Key points

Rich valuations, AI bubble worries and uncertainty about central bank rate cuts are the main negatives for shares at present and could see recent falls extend further.

Against this though, global profit growth remains strong and there is no sign of recession suggesting that the broad trend in shares may remain up.

For investors and super fund members, the danger in trying to time corrections and bear markets is that you miss out on longer-term gains. The key is to adopt an appropriate long-term investment strategy and stick to it.

Introduction

November so far has seen a pretty wobbly ride for shares. From their October highs, US shares are down 3.2% and Australian shares are down 5%. More significantly perhaps concerns about a bubble in equity markets focussed around AI have escalated since we had a look at the issue early last month (see here) with more high profile commentators and investment experts expressing concern. And share markets have not been helped by a scaling back in expectations for near term rate cuts in the US and uncertainty about whether there will be further rate cuts at all in Australia. This note looks at the key negatives and positives for shares.

The negatives for shares

Several negatives hang over shares.

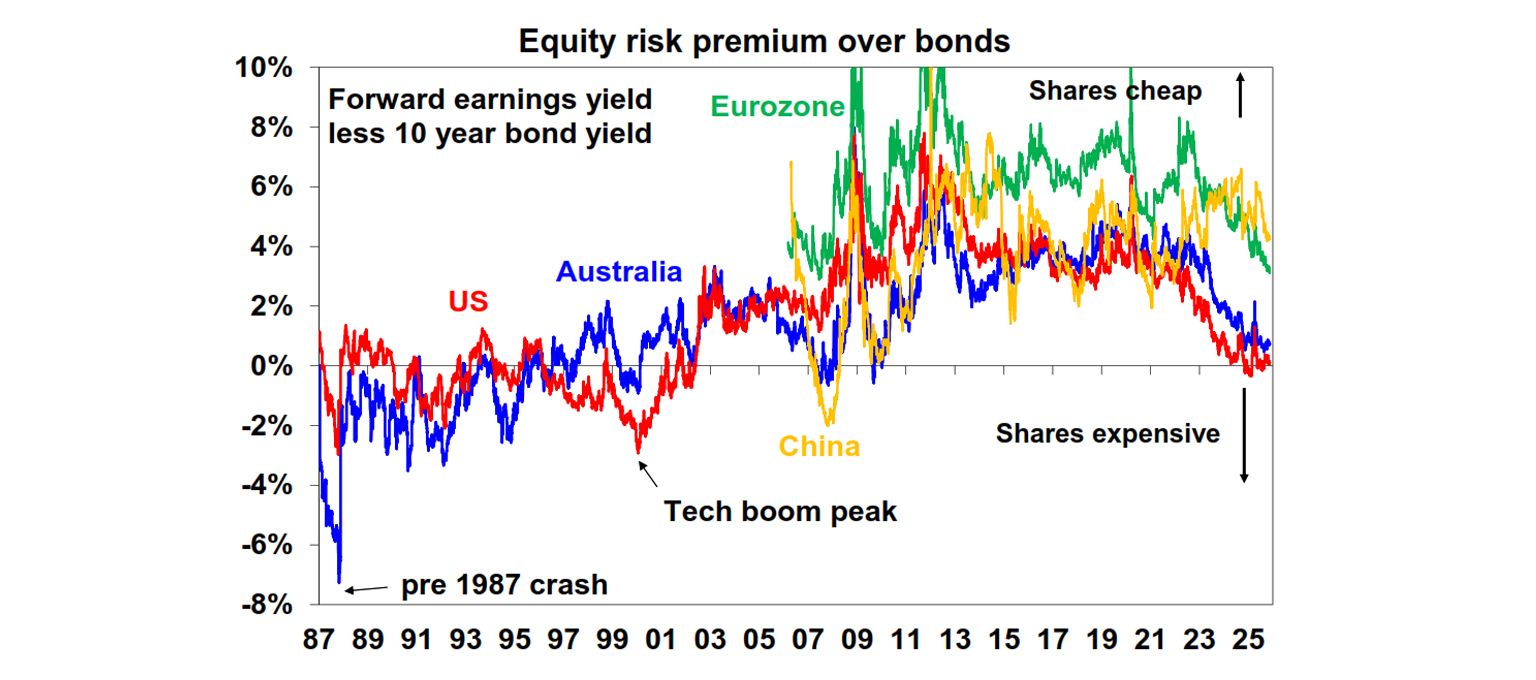

First, shares are expensive. This is nothing new but is clearly evident in relatively high price to earnings multiples. The forward price to earnings ratio on US shares is at 23.5 times, not far below the 1999-2000 tech boom high. The PE on Australian shares is well above its tech boom high despite a recent fall. Related to this, the risk premium offered by shares over bonds – the gap between the forward earnings yield and the 10-year bond yield – is very low in the US and Australia versus the post-GFC period.

It should be noted that thanks to lower bond yields the equity risk premium now is more attractive than it was prior to the 1987 crash or the tech wreck. And valuations are a poor guide to timing market movements. That said, high PEs and the low equity risk premium compared to much of the last twenty years warn of a slower return potential ahead and provide less of a buffer should things go wrong.

Second, shares have had several years of strong gains, with the last bear market in global shares being in 2022. Shares did have sharp falls into April this year on Trump’s tariffs, but the falls were less than 20% and were quickly reversed. Over the last 3 years US shares have returned 23%pa, global shares 21%pa and Australian shares 13%pa. History warns that after a run of strong above average years a weaker year and often a bear market can come along.

Third, there are signs of a bubble forming in AI shares with investor enthusiasm for AI related exposure. We covered this in the note last month referred to earlier. Specifically, the Magnificent Seven (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta and Tesla) have risen more than 30-fold over the last decade dwarfing various other bubbles and they have disproportionately driven the US share market accounting for 50% or more of its gains since 2023.

Fourth, there has been increasing uncertainty around how much central banks will cut interest rates - notably in the US and Australia - and this has been a key driver of weakness in shares since their October highs. The US money market now sees only around a 45% chance of a December rate cut. This is raising concern on several fronts as US jobs data has shown signs of weakening lately and less rate cuts may mean higher bond yields which in turn pressures share market valuations. In Australia, higher than expected September quarter inflation and associated worries about capacity constraints have seen the RBA adopt a more cautious data dependent approach with the money market seeing just a 40% chance of another rate cut.

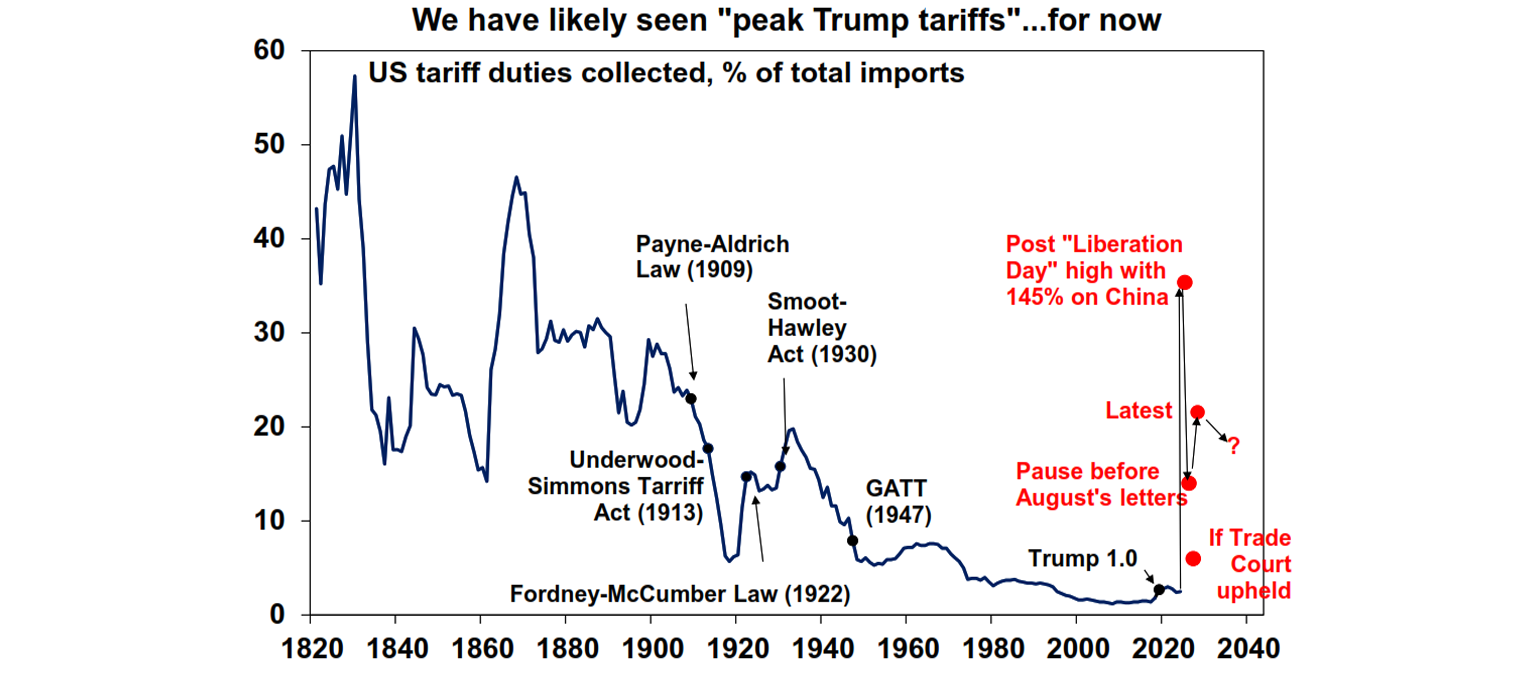

Fifth, there remains immense uncertainty around the lagged economic impact on US economic growth of Trump’s tariffs.

Finally, there remain concerns about excessive public debt levels in several countries including the US and ongoing geopolitical risks.

The positives

Against this backdrop, a number of positives provide some offset.

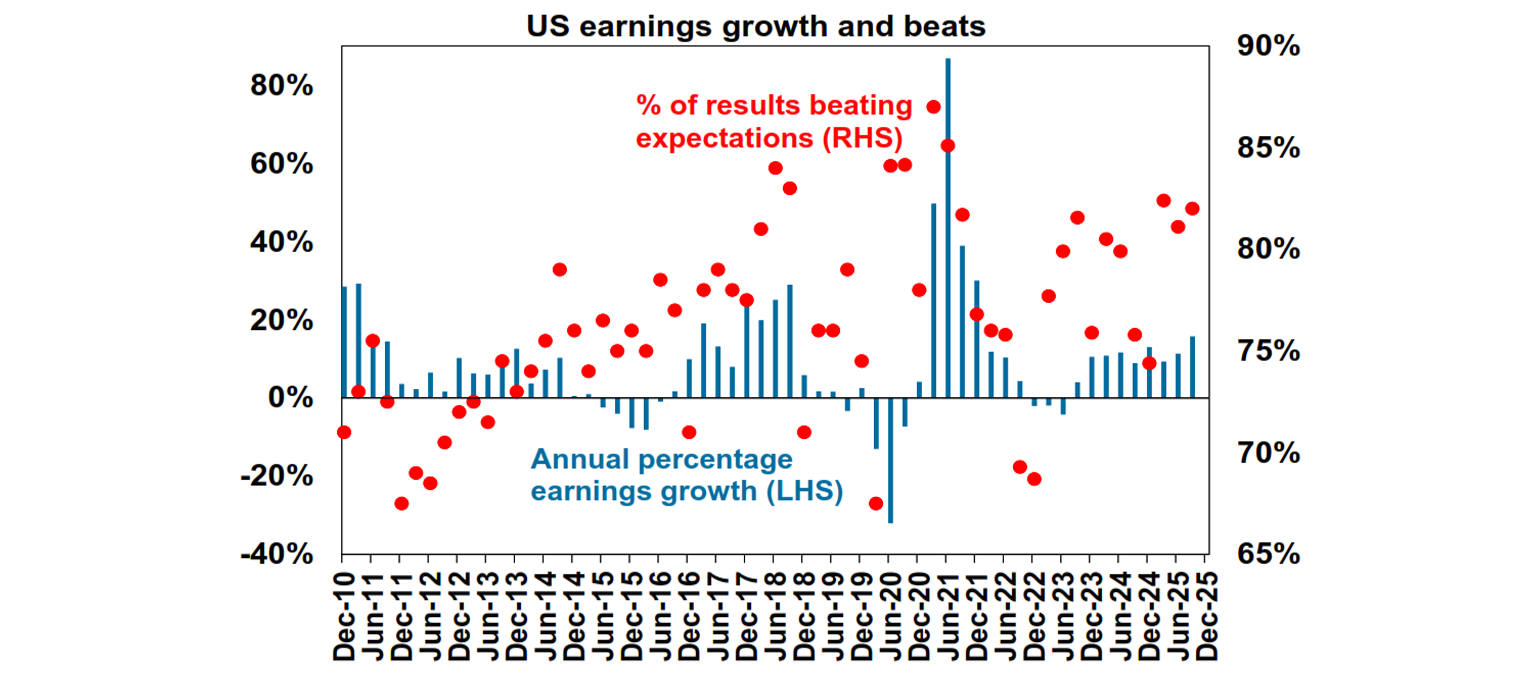

First, profit growth in the key direction setting US share market remains strong. The September quarter earnings reporting season has seen 82% of results beat expectations which is above the norm of 76% and profit growth is on track for around 15.5%yoy. Tech profits are running around 28%yoy, which contrasts with the “dot.com” stocks in the late 1990s tech boom which were making little in the way of profits. September quarter profits have generally surprised on the upside globally as well.

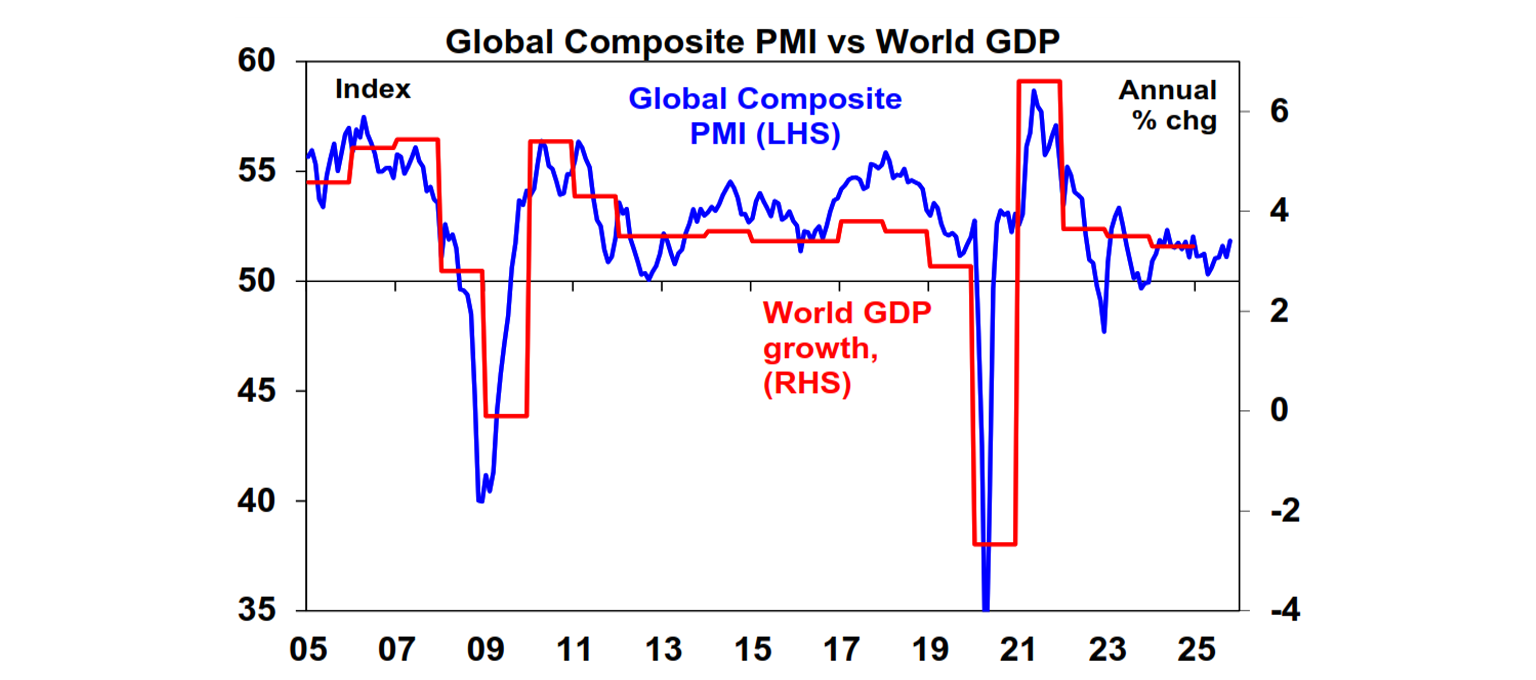

Related to this, business conditions PMIs – derived from business surveys – are at levels consistent with reasonable economic growth. And Australian economic growth is gradually improving which should lead to stronger ASX listed company profits next year. So, there is no sign of recession which is important because major bear markets in shares tend to be associated with recession – although this is no guarantee as shares often lead the way.

Third, Trump is now cutting tariffs as next year’s mid-term elections come into focus. Trump won the 2024 election largely on the back of dissatisfaction with “cost of living” increases, but recent Democrat election victories confirm that swing voters are now deserting him because he has added to the cost of living. To avoid a disaster in next year’s mid-terms he is swinging back to measures to reduce the cost of living. This was already evident in his acceptance of the latest trade truce with China which saw both sides removing imposts and threats on each other with no resolution to the key issues. But it signalled that we are well passed “peak Trump tariffs” with Trump having little choice but to back down with China as he couldn’t afford another escalation in his politically unpopular tariffs. His pivot was also evident in his talk of tariff rebates and floating the silly idea of a 50-year mortgage. But after the Democrat victories early this month the pivot is in full swing with tariff exemptions on imports of food items – like beef, tomatoes, bananas, oranges, fruit juices, nuts and coffee. This means removing tariffs that were only imposed earlier this year. So much for his argument that foreigners pay tariffs and there is no impact on prices for Americans! And his chopping and changing won’t do anything for businesses trying to work out where best to locate production – but that’s a separate issue. The key is that Trump is pivoting to more market and consumer friendly policies.

Fourth, measures of investor sentiment are still not showing the euphoria often associated with major market tops and bubbles don’t normally burst when there is so much talk about them.

Fifth, while there is much uncertainty about how much further interest rates will fall our view remains that both the Fed and RBA will cut rates further. We are allowing for three more US rate cuts and one more RBA rate cut, albeit not till around May next year.

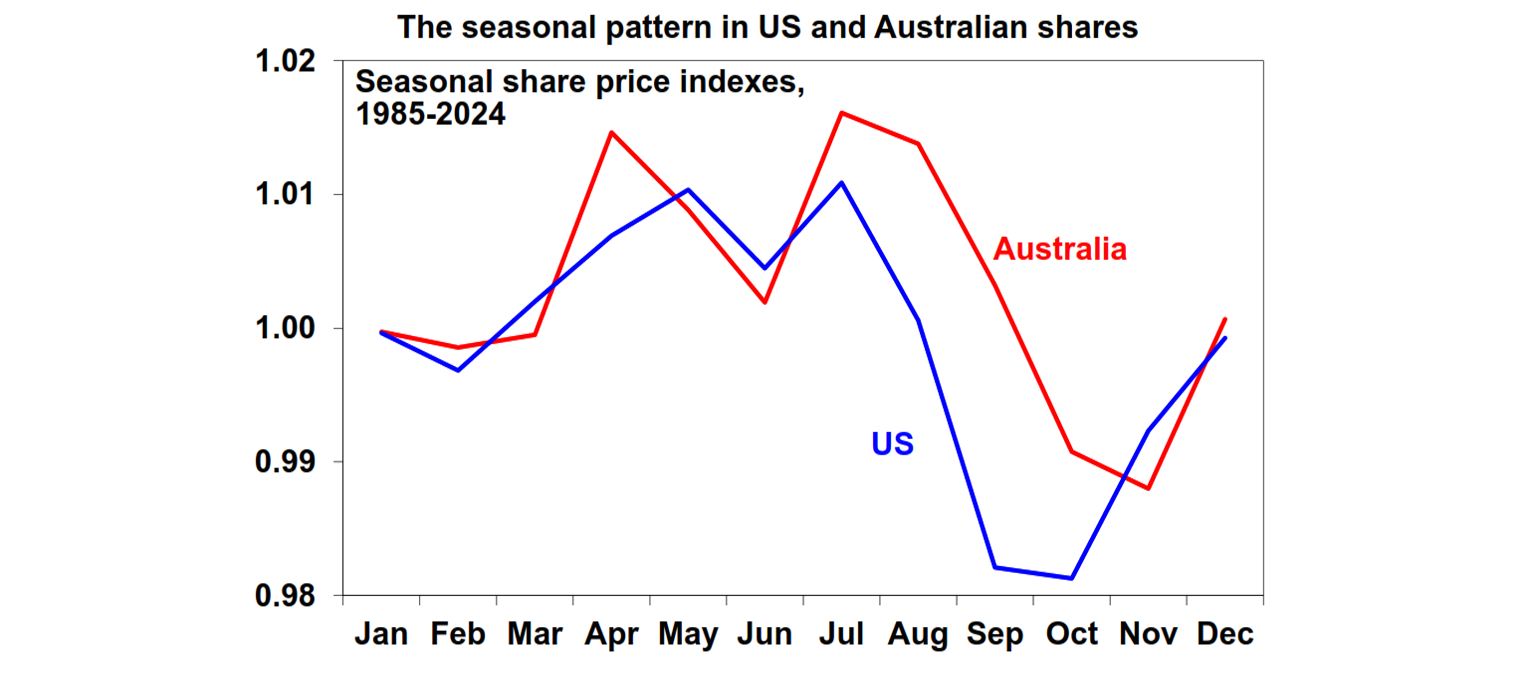

Finally, we are now entering a positive period of the year for shares from a seasonal perspective. Shares typically rally from November into the new year as part of the Santa rally.

So, while the risk of a further near-term pullback in shares is high, a more severe fall may not come till next year. And in the meantime, still strong global profit growth, little indication of a recession and the likelihood that central banks will still cut rates further suggest the broad trend in shares may still remain up. However, 2026 could be a rougher year as it’s another mid-term election year in the US. Since 1950 US shares have had an average top to bottom drawdown of 17% in mid-term election years.

Implications for investors

The bottom line is that stretched share market valuations are warning of the risk of a further fall in share markets and it’s possible that AI enthusiasm has run ahead of itself. But stretched valuations are a poor timing tool for market movements. As we saw in the 1990s any bubble could inflate further, well beyond when commentators and experts start to worry about it. Either way, rough periods are an inevitable part of share market investing but trying to time them is hard, so the key is to adopt an appropriate long term investment strategy and stick to it.

Dr Shane Oliver

Head of Investment Strategy and Chief Economist, AMP

You may also like

-

How much do you need to retire comfortably in Australia? Take the guesswork out of your retirement planning – see if you’re on track for retirement based on Australian standards. -

Weekly market update - 06-03-2026 Australian shares are a key beneficiary of the rotation trade helped by the now concluded December half earnings reporting season confirming that listed company profits are rising again. -

How women can build financial wealth, confidence and security Practical tips for women to grow their wealth. Learn about budgeting, saving, super advice and more to take control of your finances.

Important information

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account. Taxation issues are complex. You should seek professional advice before deciding to act on any information in this article.

It’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you. The super coaching session is a super health check and is provided by AWM Services and is general advice only. It does not consider your personal circumstances.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy. All information on this website is subject to change without notice. AWM Services is part of the AMP group.