Key points

Talk of RBA rate hikes is premature. Inflation at just over 3% is not a problem for the economy, there are more downside than upside risks to the economy, job ads are flat-lining, rather than accelerating, public sector spending will slow and private sector growth is not-broad based.

The consumer is more cost-conscious and sensitive to sales periods than in recent times and is unlikely to be a significant driver of economic growth in 2026.

Interest rate hikes would risk slowing the economy given these vulnerabilities. In our view, there is a larger risk of a rate cut than a hike in 2026.

Introduction

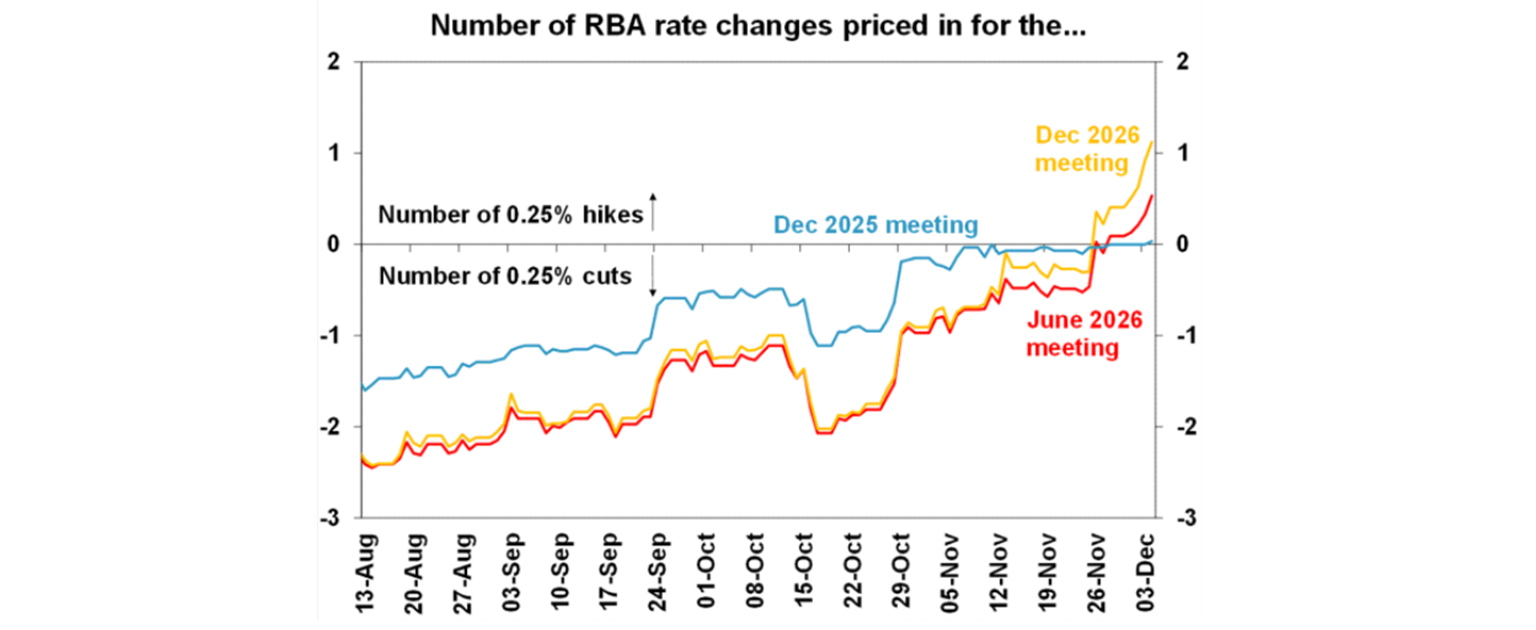

Financial markets “price” in expectations for central bank rate decisions. This is evident in asset prices like bond yields and forward rates and swaps. Financial market pricing for interest rates can move quickly on changing economic data. The general direction in which financial markets move on interest rate expectations tends to be accurate, but caution needs to be taken about the actual level of interest rates it predicts. In recent weeks in Australia, higher inflation data, hawkish comments from the Reserve Bank of Australia, better news on unemployment and stronger economic growth data have resulted in financial markets pricing in a rate hike by this time next year (see the chart below). Numerous economists and media commentators are also weighing up the risk of a rate hike as soon as February 2026.

Here are 3 reasons why the RBA should not be hiking rates anytime soon.

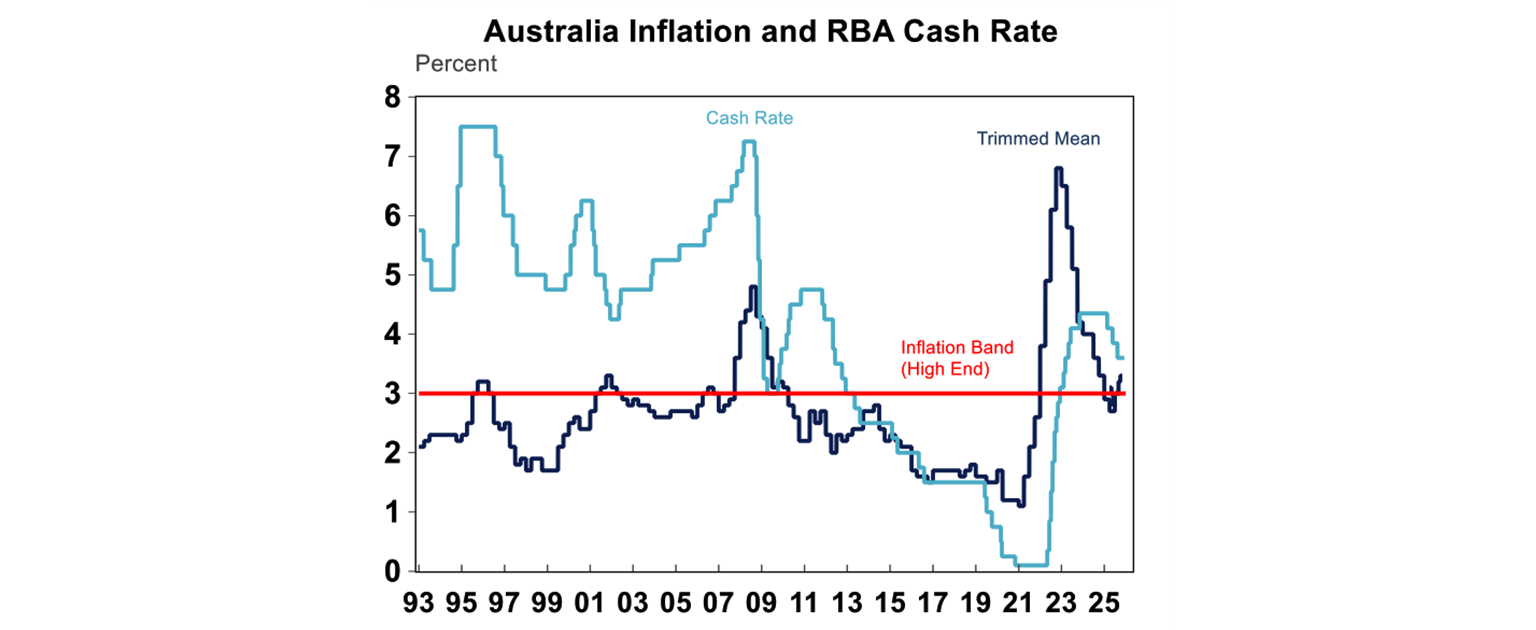

1. Inflation at around 3% is not a problem

Given current issues with interpreting monthly Australian inflation data I thought it would be better to average out the last 3 months of data to read through the volatility, which was also advised by the ABS. On this measure, Australian headline inflation is at 3.5% over the year to October which is elevated due to electricity price swings as rebates finished. Trimmed mean inflation (Australia’s version of core) is at 3.2%. This is of course well above the RBA’s 2-3% inflation target, with the RBA now even more focussed on achieving the midpoint of 2.5% (Michelle Bullock said in November at the post-meeting press conference “the Board is definitely targeting 2.5%... under 3% is not good enough”). This indicates that the Board will not be in a rush to cut interest rates again anytime soon with the annual inflation rate having a 3 in front of it. However, it does not mean that the Board will be in a rush to raise interest rates either, unless of course the recent upside surprise in the inflation data keeps going higher.

The RBA started inflation targeting in 1993. Since then, headline inflation has been in the 2-3% target 35% of the time and trimmed mean has been in target 56% of the time. The point of this is to tell you that swings outside of the target band are actually very normal. It also demonstrates that on average, inflation does average out to be between 2-3%.

Central bank inflation targets reflect optimal growth of prices in an economy. Inflation that is too high erodes purchasing power and tends to destabilise an economy (based on history) and inflation that is too low sets an economy up for poor performance. Measured inflation theoretically actually overstates the true pace of price growth due to the substitution effect and quality improvements. Lets dig into both of those.

The substitution effect

The consumer price index is constructed using a weight for each item and the price for that item. The weights of spending on items are updated once a year based on consumer spending figures. But consumer preferences for goods and services change more frequently because consumers are sensitive to price swings and substitute for cheaper items. For example, imagine a supply shortage of bananas due to a hurricane in Queensland led to surge in banana prices. Instead of purchasing bananas, consumers may choose apples which are relatively cheaper but still a suitable fruit option! The CPI weights will not adjust quickly enough to account for this small shift and will assume that consumers are eating more bananas than they actually are. So the CPI data will be overestimating inflation in this example.

Quality improvements

Think about how much you can achieve with the device that is probably positioned right next to you or you be using it right now to read this. An iPhone in 2010 cost around $999, which in today’s dollars is worth over $1400, not too much lower than the cost of the lowest range iPhone 16 these days. But, the difference in the product between what you got in 2010 versus today is worth much more than the price difference, from the quality of camera, resolution, speed and display (amongst other things!). The statistics agencies try to account for these quality improvements over time which is why we see communication prices go down over time. But quality improvements can be hard to quantify, especially in the short-term which means that inflation may be overstated.

I am not trying to say that there are not problems in some part of the inflation basket in Australia, especially for essentials. I am just trying to make the point that we should not be in a panic if inflation is slightly outside of target, especially if this is expected to be temporary.

We expect that inflation will trend down rather than up in 2026, and we see trimmed mean back around the midpoint in the second half of 2026. Wages growth is moderating, immigration is slowing from recent levels, public spending growth is softening and adding less demand into the economy, global energy prices are set to fall as wars are likely to be resolved and China’s deflation will help to contain goods prices.

I find it hard to argue that inflation is going to reaccelerate from here. Certainly, it could remain elevated and sticky in areas related to administrative costs but it’s hard to see consumer spending revving up again, which is the main reason that we could see a pick up in market services inflation.

2. The outlook for the labour market is uncertain

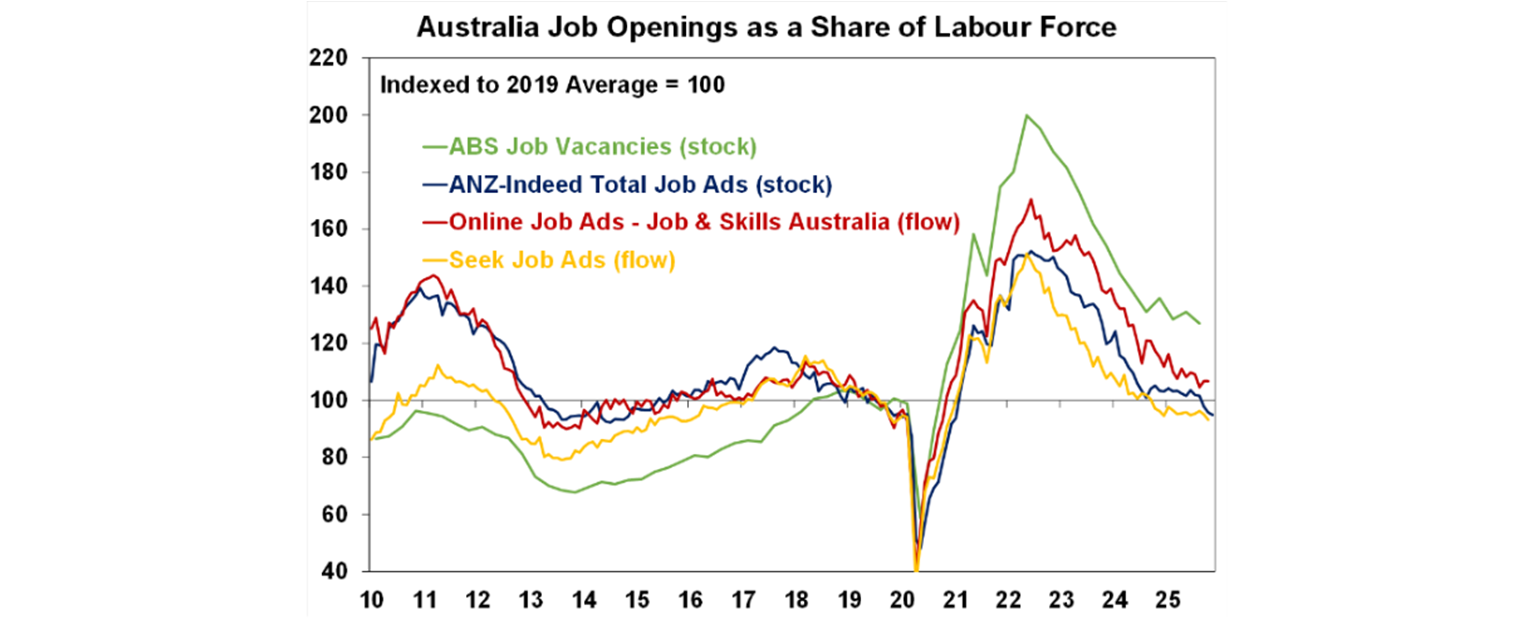

The labour market is around balanced at the moment. Employment growth has softened a little and part of this is slower supply and some softer demand. The unemployment rate has been hovering between

4.3% - 4.5% for months. Underemployment is still low. The forward-looking labour market indicators are basically flat-lining or trending a little lower. So, the risks to the labour market are with a slowing in jobs growth (rather than a jobs reacceleration), similar to what is occurring in our global peers. It would be unwise to destroy jobs just to get inflation to 2.5%.

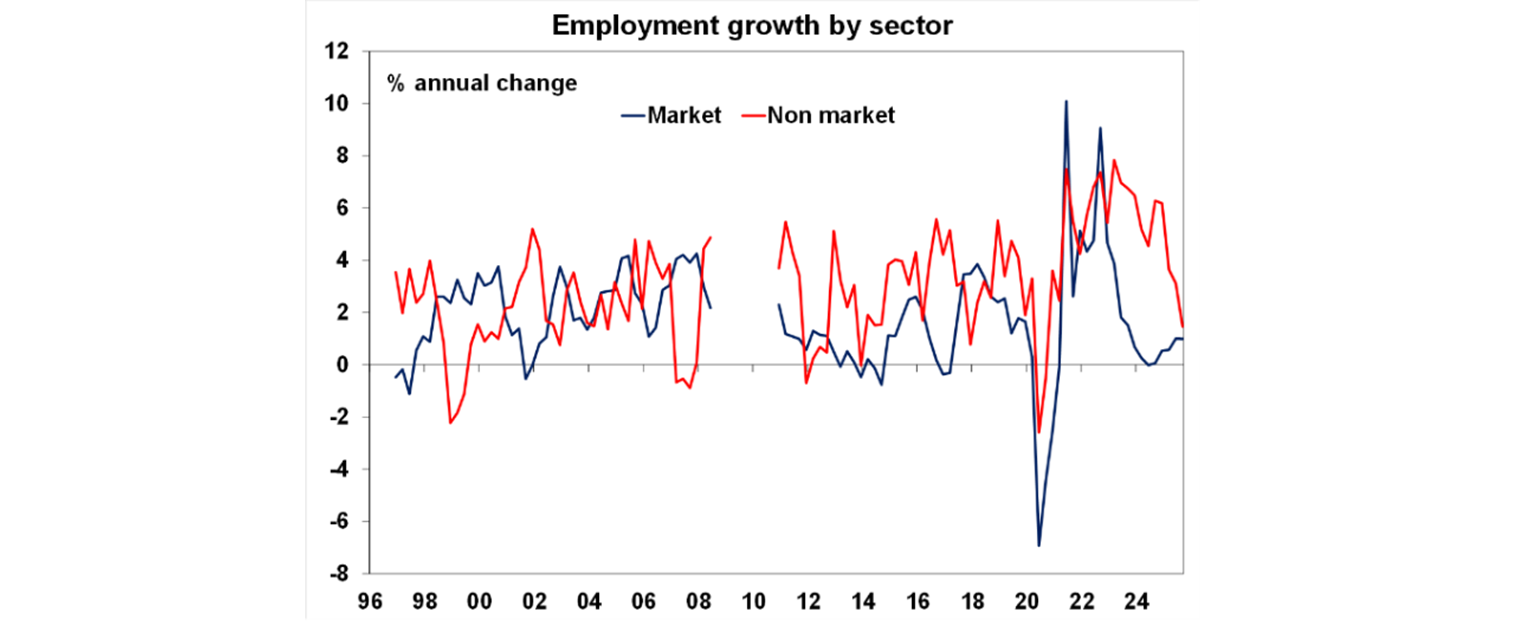

The mix of jobs growth has been squarely focussed in the non-market sector (education, healthcare and government administration). This is now slowing as public sector spending decelerates. Market jobs growth is positive, but low and needs to be stronger to fill the hole left by the non-market sector.

The public sector in the labour market

Around 18% of employees- about 2.6 million people - are directly employed by the public sector. However, this figure understates the broader influence of government on the economy. Many private industries are closely tied to public funding, such as healthcare and education, or depend on public projects, like infrastructure and professional services. Over the past year, the non-market sector (healthcare and social assistance, education, and public administration), which serves as a strong proxy for public sector employment, accounted for an extra ordinary 93% of total jobs growth. Non-market employment rose by 4.4% over the year, while market sector jobs barely grew, up just 0.2% (see chart below). Clearly, the non-market sector has been the main driver of labour market strength over the past two years.

3. The pick up in economic growth is not broad based

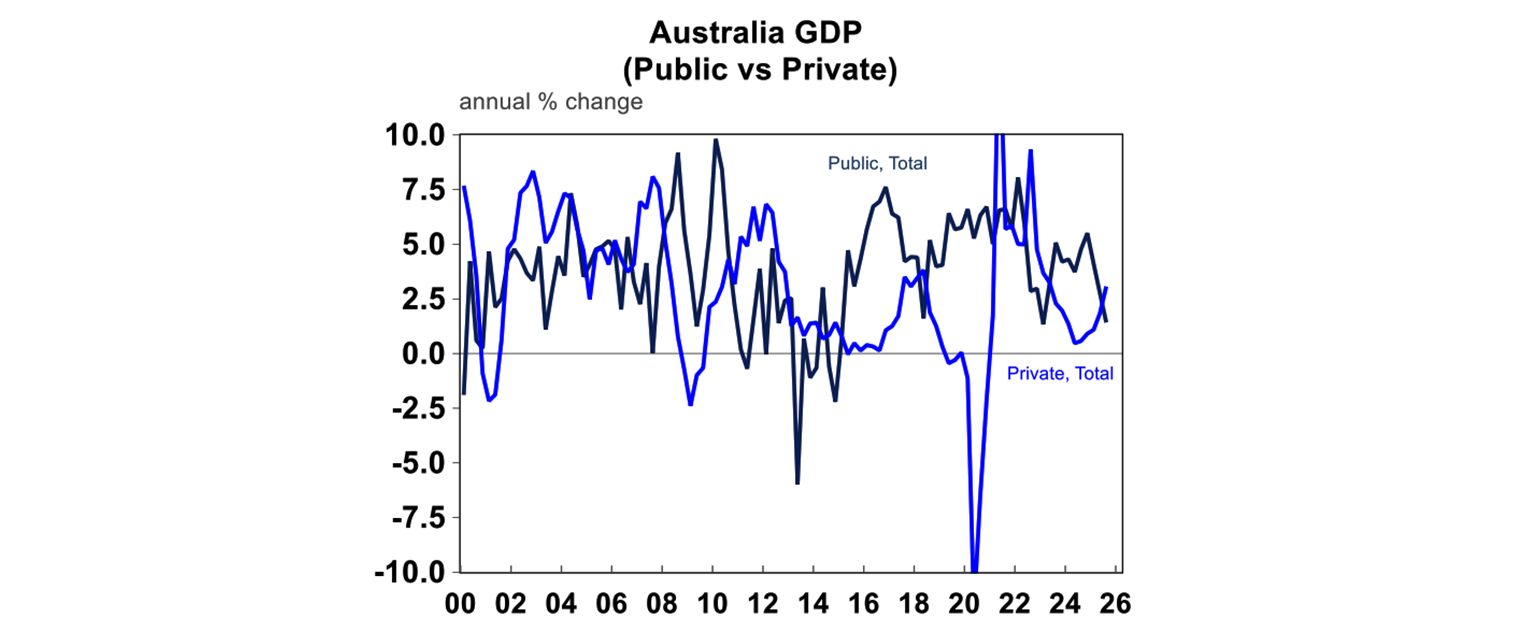

In recent years, the public sector has been a dominant contributor to economic growth. Part of this was a cyclical post-pandemic response, part is structural from an aging population that requires more service jobs and part of is fundamentally just more public sending as the Labor Party appeals to its base. The latest September quarter GDP data showed stronger private sector growth, but a lot of it was a big boost to data centre business investment while other parts of private investment are weak. Building approvals data suggests that residential construction growth is low and the consumer is not firing on all cylinders, but rather cost conscious sensitive to sales periods. It is hard to see strong growth in average consumer spending in 2026. So, private sector growth needs to be more broad-based in 2026 for GDP growth to remain at its current level.

Implications for investors

Financial markets are fickle and interest rate predictions can move quickly. It’s clear that a rate cut will not be part of the policy debate in the near-term. But there are still more risks for a rate cut than a rate hike in 2026. The most likely scenario is that interest rates are on hold for an extended period from here. Given that other central banks are cutting rates by more than Australia, there may be some upside for the $A in 2026.

Diana Mousina

Deputy Chief Economist, AMP

You may also like

-

Weekly market update - 27-02-2026 Australian shares are a key beneficiary of the rotation trade helped by the now concluded December half earnings reporting season confirming that listed company profits are rising again. -

The outlook for Australian shares – is the long underperformance over? Australian shares have had a strong start to 2026 with the ASX 200 up 3.3% and flirting with a new record high. The local market has also outperformed US shares which are down 0.1% and global shares which are up 1.6%. However, this could just be noise and follows a significant underperformance against US and global shares since 2009. -

Weekly market update - 20-02-2026 Global share markets mostly rose over the last week. Worries about AI and tech valuations took a breather and the US Supreme Court decision to strike down Trump’s emergency power tariffs with Trump immediately announcing a replacement were seen as having little impact on the US growth outlook but were seen as positive for other countries.

Important information

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account. Taxation issues are complex. You should seek professional advice before deciding to act on any information in this article.

It’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you. The super coaching session is a super health check and is provided by AWM Services and is general advice only. It does not consider your personal circumstances.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy. All information on this website is subject to change without notice. AWM Services is part of the AMP group.