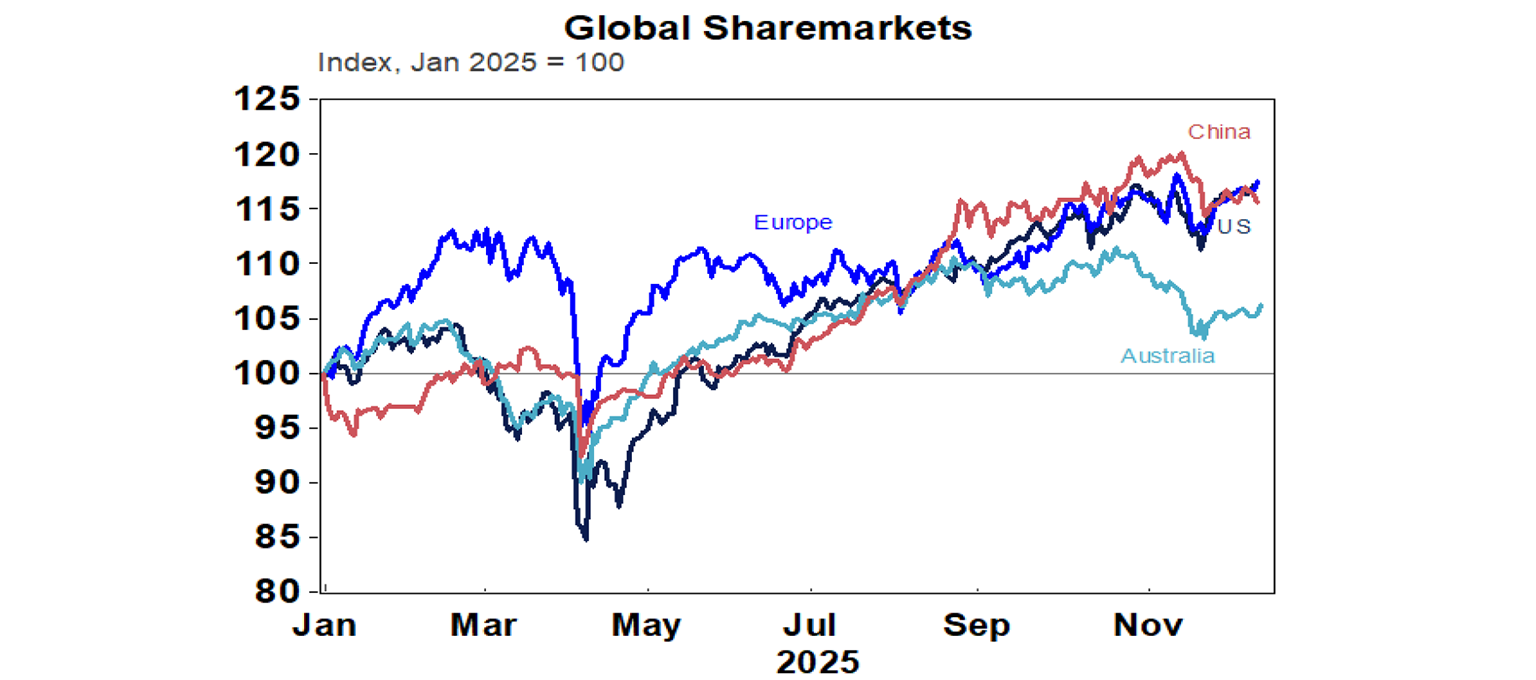

Global shares were mixed over the last week with the Fed cutting rates but AI worries remaining. US shares made it to a record high as the Fed cuts rates and its commentary was mostly friendly for risk assets but fell on Friday as a disappointing sales outlook from Broadcom along with worries about rising capex at Oracle added to concerns about AI stocks. This saw the US share market fall 0.5% for the week. Chinese shares also fell 0.1% for the week but Eurozone shares were flat, and Japanese shares rose 0.7%. In Australia, the positive global lead up until Thursday offset the negative impact from hawkish RBA guidance on interest rates and heightened expectations for rate hikes next year and saw the ASX 200 rise 0.7% for the week. Gains were led by materials, financials and property stocks with most other sectors down for the week. Bond yields rose for the week.

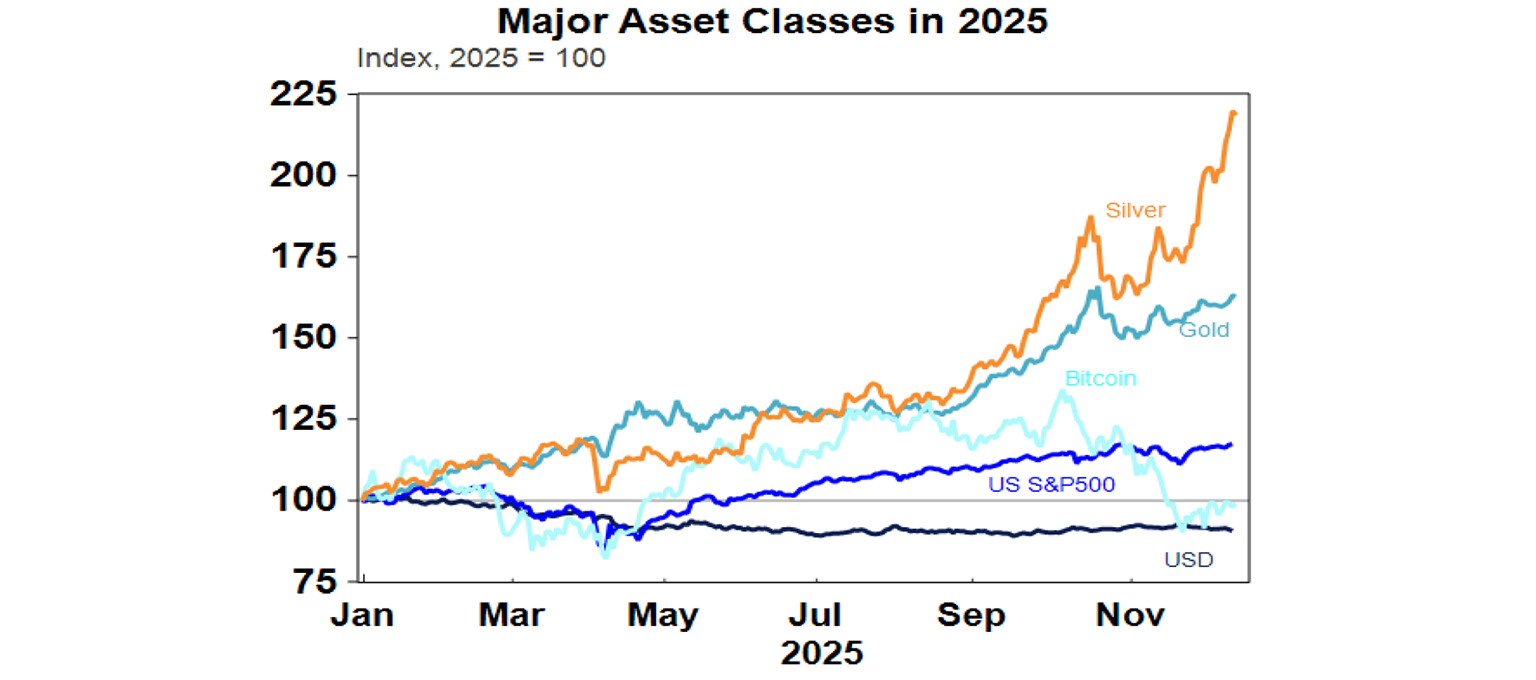

The past week saw gold, silver and Bitcoin rise helped by the risk asset friendly Fed and a further fall in the $US, with silver making a new record high possibly helped by the US adding it to its list of critical minerals. Of course, the next chart lacks any long-term context, and gold has done much better than silver over the long term. A further fall in the $US and a further widening in the expected Australian interest differential to the US with the RBA warning of rate hikes and the Fed still flagging rate cuts saw the $A rise nearer to $US0.67.

The rising trend in shares remains in place as global growth remains okay, the Fed left the door open for more rate cuts albeit its likely to pause for a while, earnings growth is likely to remain strong in the US and looks to be picking up in Australia, Trump is moving towards more consumer friendly policies (with big swings against the GOP in special elections adding pressure) and the Santa rally in shares normally kicks in from around now. Strength in consumer discretionary and material shares along with small caps, metals and the $A are positive signs from a cyclical perspective. And the break higher in the equal weighted S&P 500 index at a time when the so-called Magnificent 7 are still below their October highs suggests that breadth is improving in the US share market.

Apart from AI worries, another issue that could create a bit of angst in US and hence global investment markets is if the Supreme Court rules against Trump’s emergency powers tariffs requiring refunds with a decision likely soon. This could cause uncertainty – amongst other things it would mean a higher budget deficit and be bad news for bonds - but note Trump can replace the tariffs with a power that gives him the ability to impose up to 15% tariffs for 150 days and then use another power to run fair trade reviews and move back to current levels more permanently.

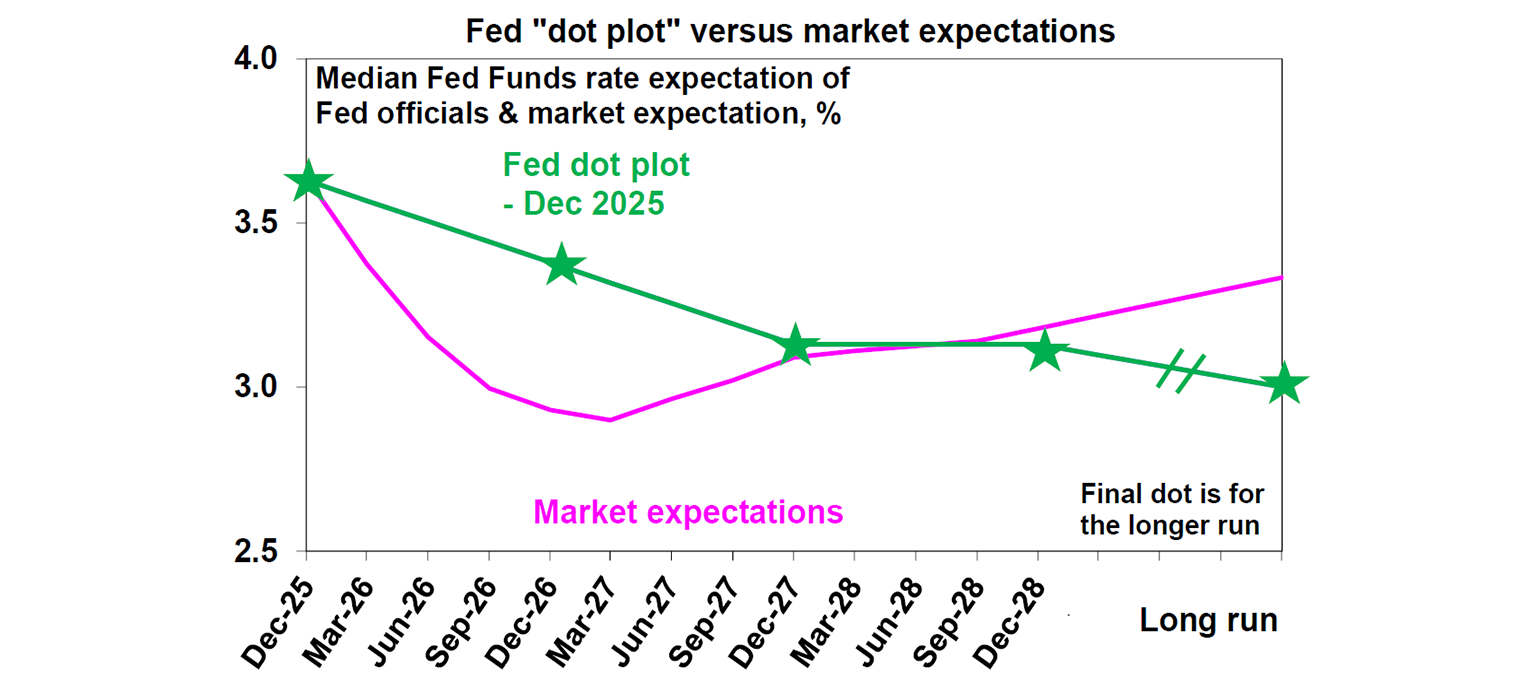

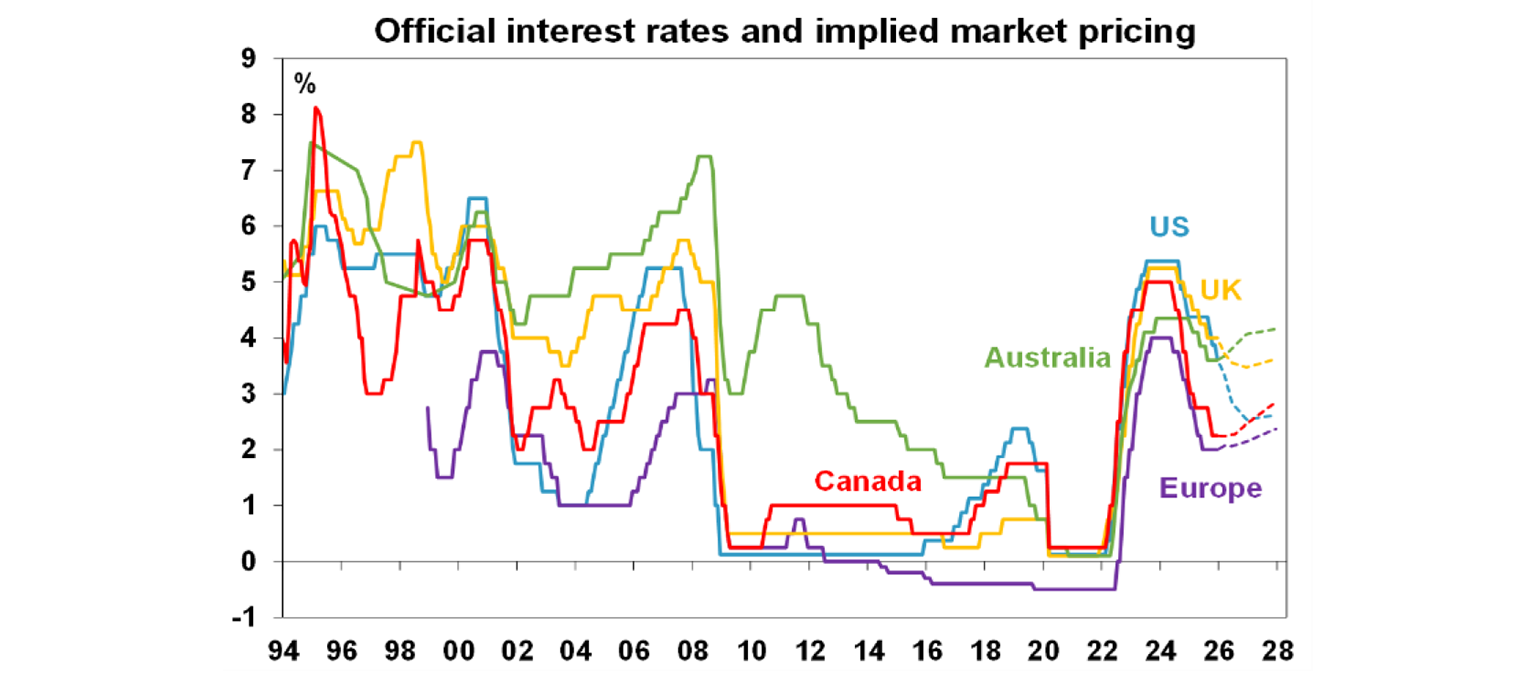

A not very hawkish cut from the Fed. As expected, the Fed cut rates for a third time this year taking the Fed Funds rate down another 0.25% to a range of 4.5-4.75%. While there was a hint of a pause after three consecutive cuts with Chair Powell noting that the Fed is now “well positioned to wait and see how the economy evolves” the overall message was less hawkish than expected and mostly risk asset friendly. In particular, there were only two dissents in favour of a hold which was less than expected, the “dot plot” of Fed officials rate expectations still allows for another cut next year and again in 2027, the Fed’s growth forecasts were revised up and key inflation forecasts revised down slightly, Chair Powell was upbeat on productivity and the Fed is to start adding to its balance sheet to ensure there are “ample reserves” in the financial system. Note that the latter is not QE but a return to the Fed expanding its balance sheet in line with the economy as it does in normal times. For now, the Fed is likHassett or former Fed Governor Kevin Warsh – and appears to be making the choice on whether he can trust them to cut rates and consult with him on rates because “I’m a smart voice and should be listened to” – which won’t do anything to allay fears about a loss of Fed independence. However, the new Fed Chair will have to convince more hawkish Fed presidents. The unanimous decision by the Fed’s Board to reauthorise 11 non-retiring regional Fed presidents for new five-year terms will put some restraint on whoever becomes the next Fed Chair.

Meanwhile the Bank of Canada left rates at 2.25%. This was no surprise with the BoC seeing rates at about the right level to keep inflation at the 2% target and support growth.

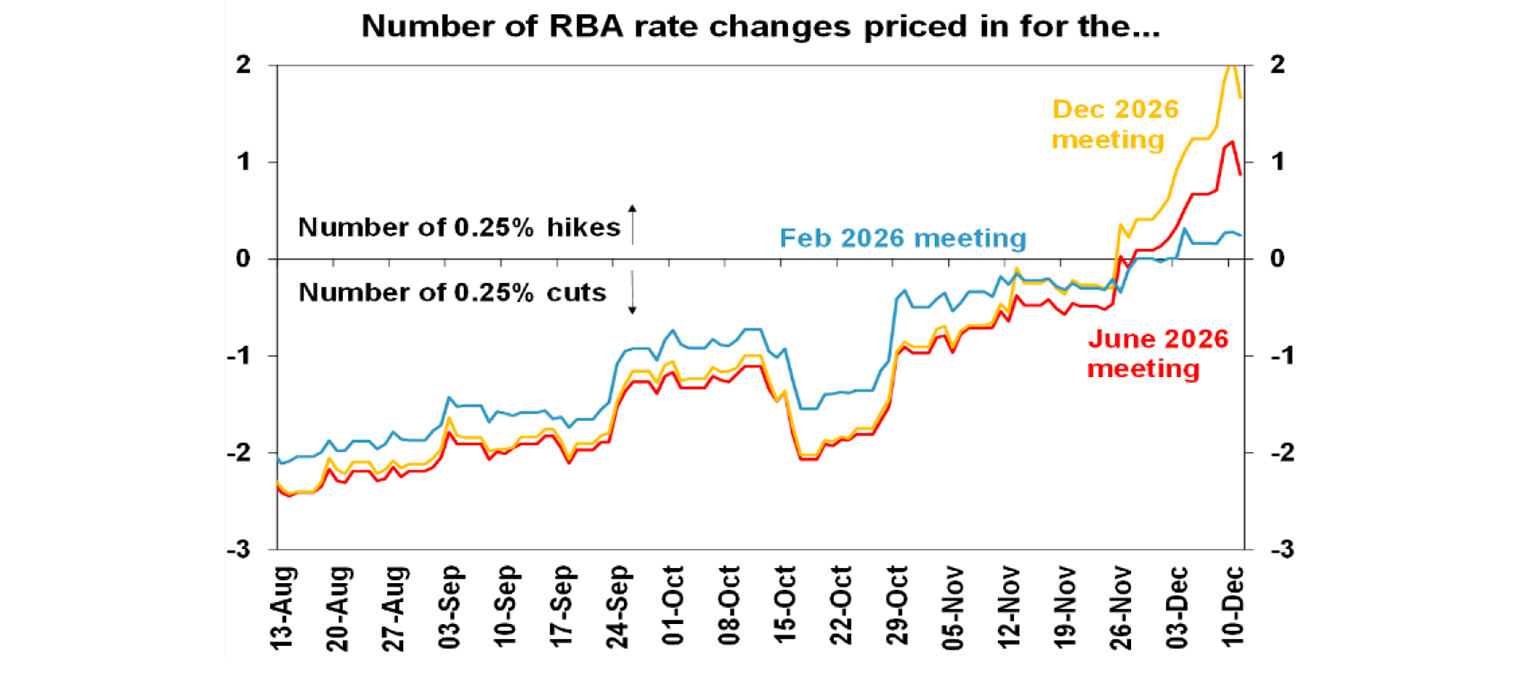

And in Australia we got a quite hawkish hold from the RBA. As expected, it left rates at 3.6% but its hawkishness was more strident than expected, with Governor Bullock indicating the RBA does not see cuts in the “foreseeable future”, so it’s a hold or hikes and if it looks like inflation is not coming back to target then it will hike. Most of the Governor’s comments were statements of the obvious but there was also some jawboning to help keep inflation expectations down and reinforce that the RBA is committed to its inflation target. But this saw some economists raise their expectations for rate hikes and provided a green light to the money market which sees nearly two hikes next year with a 28% chance of a hike in February.

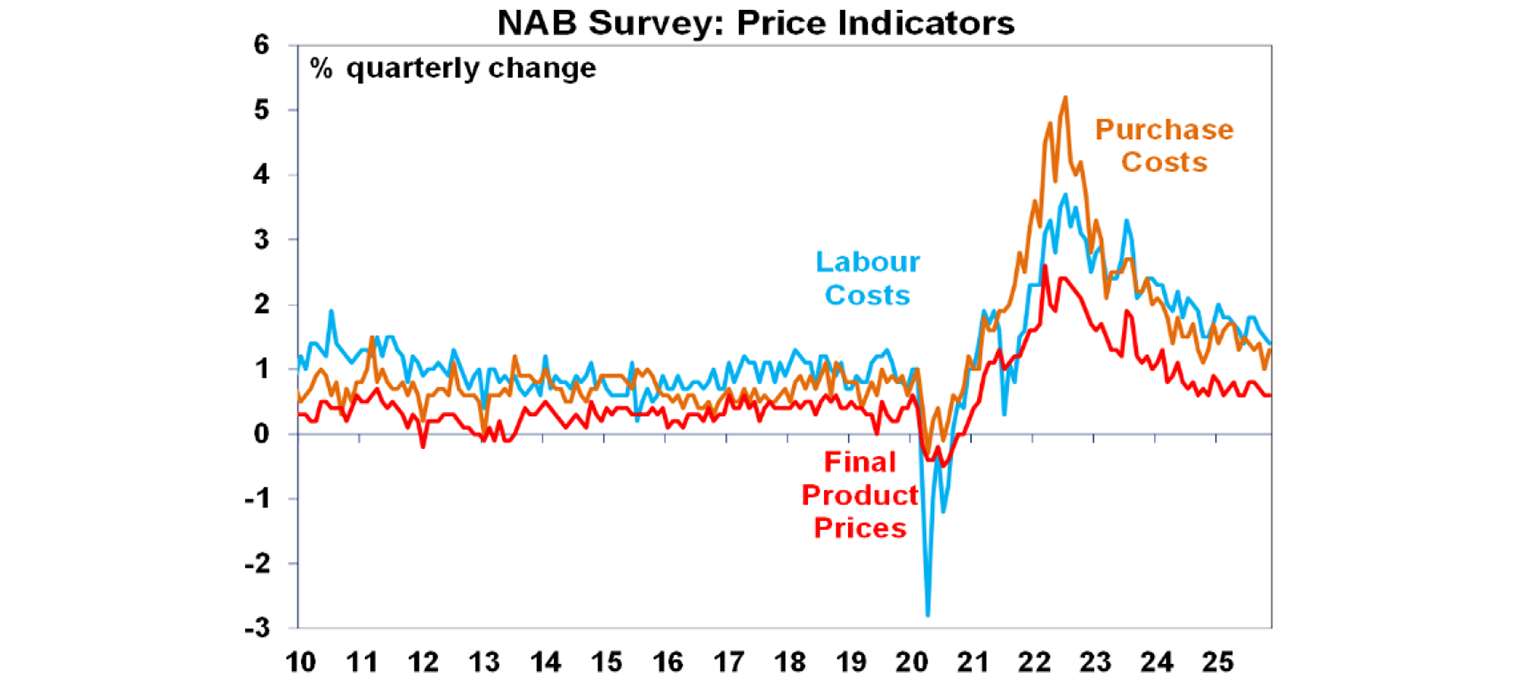

But as always, the RBA will be data dependent, and our assessment remains that the RBA will leave rates on hold next year. Don’t forget that we may have seen variations of this movie before – a year ago Governor Bullock warned “underlying inflation is still too high to be considering lowering the cash rate target in the near term”…and then we got softer trimmed mean inflation data for the December quarter and the RBA cut in February! The key to what happens early next year will be the December quarter CPI to be released in late January, with the November CPI on 7th January providing some early (imperfect) indication. Our assessment is that underlying inflation will drop back to 0.8%qoq (which is the RBA’s forecast) or slightly less from 1%qoq in the September quarter – partly supported by the weaker trend in final product prices from business surveys – allowing the RBA to remain on hold at its February meeting. More broadly we see the fall back in quarterly underlying inflation continuing in subsequent quarters providing confidence that annual inflation will come back to target allowing the RBA to avoid hiking rates next year. But worries about capacity constraints will probably prevent a cut.

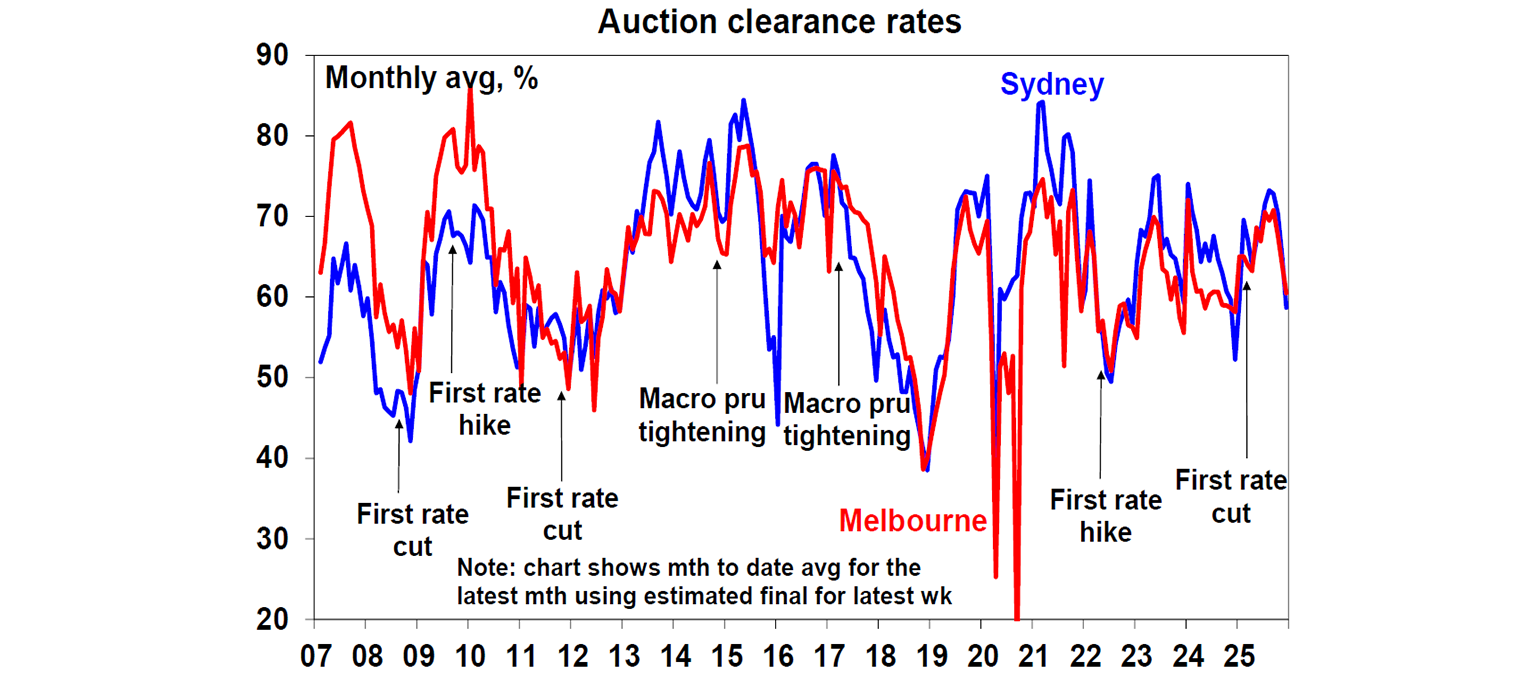

More broadly our view remains that its too early to consider raising rates as the economic recovery is still too fragile – and there is already evidence that talk of rate hikes is starting to dampen things. Auction clearance rates are one of the most timely economic indicators in Australia and in Sydney and Melbourne they have plunged since peaking in August on the back of peak rate cut optimism at the time. Some of the fall is likely seasonal but both cities have seen clearances fall more than implied by normal seasonal weakness, and so it likely also reflects the swing from expectations of rate cuts to now rate hikes. This may be good news in that it suggests some of the heat may be coming out of the property market. But if home buyers are getting nervous it’s likely that rate sensitive households will also be getting nervous. I suspect a big driver of the pickup in household spending reflects the three rates cuts plus expectations of more rate cuts to come. If rate cuts quickly turn to rate hikes with expectations for more hikes to come, then it’s likely that household spending will take a hit.

The next chart puts Australian interest rates in the context of global rates. Sure Australian rates did not go up as much as those in the US, UK and Canada and so may not come down as much but money market expectations appear to be factoring in a far stronger pick up in nominal growth in Australia requiring a faster upswing in rates than in other countries and its not clear why this would be the case. So we continue to see the Australian money market’s expectations for rate hikes next year as being too hawkish.

John Lennon’s and Yoko Ono’s Happy Xmas (War Is Over) is as relevant today as it was in 1971. The line “war is over” sounds like wishful thinking but it makes sense with the “if you want it” line. The trouble is that the people who matter often don’t want it to be over for their own egotistical reasons. They should learn to get energy from trees!

Major global economic events and implications

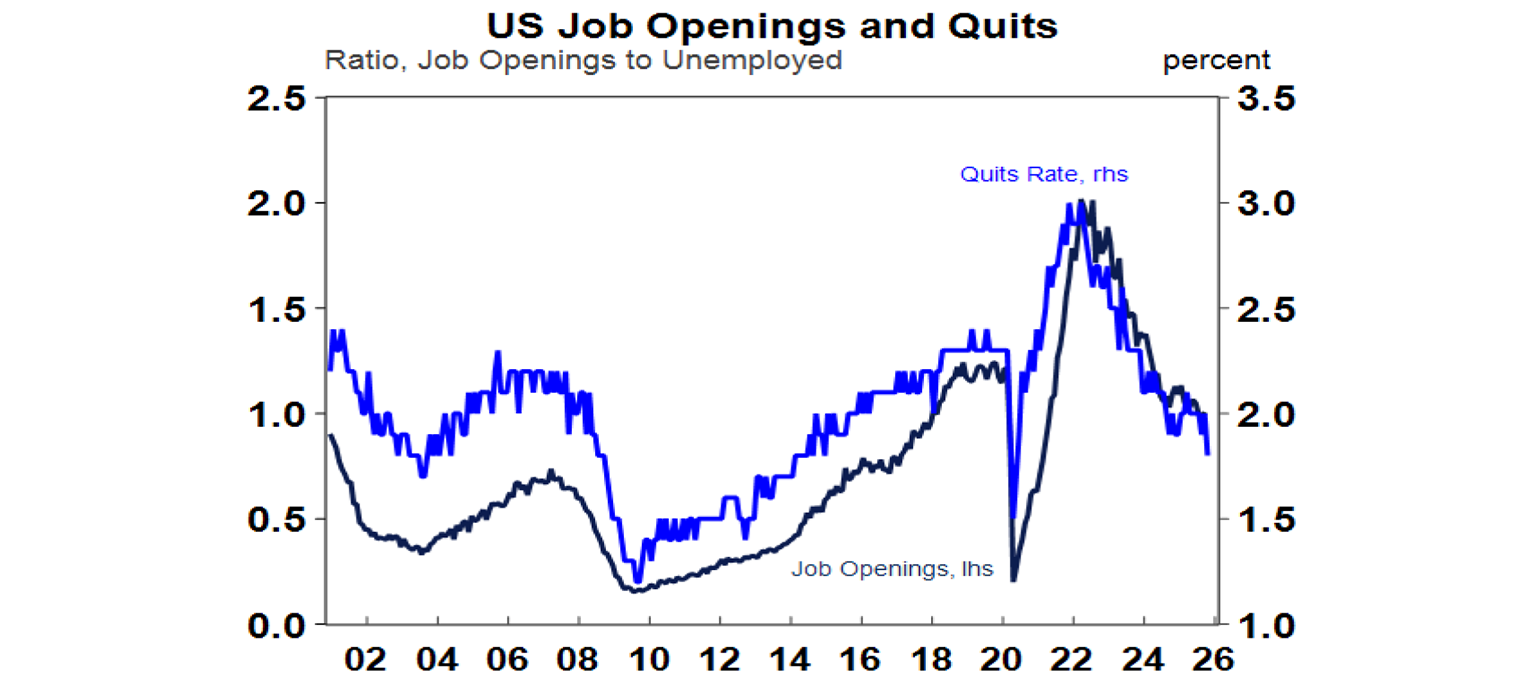

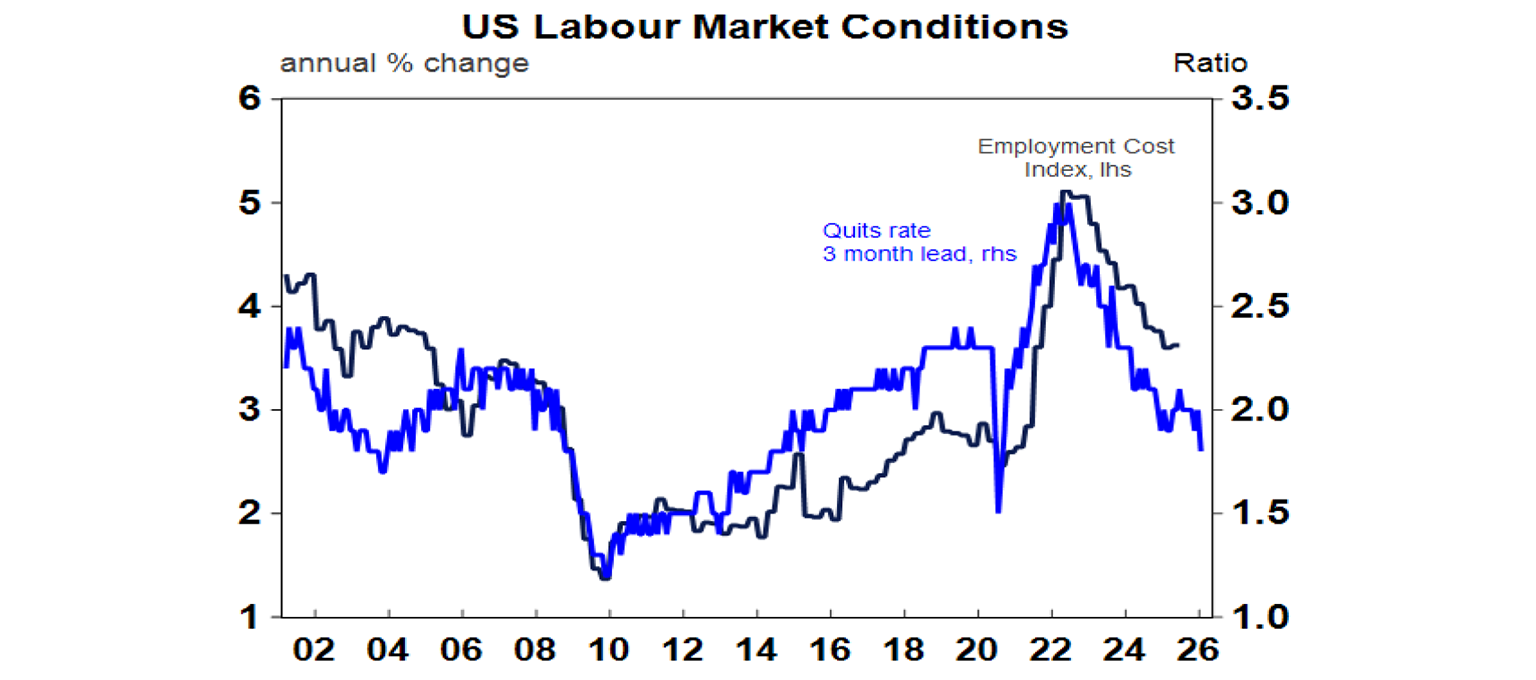

Another round of delayed of US jobs data was mostly on the soft side. Job openings rose between August and October but people quitting for new jobs and hiring fell.

The fall in the quits rate points to a further slowing in employment costs, which slowed to 3.5%yoy in the September quarter. Meanwhile small business optimism rose slightly, initial jobless claims surged after the Thanksgiving distortion but remain low and continuing claims fell as they were impacted by the Thanksgiving holiday.

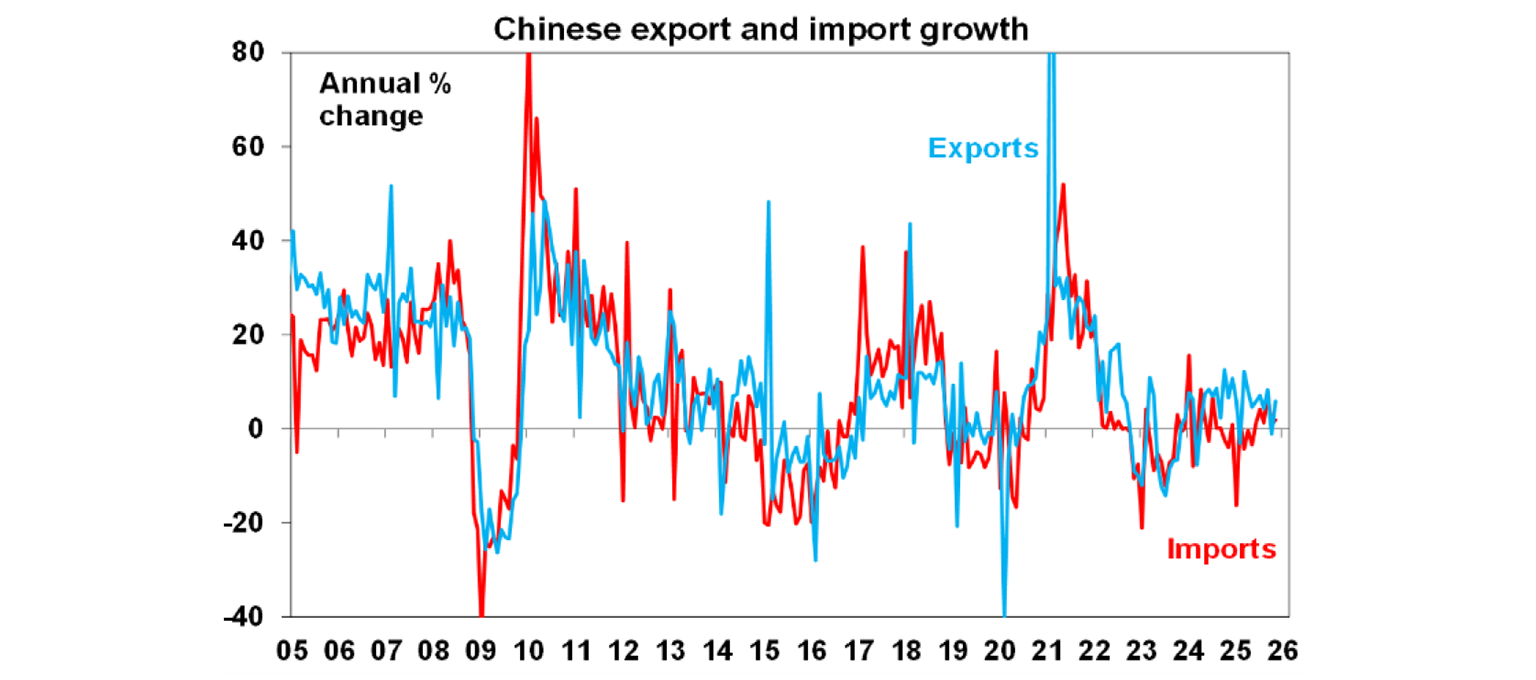

China’s December Central Economic Work Conference meeting took a modestly supportive pro-growth stance with commitments to reverse the downturn in investment and boost consumption and stabilize the property sector suggesting some ramp up in policy stimulus albeit with maybe less urgency than seen a year ago. Meanwhile, export growth rose a stronger than expected 5.4%yoy in November but import growth rose to just 1.9%yoy. Lending growth remained soft in November suggesting weak demand for loans from households and total credit growth was unchanged at 8.5%yoy.

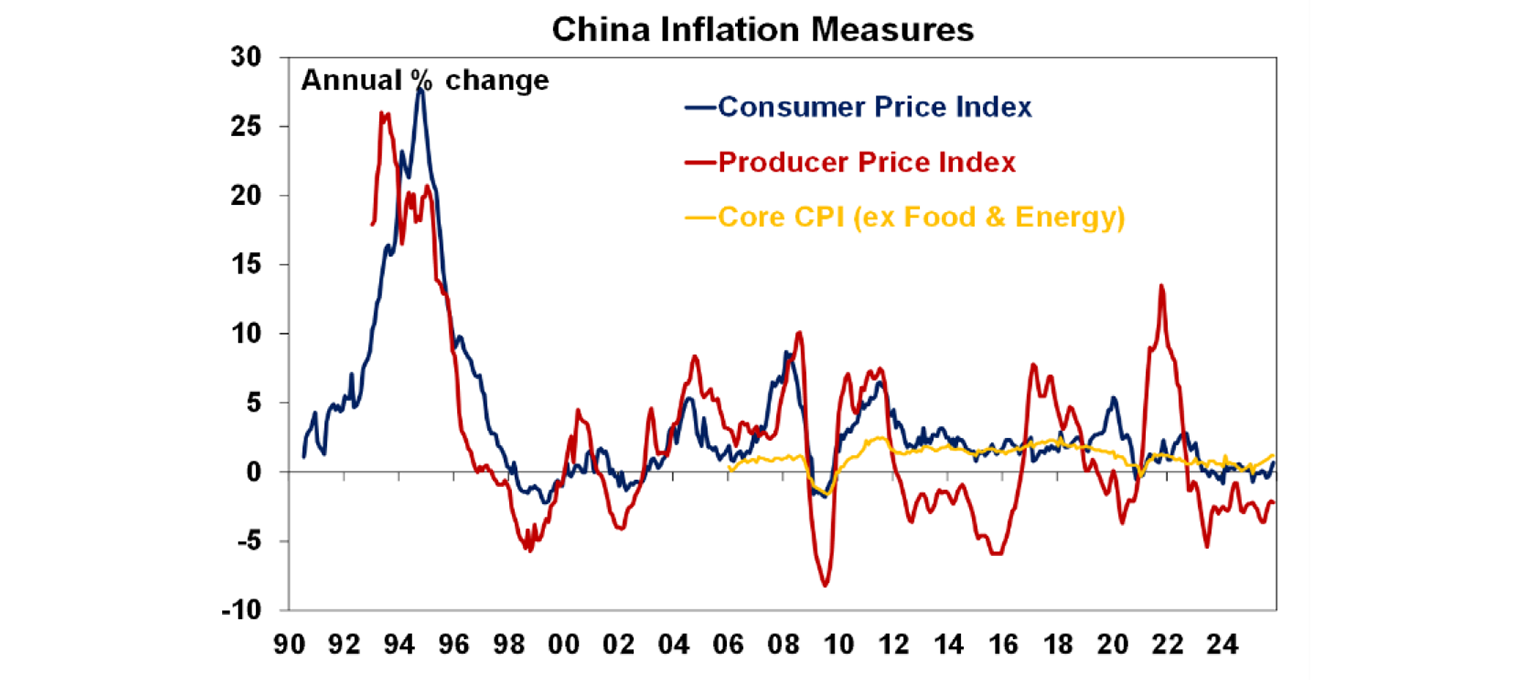

Chinese inflation rose to 0.7%yoy from 0.2%yoy due to higher food prices with core (ex food and energy) inflation flat at 1.2%yoy and producer price deflation of -2.2%yoy.

Australian economic events and implications

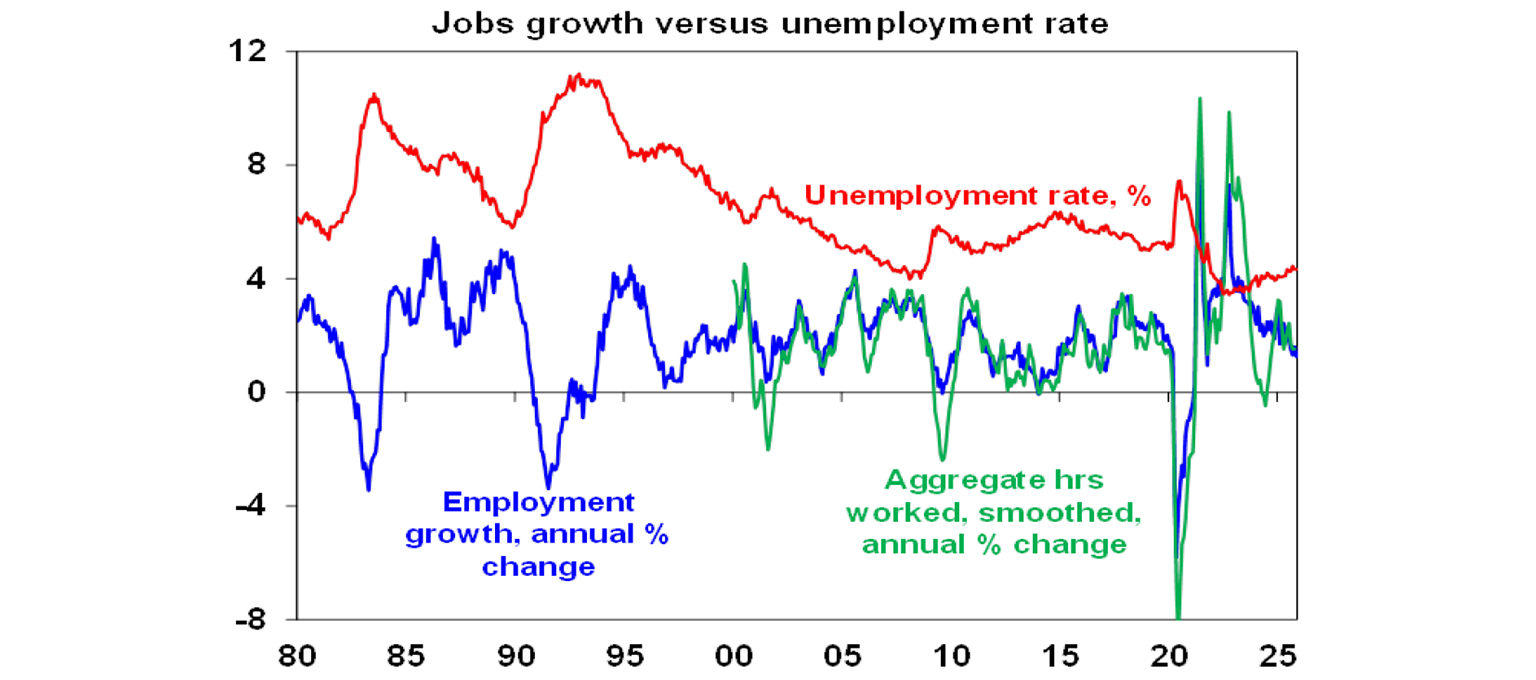

November jobs data was a mixed bag. Unemployment was unchanged at 4.3%, around the RBA’s forecast. But the details were soft with employment down by 21,300, full time jobs down 56,500, annual employment growth slowed to just 1.3%yoy (its lowest outside the pandemic since 2017) compared to population growth of 2%yoy, hours worked were flat and slowed to 1.2%yoy, underemployment rose to 6.2%, the share of the population in employment fell further and participation fell.

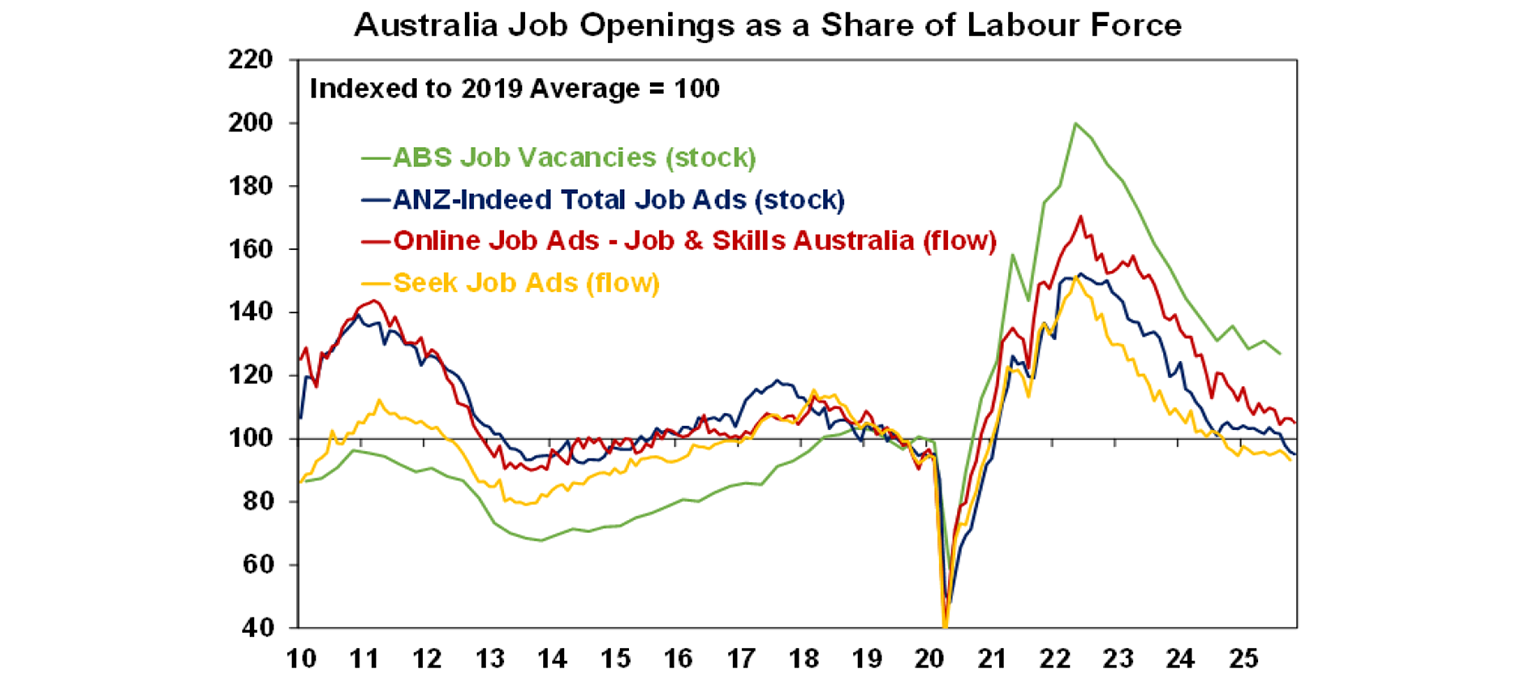

Forward looking jobs data relating to vacancies continue to trend down warning of slower jobs growth ahead. The risk is that as growth in non-market jobs (mainly in the “care economy”) slows, private sector jobs growth will be slow to fill the gap. This would result in a continuation of the two steps up/one step down rising trend in unemployment.

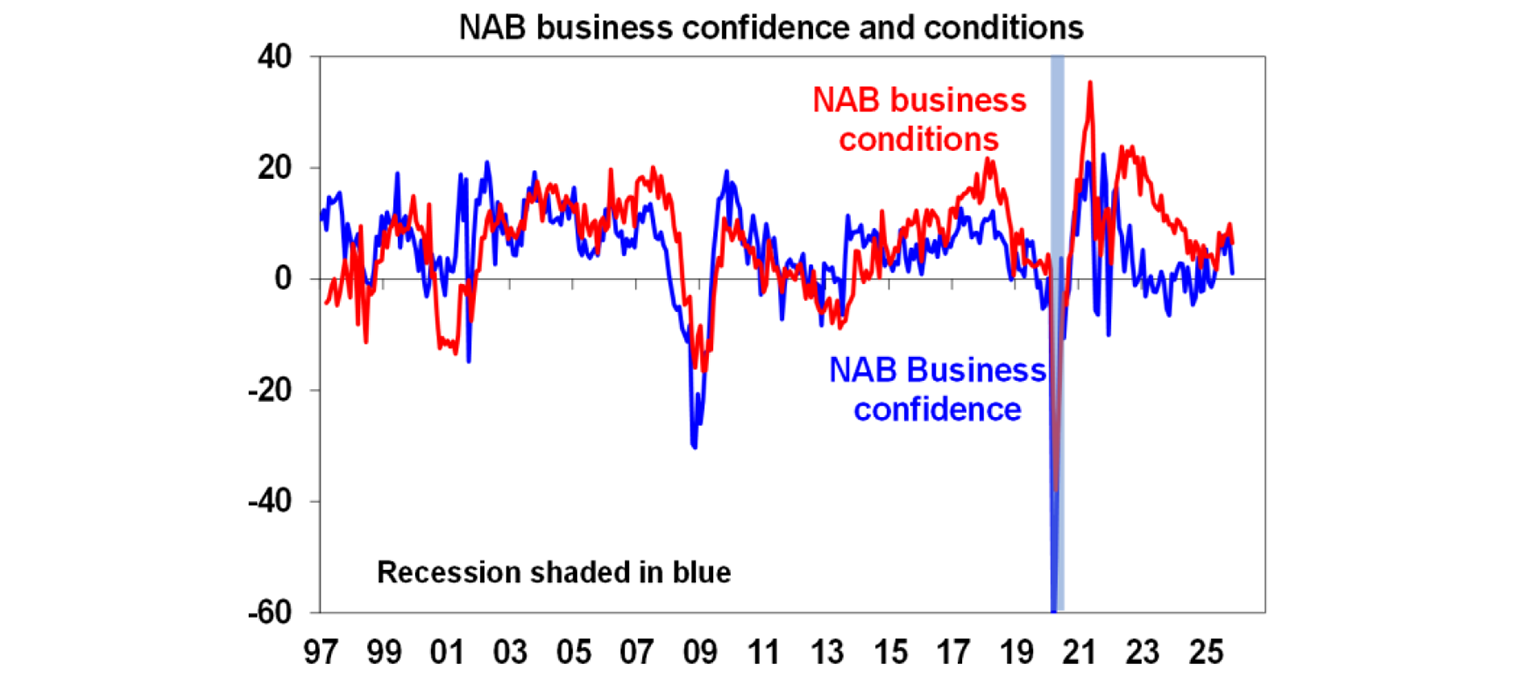

Business confidence and conditions fell in November with softer orders. Consumer sector orders have also slowed.

The good news is that cost pressures are trending down and final product prices are running at a benign 0.6% quarterly rate. Capacity utilisation is still running above average adding to concerns about capacity constraints.

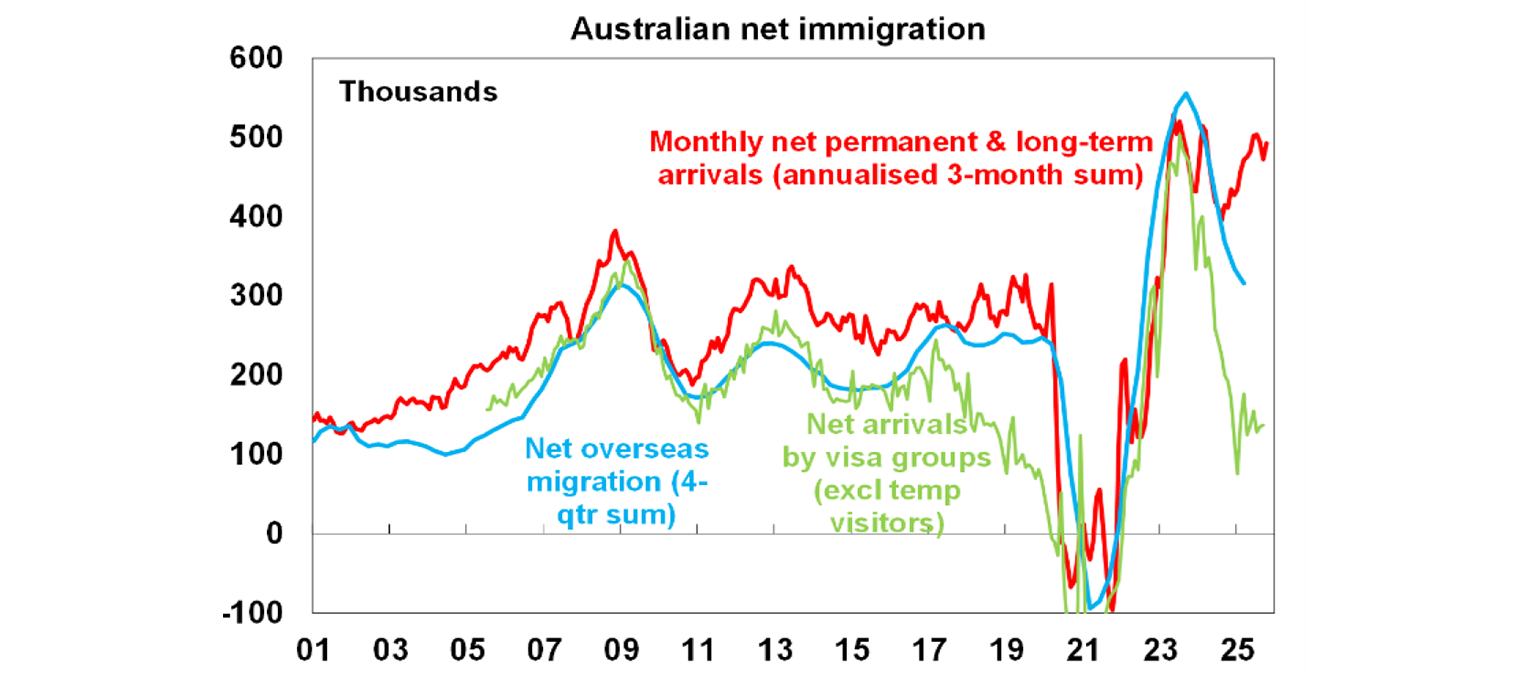

Monthly visa data and net permanent and long-term arrivals data continue to provide a conflicting picture on the trend in net migration with the former pointing down and the latter pointing up.

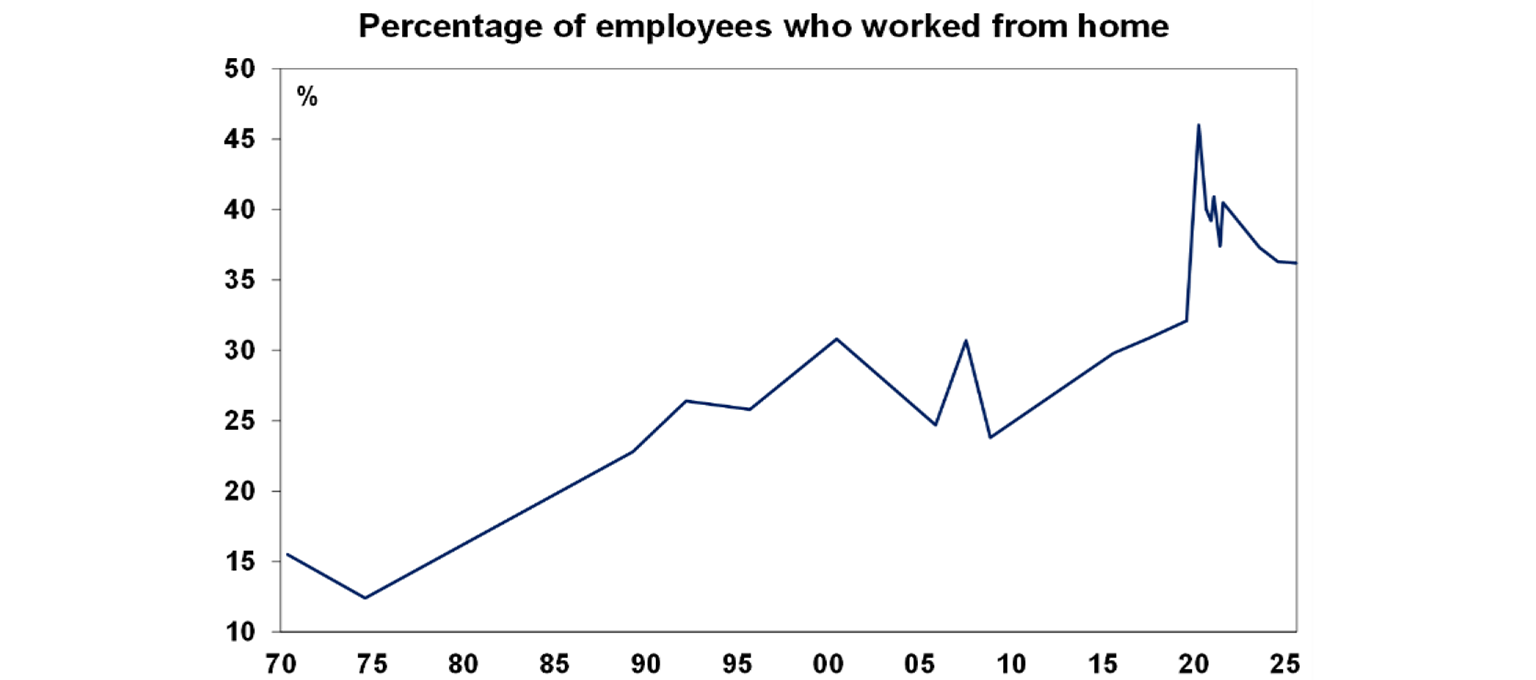

And finally, ABS data shows that about 36% of employed people work from home some or all of the time. Interestingly, the trend has been up for decades made possible by the growth of white-collar jobs, self-employment and technology along with a desire for more flexibility and less commute time.

What to watch over the week ahead?

Developed country business conditions indexes or PMIs for November will be released Tuesday and are likely to remain around levels consistent with okay global growth.

In the US, delayed jobs data for October and November (Tuesday) and are expected to show a large slump in October payrolls due to deferred DOGE related departures and a subdued 50,000 gain in November. Unemployment is expected to rise to 4.4% with wages growth of 3.6%yoy. November CPI data (Thursday) is expected to show core inflation at 3%yoy. Retail sales data for October (Tuesday) are likely to show weak growth of 0.1%mom. The NAHB’s home builder conditions index (Monday) is likely to show improvement and manufacturing conditions indexes for the New York and Philadelphia regions will also be released.

Canadian inflation (Monday) is likely to see underlying inflation measures around 2.9%yoy.

The ECB (Thursday) is expected to leave its key rate at 2%, with inflation around target and growth improving a bit.

The Bank of England (Thursday) is likely to cut to 3.75% & inflation (Wednesday) is expected to fall to 3.4%yoy.

The Bank of Japan (Friday) is expected to continue the very gradual process of normalising its interest rates with a 0.25% hike to 0.75% as flagged by Governor Ueda. While some might fret about an unwinding of the carry trade, Japanese rates are still too low and rising too slowly to cause a big reversal of capital flows out of Japan. The next rate hike is not fully priced until September next year. Meanwhile, the December quarter Tankan business survey will be released Monday and November inflation data (Friday) is expected to remain at 3%yoy with core (ex food and energy) inflation unchanged at 1.6%yoy.

Chinese data is likely to show continuing subdued growth with growth in industrial production of 5%yoy, retail sales growth of just 2.9%yoy and investment falling 2.3%yoy.

In Australia, the Federal Government’s Mid-Year Economic and Fiscal outlook (probably Wednesday) is likely to show a reduction in this financial year’s budget deficit forecast from $42.1bn to around $37bn flowing from the ongoing upside surprise in corporate and personal tax revenue. The Government is also expected to announce some measures to reign in the growth in public spending, which are sorely needed with public spending running around record levels and adding to capacity constraints and hence inflation and depressing productivity. Treasury is also likely to have revised up its inflation forecasts slightly for this financial year to 3.7%yoy from 3% in the March Budget. On the data front, the Westpac/Melbourne Institute consumer sentiment survey for November (Tuesday) is likely to show a sharp fall in response to the RBA’s guidance that it may have to raise interest rates and talk of two rate hikes next year.

Outlook for investment markets

After three years of strong returns, it’s inevitable that investment returns will slow. We have seen a bit of that in 2025 but expect a further slowing in 2026.

Global and Australian share returns are expected to slow further in the year ahead to around 8%. Stretched valuations in the key direction setting US share market, political uncertainty associated with the midterm elections (which years have seen below average returns and increased volatility) and AI bubble worries are the main drags, but returns should still be positive thanks to Fed rate cuts, Trump’s consumer friendly pivot and solid profit growth. A return to profit growth should also support gains in Australian shares even though the RBA may have finished cutting rates. Another 15% or so correction in share markets is likely along the way though.

Bonds are likely to provide returns around running yield.

Unlisted commercial property returns are likely to stay solid helped by strong demand for industrial property associated with data centres.

Australian home price growth is likely to slow to around 5-7% in 2026 after 8.5% in 2025 due to poor affordability, rates on hold with talk of rate hikes and APRA’s move to ramp up macro prudential controls.

Cash and bank deposits are expected to provide returns around 3.6%.

The $A is likely to rise as the interest rate differential in favour of Australia widens as the Fed cuts and the RBA holds and possibly hikes. Fair value for the Australian dollar is around $US0.73.

You may also like

-

The outlook for Australian shares – is the long underperformance over? Australian shares have had a strong start to 2026 with the ASX 200 up 3.3% and flirting with a new record high. The local market has also outperformed US shares which are down 0.1% and global shares which are up 1.6%. However, this could just be noise and follows a significant underperformance against US and global shares since 2009. -

Weekly market update - 20-02-2026 Global share markets mostly rose over the last week. Worries about AI and tech valuations took a breather and the US Supreme Court decision to strike down Trump’s emergency power tariffs with Trump immediately announcing a replacement were seen as having little impact on the US growth outlook but were seen as positive for other countries. -

Econosights - An update on global debt and fiscal policy With the International Monetary Fund releasing their Global Fiscal Monitor recently, AMP's Senior Economist, Diana Mousina provides an update on the global debt situation and recent fiscal policy announcements.

Important information

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account. Taxation issues are complex. You should seek professional advice before deciding to act on any information in this article.

It’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you. The super coaching session is a super health check and is provided by AWM Services and is general advice only. It does not consider your personal circumstances.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy. All information on this website is subject to change without notice. AWM Services is part of the AMP group.