The first few weeks of the New Year tend to be quiet periods in financial markets, with investor optimism usually positive, little news from central banks and slow data flow. Alas, Trump’s presidency offers a constant cycle and the New Year began with US “Operation Absolute Resolve” into Venezuela. This saw Venezuelan President Maduro and his wife captured and taken into the US and charged on terrorism, drug trafficking and money laundering charges. Tensions have been building for months between the US and Venezuela, but it still came as a surprise because of the timing, speed and quick success of the operation.

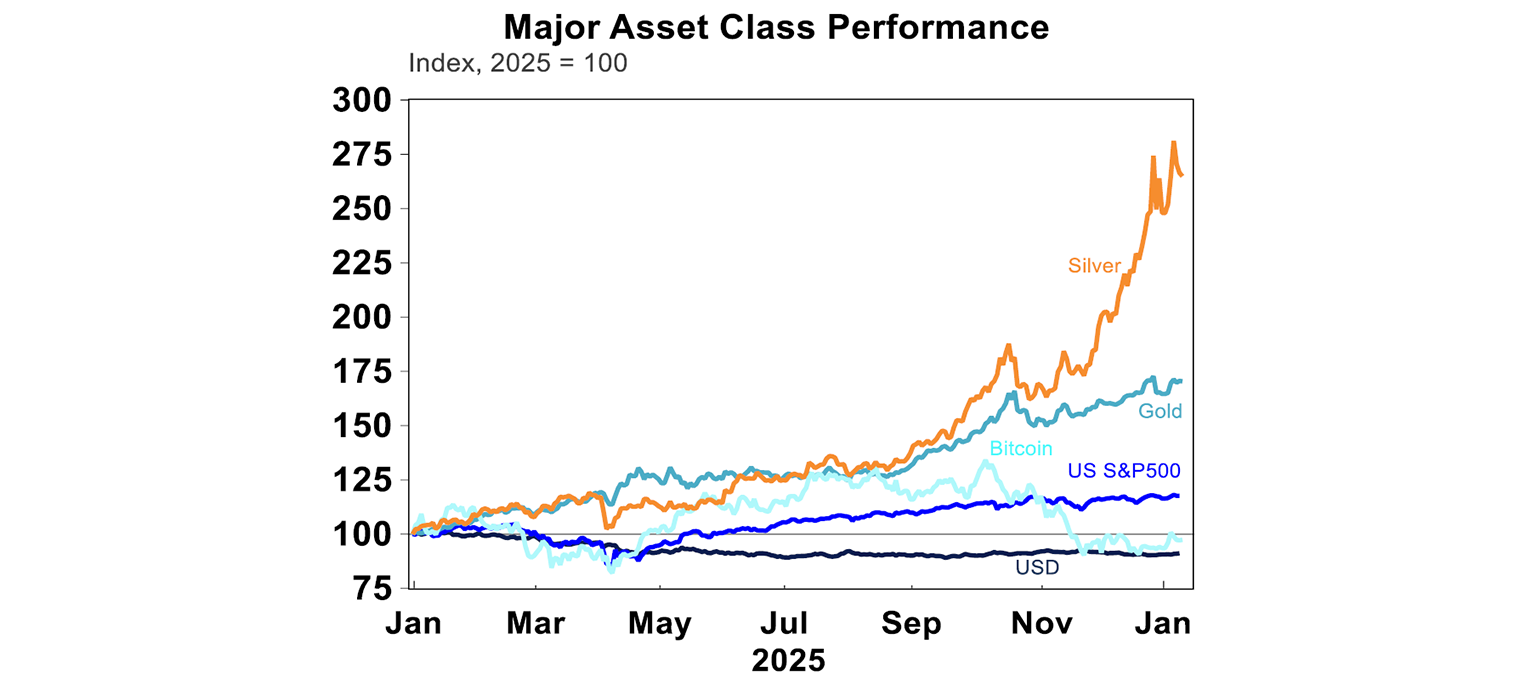

The near-term market implication of the US intervention were modest. Sharemarkets rose slightly as analysts took the view that this was a contained geopolitical event, energy stocks rose on expectations of higher future oil production, oil prices were up but only slightly (and ended the week at $63/barrel, with prices being in a range between $60-$65 for months) while safe havens like gold and silver rose on more geopolitical news.

But there are important longer-term consequences. This was the largest US intervention in Latin America since Panama in the late 1980’s and there are still large question marks over what Trump means when he says that the US will “run the country” for the time being, and that they will “rebuild the oil infrastructure”.

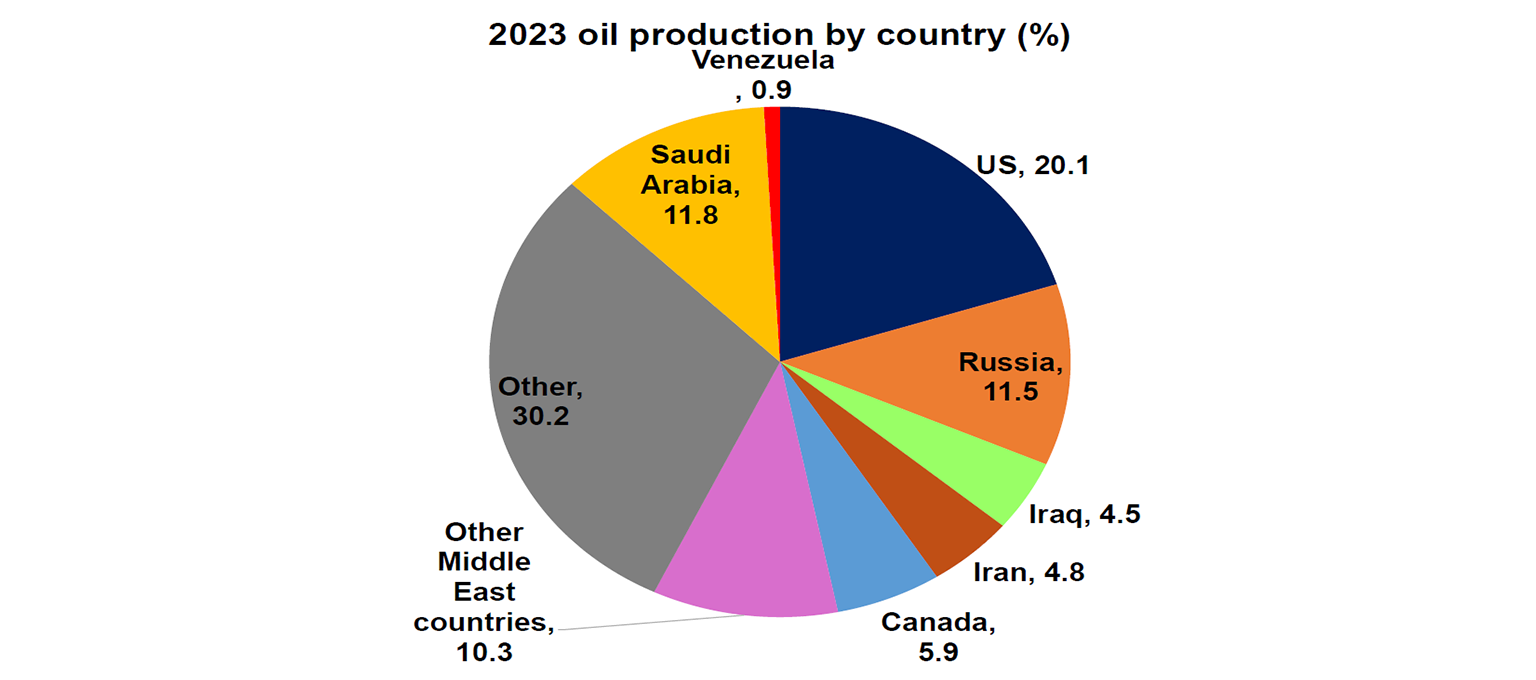

Venezuela actually has the largest proven oil reserves in the world (at 17.5%) – see the chart below.

But, Venezuelan oil production facilities are only 0.9% of global production because of years of infrastructure underinvestment, a poor economic backdrop, sanctions and government mismanagement. So longer-term, if significant investment is made into production facilities by the US, larger oil flows from Venezuela could put downward pressure on global oil prices, but this possibility is many years away. Trump attempted to tie the operation to cost of living concerns for Americans by lowering inflation, but this is unlikely to happen in the near-term.

The other long-term consequence of the US intervention relates to the implication for the global geopolitical environment under Trump 2.0. The operation is another hit to the global “rules-based order”, puts more weight on the “debasement trade” (further $USD downside) and shows Trump’s desire for the US sphere of influence in the Western World (Trump said after the operation American dominance in the Western Hemisphere will never be questioned again”). For markets, the key themes that are important from this are more spending on defence, more geopolitical risks which means non-US equities could outperform again this year, further $US downside in place of other safe havens like gold, silver and Bitcoin.

There is also now talk of the US taking over Greenland (which had already been floated before), with the US already having a strong miliary presence there. And the actions in Venezuela also put pressure on Iran, which has large-scale social unrest recently, with the potential for regime change in Iran.

Despite this frenzied start to the year, US equities hit another record high and were 1.7% higher over the week, although with some mixed outcomes across sectors. Trump’s social media posts around banning institutional investors from buying single-family homes hit home building stocks, followed by comments saying that defence contractors that they should not pay dividends, repurchase their own stocks or pay executives high salaries unless they speed up production or maintenance before saying that the military budget should be boosted (which ultimately saw higher prices for defence stocks). Another year of whiplash is likely for investors!

In Australia, stocks didn’t follow the US and fell by 0.1%, with a large fall in financials, real estate and utilities and a rise in materials and healthcare against. European and Chinese shares continue to outperform against the US and Australia (and Australia is well behind). The $A has been appreciating and is up at just under 0.7USD.

Major global economic events and implications

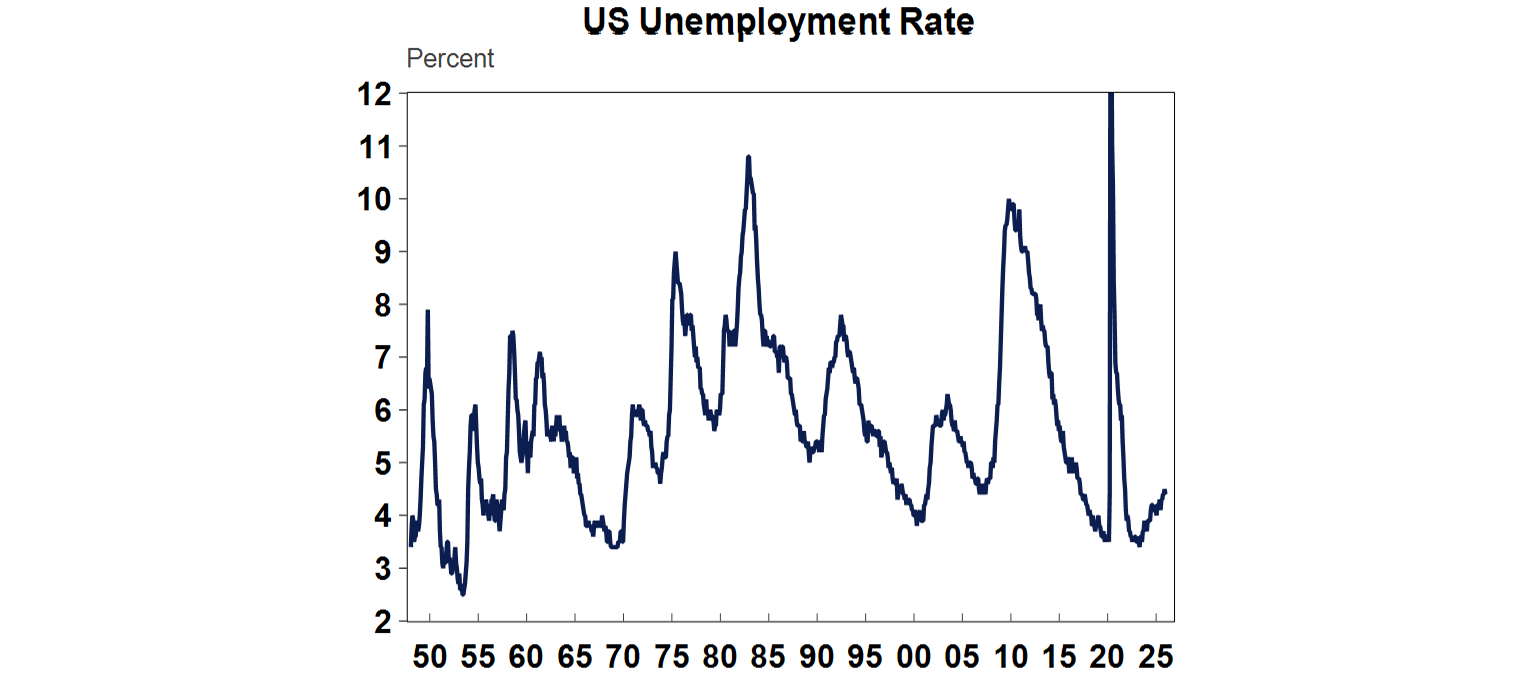

US data this week was mixed. First up, non-farm payrolls rose by 50K in December, less than the 70K expected and below last month’s gain but a fall in the participation rate pushed the unemployment rate down to 4.4% (from 4.5% last month) and the underemployment rate fell. So it was an okay figure and markets wiped all their bets that the Fed would cut rates later this month.

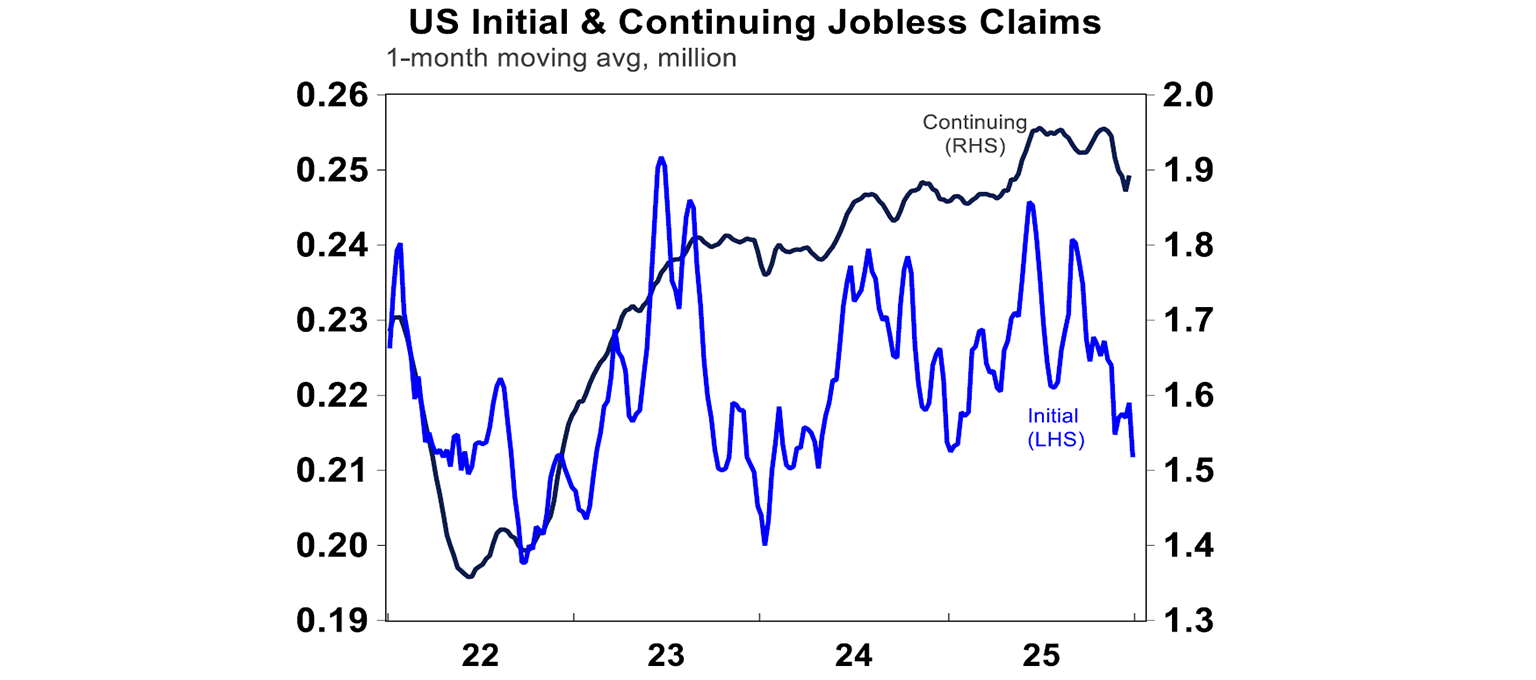

The US job openings survey was on the softer side, indicating that employment conditions continue to slowly deteriorate, but it’s still a “low hiring, low firing” environment. Job openings declined for the second month in a row and were lower than expected, hiring rates declined but the quits rate increased a little (which shows that people may still be comfortable moving jobs), although have still been trending down.

Amongst other labour market indicators, this week initial jobless claims beat expectations but continuing jobless claims were weaker. So the labour market picture overall has still moderated.

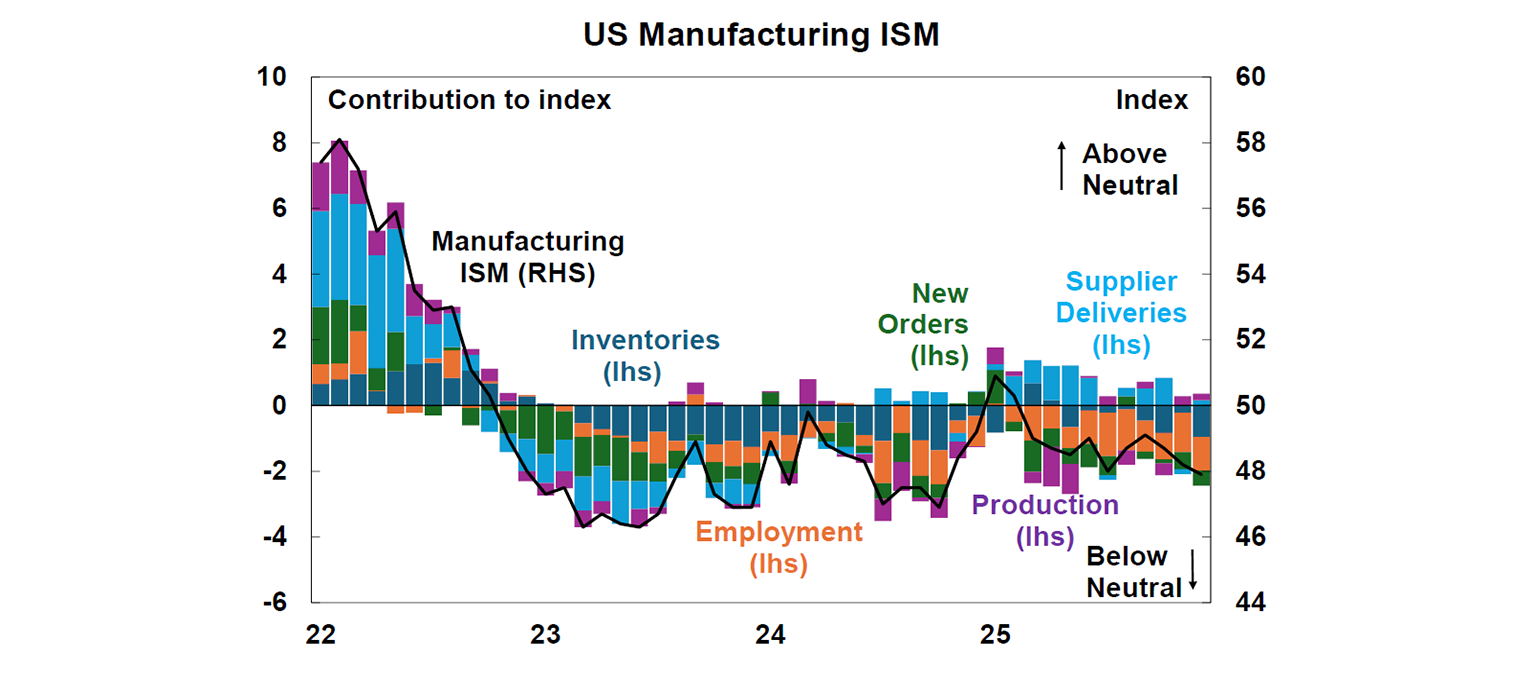

The December manufacturing ISM index disappointed expectations, dropping to 47.9, from 48.2 last month and is now at its lowest level since 2024, not a good sign of activity in the sector. Employment, new orders and inventories detracted from the index.

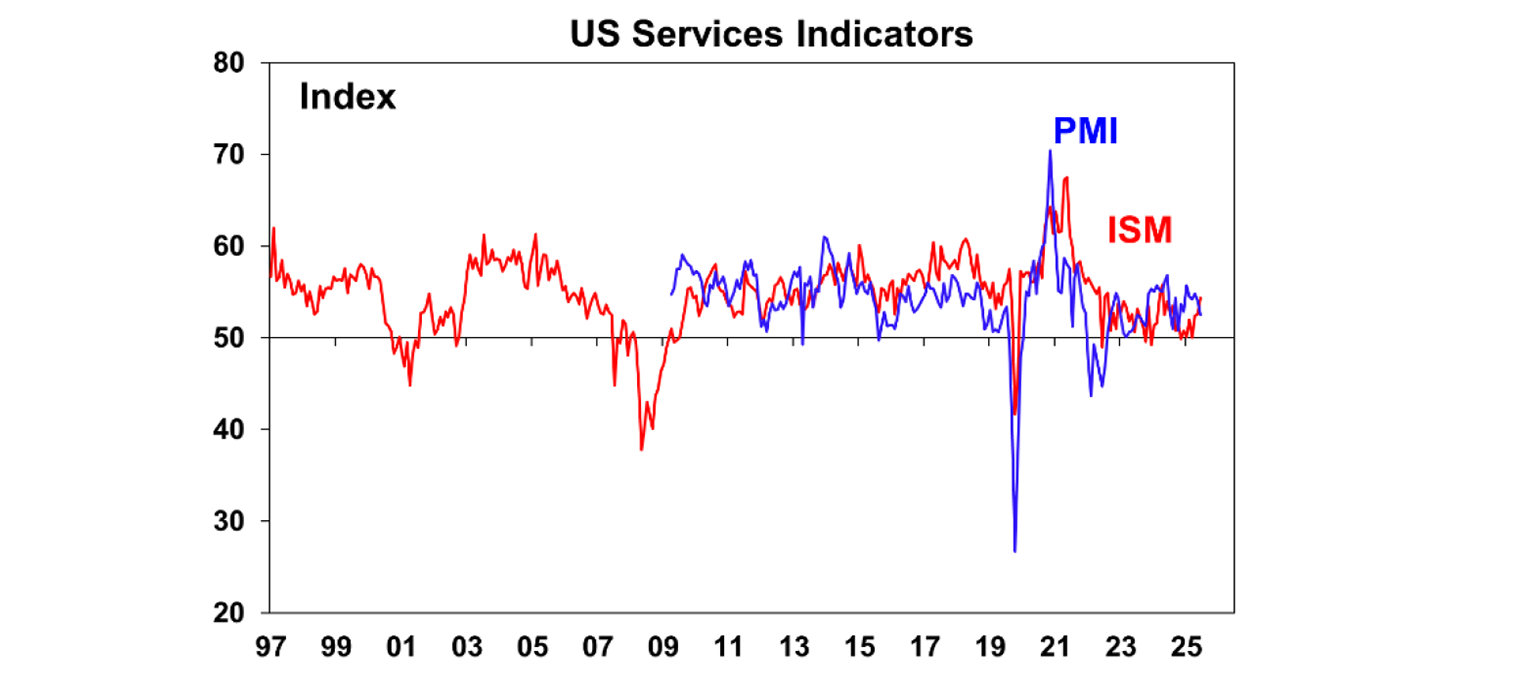

The ISM services index was a bit better though, up to 54.4 in December (from 52.6 last month). The PMI services reading has been stronger compared to the ISM recently.

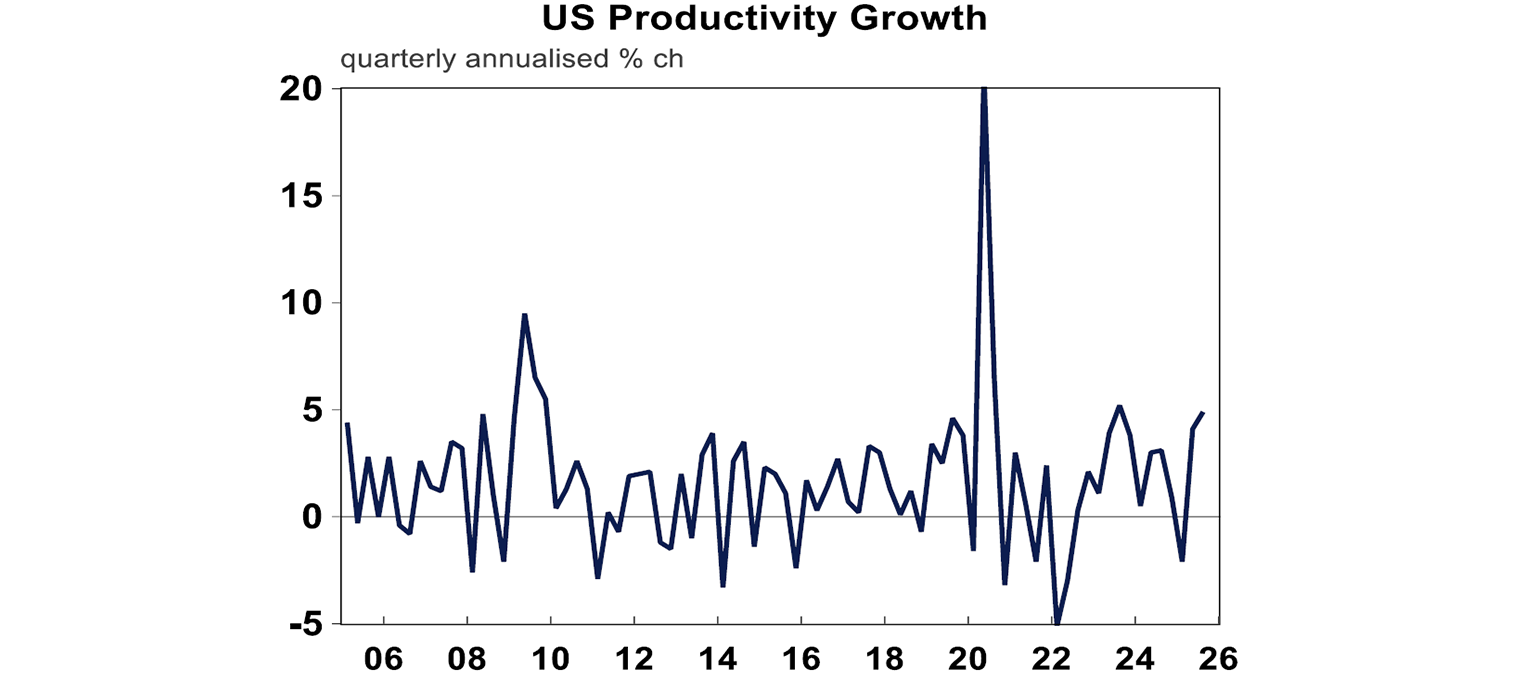

US productivity growth had another stellar outcome, up by 4.9% (annualised) in the third quarter. Strong productivity growth has helped to contain unit labour costs.

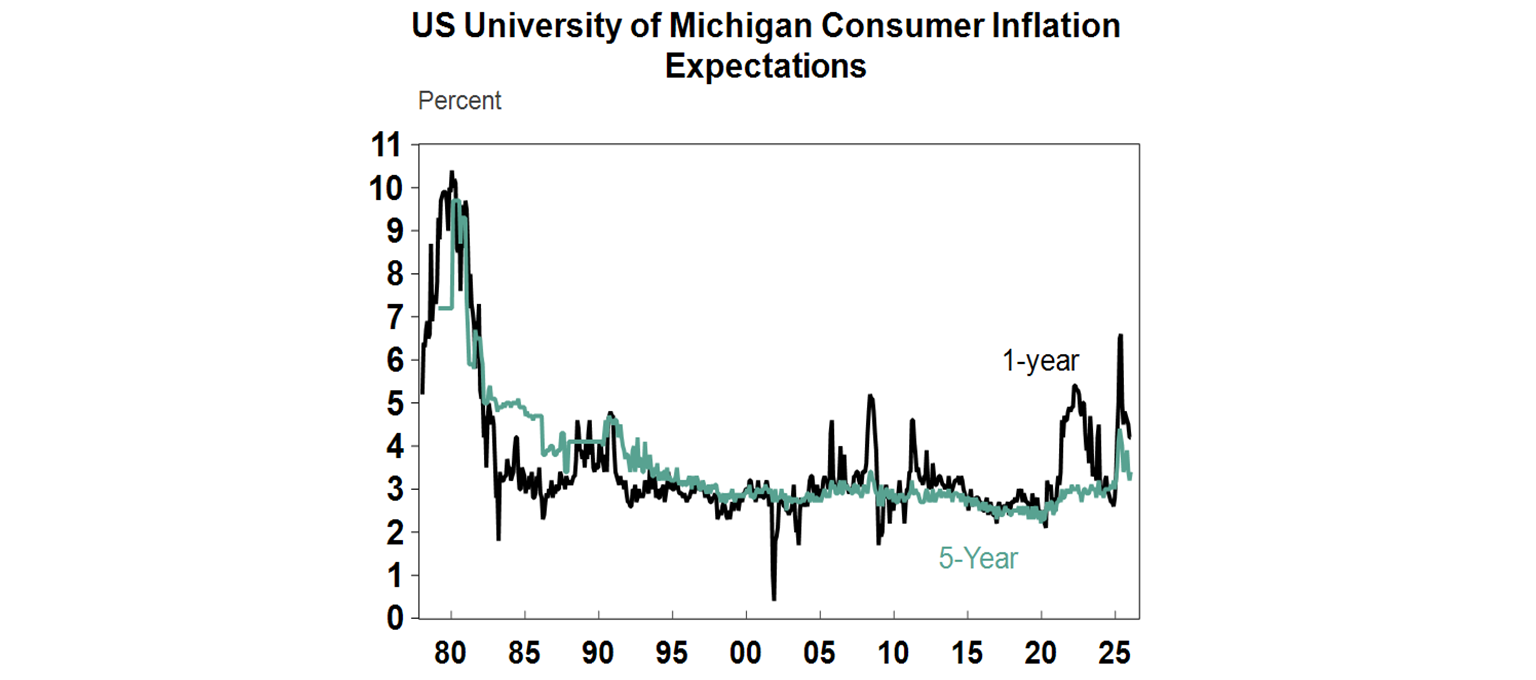

The University of Michigan consumer sentiment index improved in January, but inflation expectations remained high for the short and long-term.

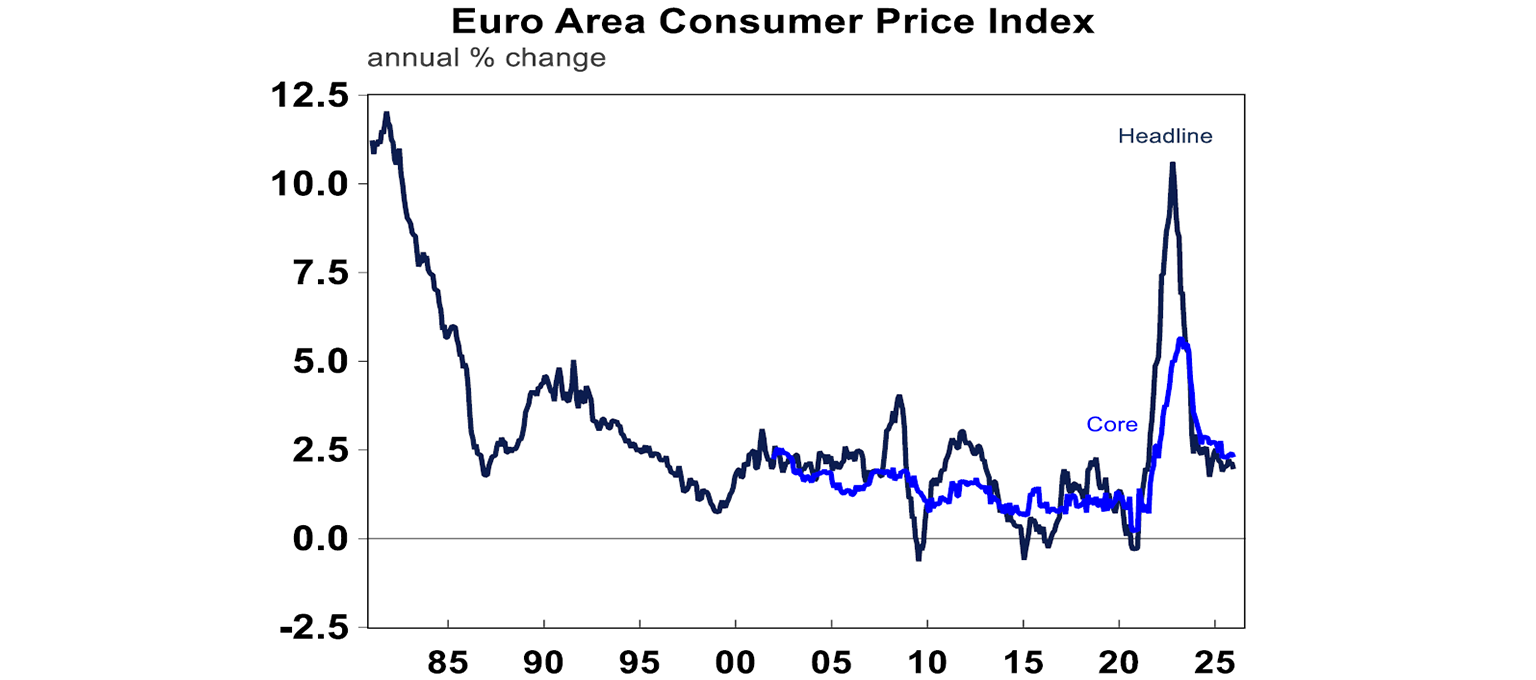

Eurozone December consumer prices were 2.0% higher in December, from 2.1% last month with core inflation at 2.3% (see the chart below). Inflation is in line with the ECB’s target, and argues for the central bank to be on hold.

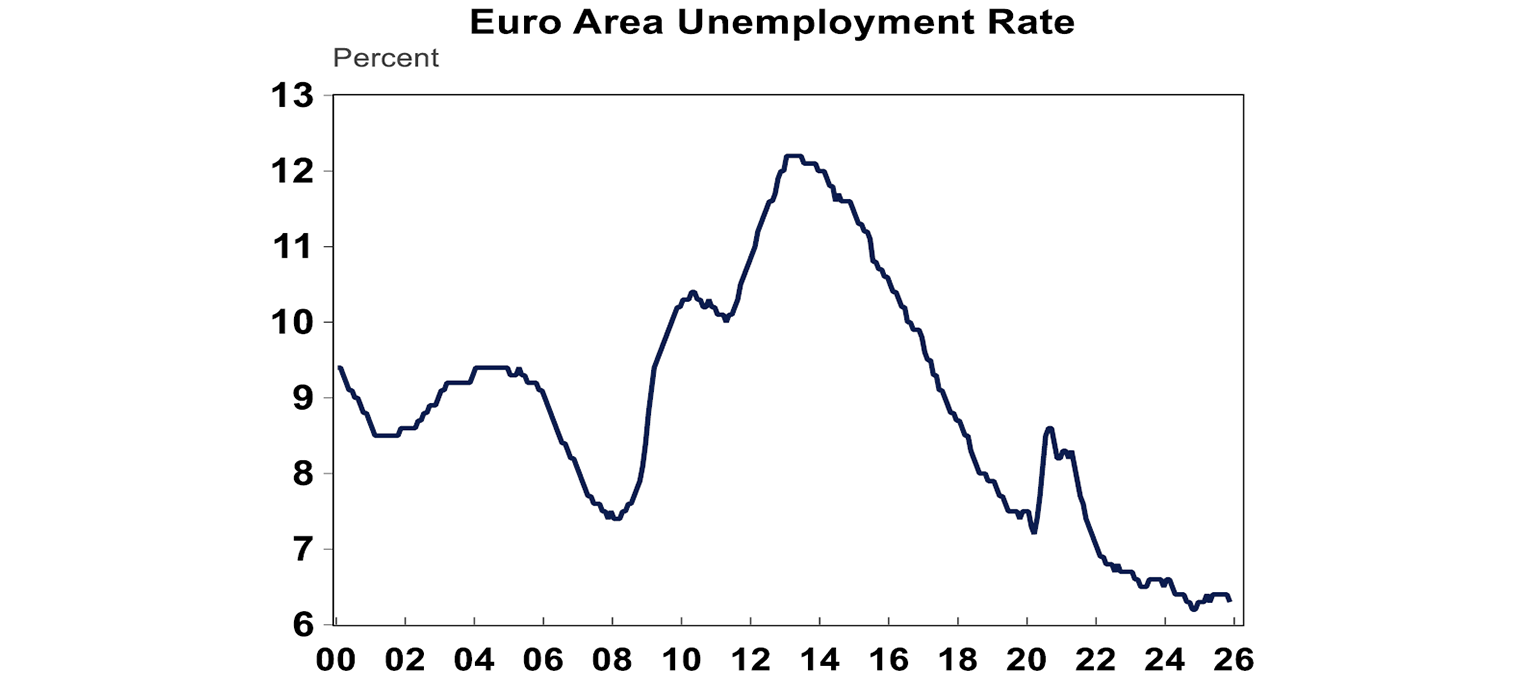

The November Eurozone unemployment rate slowed marginally to 6.3% in November, from 6.4% last month (see the chart below) which is very low for the Eurozone relative to history.

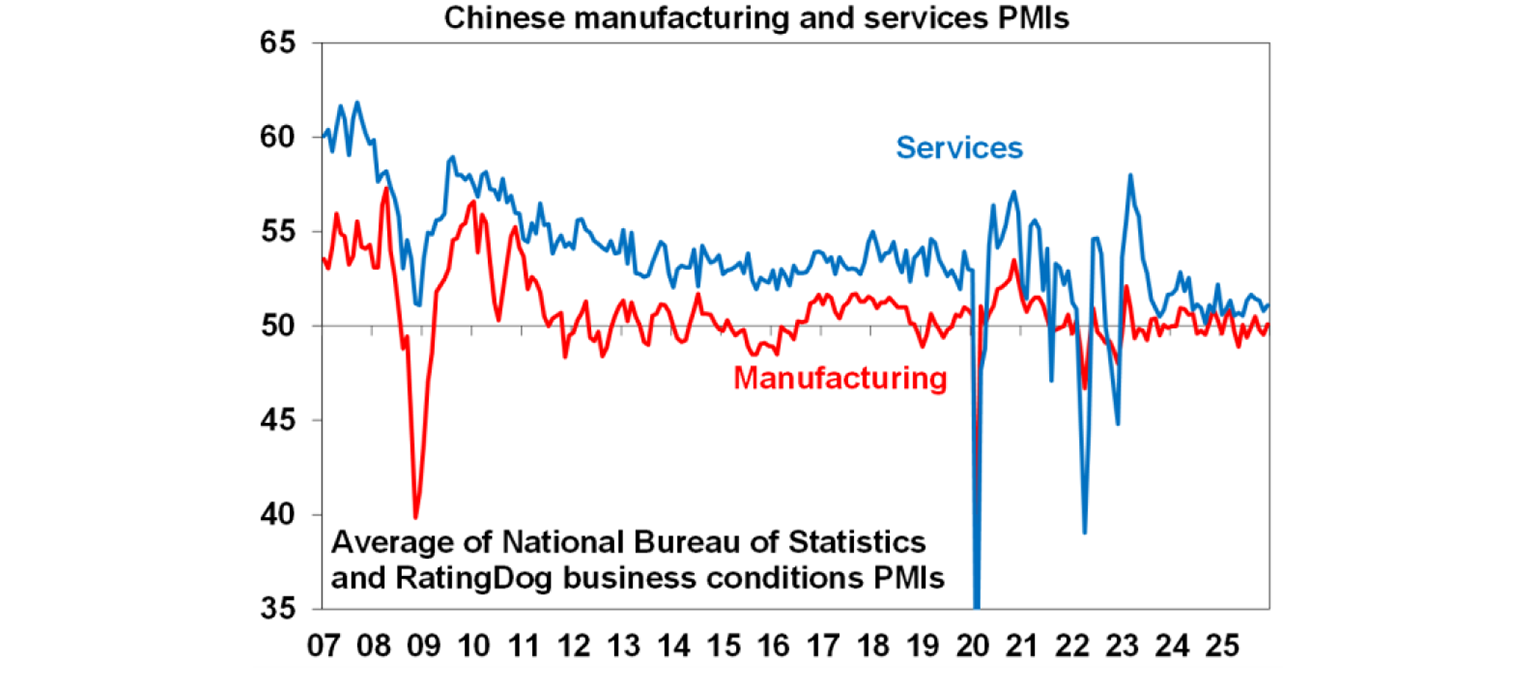

In China, the RatingDog PMI (formerly S&P) showed services activity still holding up (at an index level of 52 In December), stronger than the manufacturing reading. Broadly, conditions are still okay in China.

Australian economic events and implications

The November consumer price index was a little weaker than expected. Headline CPI rose by 3.4% (from 3.8% last month) and trimmed mean was 3.2% higher (from 3.3% last month). Both key measures of inflation remain well above the RBA’s 2.5% inflation target (the RBA has an inflation target of 2-3% but is really focussed on achieving 2.5%) so clearly inflation is still too high. But, it’s important to see that inflation is moderating and provides some signal that the last few months of hot inflation prints are unlikely to persist. The downside “surprise” in November was due to some more discounting across goods and a larger decline in domestic holiday prices.

In the month of November, the largest contributors to inflation (which accounts for both price changes and weights) were electricity (prices up 6.8% in November), petrol (2.5% higher over the year), new dwelling construction costs (which have been rising for a number of months, have a large weighting and were up by 0.5% over the month), gas (up by 3.5% over the month) and rents (up by 0.4% in November). Offsetting this, detractors from inflation included domestic holiday travel (after a rise in the prior month due to school holidays) with prices down 4.1% in November, furniture (from Black Friday sales) with a 4.6% fall in prices, motor vehicles (perhaps some cheaper electric vehicles entering the market finally?) which fell by 1.6%, garments for women (-2.7% in November) and accessories (-4.1% over the month) although this follows months of price increases.

We get the full quarterly inflation data at the end of the month, before the RBA’s February meeting. Don’t forget that the new monthly CPI is not comparable to the quarterly CPI figures for now, so the RBA has to wait for the full quarterly figures to make an accurate assessment on inflation. We expect headline CPI of 0.8% or 3.8% year on year and trimmed mean at 0.8% or 3.2% over the year, which did not change with today’s numbers. The February meeting is likely to be “live” which means it could be a close call between no change to rates and a rate hike, as the inflation data is too high for the RBA’s liking but may not be high enough to justify raising rates. In our view, we think the RBA will keep rates unchanged at the February meeting and throughout 2026 because we don’t think that the uptick in inflation will be sustained.

RBA’s Deputy Governor Hauser spoke to the ABC in an exclusive interview and said the better-than-expected November CPI data was “helpful” but largely as the RBA expected and called out rents and housing costs as still too high. The full December quarter CPI was looking perhaps ever so slightly above the RBA’s forecast in November (of 3.2% over the year to December) and pointed out multiple times that the RBA was not targeting inflation this quarter or a quarter out, but 1-2 years out. Given that the RBA’s new forecasts released on the day of the February Board meeting would contain the updated assumptions for the cash rate path (based on market pricing), the RBA’s forecasts on inflation may not be revised up as markets are now looking for rate hikes, rather than rate cuts (at the time of the last forecast update).

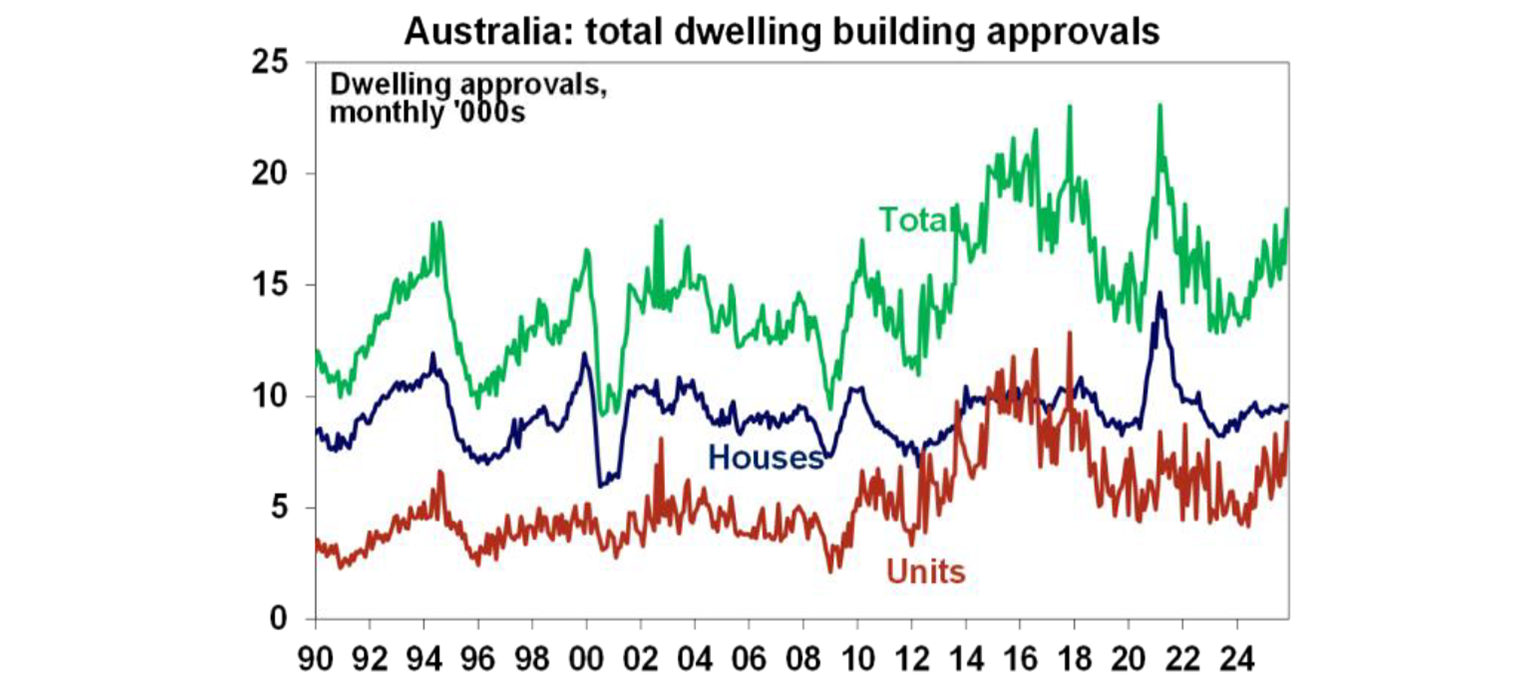

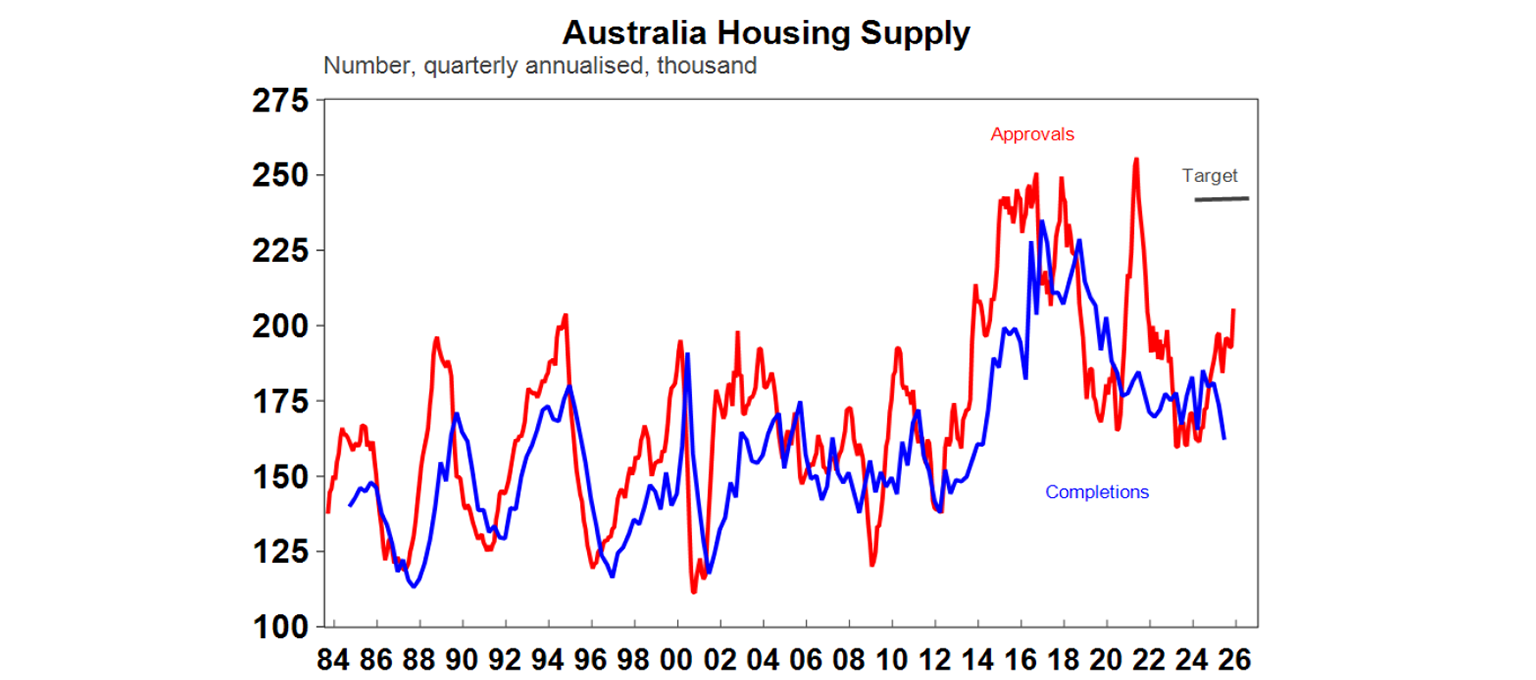

November building approvals surged by 15.2%, posting the best month in almost four years. This large gain was driven by a 36% increase in apartments and semi-detached dwellings over the month, while detached house approvals also rose by 0.7%.

Annualised approvals are running at ~205K now, an 11% rise from a year ago, which is a really good sign for housing supply in Australia. Before today, this figure has remained stagnant around 190-195k throughout the second half of 2025 (which is roughly matching demand from population growth). Overall, we are still falling short of the 240k pace targeted in the Housing Accord).

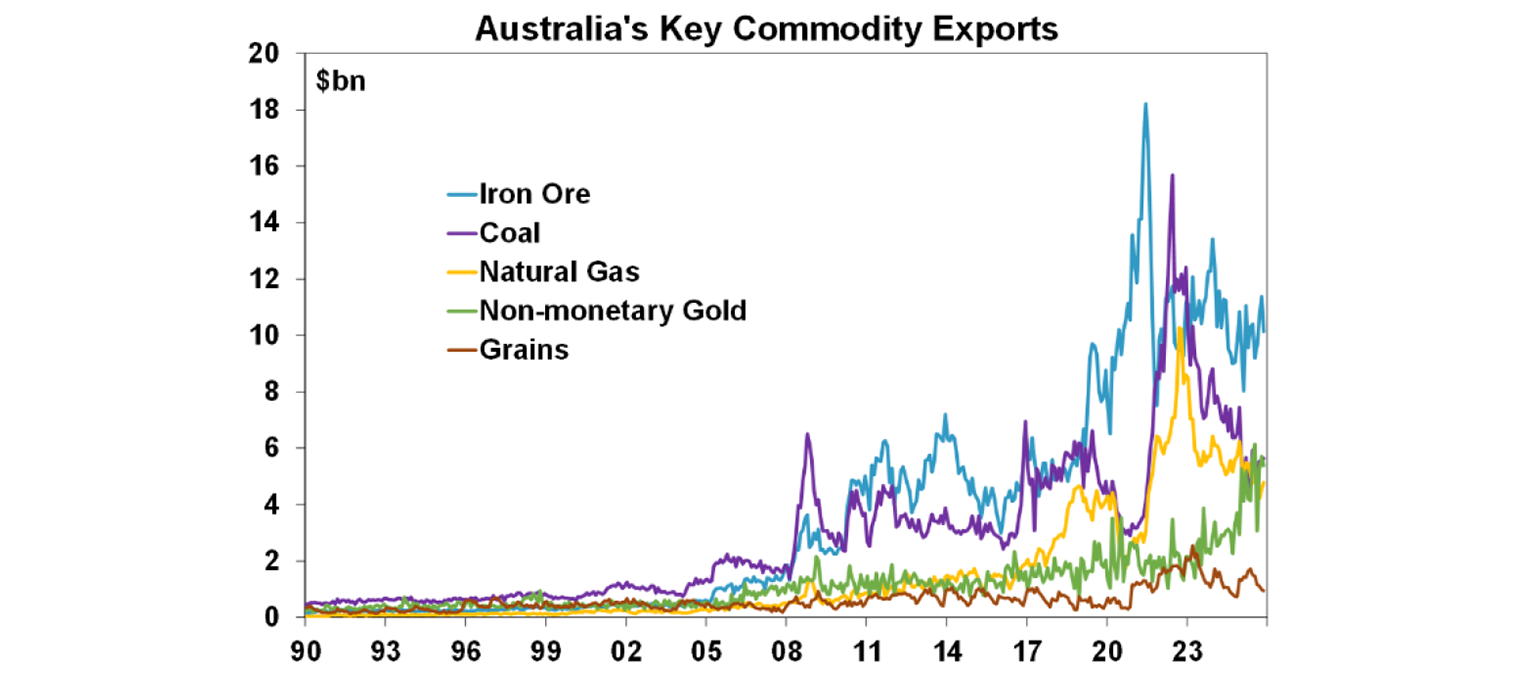

The November trade balance declined to $2.9bn, from $4.4bn last month. But this is still a high surplus. Exports declined whilst imports were basically flat.

Gold has seen a notable increase in exports recently, from both higher quantity (due to demand) and the rise in prices.

What to watch over the next three weeks?

For the US, next Tuesday US December consumer price data is out and economics are looking for annual growth of 2.7% in December, with core also at 2.7%. The US Fed meets in late January but no change is expected from the Fed, given the cut at the last meeting. November producer prices are also released, along with home sales figures and November retail sales (which should show a moderate rise of 0.4%).

The US Supreme court ruling on tariffs is due soon. There is a big chance that the Supreme court rules Trump’s tariffs illegal (which would impact around half of the tariffs levied as the others are done under other authorities). In this event, Trump and his team said they would look to reimpose some, if not all of the tariffs using other legal authorities (mostly national security provisions) which Trump has used for areas like steel and aluminium and semi-conductors. But, its still a blow to the trade policy and would put downward pressure on the effective US tariff rate. There is also the issue of companies wanting refunds for duties paid if the tariffs are deemed illegal, although this issue may have to go to the lower courts. Approximately $133bn of duties have been collected as at mid-December.

In Australia next week there is, December ANZ job advertisement figures and ABS job vacancies for the November quarter (both leading indicators for employment), household spending for November (we think it will rise by 0.6% which is modest after the strong lift in October) and the January Westpac/Melbourne Institute consumer sentiment index (likely to decline given rate hike fears).

Outlook for investment markets

After three years of strong returns, it’s inevitable that investment returns will slow. We have seen a bit of that in 2025 but expect a further slowing in 2026.

Global and Australian share returns are expected to slow further in the year ahead to around 8%. Stretched valuations in the key direction setting US share market, political uncertainty associated with the midterm elections (which years have seen below average returns and increased volatility) and AI bubble worries are the main drags but returns should still be positive thanks to Fed rate cuts, Trump’s consumer friendly pivot and solid profit growth. A return to profit growth should also support gains in Australian shares even though the RBA may have finished cutting rates. Another 15% or so correction in share markets is likely along the way though.

Bonds are likely to provide returns around running yield.

Unlisted commercial property returns are likely to stay solid helped by strong demand for industrial property associated with data centres.

Australian home price growth is likely to slow to around 5-7% in 2026 after 8.3% in 2025 due to poor affordability, rates on hold with talk of rate hikes and APRA’s move to ramp up macro prudential controls.

Cash and bank deposits are expected to provide returns around 3.6%.

The $A is likely to rise as the interest rate differential in favour of Australia widens as the Fed cuts and the RBA holds and possibly hikes. Fair value for the Australian dollar is around $US0.73.

You may also like

-

The outlook for Australian shares – is the long underperformance over? Australian shares have had a strong start to 2026 with the ASX 200 up 3.3% and flirting with a new record high. The local market has also outperformed US shares which are down 0.1% and global shares which are up 1.6%. However, this could just be noise and follows a significant underperformance against US and global shares since 2009. -

Weekly market update - 20-02-2026 Global share markets mostly rose over the last week. Worries about AI and tech valuations took a breather and the US Supreme Court decision to strike down Trump’s emergency power tariffs with Trump immediately announcing a replacement were seen as having little impact on the US growth outlook but were seen as positive for other countries. -

Econosights - An update on global debt and fiscal policy With the International Monetary Fund releasing their Global Fiscal Monitor recently, AMP's Senior Economist, Diana Mousina provides an update on the global debt situation and recent fiscal policy announcements.

Important information

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account. Taxation issues are complex. You should seek professional advice before deciding to act on any information in this article.

It’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you. The super coaching session is a super health check and is provided by AWM Services and is general advice only. It does not consider your personal circumstances.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy. All information on this website is subject to change without notice. AWM Services is part of the AMP group.