Key points

The recent missile strikes in Israel and Iran are a reminder that geopolitical events can always flare up and cause risks to the global order and markets. Geopolitical risk has been trending higher since 2021. But the 20 years prior to the pandemic was actually a relatively quiet geopolitical period, i.e. the “peace dividend” after the Cold War.

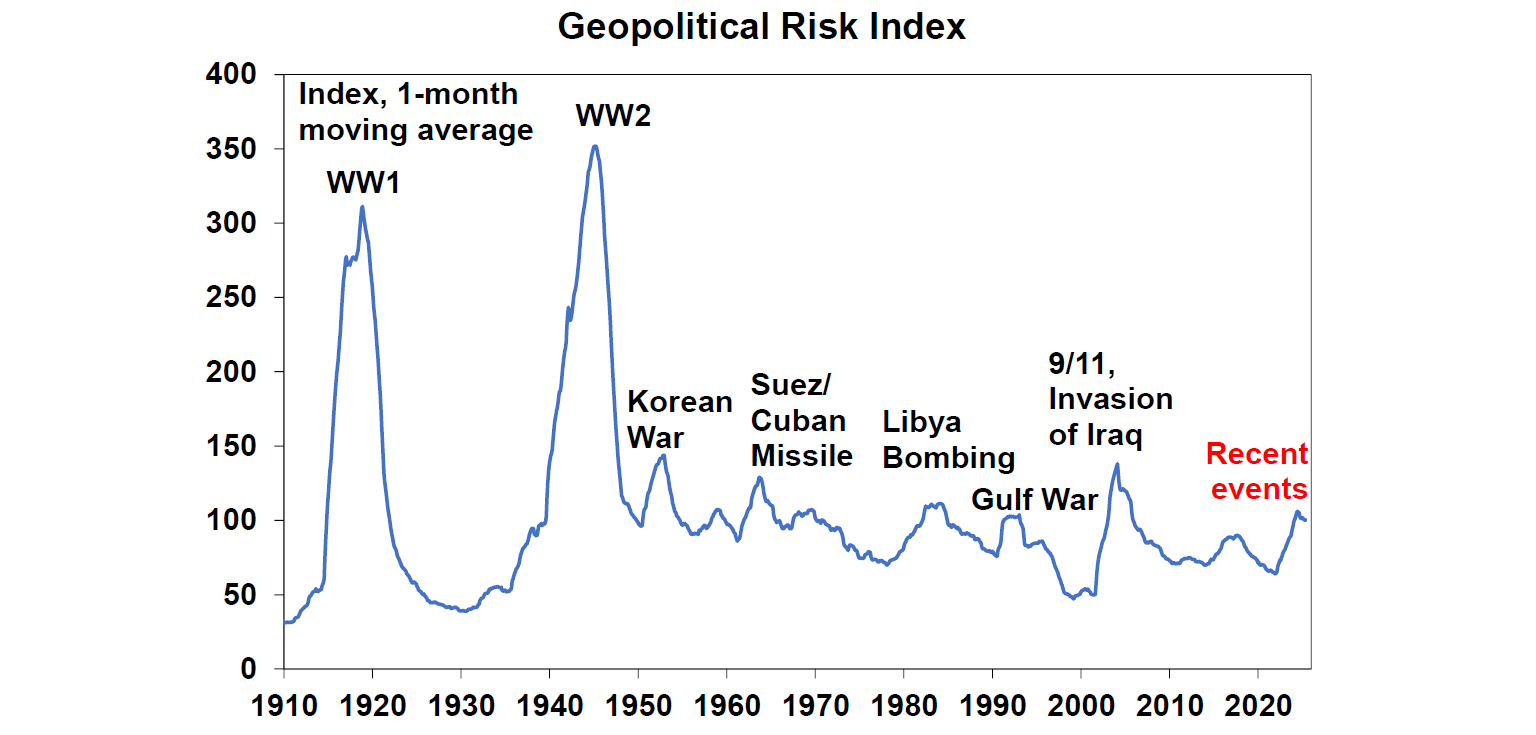

Measuring geopolitical risks is tricky, but there is a Geopolitical Risk Index that counts newspaper articles mentioning specific words around geopolitics. This is a concurrent indicator of geopolitical risks, rather than a leading indicator of potential risks.

Spikes in the Geopolitical Risk Index have historically been associated with initial moderate falls in sharemarkets. Economic factors are always occurring alongside geopolitical events which impact share returns, so it’s hard to pinpoint the exact short-term impact of geopolitical risks on markets. But what is interesting is that usually a year after the initial event, shares tend to be higher.

The world is moving from unipolarity to multipolarity, with numerous spheres of influence. Or as the geopolitical analyst Ian Bremmer calls it, the “G Zero” world. This means that geopolitical risks will remain elevated. Being ahead of the curve and predicting the exact timing of geopolitical events is next to impossible. This means that it’s important to have a diversified investment portfolio and not to panic when shocks happen, because markets tend to recover.

Introduction

The recent missile strikes in Israel and Iran are a reminder that geopolitical events are a constant risk to the global order. Our Chief Economist Shane Oliver wrote about the near-term impacts of these events here, especially as it relates to the oil market. In this Econosights we take a broader look at how geopolitics impacts financial markets and what to do about it as an investor.

Measuring geopolitical risks

While geopolitical events may appear to occur out of nowhere, the reality is that tensions are often bubbling under the surface for some time, until a tipping point is reached. This is why predicting precisely when geopolitical events will occur is extremely difficult. Although, outlining potential areas of risk can be useful for thinking about future dangers. Geopolitical events tend to create volatility in financial markets and as a result, investors have become more interested in geopolitical risks over the past few years. It feels like the world has been moving from one geopolitical event to another in recent years between the decline in globalisation and immigration crises leading to populist governments over the world, trade wars, the decline in globalisation leading to social unrest, China/Taiwan tensions, the war in Ukraine and the war between Israel and Hamas which has now involved other Middle Eastern players.

One way to measure changes in geopolitical events is through a “Geopolitical Risk Index” which was constructed by Dario Caldara and Matteo Iacoviello based on a tally of newspaper articles since 1900. The chart below shows the changes in the long-term index, with events that caused the largest spikes in the index highlighted in the chart. Newspaper articles are searched for words that include citations of war threats, peace threats, military buildups, nuclear threats, terror threats, beginning of war, escalation of war and terror acts. The index should be considered a concurrent indicator of rising or falling geopolitical risks, rather than a leading indicator of when tensions will erupt. The index shows that after the spike post 9/11 geopolitical tensions simmered in the 2 decades prior to 2020, with a reversal of that trend in recent years.

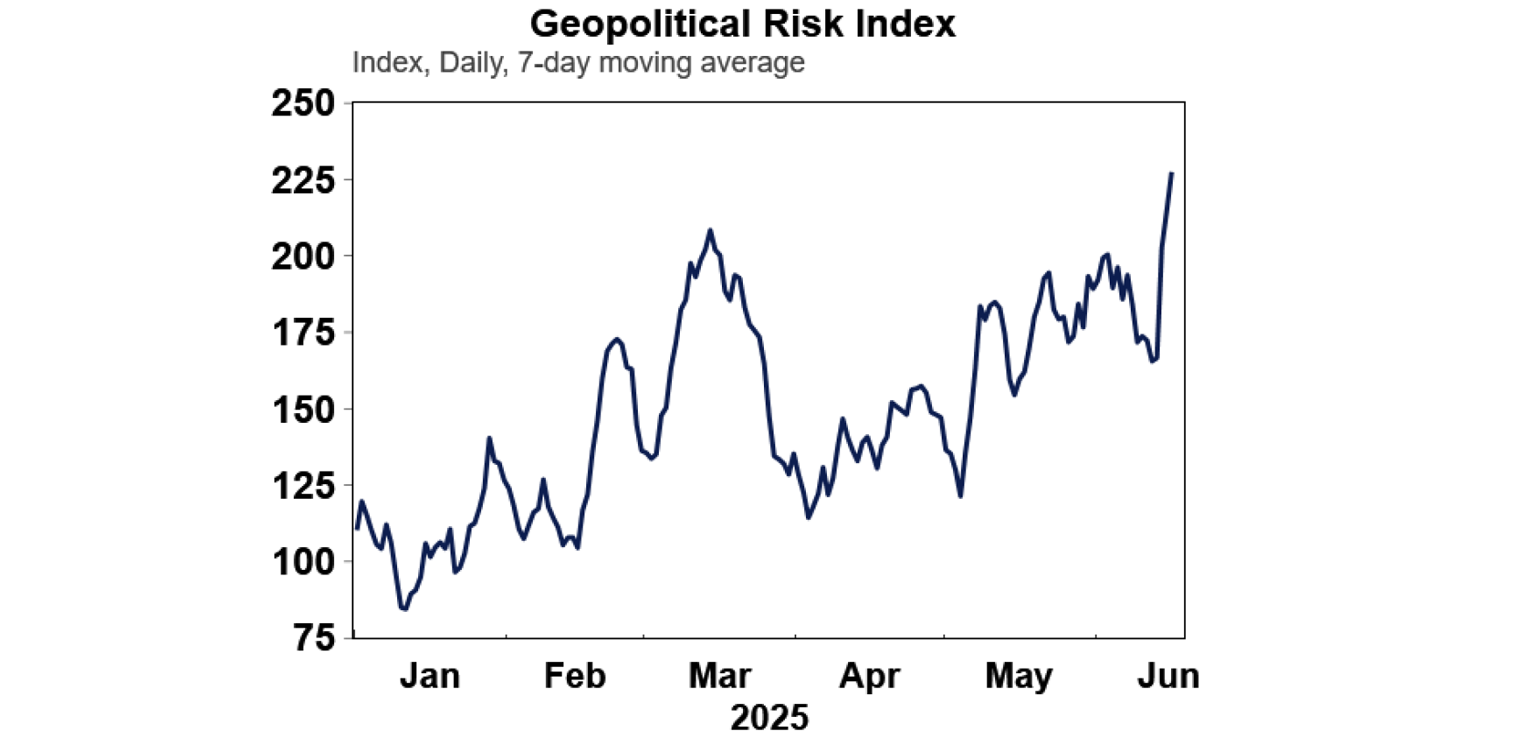

And a more detailed daily version of the daily geopolitical risk index shows the index at a current high for the year.

The impact of geopolitical risks on economies and markets

There are numerous potential impacts of geopolitics on economies. Direct impacts can occur through a loss to consumer and business confidence in the countries impacted and other players involved which flows through to spending, investment and GDP growth. In the case of war, the destruction of buildings and infrastructure has a large negative initial hit to growth, but the eventual rebuilding often causes a lift to GDP growth down the track. Countries that trade with affected countries are also impacted through the changes to import and export flows. Commodity prices are often impacted by geopolitical events because of the disruption to supply. Financial markets also respond to geopolitical risks usually via the sharemarket both in directly affected countries but also across the major economies because of the impact to confidence. Currencies of impacted countries can often experience a depreciation in response to events as investor uncertainty rises.

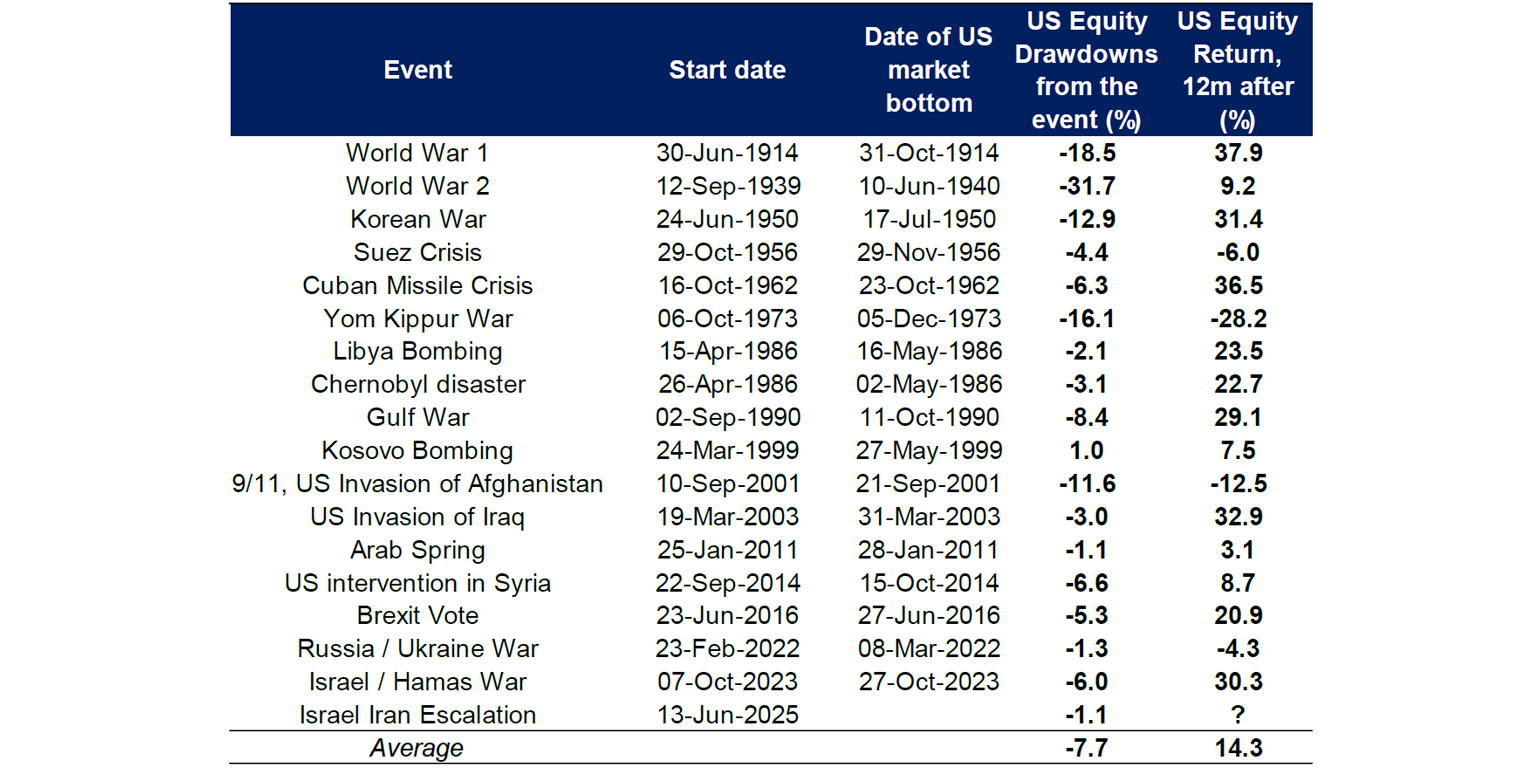

We can use historical spikes in the Geopolitical Risk Index to look at the initial impact of prior geopolitical events on financial markets. The next table looks at the major events that led to a rise in Geopolitical Risk Index and the associated market reactions in the US S&P500. This shows that the major geopolitical events are often associated with moderate drawdowns in US shares with the events highlighted in the table leading to an average fall of nearly 8% in US shares as an initial market reaction to the event.

Historical major geopolitical events

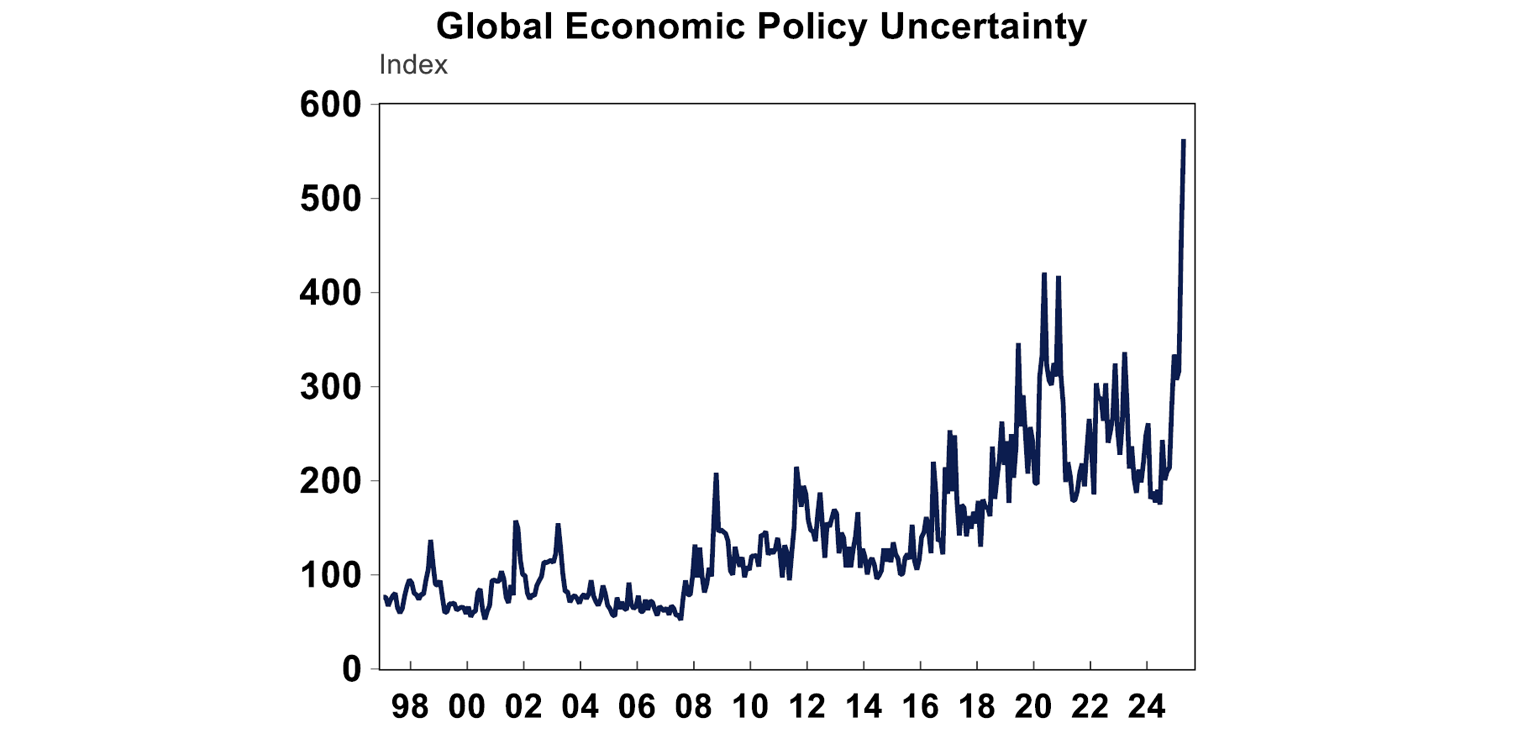

However, it’s important to keep in mind that there are economic factors at play that are also influencing returns, alongside geopolitical risks. For example, the period around the Gulf War was associated with a recession in the US and the US/Iraq war in 2003 was occurring right after the US tech crash. The current conflict between Israel and Iran is occurring against a backdrop of massive economic uncertainty (largely because of US trade policy – see the next chart) and recession risks, while major global sharemarkets are already around record highs (and therefore vulnerable to a drawdown).

Depending on the nature of the geopolitical event, the impact to sharemarkets could also be short-lived or may take longer to play out. The above table also shows that despite the negative hit to shares initially from these geopolitical events, usually sharemarkets recover with US equity returns a year after the event up by an average of 14% over the events we looked at. For the times when sharemarkets were lower a year after the geopolitical event, this was often associated with another economic event (in 2002 post 9/11 was in the middle of the tech crash and in 2023 after the Russia/Ukraine war was the inflation scare and US banking crisis).

Implications for investors

The world is moving from unipolarity (with the US as being the main sphere of influence) to multipolarity, from the rise of China. In purchasing power parity terms (which considers actual buying power based on differences in exchange rates), China surpassed the US as a share of world GDP in 2016 and is now at 19% (with the US at 15%). Trump indicates that he wants to be the peace president, that he wants to avoid conflict, end wars and not get involved in new wars. However, Trump’s MAGA party is turning the US more internally and the US is retreating from global institutions. This trend has further to grow while Trump is in power (and potentially after as well if he is still dominant in the Republican party). This will keep geopolitical risks high in the next few years. Actions in recent days also appear to indicate that the US is indirectly involved with the Israeli strikes against Iran also goes against Trump’s supposed peace narrative.

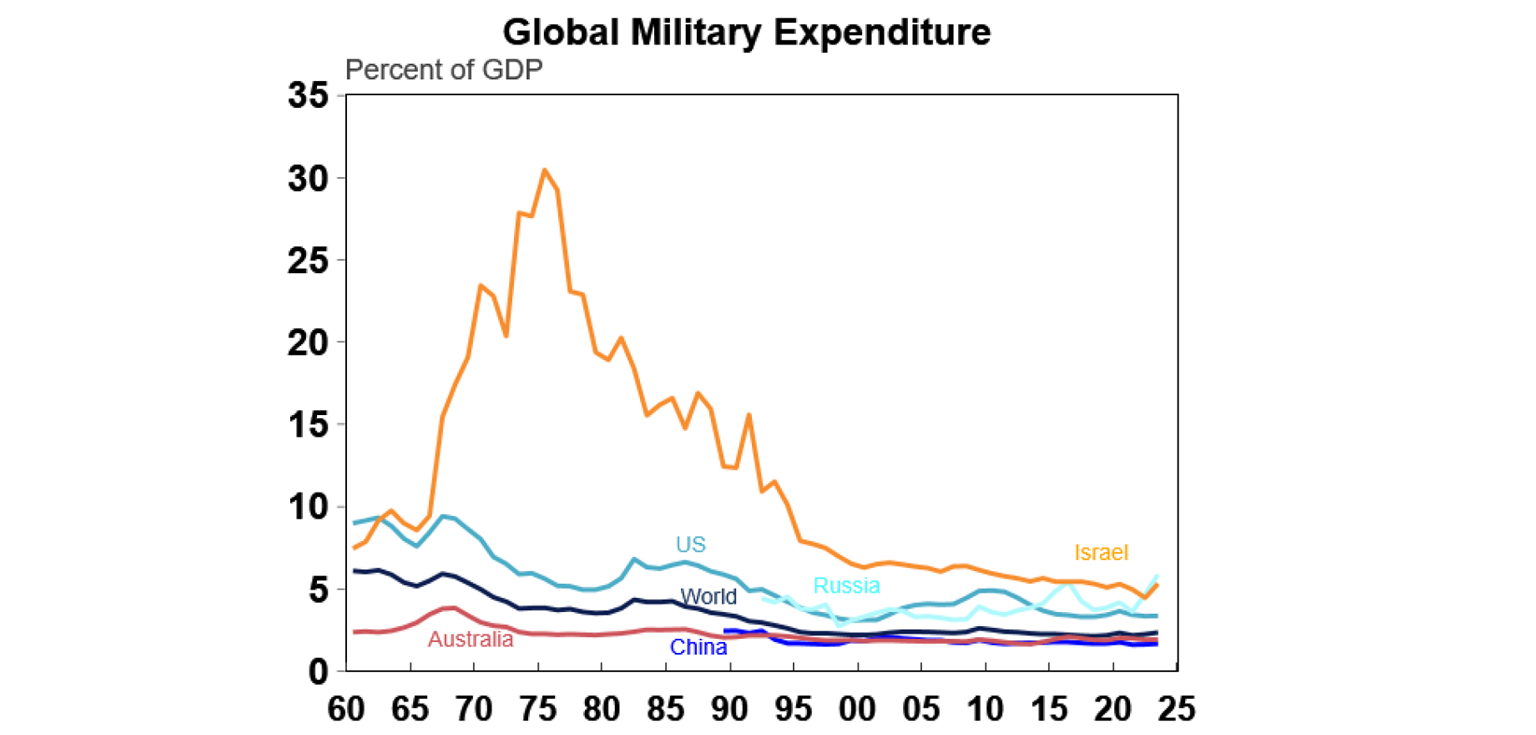

While global military spending has been on a long-term decline (see the chart below), it is ticking back up and will continue to rise based on rhetoric across all major advanced nations. Rising military spending also argues for more (rather than less) geopolitical tensions as countries use warfare as a deterrence and negotiating tool.

Geopolitical issues are currently occurring at the same time that sharemarkets are expensive, recession uncertainty is elevated, economic policy uncertainty is at a multi-year high and US bond yields are elevated despite the Fed having cut rates. This indicates that sharemarket returns are likely to be constrained in the near-term with high risk of a moderate draw-down before a recovery later in the year, prompted by good news around Trump’s One Big Beautiful Bill which will cut taxes and further Fed rate cuts.

Diana Mousina Deputy Chief Economist, AMP

You may also like

-

The outlook for Australian shares – is the long underperformance over? Australian shares have had a strong start to 2026 with the ASX 200 up 3.3% and flirting with a new record high. The local market has also outperformed US shares which are down 0.1% and global shares which are up 1.6%. However, this could just be noise and follows a significant underperformance against US and global shares since 2009. -

Weekly market update - 20-02-2026 Global share markets mostly rose over the last week. Worries about AI and tech valuations took a breather and the US Supreme Court decision to strike down Trump’s emergency power tariffs with Trump immediately announcing a replacement were seen as having little impact on the US growth outlook but were seen as positive for other countries. -

Econosights - An update on global debt and fiscal policy With the International Monetary Fund releasing their Global Fiscal Monitor recently, AMP's Senior Economist, Diana Mousina provides an update on the global debt situation and recent fiscal policy announcements.

Important information

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account. Taxation issues are complex. You should seek professional advice before deciding to act on any information in this article.

It’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you. The super coaching session is a super health check and is provided by AWM Services and is general advice only. It does not consider your personal circumstances.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy. All information on this website is subject to change without notice. AWM Services is part of the AMP group.