Key points

So far, the Israel/Iran war is limited, and various constraints suggest it may stay that way with Iran reportedly wanting to return to talks. It’s still early days though and so the risk of an escalation threatening oil supplies remains significant.

Current oil prices could boost Australian petrol prices by around 10 to 12 cents a litre, but if oil supply is not disrupted, oil and petrol prices will settle down.

While higher oil prices could add to inflation, it’s more likely to be deflationary as it will act as a “tax on spending”. So central banks, including the RBA, should look through it.

Introduction

Conflict regularly flares up in the Middle East leading to concerns of a threat to inflation and economic growth via a surge in oil prices like in the 1970s and early 1980s. But most the time the fears settle down and the oil supply is not affected. The latest conflict between Israel and Iran may be more serious though. Israel is going after Iran’s nuclear program after the International Atomic Energy Agency warned that Iran would soon have nuclear weapons capability. Iran has retaliated launching numerous drones and missiles at Israel. But so far the market reaction has been modest, with the lack of an escalation threatening oil supplies enabling markets to recover some of their losses - but it’s early days. And President Trump is arguably adding to the noise (“they want to make a deal” and then “Everyone should immediately evacuate Tehran.”)

Oil prices are up but not dramatically

Oil prices are up about $US6 a barrel to around $US73 for West Texas Intermediate since before Israel first attacked Iran Friday. They had been rising since May as fears of an attack were rising and are up from around $US61 at the end of May. However, this has just taken them back to levels seen earlier this year and they remain well below levels seen last year.

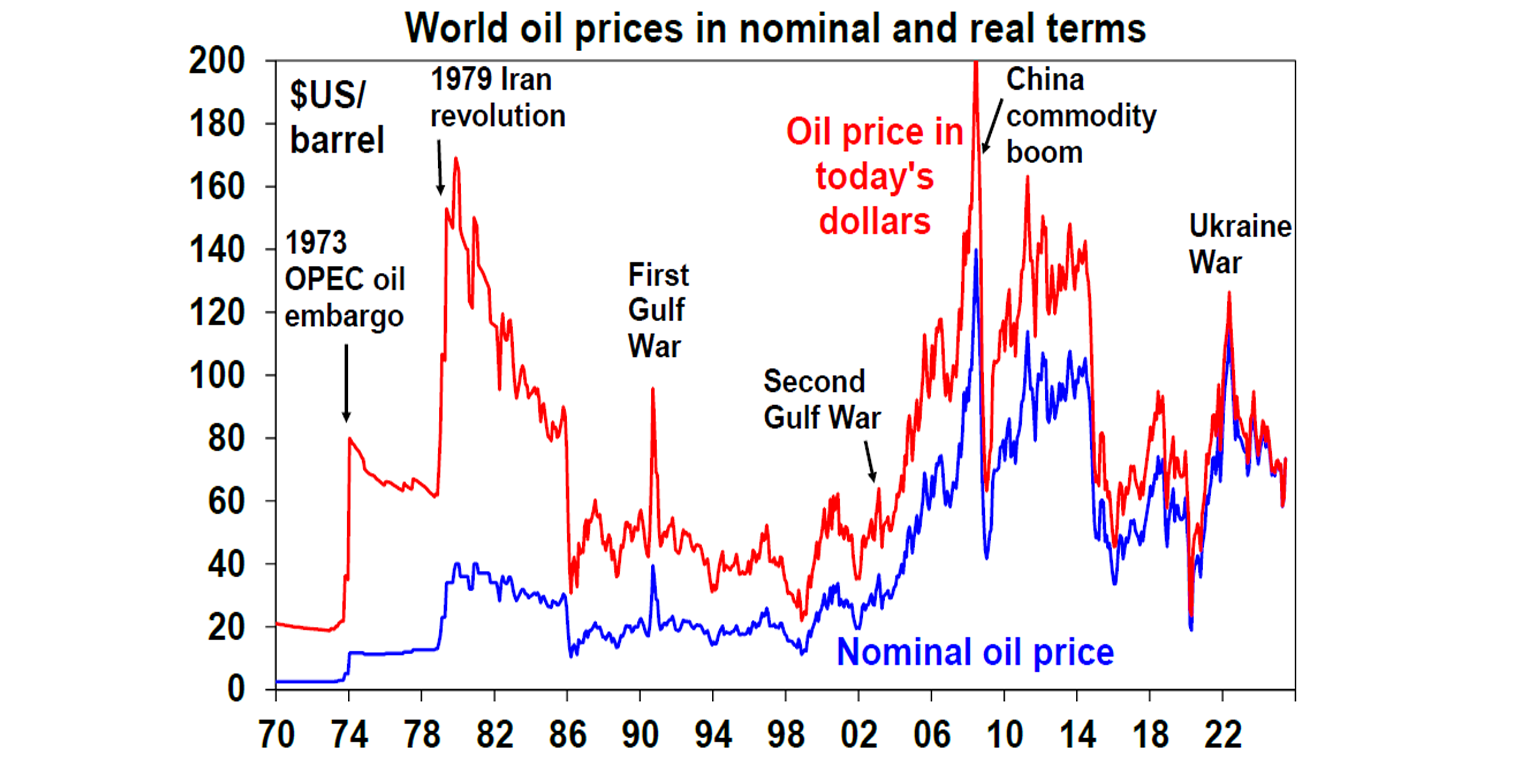

Viewed in a longer-term context the spike in oil prices since May is a non-event. The previous chart shows world oil prices since 1970 in nominal terms (blue line) and after adjusting for inflation (red line). The spike since May has left nominal oil prices in the middle of the range seen over much of the last two decades and they are well below their 2022 highs due to the Ukraine war. In real terms they are way below the highs reached in the second oil crisis in 1979 and in the commodity boom in 2008.

Oil prices and conflicts in Israel & the Middle East

While the Middle East accounts for about a third of global oil production not all conflicts there are bad for oil prices.

The 1973 global oil shock came with the Arab/Israeli war that saw OPEC boycott oil supplies to the US driving a fourfold rise in oil prices.

The second oil shock in 1979 came as the Iranian revolution saw its oil production collapse and resulted in a threefold increase in oil prices.

Since then its been more mixed: the first Gulf War in 1990-91 (which saw Iraq invade Kuwait and a coalition led by the US dislodge it) saw a spike in oil prices but it was brief; the second Gulf War in 2003 (which saw the invasion of Iraq) had little impact; and the war in Lebanon (2006), Arab Spring (from December 2010), war in Syria & numerous flare ups in the Israeli/Palestinian conflict and last year’s Israel/Iran missile exchanges all had none or little impact on oil supplies.

So, the key is whether oil supplies from major producers are impacted.

Higher risk this time?

The risks this time are elevated primarily because:

Israel is determined to wipe out Iran’s nuclear weapons capability because it sees it as an existential threat (given Iran’s often stated desire to wipe out Israel). And it wants to keep going till it does.

Israel is also seeking regime change and threatening to strike anything associated with the Iranian regime, which could include energy facilities with Iran supplying around 3% of global oil production,

The Iranian leadership sees having nuclear weapons as necessary for survival after what happened to Colonel Gaddafi & Saddam Hussein.

The more its threatened Iran may strike out at US bases in the region, neighbouring oil producers (like it’s Houthis attacked Saudi production in 2019) or by attacking Strait of Hormuz shipping through which 20% of global oil consumption and 25% of LNG flows daily.

While Gulf oil countries have around 5 million barrels per day of spare capacity (3 million in Saudi Arabia) and could use this to offset supply disruptions, this would be unreliable if the Strait of Hormuz is blocked.

This implies a high risk the war escalates in a way that disrupts oil supplies. Israel’s attacks on Iranian energy are a possible pointer in this direction. However, various constraints may head off serious disruption:

Both sides have limited arsenals to keep going. At the current rate Iran will run out of ballistic missiles in about 8 days and Israel will need renewed US armaments which gives the US a high leverage.

President Trump wants lower oil prices, and the US will likely be leaning on Israel to avoid attacking Iranian oil export infrastructure and has already told it not to assassinate Ayatollah Ali Khamenei.

So far Israel has only struck Iranian energy infrastructure focussed on internal consumption, not exports.

Given its limited arsenal Iran is likely to avoid triggering US involvement as the regime could be wiped out by that.

Following its détente with Saudi Arabia in 2022 Iran probably does not want to drag neighbouring countries into the conflict.

Attacking shipping through the Strait of Hormuz would risk an overwhelming US strike that Iran would probably prefer to avoid.

Its unclear Israel can wipe out Iran’s underground nuclear facility at Fordow without US assistance (with bunker busting bombs).

Trump will want to avoid getting into another Middle East war (although not necessarily a short-term strike on Iran).

The threat of annihilation for Iran and Israel’s probable inability to completely wipe out Iran’s nuclear weapon’s capability suggest a return to negotiations will occur, although maybe only be after they “fight it out”, as President Trump has said.

So far both sides are behaving consistently with this more limited conflict, and reports indicate that Iran wants to return to talks.

Scenarios

Base case – limited war (65% probability) - given this our base case is that the conflict stays limited to Israel and Iran trading missiles with each other without any significant disruption to global oil supplies. It may take a few weeks before this is clearly apparent so oil prices could still go higher (threatening shares) before they go lower but this would be a selling opportunity in oil and a buying opportunity in shares.

Risk case – oil supplies disrupted (35% probability) – however, the risk of an escalation leading to a significant disruption to oil supplies probably via the Strait of Hormuz is high. This could conceivably result in a doubling in oil prices to around $US150/barrel, which could drive a sharp fall in share markets. Such a disruption is likely to be temporary and would invite an aggressive US response against Iran.

Impact of higher oil prices on the global economy

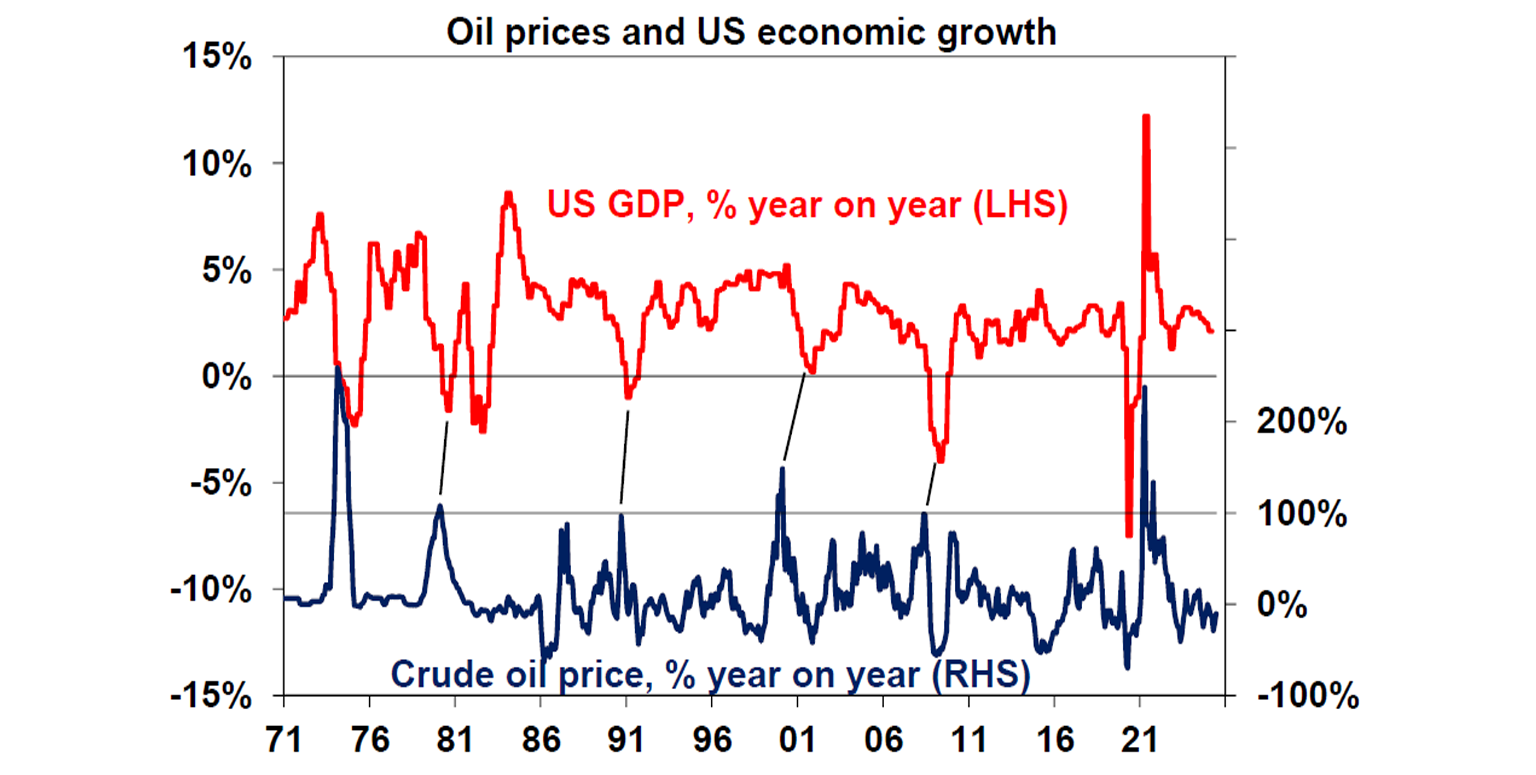

While it’s not our base case, given upside risks to oil prices its worth considering what this might mean for the global and Australian economies with many fearing it will add to inflation keeping interest rates higher for longer. But it’s not that simple. Past oil price surges have played a role in US & global downturns – in the mid-1970s, the early 1980s, the early 1990s, early 2000s and even the GFC. See the next chart. They weren’t necessarily the driver of these recessions as other factors (tight monetary policy, the tech wreck and the US housing downturn prior to the GFC) often played a much bigger role. But they made things worse because a rise in energy prices is a tax on consumer spending.

It’s not so much the oil price level that counts as its rate of change Trouble often ensues if the oil price doubles over 12 months. However, while it will ultimately depend on how high oil prices go there are some positives suggesting it may not be quite as negative as feared:

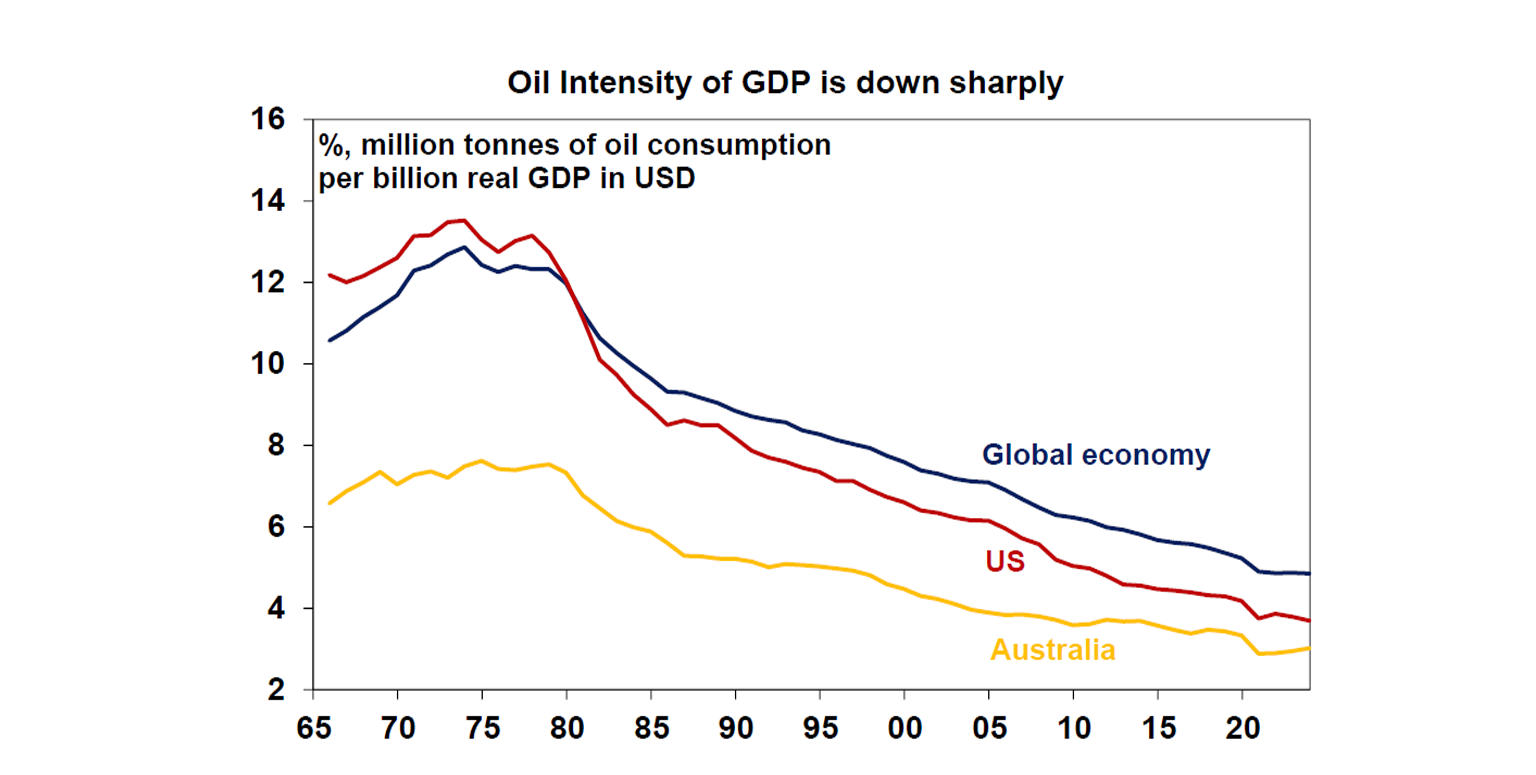

First, the oil intensity of economic activity has been falling with energy efficiencies and the growth of the services sector. So, the impact of an oil price surge today is less than it used to be.

Secondly, we have not yet seen a doubling over 12 months in oil prices suggesting they are not up enough to cause a hit to global growth.

Impact on Australia

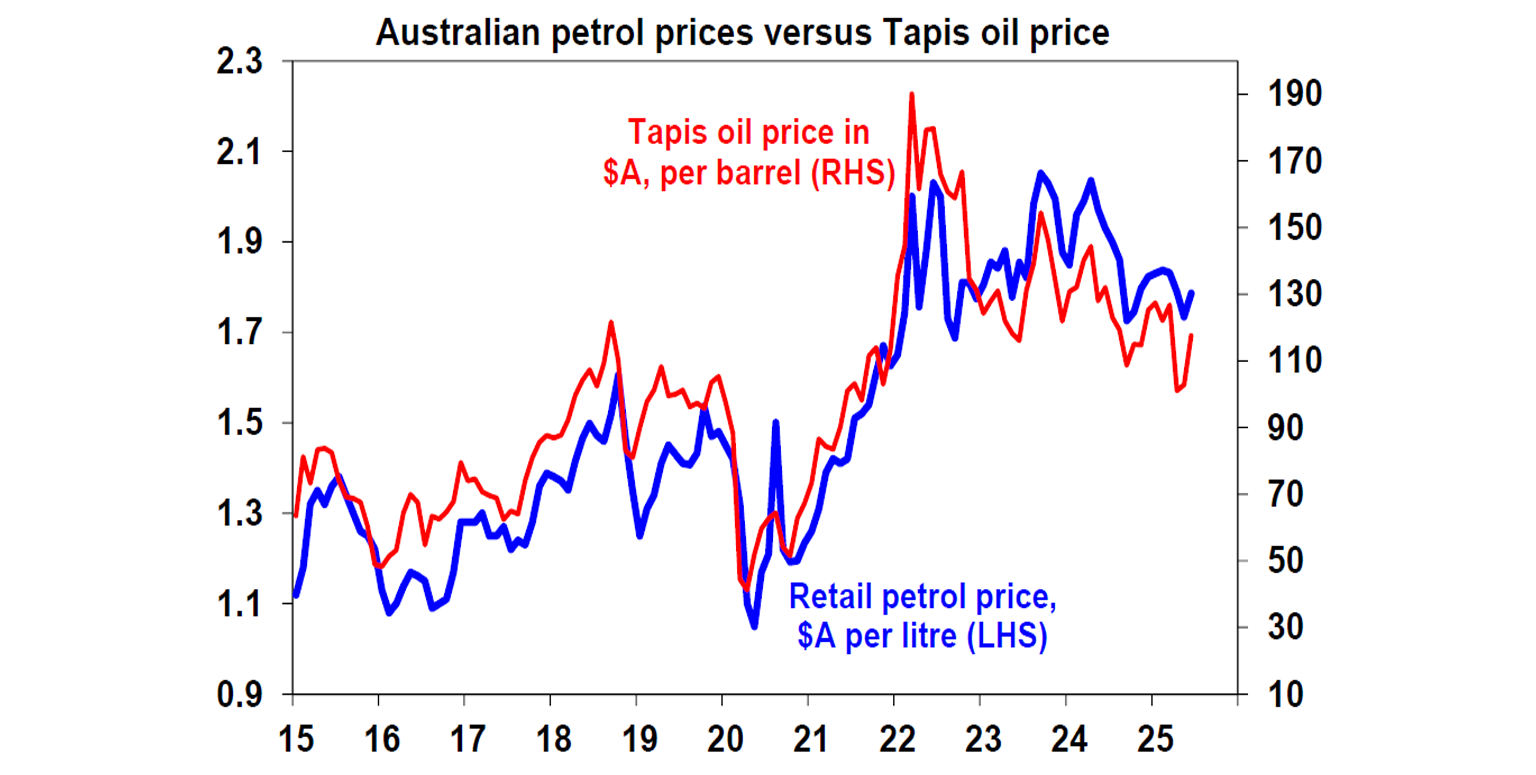

The main way Australians might feel the impact of the Israel/Iran war is via higher petrol prices. Australian petrol prices track the Asian Tapis oil price in $As closely, and Tapis tracks US oil prices. This is because our prices are largely set globally – to which is then added the GST, fuel excise, distribution costs and retail margins. The rise in oil prices so far this month of around $US12 a barrel implies a 10 to 12 cents a litre boost to petrol prices if sustained, which would add around $5 a week to the typical household’s petrol bill. This would be bad news but is consistent with normal volatility in petrol prices. The real risk would come if the conflict disrupted global oil supplies leading to a far bigger rise in petrol prices.

A 10 to 12 cents a litre rise in petrol prices if sustained would only add about 0.2% to CPI inflation but the RBA would likely look through this and focus on underlying inflation and also any dampening impact on growth from higher fuel prices. Overall, it’s not enough to change our view that the RBA will cut rates again in July and in August and November.

While higher oil prices flowing from the war could drag on Australian economic growth via weaker global growth, Australia is relatively well placed because we are a net energy exporter and so may benefit from higher prices for gas exports. And our economy is less dependent on oil.

Implications for investors

The Israel/Iran war along with tariff uncertainty poses a high risk of a renewed set back in share markets, if the conflict escalates to the point that it threatens oil supplies from the Middle East. However, various constraints should weigh against a meaningful (for investment markets) escalation. It should also be remembered that conflicts regularly flare up in the Middle East only to settle down, so the key is not to get too negative and look for any opportunities that the conflict throws up. Finally, since WW2 US shares have fallen on average by 6% in response to geopolitical events but have risen by 9% six months later and by 15% 12 months later.

Dr Shane Oliver

Head of Investment Strategy and Chief Economist, AMP

You may also like

-

Oliver's Insights - Nine key charts for investors Share markets have had a bit of a wobbly start to the year, particularly in the US. This note looks at nine key charts worth watching. -

Weekly market update - 13-02-2026 US shares fell over the last week on the back of ongoing concerns about AI disruption, excessive related capital spending and tech sector valuations. -

Four ways to maximise your Self-Managed Super Fund (SMSF) Here are four practical tips that could help you unlock more value from your SMSF, from managing cashflow to exploring property investment.

Important information

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account. Taxation issues are complex. You should seek professional advice before deciding to act on any information in this article.

It’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you. The super coaching session is a super health check and is provided by AWM Services and is general advice only. It does not consider your personal circumstances.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy. All information on this website is subject to change without notice. AWM Services is part of the AMP group.