Global markets had a volatile week amidst ongoing US tariff threats, fears of a US strike on Iran, some mixed US earnings news, Trump’s announcement of Kevin Warsh who is seen as less dovish as his nomination for Fed Chair to replace Powell, and volatility in the US dollar. US shares still managed to rise 0.3% for the week though helped by generally strong earnings news, Eurozone shares gained 0.2% and Chinese shares rose 0.1%, but Japanese shares fell 1%. Despite increased expectations for an RBA rate hike after high inflation data the Australian share market rose 0.1% for the week. Bond yields rose slightly in the US, but were flat in Japan and fell in Europe and Australia.

The main action was in gold and silver though. Ongoing erratic policy making in the US and the high levels of geopolitical risk saw gold and silver initially surge (with gold rising above $US5000 for the first time ever) only to then fall back sharply on Trump’s nomination of Warsh as Fed Chair on expectations he will be less dovish than other choices. This looks like a bit of a correction though – albeit a very severe one for silver – as both gold and silver were very overbought and vulnerable to a sharp fall having risen so far so fast. And in the near-term Warsh is likely to be dovish advocating for lower rates. Bitcoin fell again over the last week. Oil prices rose further on increasing concerns about a US strike on Iran, but metal and iron ore prices fell. The $A initially surged above $US0.70 on the back of heightened expectations for an RBA rate hike and as the $US fell further, only to then fall back on news of Warsh’s nomination. The $A still rose over the week though and the $US still ended lower.

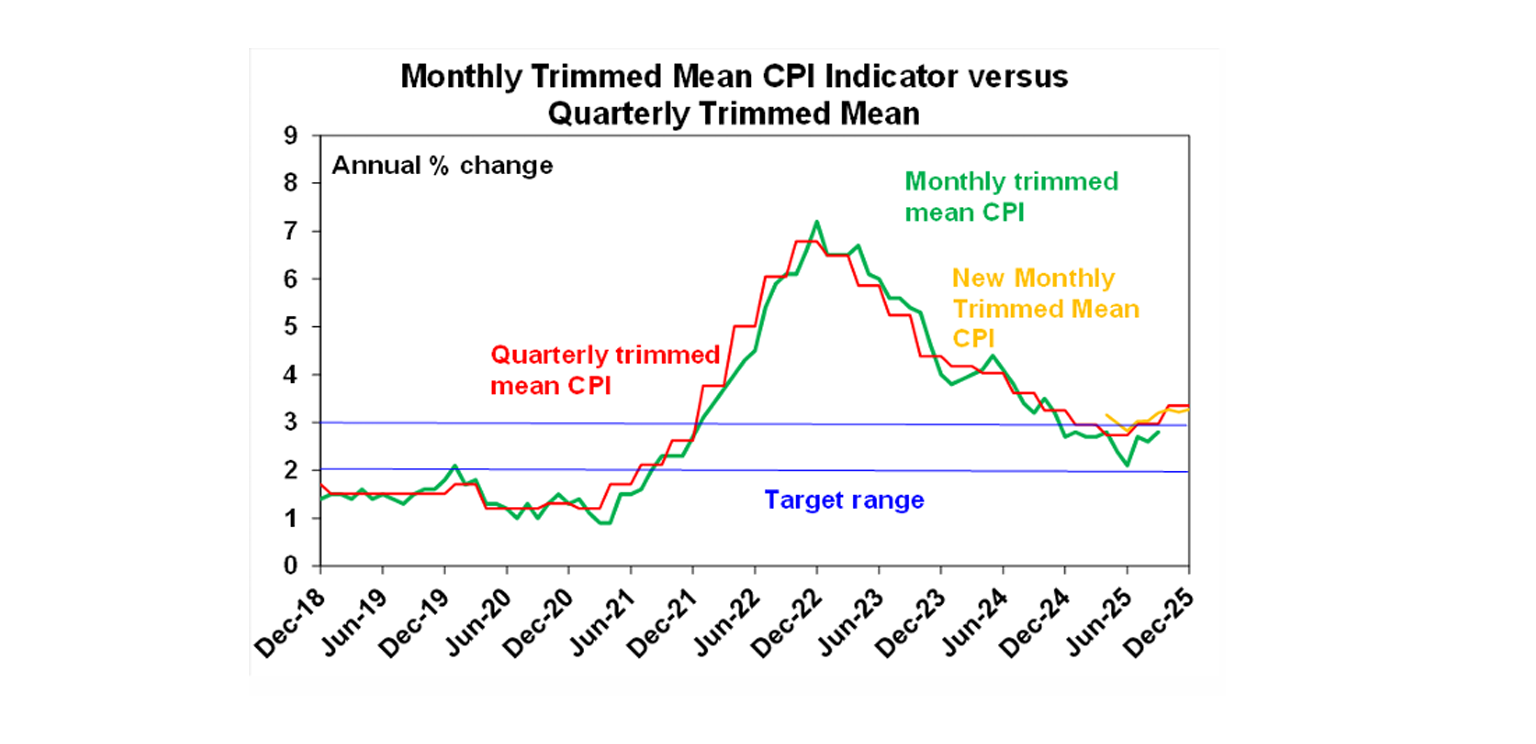

Another high inflation reading in Australia. December CPI data showed a further rise in inflation to 3.8%yoy with trimmed mean inflation rising further to 3.4%yoy in the month. The RBA will focus on the December quarter trimmed mean and it rose 0.9%qoq or 3.35%yoy.

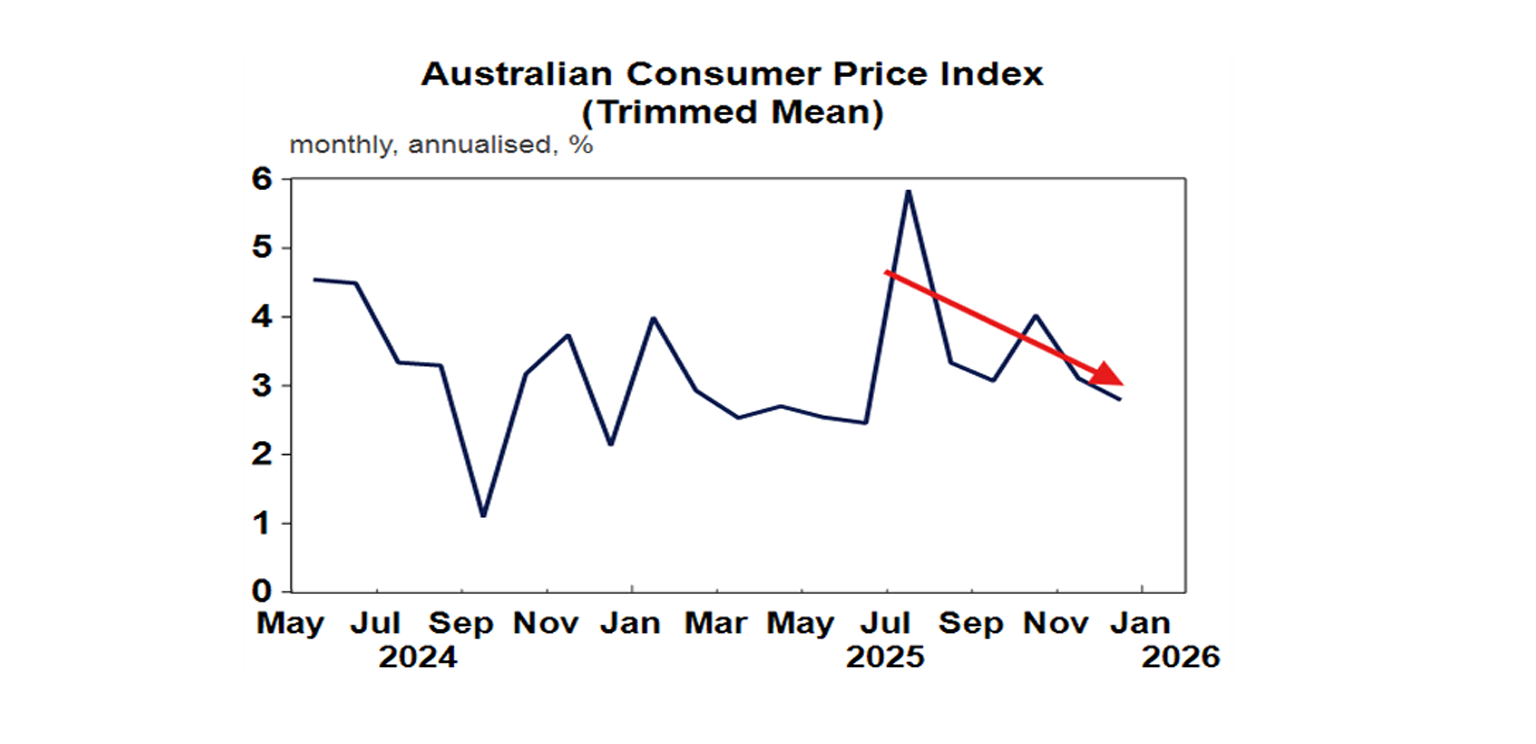

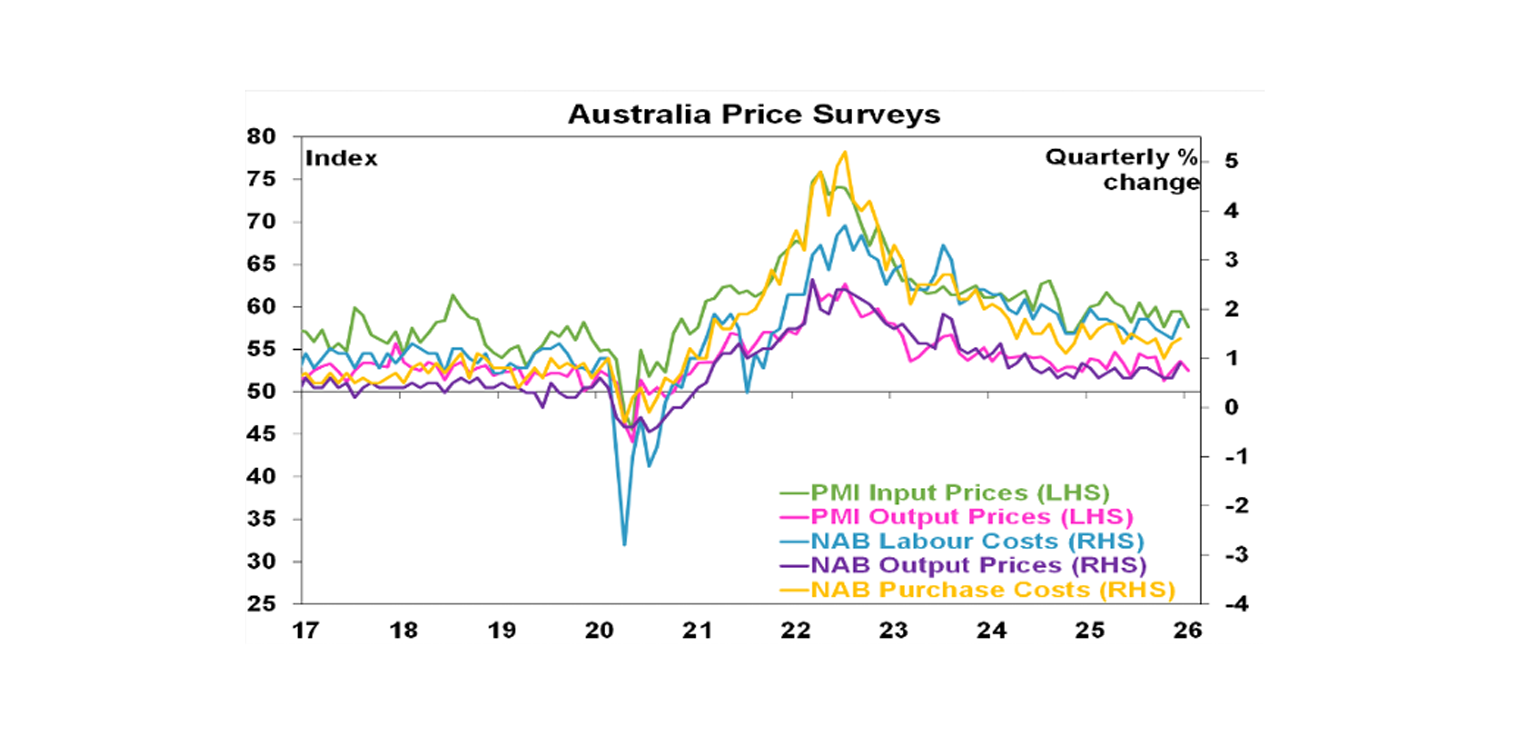

This provides a messy read in terms of what the RBA will do in the week ahead. On the one hand: all key measures of inflation are now well above target; the December quarter trimmed mean is above what the RBA was forecasting last November; services inflation edged up; goods price inflation is well up from its lows; and the gap between the proportion of items seeing price rises above 3%yoy and those seeing less than 2%yoy widened further. This has come on the back of a fall in unemployment to 4.1% indicating that the labour market remains tightish. On the other hand: monthly trimmed mean inflation has progressively trended lower from 0.47%mom in July to 0.23%mom in December (see the next chart which shows a downtrend in the annualised monthly trend mean since July) and slowed from 1%qoq in the September quarter to 0.9%qoq in the December quarter; rent and new dwelling price increases slowed in December; we still expect inflation to fall back to around target by late this year and revised RBA forecasts are likely to be similar; business surveys show output price indicators running around levels consistent with the inflation target (see the NAB survey comments below); consumer spending is likely to take a hit if we go so quickly from rate cuts to hikes as mortgage stress likely remains high; and the rise in the Australian dollar is a defacto monetary tightening that will help lower imported inflation. So, all up the RBA’s decision for Tuesday is a very close call.

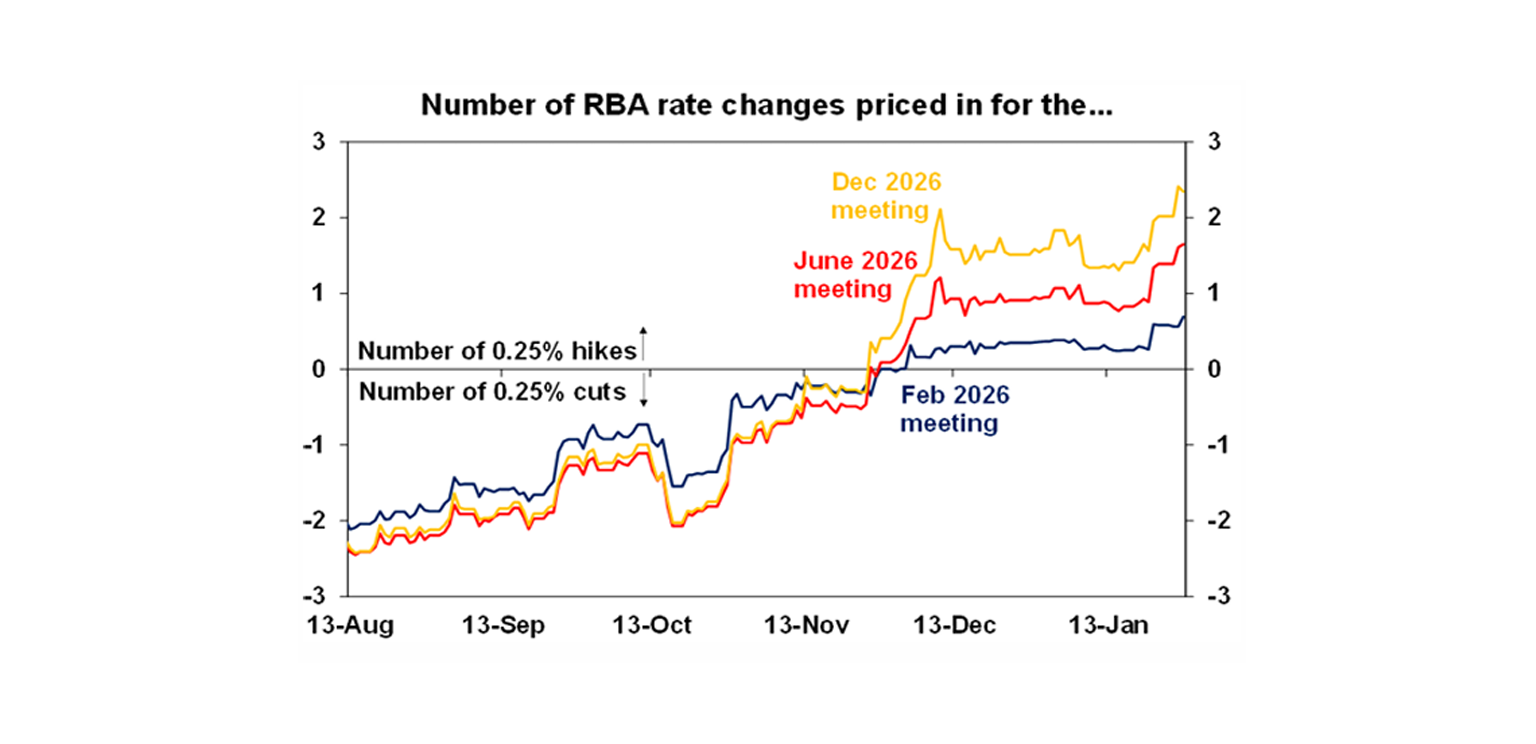

We think the RBA will probably hold. On balance we think that, given the cross currents and in particular the downtrend in trimmed mean inflation, the RBA should and probably will leave rates on hold and wait for more information but it’s a close call and not one we have a lot of confidence in. We would put the probability of a hike as being around 49% versus 51% for a hold. If there is a 0.25% hike, given the above considerations we would see it as a case of being one and done. In this context money market pricing for a 66% chance of a hike on Tuesday is too high – 51% would be more reasonable! – and the pricing in of more than two rate hikes is a bit too much.

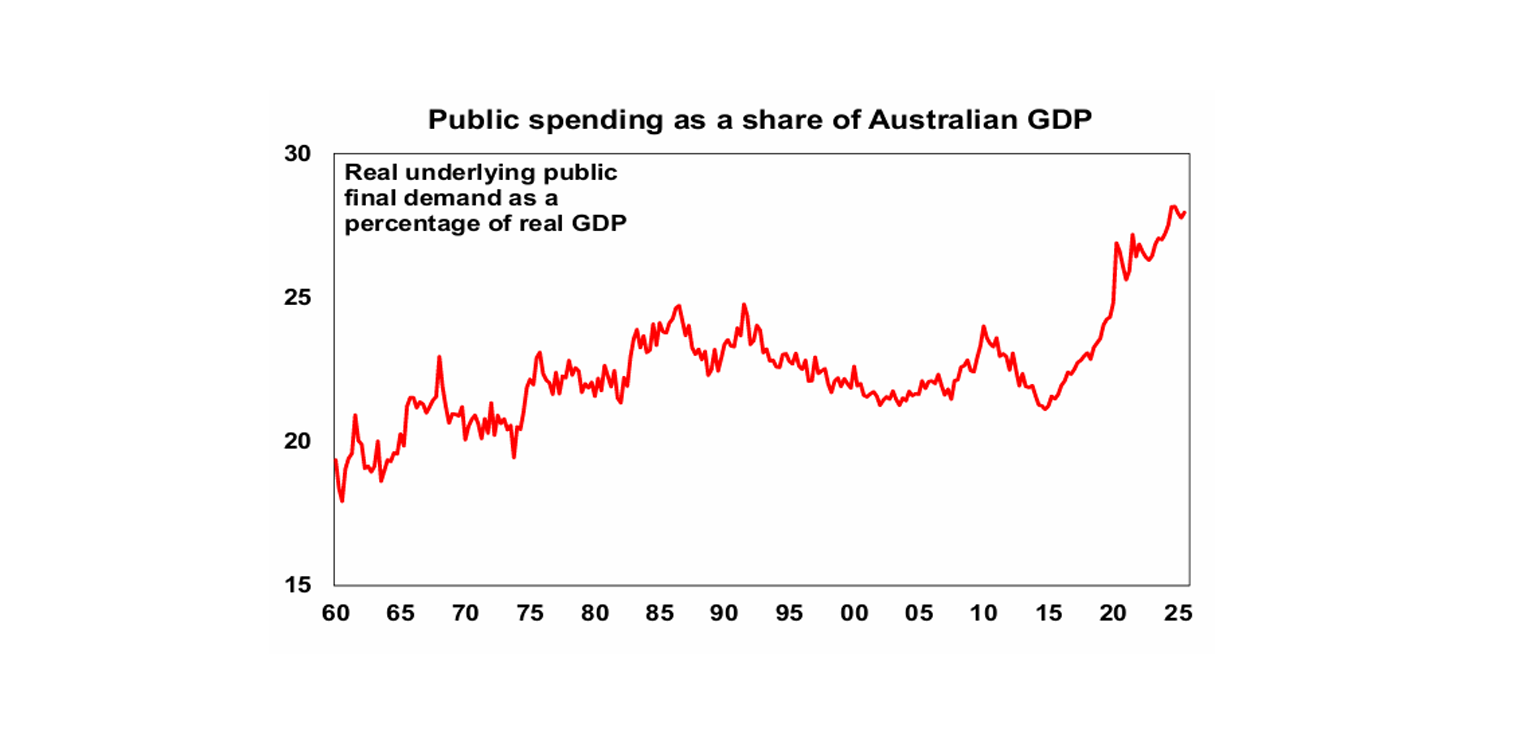

Australian governments should be doing more to make the RBA’s job easier. Government is contributing to the strength in inflation in Australia in two ways. First, prices for items administered by government or indexed are rising around 6%yoy, well above the 2.9%yoy price rises for items in the market sector of the economy. Second, while public spending growth slowed to around 1.4%yoy in the September quarter that followed many years of 4% plus growth which left public spending around a record 28% of GDP. This has constrained the recovery in private spending that can occur without seeing the economy bump up against capacity constraints, which flows through to higher prices. So the best thing that Australian governments can do to help bring down inflation would be to cut government spending back to more normal levels which would free up space for private sector growth without higher inflation. Lower public spending will also help boost productivity which should help lower inflation longer term.

For mortgage holders, if the RBA does hike by 0.25% it would likely be passed on in full to variable mortgage rates which for an average mortgage would mean roughly an extra $110 in interest payments a month or an extra $1300 a year. This will likely dent consumer confidence and spending, particularly if expectations remain for more hikes, and could snuff out the recovery in consumer spending.

Globally, Trump related mayhem continued in the last week with another flurry of activity. At a high level we saw Trump threaten a 100% tariff on Canada if its trade deal with China goes ahead and a 25% tariff for South Korea, conflicting messages regarding the falling $US with Trump implying its “great” and Treasury Secretary Bessent saying the US wants a “strong dollar” and another fatal shooting from ICE in Minneapolis leading to the threat of another partial Government shutdown from 31 January as Democrats threatened funding for ICE. And a US strike on Iran could be close with US warships now deployed to the Gulf and Trump warning Iran it needed to make a nuclear deal (which seems at odds with recent concern about protesters and claims its nuclear capability was “obliterated” last year).

Despite a bit of volatility, global share and bond markets remain fairly resilient as the US and global growth outlook remains solid, US profits are still rising strongly and investors are continuing to assume that Trump will back down from his noisy threats with a TACO or a TUNA (Trump Usually Negates Announcements – with analysis by Bloomberg Economics showing that only 20% of his tariff threats are imposed in full) with the bar to a backdown being much lower in an election year. So Trump’s threatened extra tariffs on Canada and Korea are unlikely to happen. And the shutdown is likely to be very brief as a government funding deal has been agreed, with separate funding for Homeland Security for two weeks pending talks to limit ICE with Trump realising they have gone too far. Congress is likely to pass the broader funding bill on Monday, meaning the shutdown will only last two or three days.

That said the risks around Iran are very high. A strike on Iran could threaten Iranian oil supplies which are around 3.5% of global oil production which could be offset by spare capacity in Saudi Arabia and the UAE. But the threat to oil supplies could escalate if the Iranian regime is pushed towards collapsing as it may conclude it has nothing to lose by disrupting neighbouring countries oil production or the Strait of Hormuz through which around 20% of the world’s oil supplies flows which could then drive a spike in oil prices threatening global growth. Trump likely has minimal tolerance for this though given its an election year.

President Trump announced that former Fed governor Kevin Warsh is his nomination for Fed chair to replace Powell. The move away from National Economic Council Director Hassett looks to have been due to Senate & market pressure after Powell’s statement about his subpoena from the DoJ on concerns that Hassett will be too political and dovish. As a former Fed governor and more conventional choice Warsh should see an easier Senate approval process than Powell. That said, the DoJ subpoena of Powell will have to be resolved before the Senate will consider Warsh so there could still be some delays. The initial reaction in investment markets - $US up, shares down a bit, gold and silver down sharply - reflects perceptions that he will be more hawkish than Hassett. But in reality, he is likely to come in as very dovish on rates (otherwise Trump would not have appointed him) and so will likely argue for rate cuts, but longer term he is likely to be more balanced and he is known not to like QE. In arguing for lower rates this year he will have to convince other Fed officials who likely will still include Powell. Concerns about Fed independence will likely remain but will be far less intense if Warsh is confirmed. If Powell and Cook remain on the Fed’s Board they may recede as Trump will not have control of the Board.

Despite all the noise, demand for a hedge against Trump’s weakening of “US exceptionalism” is likely to remain suggesting ongoing weakness in the $US, and a likely still rising trend in gold and silver despite the huge pullback in the last few days. The impact of Trump’s berating of allies is also evident in Canada’s deal with China and more significantly the free trade deal between the EU and China. As the US becomes more insular other global economies are agreeing trade deals and alliances!

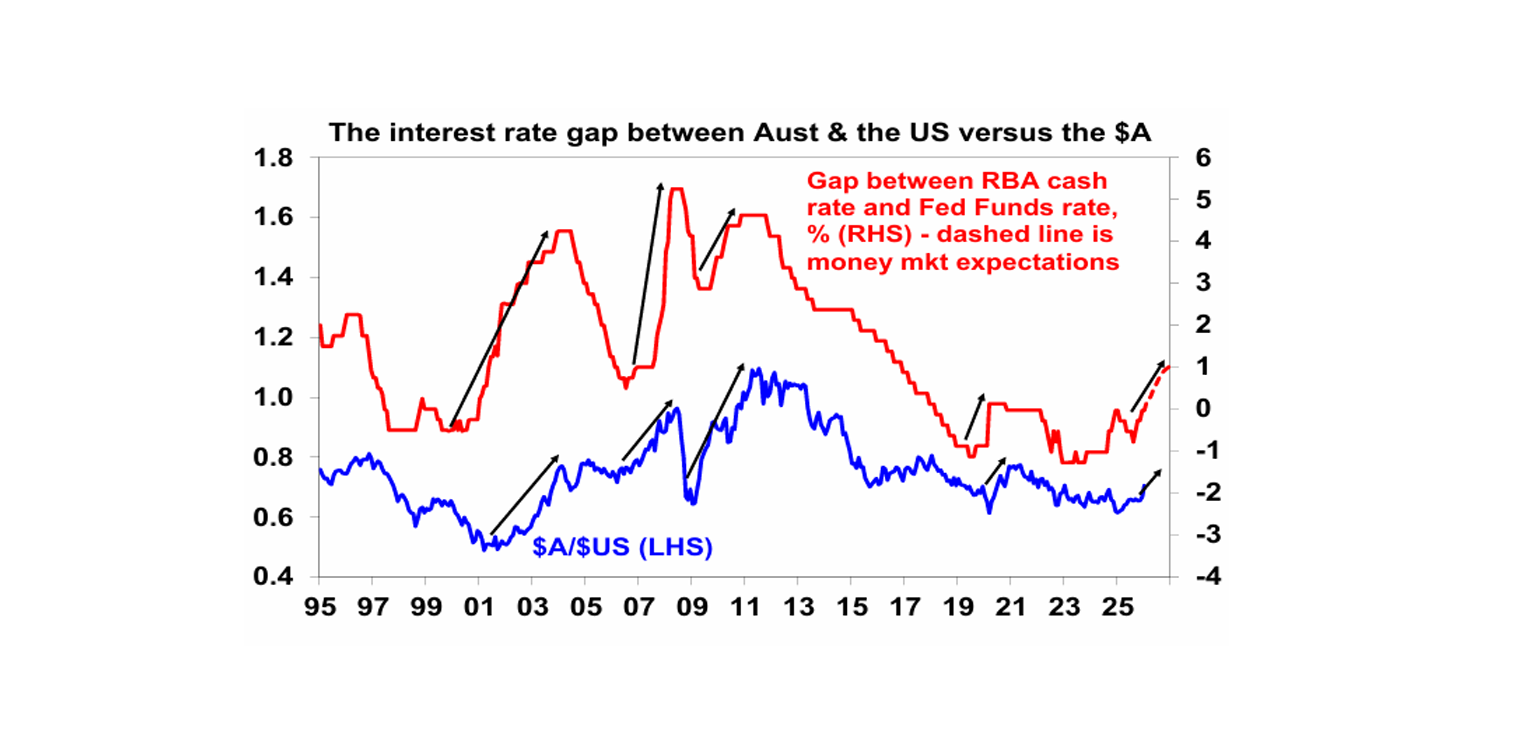

The rise in the $A partly reflects expectations that the RBA will hike at a time when the Fed is expected to cut rates. See the next chart which shows that in periods when the gap between Australian and US cash rates widens the $A invariably rises.

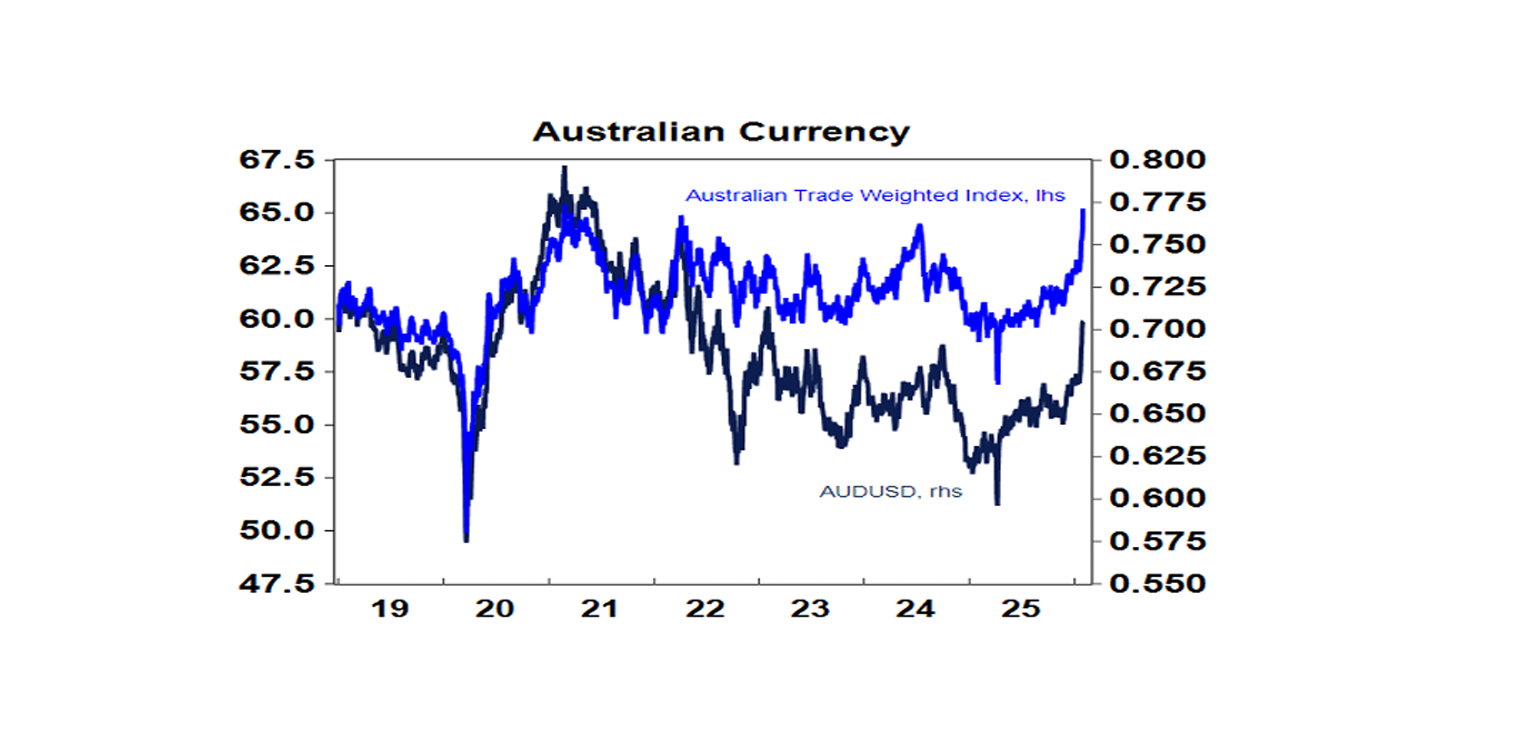

But the downtrend in the $US is also a big driver of the rising $A, so the $A is not up as much against other major currencies. That said, even the trade weighted index surged to its highest level in five years in the last week. Of course it will never go in a straight line so the $A’s pull back on Friday is just part of normal volatility.

The rise in the $A is good news for consumers who might see lower prices for imports including overseas holidays – particularly to the US for those who still want to risk it! Which might take some pressure off inflation. But it’s bad for businesses that have to compete with imports or have a business in the US (where their $US earnings will now be worth less) or for exporters who will now be less competitive. So, it’s a de facto monetary tightening, which the RBA can’t ignore.

Overall, our view remains that this year will see a volatile ride for investors on the back of geopolitical threats, Trump bluster, the US midterm election, interest rate uncertainty and AI bubble worries. And high and still rising investor optimism points to a high risk of a sharp pull back in shares at some point. But ultimately, we see it turning out okay for shares with reasonable returns on the back of good global economic and profit growth, Trump focussing on policies to help US households ahead of the midterms, the Fed cutting rates once or twice more, and profit growth turning positive in Australia after three years of falls. At the same time the US dollar is likely to remain in a downtrend as Trump’s policies continue to dent US exceptionalism and safe havens like gold are likely to continue to push higher as investors seek out a hedge to protect against risks around geopolitical conflict, high public debt levels and the threat to Fed independence. This will likely see ongoing strength in the Australian dollar.

“As goes January so goes the year”…the so-called January barometer has a mixed record when it comes to falls in January, but for gains it provides a reasonably consistent but not perfect guide to the year. Since 1980 86% of positive Januarys have gone on to a positive year in the US and in Australia its 78%. So, with US shares up 1.4% in January and Australian shares up 1.8% it’s a positive sign for the year ahead.

Major global economic events and implications

The US Fed left rates on hold as widely expected at 3.5-3.75% seeing rates as appropriate for now. TThe Fed upgraded its growth assessment from “moderate” to “solid” and noted “signs of stabilisation” in unemployment. Governors Waller and Miran dissented in favour of a cut but Bowman the other Trump appointee did not (suggesting she is not so much in the Trump low rates camp). Overall, the Fed was fairly neutral and in the absence of much weaker inflation or jobs a cut is unlikely until the new Chair arrives and even that will require the new Chair to convince other Fed officials. Money market expectations are still for nearly two rates cuts this year from the Fed.

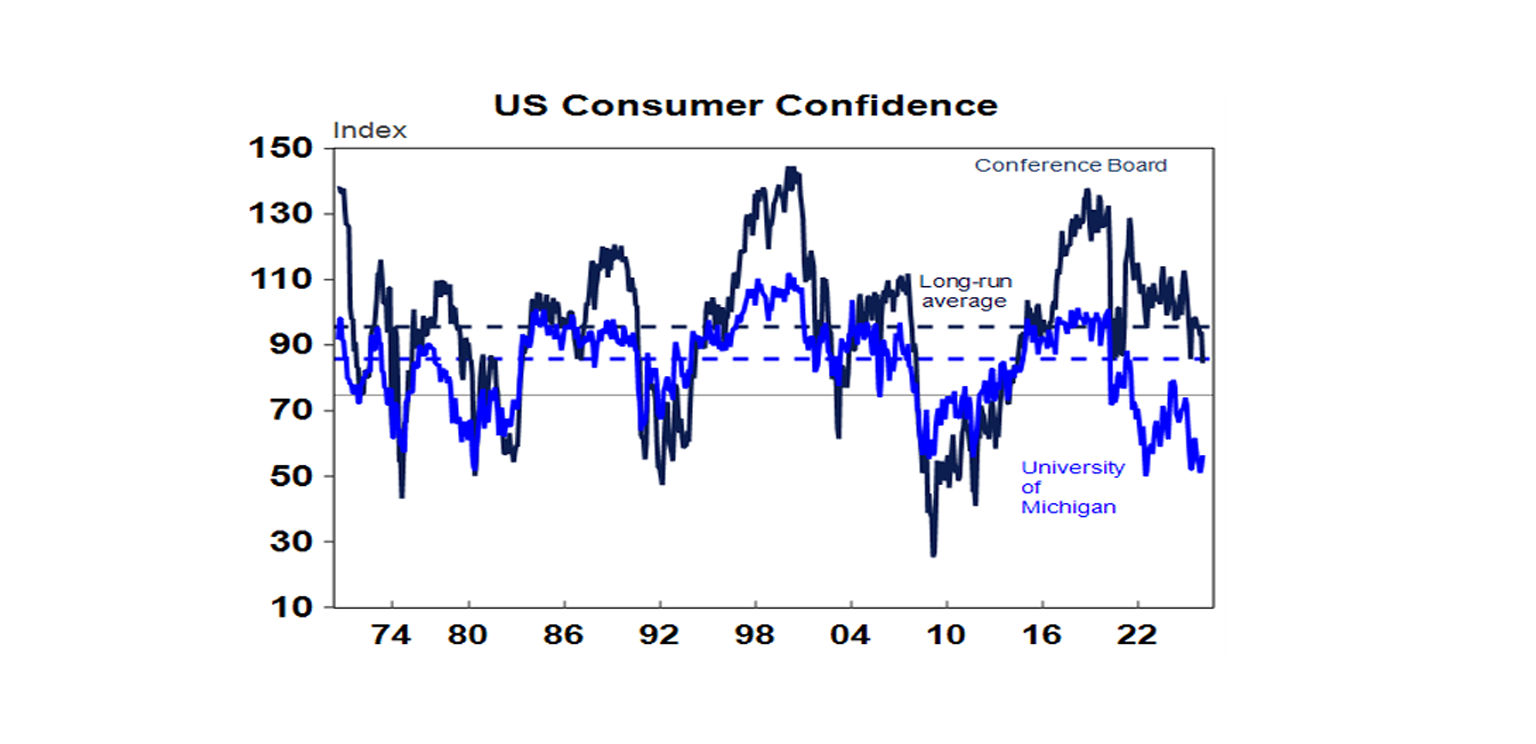

US economic data was a mixed bag. Consumer confidence fell sharply in January on the Conference Board’s measure.

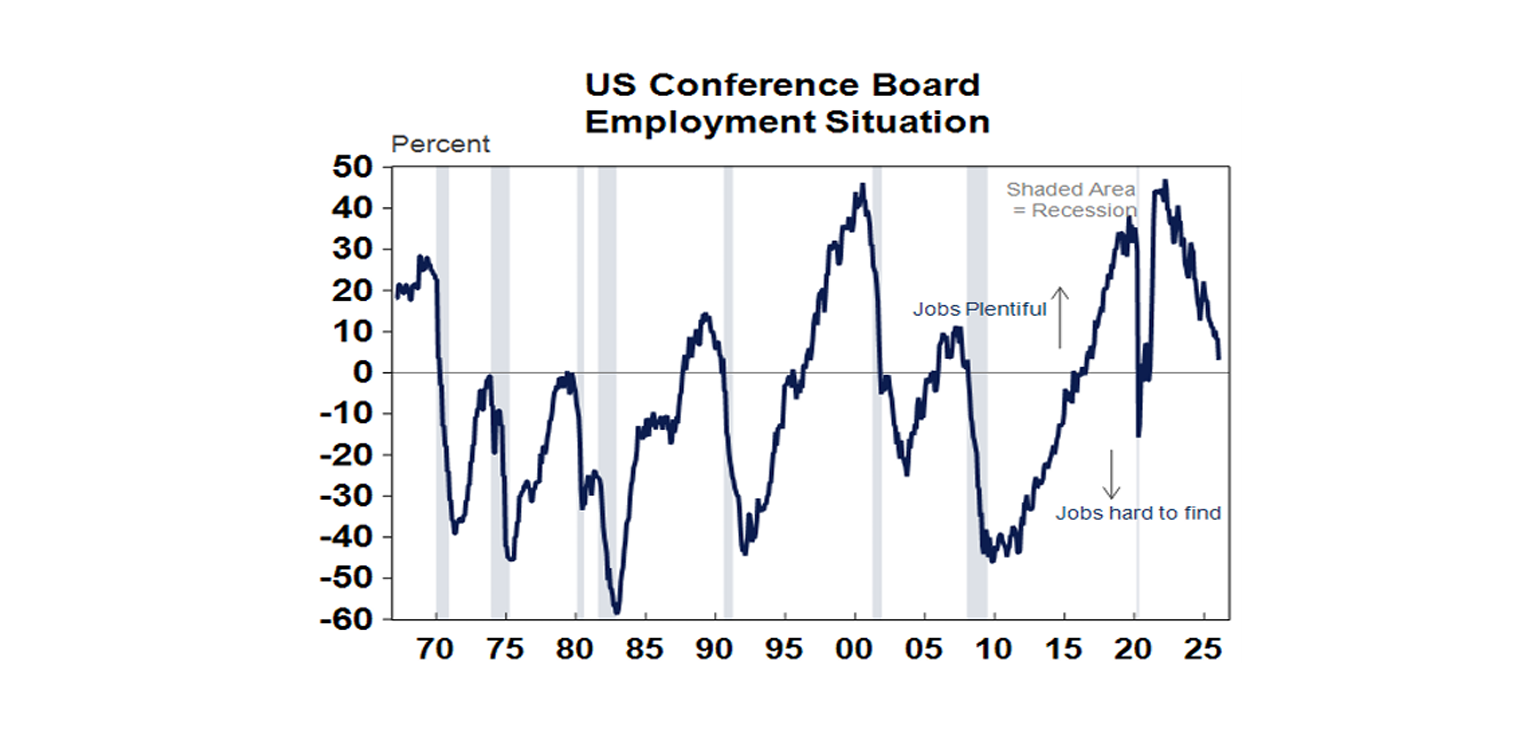

This partly reflected a further deterioration in perceptions of the labour market.

Other US economic data was stronger though with continuing solid rising trend in capital goods orders and shipments, continuing low jobless claims and an uptick in home price growth. The Atlanta Fed’s “nowcast” of US December quarter GDP growth based on released economic data is running at a strong 4.2% annualised – indicative of another strong quarter of economic growth in the US.

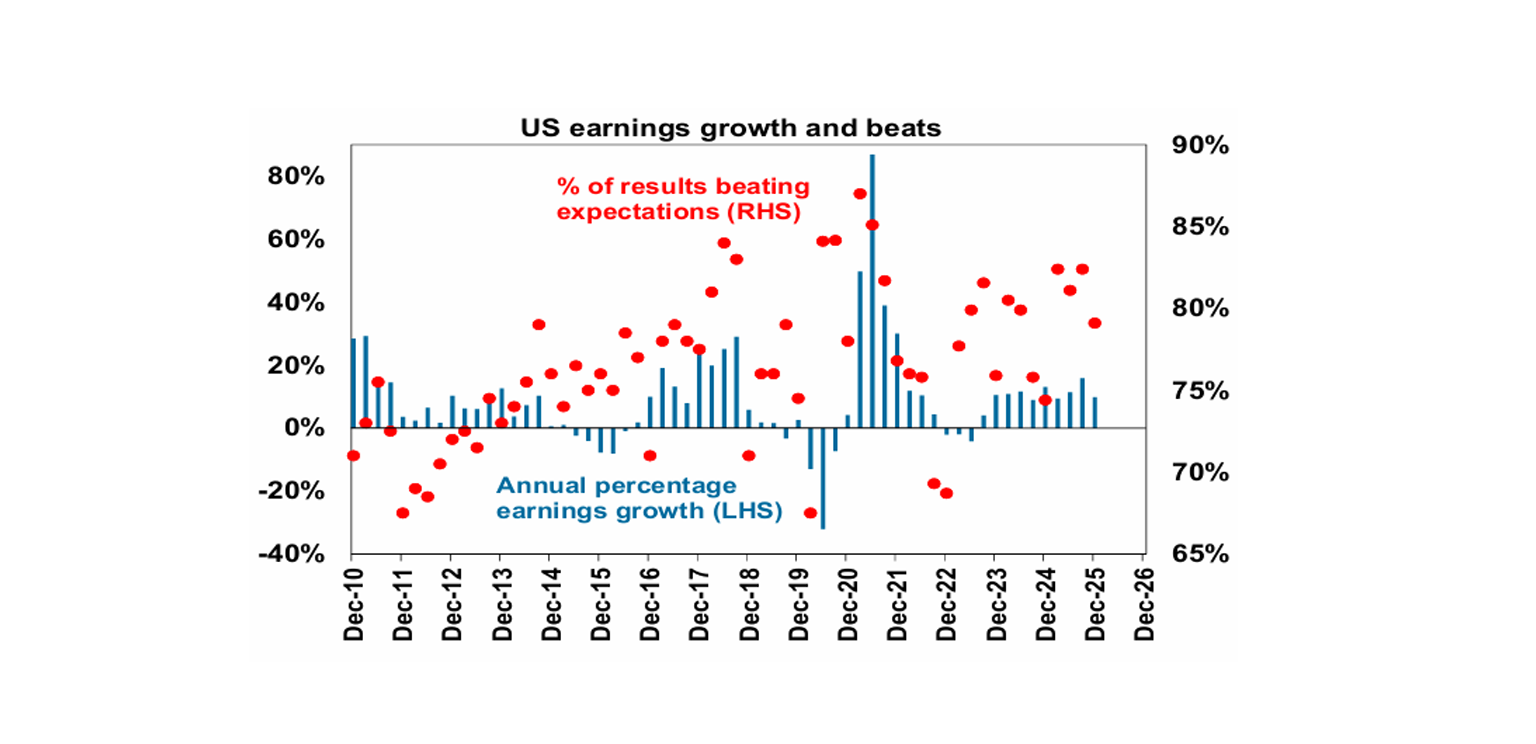

So far around a third of S&P 500 companies have reported December quarter earnings, with 79.4% beating expectations, above the norm of 76.6%. Consensus earnings expectations have increased to 10.7%yoy but are likely to come in around 12.5% allowing for normal beats.

The Bank of Canada also left rates on hold at 2.25% with little change to the outlook and neutral guidance with respect to the next move.

Similarly, the Swedish central bank left rates on hold at 1.75%. Meanwhile Eurozone economic confidence rose in January.

After three years of targeting growth around 5%, reports suggest that the Chinese Government will lower the target to around 4.5% for this year. This would suggest that any policy stimulus will remain incremental unless growth weakens a lot more. In a big picture sense it just reflects the underlying reality that the Chinese population is falling and productivity growth slows as a country develops and living standards rise. And of course, the Chinese economy is more than double what it was in the 2000s when growth reached 10% so the consequences for commodity demand are not that significant, unless growth slows a lot more rapidly.

Australian economic events and implications

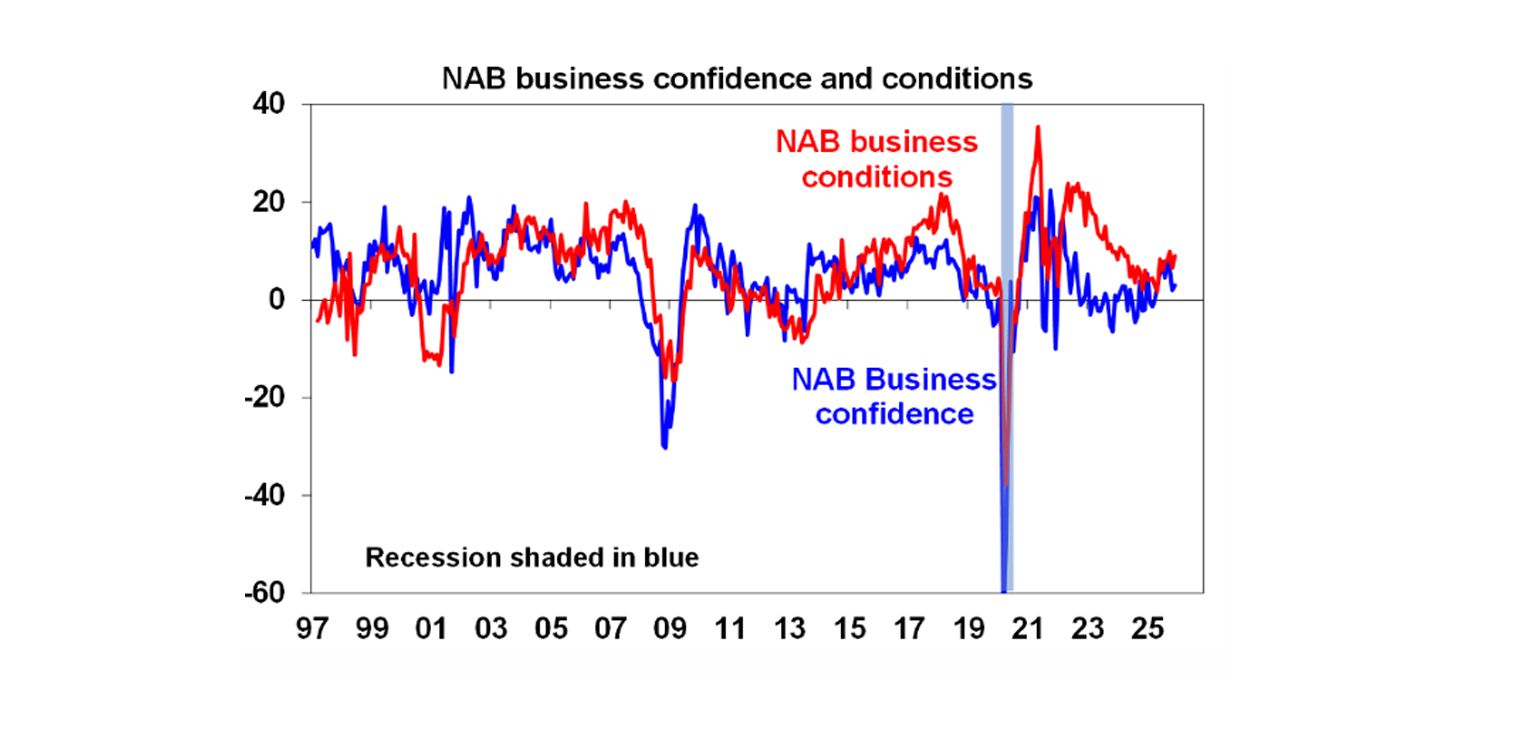

Australian business conditions remained around okay levels in December with confidence remaining soft but up according to the NAB business survey.

Interestingly, while cost and price pressures rose slightly, final product prices remain around levels consistent with the inflation target and retail price pressures fell to their lowest since 2020. It’s a similar message from the output price indicator in the January PMIs. See the pink and purple lines. This adds to confidence that the spike in inflation seen in the last six months could prove to be an aberration.

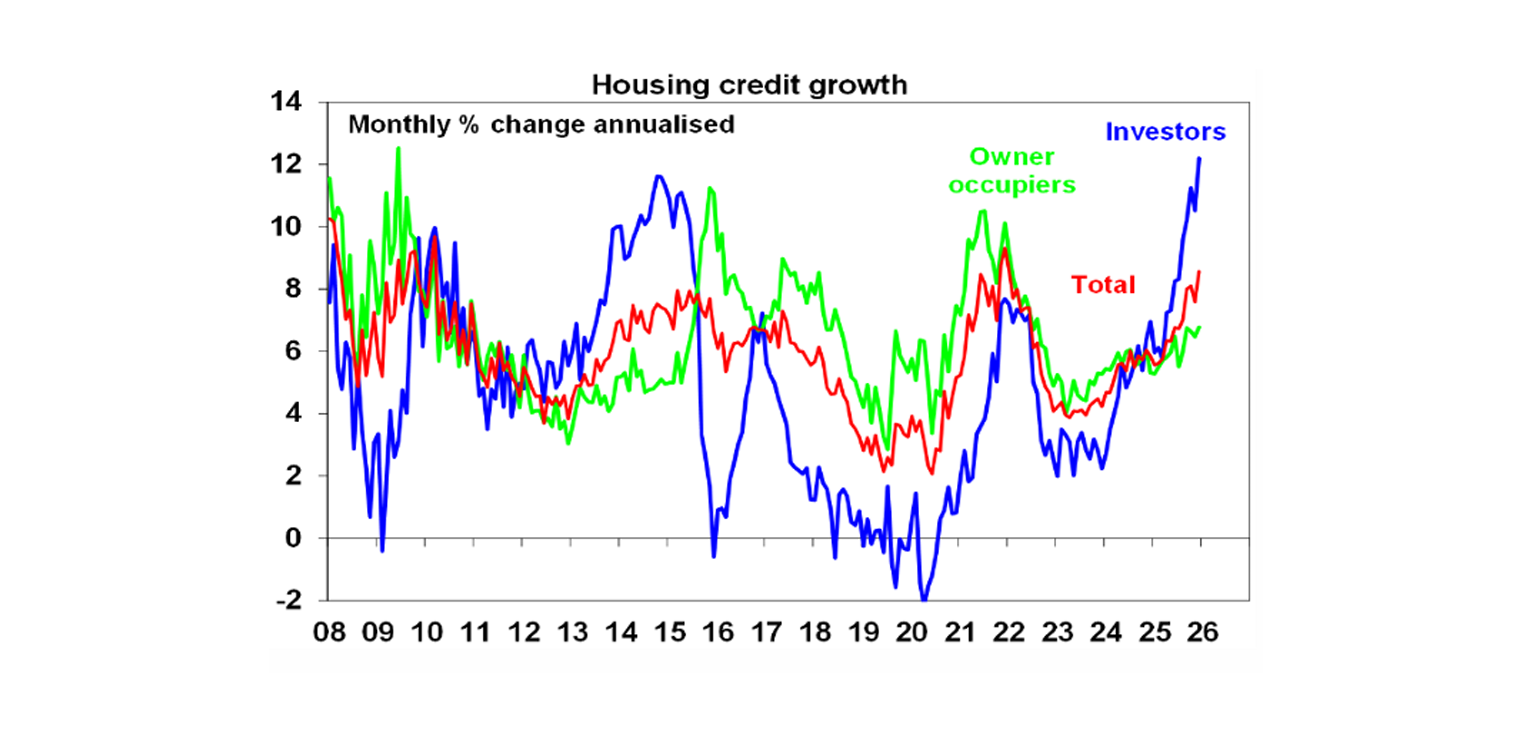

Private credit growth picked up in December with housing, personal and business all stronger. Investor credit growth is now above its 2014 high. If it continues it potentially means more moves by APRA to slow it.

What to watch over the week ahead?

In the US, the focus will be back on jobs data with January data (Friday) which is expected to show a slight light rise in payroll growth to 70,000, unemployment remaining at 4.4% and growth in average hourly earnings remaining at 3.8%yoy. Meanwhile, the ISM manufacturing conditions index for January (Monday) is expected to show a slight lift but the services ISM (Wednesday) is likely to fall slightly, December data for job and openings and quits will be released Tuesday and housing starts are expected have remained soft (Wednesday). December quarter earnings reports will continued to flow.

The European Central Bank (Wednesday) is expected to leave its deposit rate on hold at 2% while retaining a neutral bias. Eurozone core inflation (Wednesday) is expected to have remained around 2.3%yoy in January.

The Bank of England (also Wednesday) is also expected to leave rates on hold at 3.75%, having just cut in December, but will likely retain a bias towards further gradual rate cuts.

In Australia, as noted earlier the RBA (Tuesday) is expected to leave the cash rate at 3.6%, but it’s a very close call. Its Statement on Monetary Policy is expected to show a slight upwards revision to near term growth and inflation forecasts and a slight downwards revision to near term unemployment forecasts. However, with a higher $A and market forecasts for rate hikes rather than a rate cut (as was the case back in November) it’s likely to retain its forecast for trimmed mean inflation to fall to around 2.7%yoy by year end and may even lower it. RBA guidance is expected to remain cautious and hawkish, whether it hikes or not. Governor Bullock will also provide parliamentary testimony on Friday. On the data front expect Cotality data to show a 0.7% rise in average home prices for January (Monday) with a slight improvement after seasonal weakness in Sydney and Melbourne in December but momentum remaining down as talk of higher rates dampens buyer sentiment. December building approvals (Tuesday) are expected to show an 8% fall after a 15% bounce in November and the trade surplus is expected to have risen to around $3.5bn.

Outlook for investment markets

Global and Australian share returns are expected to slow to around 8%. Stretched valuations in the key direction setting US share market, political uncertainty associated with Trump and the midterm elections, AI bubble worries and geopolitical risks are the main drags, but returns should still be positive thanks to Fed rate cuts, Trump’s consumer friendly pivot and solid profit growth. A return to profit growth should also support gains in Australian shares even though the RBA may have finished cutting rates. Another 15% or so correction in share markets is likely along the way though.

Bonds are likely to provide returns around running yield.

Unlisted commercial property returns are likely to be solid helped by strong demand for industrial property associated with data centres.

Australian home price growth is likely to slow to 5-7% due to poor affordability, rates on hold with talk of rate hikes and APRA’s move to ramp up macro prudential controls.

Cash and bank deposits are expected to provide returns around 3.6%.

The $A is likely to rise as the interest rate differential in favour of Australia widens as the Fed cuts and the RBA holds or hikes. Fair value for the $A is around $US0.73.

You may also like

-

Weekly market update - 20-02-2026 Global share markets mostly rose over the last week as worries about AI and tech valuations took a breather but concerns about a US strike on Iran acted as a constraint. -

Econosights - An update on global debt and fiscal policy With the International Monetary Fund releasing their Global Fiscal Monitor recently, AMP's Senior Economist, Diana Mousina provides an update on the global debt situation and recent fiscal policy announcements. -

Oliver's Insights - Nine key charts for investors Share markets have had a bit of a wobbly start to the year, particularly in the US. This note looks at nine key charts worth watching.

Important information

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account. Taxation issues are complex. You should seek professional advice before deciding to act on any information in this article.

It’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you. The super coaching session is a super health check and is provided by AWM Services and is general advice only. It does not consider your personal circumstances.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy. All information on this website is subject to change without notice. AWM Services is part of the AMP group.