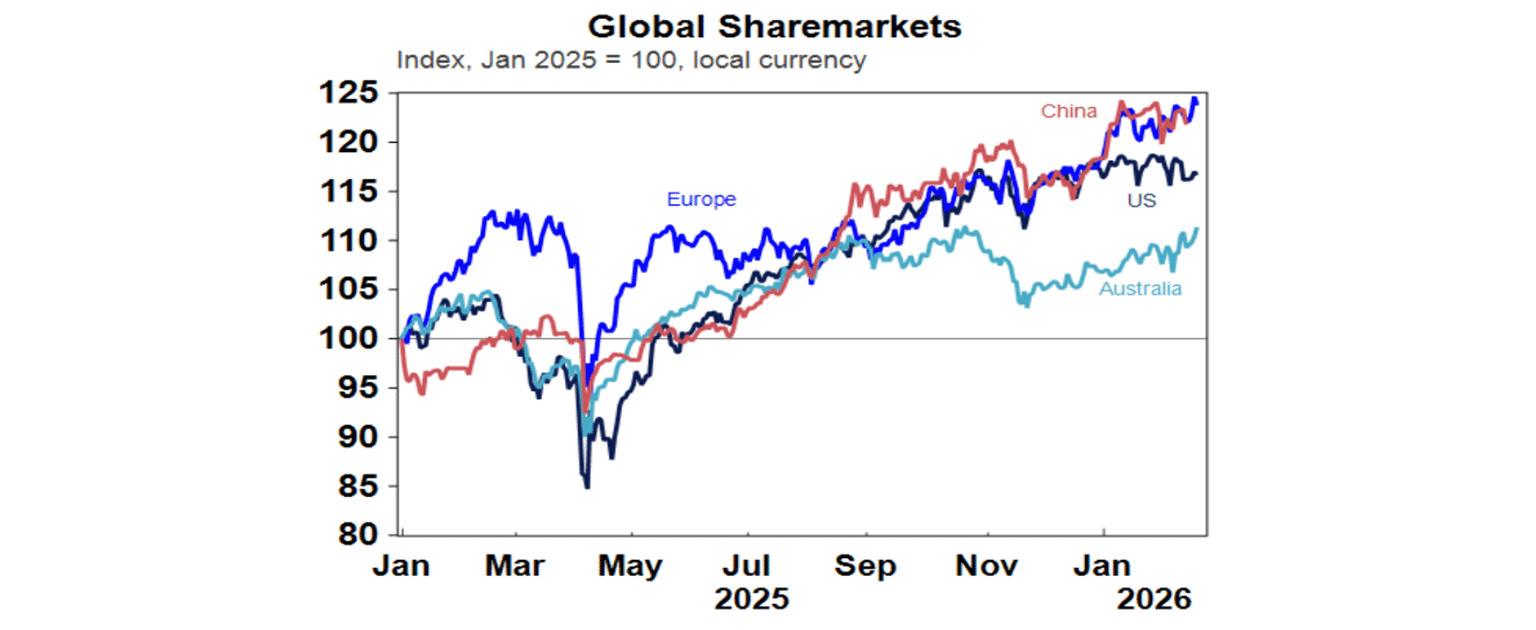

Global share markets mostly rose over the last week as worries about AI and tech valuations took a breather but concerns about a US strike on Iran acted as a constraint. US and Eurozone shares rose, but Japanese fell back slightly after a 13% rise in the previous week and Chinese shares were closed for the Lunar New Year holiday. Australian shares had another strong week making it to a new intraday high on strong earnings results before slipping back a bit but are still up around 1.8% for the week. Gains were led by IT, energy, industrial and health shares. Bond yields were little changed but rose slightly in the US and fell slightly elsewhere.

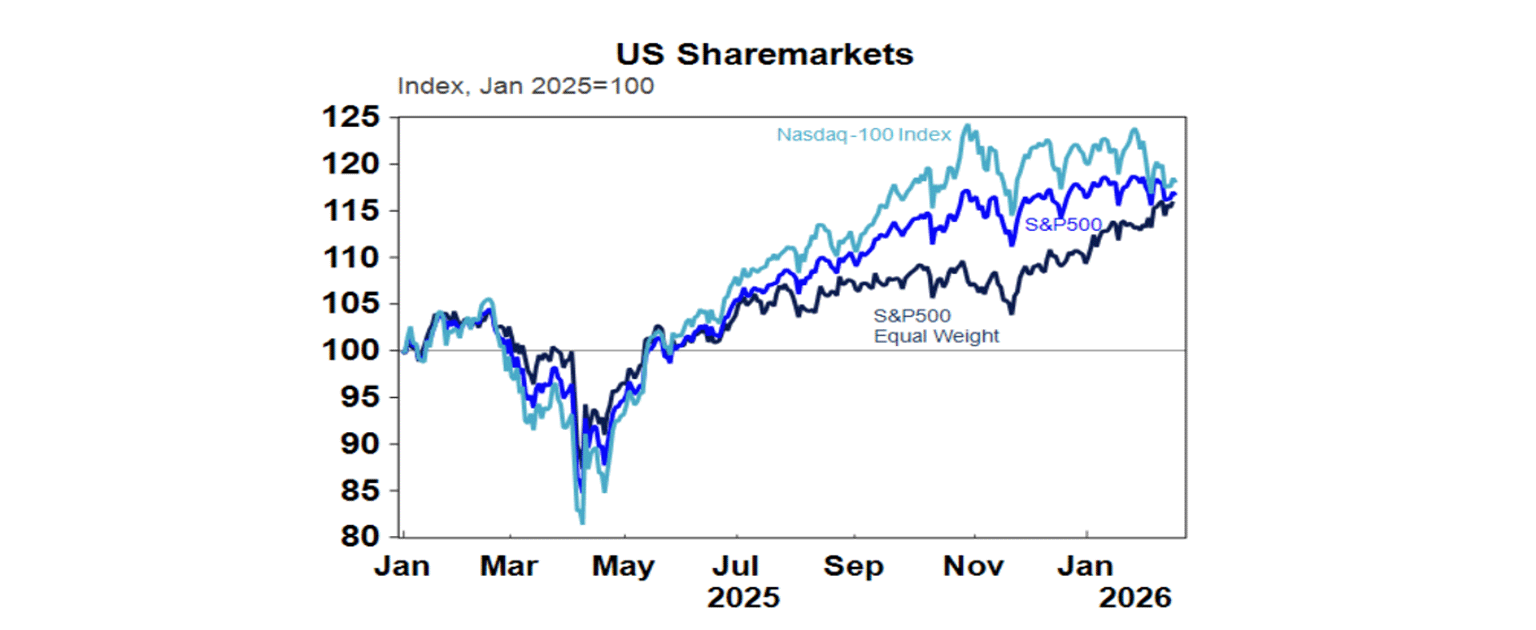

Rotation from tech to non-tech continues. This is evident in the continuing outperformance of the equal weighted S&P 500 which is up 5.8% year to date compared to the tech heavy market cap weighted S&P 500 which is up just 0.2% and in the relative outperformance so far this year of non-US share markets with Eurozone shares up 4.6% and Japanese shares up 12.7%.

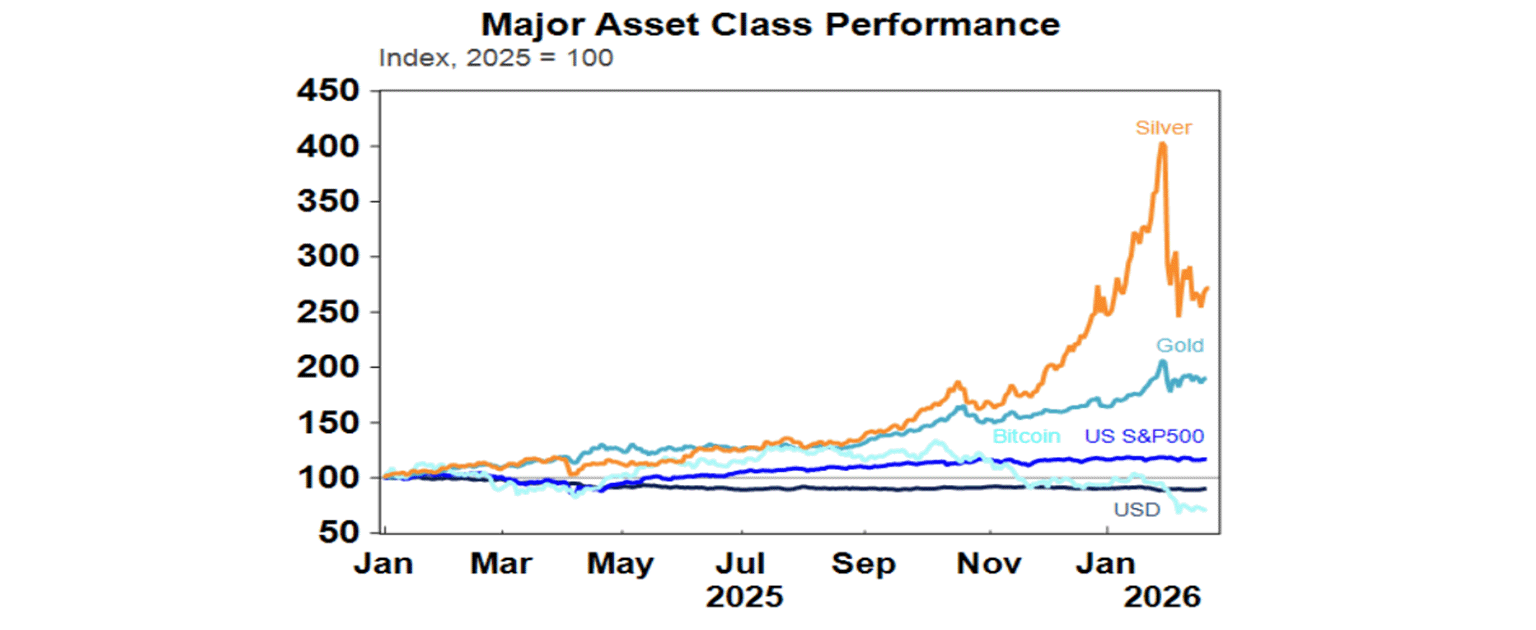

Gold prices dipped slightly but appear to be supported by the high levels of geopolitical risk, notably around Iran. Bitcoin fell but is managing to remain above its low of earlier this month. Metal and iron ore prices fell but oil prices rose to their highest since June last year (when the US last bombed Iran) on the back of worries about another conflict with Iran. The $A fell slightly on the back of geopolitical worries as the $US rose, but remains above $US0.70.

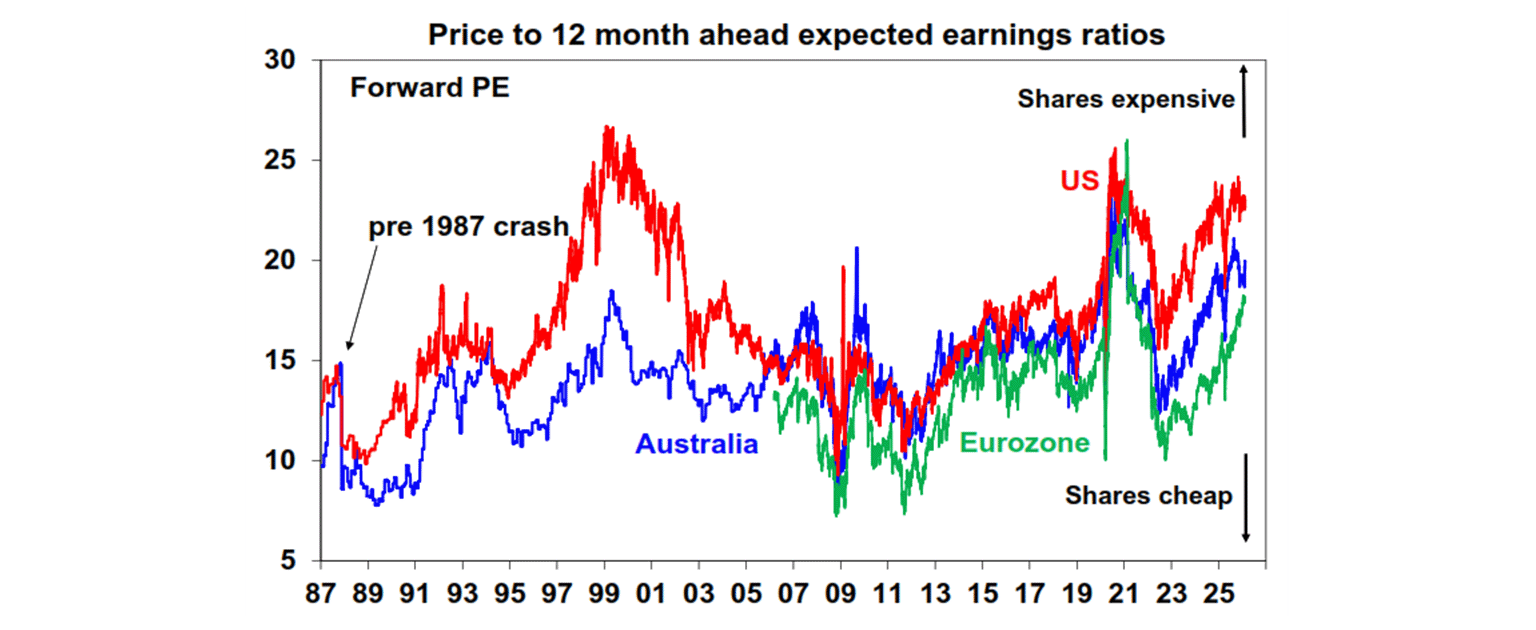

The Australian share market had another go at a record high in the past week supported by strong profit reports. It likely has more upside but expect a volatile ride. The key constraints on Australian shares are: rich valuations with the forward PE around 20 times which is well above its long-term average of 15 times; the absence of much risk premium over bonds; the RBA’s hawkish bias; and global uncertainty around tech shares, US policies and geopolitics. But it’s getting a big push along from company earnings rising again after three years of falls led by the miners and banks with December half earnings results confirming this and a global investor rotation away from the tech heavy US. So, we see more gains this year, but expect a volatile ride.

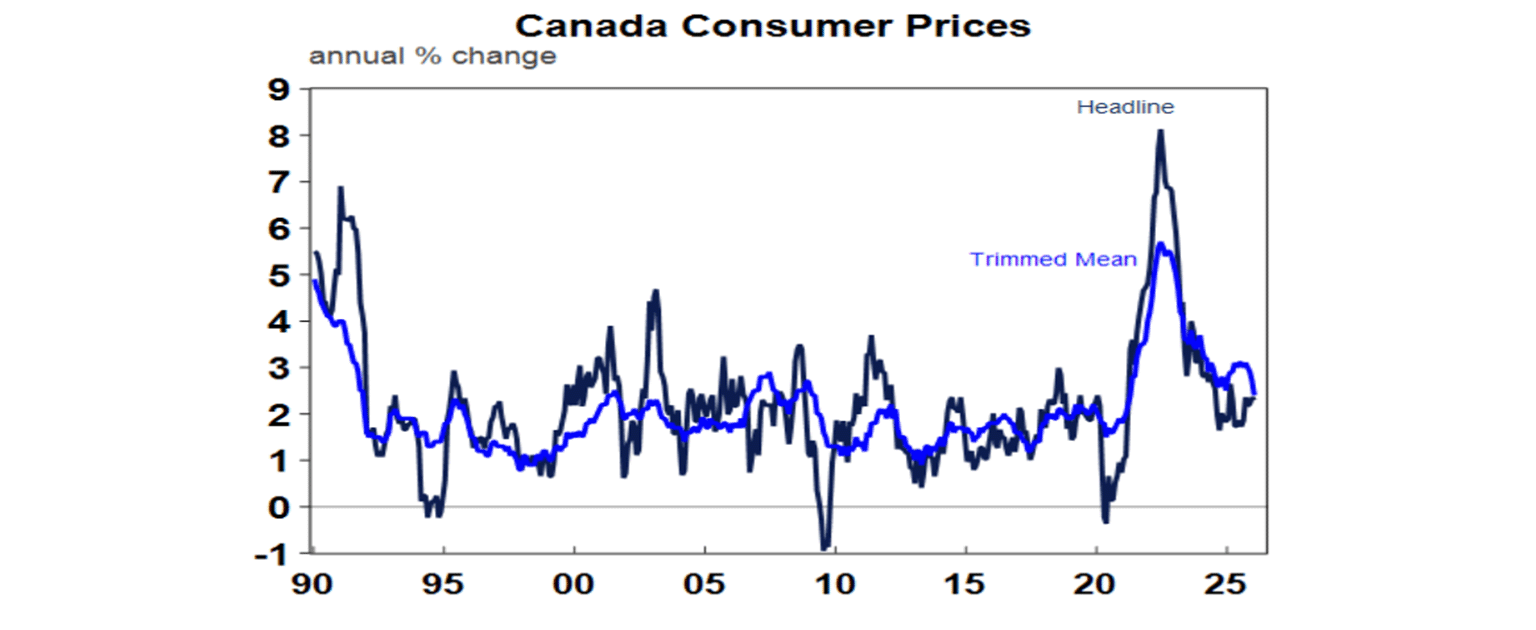

On the RBA, our base case remains for rates to remain on hold for the remainder of the year, but the risks are on the upside. The minutes from the last RBA meeting leant a bit hawkish reflecting concerns about capacity constraints and the risk that inflation could persist above target for too long. But the RBA’s comment that given the “uncertainties it’s not possible to have a high degree of confidence in any particular path for the cash rate” indicate that it’s not in a rush for another rate hike and will be data dependent. On this front December quarter wages growth was in line with its forecasts but January jobs data was on the strong side. With the RBA focussed on quarterly inflation data it will likely wait till after March quarter inflation data is released ahead of their May meeting before making another hike. That said, if inflation data due in the week ahead surprises on the upside, then taken together with the strong jobs data another hike next month would become a high risk. That said we expect inflation data to confirm a further downtrend in trimmed mean inflation enabling the RBA to leave rates on hold this year but it’s a close call and the risk is well and truly on the upside.

Overall, our view remains that this year will see a volatile ride for investors on the back of geopolitical threats, Trump bluster, the US midterm elections, interest rate uncertainty and worries around an AI bubble and tech valuation issues. So, the risk of a 15% or so correction sometime in the next six months is high. But ultimately, we see it turning out okay for shares this year with reasonable returns on the back of good global economic and profit growth, Trump focussing on policies to help US households ahead of the midterms, the Fed cutting rates once or twice more, and profit growth turning positive in Australia.

Two potential near term market moving events are whether the US strikes Iran and a possible imminent US Supreme Court decision on the validity of the US fentanyl and reciprocal tariffs.

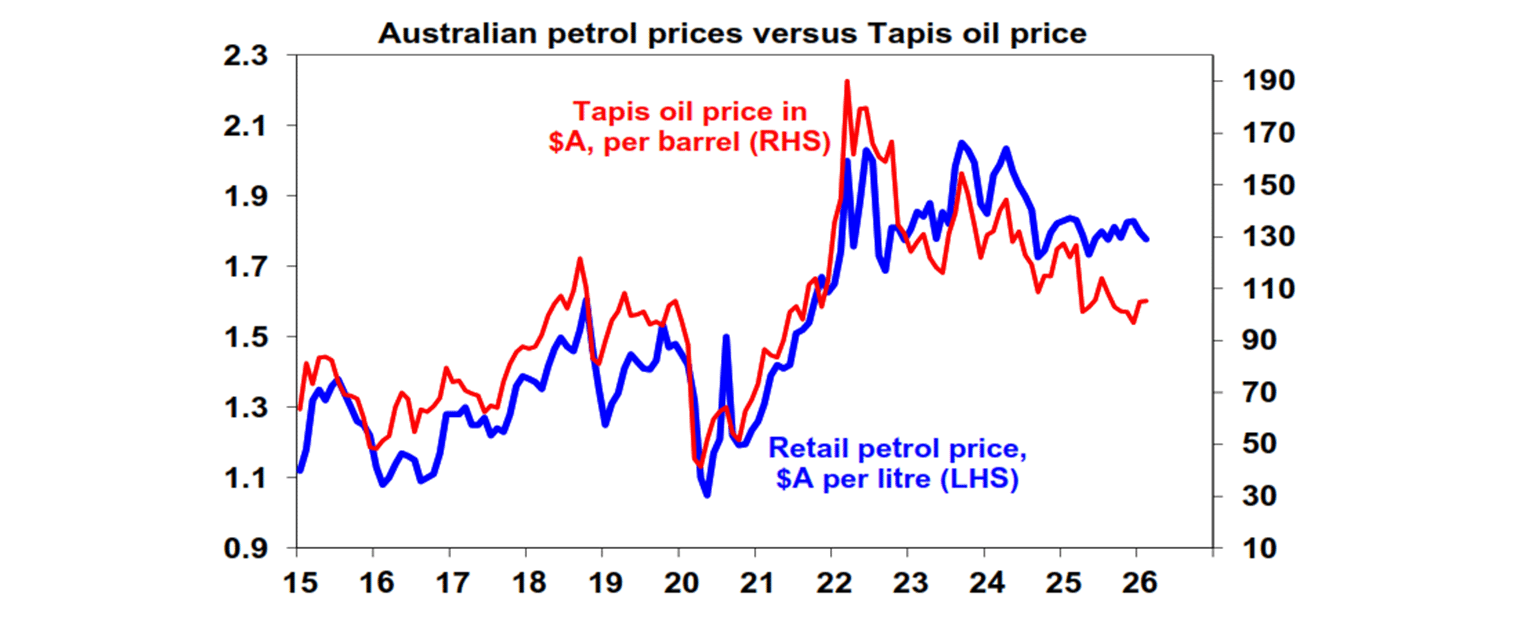

In terms of Iran, talks around US demands that it cease its nuclear ambitions and support for terrorist organisations reportedly made progress but the US military build-up in the Middle East continues so the risk is high. Oil prices have moved up from around $56/barrel to around $US67 to reflect the risk, but if there is a strike it’s likely to spike above $US70. If sustained this might add maybe 5 cents a litre or so to Australian petrol prices. But if Iran retaliates by disrupting neighbouring countries oil exports or blocking the Strait of Hormuz through which 20% of global oil supplies flow, then a spike above $US100 would be likely which could add around 40 cents a litre or more to Australian petrol prices. And this would be taken badly by global share markets. Predicting all of this is fraught though – similar fears last June were not realised, and Iran was quickly forgotten about. The massive military build up is consistent with Trump’s “maximum pressure” negotiating approach and he is likely to be wary risking another “forever war” and anything that causes a sharp spike in oil prices ahead of the midterms. So Trump is applying pressure to strike a deal and then if that fails is likely to lean towards something surgical like that seen last June which does not cause Iran to lash out and spike oil prices. But either way worries around Iran could still ramp up further from here – even if it’s just another surgical strike – before subsiding again.

If the Supreme Court rules against Trump’s emergency powers tariffs it could cause uncertainty. Refunds could amount to $US150bn or more and it would lead to a hole in budget projections, which would be bad for bonds. Trump can replace the tariffs with a power that gives him the ability to impose up to 15% tariffs for 150 days and then use another power to run fair trade reviews and move back to current levels more permanently, but this will come with its own uncertainties. Or Trump may just decide to allow a net reduction in the tariffs to help ease “cost of living” concerns ahead of the midterms.

Major global economic events and implications

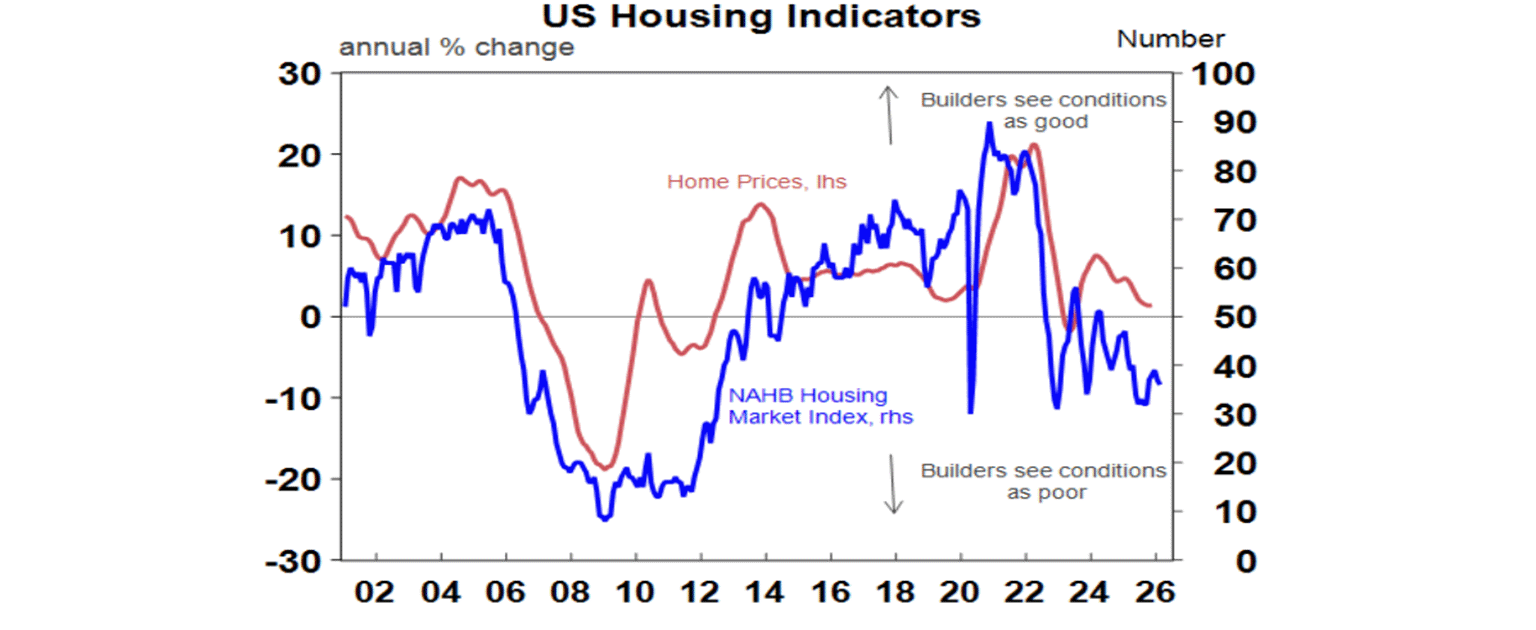

US economic data was mostly strong. Underlying capital goods orders and shipments continued to rise solidly in December pointing to strong business investment underpinned by data centres. Industrial production is continuing to trend up and the New York and Philadelphia region manufacturing conditions indexes remained at okay levels. Housing starts and permits rose in December although the later was driven by volatile multi-units and the NAHB home builder conditions index remained weak in February. Meanwhile jobless claims remain low. This is all likely to keep the Fed on hold with the minutes from its last meeting indicating a slightly hawkish tilt with “the vast majority” of Fed officials judging “the downside risks to employment had moderated…while the risk of more persistent inflation remained”. Further Fed rate cuts are still likely this year but depend on inflation cooling and are unlikely until the second half. Out of interest the Fed is starting to sound a bit like the RBA – less worried about jobs, more worried about inflation!

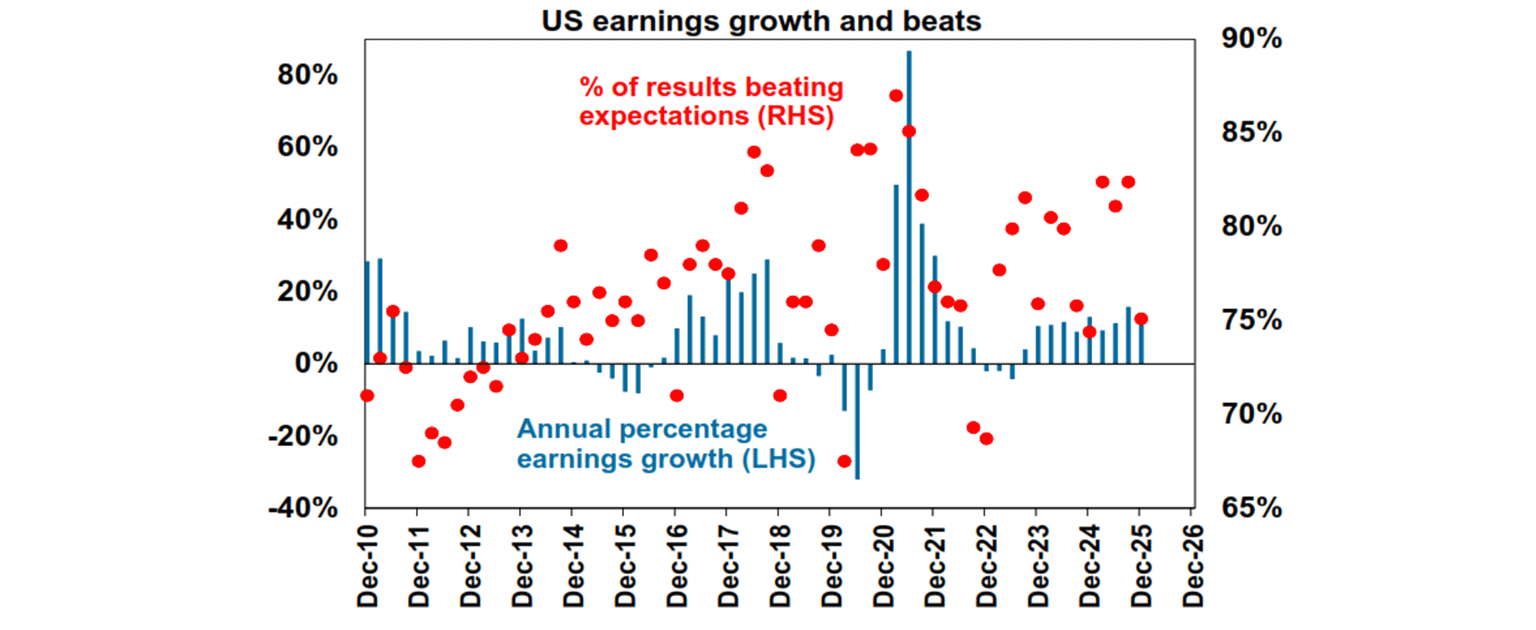

Around 85% of S&P 500 companies have reported December quarter earnings, with 75.2% beating expectations, which is slightly below the norm of 76.6%. Consensus earnings growth expectations are running at 11.9%yoy. Tech is leading the charge again with earnings up 26%yoy, financials up 12%yoy and materials up 9%yoy.

Canadian inflation for January came in a bit softer than expected leaving the Bank of Canada on hold but with still some possibility of another rate cut.

Weak UK jobs data and slowing inflation keep the Bank of England on track for rate cuts. Data for December showed unemployment rising to 5.2% with average wages slowing to 4.2%yoy. Inflation data for January saw a fall in core inflation to 3.1%yoy. Overall the soft jobs data and falling inflation leaves the BoE on track for further rate cuts.

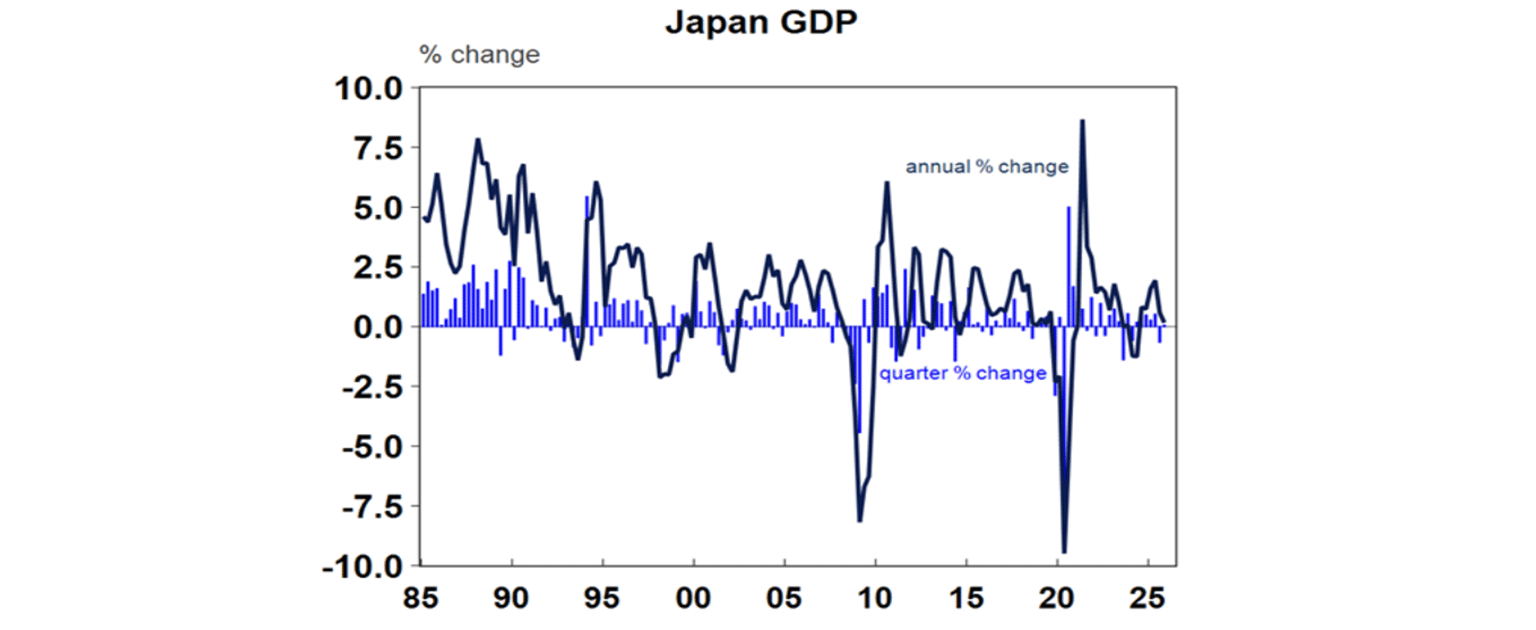

Japanese GDP growth rose a weaker than expected 0.1%qoq in the December quarter, but it masked solid growth in final demand. Inventory detracted from growth and net exports were flat. Japanese core inflation also fell to just 1.3%yoy in January. Taken together this is likely to see the BoJ remain gradual in raising rates.

The Reserve Bank of New Zealand left interest rates on hold at 2.25% as widely expected. However, its commentary was dovish relative to market expectations noting that it expects inflation to fall to the 2% target and that unemployment is elevated and that if the economy behaves as expected “monetary policy is likely to remain accommodative for some time.”

Australian economic events and implications

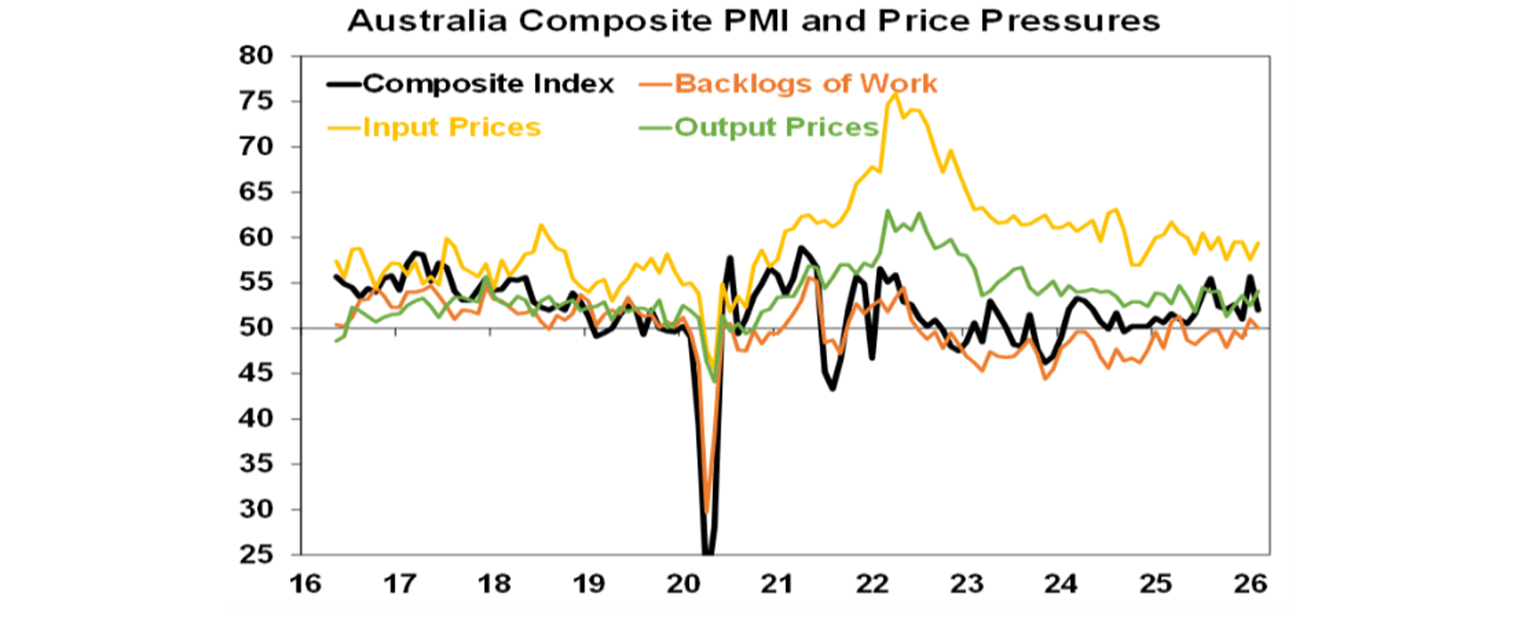

Australia’s February composite PMI fell sharply due to weaker services conditions but is trending at levels consistent with okay growth. Input and output price pressures rose but the output price index is running around levels consistent with 2-3% inflation and slower underlying inflation this quarter than last quarter.

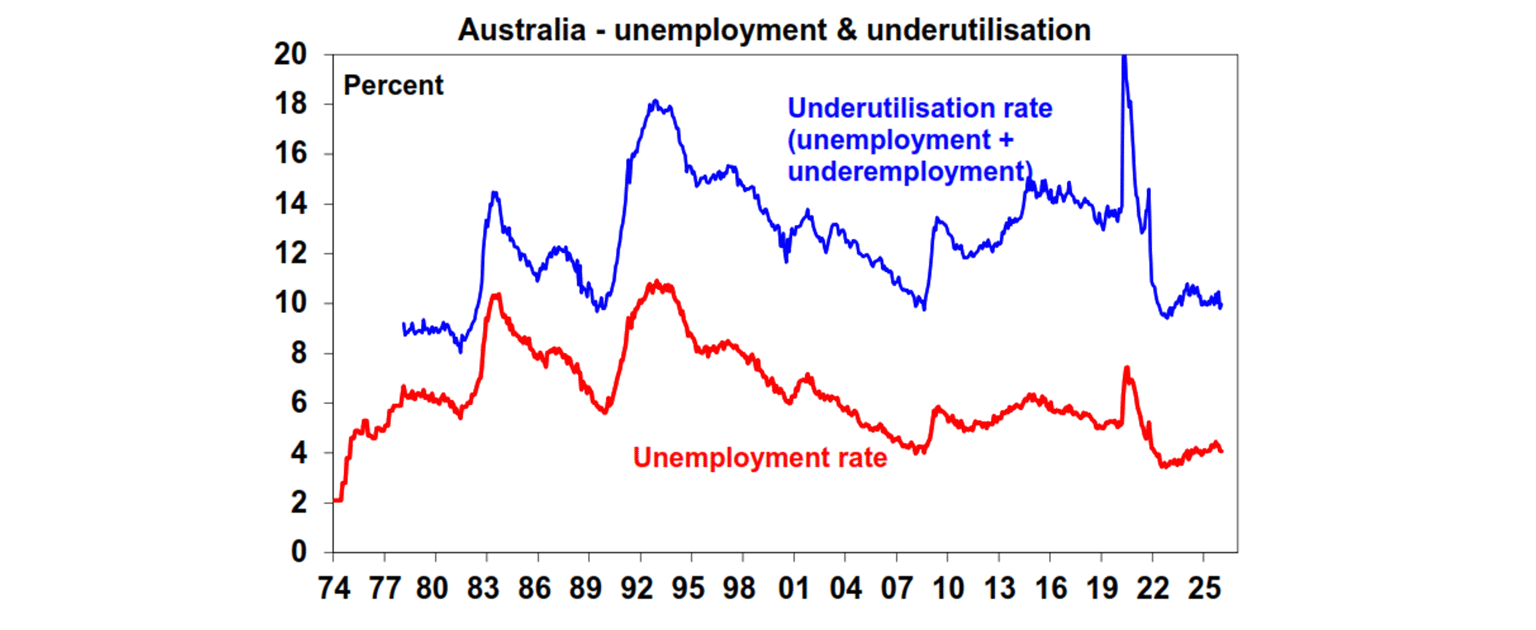

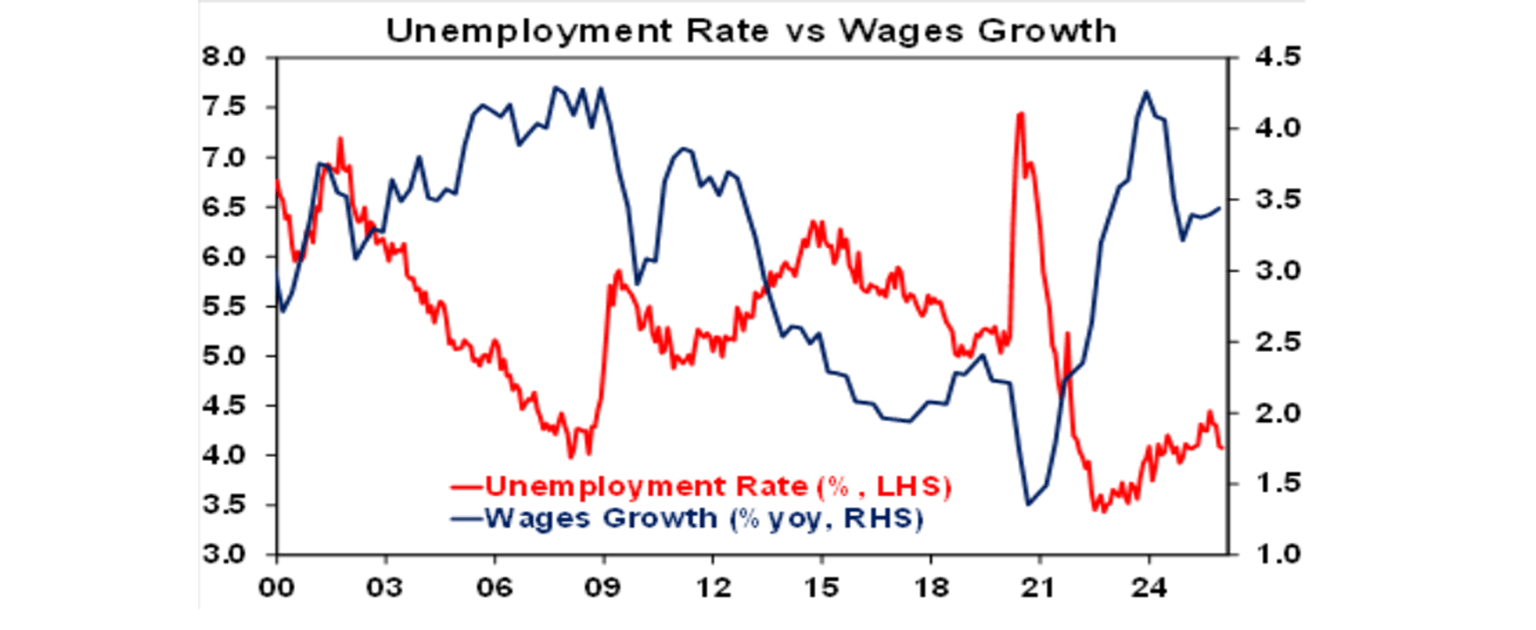

January jobs data was strong again, leaving a high risk of another rate hike. Employment rose by 17,800 after a 65,200 rise in December, hours worked rose solidly, unemployment fell to 4.1% and while underemployment rose to 5.9% it remains low historically. The participation rate remained down from its recent record highs, but this possibly suggests less pressure for some to seek work after last year’s rate cuts and rising household incomes.

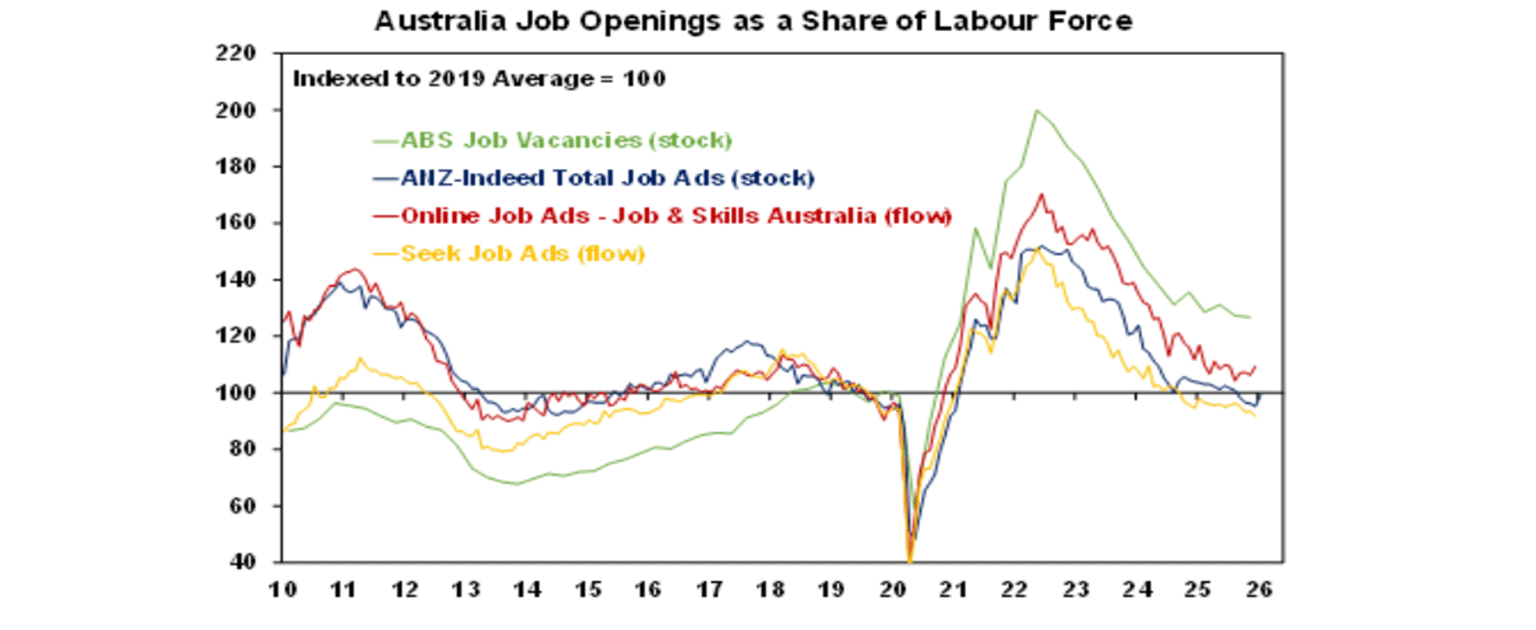

Jobs data can be volatile over the December/January period so the recent strength may prove transient. And the downtrend in job ads still warns of some slowing in jobs growth ahead. However, the RBA will likely continue to regard the labour market as being “a little tight” so on its own it adds to the case for another rate hike.

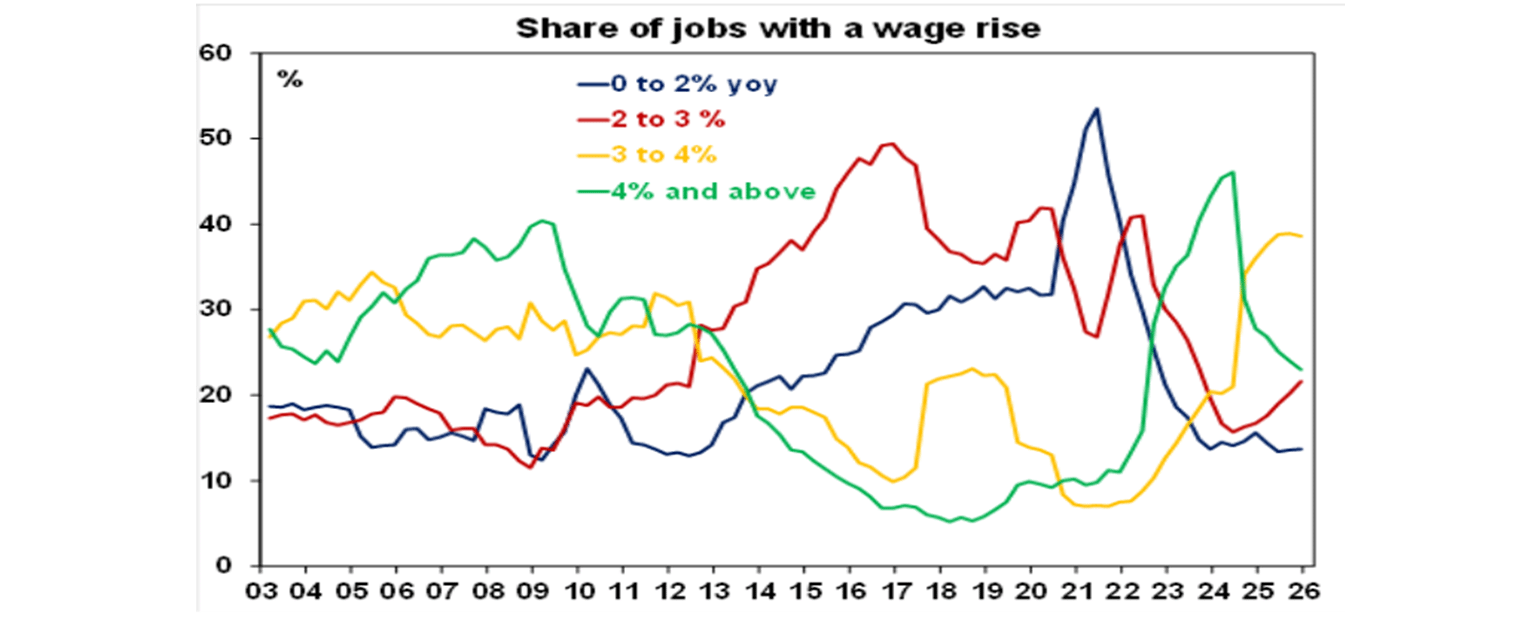

Wages growth as measured by the Wage Price Index was little changed in the December quarter at 0.8%qoq or 3.4%yoy, supported by strong growth in the public sector. Wages growth is down from its late 2023 peak of 4.3%yoy and there has been a decline in the proportion of jobs with a wage rise of 4% or more.

However, still low unemployment & strong wages growth in the public sector and in aged and child care appear to be acting to keep wages growth elevated. Demands for a catch up to higher inflation may keep it there.

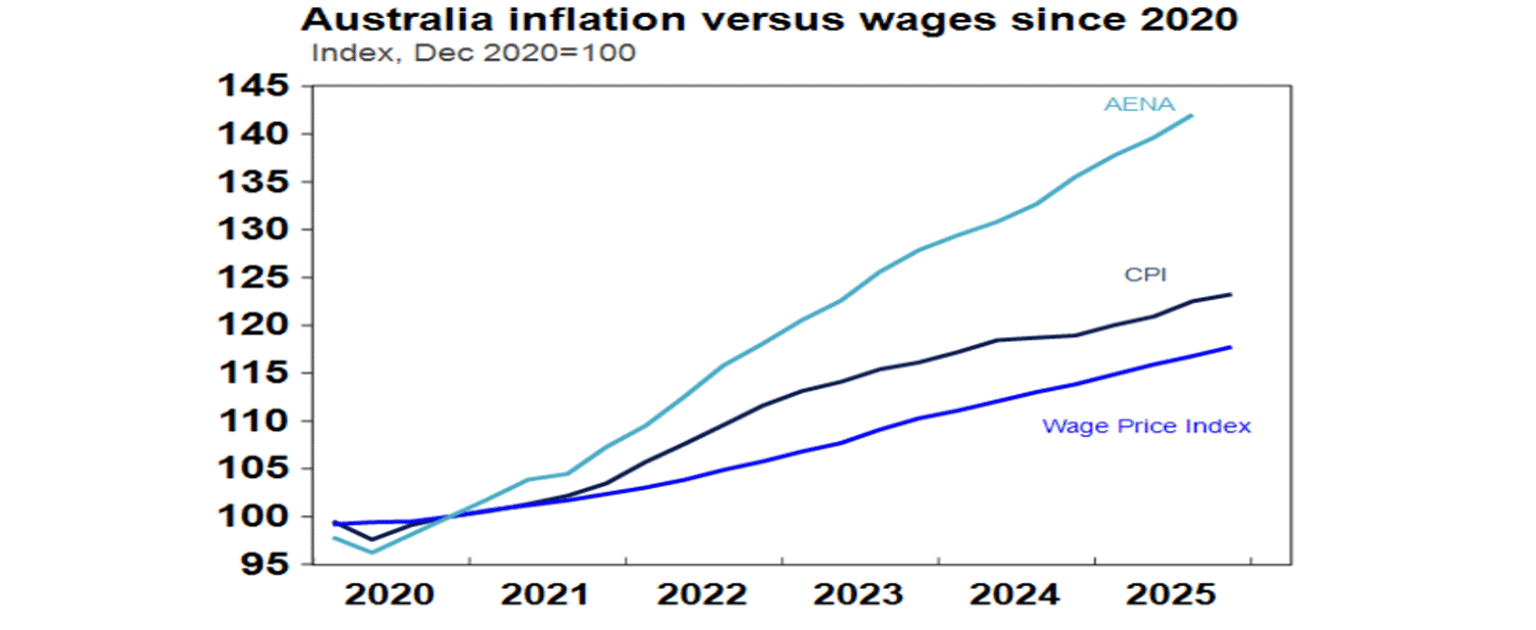

With the latest spike in inflation to 3.6%yoy (or 3.8%yoy with the monthly CPI) and the Wage Price Index up 3.4%yoy, real wages growth has gone negative again. Based on our forecasts, real wages on this measure won’t return to their 2020 level until around 2032. However, other data which is more relevant for household income growth as it makes allowance for compositional change in the workforce (ie more growth in higher paying jobs) and includes things like super payments shows average earnings growth well ahead of inflation and was up 5.6%yoy in the September quarter. Of course, this in turn suggests more a problem for inflation. The only way to sustain strong real wages growth of say 1% a year without just entrenching high inflation is to boost productivity growth to around 1% a year in order to reduce growth in unit labour costs to be more in line with the 2.5% inflation target. This requires a significant round of economic reforms – like broad based tax reform, deregulation and cuts to government spending.

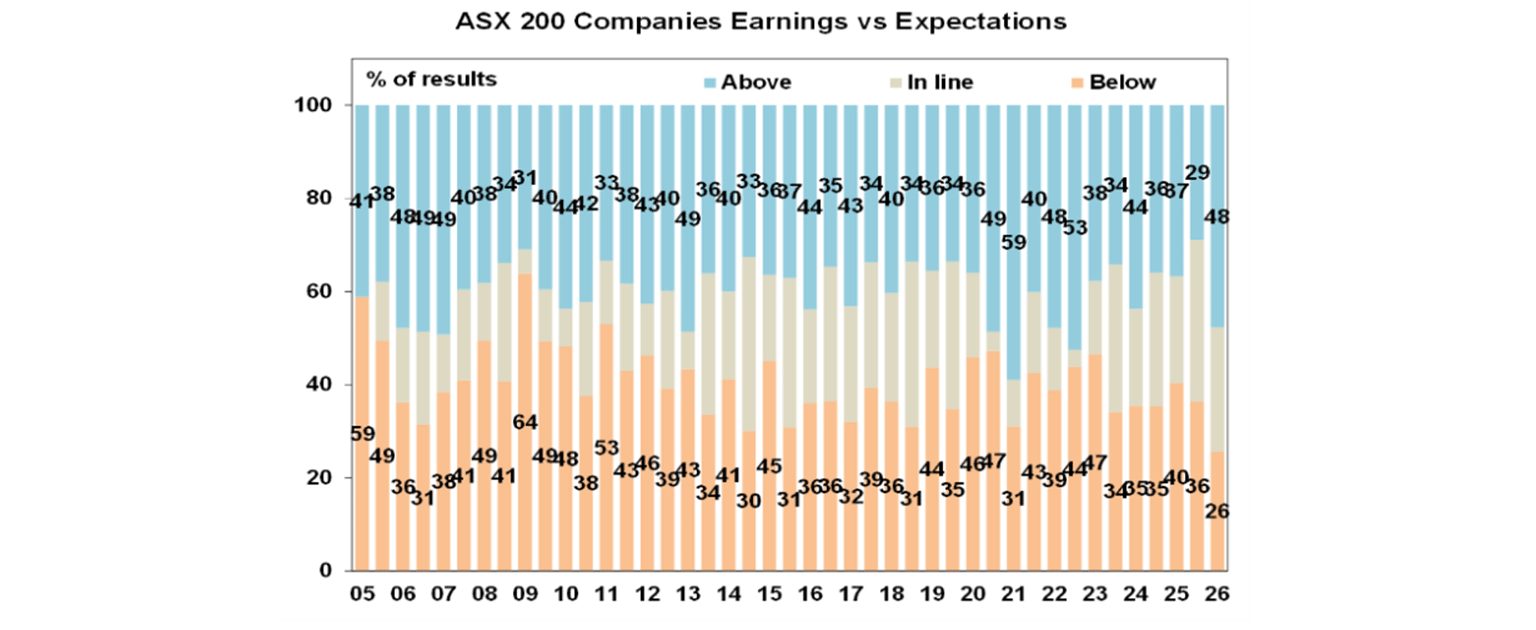

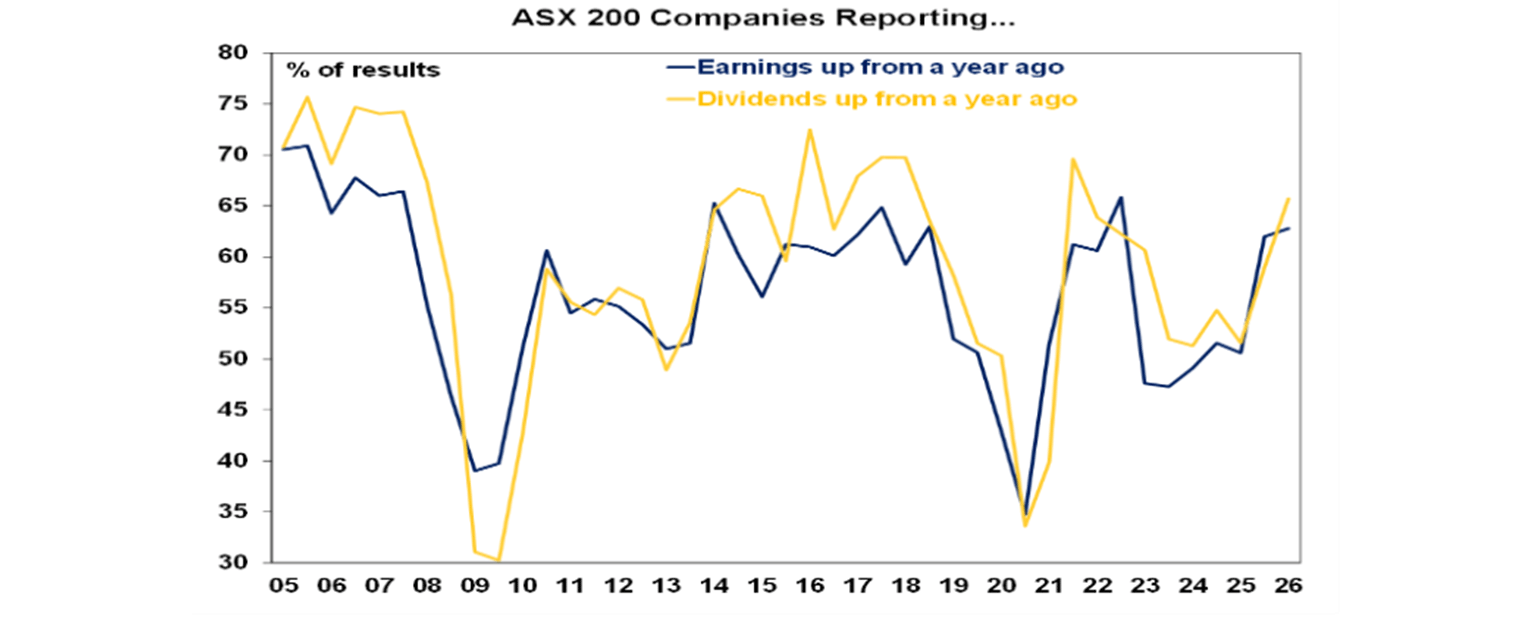

The Australian December half earnings reporting season is now about 60% complete and is confirming a return to profit growth. The consensus expectation is now for earnings growth of 12% this financial year mainly driven by a 32% surge in mining sector profits, with banks seeing around 8% growth, energy seeing an 18% fall and the rest of the market seeing profit growth around 7%. So far results are consistent with rising profits with upside surprises surpassing downside surprises by a wide margin and more companies reporting profits up on a year ago compared to what was occurring in 2023 and 2024. This is continuing to propel the share market higher. That said, results may soften over the final week as more small caps report.

So far beats are running well above misses with 48% of results surprising expectations on the upside, which is more than the norm of 40%, and just 26% have surprised on the downside which is less than the norm of 41%. This is the best since the emergence from the pandemic.

63% of companies have seen earnings rise on a year ago which is better than the norm of 56%.

66% of companies have increased their dividends on a year ago which is above the norm of 59%.

What to watch over the next week?

In the US, consumer confidence (Monday) is likely to show a slight rise, home prices (also Monday) are likely to show a further modest rise and producer price inflation data will be released Friday.

In Australia, the focus will be on January inflation data (Wednesday) which we expect to show some evidence of a cooling trend. CPI inflation is expected to show a fall to 3.5%yoy from 3.8%yoy in December as lower petrol prices and travel costs offset higher electricity prices. The all-important trimmed mean inflation rate is expected to rise 0.2%mom but with the annual rate dropping to 3.2%yoy from 3.3%yoy. If we are right then it will confirm the downtrend in monthly trimmed mean inflation since the spike last July to 0.47%mom and support our view that the RBA will leave rates on hold, but of course the RBA will continue to give more precedence to the quarterly inflation data with the March quarter data not due to late April.

In other data, expect a 2.2%qoq rise in December quarter construction (Wednesday), a 1%qoq rise in business investment (Thursday) and continued strong growth in housing credit (Friday). The Australian December half profit reporting season will wrap up with around 80 major companies due to report including Lend Lease, Woodside, Woolworths, Worley Parsons and Harvey Norman.

Outlook for investment markets

Global and Australian share returns are expected to slow to around 8% this year. Stretched valuations, political uncertainty associated with Trump & the midterm elections, AI bubble & tech valuation worries, and geopolitical risks are the main drags. But returns should still be positive thanks to Fed rate cuts, Trump’s consumer friendly pivot and solid profit growth. A return to profit growth should also support gains in Australian shares even though the RBA has increased rates. Another 15% or so correction in share markets is likely along the way though.

Bonds are likely to provide returns around running yield.

Unlisted commercial property returns are likely to be solid helped by strong demand for industrial property associated with data centres.

Australian home price growth is likely to slow to 5% or less due to poor affordability, the RBA raising rates with talk of more to come and APRA’s move to ramp up macro prudential controls.

Cash and bank deposits are expected to provide returns around 3.85%.

The $A is likely to rise as the interest rate differential in favour of Australia widens as the Fed cuts and the RBA holds or hikes. Fair value for the $A is around $US0.72.

You may also like

-

Weekly market update - 20-02-2026 Global share markets mostly rose over the last week as worries about AI and tech valuations took a breather but concerns about a US strike on Iran acted as a constraint. -

Econosights - An update on global debt and fiscal policy With the International Monetary Fund releasing their Global Fiscal Monitor recently, AMP's Senior Economist, Diana Mousina provides an update on the global debt situation and recent fiscal policy announcements. -

Oliver's Insights - Nine key charts for investors Share markets have had a bit of a wobbly start to the year, particularly in the US. This note looks at nine key charts worth watching.

Important information

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account. Taxation issues are complex. You should seek professional advice before deciding to act on any information in this article.

It’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you. The super coaching session is a super health check and is provided by AWM Services and is general advice only. It does not consider your personal circumstances.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy. All information on this website is subject to change without notice. AWM Services is part of the AMP group.