Global shares rose over the last week, as the markets digested the rebound from November’s low but with optimism about a Fed rate cut providing support. For the week US shares rose 0.3%, Eurozone shares gained 0.7%, Japanese shares rose 0.5% and Chinese shares rose 1.3%. The muted US lead and the cross current of rising talk of RBA rate hikes but improving local earnings growth expectations saw Australian shares rise by just 0.2% for the week with strong gains in resources shares but falls in most other sectors. Bond yields rose, not helped by increases in Japan on rate hike expectations and concerns about an unwinding of the Yen carry trade. Australian bond yields also rose on increasing expectations for RAB rate hikes.

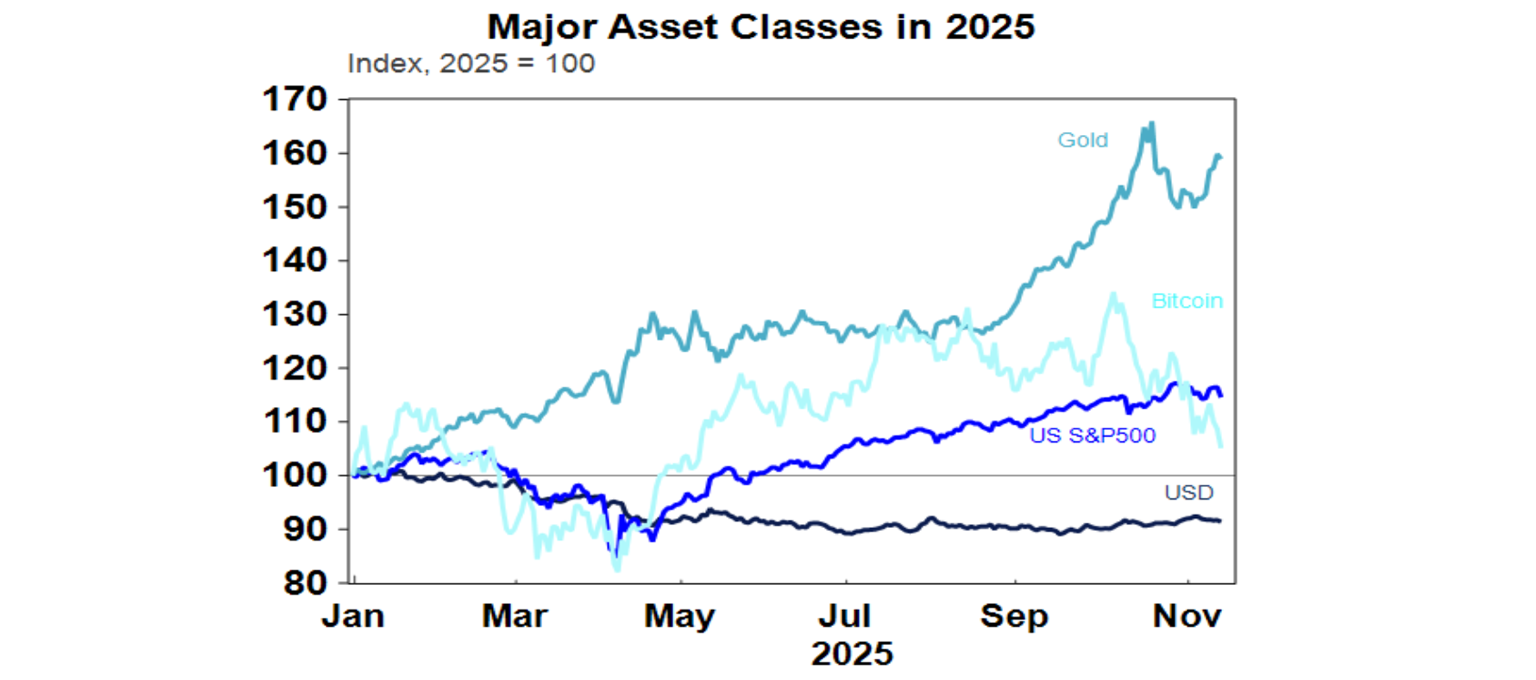

The past week saw gold fall a bit after its rebound, silver make it to a record high and Bitcoin give up gains on Friday in volatile trade. All may benefit from ongoing concerns about Fed independence with President Trump favouring close associate and rates dove Kevin Hassett as Chair Powell’s replacement, although worries about another once every four years Bitcoin winter appears to be hanging over Bitcoin. Oil, metal and iron ore prices all rose further over the last week. A fall in the $US and a further widening in the expected Australian interest differential to the US saw the $A rise above $US0.66.

While US and Australian shares only rose slightly over the last week, this looks like a pause after a strong rebound the previous week. Concerns about valuations, an AI bubble and the slowing US jobs market remain, and the Australian share market is being constrained by increasing talk of the RBA pivoting back to rate hikes next year. But these concerns are being offset by increasing confidence that the Fed will cut rates again in the next week (the US money market is factoring in a 95% probability of a cut), strong earnings growth in the US and expectations for solid earnings growth in Australian companies as economic growth picks up, Trump moving towards more consumer friendly policies and positive seasonal pressures associated with the Santa rally (although in December this doesn’t really kick in until mid-December). Overall, this suggests that the rising trend in shares will continue for now.

The 12-point swing against Republicans in a special House of Reps election in Tennessee and Trump’s poor approval rating point to a 20 to 40 Republican seat loss in the House in next year’s mid-term elections adding to pressure on Trump to do something to improve Republican prospects, like “tariff rebates”.

So far, the rebound in shares has come with outperformance by consumer discretionary shares and small caps, strength in metal prices and resource stocks like BHP and Rio and strength in the $A which is all positive from a cyclical perspective.

While Trump has said he won’t announce his nomination for Fed Chair to replace Powell until early next year, he continues to suggest it will be Kevin Hassett. This poses long term concerns about Fed independence and Hassett may struggle to convince hawkish Fed presidents of the need for substantially easier monetary policy anyway, but to the extent that his appointment (if confirmed by Trump and then the US Senate) signals a more dovish Fed it may be taken positively by the US share market in the short term.

Since 1928 when the US share market has been up for the year to date to November by more than 10% (as it has been this year) the average rise in US shares in December has been 2%, with 78% positive.

One issue that could create a bit of angst in the US is if the Supreme Court rules against Trump’s emergency powers tariffs with a decision likely in the next month or two. This could cause some uncertainty including around refunds (bad for the deficit and hence bonds) but note that Trump can replace the tariffs with a power that gives him the ability to impose up to 15% tariffs for 150 days and then use another power to run reviews and move back to the current levels of the tariffs.

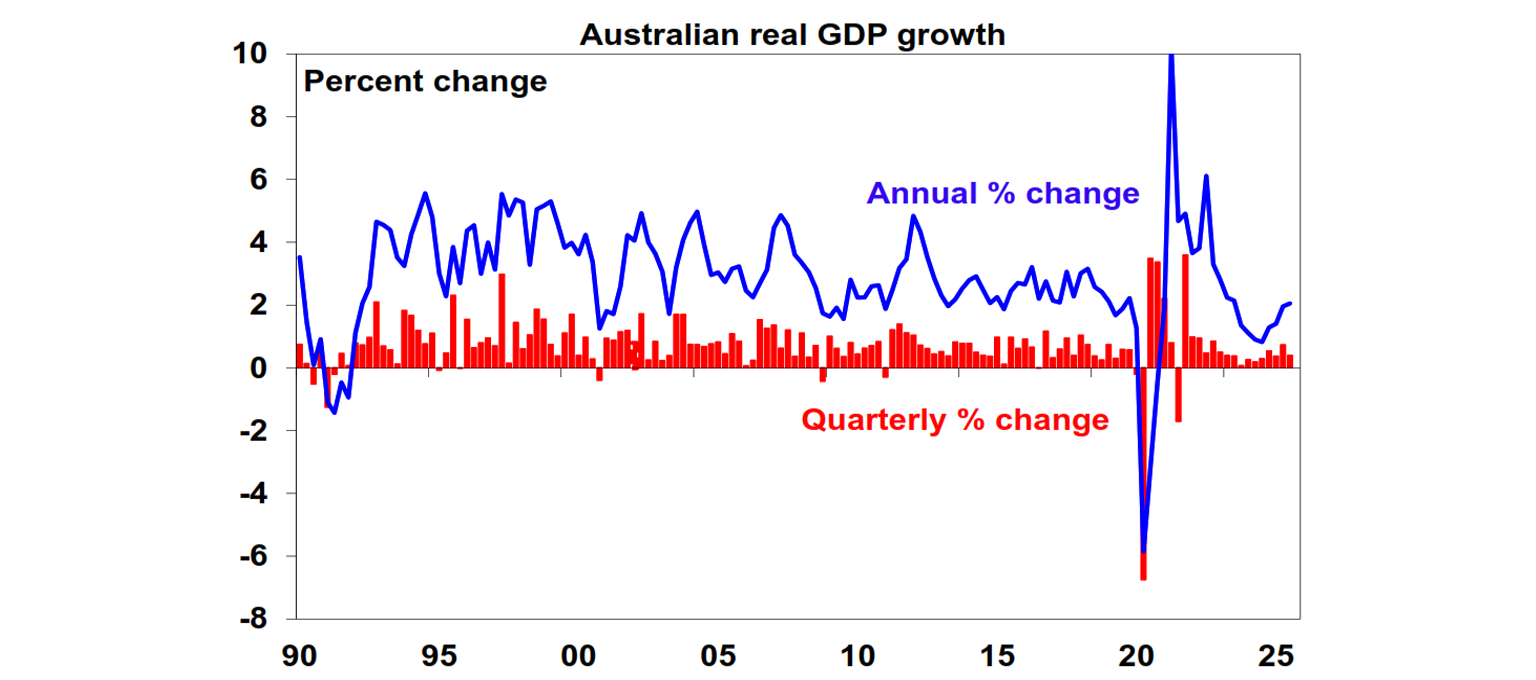

The recovery in Australian economic growth continues. While September quarter GDP growth at 0.4%qoq was soft, the details were strong. Annual growth perked up to 2.1%yoy its fastest in two years, the softness in the quarter was due to a 0.5% detraction from inventories but domestic final demand rose a strong 1.2%qoq with private demand also up 1.2%qoq, there were strong increases in dwelling investment and business investment helped by the data centre boom and household saving rose.

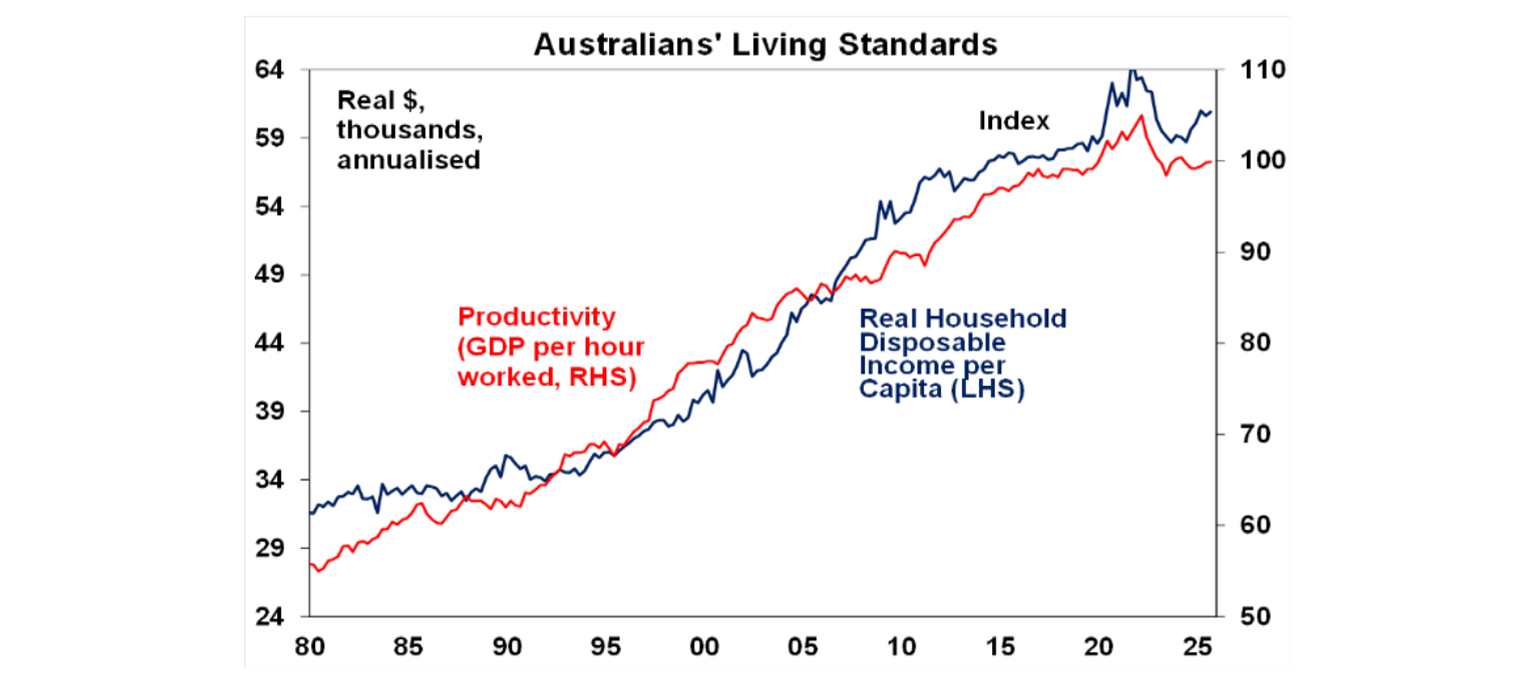

There was also some good news with productivity rising four quarters in a row and up 0.8%yoy and real household disposable income (a proxy for living standards) looking healthier.

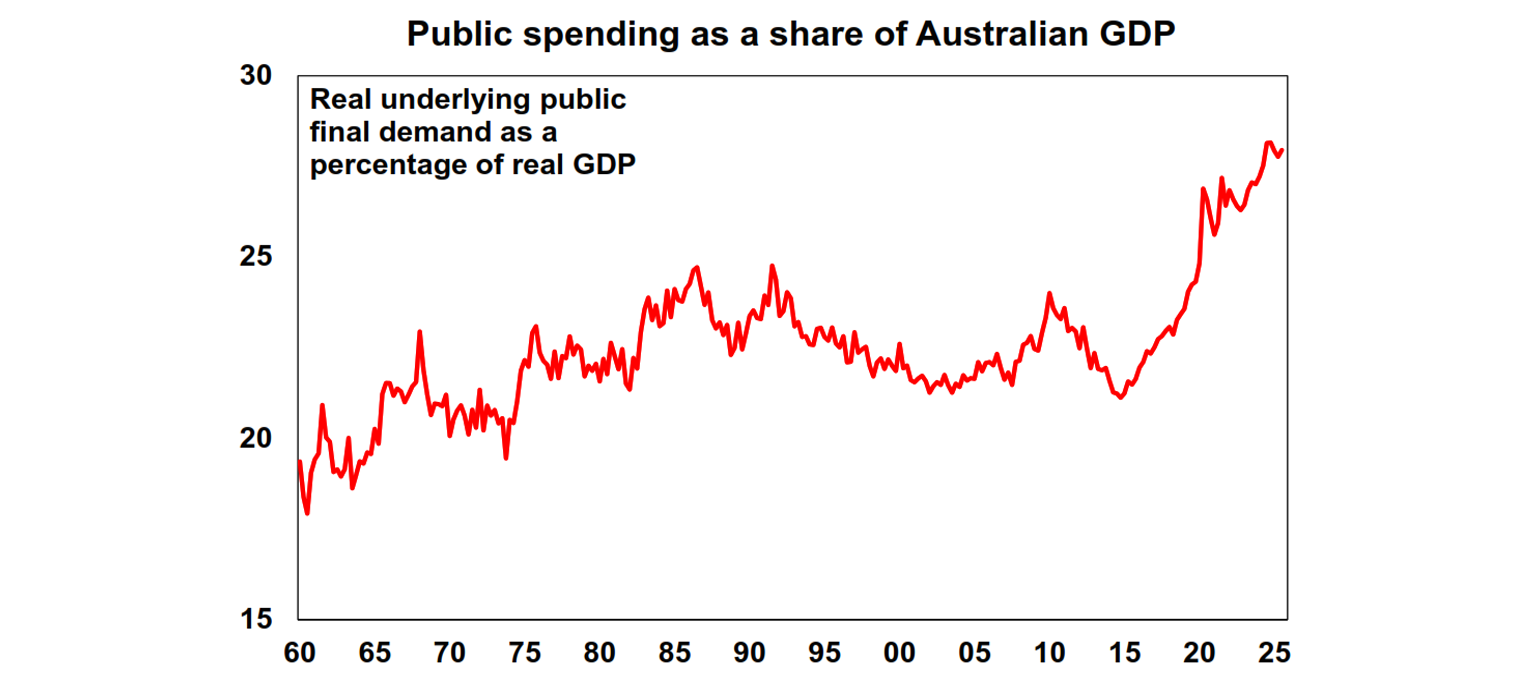

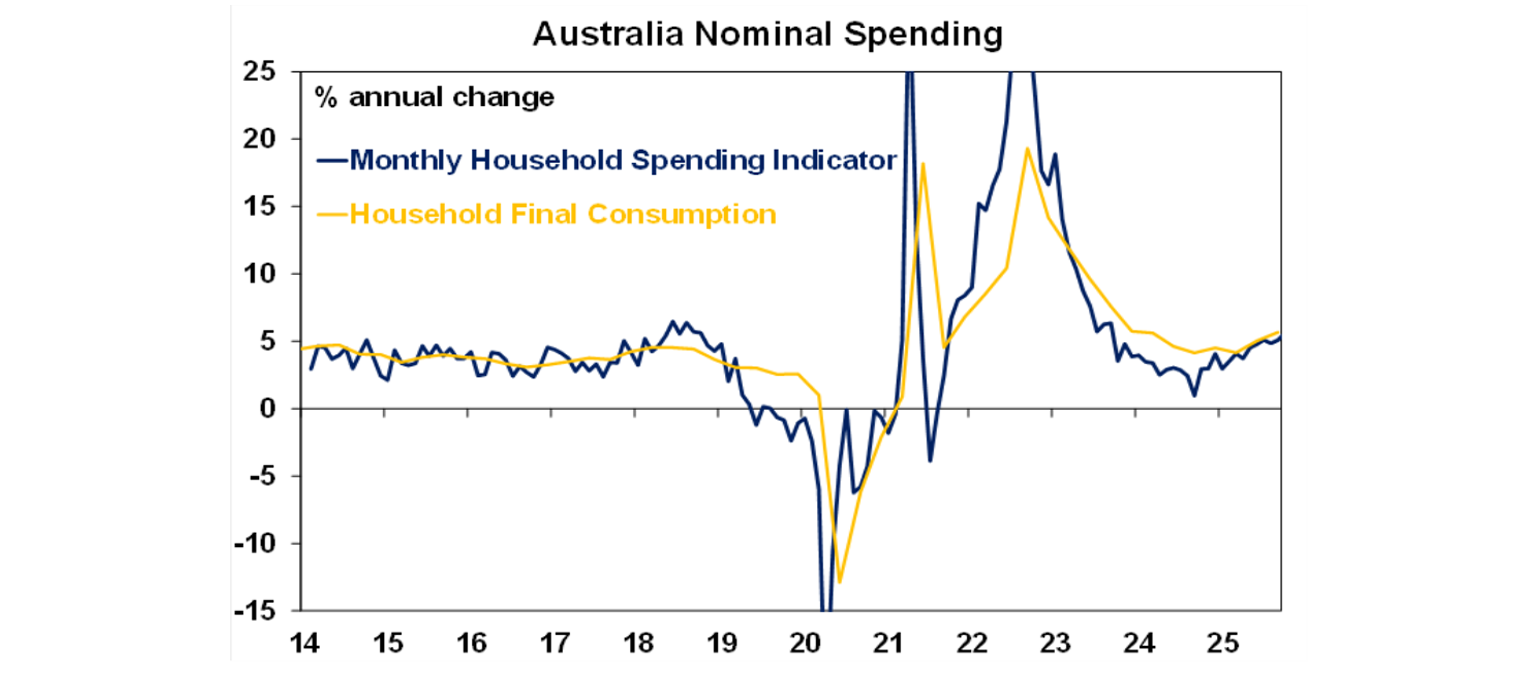

Some concerns though were that consumer spending slowed with discretionary spending falling and public sector demand growth remained strong at 1.1%qoq. The former suggests that the consumer remains a bit fragile and dependent on discounting events (of which there weren’t any in the September quarter), but the household spending indicator showed a bounce in October with more promotional events. The latter is a concern as public spending remains around a record 28.5% of GDP and is likely adding to capacity constraints, leading to lower productivity than would otherwise be the case and by competing with the private sector for resources is likely leading to higher inflation and interest rates than would otherwise be the case. The upcoming Mid-Year Economic and Fiscal Outlook provides the Government with an opportunity to start slashing the growth in public spending. And it’s the ideal time to do so with private sector growth improving and the next election not due till 2028.

All up, it looks like the recovery is continuing which along with the rise in inflation since mid-year will further add to RBA concerns that the economy is bumping up against capacity constraints and so looks likely to keep interest rates on hold for the foreseeable future. The RBA sees potential growth being around 2%yoy, against actual growth now of 2.1%yoy. The rise in productivity is welcome but is likely not enough to allay RBA concerns just yet. So, the solid GDP data along with the recent rise in inflation and still low unemployment will likely keep the RBA sidelined for now, including at this Tuesday’s rate setting meeting where it’s also likely to sound more hawkish leaving the door wide open for a hike if needed.

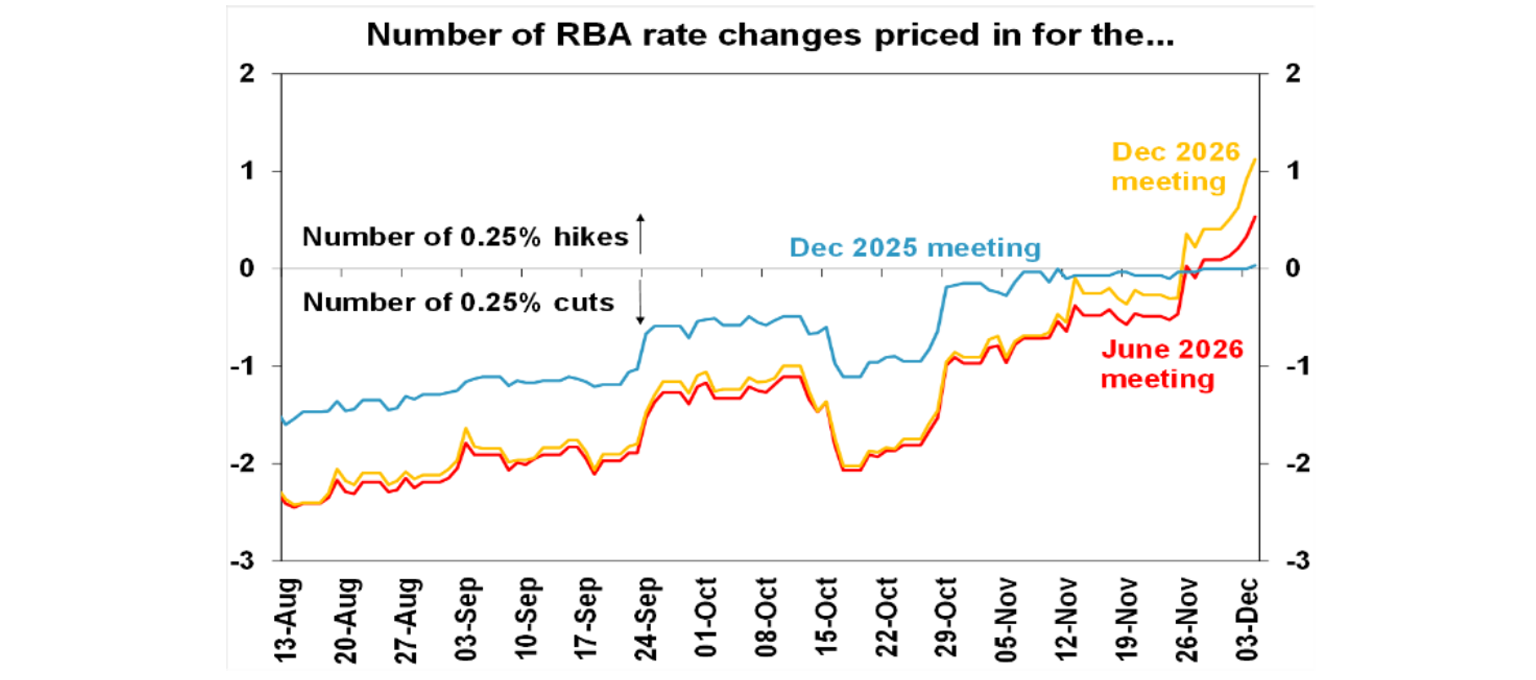

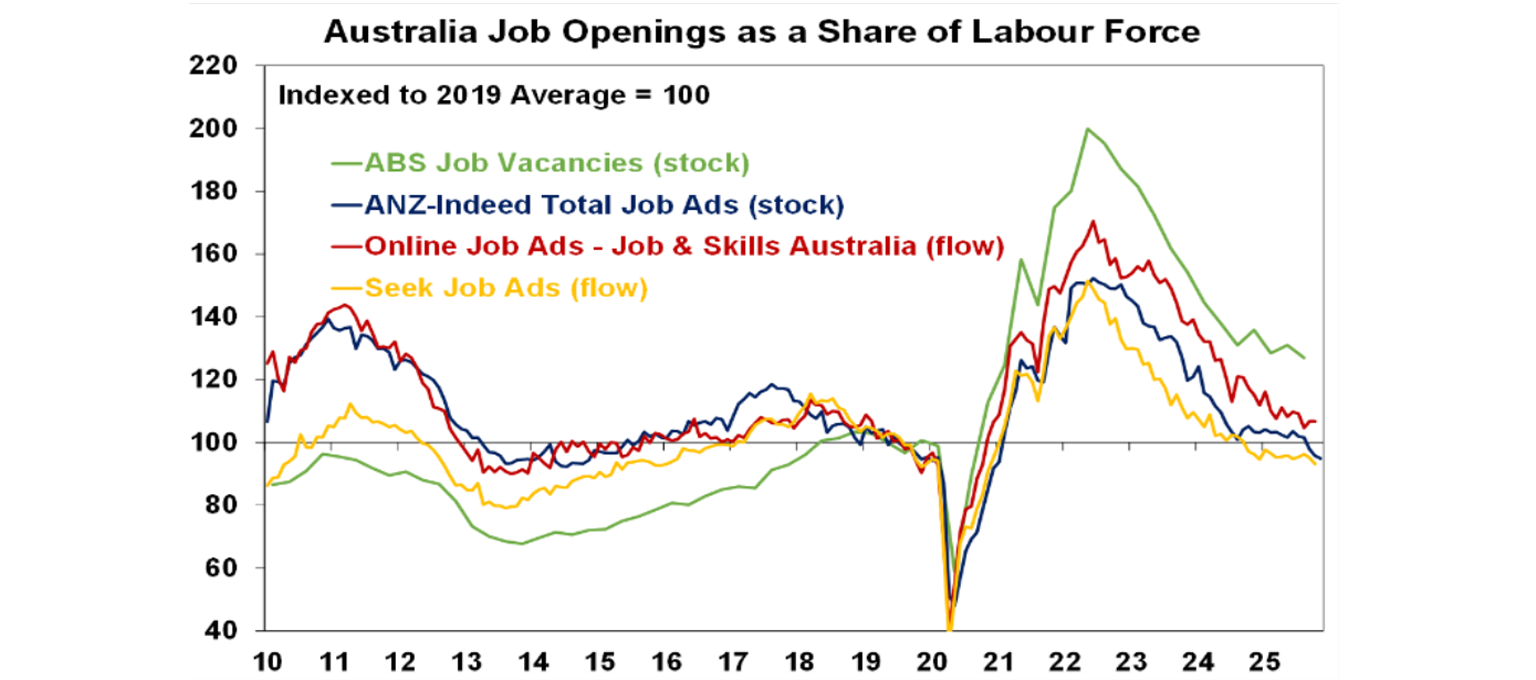

We are now forecasting rates on hold through next year, amidst conflicting economic indicators. On the one hand, the rising trend in unemployment, falling job openings, the tendency for economic data to run hot and cold, uncertainty around the new monthly CPI and business surveys suggesting its pick up could be partly temporary suggest that another rate cut is still possible. And its arguable that potential growth at present is really now above 2%yoy given productivity growth of 0.8%yoy and labour force growth of 1.9%yoy. But on the other hand, the strengthening trend in domestic demand growth and consumer spending along with the renewed rise in inflation runs the risk that the economy is bumping into capacity constraints and possibly suggests that monetary policy is no longer restrictive. Given the conflicting indicators we have decided to drop our forecast for one last rate cut next year. However, we remain of the view that expectations for the start of rate hikes next year – with the money market now seeing a 60% chance of a hike by June 2026, with some chance of another hike by December 2026 - are too bearish as we still see inflation falling back and unemployment likely to rise more than the RBA is allowing for. The move back to rate hikes is more likely a 2027 story. Note that money market expectations for the RBA cash rate are often quite volatile and very responsive to the most recent economic data. Just four months ago the money market was allowing for 2 or 3 more rate cuts by mid next year and it’s now swung to rate hikes next year. The money market struggles with the concept that rates may spend some time on hold – but they went nearly three years on hold in 2016-19.

Bad news on interest rates but better news on company profits. At a big picture level while the less favourable interest rate outlook is not good for mortgage holders, to the extent that it reflects stronger growth in the economy it’s not such a bad thing as it means a more positive economic outlook which will underpin a return to profit growth for listed Australian companies after three years of falling profits. The market consensus for earnings growth this financial year is around 7%. A continuing rise in inflation would not be good news though, but it’s not our base case.

Cliff Richard had the unusual benefit that his backing band, The Shadows, were a phenomenon in their own right who sometimes knocked Cliff off the top of the pop charts with their classic guitar instrumentals like Atlantis and Wonderful Land. When it comes to great guitarists Hank Marvin is up there with the likes of Eric Clapton and George Harrison. Out of interest, just to check perceptions that I am stuck in the 1960s (which I mostly am) according to Spotify my number one album for 2025 was The Life of a Showgirl (which I listened to for 249 minutes – must have been searching for Easter Eggs!)

Major global economic events and implications

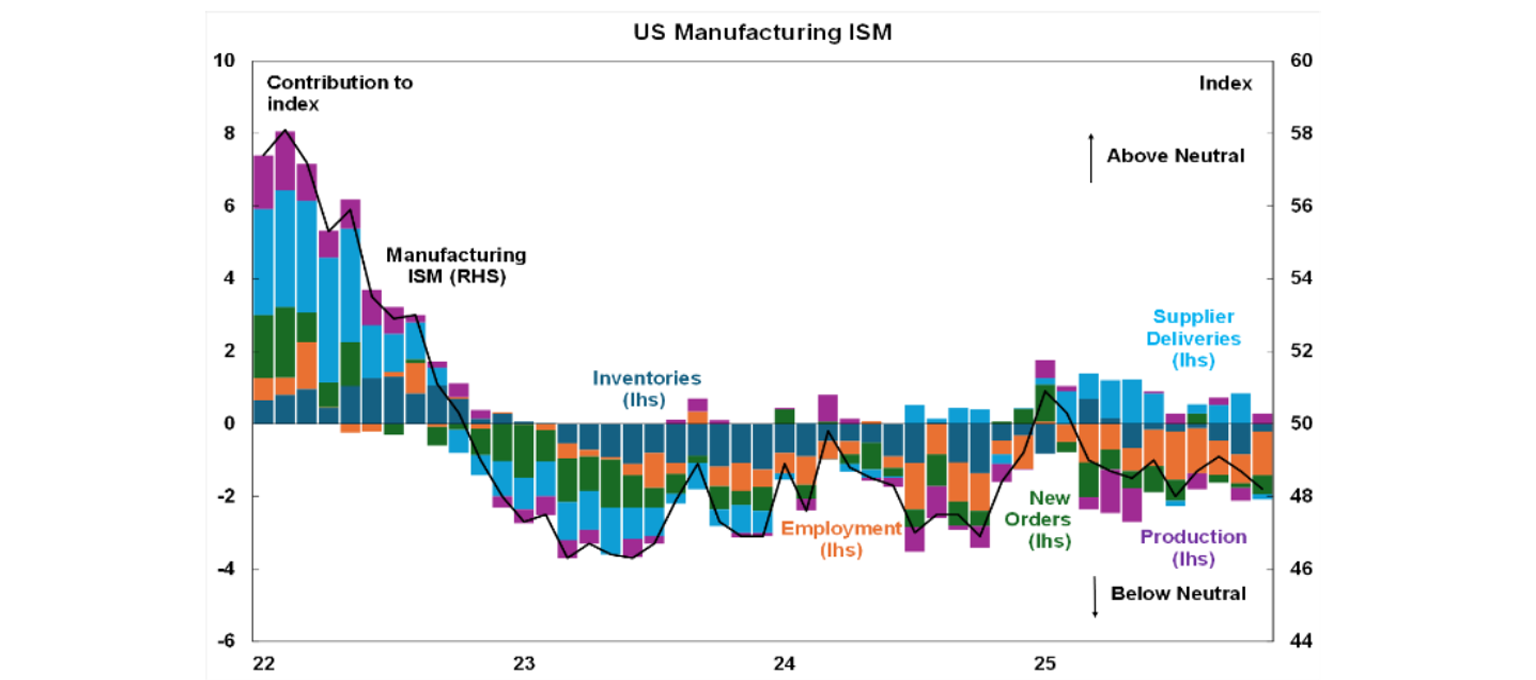

US economic data was on the soft side and mostly supportive of the Fed cutting rates in the week ahead. While the services conditions ISM index for November improved slightly to a reasonable 52.6, the manufacturing conditions ISM fell slightly to a soft reading of 48.2 with employment in both remaining weak. Delayed September personal spending data showed that it stalled in real terms and core private final consumption expenditure (PCE) inflation came in at a benign 0.2%mom or 2.8%yoy.

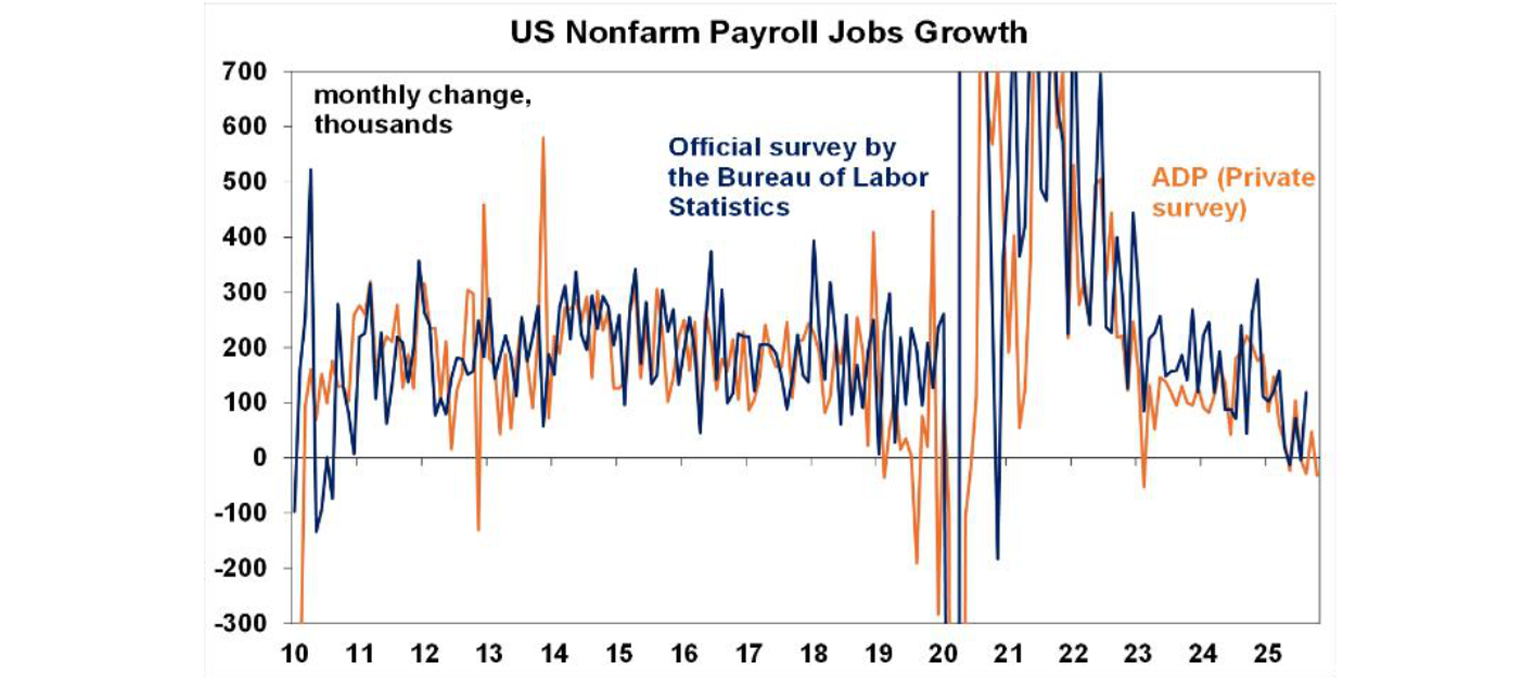

US jobs data was on the soft side with the ADP private payroll growth estimate for November coming in negative again. While it has a loose relationship with the official payroll growth each month it has correlated reasonably well on a trend basis and the trend is clearly down. While initial jobless claims fell (possibly distorted by the Thanksgiving holiday) and remain low, continuing claims remain elevated suggesting it’s hard to get a job once lost. Meanwhile, job cuts fell back in November according to Challenger, Gray and Christmas but remain high and in a rising trend. This is the last jobs data that the Fed will get prior to its meeting in the week ahead and along with benign September core PCE inflation supports those advocating for another rate cut.

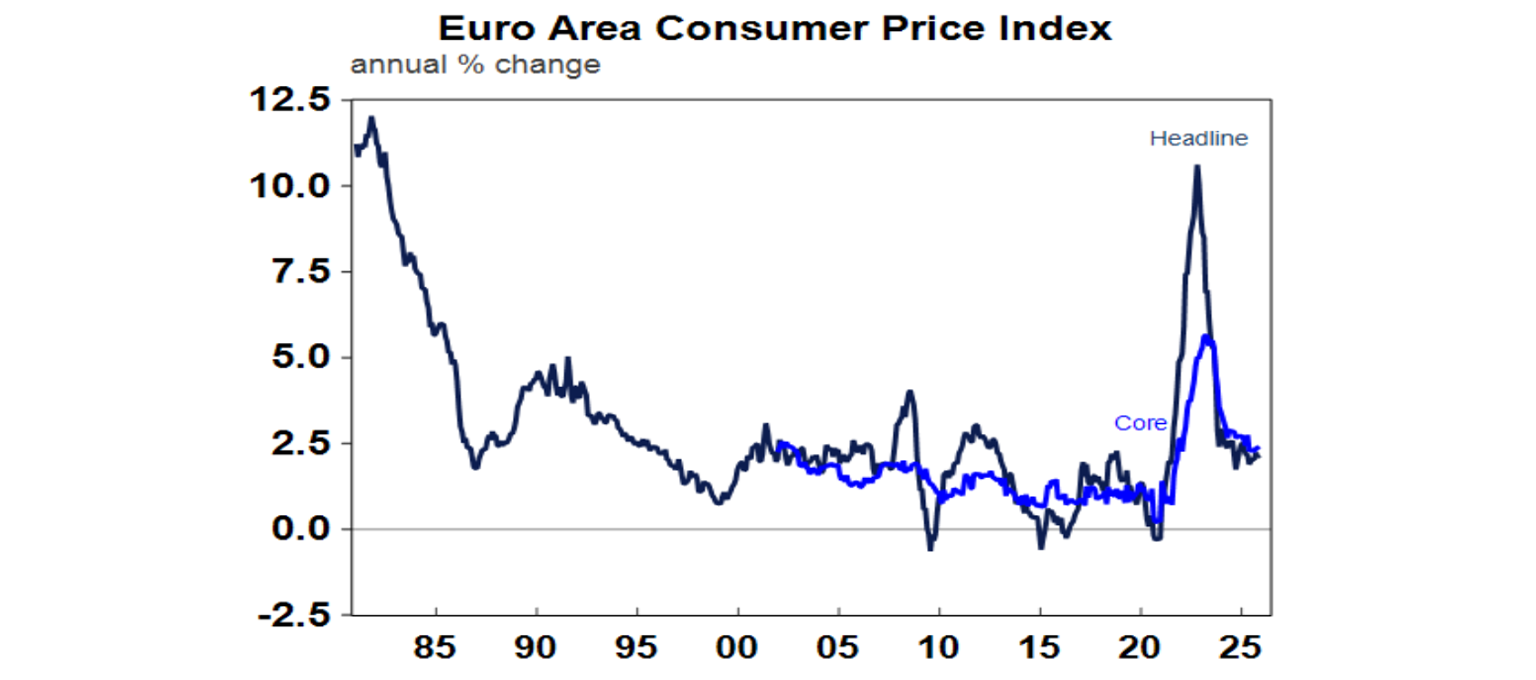

Eurozone core inflation was 2.4%yoy which leaves the ECB on hold at 2%. Unemployment was flat at 6.4%.

Bank of Japan Governor Ueda signalled another rate hike this month. This will take the Japanese cash rate to 0.75% and while some might fret about an unwinding of the carry trade, Japanese rates are still too low and rising too slowly to cause a big reversal of capital flows out of Japan.

Chinese business conditions PMIs fell slightly on average in November, but remain in the range they have been in for the last few years which saw GDP growth around 5%.

Australian economic events and implications

Apart from the strong domestic demand picture in the GDP data, other Australian data released over the last week was mixed. On the strong side household spending rose a much stronger than expected 1.3%mom or 5.6%yoy in October as promotional activity and cultural events drove a rebound in discretionary spending. Black Friday will probably keep it strong in November. Australian households are in a better place financially with the three rate cuts and stronger wages growth but they are still reliant on discounts to get out there and spend highlighting the cost-of-living crisis hasn’t fully gone away.

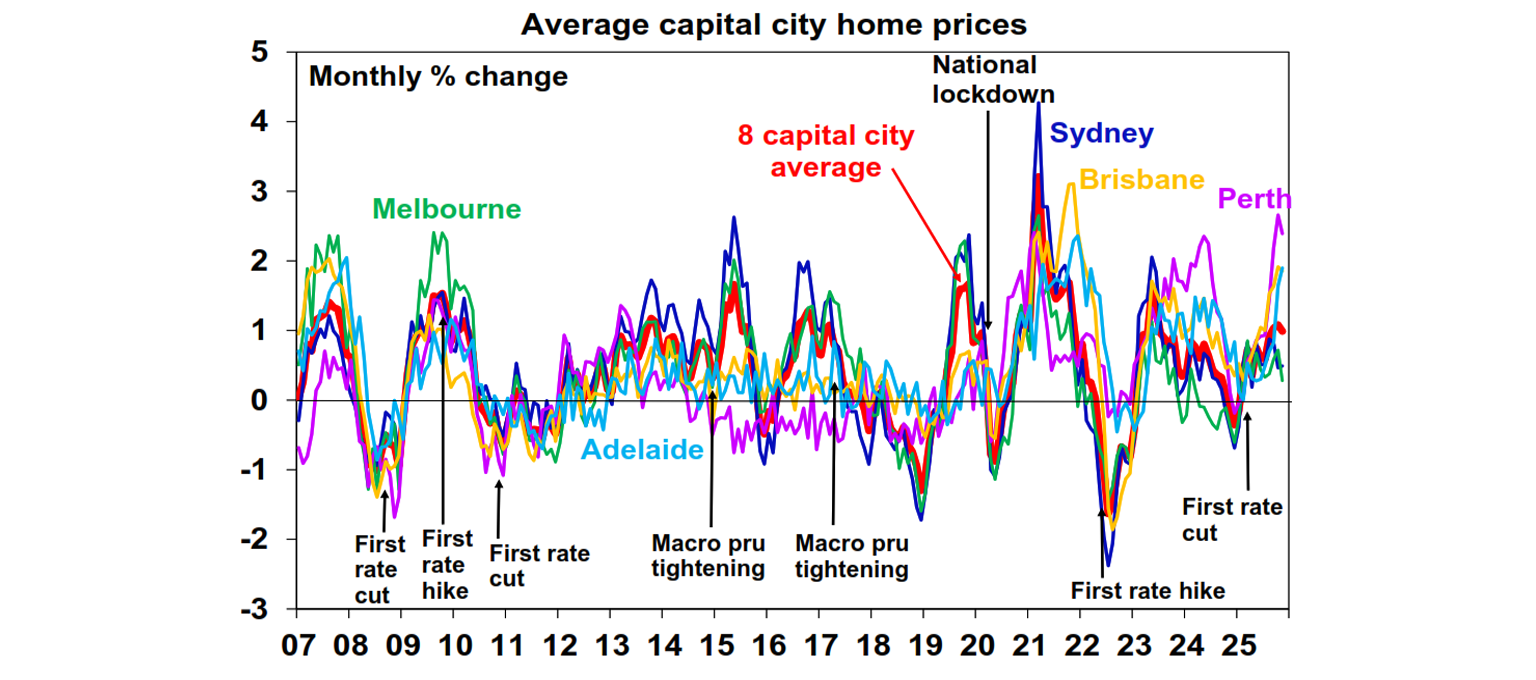

House prices continued to rise strongly in November. The lagged impact of this year’s rate cuts, support for first home buyers and the housing shortage will likely keep prices rising in 2026 but gains are likely to slow given talk of rate hikes, worsening affordability and APRA moves to slow investors. Meanwhile, the rise in prices provides a positive wealth affect for homeowners to consume.

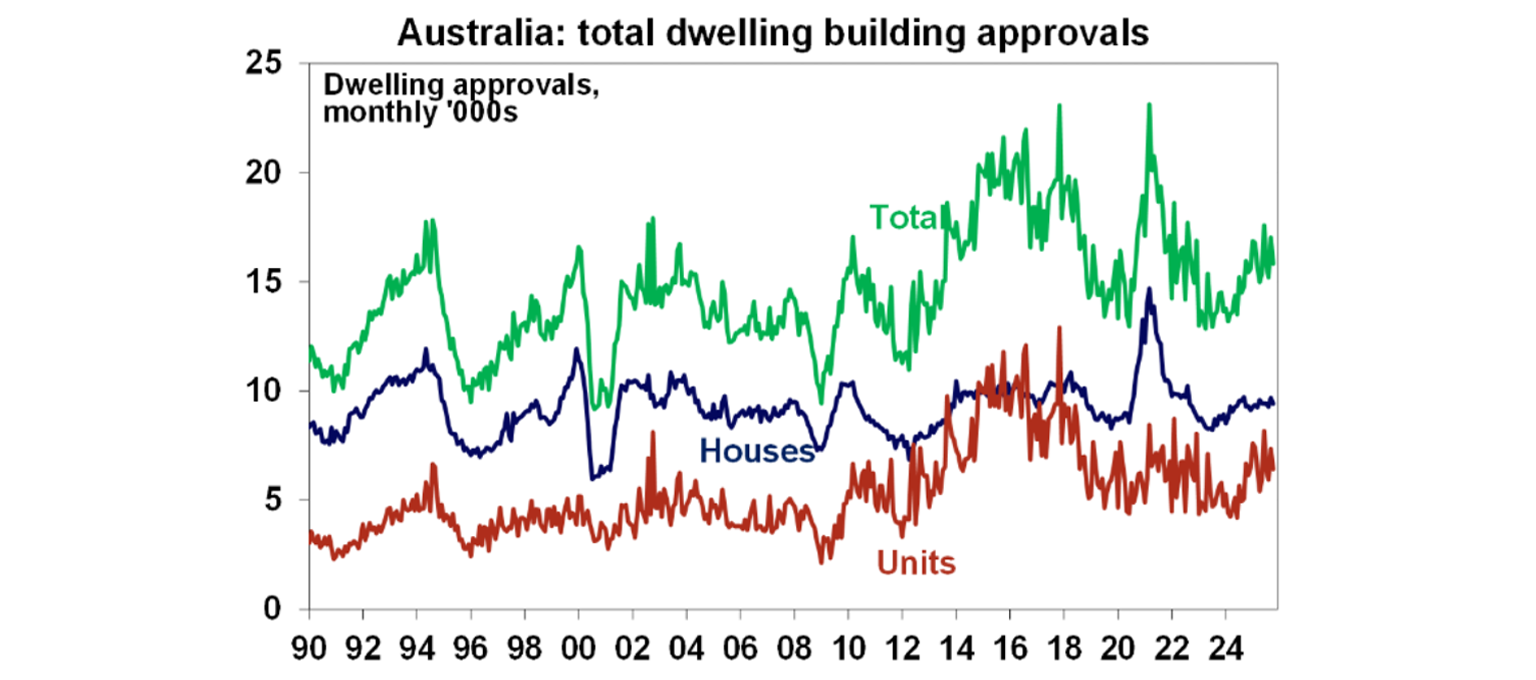

On the soft side, building approvals fell 6% in October and appear to be trending sideways. The good news is that they are running around 190,000 dwellings on an annualised basis, which is slightly ahead of our estimate of underlying housing demand at present of around 185,000 dwellings. The problem is that this is well below the Housing Accord target of 240,000 homes a year and not enough to make much of an impact on the 200-300,000 accumulated housing shortfall. We also need to get the unit share in the mix up if we are to have any hope of raising supply much.

In addition, ANZ Indeed job ads fell further in November and continue to warn of slower jobs growth ahead.

The November Melbourne Institute Inflation Gauge provided some slightly better news on inflation with a rise of 3.2%yoy and its trimmed mean is up from its lows but remains around 2%yoy suggesting downside for the ABS’ measure. That said the Inflation Gauge has tended to understate inflation over much of the last two decades.

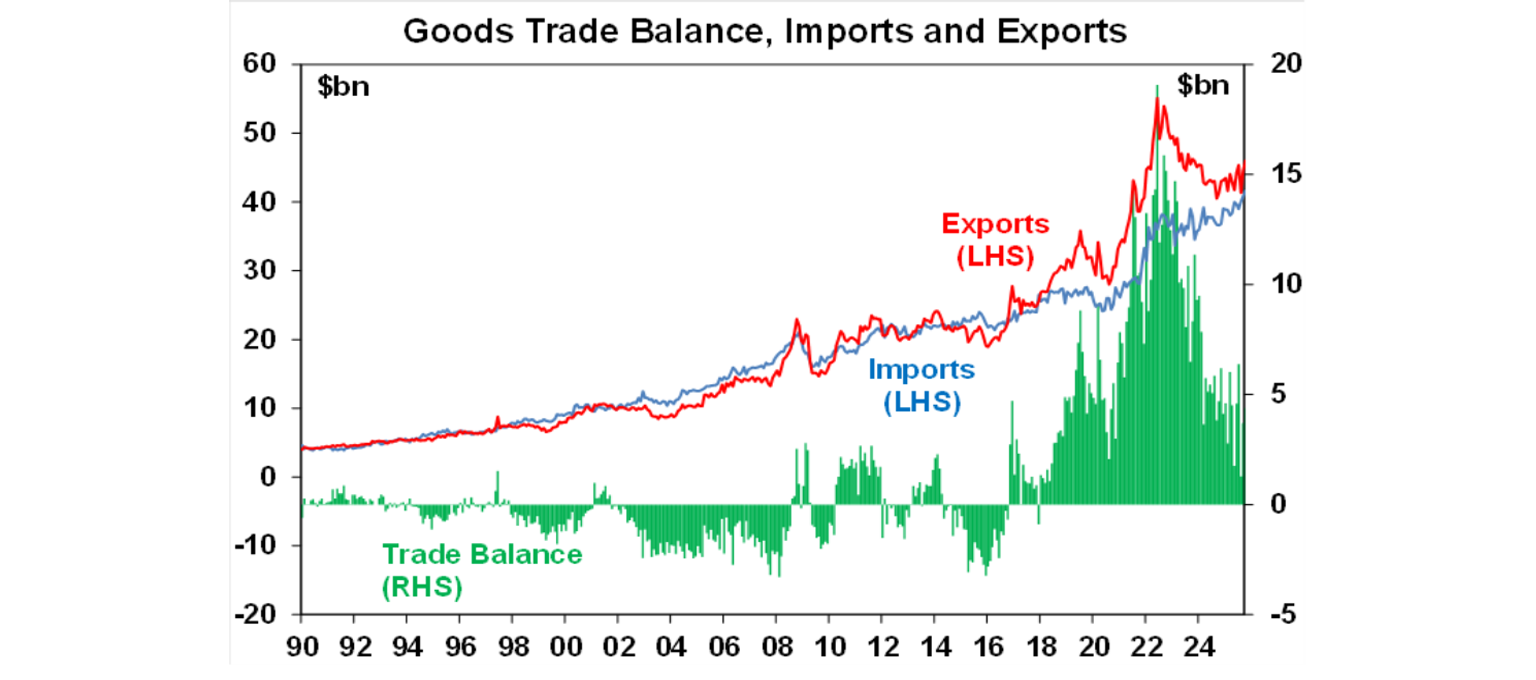

Finally, Australia’s goods trade surplus widened in October to $4.4bn helped by stronger exports.

What to watch over the week ahead?

In the US, the Fed is expected to cut interest rates by 0.25% taking the Fed Funds rate 3.5%-3.75% reflecting signs of a further slowing in the US jobs market and indications that inflation may have peaked. Several dissents are possible though with Miran advocating for a 0.5% cut and some Fed officials may advocate for no change. Expect the median dot plot of Fed officials’ rate expectations to continue to allow for one rate cut next year and one in 2027. The Fed is also ending Quantitative Tightening and will likely indicate that it will start expanding its balance sheet again in line with the economy. On the data front, small business optimism is out Tuesday, job openings data is due Wednesday, and the September quarter Employment Cost Index is due Thursday.

The Bank of Canada (Wednesday) is expected to leave rates on hold at 2.25% and the Swiss central bank (Thursday) is expected to hold at zero.

In China, expect trade data for November (Monday) to show an acceleration in export growth to 4%yoy and import growth to 2.8%yoy and inflation data (Wednesday) to show a further rise in CPI inflation to 0.7%yoy with producer price deflation remaining around -2%yoy.

In Australia, the RBA (Tuesday) is expected to leave rates on hold but with the commentary becoming more hawkish following the stronger than expected October CPI data and data showing strong growth in domestic demand. The RBA will likely express caution about reading too much into the new monthly CPI showing a further rise in inflation and reiterate that it expects some of that to be temporary. But the RBA is also likely to reiterate its concerns about capacity constraints and provide a similar warning to that seen from Governor Bullock at the Senate Economics Committee that if higher inflation proves “more persistent” then it “might have implications for…monetary policy.” It’s also likely to state that it will do whatever is necessary to bring inflation back to target, leaving the door wide open for a hike next year. The December quarter CPI to be released in late January will be key and we remain more optimistic on inflation and a more wary about the jobs market but expect the message from the RBA to be hawkish for now. Of course, if trimmed mean inflation in the December quarter does not fall back as we expect than a hike as early as February is possible.

On the data front in Australia, expect jobs data for November (Thursday) to show a 25,000 gain in employment and unemployment rising to 4.4%. The NAB business survey for November (Tuesday) is likely to show continuing reasonable levels for confidence and conditions.

Outlook for investment markets

Share markets remain at risk of further corrections given stretched valuations, risks around US tariffs and an AI bubble and the softening US jobs market. But with Trump pivoting towards more consumer friendly policies, the Fed still likely to cut rates further and the AI boom likely to go for a while yet, shares are likely to provide reasonable gains on a 6-12 month horizon. A return to profit growth should also support further gains in the Australian share markets even though the RBA may have finished cutting rates.

Bonds are likely to provide returns around running yield.

Unlisted commercial property returns are likely to be okay as the “work from home” damage to office prices is behind us.

Australian home prices are in an upswing on the back of lower interest rates, more support for first home buyers and the housing shortage. But it’s likely to be constrained next year by poor affordability, rates on hold with talk of rate hikes and APRA’s move to ramp up macro prudential controls. We expect national home price growth of 5-7% in 2026, after around 8.5% this year.

Cash and bank deposits are expected to provide returns of around 3.5%.

The $A is likely to rise as the interest rate differential in favour of Australia widens as the Fed cuts and the RBA holds and possibly hikes. Undervaluation should support it on a medium-term view with fair value around $US0.73.

You may also like

-

The outlook for Australian shares – is the long underperformance over? Australian shares have had a strong start to 2026 with the ASX 200 up 3.3% and flirting with a new record high. The local market has also outperformed US shares which are down 0.1% and global shares which are up 1.6%. However, this could just be noise and follows a significant underperformance against US and global shares since 2009. -

Weekly market update - 20-02-2026 Global share markets mostly rose over the last week. Worries about AI and tech valuations took a breather and the US Supreme Court decision to strike down Trump’s emergency power tariffs with Trump immediately announcing a replacement were seen as having little impact on the US growth outlook but were seen as positive for other countries. -

Econosights - An update on global debt and fiscal policy With the International Monetary Fund releasing their Global Fiscal Monitor recently, AMP's Senior Economist, Diana Mousina provides an update on the global debt situation and recent fiscal policy announcements.

Important information

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account. Taxation issues are complex. You should seek professional advice before deciding to act on any information in this article.

It’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you. The super coaching session is a super health check and is provided by AWM Services and is general advice only. It does not consider your personal circumstances.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy. All information on this website is subject to change without notice. AWM Services is part of the AMP group.