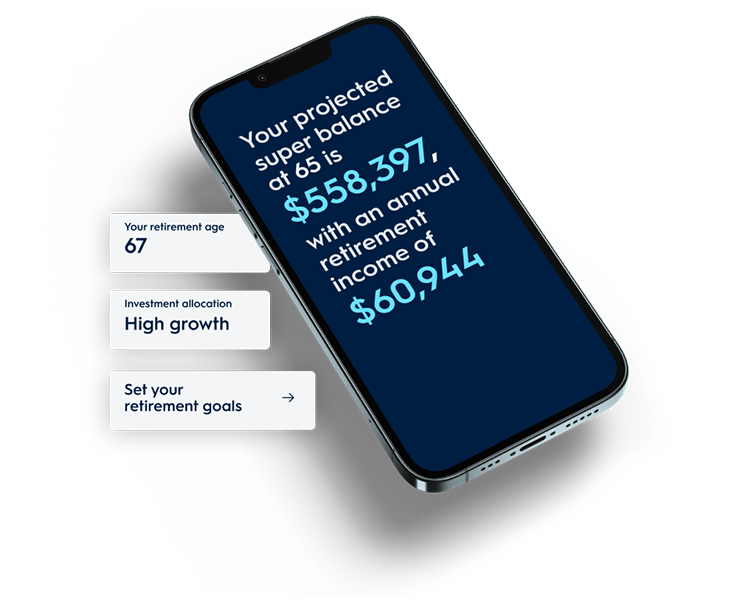

Simulate your retirement

Retirement simulator

Our retirement simulator lets you see how different choices like adding the Lifetime solution might impact how much income you have in retirement and how long your money may last.

At AMP, we know our members are keen to get the most out of their super. That’s why we’ve introduced AMP Super Lifetime Boost, an innovative feature designed to help you grow your super balance and invest in your future with confidence.

We’ve collected the most common questions from our social channels and customer service team and asked our experts to provide clear and simple answers, so you can make informed decisions about your super.

Lifetime Boost is available to eligible members as part of an AMP Super account, and once added it'll work hard in the background to boost your retirement income. When it's time to retire and you decide to allocate some of your super to an AMP Lifetime Pension1, the AMP Super Lifetime Boost could give your Age Pension eligibility an actual boost - we'll go into how in the next question. This could mean a higher income in retirement for you.

Lifetime Boost works in the background of your super account. It calculates a lower amount of growth to your account balance than typical actual growth. The rate used to do this is called a 'deeming rate' and it's set by the Government.

The deeming rate is currently 2.75% which is expected to be lower than the actual growth on your account, especially over the long-term.

This results in a lower amount being calculated, which compounds over your working life from the day Lifetime Boost is added.

When you eventually meet a full condition of release to access your money in super, if you decide to allocate at least some of your super into an AMP Lifetime Pension, the lower amount relevant to the proportion you move into Lifetime Pension is what Centrelink will use in the asset test to determine your eligibility for the Age Pension. A lower amount used in the 'asset test' by Centrelink creates a better opportunity to get more Age Pension to add to your retirement income.

Adding Lifetime Boost doesn't change how your super account works. There's no extra cost and it doesn't lock you into anything.

The earlier you add Lifetime Boost, the bigger the advantage could be in retirement.

Lifetime Boost itself does not cost anything and has no extra fees – we've simply added it onto the existing AMP Super product. It works in the background of your super to help increase retirement income potential without impacting your actual super balance or investment strategy.

That uplift comes from three sources. First, higher income rate when you retire – a lifetime pension converts retirement savings into income for life efficiently backed by insured living bonus to ensure income never runs out. The second uplift comes from Government Age Pension concessions. For example, there’s a 40% discount for asset tests for any allocation into a lifetime pension. The concessions are boosted up from 40% the earlier you added Lifetime Boost in your AMP Super account to as much as 100% discount on the asset test. That means your super could unlock more pension benefits. And finally, confidence to spend more freely, knowing you can enjoy an income that will never run out.

You can see a more detailed case study calculated here.

If you’re not an AMP Super member but considering switching, Lifetime Boost will automatically be added to your account when you join online.

For existing AMP Super members who have made investment choices in the past, we have automatically added the feature to your account.

Members who haven't made any investment choices before can easily add Lifetime Boost to their account by logging in to My AMP and clicking on the ‘Add Lifetime feature’ in the ‘Manage your super’ menu. You can also call us on 131 267. We would have written to you to confirm if it's been added automatically or if you'll need to opt in. You can check anytime on your My AMP account online.

Think of Lifetime Boost as a bonus feature inside your super. It doesn’t cost extra, and you’re not locked in, so you don’t lose flexibility, and there’s nothing complicated to do. You’re basically preparing a better pension for your future self, so when you retire, it has already been working hard in the background for you if you want that option.

The benefit comes from Lifetime Boost tapping into Government Age Pension concessions, increasing the discount on assets tested for the Age Pension from 40% to as much as 100%3.

However, depending on individual members circumstances, the reduced asset value used in the asset test does not necessarily always result in a higher Age Pension payment outcome. For example:

Members with low balances and minimal assets outside of super may already qualify for the maximum Age Pension.

Members with very high super balances (including outside AMP) and/or members who have other significant assets outside of super may not qualify for the Age Pension at all.

Members should speak to an Adviser or AMP Super Coach (Intrafund Advice) to consider their personal circumstances.

Australia has one of the most mature accumulation systems for retirement savings in the world, thanks to compulsory superannuation contributions. However, many retirees lack confidence when it comes to spending down their savings due to the fear of running out. This often results in underutilisation of retirement funds and reduced quality of life.

To address this, the Retirement Income Covenant legislated in 2022, highlighted the need for solutions that maximise retirement income while managing the sustainability and stability of that income and balancing needs for flexibility. While all super funds offer flexible income through an account-based pension, lifetime solutions were identified as the missing option for retirees. To encourage both the offering and uptake of lifetime solutions, the Government introduced Age Pension concessions.

AMP Super launched Lifetime Boost to leverage the concessions provided to help improve members’ income when they retire and further boost up the benefit of an AMP Lifetime Pension. Lifetime Boost is also designed to start meaningful conversations about retirement planning earlier, empowering members explore options, and to make informed decisions to enjoy a more secure and confident retirement.

Lifetime Boost is designed to increase your retirement income if you decide to allocate at least some of your super into an AMP Lifetime Pension when you meet a full condition of release to access your money in super. It works with the Government’s deeming rates, which are currently 2.75%. Let’s break it down:

Once Lifetime Boost is added to your super account, it runs automatically in the background while your super grows, creating a separate purchase price (or “concessional balance”).

This balance grows using the Government’s deeming rate instead of your actual investment returns, so it usually ends up appearing smaller than your real super balance especially over a long period of time.

Since Centrelink uses this smaller balance to assess your Government Age Pension eligibility, you could potentially qualify for a higher Age Pension.

When you combine this with your savings, you’ll be set up to retire better, with a higher income that lasts for a lifetime.

Read more about deeming rates in our article here.

Head to our Lifetime Boost page for everything you need to know about the feature, including helpful articles that go deeper into how Lifetime Boost works, an interview with the team who created it, how compound returns help boost your retirement income, what deeming rates have to do with it, and how our retirement simulator can help show how Lifetime Boost could affect you.

1 The AMP Lifetime Pension is not currently available but is expected to be available in 2026.

2 This information is illustrative only and does not replace financial advice. It illustrates the potential benefits for an average Australian with the AMP Super Lifetime Boost feature activated for 28 years leading up to retirement, who allocates their balance 50/50 between an AMP Lifetime Pension and an AMP Allocated Pension. The average Australian in this illustration is assumed to be a single female aged 39, with a $62k super balance and $88k salary. The illustration assumes annual investment returns of 6.33% and wage inflation of 3% p.a and the current upper deeming rate of 2.75%pa. All figures are shown in today’s dollars and are adjusted for 3% annual inflation. The benefits of Lifetime Boost are only realised if you take out a Lifetime Pension. There is no obligation to take up this pension if you have the Lifetime Boost feature, but the benefits will not apply if you do not.

3 To get the 100% asset test discount for Lifetime Pension, the discounted amount on roll-over date needs to be equal to or lesser than the amount you roll into an allocated pension.

Lifetime Boost is a feature of AMP Super which is issued by N. M. Superannuation Proprietary Limited ABN 31 008 428 322 AFSL 234654 as trustee of the AMP Super Fund ABN 78 421 957 449. Any advice is general only, doesn't consider your personal goals, financial situation or needs, and is provided by AWM Services Pty Ltd ABN 15139 353 496 AFSL 366121.

The super coach session is a super health check and is provided by AWM Services. It is general advice conversation only. It does not consider your personal circumstances.The Super Projection is a general advice conversation only, provided by AWM Services to eligible members of the AMP Super Fund.

Digital Financial Advice is available to eligible members of the AMP Super Fund.

You should consider your own circumstances and the AMP Super PDS and TMD on amp.com.au to consider if AMP Super or Lifetime Boost is right for you. Information is based on today's superannuation, tax and social securities laws (including deeming rates). Government policies and laws will change in the future, which may impact this feature, and the benefits discussed.

The issuer of AMP Lifetime Pension is NM Super. The TMD and PDS for AMP Lifetime Pension is expected to be available in mid-2026 on www.amp.com.au/resources#pds. Please review the PDS before deciding to acquire or hold the Lifetime Pension as there may be features or conditions of the Lifetime Pension that may not be suitable to you. NM Super may withdraw or change the Lifetime pension in the future and therefore these benefits may not apply.