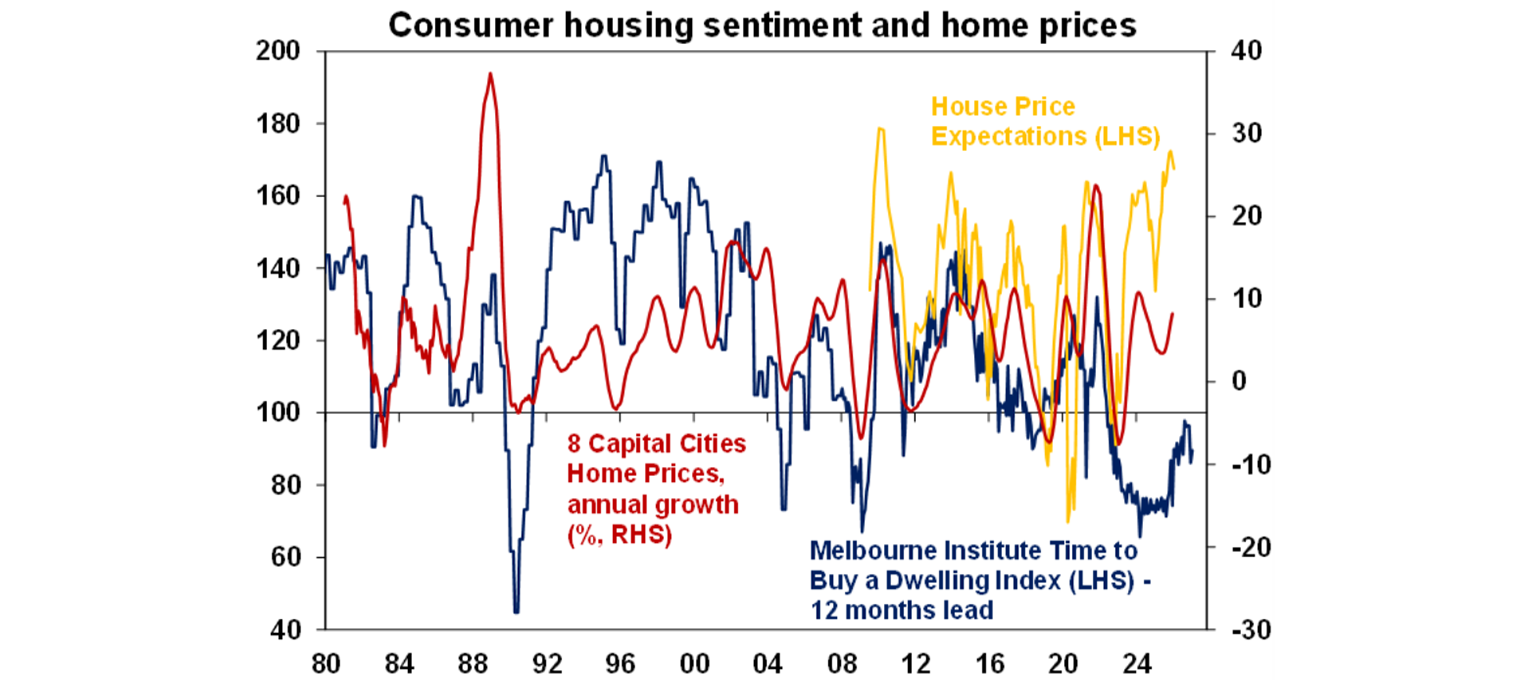

The Westpac/MI consumer survey showed home price growth expectations remain very strong, but perceptions as to whether now is a good time to buy remain low.

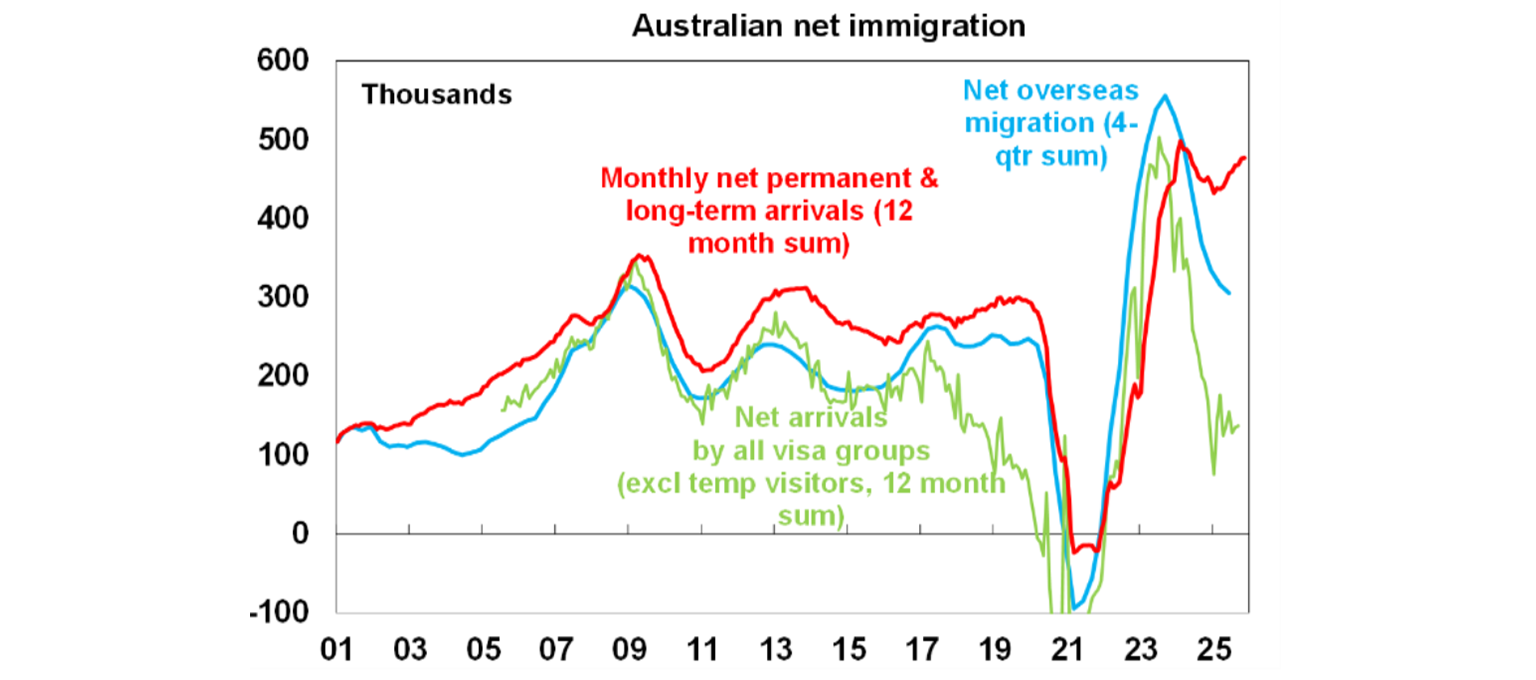

Monthly arrivals and visa data continue to point to a mixed picture for net migration into Australia – with the former pointing up but the latter pointing down. So far, the quarterly net migration data has been running in the middle between the two!

What to watch over the next three weeks?

Developed country business conditions indexes or PMIs for January will be released Friday and are likely to remain around levels consistent with okay global growth.

In the US, personal spending data for November (Thursday) is likely to show solid growth and core private final consumption deflator inflation is likely to be around 2.8%yoy. This data is rather dated though so its unlikely to impact expectations for the Fed to leave rates on hold this month. The December quarter earnings reporting season will also start to ramp up with the consensus expecting earnings growth of 9%yoy, but is likely to come in around 12% allowing for normal beats.

Canadian inflation for December (Monday) is expected to show core inflation at 2.8%yoy and UK inflation data (Wednesday) is likely to show core inflation at 3.2%yoy.

The Bank of Japan (Friday) is expected to leave rates on hold at 0.75% having just hiked in December. CPI data for December (also Friday) is likely to show a fall with core inflation at 1.5%yoy.

Chinese GDP growth for 2025 (Monday) is likely to show growth for the year as a whole of 5% which is in line with the official target, but slowing to 4.5%yoy in the December quarter. December monthly data is likely to show a further slowing in retail sales and investment growth but a slight pickup in growth in industrial production.

In Australia jobs data (Thursday) is expected to show a gain in employment of 30,000 with unemployment rising to 4.5% on the back of a bounce back in participation.

Outlook for investment markets

Global and Australian share returns are expected to slow further in the year ahead to around 8%. Stretched valuations in the key direction setting US share market, political uncertainty associated with the midterm elections and AI bubble worries are the main drags but returns should still be positive thanks to Fed rate cuts, Trump’s consumer friendly pivot and solid profit growth. A return to profit growth should also support gains in Australian shares even though the RBA may have finished cutting rates. Another 15% or so correction in share markets is likely along the way though.

Bonds are likely to provide returns around running yield.Unlisted commercial property returns are likely to be solid helped by strong demand for industrial property associated with data centres.

Australian home price growth is likely to slow to 5-7% due to poor affordability, rates on hold with talk of rate hikes and APRA’s move to ramp up macro prudential controls.

Cash and bank deposits are expected to provide returns around 3.6%.

The $A is likely to rise as the interest rate differential in favour of Australia widens as the Fed cuts and the RBA holds and possibly hikes. Fair value for the Australian dollar is around $US0.73.

You may also like

-

Weekly market update - 27-02-2026 Australian shares are a key beneficiary of the rotation trade helped by the now concluded December half earnings reporting season confirming that listed company profits are rising again. -

The outlook for Australian shares – is the long underperformance over? Australian shares have had a strong start to 2026 with the ASX 200 up 3.3% and flirting with a new record high. The local market has also outperformed US shares which are down 0.1% and global shares which are up 1.6%. However, this could just be noise and follows a significant underperformance against US and global shares since 2009. -

Weekly market update - 20-02-2026 Global share markets mostly rose over the last week. Worries about AI and tech valuations took a breather and the US Supreme Court decision to strike down Trump’s emergency power tariffs with Trump immediately announcing a replacement were seen as having little impact on the US growth outlook but were seen as positive for other countries.

Important information

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account. Taxation issues are complex. You should seek professional advice before deciding to act on any information in this article.

It’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you. The super coaching session is a super health check and is provided by AWM Services and is general advice only. It does not consider your personal circumstances.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy. All information on this website is subject to change without notice. AWM Services is part of the AMP group.