Here are the top 5 lessons I learnt in 2025

1. Politics matters

In the post-Covid world, government intervention into many parts of the economy has increased. This means that economic growth is increasingly tied to changes in government spending and other forms of intervention like regulation and taxes. As a result, financial markets can move more off political noise than in prior periods.

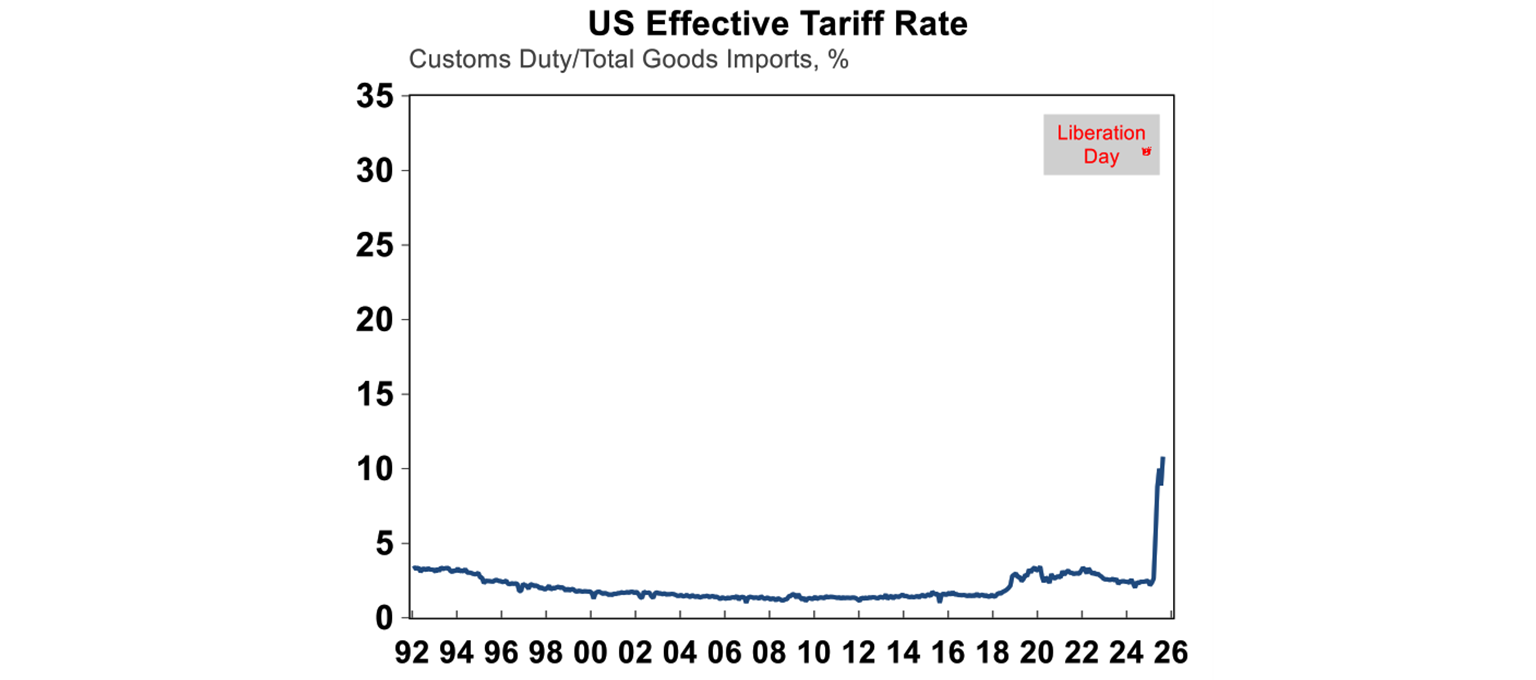

This year in the US there were many important policy changes. The main one was the increase to tariffs under Trump 2.0. Trump threatened to increase tariffs to above 30% in April (“Liberation Day”) from ~3% at the start of the year, which would have taken US tariffs to their highest level since the late 1800’s. The US sharemarket responded negatively to this event, falling by nearly 19% peak-to-trough because of concern that tariffs would hit US economic growth. Subsequent deals made with US trading partners that reduced tariffs (particularly on key consumer products) means the average US tariff rate is likely to end up somewhere at 15% or below. While this is still the highest level of tariffs the US has had since the 1930’s, markets rallied on news that it was better than feared.

Other major US government policy announcements this year included the One Big Beautiful Bill Act, which was mostly seen to be market-friendly through short-term fiscal stimulus. Other policy changes include the crackdown on illegal immigration and the closure of the border which reduced labour supply. The Trump administration also had a closer tie to cryptocurrencies and tech companies (like dinners with head of all major tech companies and the US government stake directly into Intel and other major companies), actions which could be perceived as the government effectively endorsing these companies. Trump also became more involved with the US Federal Reserve, pressuring Fed Chair Powell to cut interest rates significantly, attempting to fire a Governor and appointing a dovish governor to replace an outgoing member.

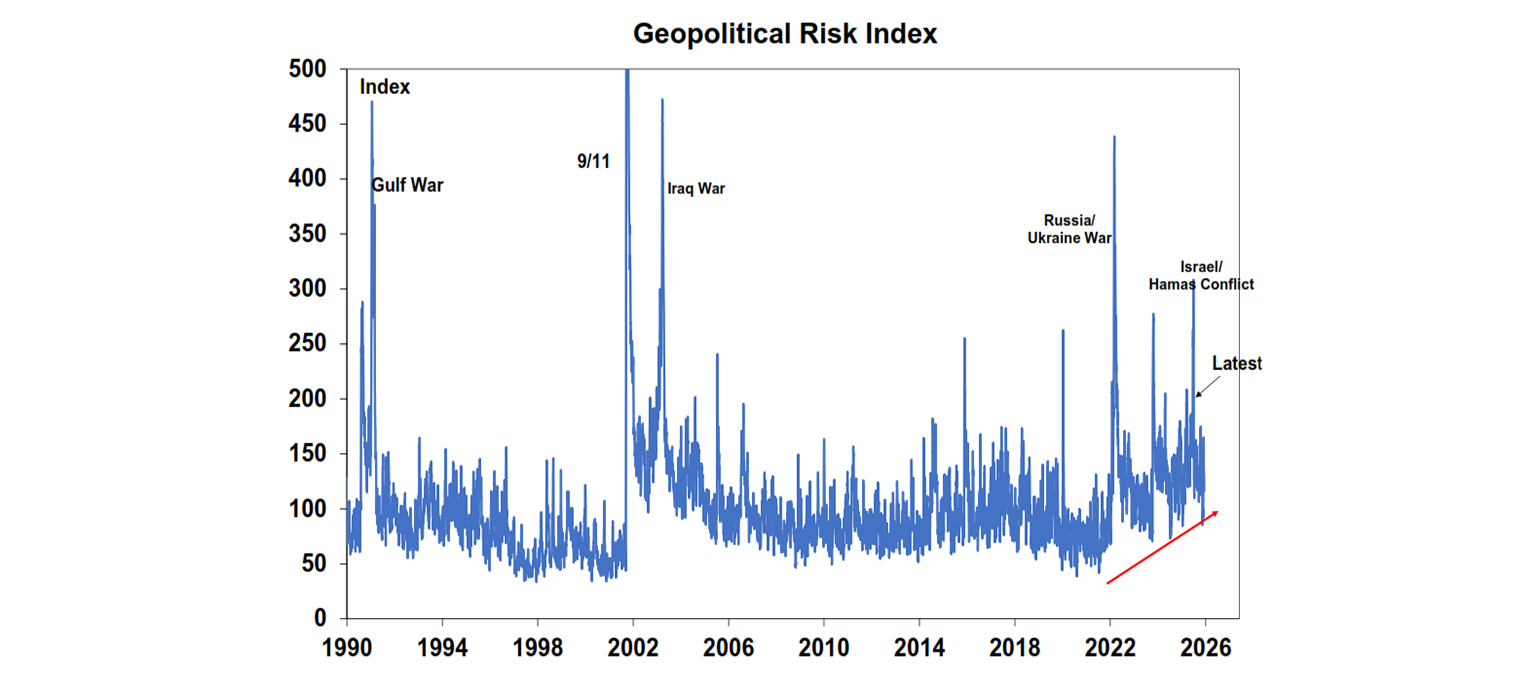

US sharemarkets have also been sensitive to news around the end of the Israel/Gaza and Russia/Ukraine conflict, usually lifting on news that these conflicts may be abating. Of course, the impact of this geopolitical news on markets has been a side show relative to the impact of earnings on markets and interest rates.

In Australia, the biggest influence from the government in recent years has been high public spending. Government consumption and investment is running at nearly 29% of GDP, around a record high. This fiscal boost to the economy has bolstered GDP and public sector employment growth while private sector activity has been soft. It also added to the higher inflation backdrop of recent years, contributing to elevated interest rates.

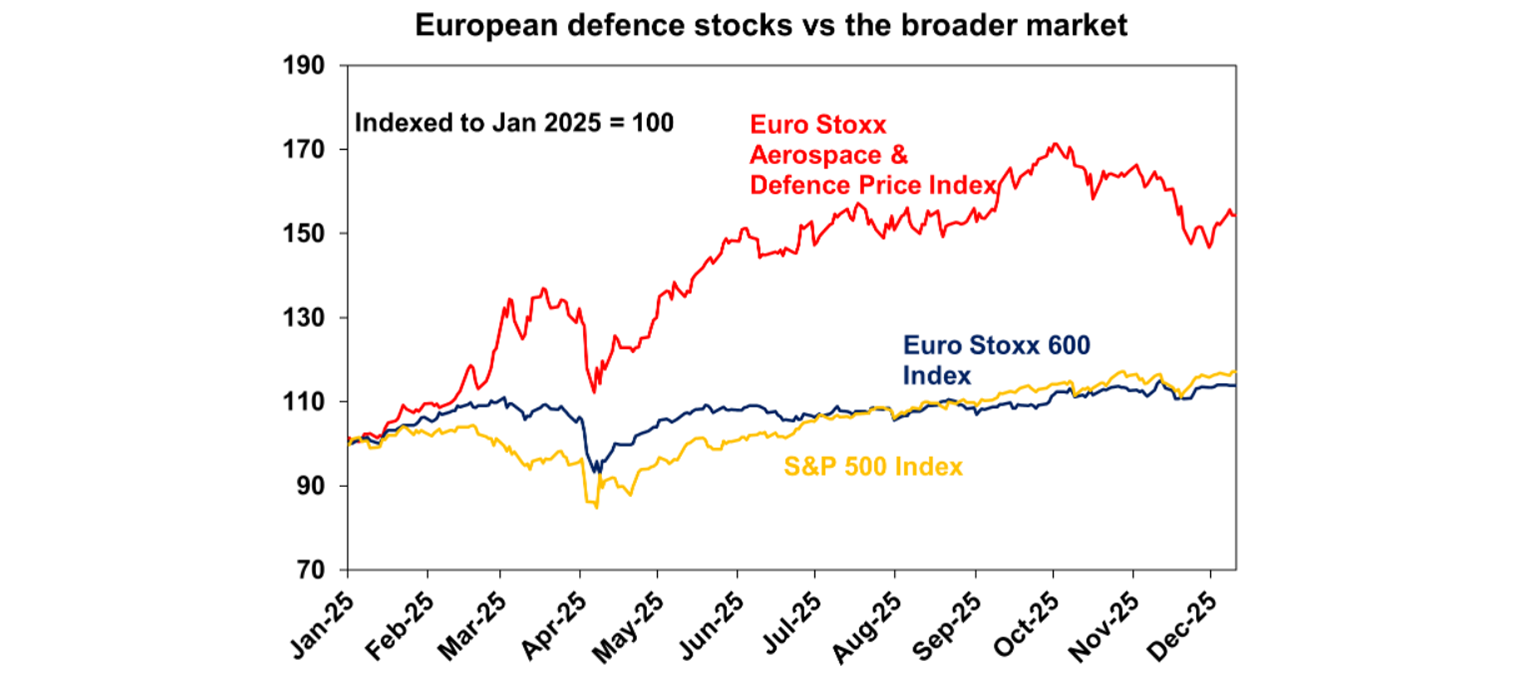

Trump and US Vice President JD Vance sent a clear message to European leaders this year that the US will be scaling back its security guarantees, unless NATO members increase spending significantly. Expectations of higher European defence spending helped European sharemarkets rally, with the aerospace and defence stocks outperforming the broader market (see the chart below).

Some of these global political factors can be reflected in a “Geopolticial Risk Index” which we can track, although its very volatile. There may be less geopolitical risks for markets in 2026 if some of the “forever” wars flare down and the US acts more as a global balancing agent (rather than an instigator of conflict). However, domestic politics will still be important as US mid-term election years tend to be more volatile and negative for sharemarkets compared to other years in the cycle.

2. Take Trump seriously not literally

I can’t remember where I saw this quote saying that you should take Trump seriously but not literally, but I think it’s a good guide to understanding how to assess the investment implications from a Trump Presidency. This played out with the “TACO” trade (Trump Always Chickens Out), with investors eventually diminishing hyperbolic comments and threats around higher tariffs, realising that deals are likely to be made. This is evident in the actual tariff rate being paid on imports, based on customs data (otherwise known as the “effective” tariff rate) being lower than expected. The effective tariff rate is around 11%, which is below the rate that should be paid based on deals. The effective tariff rate ends up being lower than expected because of substitution – consumers move away from higher costing tariff goods to either an alternative or a different good from a country with a lower tariff rate. Trump also keeps making deals lowering tariff rates or excluding certain goods which has helped to lower tariffs from Liberation day highs.

3. Fundamentals don’t always work (in the short-run anyway)

One of the biggest surprises for me this year was the rally in the gold price. There have been some fundamental factors that have been driving the gold price higher including: more central bank demand, investor demand as a hedge against inflation, a “debasement trade” over concern that the $US is losing its global standing and geopolitical concerns including sanctions (like those on Russia which led to losses of $US assets). However, these fundamentals probably don’t explain the steep 64% rally in the gold price since the beginning of the year, particularly the speed of the increase. The line down the street at the Sydney ABC gold bullion store shows that sometimes FOMO power is better than fundamentals, and can keep a rally going after fundamentals start waning.

Concerns about a tech-related sharemarket crash have been bubbling all year based on some fundamental valuations for tech stocks, which have a major weighting in indices like the S&P500 (worth around 50% if you include the tech names in the consumer discretionary space). The Price-to-earnings ratio of US stocks still looks very expensive (see the chart below) and is around other highs in the US market that were followed by a bear market. However, this fundamental analysis didn’t work again this year. “Expensive” US tech stocks didn’t stop these stocks from having another solid year of performance.

4. Don’t always listen to what central banks say

This year we had more divergence in views on interest rates from the US Federal Reserve members, ranging from the ultra hawkish (favouring higher interest rates) to the ultra dovish (favouring lower interest rates) and everywhere in between! Members who lean more hawkish (including Goolsbee and Schmid recently) mostly cite elevated inflation and timing as the key reason not to cut interest rates again. In contrast, Trump’s recent appointment on the Fed Board (Miran) has been arguing for outsized rate cuts. The Federal Reserve has regional Bank presidents that may not be on the Federal Open Markets Committee (due to rotating Presidents) which is the group that makes decisions on interest rates. But these regional Presidents are still involved in meetings and have influence on forecasts (like the dot plot). This means that there can be a whole lot of opinions from members, especially as Fed officials often make speeches and talk to the media. On top of the mixed US economic data picture, more “Fed Speak” can create more uncertainty for markets around pricing for interest rate changes. Prior to the December meeting for example, mixed commentary from Fed members led to significant moves in market pricing for the December Fed meeting. But if you listened to every comment made by the members, it wouldn’t have given you any more clarity about what the central bank was likely to do! Sometimes less communication from the central bank is better. For economists it is often better to forecast growth and inflation and therefore the implication for the central bank, rather than forecasting what the central bank will do looking ahead, as Board members inevitably have a range of opinions.

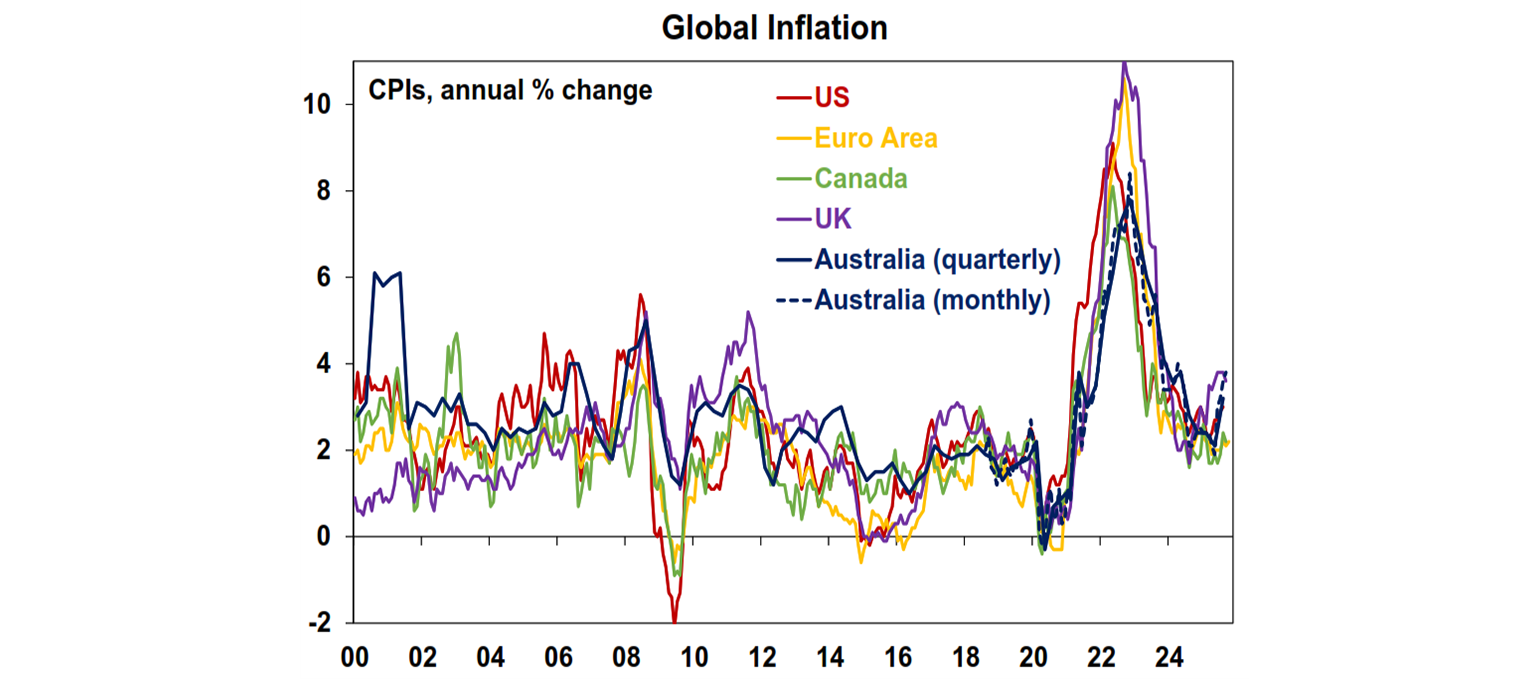

5. High inflation hurts for years

After reaching ~8-10% in 2022 across the major global economies, Inflation moderated to sub 3% in 2024 and it was assumed that it was “job well done” on getting inflation down. However, this proved to be premature as inflation started trending up again this year and remained elevated for services. Most major economies are seeing inflation rates at around 3%, higher than central bank targets. Consumers are also still citing cost-of-living challenges, as wages growth has not kept up with the high inflation of recent years. Elevated inflation can take a while to abate as often spikes in goods prices seep into services which is “stickier” and takes longer to slow. In 2026, services inflation should moderate as global unemployment rates have been trending up, which will reduce wages inflation.

Diana Mousina

Deputy Chief Economist, AMP

You may also like

-

The outlook for Australian shares – is the long underperformance over? Australian shares have had a strong start to 2026 with the ASX 200 up 3.3% and flirting with a new record high. The local market has also outperformed US shares which are down 0.1% and global shares which are up 1.6%. However, this could just be noise and follows a significant underperformance against US and global shares since 2009. -

Weekly market update - 20-02-2026 Global share markets mostly rose over the last week. Worries about AI and tech valuations took a breather and the US Supreme Court decision to strike down Trump’s emergency power tariffs with Trump immediately announcing a replacement were seen as having little impact on the US growth outlook but were seen as positive for other countries. -

Econosights - An update on global debt and fiscal policy With the International Monetary Fund releasing their Global Fiscal Monitor recently, AMP's Senior Economist, Diana Mousina provides an update on the global debt situation and recent fiscal policy announcements.

Important information

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account. Taxation issues are complex. You should seek professional advice before deciding to act on any information in this article.

It’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you. The super coaching session is a super health check and is provided by AWM Services and is general advice only. It does not consider your personal circumstances.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy. All information on this website is subject to change without notice. AWM Services is part of the AMP group.