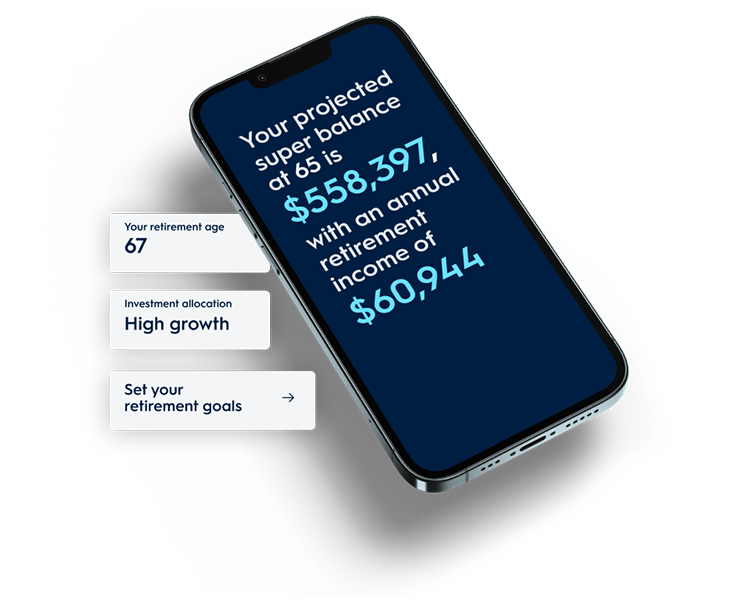

Simulate your retirement

Retirement Simulator

Our Retirement Simulator lets you see how different choices like adding the Lifetime solution might impact how much income you have in retirement and how long your money may last.

Key takeaways

On 20 August 2025, Federal Social Services minister Tanya Plibersek announced changes to deeming rates. Not sure what they are or why they matter? Don’t worry, we’re here to break it down in a simple way without the jargon, so you can stay ahead and make smarter moves for retirement (even if it still feels like a long way off).

When it comes to figuring out how much Age Pension you'll get, rather than dig through every bank account or investment everyone has (timely and costly!), the Government use what’s called a deeming rate. It’s a standard interest rate used to estimate how much income your assets could be earning, rather than what you’re actually earning. That estimated income helps determine how much Age Pension support you’ll get to retire with.

Deeming rates are used to keep things fair, treating all financial assets the same, no matter where or how your money's invested. That means:

If you’re getting high interest on your investments: you aren’t penalised for being savvy.

If your returns are lower: you don’t get an unfair advantage.

From 20 September 2025, the lower deeming rates was raised from 0.25% to 0.75%, while the upper deeming rate was raised from 2.25% to 2.75%1. These two rates apply depending on how much you hold in financial assets, with lower rates applying up to a certain threshold, and higher rates kicking in above that.

Deeming rates have been frozen for the last few years to protect pensioners during the economic uncertainty caused by the pandemic. Now, with interest rates and markets stabilising, the Government is adjusting deeming rates to betteralign with interest rates.

It's may not exactly seem like a thrilling topic, but deeming rates can have an impact on your future income and affect your pension. With the changes rolled out from 20 September, it’s worth understanding, especially if they could affect your overall retirement plan (or inspire you to start one!).

Here’s why it matters:

When deeming rates go up: the Government assumes you’re earning more from your assets (even if you’re not) and may result in a lower Age Pension.

Increasing the Age Pension: Alongside the deeming rate increase, the Government is also raising Age Pension payments to help with the cost of living. Singles on a full Age Pension will see an increase of $30 a fortnight and couples on a full Age Pension will see an increase of $22.40 each per fortnight.

AMP Super Lifetime Boost is designed to increase your retirement income if you decide to convert at least some of your super into an AMP Lifetime Pension when you reach retirement. It works with the Government’s deeming rates. Let’s break it down:

Once Lifetime Boost is added to your super account, iruns automatically in the background while your super grows, creating a separate purchase price (or “concessional balance”).

This balance grows using the Government’s deeming rate instead of your actual investment returns, so it usually ends up appearing smaller than your real super balance.

Since Centrelink uses this smaller balance to assess your Government Age Pension eligibility, you could potentially qualify for a higher Age Pension.

When you combine this with your savings, you’ll be set up to retire better, with an income that lasts for a lifetime.

If you want to see how the Lifetime feature could boost your future retirement, AMP’s Retirement Simulator can show you.

1 Services Australia, Deeming Rates Are Increasing

Products in the AMP Super Fund and the Wealth Personal Superannuation and Pension Fund are issued by N. M. Superannuation Proprietary Limited ABN 31 008 428 322 (NM Super), who is part of the AMP group.

AMP Super refers to SignatureSuper® which is issued by NM Super and is part of the AMP Super Fund (the Fund) ABN 78 421 957 449. ® SignatureSuper is a registered trademark of AMP Limited ABN 49 079 354 519.

Any advice and information is general in nature. It hasn’t taken your financial or personal circumstances into account. You should seek professional advice before deciding to act on any information in this article. It’s important to consider your particular circumstances and read the product disclosure statement (PDS) and Target Market Determination (TMD) for AMP Super (SignatureSuper), available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you.

You can read our Financial Services Guide https://www.amp.com.au/financial-services-guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services it provides. You can also ask us for a hard copy. All information on this website is subject to change without notice.

The AMP Lifetime Pension is not currently available but is expected to be available in 2026. The issuer of AMP Lifetime Pension is NM Super. The TMD and PDS for AMP Lifetime Pension is expected to be available in mid-2026 on www.amp.com.au/resources#pds. Please review the PDS before deciding to acquire or hold the Lifetime Pension as there may be features or conditions of the Lifetime Pension that may not be suitable to you. NM Super may withdraw or change the Lifetime pension in the future and therefore these benefits may not apply.