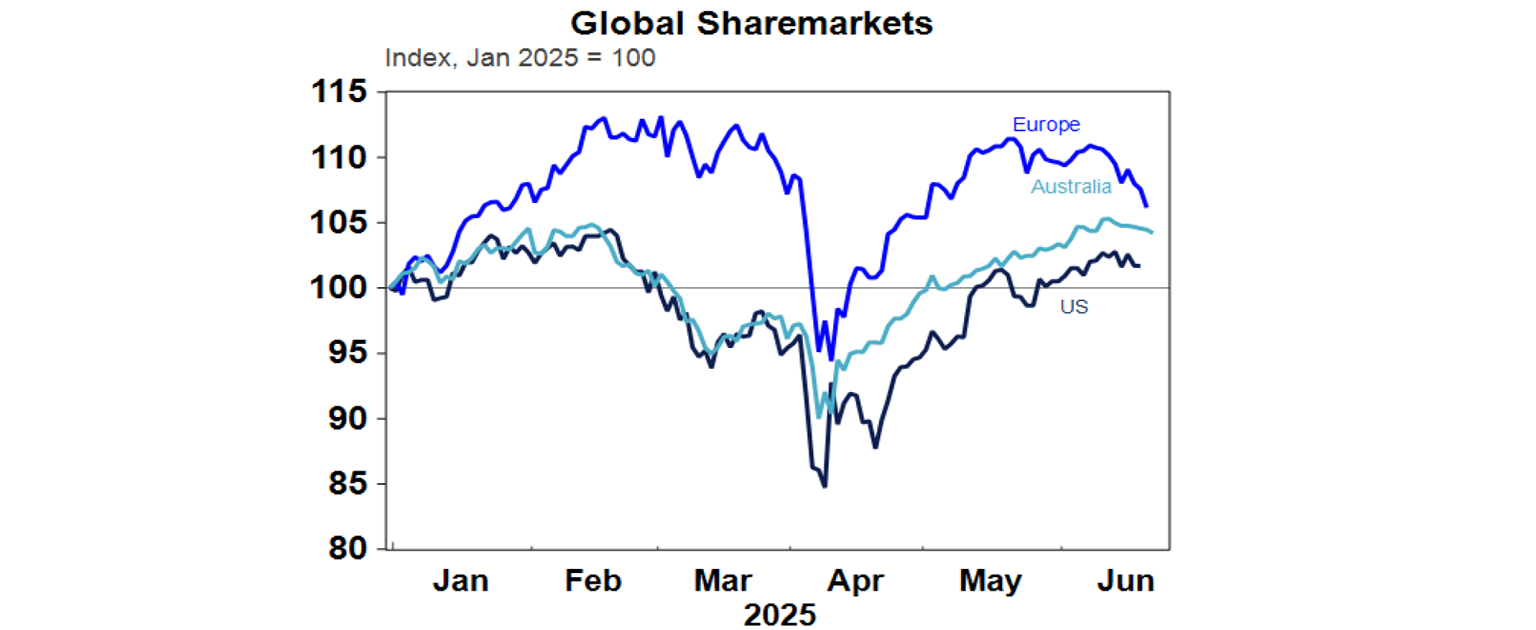

Share markets were mostly soft over the last week as the escalating Israel/Iran war - with Trump indicating the US may join in risking a disruption to oil supplies - kept investors cautious. For the week US shares fell 0.2%, Eurozone shares fell 1.1% and Chinese shares fell 0.5%, but Japanese shares rose 1.5%. Reflecting the uncertainty the Australian share market drifted down by 0.5% with falls in material, utility and consumer staple shares more than offsetting gains in energy and IT shares. Bond yields were little changed – down slightly in the US and Japan but up slightly in Europe and Australia. Oil prices drifted up another 2.7% and metal prices rose, but gold and iron ore prices fell. The $US rose slightly, and the $A and Bitcoin fell slightly.

While the impact on investment markets has so far been modest, the Israel/Iran conflict continues to pose a high risk:

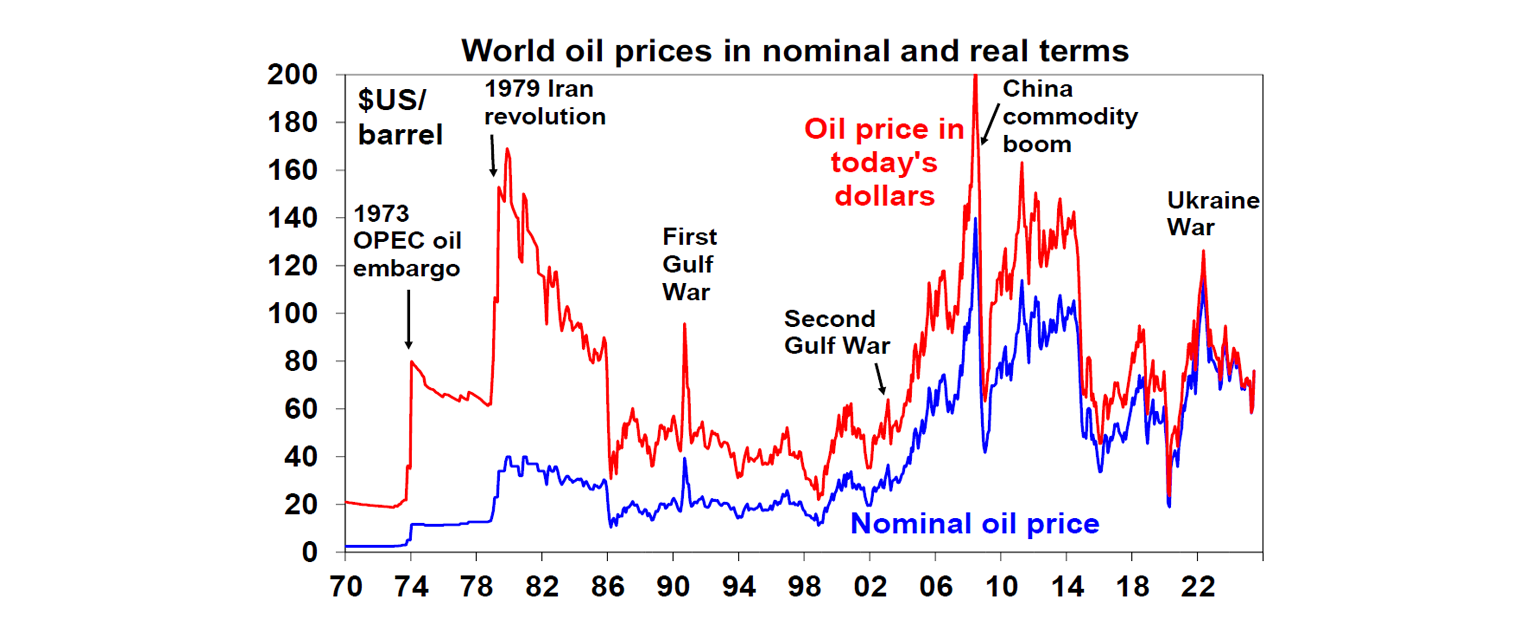

While the loss of life in any war is horrible share markets only get really concerned if there is a meaningful disruption to economic activity – and the main way this can occur from conflicts in the Middle East is via disruption to global oil supplies as the region accounts for a third of oil production.

So far, the weeklong war has not threatened oil supplies and investors appear to be assuming that this will remain the case so US, global and Australian shares are only down around 1% from their level before Israel struck and while the oil price is up 10% it’s still below last year’s average levels and a bit of a non-event historically.

However, with the US considering becoming involved in the conflict the risk of a meaningful disruption to oil supplies, even if only brief, is now high.

Trump and most of his base do not want the US to enter another “forever war” bent on regime change in the Middle East. But Israeli success so far in destroying Iran’s military and nuclear capabilities appears to have changed the equation and is now temping Trump to join in and finish the job. Specifically, by using “bunker busting bombs” to destroy Iran’s underground Fordow nuclear facility and others.

To this end Trump has demanded an “unconditional surrender” from Iran (presumably requiring complete dismantling of any nuclear program amongst other things).

If Iran capitulates (to avoid a wipe out) then things will quickly settle down. But so far it has refused.

Trump still sees a “substantial chance” that Iran will capitulate and negotiate but has indicated he will make a decision on whether to strike Iran “within the next two weeks”, which he says is “giving them a period of time” to think about it, but could also be for the US and Israel to get prepared or both.

His comments that he might consider backing a ceasefire but might also decide to strike earlier than the two weeks deadline add to the uncertainty.

If the US does join in the war, the risks is that this could see Iran strike neighbouring oil producers (which it’s unlikely to want to do as it will end up in a wider war) or disrupt shipping through the Strait of Hormuz (which is more likely).

The bottom line is that US military intervention in Iran would mean an increasing risk of a significant disruption to global oil supplies – 20% of which flows through the Strait of Hormuz – which could push oil prices well beyond $US100 a barrel, possibly to around $US150/barrel. This would likely only be brief, as the US military would likely quickly move to stop Iran’s capabilities. But even if it’s for a few weeks or months it could still risk a significant blow to confidence regarding the economic outlook and so could push share markets down sharply.

Global and Australian shares have seen a strong rebound from their April lows – but they remain at high risk of a sharp near term pull back as the risk of an oil supply disruption flowing from the war with Iran is high and Trump’s tariff threat is far from resolved. On the tariff front its notable that the 9th July tariff deadline is rapidly approach and no deals have been struck beyond that with the UK with indications that some countries may end up with tariffs well above 10%. With US and even Australian shares offering a very low risk premium over bonds, this leaves them vulnerable to shocks on the oil and tariff front.

The main way Australians would be impacted would be via higher petrol (and potentially gas) prices. So far the rise in oil prices this month of around $US14/barrel implies about a 14 cent a litre boost to petrol prices if sustained, which would add about 0.2% to headline inflation. This would not be enough to impact the RBA’s thinking on interest rates, and it would focus on underlying inflation. Of course, the impact on petrol prices will be much bigger if oil supplies are disrupted – which could see petrol prices briefly spike to record highs.

History warns about getting too negative on shares regarding geopolitical events. As my colleague Diana Mousina has shown here, the typical playout for geopolitical shocks based on historical events is for a sharp fall in share markets initially (averaging around 8% but with a wide range depending on the event) but then a recovery over the next 12 months averaging around 14% (but again with a wide range). And interestingly while there was much investor fear and trepidation ahead of the US intervention in the first and second Gulf wars shares actually rose from the moment the US started firing missiles! Trying to time geopolitical events and their impact on markets is next to impossible but they do throw up opportunities (eg cheap shares, overvalued oil) for investors. The best approach is to maintain an appropriate long term investment strategy with a well-diversified portfolio.

While the near term outlook for shares is messy, shares should benefit on a 6-12 month view as the threat to oil prices reverses, Trump pivots towards more market friendly policies, the Fed starts cutting rates again along with ongoing rate cuts from other central banks including the RBA.

Good news and bad news on the productivity front in Australia from the Treasurer’s National Press Club speech. The good news is that the Treasurer clearly understands the need to boost productivity in order to boost living standards, that this requires tax reform and less red tape and that nothing is ruled in or ruled out ahead of the Productivity Summit to be held in August. The potential bad news though is that the Treasurer is sceptical about raising or broadening the GST without which it will be hard to meaningfully lower the income tax burden and there is a risk that the Treasurer’s willingness to consider tax reform may really be just a desire to find more tax revenue in order to improve the budget outlook without constraining spending. In particular, without more revenue from the GST, lower income tax rates may have to financed by lower income tax concessions which could have the perverse effect of actually raising the tax burden for high income earners (the top 10% already account for nearly 50% of income tax collected) which would actually reduce the rewards from work! Hopefully the focus is actually on seeing tax reform in the context of boosting productivity rather than just raising more revenue. Both serious tax reform (including a rebalancing from income tax to the GST) and capping public spending as a share of the economy should be high on the list of things to do in order to boost productivity.

A Whiter Shade of Pale. While the album that marked the Summer of Love in 1967 was The Beatle’s Sergeant Peppers, the song was arguably Procol Harum’s Whiter Shade of Pale. This has everything for a psychedelic classic – weird title (which has become part of the lexicon), cryptic lyrics (it’s about a relationship but what has The Miller’s Tale got to do with it?), a Bach inspired instrumental (although it’s not Bach) played on a Hammond Organ – although according to the lyricist “it was influenced by books, not drugs”. Annie Lennox had an excellent cover nearly 30 years later, replacing the organ with a cool keyboard sound. And its great head kandy.

Major global economic events and implications

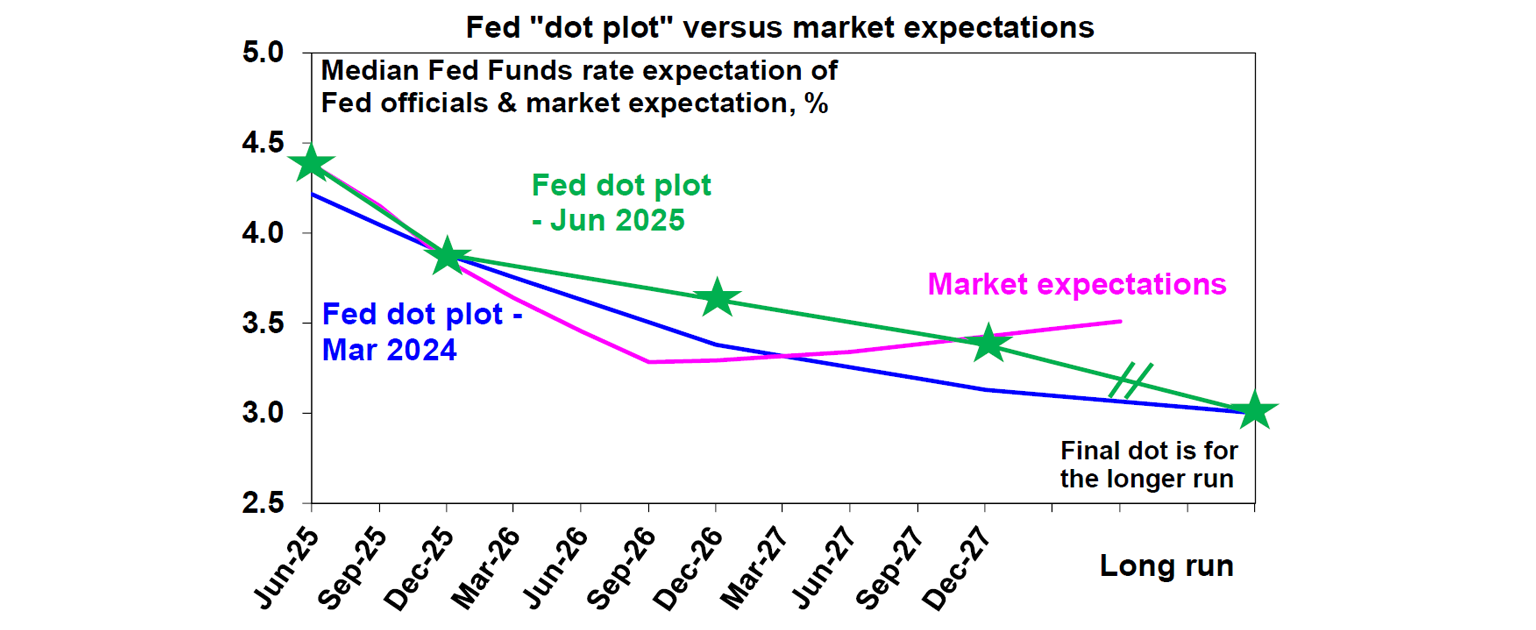

The Fed remains in wait and see mode. It left rates at 4.25-4.5% as widely expected and the median dot of Fed officials’ interest rate expectations remained for two rate cuts for this year. But it sees one less rate cut next year and remains in wait and see mode given the uncertainty around the impact of tariffs on inflation and with the economy still solid and unemployment low. While the Fed’s Waller (a recent dove) says the Fed could cut as soon as July, other Fed officials are more cautious. There are a lot of balls in the air at present – tariffs, the Middle East war, tax cut stimulus for next year, good recent inflation data and still low unemployment - so its understandable the Fed wants to wait a bit longer but there are sign of softening in US data and this is ultimately likely to see a resumption of rate cuts from September, and more rate cuts through next year than the Fed is allowing for.

“Maybe, just maybe, I’ll have to change my mind about firing him [Powell]?” Predictably, Trump is not happy and thinks he should “go to the Fed” as “I’d do a much better job” and it should now cut “2 points, 2 and a half points” to save the US Government “$800 billion, $700 billion” in interest payments. A week ago Trump wanted a “one point cut”, so it’s gone up. This is all just about politics to set the Fed up for blame if Trump’s policies cause a recession. And if the Fed did cut by as much as Trump wants it’s likely inflation expectations would surge pushing up bond yields and the US Government would actually be paying billions more in interest payments, not less! It’s good for a laugh though!

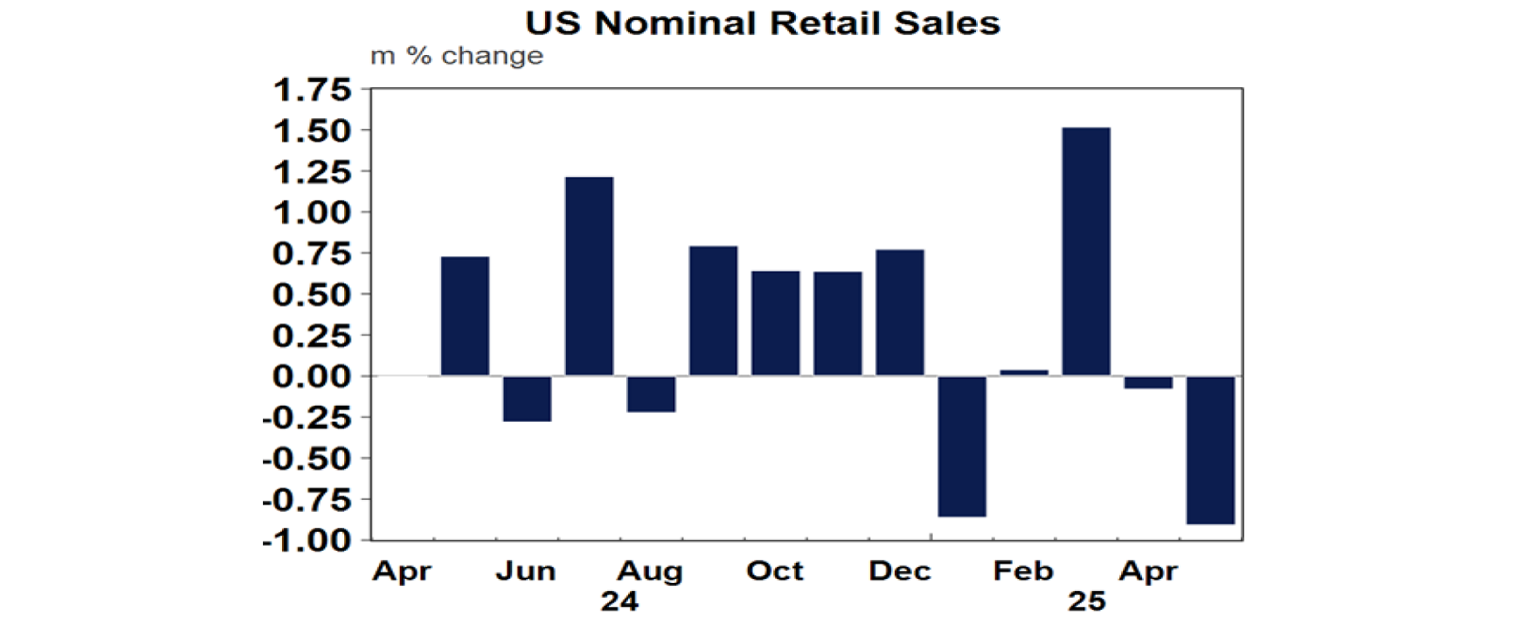

US economic data was weak. Retail sales, industrial production and housing starts fell in May. Housing starts in particular are soft with the NAHB home builders’ conditions index continuing to point to weakness ahead as high mortgage rates impact. Manufacturing conditions in the New York region also weakened in June with a sharp fall in orders and ongoing high indications regarding prices on the back of the tariffs.

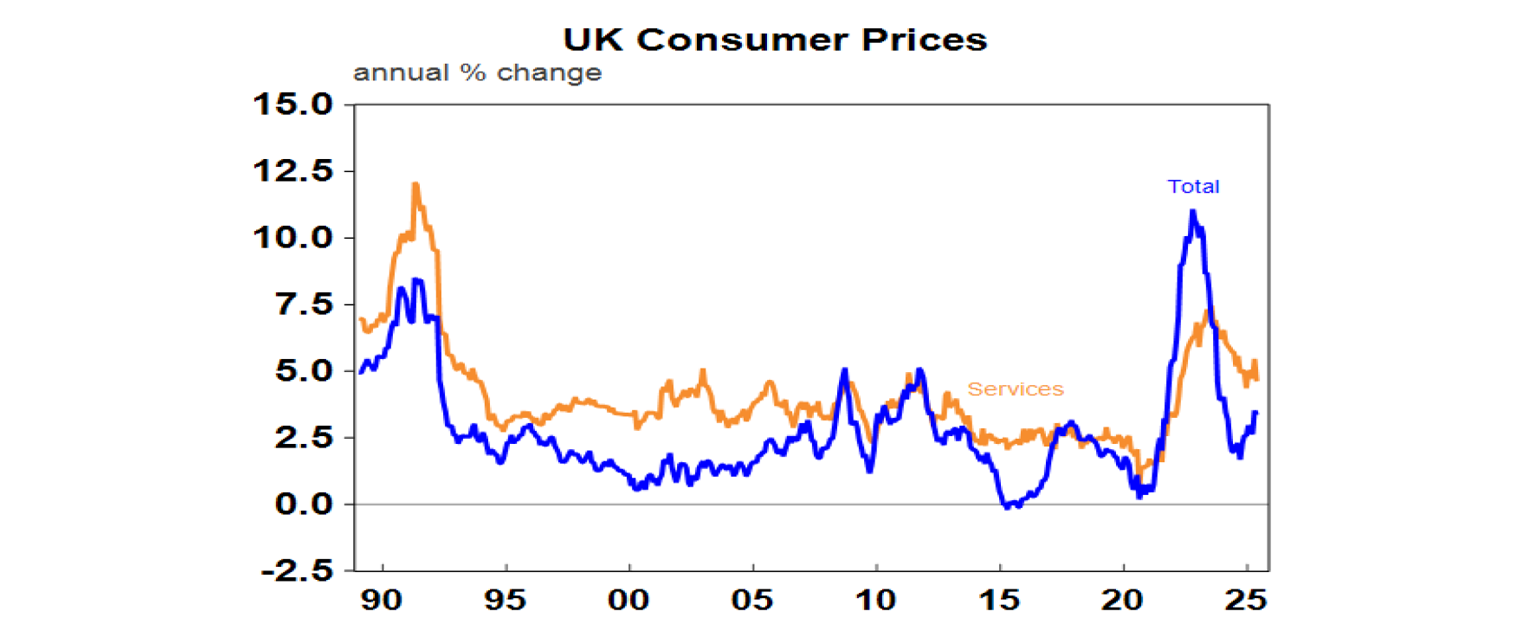

The Bank of England left rates at 4.25%, but was dovish & looks on track to cut twice by year end. UK May inflation fell slightly.

The Swedish, Norwegian and Swiss central banks cut rates by another 0.25% to 2%, 4.25% and zero respectively and all were dovish. The return to zero and potentially negative interest rates in Switzerland reflects a specific problem with the strong Swiss Franc leading to deflationary pressures and so is unlikely to be a pointer to other countries heading back to zero or negative rates.

The Bank of Japan left rates on hold at just 0.5%. It’s in a different cycle to other countries and is still in the process of raising rates to more normal levels supported by higher inflation. However, with trade uncertainty, the next rate hike looks months away. However, it did announce a slowing in the pace at which it’s reducing its buying of very long-term bonds which looks aimed at reducing upwards pressure on long term bond yields beyond ten years. Inflation fell slightly in May to 3.5%yoy but with core (ex food and energy) inflation unchanged at 1.6%yoy.

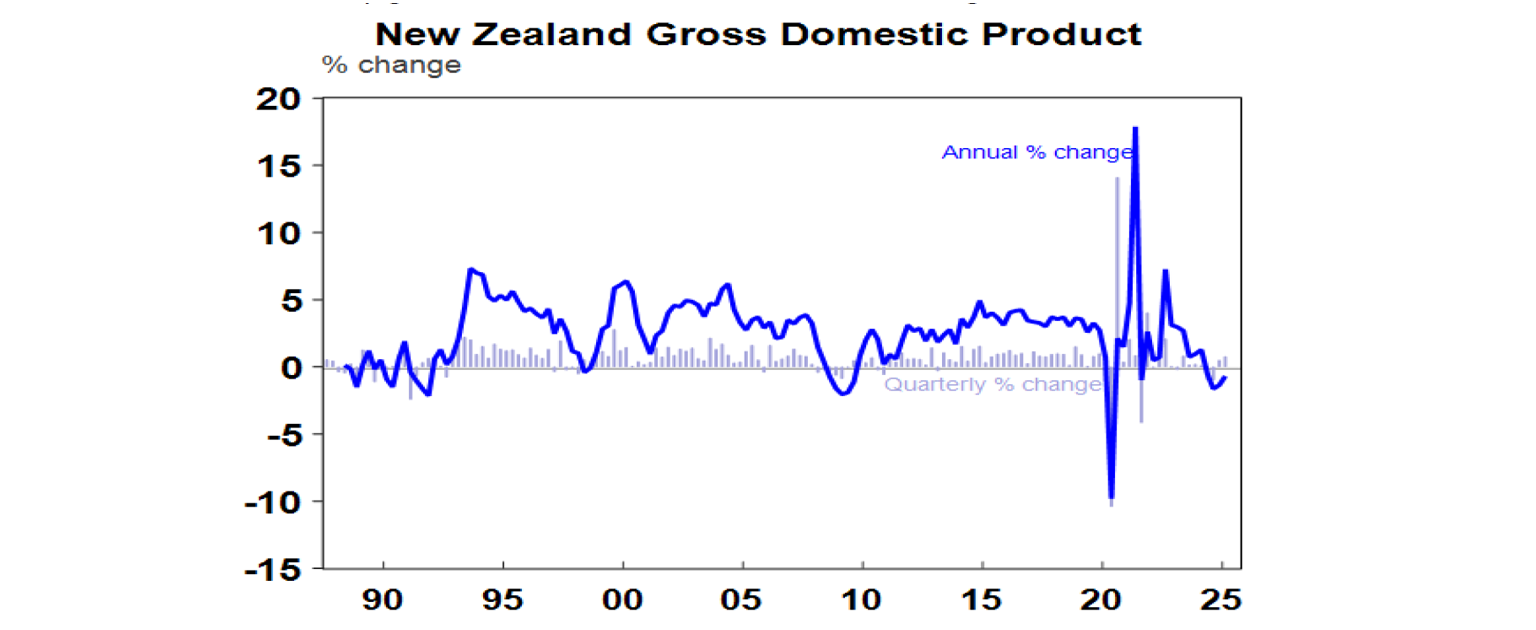

New Zealand March quarter GDP rose 0.8%qoq with solid consumer and government spending and housing investment. But NZ data is very volatile and one or two more RBNZ rate cuts are likely given the various threats to economic growth.

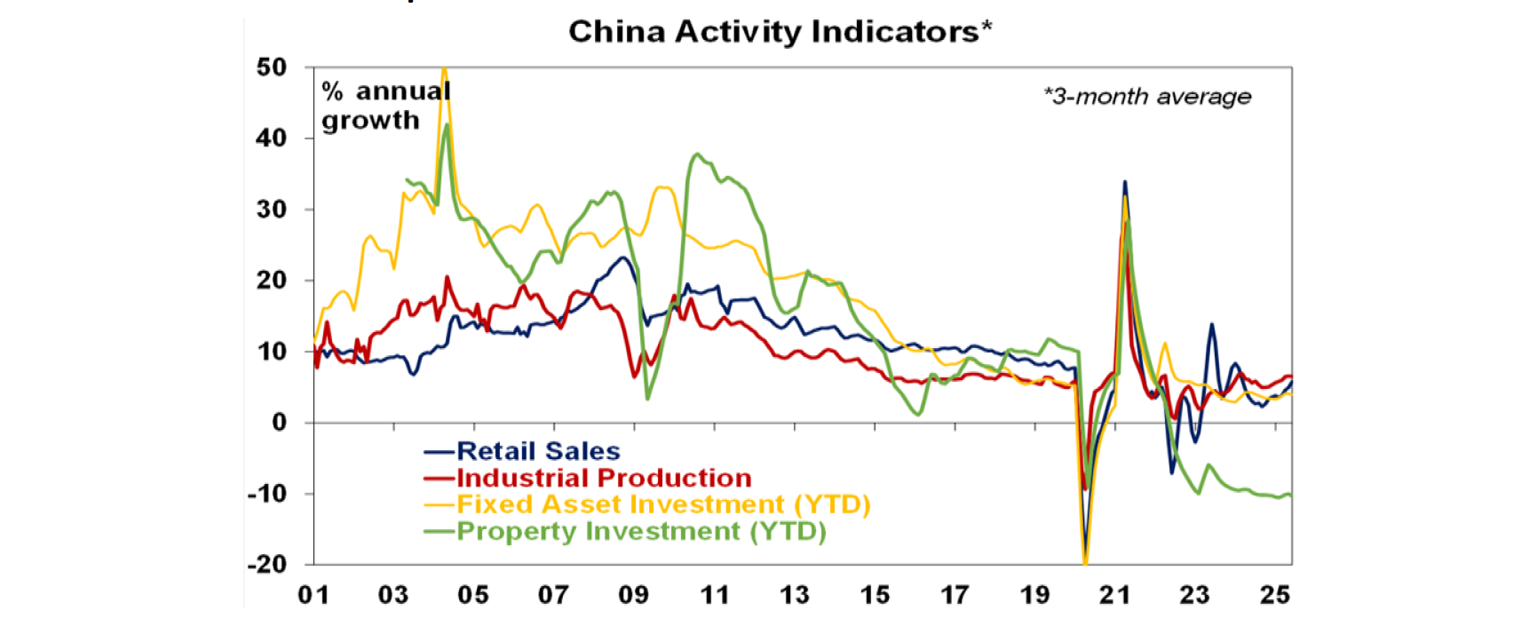

Chinese economic activity data for May was a mixed bag with stronger retail sales and lower unemployment but softer industrial production and investment.

Property sales were also weaker, and the pace of falling home prices accelerated again. Further policy stimulus is likely in China but at this stage it’s likely to remain incremental.

Australian economic events and implications

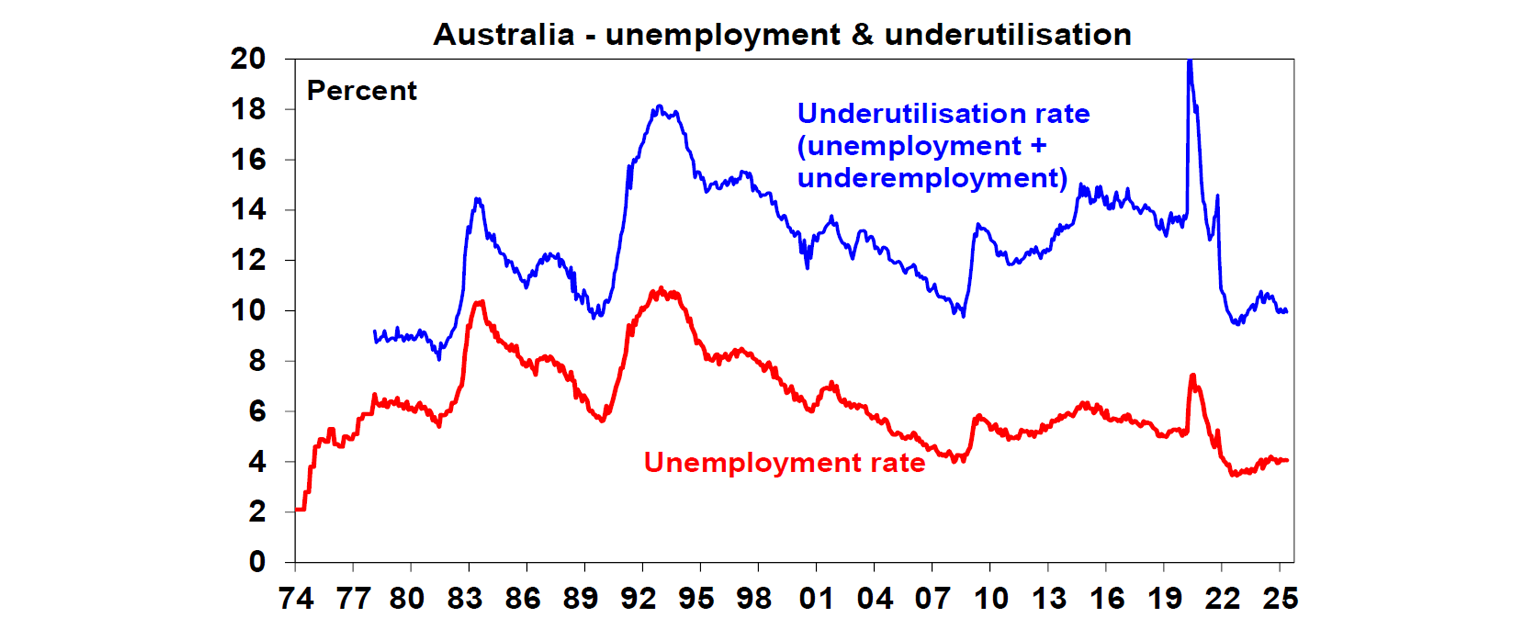

The Australian jobs market remains strong. Employment fell by 2500 in May but full-time jobs rose by 38,700, hours worked rose solidly, unemployment remained unchanged and low at 4.1% and underutilisation fell to 9.9% remaining low in the context of the last three decades.

The still solid jobs market on its own argues against another rate cut just yet, but we still expect another rate cut in July. The labour market is arguably not as tight as historical comparisons suggest and hasn’t prevented a slowdown in wages growth and the RBA is open to the so-called NAIRU being lower than its own estimate of around 4.5%. What’s more various leading jobs growth indicators still point to slower jobs growth ahead. So given cooling inflation, recent weak economic data including for GDP and downside risks to the outlook from Trump’s trade war and the conflict in the Middle East we continue to expect a 0.25% rate cut in July with further cuts in August, November and February taking the cash rate down to a low of 2.85%. The money market still sees an 80% chance of a rate cut in July.

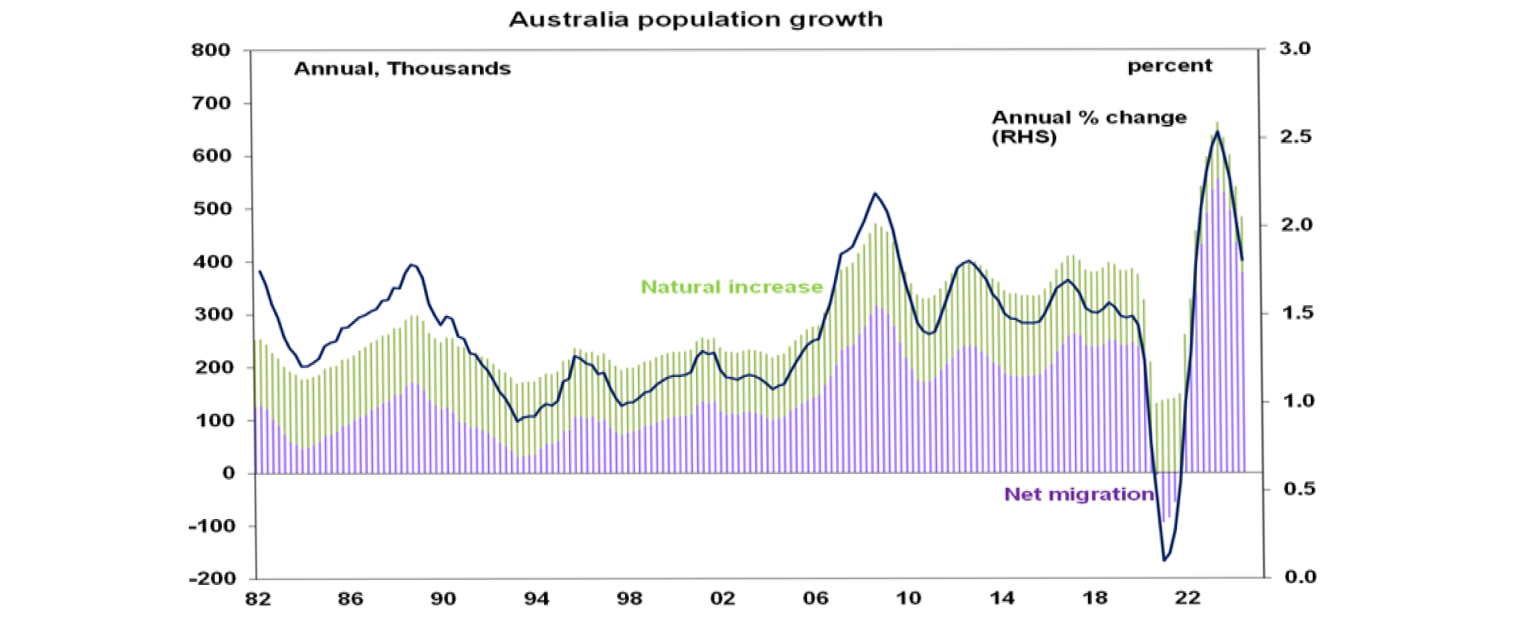

Australia’s population growth slowed further to 1.7%yoy over the year to the December quarter last year, from a peak of 2.5%yoy in the September quarter 2023. The slowdown continues to be due to slowing annual net migration, to 341,000 from a record 556,000 at the peak. This in turn has been driven by tougher student visa rules and a return to more normal conditions of returning and arriving students after the pandemic distortions. With the latest slowdown in immigration implying underlying housing demand of around 180,000 a year its now more in line with new housing completions. Of course, this just means new immigration is not adding to the underlying housing shortfall but the accumulated housing shortage still remains around 200,000 to 300,000 dwellings as a result of years of underbuilding. Key to getting it down will be a further slowing in immigration and getting home building up to the Housing Accord target of 240,000 dwellings a year.

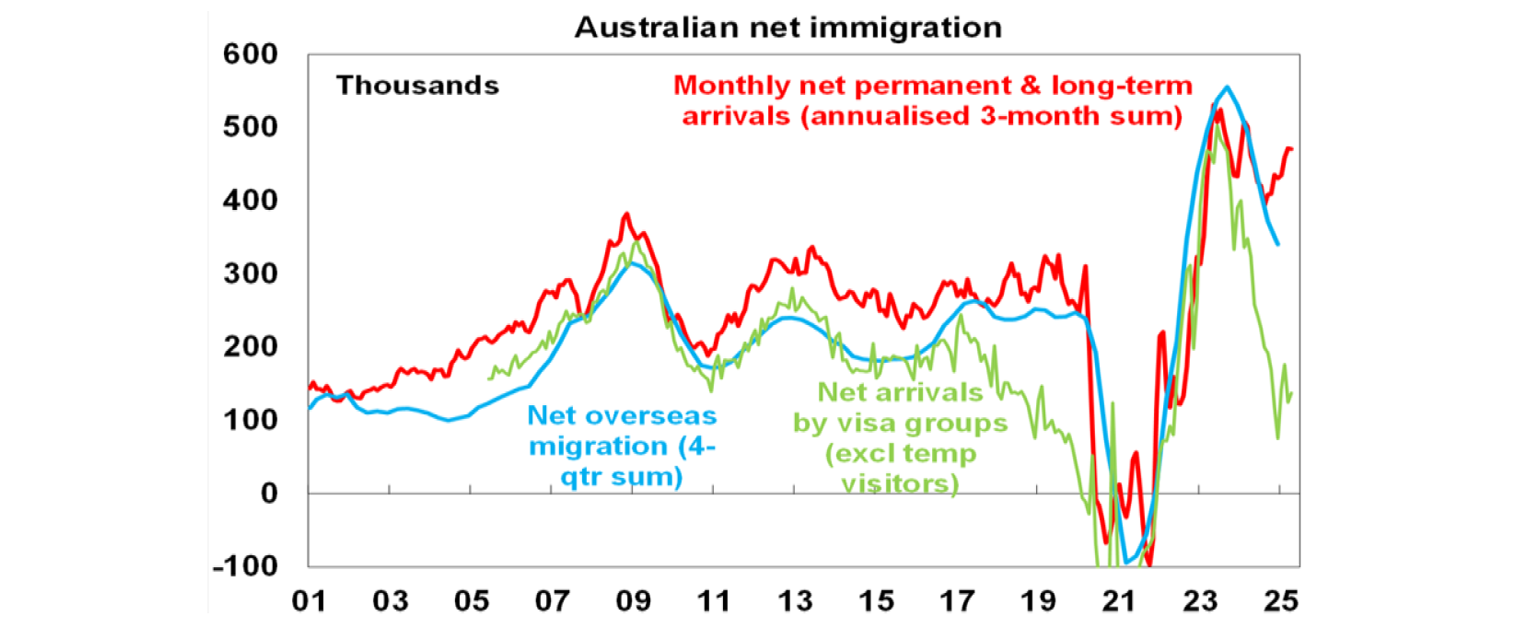

In terms of the outlook for immigration monthly data is mixed with visa data, excluding tourists, pointing to a further fall but net permanent and long-term arrivals data suggesting the slowdown has stalled. I suspect the outcome will be between these extremes.

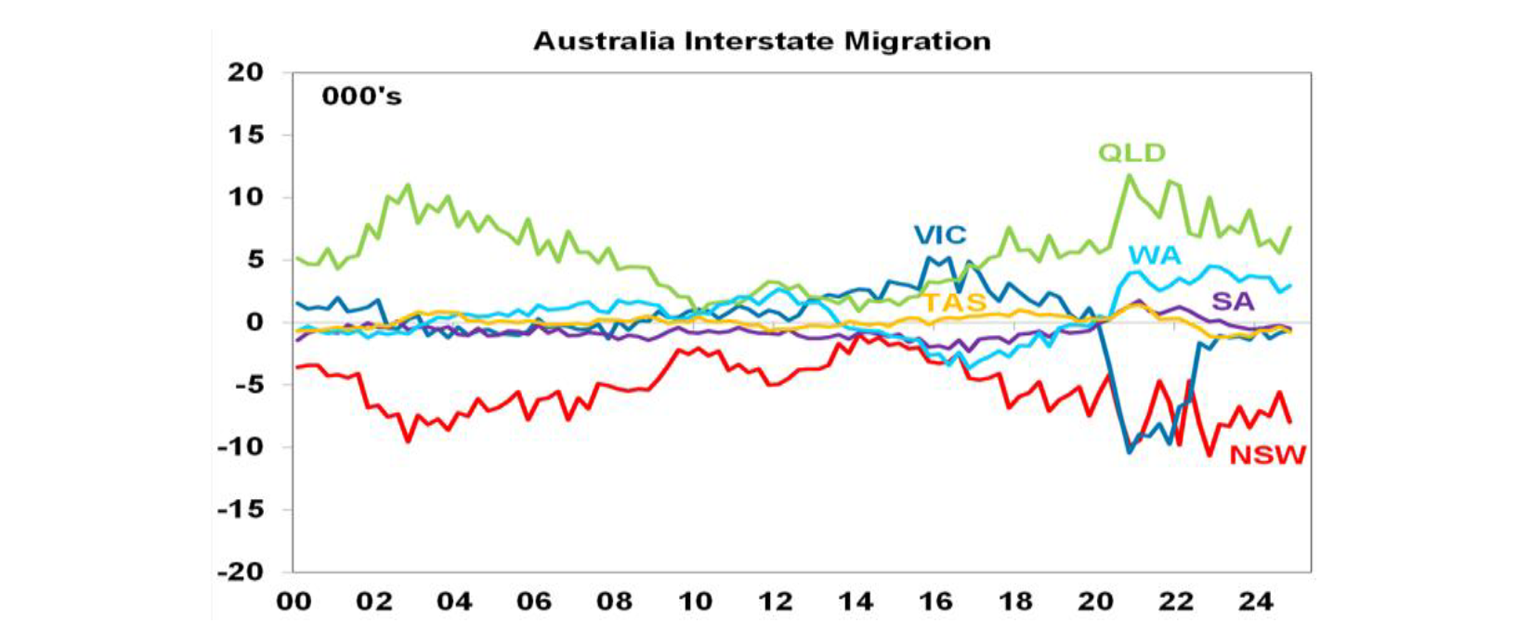

Western Australia is continuing to see the strongest population growth rate at +2.4%yoy with Tasmania the weakest at +0.3%yoy. Both Queensland and Victoria are seeing above average population growth with South Australia below. Queensland is a big beneficiary of interstate migration as is WA which explains their strong housing markets lately but it’s a bit harder to explain housing market strength in SA which sees below average population growth and negative interstate migration. Deteriorating housing affordability also appears to be weighing on interstate migration to Queensland lately which in turn will likely start to constrain home price growth there.

What to watch over the week ahead?

Business conditions PMIs for June for major countries to be released on Monday are expected to remain subdued reflecting tariff uncertainty and concerns about the Israel/Iran war.

In the US, Fed Chair Powell’s congressional testimony (Tuesday) is likely to retain the Fed’s wait and see guidance before cutting rates again. On the data front, expect falls in existing home sales, a rise in consumer confidence but softer growth in home prices (Tuesday), a rise in durable goods orders (Thursday) and core private final consumption deflator (Friday) for May remaining low at 0.1%mom or 2.6%yoy.

In Australia, monthly inflation for May is expected to show a fall of -0.1%mom taking annual inflation to 2.4%yoy with trimmed mean inflation slowing to 2.5%yoy. Job vacancies for May are expected to fall 2%qoq after a 4.5% fall in the three months to May.

Outlook for investment markets

Shares are at high risk of near-term pullback given the ongoing a high risk that the war with Iran will disrupt oil supplies, tariff uncertainties, concerns about US debt and likely weaker growth and profits. But with any Middle East disruption to oil supplies likely to be brief, Trump likely to pivot towards more market friendly policies and central banks, including the Fed and RBA, likely to cut rates further shares are likely to recover on a more sustained basis into year end. It’s likely to be a rough ride though.

Bonds are likely to provide returns around running yield or a bit more, as growth weakens, and central banks cut rates. A US public debt crisis is the main threat to this.

Unlisted commercial property returns are likely to improve in 2025 as office prices have already had sharp falls in response to the lagged impact of high bond yields and working from home.

Australian home prices have likely started an upswing on the back of lower interest rates. But it’s likely to be modest initially with US tariff worries constraining buyers. We now see home prices rising around 5 or 6% this year given the more dovish RBA.

Cash and bank deposits are expected to provide returns of around 4%, but they are likely to slow as the cash rate falls.

The $A is likely to be buffeted between the negative impact of US tariffs and the global trade war and the potential positive of a further fall in the overvalued US dollar. This could leave it weak around $US0.60 in the near term. Undervaluation should support it on a medium-term view with fair value around $US0.73.

You may also like

-

The outlook for Australian shares – is the long underperformance over? Australian shares have had a strong start to 2026 with the ASX 200 up 3.3% and flirting with a new record high. The local market has also outperformed US shares which are down 0.1% and global shares which are up 1.6%. However, this could just be noise and follows a significant underperformance against US and global shares since 2009. -

Weekly market update - 20-02-2026 Global share markets mostly rose over the last week. Worries about AI and tech valuations took a breather and the US Supreme Court decision to strike down Trump’s emergency power tariffs with Trump immediately announcing a replacement were seen as having little impact on the US growth outlook but were seen as positive for other countries. -

Econosights - An update on global debt and fiscal policy With the International Monetary Fund releasing their Global Fiscal Monitor recently, AMP's Senior Economist, Diana Mousina provides an update on the global debt situation and recent fiscal policy announcements.

Important information

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account. Taxation issues are complex. You should seek professional advice before deciding to act on any information in this article.

It’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you. The super coaching session is a super health check and is provided by AWM Services and is general advice only. It does not consider your personal circumstances.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy. All information on this website is subject to change without notice. AWM Services is part of the AMP group.