Introduction

In this Econosights we look at some of the key headlines that have been impacting financial markets in early 2026 and what the implications are for investors. Most of this note will focus on what’s been going on in the US, because it has been the major driver of political news and is the epicentre of global markets.

What is going on with geopolitics?

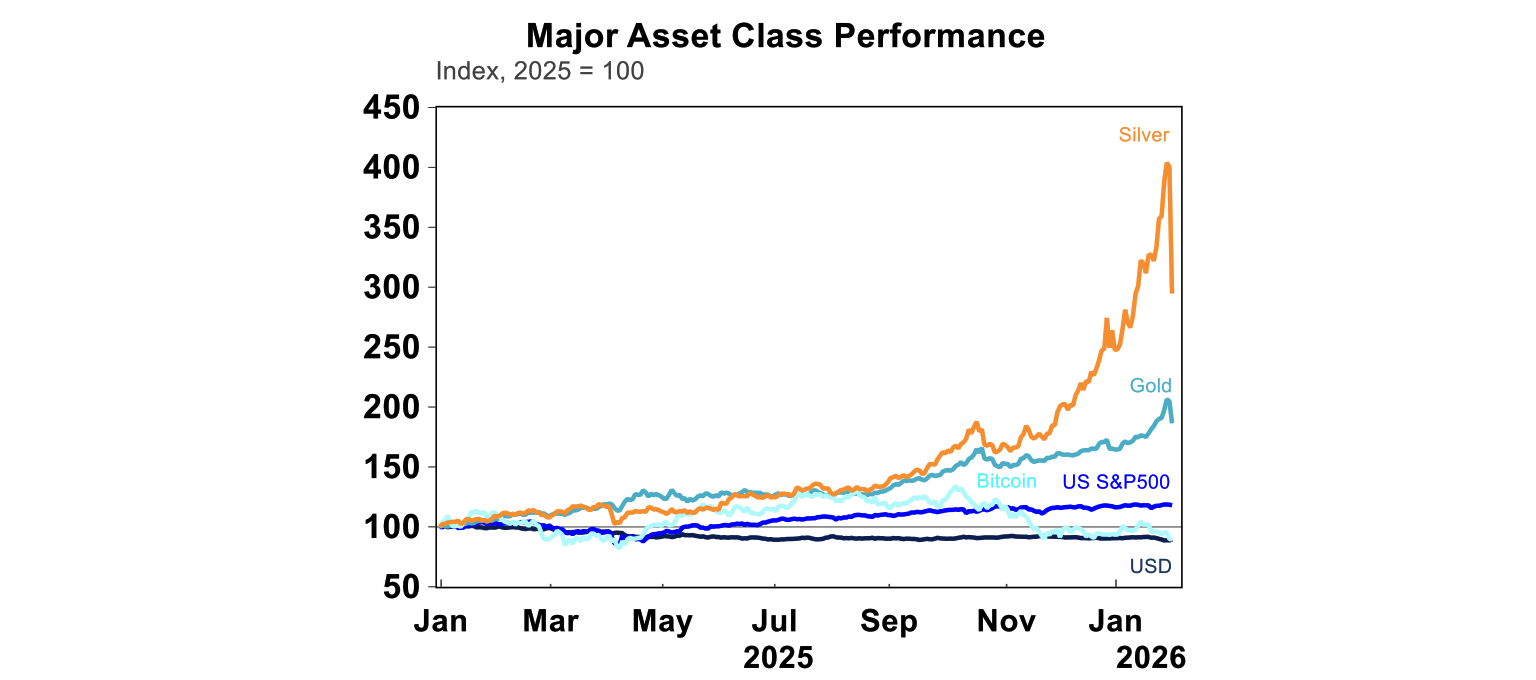

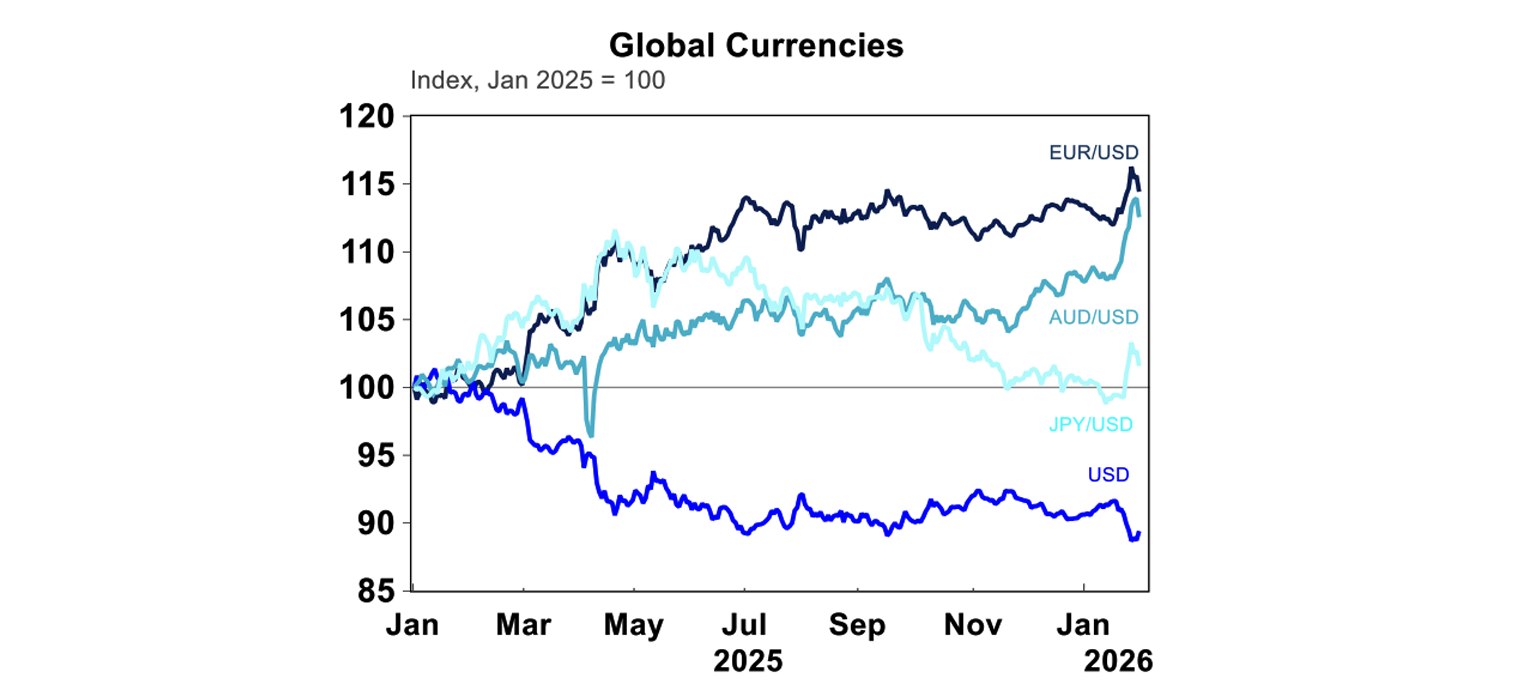

2026 has started with a lot of geopolitical news, mostly from decisions taken by Trump and his team including “Operation Absolute Resolve” to remove Venezuelan President Maduro and getting into a rift with NATO about acquiring Greenland. While neither outcome had a particularly long-lasting impact on sharemarkets, they are another example of the US showing its global dominance and the “America First” strategy pushed by Trump and his team (i.e. policies that pursue US interests above international commitments especially amongst allies). This means we should expect continued US protectionism (i.e. tariffs levied by the US), tight US borders, foreign relation policies that put the US at the centre and make Trump look like the winner and deal-maker-in-chief and weaker global alliances. This environment makes investors question the “global rules-based order”, the international framework that the world became used to post-WWII, which the US benefitted from as the global hegemon! This framework refers to the US involvement in institutions such as NATO, UN and Bretton Woods and questions international law, sovereignty and multi-lateral decision making. This has led to investor concern that the US is no longer a “safe haven” country or asset class and led to a 10% depreciation in the US dollar since early 2025, which has continued into this year (see the chart below).

Instead, investors are fleeing to other “safe haven” assets, especially gold and silver (as per the chart above), albeit with some recent pullback which looks normal given the large run up in prices. Bitcoin was performing well to mid-2025, but has since fallen despite support for cryptocurrencies from the US administration.

Given the heightened geopolitical climate of the last 12 months and likelihood of Trump pursing America-First policies, it’s likely that the trend of the lower $US and support for precious metals is likely to continue. Bitcoin could also start to benefit in 2026, as an alternative asset class. US equities have managed to rally amongst the geopolitical noise, although with some down days in between. Unless there is a sign that the US is involving “boots on the ground” in any outright wars, sharemarkets are likely to keep trending higher off solid earnings growth forecasts and decent economic growth outcomes, alongside some help from lower interest rates.

The politicisation of the US Federal Reserve

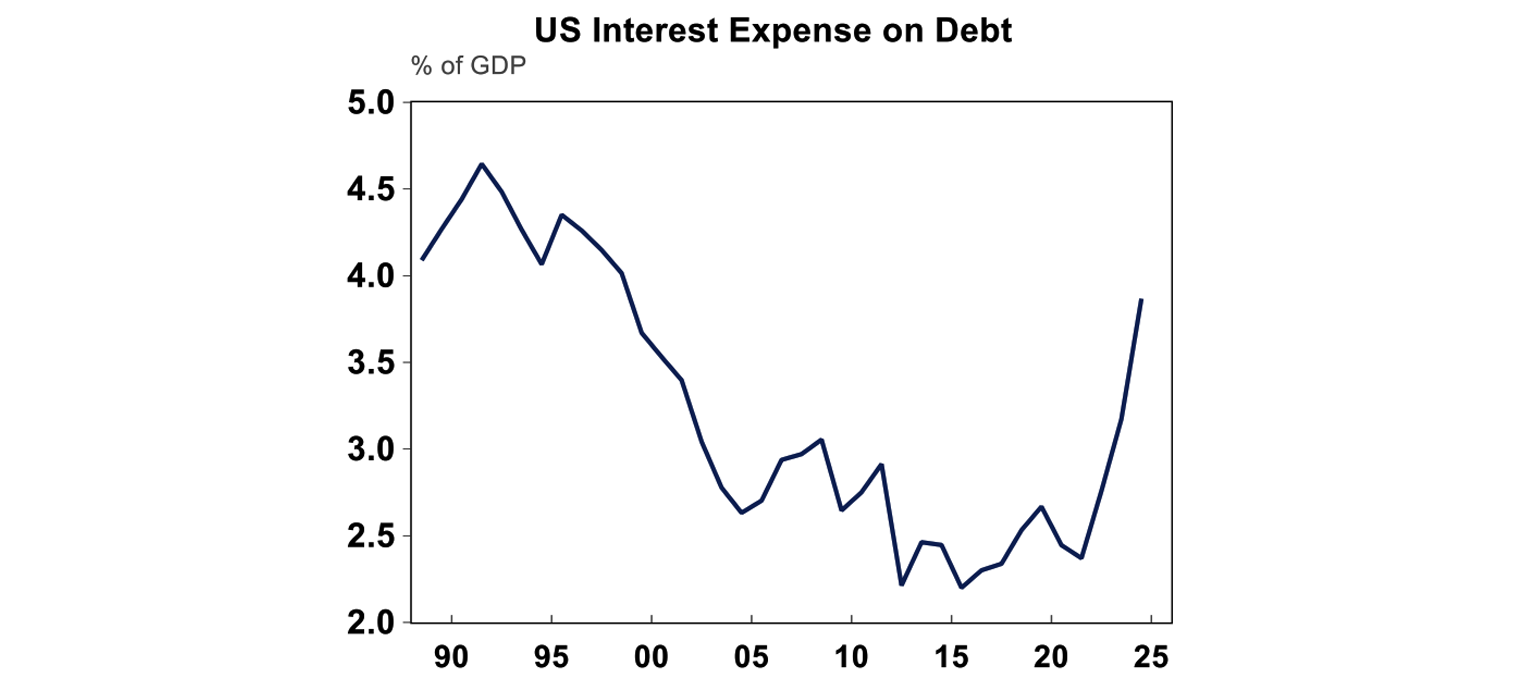

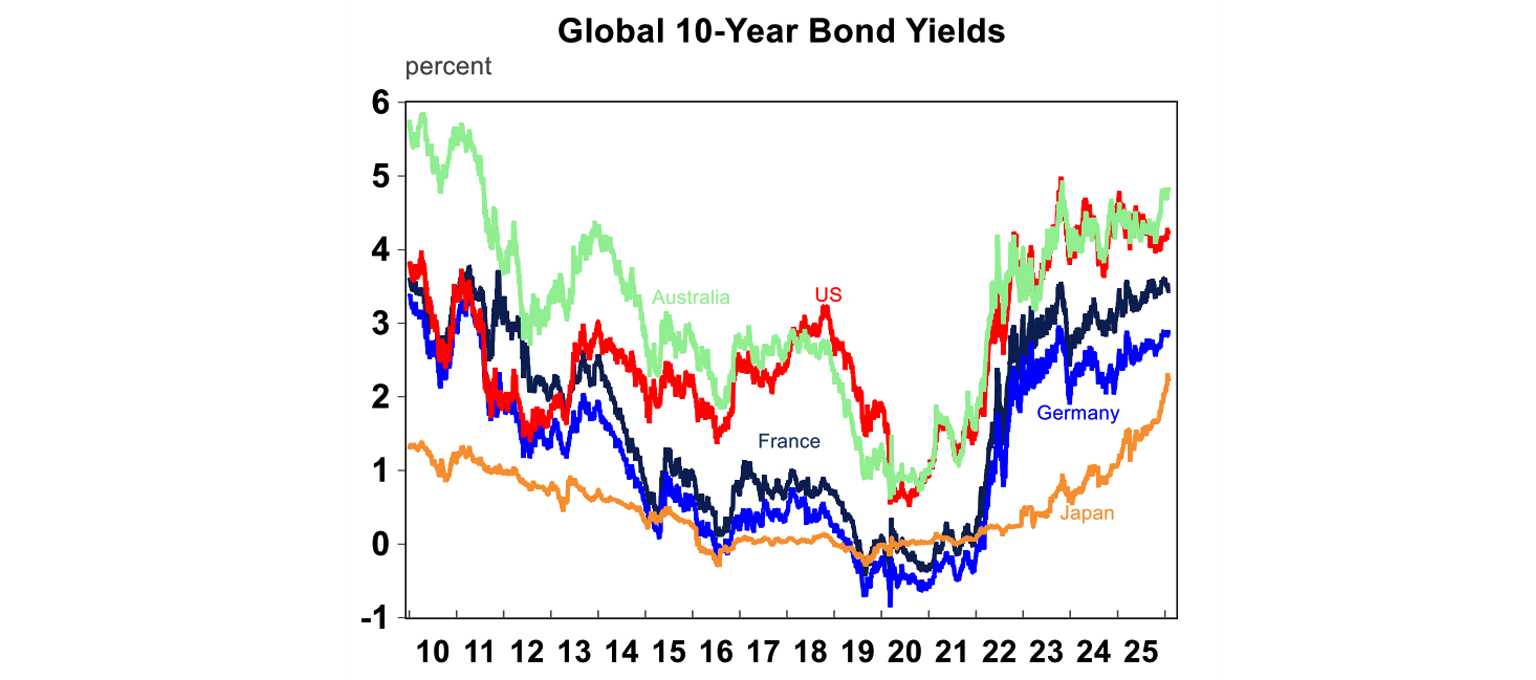

The US Federal Reserve decisions on interest rates impact borrowing costs for individuals, businesses and the government and influence economic activity. The US central bank has cut interest rates by 1.75% since late 2024, taking interest rates from a high of 5.25-5.5% to its current level of 3.5-3.75%. However, Trump would like interest rates to be lower to help reduce government borrowing costs and support economic growth. Government borrowing costs have risen to their highest level since 1999, due to the increase in bond yields (see the chart below) which reflect higher inflation (and therefore interest rates) and elevated budget deficits.

Trumps taunting of Fed Chair Powell by calling him “Too Late Powell” and accusations of going over budget on the new Fed building renovations has led to an investigation of Powell by the Department of Justice. Trump also tried to fire another Fed governor, Lisa Cook, accusing her of mortgage fraud with this case still to be determined. As a result, the independence of the US Fed is being seriously questioned which has been a reason for investors to avoid extra allocations into US dollar and to demand higher bond yields because of a loss of faith in US institutions and the central bank’s commitment to keep inflation at 2%.

Trump announced that Kevin Warsh would be replacing Chair Powell in May, once his term expires. Warsh is a former Fed governor and a conventional choice for Governor. But, there is no doubt that Trump will put pressure on Warsh and the Fed to lower rates. Investors should expect interest rates to continue to decline. While lower interest rates are a tailwind for sharemarkets and economic growth, it could lead to higher inflation down the track.

Domestic US politics

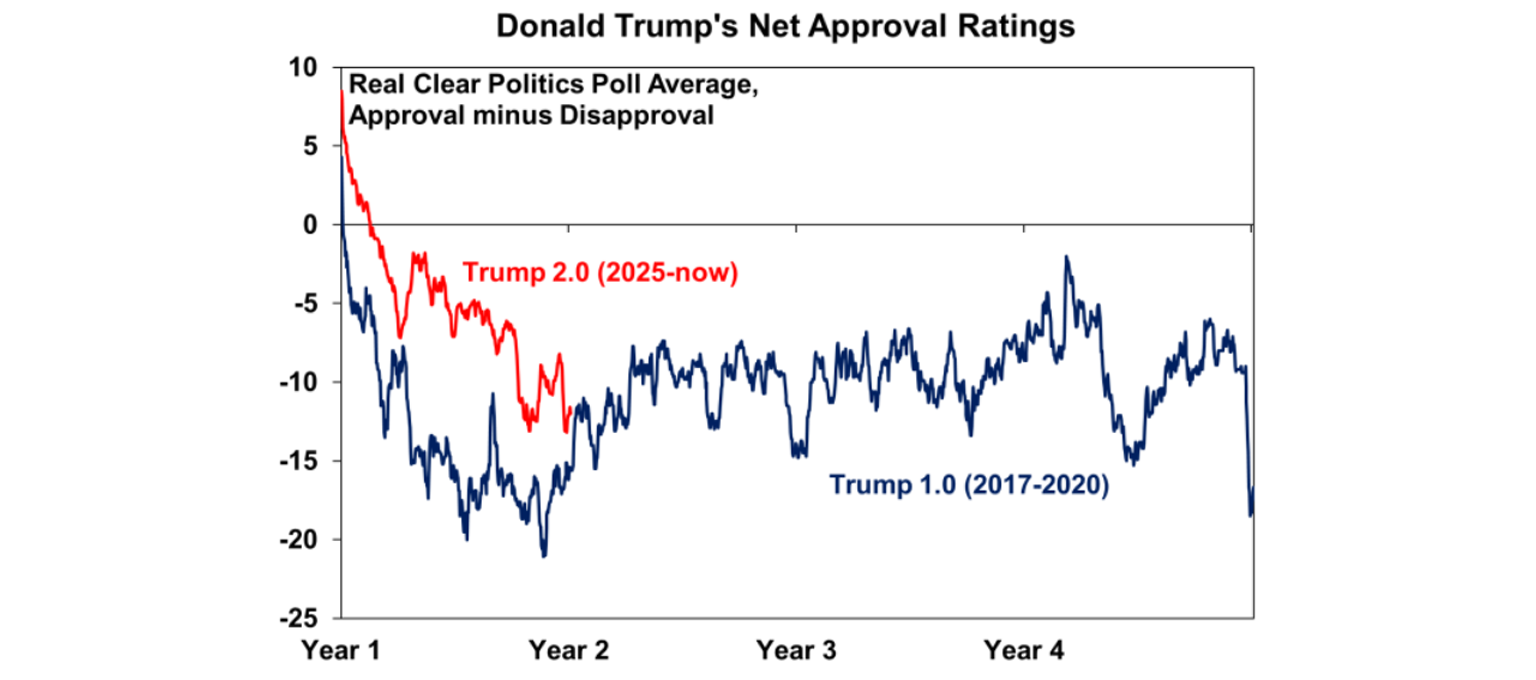

Domestically, the political situation is messy. Trump’s approval rate is a net negative (more disapproval than approval) and has taken a bit of a hit recently and is now close to the Trump 1.0 net approval rating (see the chart below). This is because of the fallout from the government shutdown (that meant some workers were not being paid), the second government partial shutdown, ongoing cost of living concerns, recent severe ICE crackdowns, concern about intervening in other countries (like Venezuela and Greenland) from fearing it could turn into other “forever wars”.

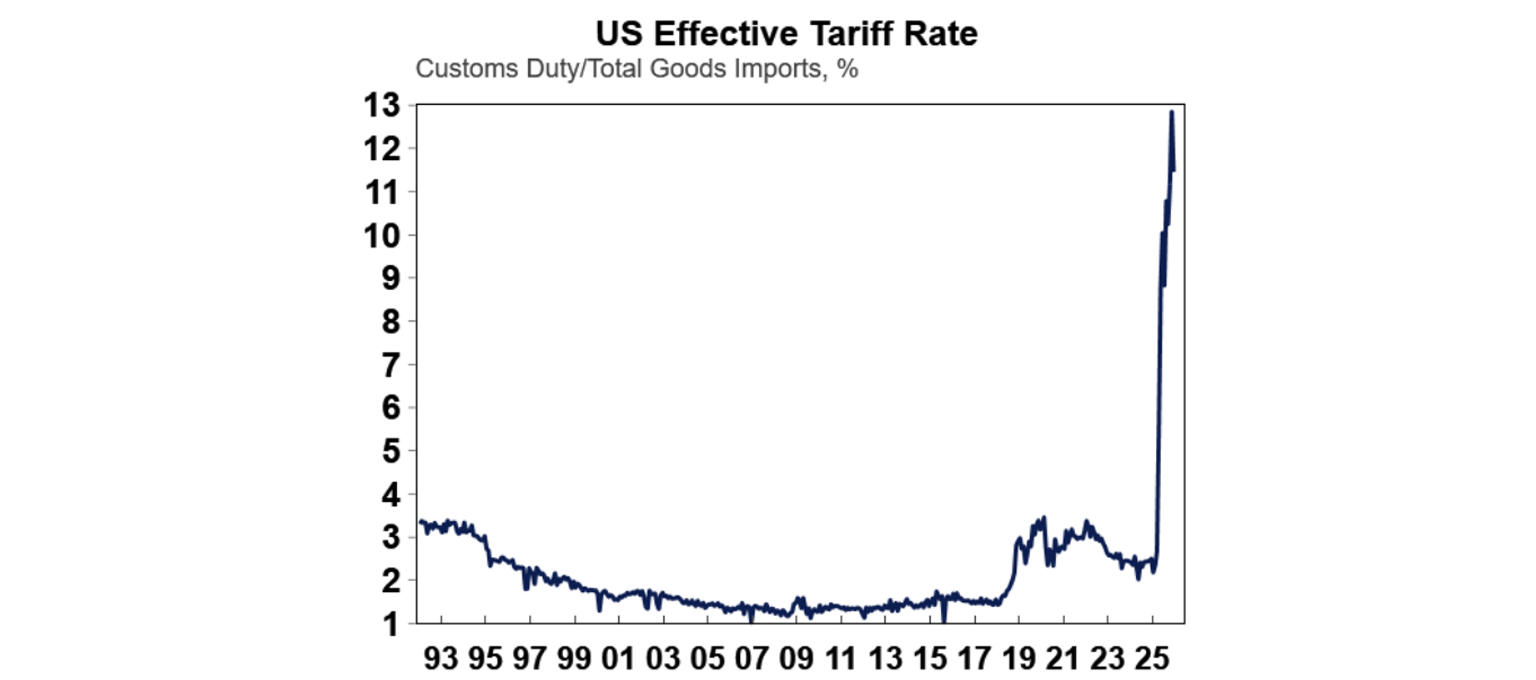

The US Supreme Court still has to release its ruling on Trump’s tariffs that were imposed under the International Emergency Economic Powers Act (IEEPA). The other tariffs that Trump has used outside of the IEEPA include Section 301 (China tariffs related to unfair trade practices which started in 2018) and Section 232 (steel and aluminium tariffs) but it’s harder to push all tariffs using this method because often they require long investigations, they are too narrow, temporary or too slow to impose. If the Supreme Court rules that Trump’s IEEPA tariffs are illegal then he has the ability under Section 122 to levy 15% tariffs for 150 days before pivoting to reviews for specific Section tariffs (like done under 301/232). It’s estimated that around half of the current imposed tariffs are done under IEEPA. This means that if they are ruled illegal the average US tariff rate imposed on imports would fall from its current level of ~12% which is the highest tariff rate since (see the chart below) to ~6%, although these are subject to change given recent threats to Korea and Canada around higher tariffs.

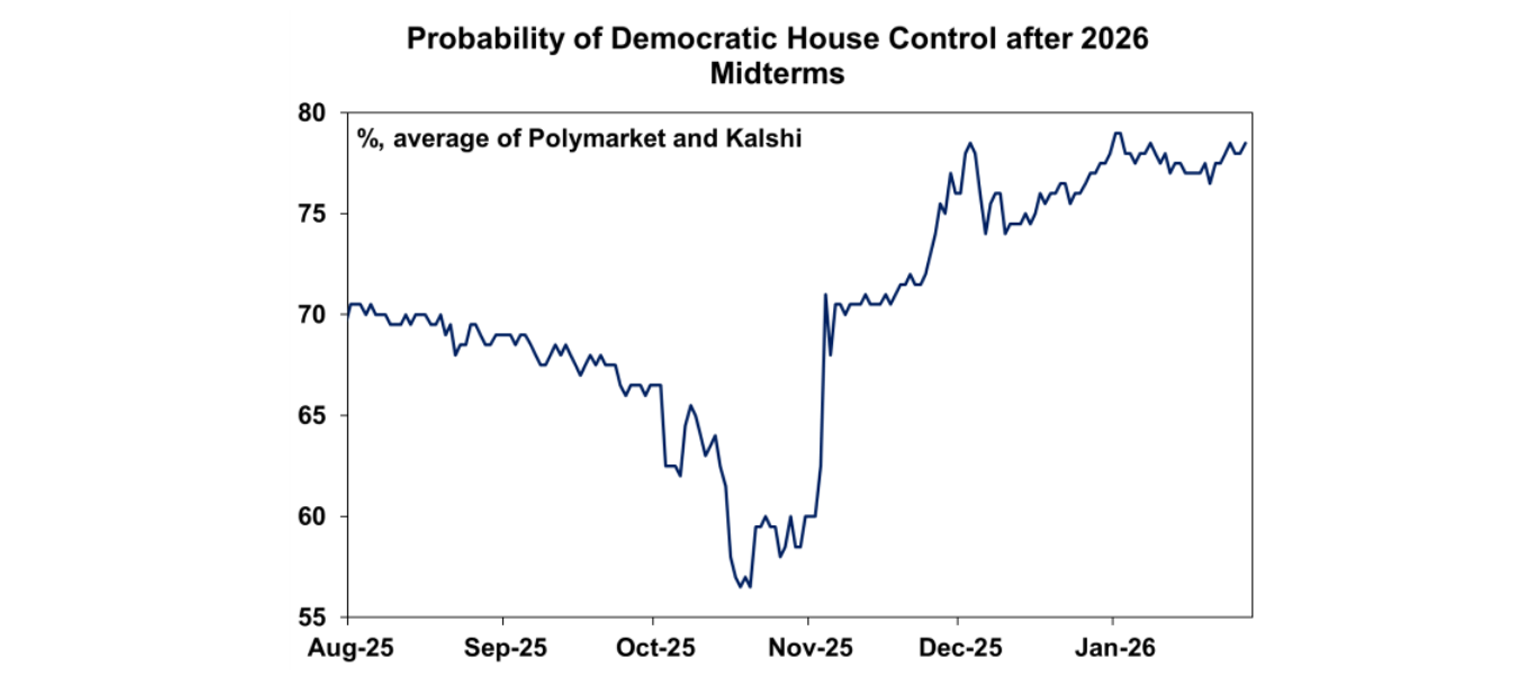

In November this year, the US will have ”midterm” elections. These are held at the mid-point of the president’s four-year cycle where all seats in the House of Representatives and one-third of Senate seats are up for re-election and are done as a check on the President. There is something known as the “mid-term curse” in the US, where the incumbent party tends to lose seats in the House. In the last 20 mid-terms since WWII, 18 have seen the President’s party loose House seats. This tends to happen because there is often some voter fatigue and unhappiness with government policies. Betting markets are assigning a high probability (just under 80% chance) that the Democrats win the House (see chart below), because the Republicans already have a very slim majority (of 3) in the House. The Senate is likely to continue to be held by the Republicans. Numerous state and local US elections in 2025 saw larger support for Democratic candidates, which look to be a “rebuke” of Trump’s agenda.

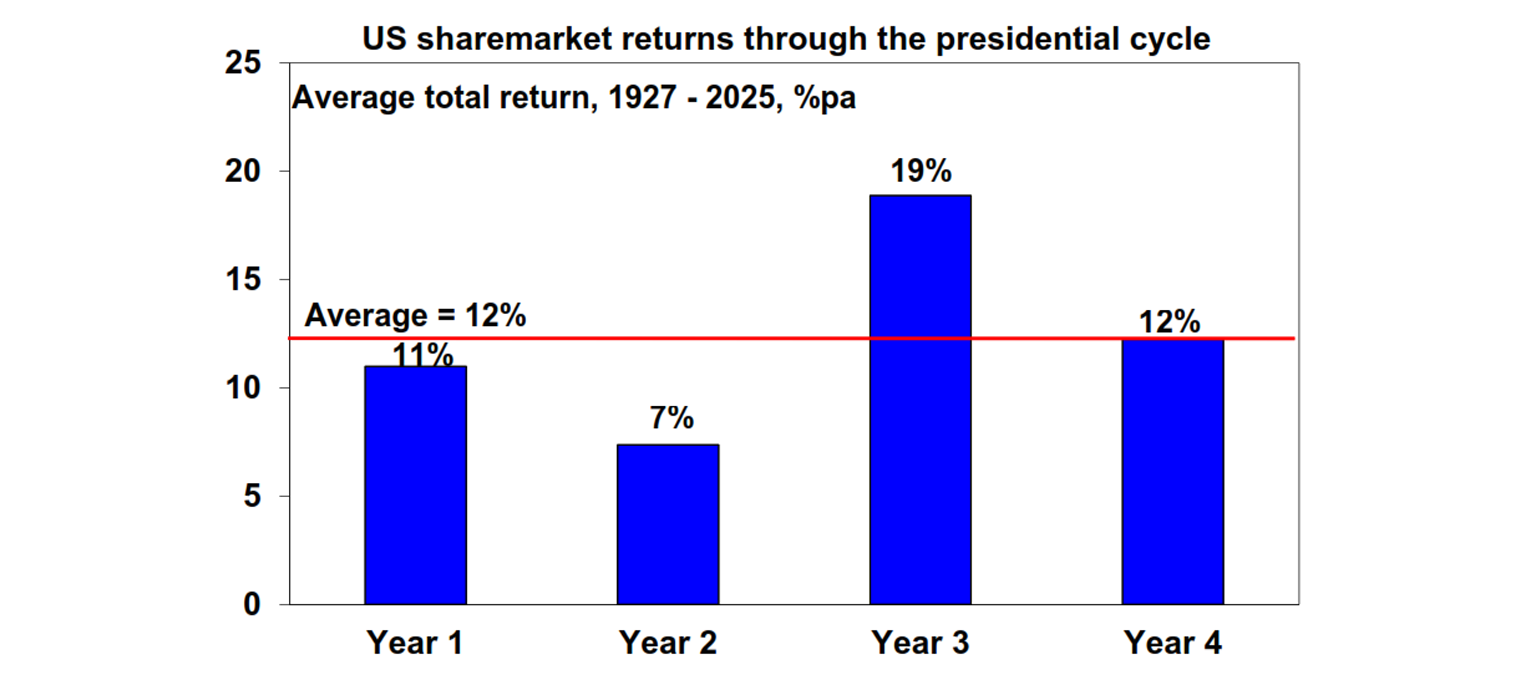

Mid-term election years tend to be the worst year for sharemarket performance across the four-year election cycle (see the next chart). The average total return for US shares in the second year is 7%, compared to the average of 12% over the course of a four-year Presidential cycle. This tends to occur because favourable policies are put through in the first-year of the term and in the second-year presidents often become more populist, as approval ratings tend to decline. Markets also don’t like uncertainty, which happens during mid-terms and are reflected in lower sharemarket returns.

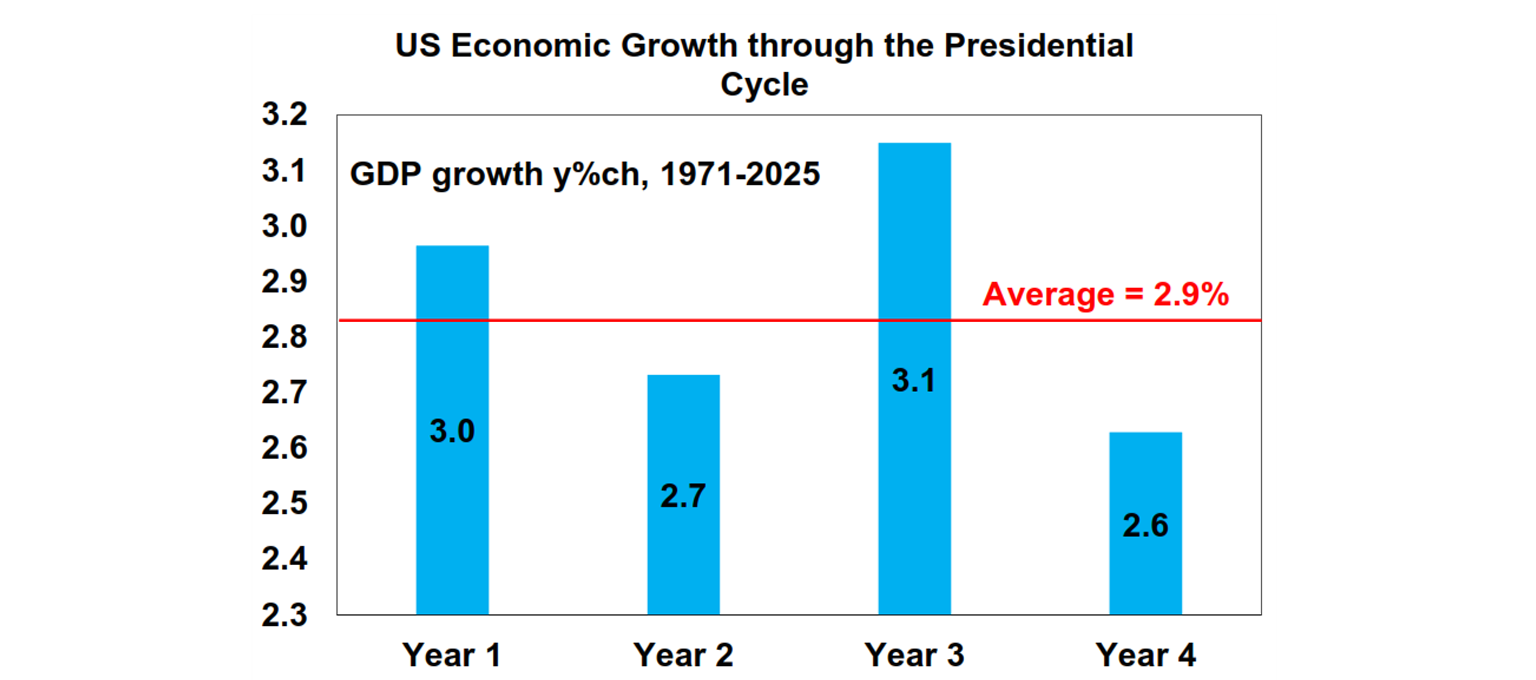

The same trends can be observed for GDP outcomes. Economic growth gets a boost in Year 1 of a Presidential Cycle and then suffers in Year 2, for similar reasons around the types of policies pursed by the President over the four-year cycle.

Other key domestic political issues have included a focus on easing housing affordability concerns, with an aim to lift home ownership rates. Recent policy changes have included instructing financial institutions like Fannie Mae and Freddie Mac to purchase mortgage-backed securities, which helps to reduce borrowing costs and prohibited large institutional investors from purchasing single-family rental homes. Other broader cost-of-living policy changes have been a cap on credit card interest rates. All of these measures are meant to ease the cost-of-living concerns consumer have had in recent years, predominantly due to high inflation.

US earnings outcomes

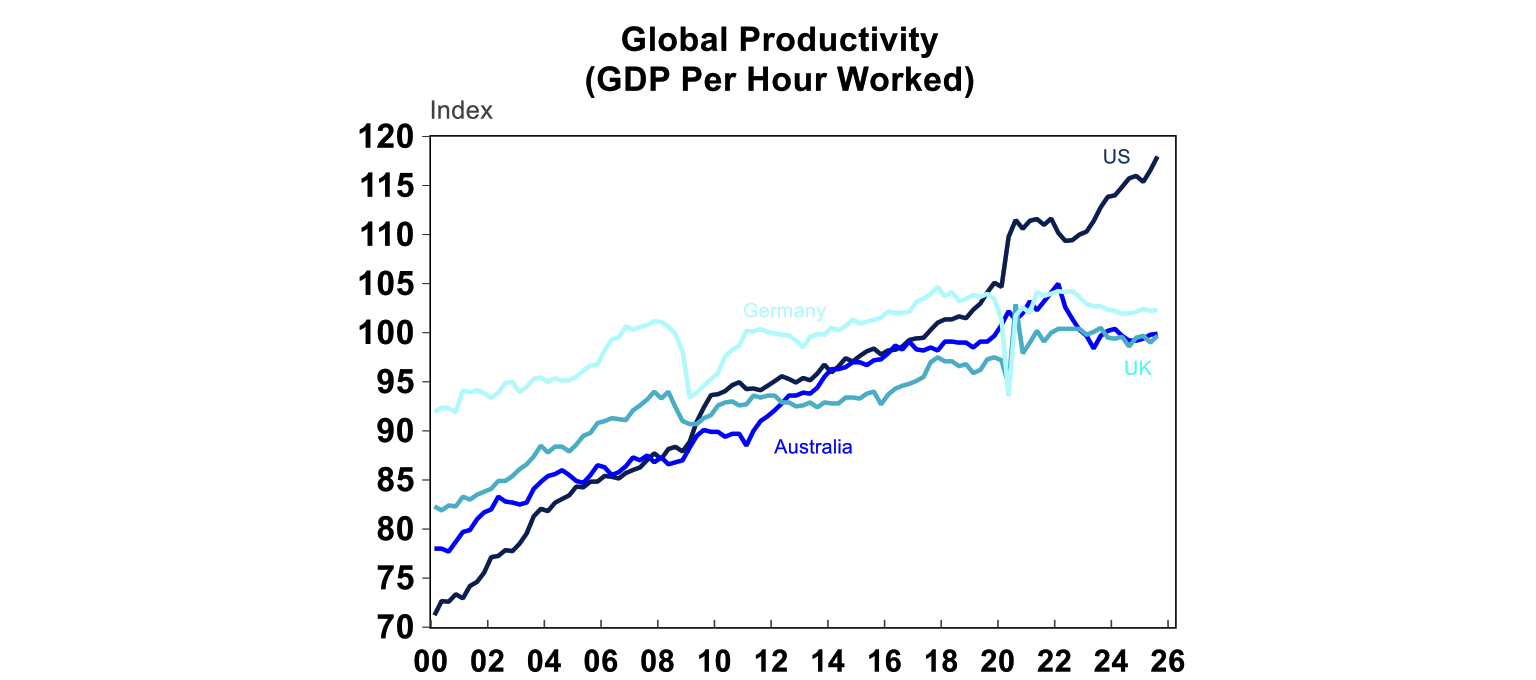

Despite everything going on in the US domestic political landscape and investor concern over long-term US exceptionalism, the US sharemarket continues to charge ahead, thanks to very strong tech earnings growth, solid economic growth and soaring productivity (running at 1.9% over the year to September) that is significantly outpacing its peers. This mostly all relates to the strong US tech sector.

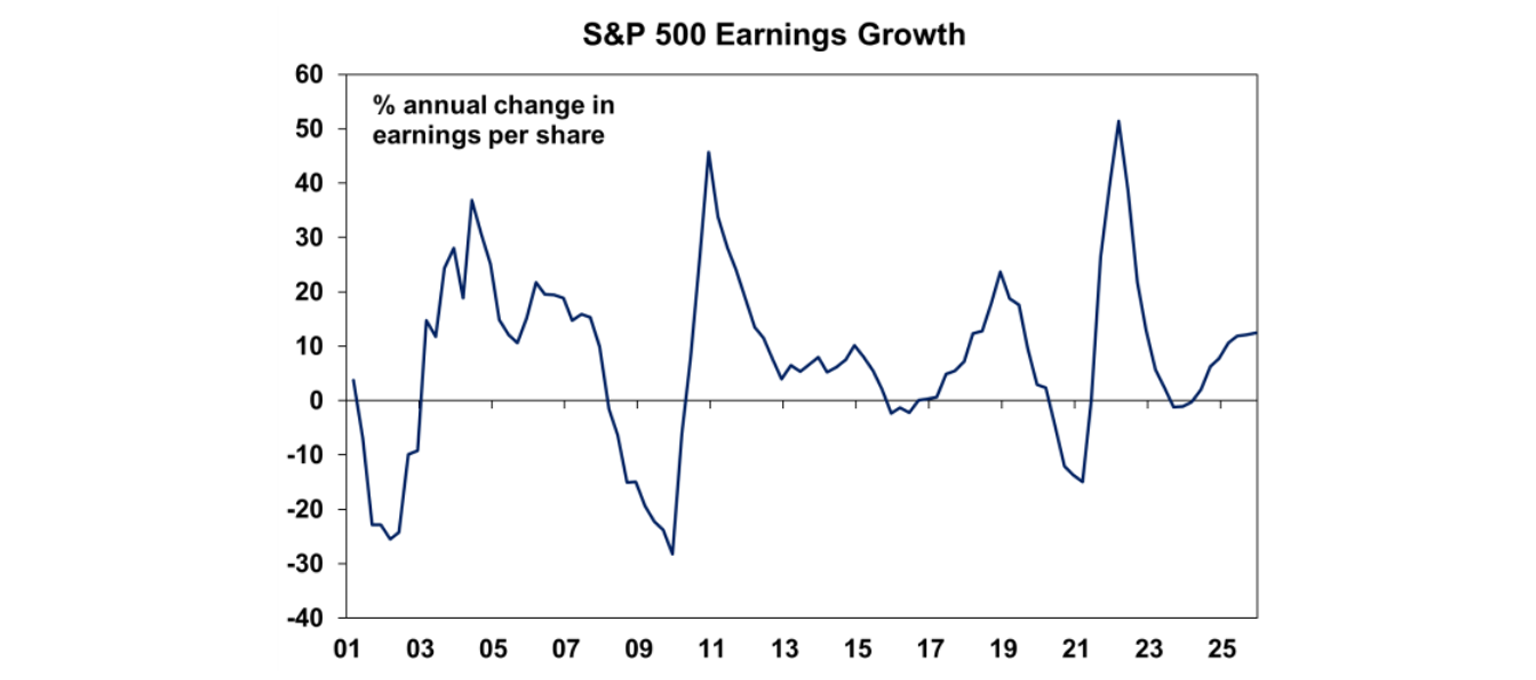

US December quarter earnings season has begun. Despite concerns about a potential tech bubble in the US share market, tech earnings are still good - up by around 22% over 2025, compared to 9% for the overall S&P500. Earnings growth is expected to be around 10% in 2026.

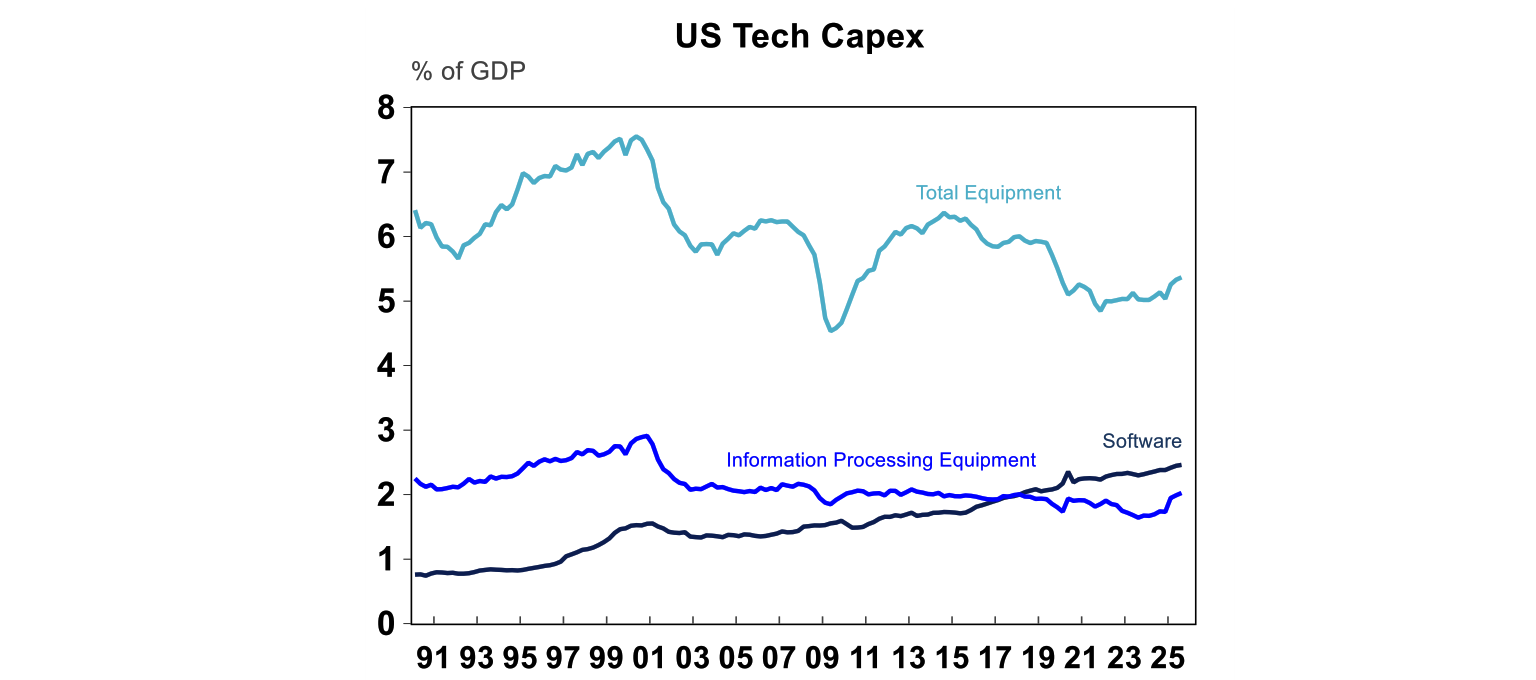

Solid earnings growth has been a tailwind for US returns. Investment in tech capital spending has been increasing in recent years, mostly driven by AI data centre capex. But, compared to equipment spending in the early 2000’s during the “tech bubble”, capex spending on tech still looks low which suggests that it’s still early days in the associated capex build up which support tech earnings in 2026.

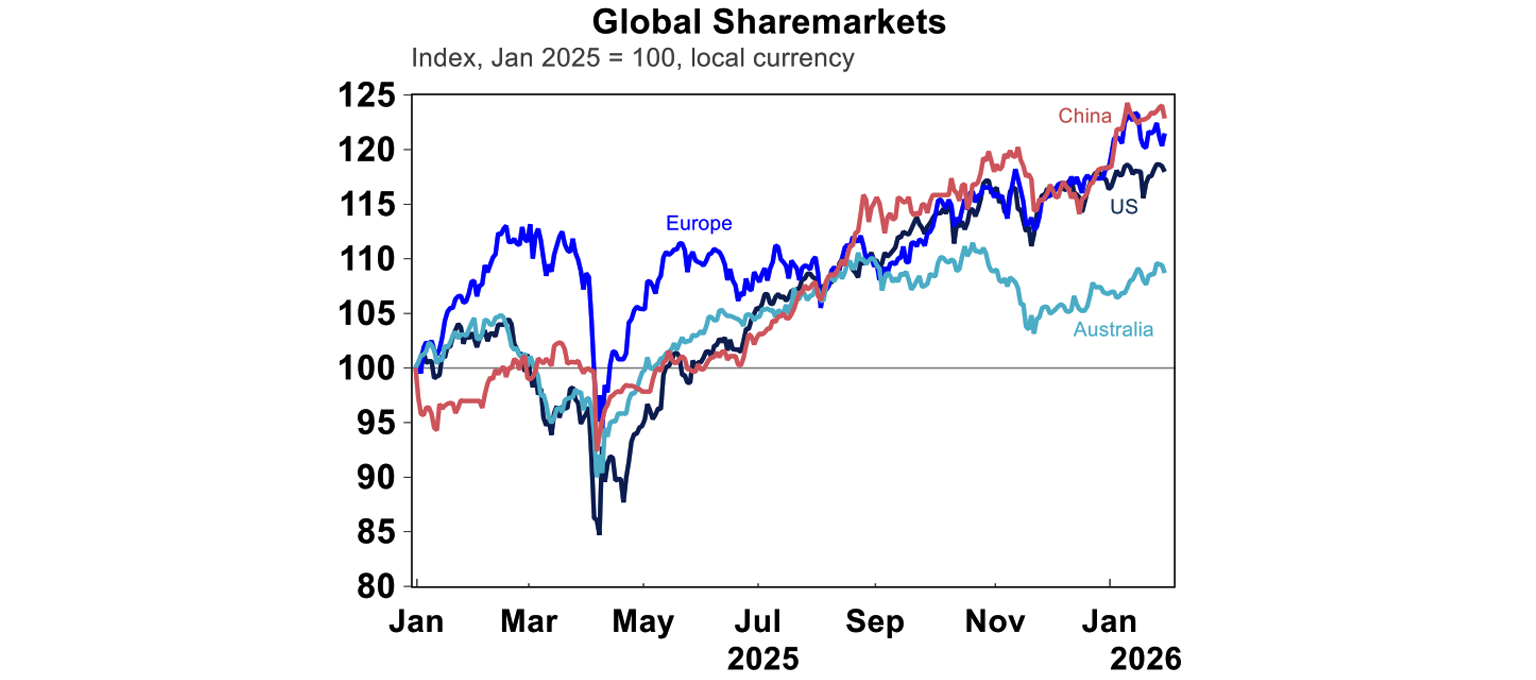

Australian half-year results are released in February, but expectations are for a better year for Australian equities, after underperformance in 2025 against major peers. Earnings growth is expected to be ~10% in 2026, from stronger mining earnings and the AI-related stocks. However, given the dominance of the tech sector in the US sharemarket (worth over 40% of the index), stronger GDP growth and likelihood of rate cuts, US shares are likely to outperform Australia in local currency terms. However, the slide in the $US and stronger $A means that in $US terms, Australian share returns may be stronger. So, hedging may become more important for investors in 2026 because of a weaker $US.

The economic data

US economic data has been mixed lately. Labour market indicators are holding up. Employment growth has slowed, but the unemployment rate is still low at 4.4%. So it remains a “low hiring low firing” environment, which is good for consumers. But consumer confidence has tanked in early 2026, related to concerns about the Trump’s administration policies and what it means for growth in 2026. There has been some good news on inflation, with annual growth running at 2.7%, compared to 3% just a few months ago. Housing-related inflation has been particularly high and has been moderating. Wages growth has also slowed, which would be helping to reduce inflation.

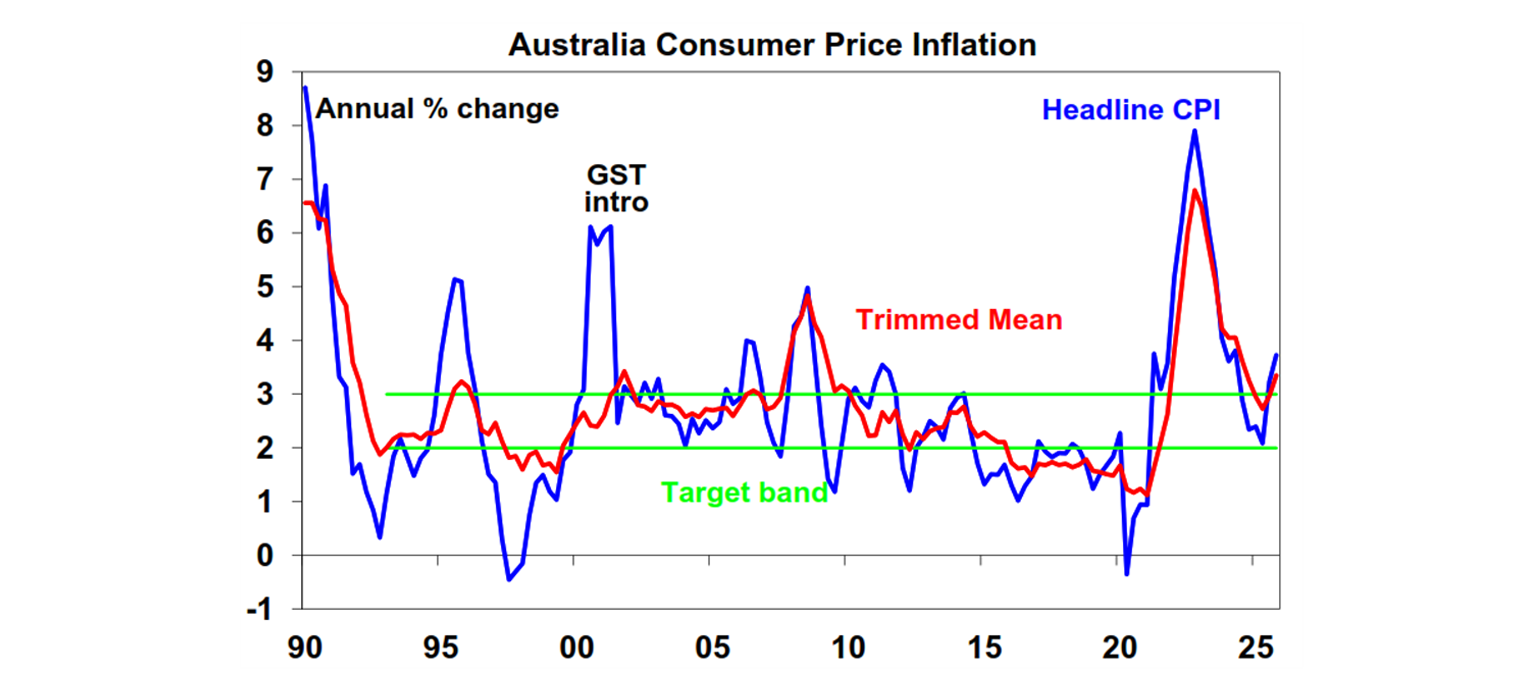

In Australia, we have seen a run of stronger economic data for the second half of 2025. The December quarter inflation data confirmed that inflation is too high, with quarterly trimmed mean at 3.4% over the year to December – way above the 2.5% the RBA is targeting (see the chart below), slightly outpacing the central bank’s latest forecasts. But, the December monthly inflation data showed softer momentum in “problem” areas like rents, new dwelling construction costs, market services and durable goods. Business surveys are showing output price indicators running around levels consistent with the inflation target. We still expect inflation to fall back into target later this year and revised RBA inflation forecasts should be similar, especially helped by the stronger $A (which decreases imported inflation). The September quarter GDP data was also good, showing annual GDP growth of 2.1% - around the RBA’s estimate of Australia’s potential growth and signs of a private sector recovery. The December jobs data showed the unemployment rate falling back to 4.1%, back to its May 2025 low, but this at odds with job vacancies and advertisements which are flat-lining or even slowing. The average economist expects the Reserve Bank to hike interest rates from 3.6% to 3.85% in February and the market is pricing in around a 65% chance of a hike. Whilst it’s a very close call and the Board is likely to be split, we expect rates to remain on hold.

Global currencies

Expectations for RBA rate hikes against expectations of further US rate cuts this year has lifted the interest rate differential between the US and Australia and pushed the $A higher, and it touched 70 US cents, for the first time in nearly 3 years. The stronger $A will keep a lid on imported inflation, benefit Australian’s travelling overseas but hasn’t increased enough (yet) to be a concern for exporters.

The $US fell by over 10% in 2025 and has taken another hit recently, notably after issues related to Venezuela and Greenland. This has provided the Euro, Aussie and Japanese Yen strength (see the chart below). The $US could slide a little further this year as investors no longer see the US as a “safe haven” asset, which we think will keep the $A around 70 cents.

Implications for investors

Despite all of the political chaos in early 2026, US shares have managed to lift by 2% so far in 2026, after a rise of 16% in 2025. European and Chinese shares did better than the US last year, especially in USD terms as the $US fell. Australian shares underperformed in 2025, up around 7%. We expect slower returns in shares this year, around 8% given stretched valuations, further political uncertainty prior to the midterms and softer growth in tech earnings. While we ultimately expect sharemarkets to end the year higher, there will be volatility along the way and a 15% or so correction in sharemarkets is likely along the way.

Bond yields are likely to remain elevated in the US given high budget deficit projections and concern over the US “safe haven” status, despite the Fed likely cutting interest rates this year. The recent lift to Japanese bond yields, from expectations of higher fiscal spending this year in Japan could also keep yields higher this year.

In this world of political uncertainty, the key for investors is to maintain a diversified portfolio and focus on markets with solid economic growth reasonable profit growth.

Diana Mousina

Deputy Chief Economist, AMP

You may also like

-

Weekly market update - 20-02-2026 Global share markets mostly rose over the last week. Worries about AI and tech valuations took a breather and the US Supreme Court decision to strike down Trump’s emergency power tariffs with Trump immediately announcing a replacement were seen as having little impact on the US growth outlook but were seen as positive for other countries. -

Econosights - An update on global debt and fiscal policy With the International Monetary Fund releasing their Global Fiscal Monitor recently, AMP's Senior Economist, Diana Mousina provides an update on the global debt situation and recent fiscal policy announcements. -

Oliver's Insights - Nine key charts for investors Share markets have had a bit of a wobbly start to the year, particularly in the US. This note looks at nine key charts worth watching.

Important information

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account. Taxation issues are complex. You should seek professional advice before deciding to act on any information in this article.

It’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you. The super coaching session is a super health check and is provided by AWM Services and is general advice only. It does not consider your personal circumstances.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy. All information on this website is subject to change without notice. AWM Services is part of the AMP group.