Key points

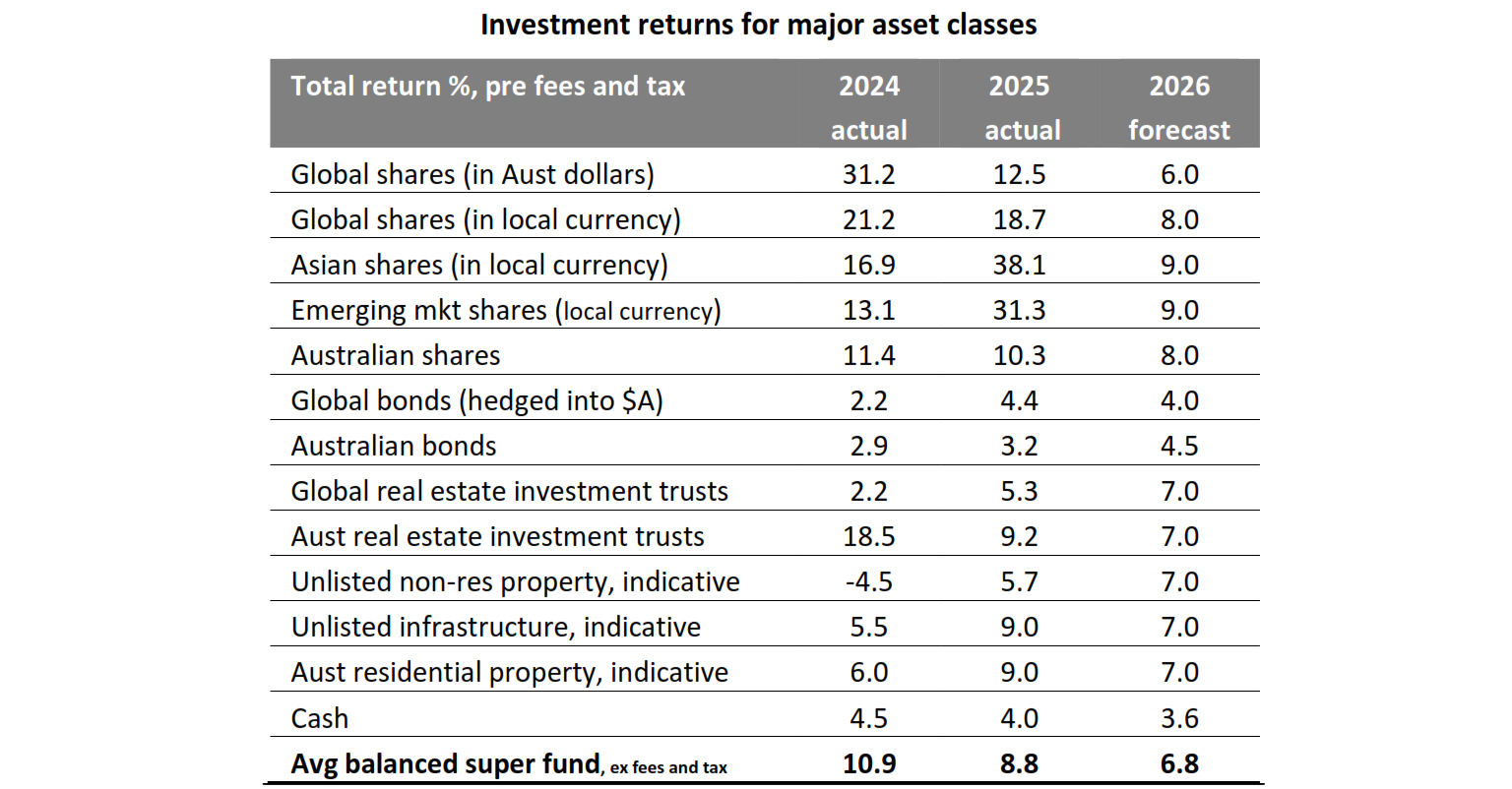

The key themes for 2025 were: tariff turmoil; global resilience helped by AI enthusiasm; sticky inflation; lower rates; and lots of geopolitical noise. For the third year in a row, returns were strong, albeit they slowed.

2026 is likely to see volatility around US politics, geopolitics & central bank rates at the lows, but returns should be ok.

Expect the RBA cash rate to hold at 3.6%, the ASX 200 to rise to 8900 & balanced super funds to return around 6.8%.

Australian home price gains are likely to slow to 5-7% with poor affordability and a less favourable rate outlook.

Key things to keep an eye on are: interest rates, the US midterms, AI enthusiasm, China, and Australian consumers.

Lots of uncertainty by 2025 turned out okay…

2025 initially saw turmoil as US President Trump announced tariffs that were much higher than expected along with a bunch of other moves to upend US institutions and the global economic order. But the global economy held up okay. Key big picture themes for investors were:

1. US tariff turmoil. Trump’s constant “fill the space” with policy announcements created much uncertainty. Tariffs were the big one with at one stage just after “Liberation Day” average US tariffs looking like they would rise over 30%, up from 2.5% at the start of year. Fortunately, Trump backed down fearing financial chaos and as countries decided there was no point hitting their own consumers, so retaliation was limited, deals were cut, and a trade war was averted.

2. AI enthusiasm. It surged along with related investment.

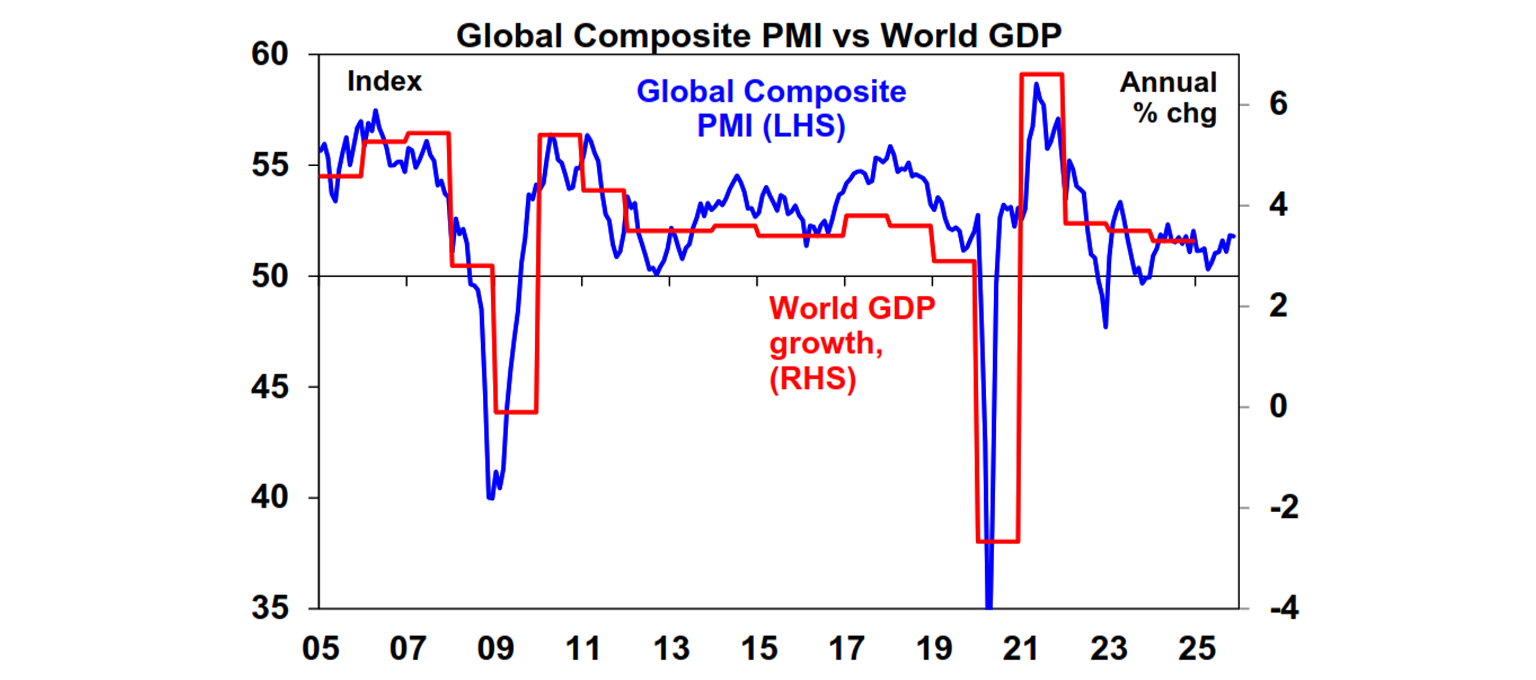

3. Global resilience. Despite Trump’s tariffs the global economy did not collapse as a trade war was averted and AI enthusiasm, rate cuts and fiscal stimulus provided an offset. So, global growth remained just above 3%. This was helped by Chinese growth holding up around 4.8% despite its property collapse. In Australia, the “per capita recession” ended helped by tax cuts, rates cuts and stronger wages growth with economic growth rebounding to 2% from 1% in 2024.

4. Sticky inflation. Inflation is down from peaks of 8 to 11% in 2022 but underlying inflation bounced around 3%, including in Australia.

5. Lower interest rates. Central banks continued to cut, including in the US after a tariff related pause. In Australia rates were cut three times.

6. Lots of geopolitical noise, but not so bad. War continued in Ukraine, but despite a flare up in the Israel war that saw the US bomb Iran, the fallout was minimal. And the US and China entered a détente.

…resulting in slower but still strong returns

There was a bump into April on Trump’s tariff turmoil (that saw global shares fall 17% and Australian shares fall 14%) but it was quickly reversed as Trump backed down, a global trade war was averted and AI enthusiasm dominated. For diversified investors 2025 was another strong year.

Despite worries about valuations and an AI bubble, global shares had a strong year, albeit less so than in 2024 but better than expected, as growth held up, AI enthusiasm dominated, and rates fell.

US shares underperformed though on valuation and tariff worries with Asian, emerging markets, Eurozone and Japanese shares all outperforming helped by better valuations and mostly easier monetary policy. Chinese shares continued their recovery.

Australian shares did well with three rate cuts and anticipation of stronger profits, but underperformed again as profits fell, the low-tech exposure weighed and with talk turning to RBA rate hikes.

Government bond returns rose but were constrained by public debt worries in the US, France and UK and rate hike talk in Japan and Australia.

Unlisted property returns improved after the working from home hit.

The Australian residential property cycle took off again with rate cuts, more help for first home buyers and the housing shortage.

The $A rose as commodity prices rose, the expected cash rate outlook widened in Australia’s favour and the $US fell on Trump’s policies.

Reflecting all this, balanced super funds had solid and slightly better than expected returns for a third year in a row, but they slowed a bit.

The worry list for 2026

As always there seems to be a long worry list for investment markets:

Share valuations remain stretched relative to their history with US shares offering little risk premium over bonds and Australian shares not much better. Fortunately, Eurozone and Asian shares are cheaper.

Concern remains high that AI shares are in a bubble and that surging data centre capex increasingly being funded by debt is a sign of this.

Some central banks are either at or close to the bottom on rates. This includes the ECB, Bank of Canada and the RBA with Australian money market now factoring in one or two rate hikes next year.

There remains uncertainty about the lagged economic impact of Trump’s policies particularly in relation to tariffs, immigration, university research, the rule of law and his attacks on Fed independence which could intensify in the year ahead as Chair Powell is replaced. All of which threaten “US exceptionalism.”

The risk of recession remains in the US with a slowing jobs market.

Risks for China’s economy remain as its property slump continues.

High public debt in the US, France the UK and Japan is a problem.

Geopolitical risk remains: the Ukraine war is yet to be resolved with a risk it could expand; problems in the Middle East could flare up again; US tensions with China could escalate again; political uncertainty will likely be high in Europe with issues around the French budget and the rise of the far right; and the midterm elections in the US are often associated with share market volatility with an average 17% top to bottom drawdown in US shares in midterm election years since 1950.

And in Australia, inflation has worsened lately which could see the RBA hike prematurely and snuff out the consumer recovery. But worries in Australia are a non-event compared to other countries!

These considerations point to a high risk of another year of volatility compared to the relative calm of 2024.

But 2026 will probably turn out to be another okay year

However, despite these worries there are several grounds for optimism. First, while AI may be in the process of becoming a bubble there are many more favourable comparisons with the late 1990s tech bubble: valuations are cheaper; Nasdaq is up less; tech sector profits are very strong; bond yields are lower; and it’s early days in the associated capex build up around data centres (see the next chart which shows information procession equipment capex up over the last 18 months as a share of US GDP versus a much longer and bigger build up in the late 1990s).

Second, while central banks are likely close to the bottom on interest rates, rate hikes are likely still a way off (probably a 2027 story). For the Fed, another rate cut is likely in 2026, and a Trump appointee will likely be given some leeway before Fed independence worries really kick in as US inflation is likely to drift a bit lower. In Australia we expect some fall back in underlying inflation to allow the RBA to avoid a rate hike but worries about capacity constraints to prevent a cut, so we see the RBA leaving rates on hold at 3.6%. The risk is now on the upside for RBA rates though.

Third, Trump is pivoting to more consumer-friendly policies ahead of the midterms with his poor approval rating and big swings to Democrats in recent elections pointing to a 20 to 40 Republican seat loss in the House. While the tariff story is not completely over (it could still flare up with Canada, Mexico and China) we have likely seen “peak Trump tariffs” for at least a year, he has already cut some food tariffs and is talking about “$2000 tariff rebates.” There is a chance he could now pivot towards the populist left. But mostly his shift will likely be more market friendly and given the elections he has an interest in keeping geopolitical flareups low.

Fourth, global growth is likely to stay just above 3% as the lagged impact of rate cuts feed through along with some policy stimulus in the US, with US growth around 2% and Chinese growth around 4.8% as its policy makers do just enough to keep growth okay. Australian growth is likely to edge up to 2.2% helped by rising real wages, tax cuts and rate cuts and this should see profit growth return. Currently global business conditions surveys are still around levels consistent with okay global growth.

Finally, okay economic growth is likely to underpin solid profit growth. The market consensus expectation for US profit growth in 2026 is 14% and for global growth its 13%. In Australia profit growth is expected to pick up to 7% after three years of falls as economic growth picks up.

Implications for investors

After three years of strong returns, it’s inevitable that returns will slow. We have seen a bit of that in 2025 but expect a further slowing in 2026.

Global and Australian share returns are expected to slow further in the year ahead to around 8%. Stretched valuations in the key direction setting US share market, political uncertainty associated with the midterm elections (which years have seen below average returns and increased volatility) and AI bubble worries are the main drags but returns should still be positive thanks to Fed rate cuts, Trump’s consumer friendly pivot and solid profit growth. A return to profit growth should also support gains in Australian shares even though the RBA may have finished cutting rates. Another 15% or so correction in share markets is likely along the way though.

Expect the ASX 200 to end 2026 at around 8,900 points.

Bonds are likely to provide returns around running yield.

Unlisted commercial property returns are likely to stay solid helped by strong demand for industrial property associated with data centres.

Australian home price growth is likely to slow to around 5-7% in 2026 after 8.5% in 2025 due to poor affordability, rates on hold with talk of rate hikes and APRA’s move to ramp up macro prudential controls.

Cash and bank deposits are expected to provide returns around 3.6%.

The $A is likely to rise as the interest rate differential in favour of Australia widens as the Fed cuts and the RBA holds and possibly hikes. Fair value for the Australian dollar is around $US0.73.

What to watch?

The main things to keep an eye on are interest rates, the US midterms, the AI boom, China’s property market, and the Australian consumer.

Dr Shane Oliver

Head of Investment Strategy and Chief Economist, AMP

You may also like

-

Weekly market update - 27-02-2026 Australian shares are a key beneficiary of the rotation trade helped by the now concluded December half earnings reporting season confirming that listed company profits are rising again. -

The outlook for Australian shares – is the long underperformance over? Australian shares have had a strong start to 2026 with the ASX 200 up 3.3% and flirting with a new record high. The local market has also outperformed US shares which are down 0.1% and global shares which are up 1.6%. However, this could just be noise and follows a significant underperformance against US and global shares since 2009. -

Weekly market update - 20-02-2026 Global share markets mostly rose over the last week. Worries about AI and tech valuations took a breather and the US Supreme Court decision to strike down Trump’s emergency power tariffs with Trump immediately announcing a replacement were seen as having little impact on the US growth outlook but were seen as positive for other countries.

Important information

While every care has been taken in the preparation of this document, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance.

This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs.

An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.

This document is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.